Rotary Pump Market Size, Share, Trends and Forecast by Type, Operating Capacity, Pump Characteristics, Raw Material, End–Use Industry, and Region, 2025-2033

Rotary Pump Market Size and Share:

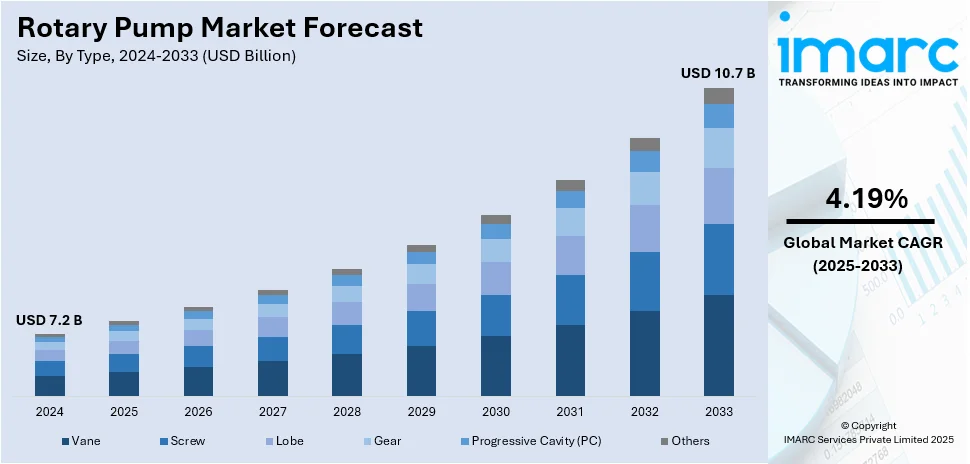

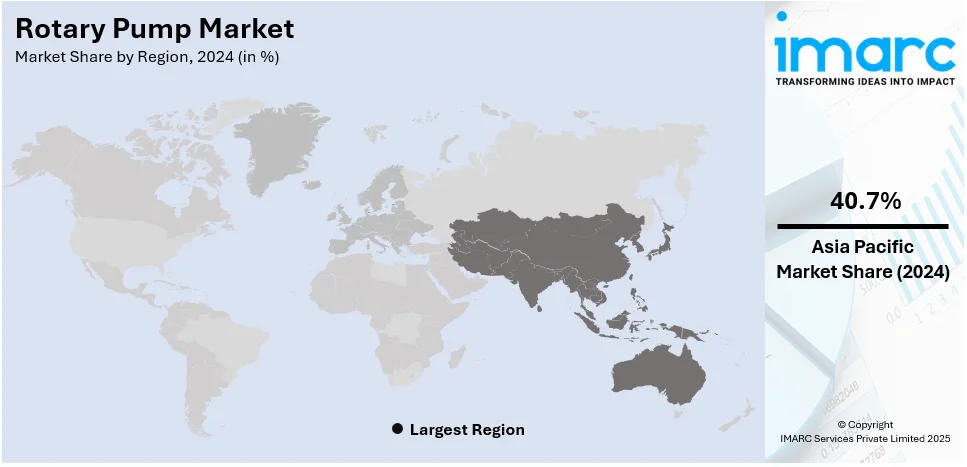

The global rotary pump market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.7 Billion by 2033, exhibiting a CAGR of 4.19% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.7% in 2024. Increasing oil and gas exploration, rising wastewater treatment projects, industrial expansion in chemicals, pharmaceuticals, and food processing, surging demand for energy-efficient solutions, advancements in pump technology, automation in manufacturing, and stringent environmental regulations are factors propelling the rotary pump market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.2 Billion |

