Reverse Logistics Market Report by Return Type (Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of life Returns), Service (Transportation, Warehousing, Reselling, Replacement Management, Refund Management Authorization, and Others), End User (E-Commerce, Automotive, Pharmaceutical, Consumer Electronic, Retail, Luxury Goods, Reusable Packaging), and Region 2026-2034

Reverse Logistics Market Size:

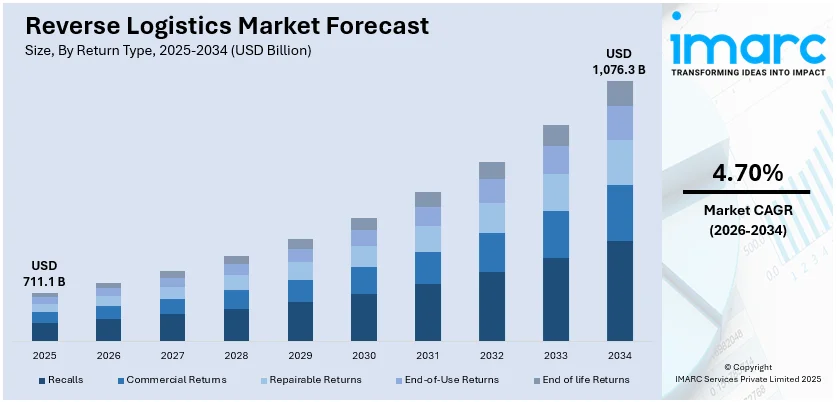

The global reverse logistics market size reached USD 711.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1,076.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.70% during 2026-2034. Environmental concerns and regulations, the rise of e-commerce and online returns, the emphasis on sustainability, technological advancements, such as blockchain and the Internet of Things (IoT), the adoption of circular economy principles, and increasing consumer expectations for hassle-free returns are some of the factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 711.1 Billion |

|

Market Forecast in 2034

|

USD 1,076.3 Billion |

| Market Growth Rate 2026-2034 | 4.70% |

Reverse Logistics Market Analysis:

- Major Market Drivers: As per the reverse logistics market analysis, the primary drivers include the acceleration of e-commerce, increased consumer demand for sustainable practices, and the acknowledged importance of return policies in buying decisions. In line with this, technological advancements that ensure speedy and efficient returns management and governmental and regulatory pressures concerning storage and waste are factors supporting the reverse logistics market growth. As per the reverse logistics market recent developments, the increasing number of returns caused by online shopping, and the recovered earnings from returned products significantly drive the reverse logistics market share.

- Key Market Trends: Emerging reverse logistics market trends include the integration of artificial intelligence (AI) and machine learning (ML) in creating predictive return management, blockchain for transparency in the return supply chain, and data analytics in providing information on the aspect of returns. Moreover, there is a trending formation of specialized reverse logistics service providers, the emergence of return policies as a standout factor in competition, the implementation of eco-friendly packaging, and advanced return processing centers, which are revolutionizing the reverse logistics market demand. Additionally, there is the growth of customer loyalty programs as a way of managing return and the increase in refurbishing, which is providing optimum reverse logistics market opportunities.

- Geographical Trends: North America leads the market, due to its advanced logistics infrastructure, high e-commerce penetration, and stringent regulatory environment that mandates efficient waste management and recycling practices. The region's robust technological adoption and consumer awareness regarding sustainability further contribute to its dominance in the reverse logistics market outlook.

- Competitive Landscape: As per the reverse logistics market overview, some of the key players in the include C.H. Robinson Worldwide, Inc, Core Logistic Private Limited, DB Schenker, FedEx, Happy Returns, Kintetsu World Express, Inc, Reverse Logistics Group (RLG), Safexpress Private Limited, United Parcel Service of America, Inc., Yusen Logistics Global Management Co., Ltd., etc.

- Challenges and Opportunities: The significant challenges in the reverse logistics market statistics include cost management of reverse logistics, the need for full environmental compliance situation, and dealing with variations in returns. Nevertheless, in all three cases, organizations can seize maximum opportunities, as the outlined challenges create the grounds for innovations in cost management approaches, sustainability initiatives, and the development of more flexible logistics schemes, which is further accelerating the reverse logistics market price. As the issue of sustainability gains traction, organizations will have the chance for differentiation within sustainable reverse logistics. Furthermore, all possible challenges in reverse logistics processes appear to be aligned with technological workarounds aimed at improving operations through automation and robotics, which is further driving the reverse logistics market revenue.

