Robotic Process Automation Market Report by Component (Software, Services), Operation (Rule-based, Knowledge-based), Deployment Model (On-premises, Cloud-based), Organization Size (Large Enterprises, Small and Medium Sized Enterprises), End User (BFSI, Healthcare and Pharmaceuticals, Retail and Consumer Goods, IT and Telecommunication, Government and Defense, Transportation and Logistics, Energy and Utilities, Others), and Region 2025-2033

Market Overview 2025-2033:

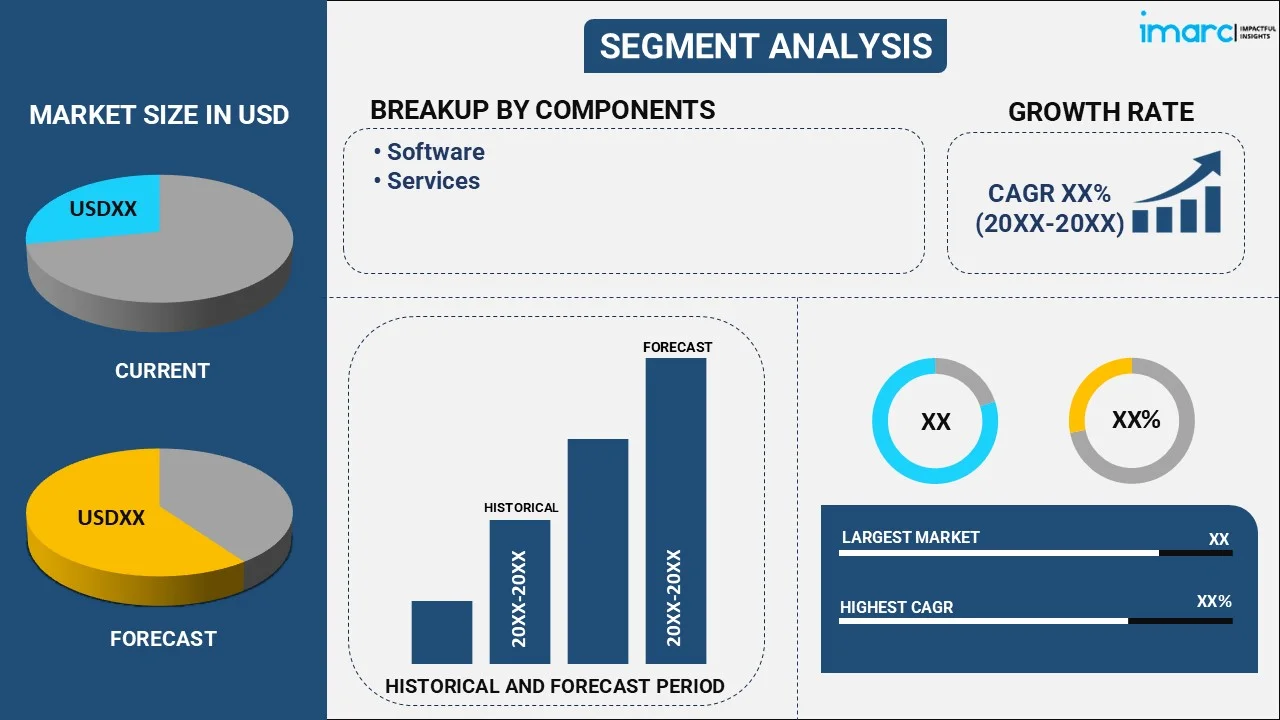

The global robotic process automation market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.4 Billion by 2033, exhibiting a growth rate (CAGR) of 24.9% during 2025-2033. The increasing need for operational efficiency, cost reduction, and enhanced accuracy in repetitive tasks, along with the rise of digital transformation initiatives and widespread integration of artificial intelligence are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 37.4 Billion |

| Market Growth Rate 2025-2033 | 24.9% |

Robotic process automation (RPA) refers to an advanced software technology that builds, deploys, and manages software robots. It aids in manipulating data, passing data from different applications, triggering responses, or executing transactions. It also assists in streamlining workflows and increasing employee satisfaction, engagement, and productivity by eliminating repetitive tasks from their workdays. Apart from this, it offers greater resilience and higher accuracy, and accelerates transformation, improves compliance and boosts productivity. As it is also scalable, requires minimal investment, and provides a significant return on investment (ROI), the application of RPA is expanding among numerous industry verticals across the globe.