|

Market Forecast in 2033

|

USD 10.7 Billion |

| Market Growth Rate (2025-2033) | 4.19% |

The market is significantly influenced by the increasing demand for energy-efficient pumping solutions across industries. Additionally, the rising exploration and production activities in the oil and gas sector necessitate advanced pumping systems with high reliability and durability, which is providing an impetus to the market expansion. Moreover, the growth in precision chemical dosing applications is accelerating the need for rotary pumps with enhanced flow control, thereby contributing to the growth of the market. Besides this, continual advancements are improving operational efficiency, leading to wider adoption, which is also a significant growth-inducing factor for the market. For example, on November 14, 2024, ULVAC, Inc. introduced the Gv135 oil rotary vacuum pump, specifically designed for the analytical equipment sector. This pump offers significant noise reduction, achieving 46 dB, and incorporates a non-contact magnetic coupling to prevent oil leakage, along with automatic valves to avert oil backflow. These features collectively enhance operational productivity and ensure a cleaner working environment.

The U.S. rotary pump market is experiencing significant growth due to the increasing adoption of these pumps in food processing industries, driven by stringent safety regulations. According to a latest industry report, the U.S. Department of Commerce reported 42,708 food and beverage processing facilities in the United States in 2022. The expanding scale of food production necessitates efficient, hygienic, and precise fluid-handling systems, further driving the demand for rotary pumps. In line with this, rising investments in shale gas extraction are increasing the demand for robust rotary pump systems, thereby fueling market growth. Furthermore, the proliferation of precision agriculture, requiring efficient fluid-handling solutions, is a significant rotary pump market trend. Also, the implementation of government incentives for energy-efficient equipment adoption is accelerating the replacement of conventional pumps with advanced rotary models, which is providing a boost to market expansion. Apart from this, increasing pharmaceutical and biotech research and development (R&D) activities are also propelling demand, as rotary pumps provide precise and contamination-free fluid handling for critical applications.

Rotary Pump Market Trends:

Increased Demand in the Oil and Gas Sector

Rotary pumps are widely used in the oil and gas industry for pumping viscous fluids with high efficiency as they can easily move heavy oils, lubricants, and crude oil. Moreover, the burgeoning exploration activities are adding to the demand of rotary pumps due to their reliability, durability, and cost-efficiency, which is also positively influencing the rotary pump market outlook. As per the industry reports, plans to increase oil production capacity to 4.75 million barrels per day (mmb/d) by 2040 were announced by the Kuwait Petroleum Corporation (KPC). In addition to this, the soaring global oil demand have pushed oil refineries and processing units to implement more efficient pumping solutions, which is driving the market growth.

Growth of Wastewater Treatment Initiatives

Rotary pumps are used extensively in wastewater treatment plants for chemical dosing and sludge handling applications, which is accelerating the market growth. The sanitation and environment movements, especially in emerging economies, have driven the implementation of numerous wastewater treatment projects, which is further fostering the rotary pump market growth. According to the US Environmental Protection Agency (EPA), the agency has extended its Closing America's Wastewater Access Gap Community Initiative to 150 additional communities across the United States as part of President Biden's Investing in America initiative. Rotary pumps are renowned for their capacity to manage abrasive particles and provide a constant flow, even under challenging circumstances. Apart from this, rapid urbanization and industrialization has escalated the need to treat wastewater, which is encouraging governments as well as private organizations to invest in advanced pumping solutions, further providing a thrust to the rotary pump market revenue.

Industrial Growth in Chemicals, Pharmaceuticals, and Food Processing

The expansion of the food processing, pharmaceutical, and chemical industries plays an important role in driving the rotary pump market demand. They are used across several sectors, including chemical processing, for handling dangerous and hazardous liquids with very high accuracy of chemical dosing and transfer. This is particularly crucial in the rapidly expanding Indian chemical sector, which, according to the India Brand Equity Foundation, is currently worth USD 220 Billion and is anticipated to reach USD 300 Billion by 2030. This, in turn, is promoting safety and growth in a rapidly evolving rotary pump market. Rotary pump in the pharmaceutical industry is one of the most necessary equipment for maintaining cleanliness and making precision amount of liquid, which is essential for medicinal production. In the food processing industry, they are used for transferring viscous liquids like syrups, oils, and sauces, without damaging the product and hygiene, which is further propelling the market growth.

