Robot End Effector Market Size, Share, Trends and Forecast by Product, Application, End Use Industry, and Region, 2025-2033

Robot End Effector Market Size and Share:

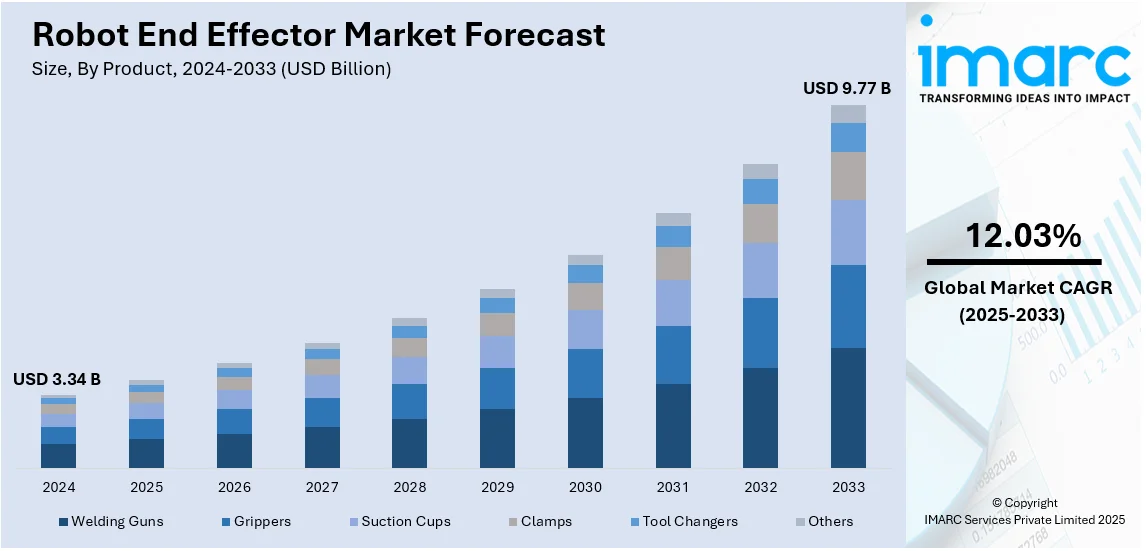

The global robot end effector market size was valued at USD 3.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.77 Billion by 2033, exhibiting a CAGR of 12.03% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 42.8% in 2024. The robot end effector market share is expanding, driven by the increasing need for automation in different industries, along with the rising adoption of artificial intelligence (AI), enabling more precise handling, improved adaptability, and enhanced decision-making capabilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.34 Billion |

|

Market Forecast in 2033

|

USD 9.77 Billion |

| Market Growth Rate (2025-2033) | 12.03% |

As industries keep automating processes to boost efficiency and reduce labor costs, the demand for efficient robot end effector is rising. Companies use robots in manufacturing, logistics, and healthcare. Besides this, the expansion of e-commerce platforms is encouraging warehouses to adopt robotic grippers for faster order fulfillment. Additionally, in healthcare, robotic arms assist in surgeries and patient care, promoting innovations in precision tools. The shift towards electric vehicles (EVs) also creates the need for robotic welding and assembly. Apart from this, advancements in AI and sensors make end effectors smarter, allowing them to handle delicate or complex tasks with greater accuracy.

The United States has emerged as a major region in the robot end effector market owing to many factors. The rising reliance of industries on automation to improve productivity and reduce labor shortages is offering a favorable robot end effector market outlook. The manufacturing sector relies on robotic arms for assembly, welding, and material handling. Besides this, the expansion of online retail channels is encouraging warehouses to employ robotic grippers for faster packaging and sorting. AI and sensor advancements further make end effectors more efficient, helping businesses to manage complex tasks. Moreover, government initiatives supporting AI infrastructure, automation, and reshoring of manufacturing also promote the adoption of robot end effectors. In January 2025, the US President, Donald Trump declared private sector spending reaching up to USD 500 Billion to support infrastructure for AI, with the goal of surpassing competitor countries in the technology sector. Small and medium businesses also invest in affordable robotic solutions, making automation more widespread.

Robot End Effector Market Trends:

Increasing Demand for Flexible Automation

There is a growing demand for robots that can perform multiple tasks using different end effectors, as industries evolve. This flexibility allows companies to streamline operations and adapt quickly to varying production needs. For instance, in August 2024, ATI Industrial Automation unveiled the GBX 10 Gigabit Ethernet Tool Changer Module, enhancing robotic flexibility and performance. This module aimed at refining communication, supporting fast data transfer, and enabling seamless tool changes. This, in turn, assists in reducing downtime and increasing overall operational efficiency in manufacturing and logistics. The global logistics market is set to attain USD 8.1 Trillion by 2033, exhibiting a CAGR of 4.02% from 2025-2033, according to recent industry reports.

