Router and Switch Market Size, Share, Trends and Forecast by Product, Service, and Region, 2025-2033

Router and Switch Market Size and Share:

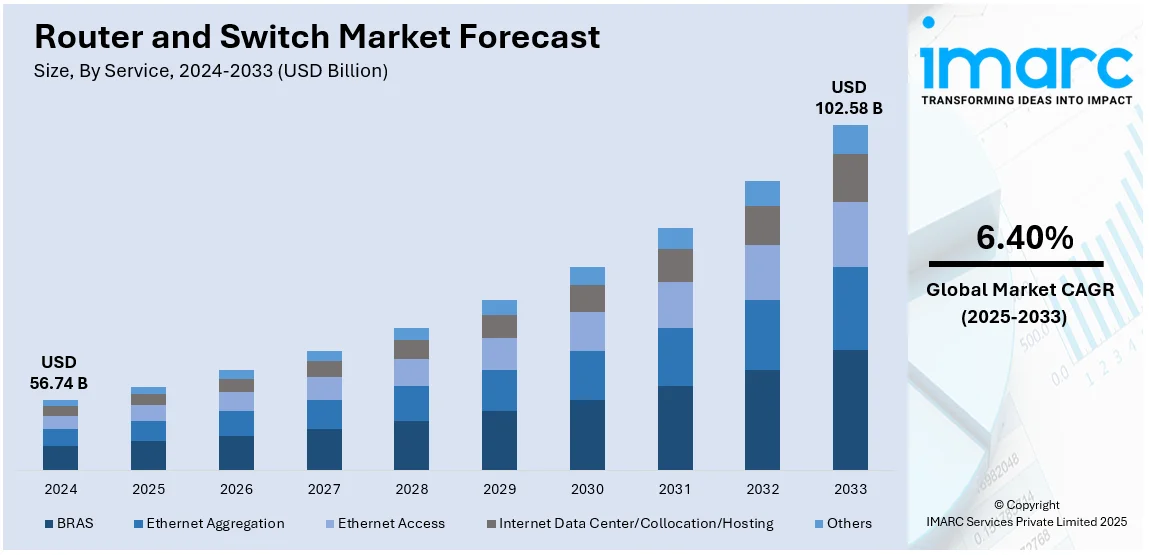

The global router and switch market size was valued at USD 56.74 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 102.58 Billion by 2033, exhibiting a CAGR of 6.40% from 2025-2033. North America currently dominates the market, holding a market share of over 36.7% in 2024. This dominance is driven by elevated cloud adoption and upgraded network infrastructure across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.74 Billion |

| Market Forecast in 2033 | USD 102.58 Billion |

| Market Growth Rate (2025-2033) | 6.40% |

The global router and switch market is propelled by numerous major factors, encompassing the heightening proliferation of data centers, magnifying utilization of cloud-based services, and elevating need for high-speed internet connectivity. The innovations in 5G technology and expansion of the Internet of Things (IoT) devices further boost market expansion by necessitating resilient network infrastructure. In addition to this, the increase in digital transformation ventures across key sectors, coupled with magnifying cybersecurity concerns, bolster investment in enhanced networking equipment. Moreover, the requirement for effective, dependable, and adaptive network solutions highlights the market's stable growth, aided by ongoing infrastructure modernization and technological advancements efforts.

The United States exhibit critical role in the global router and switch market, mainly impacted by extensive digital transformation across various industries and enhanced technological infrastructure. It serves as a major hub for advancements, with leading players heavily investing in next-generation networking services to cater to the escalating needs for resilient data management and high-speed connectivity. The accelerating implementation of IoT, cloud computing, and 5G further boosts market growth. For instance, as per industry reports, the U.S. leads in 5G network deployment, achieving substantial progress by early 2024, with major providers constantly expanding the coverage, providing access to over 75% of subscribers. In addition, the U.S. government’s active focus on infrastructure modernization and cybersecurity offers numerous growth prospects. With its robust research and development abilities and a competitive business ecosystem, the nation remains a crucial market for routers and switches globally.

Router and Switch Market Trends:

Surge in Demand for High-Speed Connectivity

The global router and switch market is experiencing robust growth, driven by increasing demand for high-speed internet connectivity. The proliferation of cloud computing, video streaming, and IoT devices has elevated the need for advanced network infrastructure. For instance, as per industry reports, in the first quarter of 2024, online videos reached 92.3% of global internet users, including approximately 164.6 million live-stream viewers in the U.S. Resultantly, enterprises are investing in high-performance routers and switches to enhance data transmission speeds and ensure seamless connectivity. Additionally, the rollout of 5G networks is accelerating the adoption of next-generation hardware to support low-latency, high-bandwidth applications. This trend is expected to intensify as industries digitalize, requiring scalable and efficient network solutions to accommodate rising data traffic.