Rotary Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rotary pump market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, operating capacity, pump characteristics, raw material, and end-use industry.

Analysis by Type:

- Vane

- Screw

- Lobe

- Gear

- Progressive Cavity (PC)

- Others

Gear leads the market with around 35.1% of market share in 2024 due to efficiency, durability, and the pumping of a wide variety of fluids, including viscous and abrasive ones. The pumps operate on intermeshing gears that impart a constant flow, making them ideal for applications needing the most accurate transfer of fluids, such as chemical processing, food and beverage, and lubrication systems. The simple design of the pump provides for low maintenance and long service life, thereby contributing to its widespread acceptance in various industries. Gear pumps are preferred in situations where high-pressure fluid transfer operations are needed, such as in oil and gas and automotive manufacturing. Furthermore, the continued development of materials and sealing enhances their efficiency, reducing leakage and improving overall performance. This versatility and reliability make gear pumps a crucial component of the rotary pump market.

Analysis by Operating Capacity:

- Small (Upto 500 gpm)

- Medium (500-1000 gpm)

- High (More Than 1000 gpm)

Small (upto 500 gpm) leads the market with around 55.0% of market share in 2024. The small (upto 500 gpm) segment is driven by the increasing demand for compact and efficient rotary pumps in industries with limited space and lower flow rate requirements. These pumps are highly suitable for small-scale operations in sectors such as food and beverage, pharmaceuticals, and chemical processing, where precise control and energy efficiency are crucial. The rising trend of automation in these industries further fuels the adoption of small rotary pumps, as they offer better integration with automated systems and require less maintenance. Additionally, advancements in pump technology are improving these smaller units' performance to make them more dependable and long-lasting when handling different fluids. Growing environmental regulations also encourage the use of energy-efficient pumps, pushing industries to opt for smaller, more efficient models.

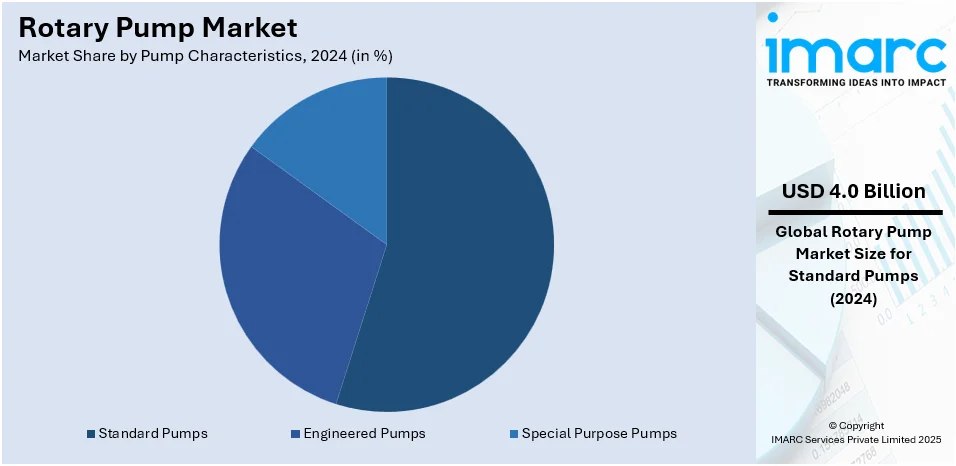

Analysis by Pump Characteristics:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

Standard pump leads the market with around 54.8% of market share in 2024. The standard pump segment is driven by the increasing demand for cost-effective and versatile pumping solutions across multiple industries. Due to their dependable operation, simplicity in installation, and low maintenance needs, these pumps are extensively utilized in many different applications. Standard pumps are used in a variety of industries, including food and beverage, water and wastewater, and oil and gas, because of their versatility in handling low to medium viscosity liquids. Standard pumps are being more widely used in water distribution and treatment facilities as a result of the increased emphasis on infrastructure development, especially in emerging economies. Additionally, enterprises looking to cut operating expenses are finding these pumps more appealing due to developments in pump technology, such as increased durability and energy efficiency.