Advancements in AI-Oriented Robot End Effectors

Innovations in AI-based robot end effectors are fueling the market growth. Modern robot end effectors are becoming more intelligent with the integration of AI. As per the IMARC Group, the global AI market reached USD 115.62 Billion in 2024 and is anticipated to grow at a CAGR of 23.64% during 2025-2033. These advancements enable more precise handling, improved adaptability, and enhanced decision-making capabilities, thereby allowing robots to perform complex tasks autonomously while reducing human intervention in various industrial applications. For instance, in March 2024, Agility Robotics introduced Agility Arc, a cloud automation platform that could enhance robotic fleet management and streamline end effector operations. This development boosts automation efficiency in logistics and manufacturing, thereby simplifying robot end effectors deployment and integration.

Growth in Precision Tasks Across Industries

The expansion of precision tasks across industries is impelling the robot end effector market growth. In manufacturing, robotic arms with advanced grippers and tool changers assemble small and delicate components in electronics and automotive production. In healthcare, robotic-assisted surgeries demand precise end effectors for accuracy and safety. The rise of EVs also catalyzes the demand for specialized tooling in battery production. Modern sensors enhance robotic precision, enabling adaptive gripping for complex tasks. As industries seek greater efficiency and quality control, the need for high-precision robotic end effectors is rising, making them essential for modern automated systems. In response, firms are working to develop innovative solutions. For instance, in June 2024, ABB revealed the OmniCore platform, delivering quicker and more accurate robotic control featuring built-in AI and sensor technologies. This platform aimed to refine automation potential in precise operations, allowing robots to work more effectively while lowering power usage by as much as 20%

Robot End Effector Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global robot end effector market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use industry.

Analysis by Product:

- Welding Guns

- Grippers

- Suction Cups

- Clamps

- Tool Changers

- Others

Grippers held 37.6% of the market share in 2024. They are essential for handling, assembling, and packaging tasks across various industries. As automation increases in manufacturing, logistics, and healthcare, the demand for robotic grippers grows due to their ability to handle objects with precision and speed. In e-commerce and warehousing, vacuum and mechanical grippers help to sort and package goods efficiently, improving order fulfillment. The rise of collaborative robots (cobots) also drives the demand for flexible grippers that can safely work alongside humans. In automotive and electronics manufacturing, grippers assist in assembling small and delicate components with high accuracy. Technological advancements, such as AI-based adaptive gripping and soft robotics, make grippers more versatile, allowing them to handle objects of different shapes and textures. Their affordability and easy integration into existing robotic systems further strengthen their market dominance. As industries continue to automate processes, grippers remain the preferred choice for reliable and precise material handling.

Analysis by Application:

- Handling

- Assembling

- Welding

- Dispensing

- Painting

- Others

Handling accounts for 48.0% of the market share. It is a fundamental requirement across various industries, including manufacturing, logistics, and healthcare. As automation activities expand, businesses rely on robotic end effectors for material handling, pick-and-place operations, and packaging, making handling applications the most widely employed. In warehouses and e-commerce fulfillment centers, robots equipped with grippers and suction cups speed up sorting and packaging, improving efficiency. In manufacturing, robotic arms handle raw materials, assemble products, and transport components, reducing labor costs and enhancing precision. The increasing adoption of cobots further boosts handling applications, as these robots aid human workers in repetitive or heavy-lifting tasks. Additionally, technological advancements in AI and machine vision refine the ability of robot end effectors to handle different shapes, sizes, and textures with accuracy. As companies prioritize automation for efficiency and cost savings, handling applications remain the leading driver in the market.