Robotic Process Automation Market Trends:

Increasing Demand for Operational Efficiency

The rising demand for operational efficiency is a significant factor driving the robotic process automation (RPA) market. Businesses are constantly seeking ways to optimize workflows, reduce operational costs, and improve overall productivity. RPA enables organizations to automate repetitive and rule-based tasks, such as data entry, invoice processing, and report generation, leading to significant time savings and reduced human error. By streamlining processes, companies can allocate resources more effectively, allowing employees to focus on higher-value tasks that require critical thinking and creativity. This shift not only enhances employee satisfaction but also improves service delivery, enabling organizations to respond more quickly to customer needs. According to the robotic process automation market forecast, the emphasis on operational efficiency will continue to propel the adoption of RPA solutions across various industries.

Rapid Advancements in Technology

Rapid advancements in technology are significantly influencing the growth of the RPA market. The integration of artificial intelligence (AI) and machine learning (ML) with RPA tools has expanded automation capabilities beyond simple, rule-based tasks to more complex processes involving decision-making and data analysis. These technological innovations allow RPA to handle unstructured data, interact with multiple applications, and learn from past interactions, making it a more versatile solution for organizations. In line with this, as technology continues to evolve, organizations are increasingly looking to leverage RPA solutions to enhance their operational efficiency and competitiveness in a fast-paced digital landscape, which, in turn, is contributing to the robotic process automation market growth.

Shift Towards Digital Transformation

Organizations across various industries are recognizing the need to embrace digital technologies to stay competitive and meet changing customer expectations. RPA serves as a vital component of digital transformation initiatives, enabling businesses to automate mundane tasks and improve process efficiency. By integrating RPA into their operations, companies can achieve greater agility, enhance data accuracy, and accelerate service delivery. In addition to this, the push for digital transformation encourages organizations to invest in RPA technologies, positioning it as a key driver of innovation and growth in the modern business landscape. This ongoing shift toward digital transformation is increasing the overall robotic process automation market share.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global robotic process automation market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on component, operation, deployment model, organization size and end user.

Breakup by Component:

- Software

- Services

Breakup by Operation:

- Rule-based

- Knowledge-based

Breakup by Deployment Model:

- On-premises

- Cloud-based

Breakup by Organization Size:

- Large Enterprises

- Small and Medium Sized Enterprises

Breakup by End User:

- BFSI

- Healthcare and Pharmaceuticals

- Retail and Consumer Goods

- IT and Telecommunication

- Government and Defense

- Transportation and Logistics

- Energy and Utilities

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global robotic process automation market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Amelia US LLC

- Automation Anywhere Inc.

- AutomationEdge

- Blue Prism Group PLC

- Infosys Limited

- International Business Machines Corporation

- Kofax Inc.

- NICE Ltd.

- Pegasystems Inc.

- UiPath

- Verint Systems

- WorkFusion Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Robotic Process Automation Market News:

- In February 2023, Robocorp, the leading Gen2 robotic process automation (RPA) company, announced their new partnership with Neostella, a North American leader in the Robot as a Service space, specializing in automation, business consulting, and implementation services.

- In October 2023, NewVision Software, a leading global digital transformation services and consulting company, became an authorized implementation and reseller partner of UiPath, a leading enterprise Robotic Process Automation (RPA) software company. The partnership is aimed at enabling global businesses to accelerate automation, drive digital transformation, and reduce costs.

- In December 2023, Saudia Private announced a digital transformation strategy encompassing a range of technological advancements, including the soft launch of Robotic Process Automation (RPA), as a part of its efforts to reimagine customer experience and achieve operational excellence.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Component, Operation, Deployment Model, Organization Size, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amelia US LLC, Automation Anywhere Inc., AutomationEdge, Blue Prism Group PLC, Infosys Limited, International Business Machines Corporation, Kofax Inc., NICE Ltd., Pegasystems Inc., UiPath, Verint Systems, WorkFusion Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global robotic process automation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global robotic process automation market?

- What are the key regional markets?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the operation?

- What is the breakup of the market based on the deployment model?

- What is the breakup of the market based on the organization size?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global robotic process automation market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)