Analysis by Raw Material:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Other

Stainless steal leads the market in 2024 due to its remarkable resilience to corrosion, longevity, and capacity to handle a variety of fluids. Because they can handle caustic fluids and uphold hygienic standards, stainless steel rotary pumps are commonly employed in industries including chemicals, pharmaceuticals, and food processing. Rotating pumps made of stainless-steel guarantee low contamination, which makes them perfect for uses where high purity requirements are necessary. Because the substance is non-reactive, it won't contaminate delicate goods, which is crucial in industries like food and medicine. Furthermore, stainless steel has a high strength and wear resistance, which makes it appropriate for uses requiring abrasive materials or high-pressure fluids. The need for stainless steel rotary pumps is being further increased by the increased emphasis on energy efficiency and longer equipment lifespans.

Analysis by End-Use Industry:

- Oil and Gas

- Power Generation

- Chemical and Petrochemical

- Water and Wastewater

- Food and Beverage

- Others

Water and waste water lead the market in 2024. The water and wastewater segment is driven by the increasing need for efficient infrastructure to manage growing urban populations and industrial activities. As cities expand and industries generate more waste, the demand for advanced wastewater treatment systems rises, pushing the adoption of rotary pumps for their reliability and capacity to handle high-viscosity fluids like sludge. Government regulations and initiatives to improve sanitation and reduce environmental pollution further drive investments in wastewater treatment facilities. Rotary pumps are preferred for their ability to manage challenging fluids, including those with suspended solids, making them essential in these processes. Additionally, the shift toward sustainable water management practices, including the reuse and recycling of water, is changing the rotary pump market dynamics.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 40.7%. The Asia Pacific regional market is driven by the rapid industrialization and urbanization across countries like China, India, and Japan, which is boosting demand for rotary pumps in sectors such as oil and gas, water treatment, and chemical processing. Rotating pumps are being more widely used for effective fluid handling as a result of growing infrastructure developments, especially in the water and wastewater management sector. The region's expanding industrial sector is also driving market expansion, particularly in the areas of chemicals, pharmaceuticals, and food processing. The implementation of environmental regulations and the growing emphasis on energy-efficient systems are also pushing enterprises to invest in sophisticated rotary pumps in order to minimize emissions and maximize operations, which are further factors propelling the growth of the rotary pump market.

Key Regional Takeaways:

United States Rotary Pump Market Analysis

The United States holds a substantial share of the North American rotary pump market at 85.40% in 2024. The US rotary pump market is gradually becoming more sought after, as industrial processes in such fields as oil and gas, food and beverage, and the chemical industry continue their expansion. Furthermore, relying on technological updates, including the use of energy-efficient and corrosion-resistant materials, as well as entering new fields. This is encouraged both by its highly developed industrial landscape and an ongoing effort to lay down new infrastructure that will help to increase production and productivity. These include commitments as stated by the U.S. Department of Energy, where over USD 350 Million was invested by IEDO in industrial innovation aimed at pushing America's global competitiveness. This shift toward clean energy investments is also driving requirement for more eco-friendly and energy-efficient pumping solutions. Rotating pumps are benefiting as more production processes in the manufacturing world are automated for higher operational efficiency. The oil and gas sector's demand for reliable pumps to handle hazardous corrosive liquids also drives up prices on the rotary market. Increasing environmental regulations further improves the competitive position of these area manufacturers who produce environmentally friendly pumps.