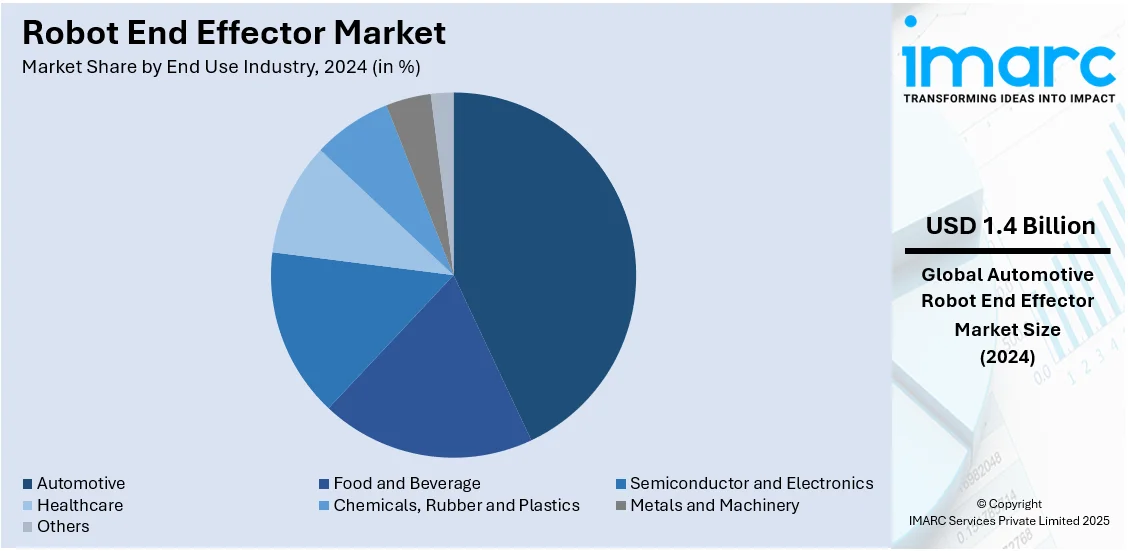

Analysis by End Use Industry:

- Automotive

- Food and Beverage

- Semiconductor and Electronics

- Healthcare

- Chemicals, Rubber and Plastics

- Metals and Machinery

- Others

Automotive holds 43.2% of the market share. It relies heavily on automation for manufacturing, assembly, and material handling. As car production becomes more advanced, robotic arms with specialized end effectors are essential for welding, painting, and assembling intricate components with high precision. The rising shift towards EVs further drives the demand for robotic automation, as battery assembly and lightweight material handling require specialized grippers and tool changers. Automotive manufacturers also use robotic end effectors for quality control, ensuring consistency and reducing defects in mass production. The need for faster production cycles and cost efficiency encourages companies to adopt flexible and adaptive end effectors that can handle various tasks. Additionally, cobots with modern gripping and sensing technology assist human workers in assembly lines, improving safety and productivity. As the automotive industry continues to evolve with new technologies, the requirement for high-performance robot end effectors remains strong.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 42.8%, enjoys the leading position in the market. The region is recognized for its strong manufacturing base, rapid industrial automation, and growing adoption of robotics. Countries like China, Japan, and South Korea dominate worldwide production in industries, such as automotive, electronics, and consumer goods, driving high demand for robotic end effectors. As labor costs rise, businesses invest in automation to improve efficiency and reduce dependence on human workers. Besides this, the expansion of e-commerce portals creates the need for robotic grippers and suction cups in warehouses and fulfillment centers. Government initiatives supporting smart factories and Industry 4.0 also encourage companies to adopt advanced robotic technologies. Additionally, the rise of EV production in the area catalyzes the demand for robotic tooling in battery assembly and lightweight material handling. According to the IBEF, India aims to increase the share of EV sales to 30% for private cars, 70% for commercial vehicles, 80% for two-wheelers and three-wheelers, and 40% for buses by 2030. This represents an ambitious goal of 80 Million EVs on Indian roads by 2030.

Key Regional Takeaways:

United States Robot End Effector Market Analysis

The United States market is expanding due to increasing automation across industries, such as manufacturing, agriculture, logistics, and healthcare. The growing adoption of cobots in small and medium-sized enterprises (SMEs) is driving the demand for modern end effectors, including adaptive grippers, vacuum suction cups, and tool changers that enhance flexibility and efficiency. The rise of e-commerce and warehouse automation has further heightened the need for robotic arms with specialized end effectors capable of handling diverse packaging, sorting, and material-handling tasks. Additionally, advancements in AI and machine learning (ML) are enabling smarter and more responsive end effectors that can adjust to varying tasks and materials. The healthcare sector is also propelling the market growth, with the high popularity and success of robotic-assisted surgeries and laboratory automation, which require high-precision robotic grippers and force-sensitive end effectors. According to the United States National Institutes of Health (NIH), with individuals who underwent robotic surgery in 2022, there was a 77% reduction in the occurrence of blood clots and a 52% decrease in the risk of readmission in comparison to those who underwent open surgery. Besides this, the focus on greater productivity and reliability in automotive and aerospace manufacturing is catalyzing the demand for sophisticated robot end effectors competent for managing complex assembly processes.

