Rice Bran Oil Market Size, Share, Trends and Forecast by End-Use and Region, 2025-2033

Rice Bran Oil Market Size and Share:

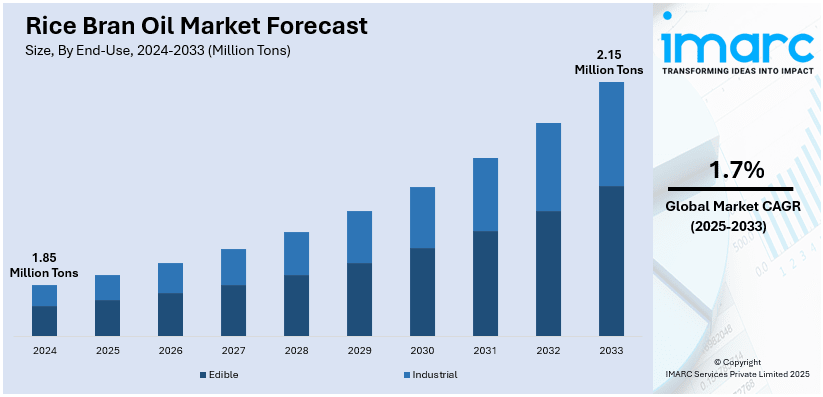

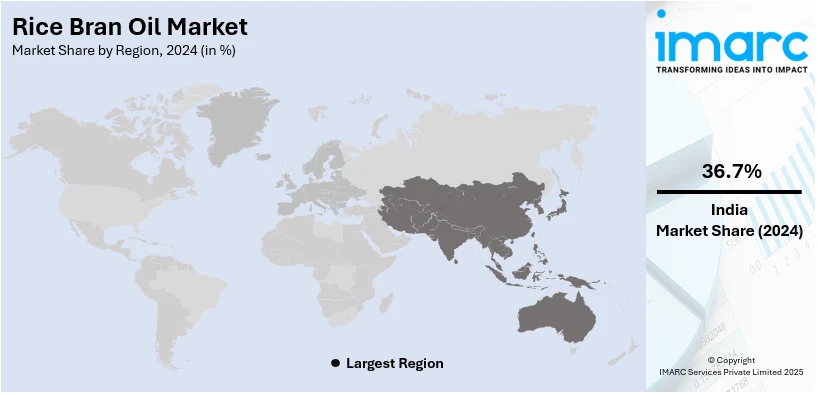

The global rice bran oil market size was valued at 1.85 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 2.15 Million Tons by 2033, exhibiting a CAGR of 1.7% during 2025-2033. India currently dominates the market, holding a significant market share of over 36.7% in 2024. The rice bran oil market share is primarily driven by the growing edible oil demand, increasing rice production, rising awareness regarding the health benefits of rice bran oil, and innovations in advertisement and extraction technology to improve oil yield and quality.

Rice Bran Oil Market Highlights:

- A unique driver in the rice bran oil market is its growing demand as a "heart-friendly" cooking oil due to its high oryzanol content, which helps reduce cholesterol levels. This health benefit appeals strongly to health-conscious consumers, especially in urban populations seeking alternatives to traditional oils. Additionally, its light flavor, high smoke point, and antioxidant properties make it suitable for various cooking methods, further enhancing its popularity in both household and food service sectors worldwide.

- In 2024, India held the largest rice bran oil market share at over 36.7%, driven by supportive government policies and rising health consciousness. Initiatives like NAFED's 2021 launch of fortified rice bran oil under the 'Aatmnirbhar Bharat' scheme encourage domestic production, boosting demand for healthier edible oil alternatives nationwide.

- The edible segment led the rice bran oil market with a 78.7% share in 2024, owing to its health advantages, neutral taste, and high smoke point, making it suitable for various cooking methods. Its cholesterol-lowering properties further attract health-conscious consumers, solidifying its position as a preferred edible oil choice.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1.85 Million Tons |

|

Market Forecast in 2033

|

2.15 Million Tons |

| Market Growth Rate 2025-2033 | 1.7% |

The rice bran oil market is driven by increasing consumer awareness of its health benefits, including cholesterol reduction, heart health support, and antioxidant properties due to oryzanol and vitamin E content. Growing demand for healthy cooking oils, particularly in Asia-Pacific, fuels market expansion. The food industry’s preference for rice bran oil in frying and baking because of its high smoke point further supports growth. Government initiatives promoting healthier edible oils and rising plant-based diet adoption enhance the rice bran oil market demand. Additionally, technological advancements in extraction and refining processes improve oil yield and quality. Expanding applications in pharmaceuticals, cosmetics, and animal feed, along with increasing global rice production, contribute to market growth by ensuring stable raw material availability.