Rising Adoption of SDN and NFV Technologies

The adoption of software-defined networking (SDN) and network functions virtualization (NFV) is reshaping the router and switch market. These technologies enable greater network agility, cost savings, and centralized management, which are critical for modern enterprises. Moreover, service providers are leveraging SDN and NFV to optimize network performance, automate operations, and introduce new services efficiently. This shift from hardware-centric to software-driven solutions is driving demand for programmable routers and switches. In addition, as industries prioritize digital transformation, the integration of SDN and NFV technologies is anticipated to be a key growth driver for the market. For instance, industry reports states that as of 2024, SDN has already been implemented by 15% of organizations.

Expansion of Smart Cities and Edge Computing

The expansion of smart cities and edge computing is significantly influencing the global router and switch market. Smart city initiatives require robust networking solutions to support real-time data processing, surveillance, and IoT applications. Similarly, the growth of edge computing is driving the need for routers and switches with enhanced processing capabilities to manage decentralized data traffic. Enterprises are deploying edge-ready solutions to reduce latency and improve operational efficiency. For instance, in February 2024, Digi International Inc. unveiled its latest 5G edge computing based IoT cellular router solution Digi IX40. This solution is particularly developed for Industry 4.0 operations. Furthermore, as urbanization and IoT adoption accelerate globally, investments in advanced networking infrastructure are poised to grow, presenting significant opportunities for market players.

Router and Switch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global router and switch market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and service.

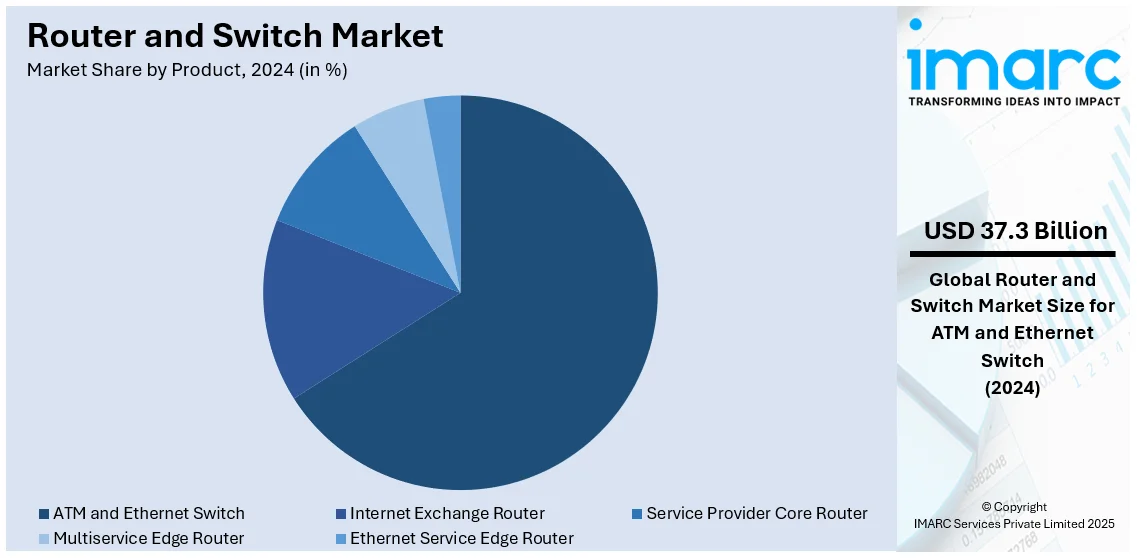

Analysis by Product:

- Internet Exchange Router

- Service Provider Core Router

- Multiservice Edge Router

- Ethernet Service Edge Router

- ATM and Ethernet Switch

In 2024, ATM and ethernet switch lead the product segment, accounting for 65.7% of the market share. This is due to their pivotal role in modern networking. Ethernet switches, widely used in enterprise and data center networks, enable high-speed, reliable communication between devices. Their scalability and cost-effectiveness make them essential for expanding digital infrastructure. ATM switches remain relevant in specific industries requiring high-quality service and guaranteed bandwidth, such as telecommunications. Moreover, the increasing demand for low-latency and high-performance networking solutions drives the adoption of these switches, especially in regions prioritizing advanced network deployments. Technological advancements, including support for higher bandwidths and energy-efficient designs, further enhance their market appeal, ensuring their dominance in diverse applications ranging from corporate networks to industrial automation.