Europe Robot End Effector Market Analysis

The market is growing rapidly on account of the strong presence of prominent automotive manufacturers in Germany, France, and Italy, which is driving the demand for advanced robotic grippers, welding tools, and force-sensitive end effectors to improve production efficiency. Moreover, the expansion of smart factories and Industry 4.0 initiatives across Europe is further enabling the adoption of intelligent end effectors with enhanced precision, adaptability, and ML capabilities. The logistics and e-commerce sectors are also investing in robotic systems equipped with vacuum grippers and adaptive suction cups to optimize warehouse automation and order fulfillment. According to a report by the IMARC Group, the Europe e-commerce market is projected to hit USD 8.46 Trillion by 2033, growing at a CAGR of 8.30% during 2025-2033. Additionally, the stringent labor regulations of the European Union and rising labor costs in the region are encouraging businesses to deploy robots with highly efficient robot end effectors to reduce dependency on human labor. The food and beverage (F&B) industry is also witnessing increased adoption of robotic end effectors designed for delicate handling and hygienic processing, driven by strict EU safety and quality regulations.

Asia-Pacific Robot End Effector Market Analysis

The market in the Asia-Pacific region is driven by the growing automotive production in the region, particularly in nations, such as India and Japan, where manufacturers are increasingly employing robotic systems for welding, assembly, and material handling. For example, in India, 25.9 Million vehicles were manufactured and 47,61,487 automobiles were exported in FY23. Similarly, the number of sales of new passenger cars reached 3,448,272 in Japan in 2022. In addition to this, the rising focus on EV manufacturing is further catalyzing the demand for advanced robot end effectors capable of handling battery components and lightweight materials. Expanding investment in AI-based robotics and soft grippers is also refining automation capabilities, making robotic systems more adaptable for delicate and complex tasks. Furthermore, government-supported initiatives that promote domestic robotics manufacturing and research are expediting the development of next-generation robot end effectors in the region.

Latin America Robot End Effector Market Analysis

The Latin America market is growing due to increasing automation in industries, such as automotive, food processing, and logistics. The rise in vehicle manufacturing in Brazil, Mexico, and Argentina is driving the demand for robotic grippers and welding tools to improve production efficiency. Moreover, the region’s burgeoning e-commerce sector is attracting investments in warehouse automation where robotic arms with suction cups and adaptive grippers enhance material handling. As per recent industry reports, the e-commerce market in Brazil is projected to expand at a CAGR of 13.32% during 2025-2033, while the Mexico e-commerce market is anticipated to grow at a CAGR of 14.5% over the same period. Additionally, foreign direct investment (FDI) in robotics manufacturing, particularly in Mexico and Brazil, is fostering technological advancements in adaptive and AI-based robot end effectors.

Middle East and Africa Robot End Effector Market Analysis

The market in the Middle East and Africa is expanding due to the increasing employment of automation in industries, such as oil and gas, manufacturing, and logistics. The region’s growing reliance on robotics for industrial operations, particularly in the UAE and Saudi Arabia, is catalyzing the demand for modern robot end effectors capable of handling complex tasks. Moreover, the market growth is also supported by the high adoption of robotics in renewable energy projects, particularly in solar panel manufacturing and installation where precision robotic grippers enhance efficiency. According to the International Energy Agency (IEA), in 2024, investments in energy were set to reach USD 175 Billion in the Middle East, of which renewable energy accounted for approximately 15%. Besides this, the mining industry also utilizes rugged robotic end effectors for exploration and extraction in harsh environments, further contributing to overall industry expansion.

Competitive Landscape:

Key players work on developing new automation solutions to meet the high robot end effector market demand. Big companies are creating advanced grippers, suction cups, and tool changers to refine precision and flexibility in industries like manufacturing, logistics, and healthcare. They wager on AI and sensor technology to enhance robot efficiency and adaptability, making automation more accessible for various applications. Partnerships with automotive and electronics manufacturers help to integrate robotic solutions into production lines, boosting efficiency and reducing costs. Firms also focus on affordability and customization, encouraging small and medium businesses to adopt robotics. Mergers and acquisitions strengthen market positions and broaden item portfolios. By improving technology, forming industry collaborations, and expanding market reach, key players accelerate the adoption of robotic end effectors across different sectors. For instance, in February 2024, Anyware Robotics conducted tests on its Pixmo robot, which utilized a vacuum-operated device to autonomously unload containers. It aimed to enhance logistics safety and efficiency by employing AI for intelligent operations. It was capable of adjusting to various tasks with simple deployment and software upgrades.