To get more information on this market, Request Sample

The U.S. rice bran oil market is driven by increasing consumer preference for healthier cooking oils due to rising awareness of heart health and cholesterol management. Heart disease has been the top cause of death in the United States for the past century, according to the American Heart Association's 2024 Heart Disease and Stroke Statistics: A Report of U.S. and Global Data. The oil’s high oryzanol and antioxidant content make it attractive for health-conscious consumers. Growing demand for plant-based and non-GMO food products further supports market growth. The food service industry, including restaurants and snack manufacturers, prefers rice bran oil for frying due to its high smoke point and neutral flavor. Expanding applications in cosmetics, pharmaceuticals, and nutraceuticals also contribute to demand. Additionally, rising imports from major producers like India and Thailand, along with advancements in refining technologies, ensure a stable supply, supporting the market’s expansion in the United States.

Rice Bran Oil Market Trends:

Rising Edible Oil Demand

According to the National Institution for Transforming India (NITI) Aayog, the edible oil demand is projected to increase to 29.8 million tons by 2030 and further to 32.6 million tons by 2047. These forecasts are grounded in predictions of population growth and an established annual per capita consumption rate of 19.7 kg, which resulted in a total demand of 27.7 million tons in 2021. This traction is largely due to its recognized health benefits, including high levels of antioxidants and beneficial fats, which contribute to cardiovascular health and cholesterol management. The increasing consumer awareness and preference for healthier dietary choices are pivotal in propelling the demand for rice bran oil. As health trends continue to influence food choices, rice bran oil is positioned for further growth, benefiting from its health-centric attributes in a market where consumers are increasingly turning away from traditional, less healthy oils.

Increased Rice Production

The foundation of rice bran oil production is inherently tied to global rice production which is creating a positive rice bran oil market outlook. According to the Food and Agriculture Organization (FAO) of the United Nations, global rice production hit 523.9 million tonnes on a milled basis for the 2023-2024 season, representing an increase of 0.8% from the yield recorded in 2022-2023. The substantial rice output, especially in the Asia-Pacific region the hub of rice cultivation and rice bran oil production ensures a steady supply of rice bran, the raw material for the oil. This correlation means that increases in rice production directly enhance the availability of rice bran for oil extraction. This dynamic is crucial as it allows rice bran oil producers to scale up operations in response to growing market demand without facing significant raw material shortages. Furthermore, as rice production increases, the rice bran oil sector is set to expand, supported by robust supply chains and enhanced production capabilities in these regions.

Technological Advancements

Technological innovations in the various advertisement and extraction processes of rice bran oil, such as cold pressing and solvent extraction, have significantly enhanced yield and quality. These advancements are critical as they improve the efficiency of oil extraction pushing extraction rates and ensuring a higher quality product by preserving nutrients and antioxidants. For instance, in June 2024, Gemini Edibles & Fats India Ltd unveiled an innovative print advertising campaign for Freedom Rice Bran Oil, named ACT TODAY. This pioneering campaign incorporates quick response (QR) code technology, marking a first in India for an edible oil brand to enhance how consumers engage with a product through print media. Additionally, customers can activate a dynamic video from a static image, which highlights the advantages of Freedom rice bran oil, touted as the 'cholesterol ki safai ka specialist' by scanning the QR code featured in the print ads. This technology-driven approach aims to improve interaction, convenience, and overall brand experience. The adoption of these advanced technologies makes the production process more profitable and sustainable. They enable producers to maintain competitive prices and high-quality standards, making rice bran oil more accessible to a broader market and further driving its growth in the edible oil industry.

Rice Bran Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rice bran oil market report, along with forecasts at the global and country levels from 2025-2033. Our report has categorized the market based on end-use.

Analysis by End-Use:

- Edible

- Industrial

Edible leads the market with around 78.7% of the market share in 2024. The edible segment dominates the rice bran oil market share due to its health benefits, mild flavor, and high smoke point, making it ideal for cooking. Rich in antioxidants, vitamin E, and oryzanol, it supports cholesterol management and heart health, attracting health-conscious consumers. Increasing demand for healthy edible oils, especially in India, China, and Japan, drives market growth. The food industry's preference for rice bran oil in frying and baking further strengthens its dominance. Government initiatives promoting healthier cooking oils and the rising popularity of plant-based diets also contribute to the segment’s leading market share in the rice bran oil industry.

Regional Analysis:

- India

- China

- Japan

- Others

In 2024, India accounted for the largest market share of over 36.7%. Indian rice bran oil is growing strongly with the support of government policies and growing consumer health awareness. For example, in 2021, fortified rice bran oil was launched under the 'Aatmnirbhar Bharat' scheme by the National Agricultural Cooperative Marketing Federation of India Ltd (NAFED) for promoting domestic production and self-sufficiency. Additionally, in June 2021, fortified rice bran oil was introduced by the Ministry of Consumer Affairs of India. The Directorate of Economics and Statistics, Government of India, stated that the yield of rice in the country during 2021 was around 2.7 thousand kilograms per hectare, which was up from around 2.6 thousand kilograms per hectare during the last year. This increase in rice cultivation guarantees a consistent supply of rice bran, the major raw material used in extracting rice bran oil. Increasing health consciousness among consumers is also driving demand, as rice bran oil is rich in antioxidants, vitamin E, and heart-friendly unsaturated fats. All of these together drive the India rice bran oil market growth.