Analysis by Service:

- BRAS

- Ethernet Aggregation

- Ethernet Access

- Internet Data Center/Collocation/Hosting

- Others

In 2024, internet data center/collocation/hosting lead the service segment, accounting for 37.2% of the market share. This segment is driven by the surging need for robust, scalable IT infrastructure. As organizations increasingly migrate to cloud-based platforms, the demand for reliable data center solutions has surged. Moreover, colocation services offer cost-effective alternatives to owning and managing on-site data centers, attracting businesses seeking flexibility and operational efficiency. On the other hand, hosting services provide scalable resources tailored to the growing digital economy's requirements. Furthermore, this segment benefits from technological advancements like edge computing and 5G, which enhance connectivity and reduce latency. In addition, the focus on green data centers and energy-efficient operations strengthens the market position of these services, supporting organizations in meeting sustainability goals while ensuring seamless network performance and data security.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.7%. This regional market is driven by its advanced technological infrastructure and rapid adoption of cutting-edge networking solutions. The region heavily benefits from significant investments in 5G deployment, cloud computing, and IoT applications, which drive demand for high-performance routers and switches. For instance, in December 2024, the government of Canada allocated a significant investment of $700 million for expanded or new data centers and around $1 billion for the development of transformative public computing infrastructure. Besides, major technology companies and data centers headquartered in North America further contribute to the region's market dominance by fostering innovation and upgrading network capabilities. Additionally, the growing reliance on secure, scalable enterprise networks across industries, such as healthcare, finance, and retail, supports steady market growth. Government initiatives to improve broadband accessibility and promote digital transformation further amplify the adoption of advanced networking solutions. Moreover, with a robust focus on technological advancements and a well-established IT ecosystem, North America is poised to maintain its leadership position in the global router and switch market.

Key Regional Takeaways:

United States Router and Switch Market Analysis

In 2024, United States accounted for 80.60% of the market share in North America. This nation is driven by robust investments in advanced telecommunications infrastructure and the widespread adoption of cutting-edge networking technologies. With the proliferation of IoT devices, 5G deployments, and cloud-based solutions, the demand for high-performance routers and switches has surged across industries. For instance, as per industry reports, around one-third of cloud users are investing more than $12 million annually in public cloud services like Google Cloud, AWS, and Microsoft Azure, which are all U.S.-based. Moreover, the nation's thriving data center market, fueled by its leadership in technology and digital transformation, further strengthens its position. Enterprise networks in sectors such as healthcare, finance, and education are increasingly relying on scalable and efficient networking solutions to manage vast amounts of data securely and efficiently. Furthermore, strategic partnerships and acquisitions by key market players enhance innovation and market penetration. Federal initiatives promoting digital connectivity and cybersecurity bolster the demand for advanced networking equipment. In addition, the presence of leading technology firms and a tech-savvy consumer base ensures the United States remains at the forefront of the router and switch market, continuously driving technological advancements.

Europe Router and Switch Market Analysis

Europe is a prominent market for routers and switches, underpinned by extensive adoption of digital technologies and robust government initiatives supporting digital infrastructure development. Several countries are actively profiting from advanced 5G implementation plans and growing investments in cloud computing. For instance, as per industries reports, Denmark, the Netherlands, Malta, and Cyprus are the four European countries that have achieved 100% 5G household coverage. In addition, the region’s strong emphasis on industrial automation, smart cities, and IoT integration is driving the need for reliable and high-speed networking solutions. Furthermore, Europe’s focus on cybersecurity and data privacy aligns with the increasing deployment of secure and efficient network infrastructure. The expanding e-commerce sector and growing demand for remote working solutions further fuel market growth. Moreover, collaboration between governments and private enterprises accelerates the deployment of next-generation networks, solidifying Europe's position as a critical player in the global router and switch market.

Asia Pacific Router and Switch Market Analysis

Asia Pacific is experiencing rapid growth in the router and switch market, driven by expanding internet penetration and increasing demand for high-speed connectivity. For instance, as per industry reports, by 2030, Asia Pacific is expected to have 1.8 billion mobile internet users, with a penetration rate of 61%. Countries like Japan, China, and India are leading the charge with significant investments in 5G infrastructure and smart city projects. The region’s booming e-commerce, digital services, and cloud computing industries amplify the need for advanced networking solutions. Rising digital transformation across various sectors, coupled with government initiatives to enhance connectivity, further supports market expansion. Asia Pacific’s large population and growing tech adoption ensure sustained demand, making it a key growth region in the global market.