To get more information on this market Request Sample

Reverse Logistics Market Trends:

Environmental Concerns and Regulations

One of the major factors influencing the global market for reverse logistics is increasing environmental issues and regulations restricting returns and disposal of products. Due to more stringent environmental policies implemented by governments across the globe, organizations must establish sound reverse logistics operations to reduce waste and carbon print. Moreover, compliance with recent policies necessitates effective handling of the returned goods, which can involve recycling, restoration, or adequate disposition.

Rise of E-commerce and Online Returns

Since the expanding e-commerce sector has been growing exponentially, the trend for returning goods has increased accordingly and had a profound influence on the reverse logistics market. E-commerce affords consumers comfort and convenience, and then the task of managing product returns arises. Because consumers expect a more straightforward approach to return unwanted items, retailers have implemented reverse logistics services to help process returns, remanufacture, repair, or resell returned items. The turnaround in item returns has also made it necessary to implement sophisticated reverse supply chain schemes to aid inventory and cost management while boosting customer satisfaction and stimulating the reverse logistics market.

Emphasis on Sustainability and Corporate Social Responsibility

Sustainability and corporate social responsibility are the drivers that influence consumer choices and brand image in the modern business context. Many organizations utilize reverse logistics to recycle and reduce waste and maximize their products’ lifecycle, adhere to eco-conscious business ethics. They have also introduced several eco-friendly and sustainable reverse logistics procedures that help in decreasing carbon emission, increasing competitiveness, and customer orientation. Consumer consciousness and pressure from various stakeholders have forced firms to capitalize on the emphasis on saving the environment, leading to innovation of the practices and technologies in the area of reverse logistics.

Reverse Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on return type, service, and end user.

Breakup by Return Type:

- Recalls

- Commercial Returns

- Repairable Returns

- End-of-Use Returns

- End of life Returns

Commercial returns represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the return type. This includes with recalls, commercial returns, repairable returns, end-of-use returns, and end of life returns. According to the report, commercial returns represented the largest segment.

The commercial returns segment is driven by the increasing complexity of products and supply chains, as businesses deal with a diverse range of products requiring specialized handling and disposition processes. This complexity stems from factors such as technological advancements, customization, and product differentiation strategies aimed at meeting evolving consumer demands. As products become more sophisticated, businesses face challenges in efficiently managing returns due to factors like varied product configurations, compatibility issues, and the need for specialized expertise in handling and refurbishing returned items. Furthermore, the rise of e-commerce has significantly contributed to the growth of commercial returns, as online retailers experience higher return rates compared to traditional brick-and-mortar stores. This trend is fueled by factors such as the inability of customers to physically inspect products before purchase, leading to higher instances of buyer's remorse, sizing discrepancies, or receiving damaged goods. Additionally, the ease of online shopping encourages impulse buying, resulting in more frequent returns.

Breakup by Service:

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management Authorization

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes transportation, warehousing, reselling, replacement management, refund management authorization, and others.

The transportation segment in the reverse logistics market is driven by the increasing demand for efficient and cost-effective return shipping solutions. Factors such as the rise in e-commerce returns, the need for timely pickups and deliveries, and the emphasis on reducing carbon footprints in logistics operations are pivotal. Innovations in routing and consolidation help mitigate costs and improve service quality.

The warehousing segment is propelled by the growing necessity for specialized facilities that can handle the sorting, inspecting, and repackaging of returned goods. The expansion of e-commerce, coupled with the consumer expectation for swift refunds or exchanges, requires advanced warehousing solutions that can efficiently process returns. Automation and smart warehousing technologies are increasingly adopted to enhance throughput and accuracy.

Reselling in the reverse logistics market benefits from the escalating consumer interest in sustainable purchasing options, such as refurbished or second-hand goods. This trend is supported by advancements in product refurbishment and certification processes, which assure consumers of the quality and reliability of resold items. Online platforms and brick-and-mortar stores specializing in resold goods are expanding, driven by the appeal of discounted prices and environmental consciousness.

Replacement management is critical due to the emphasis on customer satisfaction and brand loyalty. Efficient replacement of faulty or unsatisfactory products is essential in maintaining consumer trust. This segment thrives on robust inventory management systems and responsive customer service practices that ensure quick turnaround times for replacements.

Refund management authorization sees growth from the need for transparent and user-friendly return policies. Consumers demand clarity and ease in initiating returns, driving the adoption of automated systems that expedite refund authorizations. This segment benefits from technologies that streamline the refund process, enhancing customer experience and loyalty.