Key Regional Takeaways:

China Rice Bran Oil Market Analysis

The Chinese market for rice bran oil is expanding with increasing edible oil demand and higher rice production. According to Agriculture and Agri-Food Canada, retail value of edible oils in China was worth USD 15.48 Million in 2021, reflecting strong consumer demand. In addition, in 2024, China produced approximately 207.5 million metric tons of rice, according to the industry reports, supplying a steady supply of rice bran—the major raw material to produce rice bran oil. The increasing recognition of health benefits offered by rice bran oil, including high antioxidant levels, cholesterol-reducing qualities, and even fatty acid balance, is also contributing to market expansion. Since consumers are increasingly looking for healthier options in cooking oils, rice bran oil is also becoming popular because it is heart friendly. In addition, the emphasis of the Chinese government on food security and agricultural development favors the effective use of rice by-products, further robustifying the rice bran oil industry in the nation.

Japan Rice Bran Oil Market Analysis

The Japanese rice bran oil market is growing steadily, fueled by rising consciousness about health and evolving methods of production. TSUNO of Japan launched Expeller Pressed Rice Bran Oil, a high-end product processed by natural extraction, in response to the trend for high-quality and low-processing cooking oils, in September 2021. In addition, the domestic high production of rice in Japan ensures raw material stability for rice bran oil production. According to industry sources, the country's milled rice production volume reached approximately 7.45 million metric tons in 2022, further supporting its capacity to sustain uninterrupted rice bran oil production. Growing demand for heart-healthy cooking oils and Japan's focus on functional foods and nutraceuticals are also driving market growth. Further, its growing applications in the food, cosmetics, and pharmaceutical industries consolidate its market ground. These, coupled with ongoing advances in the technologies of extraction, are driving Japan's rice bran oil business growth.

Competitive Landscape:

The rice bran oil market is characterized by intense competition among key players, including Ricela Group, BCL Industries Ltd., Cargill Inc., 3F Industries Ltd., and A.P. Refinery Pvt. Ltd. Companies focus on product innovation, refining technologies, and expanding production capacities to strengthen their market position. Strategic partnerships, mergers, and acquisitions drive growth, while sustainability initiatives and premium product offerings enhance brand differentiation. Market players also target rising health-conscious consumers by promoting rice bran oil’s nutritional benefits. Asia-Pacific, particularly India and China, remains a dominant region due to high production and consumption, with expanding global exports influencing market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the rice bran oil market with detailed profiles of all major companies.

Recent Developments:

- September 2024: Myanmar Rice Bran Oil Company Limited (MRBO) announced the establishment of its inaugural rice bran oil facility in the Pyinmana township of Nay Pyi Taw Union Territory. Additionally, with support from the union government and the Myanmar Rice Federation, construction began in February on a plant capable of processing 200 tons of crude rice bran oil and refining 50 tons of oil. The facility is designed to produce an annual output of 90,000 tons of crude oil and 6,300 tons of refined oil, according to the company. The initiative aims to meet domestic demand for edible oil and introduce rice bran oil as a new agricultural export from Myanmar.

- March 2024: Gemini Edibles & Fats India Ltd. introduced a new advertising campaign for Freedom Rice Bran Oil, titled "Cholesterol Ki Safai ka Specialist." The move is an extension of their earlier campaign, "Rice Bran Oil Kare Andar Se Safai," highlighting the benefits of the oil for cholesterol cleansing. Such promotional campaigns are designed to raise consumer awareness and generate demand for rice bran oil.

- February 2024: Emerald Oil is set to invest TK 400 crore in establishing a new facility within the Jamalpur Economic Zone to augment its rice bran oil production, particularly for the export market, with a target of 100 tonnes per day. The company aims to commence commercial operations by March 2025.

- October 2023: A U.S. wholesaler, Shay & Company, launched two new waxes—rice bran wax and cera bellina wax—for a range of applications, from skincare and haircare to soap making. These launches reflect the increasing popularity of natural ingredients in personal care products.

Rice Bran Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Edible, Industrial |

| Regions Covered | India, China, Japan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Rice Bran Oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Rice Bran Oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Rice Bran Oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rice bran oil market size reached at 1.85 Million Tons in 2024.

The rice bran oil market is projected to exhibit a CAGR of 1.7% during 2025-2033, reaching a volume of 2.15 Million Tons by 2033.

The key factors driving the rice bran oil market include rising health consciousness, increasing demand for natural and minimally processed oils, and the oil's high content of antioxidants and unsaturated fats. Additionally, its use in cosmetics, and pharmaceuticals, and growing awareness of its cardiovascular benefits further fuel market growth.

India currently dominates the rice bran oil market, accounting for a share of 36.7%. Health benefits, rising consumer awareness, growing demand for healthy oils, government support, and expanding applications in food and pharmaceuticals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)