Europe Rotary Pump Market Analysis

Europe's rotary pump market is growing rapidly, spurred by the region's expansion of industrial base, notably into processing industries such as chemical treatment, water treatment, and automotive. Countries such as Germany, the United Kingdom, and France all play important roles in the rotation pump market, putting an even heavier emphasis on technology-driven advancement and more precision pumps with less energy expenditure. The oil and natural gas industries are also increasingly seeking out rotary pumps to refine operations where absolute liquid handling grabs corner talk accuracy essential. Strict environmental protection regulations have fostered the development of self-sufficient, ultra-low energy consumption pumps, compatible with the general trend in Europe toward greater environmental care and conservation. Manufacturers are working to produce efficient and durable pumps with the ability to withstand harsh conditions. Automation needs to be thrown at different industries to promote market growth. In the chemical sector, for example, Cefic reported an increase of 1.2% over Q2-2024 in production and production output, reflecting a healthy industry climate of implicit need for rotary pumps at industry bottom-end businesses.

Asia Pacific Rotary Pump Market Analysis

With industrialization powered by emerging economies like China and India, the market for rotary pumps in the Asia Pacific is getting bigger and larger fast. The primary forces driving this growth come from the chemical, oil and gas, and water treatment sectors. As industries in the region take up advanced technology to boost their productivity and cut costs of operation, so does the demand for reliable rotor pumps, which are both efficient and durable. India's oil and gas industry, for example, according to the India Brand Equity Foundation, will see demand for primary energy soar, almost doubling to 1,123 Million Tons of oil equivalent as the country’s GDP reaches USUSD 8.6 Trillion in 2040. This surge in the energy sector, including tremendous growth in oil and gas, also requires reliable rotary pumps to satisfy needs such as fluid transfer or chemical dosing. In addition, the region's comparatively good base of manufacturing is creating an atmosphere favorable for increased usage of rotary pumps in a diversity of applications. Government programs for the development, upgrade, or renewal of infrastructure and enforcement of environmental protection laws will offer great opportunities for expanding market share.

Latin America Rotary Pump Market Analysis

The Latin American rotary pump market has been doing well recently, with strong growth in industries such as oil and gas, agriculture, chemical processing, and others. Brazil and Mexico are leading the demand due to their strong industrial sectors and large-scale infrastructure projects. In Latin America, with the renewed emphasis on projects such as improving water and wastewater management systems and developing power resources covering a broader area of the surface before noticeably dwindling at last, rotary pump demand has risen accordingly. The World Bank states that a USD 150 Million project has been approved to upgrade road infrastructure in Bahia, Brazil, involving seven municipalities serving 2.35 Million people as part of a larger USD 1.662 Billion program. Such infrastructure improvements are helping to create the conditions for greater demand for tools and related equipment. Rotary pumps are used in all kinds of applications, for transporting fluids or dosing chemicals with precision. With its rising investment in automation and industrial equipment, the region's economic growth is bringing continuous enthusiasm to this field.

Middle East and Africa Rotary Pump Market Analysis

The Middle East and Africa rotary pump market is experiencing steady growth, mainly due to the burgeoning oil & gas industry in this region. Big contributors include Saudi Arabia and the United Arab Emirates, which are ploughing money into energy infrastructure projects and refining plants. The demand in the region for reliable and economical fluid handling solutions is growing rapidly, and rotary pumps have become popular both for their accuracy and stability. Furthermore, according to International Energy Agency projections, by 2024, investments in the Middle East would amount about USD 175 billion, of which 15% will go toward renewable energy. This trend toward cleaner energy investments is driving demand for pumping solutions that are more energy-efficient and less taxing on the environment. Increased need for water treatment and desalination projects as more regions encounter scarcity problems, their water supply is also giving an added boost to the demand for rotary pumps.

Competitive Landscape:

The rotary pump market is highly competitive due to demand from industries such as oil and gas, chemicals, food and beverage, and wastewater treatment. The competition mainly revolves around technology, product efficiency, durability, and operational cost-effectiveness. Manufacturers' emphasis is mainly on enhancing the flow rates, increasing energy efficiency, and improving materials for better wear resistance. Market participants are expanding through strategic mergers, acquisitions, and partnerships to strengthen distribution networks and increase production capacity. Customization for the industry-specific requirement types is another differentiator. The smart pump with internet of things (IoT) integration and predictive maintenance will define a new landscape in competition, with innovation holding the ace when it comes to market positioning and customer retention.

