Rice Noodles Market Report by Cooking Method (Instant, Conventional), Product (Vermicelli, Stick, Wide, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, and Others), and Region 2025-2033

Global Rice Noodles Market:

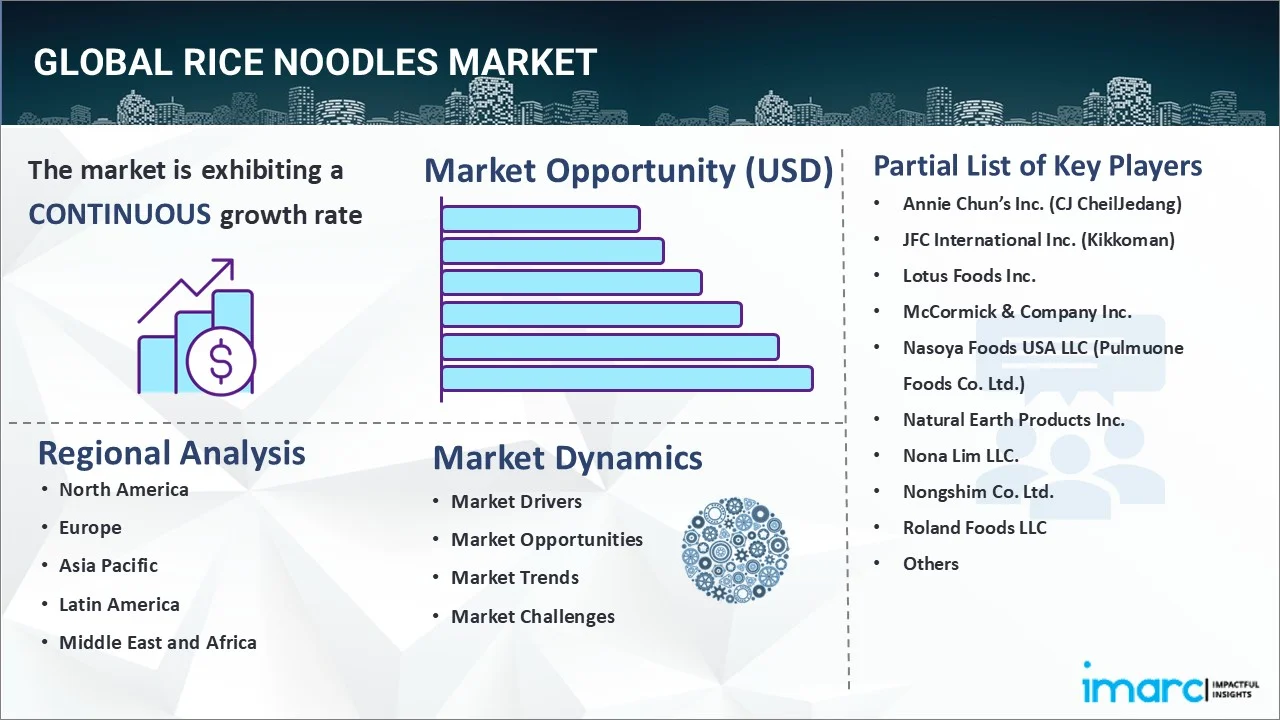

The global rice noodles market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.4 Billion by 2033, exhibiting a growth rate (CAGR) of 11.7% during 2025-2033. The growing popularity of Asian cuisine, the easy availability of fresh, frozen, and dried rice noodles in various shapes and excellent textures, and the increasing demand for healthy and gluten-free noodles are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.0 Billion |

| Market Forecast in 2033 | USD 17.4 Billion |

| Market Growth Rate (2025-2033) | 11.7% |

Rice Noodles Market Analysis:

- Major Market Drivers: The rising health consciousness among consumers is augmenting the demand for noodles made from healthy ingredients, like rice, which is primarily driving the rice noodle market growth. Rice noodles are manufactured using bran and germ of rice and are thus a rich source of essential vitamins and minerals that aid in improving digestion.

- Key Market Trends: Several product innovations, such as the launch of ready-to-eat (RTE) instant rice noodles in a variety of flavors are significant key trends, propelling the rice noodles market share. Additionally, the escalating number of Quick Serving Restaurants (QSRs), serving rice noodles are further contributing to the rice noodles market demand.

- Geographic Landscape: According to the rice noodle market research report, North America currently dominates the global market. According to the report, North America currently dominates the global market. The escalating number of Asian restaurants and the rising migration of the Asian population to Canada, the U.S., and Mexico are the major factors bolstering the growth of the regional market.