Latin America Router and Switch Market Analysis

Latin America’s router and switch market is growing steadily, fueled by expanding internet access and investments in telecommunication infrastructure. Countries such as Brazil and Mexico are leading regional adoption, supported by increasing digital transformation across industries. For instance, in September 2024, Scala Data Centers, a prominent sustainable data center platform across Latin America, and the government of Rio Grande do Sul, announced collaboration for the development of the largest, cutting-edge digital infrastructure venture Scala AI City, with a significant initial expenditure of USD 500 million. The demand for improved connectivity and cloud-based services is driving market growth, particularly in urban areas. Government efforts to enhance network coverage and private sector investments in next-generation technologies further support market expansion in this emerging region.

Middle East and Africa Router and Switch Market Analysis

The Middle East and Africa router and switch market is driven by growing investments in digital infrastructure and the adoption of advanced networking solutions. Key markets like South Africa, the UAE, and Saudi Arabia, are spearheading this growth, fueled by initiatives in smart city development and 5G deployment. For instance, in September 2024, Oman announced plans to launch a Smart City project with a significant investment of USD 2.6 billion. Increasing internet penetration and government-led digital transformation projects are creating significant opportunities for market players. The region’s focus on enhancing connectivity in remote areas also contributes to the market's steady expansion.

Competitive Landscape:

The market is characterized by heavy competition among key players that are currently focusing on advancements, providing leading-edge networking solutions customized to address the diverse demands of both service providers and enterprise. Tactical ventures, including product launches, partnerships, and acquisitions are highly prevalent, targeting to proliferate market foothold and cater to the magnifying requirement for energy-saving, superior-performance equipment. For instance, in January 2024, Juniper Networks, a prominent routers and switch provider, announced a significant investment of USD 14 billion on Juniper Networks, another well-established routers and switches company, to compete with Cisco Systems, a major market leader. The market also experiences heavy investments in research projects to incorporate innovative technologies, including SDN and AI, for improved effectiveness and adaptability. Regional players bolster competition further by adhering to localized needs, prompting a dynamic ecosystem where scalability and advancements are crucial for sustaining domination.

The report provides a comprehensive analysis of the competitive landscape in the router and switch market with detailed profiles of all major companies, including:

- Actelis Networks, Inc.

- ALE International

- Arista Networks, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Extreme Networks

- Huawei Technologies Co., Ltd.

- Ribbon Communications Operating Company, Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Latest News and Developments:

- In September 2024, Cisco announced a strategic partnership with Flex, a global electronics production company, for the development as well as expansion of a manufacturing plant in India. This facility will initially emphasize on the production of Cisco's NCS 540 Series of routers.

- In March 2024, Department of Telecom, India, in collaboration with CDOT and Nivetti Systems, India-based network operating system provider, launched nation's indigenously produced, fastest Multiprotocol Label Switching router, with an excellent capacity of 2.4 tdps.

Router and Switch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Internet Exchange Router, Service Provider Core Router, Multiservice Edge Router, Ethernet Service Edge Router, ATM and Ethernet Switch |

| Services Covered | BRAS, Ethernet Aggregation, Ethernet Access, Internet Data Center/Collocation/Hosting, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Actelis Networks, Inc., ALE International, Arista Networks, Inc., Cisco Systems, Inc., Dell Inc., Extreme Networks, Huawei Technologies Co., Ltd., Ribbon Communications Operating Company, Inc., Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the router and switch market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global router and switch market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the router and switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global router and switch market was valued at USD 56.74 Billion in 2024.

The market is estimated to reach USD 102.58 Billion by 2033, exhibiting a CAGR of 6.40% from 2025-2033.

The market is driven by increasing internet penetration, rising demand for high-speed data transmission, and growing adoption of cloud computing and IoT technologies. Expanding enterprise networks, advancements in 5G infrastructure, and the need for efficient data center management further fuel market growth.

North America currently dominates the global router and switch market. The dominance is driven by a well-established IT and telecommunications infrastructure, high demand for advanced networking technologies, and significant investments in data centers and cloud computing.

Some of the major players in the global router and switch market include Actelis Networks, Inc., ALE International, Arista Networks, Inc., Cisco Systems, Inc., Dell Inc., Extreme Networks, Huawei Technologies Co., Ltd., Ribbon Communications Operating Company, Inc., Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)