The report provides a comprehensive analysis of the competitive landscape in the rotary pump market with detailed profiles of all major companies, including:

- Dover Corporation

- SPX Flow, Inc.

- Xylem Inc.

- Colfax Corporation

- IDEX Corporation

- Busch Systems International Inc.

- Gardner Denver, Inc.

- Atlas Copco AB

- Pfeiffer Vacuum GmbH

- ULVAC Technologies, Inc

Latest News and Developments:

- In 2024, Atlas Copco launched its new DVS series of dry rotary vane pumps, specifically designed to enhance efficiency in industrial applications. These pumps feature a compact design and operate with minimal noise, making them suitable for environments requiring low operational sound levels. The DVS series is engineered to deliver high performance with reduced energy consumption, aligning with growing industry demands for sustainable solutions.

- In 2024, Dover Corporation announced the launch of its revolutionary patent-pending all-vehicle lift, which utilizes advanced rotary pump technology to enhance operational efficiency in automotive service applications.

- In 2024, SPX FLOW's Waukesha Cherry-Burrell® introduced the Universal® 2 ND Positive Displacement Pump (U2 ND) Series for industrial use. The pumps improved efficiency, reliability, and affordability by minimizing slip, enhancing volumetric efficiency, and providing long-lasting materials. The series broadened WCB's pump portfolio, backed by a robust sales network and local manufacturing.

- In 2024, Atlas Copco launched the DZS A series, a new-generation dry claw vacuum pump range that improved performance, efficiency, and reliability. In fixed and variable speed configurations, it provided higher pumping speeds, reduced noise, increased durability, and easier maintenance, decreased energy consumption and operating expenses for industrial processes.

- In 2024, Pfeiffer Vacuum+Fab Solutions introduced DuoVane, the new range of rotary vane vacuum pumps, which replaced the Pascal and DuoLine ranges. With 6–22 m³/h pumping speed, enhanced safety valves, water vapor compatibility, and low noise, DuoVane provides efficient, low-energy operation for uses such as freeze drying, sterilization, and analytical equipment globally.

Rotary Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vane, Screw, Lobe, Gear, Progressive Cavity (pc), Others |

| Operating Capacities Covered | Small (Upto 500 Gpm), Medium (500-1000 Gpm), High (More Than 1000 Gpm) |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End-Use Industries Covered | Oil and Gas, Power Generation, Chemical and Petrochemical, Water and Wastewater, Food and Beverage, Others |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | Dover Corporation, SPX Flow, Inc., Xylem Inc., Colfax Corporation, IDEX Corporation, Busch Systems International Inc., Gardner Denver, Inc., Atlas Copco AB, Pfeiffer Vacuum GmbH, ULVAC Technologies, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rotary pump market from 2019-2033.

- The rotary pump market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rotary pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rotary pump market was valued at USD 7.2 Billion in 2024.

The rotary pump market is projected to exhibit a CAGR of 4.19% during 2025-2033, reaching a value of USD 10.7 Billion by 2033.

The market is driven by the increasing demand for efficient fluid handling in industries such as oil & gas, chemicals, and water treatment. Technological advancements, rising industrial automation, and stringent environmental regulations promoting energy-efficient pumps are also contributing to market growth. Expanding pharmaceutical and food processing sectors further drives demand.

Asia Pacific currently dominates the rotary pump market, accounting for a share of 40.7% in 2024. The dominance is fueled by rapid industrialization, strong manufacturing growth in China and India, increasing infrastructure development, and high investments in oil & gas, chemicals, and water treatment projects.

Some of the major players in the rotary pump market include Dover Corporation, SPX Flow, Inc., Xylem Inc., Colfax Corporation, IDEX Corporation, Busch Systems International Inc., Gardner Denver, Inc., Atlas Copco AB, Pfeiffer Vacuum GmbH, ULVAC Technologies, Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)