- Competitive Landscape: Some of the major players in the global rice noodles market include Annie Chun’s Inc. (CJ CheilJedang), JFC International Inc. (Kikkoman), Lotus Foods Inc., McCormick & Company Inc., Nasoya Foods USA LLC (Pulmuone Foods Co. Ltd.), Natural Earth Products Inc., Nona Lim LLC., Nongshim Co. Ltd., Roland Foods LLC, Thai President Foods Public Company Limited, and Ying Yong Food Products, among many others.

- Challenges and Opportunities: The rice noodles market faces challenges, such as competition from other noodle varieties and fluctuations in rice prices. However, there are opportunities for growth, driven by increasing consumer interest in gluten-free and healthier food options. Innovations in packaging and distribution channels also present opportunities for market expansion.

Rice Noodles Market Trends:

The Increasing Healthy Snacking Options

The expanding working population with hectic lifestyles and busy schedules across countries is inflating the demand for meals and snacks that are convenient, ready-to-make, and gluten-free. Consequently, numerous companies are introducing gluten-free products, like rice noodles, that go beyond conventional bakery items, such as biscuits, pastries, pasta, cakes, etc. For instance, in March 2024, Lotus Foods, the leading heirloom, and organic rice company, introduced an enhancement to their Organic Asian Rice Noodle Line with two even better Pad Thai Rice Noodles in traditional and brown rice varieties. Furthermore, the inflating spending capacities of consumers, along with the increasing product availability across online marketplaces, are anticipated to positively impact the rice noodles market outlook in the coming years.

Increasing Brand Offerings

The wide presence of multinational companies that are focusing on manufacturing innovative flavors in rice noodles to expand their product portfolio by entering into strategic partnerships and collaborations, are fueling the global rice noodles market growth. For instance, Asia Rice Noodles opened a new fast-casual Chinese eatery in Greenpoint in September 2023. The new restaurant joined the influx of casual Asian cuisine in North Brooklyn with spots like Milu, Nan Xiang Express, and Oh Dumplings. In addition to this, various rice noodle brands are also experimenting with flavors and seasonings to cater to the evolving needs of consumers. For instance, Duy And, Vietnam, a brand that specializes in rice products, developed rice noodles in watermelon flavor-an unusual combination that seems to have worked, as the product has won numerous local and regional awards. Similarly, Thai rice noodles from Foodle Noodle offer a range of clean-label rice noodles made with organic ingredients. The firm believes that its range of rice noodles will pull consumers away from unhealthy labels. Such innovations in product offerings are projected to catalyze the growth of the market in the years to come.

Growing Preference for Cross-Continental Cuisines

The emerging preferences for cross-continental cuisines, like Chinese and Thai, are further catalyzing the market for rice noodles. Rice noodles originated in China thousands of years ago and are currently enjoyed by individuals of numerous cultures across the globe. According to a Meituan-Dianping report, over 600,000 Chinese fine-dining restaurants have been witnessing remarkable growth overseas. Moreover, restaurants serving Cambodian, Burmese, Filipino, Indonesian, Lao, Malaysian, Thai, and Vietnamese cuisines have also been recording growing demand for rice noodles domestically and overseas. In addition to this, Asian food establishments are stepping up by offering a wide range of meat-free options that celebrate the essence of traditional Asian flavors, which is creating a positive outlook for the overall market.

Global Rice Noodles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rice noodles market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on cooking method, product and distribution channel.