The report provides a comprehensive analysis of the competitive landscape in the robot end effector market with detailed profiles of all major companies, including:

- ABB Ltd.

- Applied Robotics Inc.

- ATI Industrial Automation Inc.

- Bastian Solutions LLC (Toyota Industries Corporation)

- Festo Beteiligungen GmbH & Co. KG

- FIPA Inc.

- KUKA Aktiengesellschaft (Midea Group Co. Ltd.)

- Schmalz-International GmbH

- SMC Corporation

- Soft Robotics Inc.

- Weiss Robotics GmbH & Co KG

- Zimmer Group GmbH

Latest News and Developments:

- February 2025: TESOLLO, a prominent maker of robot grippers located in South Korea, unveiled the Delto Gripper-5 Finger (DG-5F), an advanced and creative robotic hand designed for humanoid robots. The innovative item boasted 20 degrees of movement, five fingers that functioned independently, and four joints, closely resembling a human hand. The DG-5F was to open up for sale beginning March 2025.

- January 2025: Piab, a global leader in robotic equipment, broadened its range of industrially appropriate devices to feature magnetic grippers. The magnets were developed to enhance handling and assembly processes by providing stable and efficient gripping and movement of metal parts.

- January 2025: Shadow Robot teamed up with Google DeepMind to develop a cutting-edge robotic hand, the DEX-EE, to meet the needs of their real-world ML applications. The item’s ultra-quick sensor arrays provided numerous tactile detection lines for every finger, accompanied by comprehensive data from the sensors.

- October 2024: In partnership with Meta AI, GelSight introduced the Digit 360, designed for robot end effector fingers. The Digit 360 was a fingertip-shaped robotic touch sensor that converted touch into digital signals with human-like precision to deliver detailed tactile feedback. It represented the subsequent stage in the partnership between GelSight and Meta AI and intended to enhance this field of sensory perception technologies.

- July 2024: WEISS North America released the DR series delta robots designed for rapid assembly and handling tasks. These robots utilized lightweight materials, improved accuracy, and built-in control systems.

- February 2024: The TIAGo Industrial Project introduced a flexible mobile manipulator aimed at boosting robotic efficiency in manufacturing. This initiative emphasized improving human-robot collaboration.

Robot End Effector Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Welding Guns, Grippers, Suction Cups, Clamps, Tool Changers, Others |

| Applications Covered | Handling, Assembling, Welding, Dispensing, Painting, Others |

| End Use Industries Covered | Automotive, Food and Beverage, Semiconductor and Electronics, Healthcare, Chemicals, Rubber and Plastics, Metals and Machinery, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Applied Robotics Inc., ATI Industrial Automation Inc., Bastian Solutions LLC (Toyota Industries Corporation), Festo Beteiligungen GmbH & Co. KG, FIPA Inc., KUKA Aktiengesellschaft (Midea Group Co. Ltd.), Schmalz-International GmbH, SMC Corporation, Soft Robotics Inc., Weiss Robotics GmbH & Co KG, Zimmer Group GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the robot end effector market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global robot end effector market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the robot end effector industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The robot end effector market was valued at USD 3.34 Billion in 2024.

The robot end effector market is projected to exhibit a CAGR of 12.03% during 2025-2033, reaching a value of USD 9.77 Billion by 2033.

As the manufacturing sector continues to integrate robotics for assembly, welding, and material handling, the demand for advanced end effectors rises. Besides this, the shift towards EVs also drives the demand for specialized robotic tools in battery production and assembly. Additionally, advancements in AI, sensors, and adaptive gripping technologies enable robot end effectors to handle delicate and complex tasks.

Asia-Pacific currently dominates the robot end effector market, accounting for a share of 42.8% in 2024, driven by its strong manufacturing base, rising automation adoption, and expansion of e-commerce sites. Countries like China and Japan drive the demand in automotive and electronics industries, while government support and technological advancements further encourage robotic adoption.

Some of the major players in the robot end effector market include ABB Ltd., Applied Robotics Inc., ATI Industrial Automation Inc., Bastian Solutions LLC (Toyota Industries Corporation), Festo Beteiligungen GmbH & Co. KG, FIPA Inc., KUKA Aktiengesellschaft (Midea Group Co. Ltd.), Schmalz-International GmbH, SMC Corporation, Soft Robotics Inc., Weiss Robotics GmbH & Co KG, Zimmer Group GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)