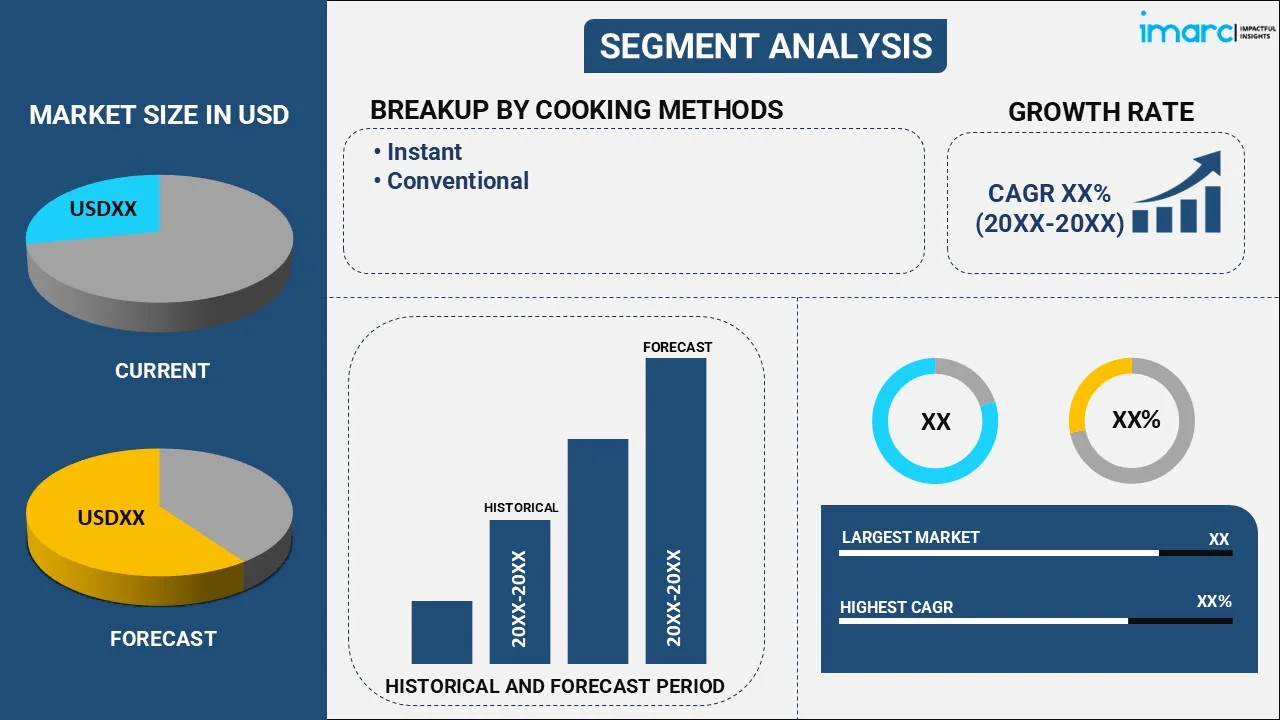

Breakup by Cooking Method:

- Instant

- Conventional

Currently, the conventional method holds the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the cooking method. This includes instant and conventional. According to the rice noodles market report, the conventional method holds the majority of the total market share.

Many consumers prefer the taste and texture of rice noodles made using traditional methods, which often involve soaking rice, grinding it into a paste, and steaming it to form noodles. This traditional method is seen as more authentic and retains the original flavor of rice. Moreover, the conventional method has been used for centuries and established a strong foothold in the market. Consumers are familiar with these noodles and trust the quality and taste they offer, leading to continued demand and market dominance.

Breakup by Product:

- Vermicelli

- Stick

- Wide

- Others

Stick currently exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes vermicelli, stick, wide, and others. According to the report, stick currently exhibits a clear dominance in the market.

The versatility of stick noodles has resulted in significant production adoption. These products are used for preparing numerous dishes, including Ka Teu, char kway teow, Mohinga, Pancit Bihon, Bihun, Khao Poon, Asam Laksa, Khao Soi, etc. Moreover, stick rice noodles provide carbohydrates for energy and are relatively low in fat, making them more desirable than other rice noodle variants.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets account for the largest market share

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, and others. According to the report, supermarkets and hypermarkets account for the largest market share.

The availability of rice noodles in hypermarkets and supermarkets is driven by an increasing number of Asian immigrants across the globe. Moreover, supermarkets and hypermarkets offer a wide range of rice noodle brands and varieties, making them easily accessible to consumers. In addition to this, the increasing urbanization and busy lifestyles of consumers have resulted in a preference for one-stop shopping destinations like supermarkets and hypermarkets.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

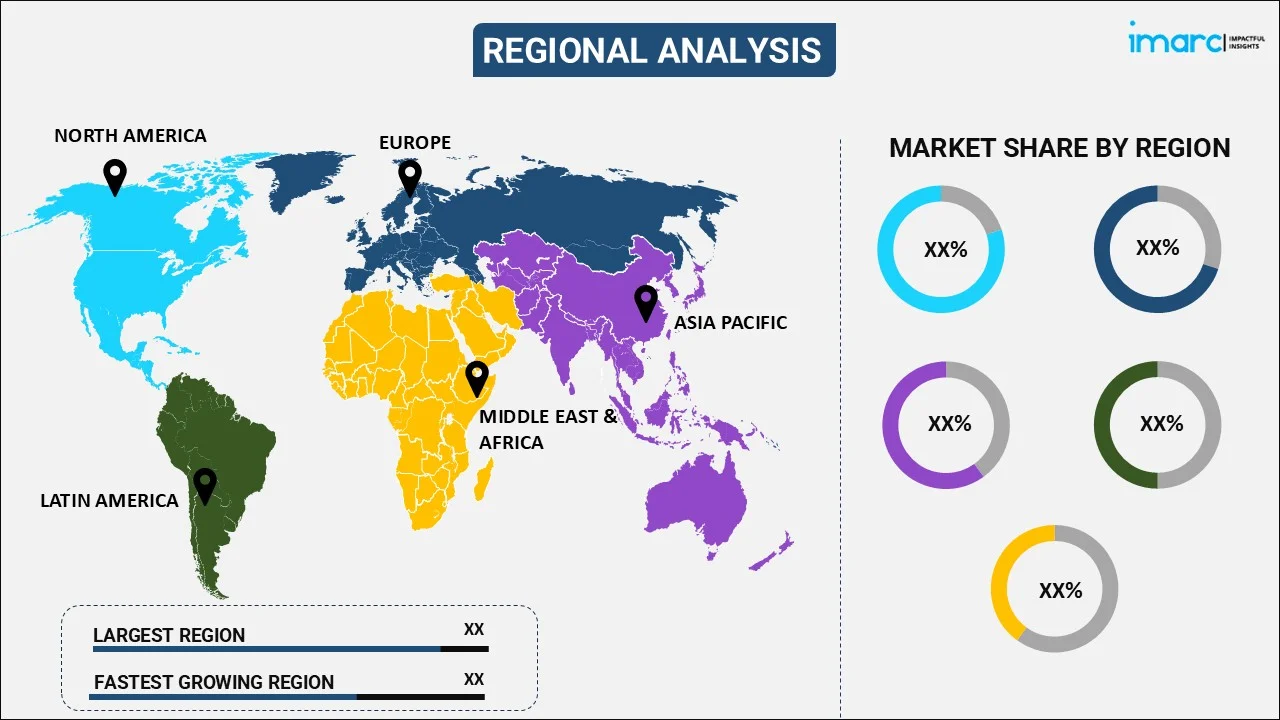

North America currently dominates the global market

The report has provided a detailed breakup and analysis of the market based on the region. This includes North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa. According to the report, North America currently dominates the global market.

The escalating number of Asian restaurants and the rising migration of the Asian population to Canada, the U.S., and Mexico are the major factors bolstering the growth of the regional market. The concept of instant rice noodles is also attracting a large number of Americans to try the product. The ease of preparation makes it a feasible diet alternative. Moreover, various Asian restaurants are being opened in the region to cater to the demand for Asian cuisines, like rice noodles. For instance, Ten Seconds Yunnan Rice Noodle, a Chinese chain having 70 branches in North America, opened a new branch in Hawaii in August 2023.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Annie Chun’s Inc. (CJ CheilJedang)

- JFC International Inc. (Kikkoman)

- Lotus Foods Inc.

- McCormick & Company Inc.

- Nasoya Foods USA LLC (Pulmuone Foods Co. Ltd.)

- Natural Earth Products Inc.

- Nona Lim LLC.

- Nongshim Co. Ltd.

- Roland Foods LLC

- Thai President Foods Public Company Limited

- Ying Yong Food Products

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Rice Noodles Market News:

- September 2023: Asia Rice Noodles opened a new fast-casual Chinese eatery in Greenpoint. The new restaurant joined the influx of casual Asian cuisine in North Brooklyn with spots like Milu, Nan Xiang Express, and Oh Dumplings.

- August 2023: Ten Seconds Yunnan Rice Noodle opened a new outlet at Pearlridge Center, Hawaii. The noodle menu includes golden hot and sour soup, pork bone soup, a vegetarian tomato soup, Szechuan mala spicy soup, and more. Noodles are made with rice flour, making them gluten-free.

Global Rice Noodles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Cooking Method, Product, Distribution Channel, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Annie Chun’s Inc. (CJ CheilJedang), JFC International Inc. (Kikkoman), Lotus Foods Inc., McCormick & Company Inc., Nasoya Foods USA LLC (Pulmuone Foods Co. Ltd.), Natural Earth Products Inc., Nona Lim LLC., Nongshim Co. Ltd., Roland Foods LLC, Thai President Foods Public Company Limited and Ying Yong Food Products |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rice noodles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rice noodles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rice noodles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global rice noodles market to exhibit a CAGR of 11.7% during 2025-2033.

The rising adoption of vegan dietary patterns, coupled with the widespread availability of rice noodles in fresh, frozen, and dried variants, that are seasoned with herbs, spices and oils to obtain the desired flavor, is primarily driving the global rice noodles market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of rice noodles.

Based on the cooking method, the global rice noodles market can be segmented into instant and conventional. Currently, conventional method holds the majority of the total market share.

Based on the product, the global rice noodles market has been divided into vermicelli, stick, wide, and others. Among these, stick currently exhibits a clear dominance in the market.

Based on the distribution channel, the global rice noodles market can be categorized into supermarkets and hypermarkets, convenience stores, online stores, and others. Currently, supermarkets and hypermarkets account for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global rice noodles market include Annie Chun’s Inc. (CJ CheilJedang), JFC International Inc. (Kikkoman), Lotus Foods Inc., McCormick & Company Inc., Nasoya Foods USA LLC (Pulmuone Foods Co. Ltd.), Natural Earth Products Inc., Nona Lim LLC., Nongshim Co. Ltd., Roland Foods LLC, Thai President Foods Public Company Limited, and Ying Yong Food Products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)