Other segments in the reverse logistics market, including recycling and disposal, are gaining momentum with the global push towards sustainability. Regulations mandating environmentally responsible disposal and recycling of products, combined with consumer preference for green brands, drive the development of eco-friendly reverse logistics solutions. Companies are innovating in waste reduction, material recovery, and sustainable packaging to meet these demands.

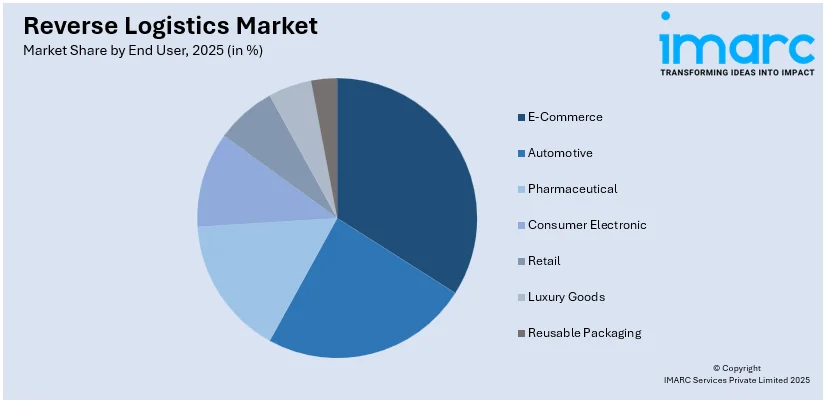

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- E-Commerce

- Automotive

- Pharmaceutical

- Consumer Electronic

- Retail

- Luxury Goods

- Reusable Packaging

E-commerce represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes e-commerce, automotive, pharmaceutical, consumer electronic, retail, luxury goods, and reusable packaging. According to the report, e-commerce represented the largest segment.

The e-commerce segment is driven by the increasing convenience and accessibility of online shopping, fueled by advancements in technology and digital infrastructure. With the proliferation of smartphones and internet connectivity, consumers can now browse and purchase products from anywhere at any time, leading to a surge in online retail activity. Furthermore, the growing preference for contactless shopping, especially in the wake of the COVID-19 pandemic, has accelerated the adoption of e-commerce as consumers prioritize safety and convenience. Additionally, the availability of a wide range of products and services online, coupled with personalized recommendations and targeted marketing strategies, enhances the overall shopping experience, driving customer loyalty and repeat purchases. Moreover, the rise of social media and influencer marketing has transformed how brands engage with consumers, facilitating direct communication and fostering brand advocacy, thus driving e-commerce growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest reverse logistics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for reverse logistics.

The Asia Pacific region is driven by the increasing globalization of supply chains, which has led to a surge in cross-border trade and consequently, higher volumes of returns and reverse logistics activities. As businesses expand their operations across borders to capitalize on emerging markets and access a wider consumer base, the need for efficient reverse logistics becomes paramount to manage product returns, repairs, and refurbishments effectively. Additionally, the rapid growth of e-commerce in the region, fueled by rising internet penetration and smartphone usage, further intensifies the demand for reverse logistics services. With more consumers turning to online shopping for convenience and variety, the volume of returns in the Asia Pacific region has skyrocketed, necessitating robust reverse logistics infrastructure to handle the influx of returned goods efficiently. Moreover, the increasing focus on sustainability and environmental responsibility drives the adoption of reverse logistics practices aimed at minimizing waste and maximizing the reuse or recycling of products. As environmental awareness grows among businesses and consumers alike, there is a greater emphasis on implementing eco-friendly reverse logistics solutions, such as recycling programs and product refurbishment initiatives, to reduce the carbon footprint associated with returns.

Competitive Landscape:

In the competitive landscape of the reverse logistics market, key players are actively leveraging technological advancements to enhance their service offerings and gain a competitive edge. These players are investing heavily in innovative solutions such as blockchain, Internet of Things (IoT), and artificial intelligence (AI) to improve visibility, traceability, and efficiency throughout the reverse logistics process. Additionally, there is a notable trend towards collaboration and partnerships among players, as they seek to broaden their service portfolios and reach new markets. Many players are also focusing on sustainability initiatives, integrating environmentally friendly practices into their operations to align with growing consumer expectations and regulatory requirements. Furthermore, mergers and acquisitions are prevalent strategies employed by key players to expand their market presence and capabilities, consolidating their positions as leaders in the reverse logistics industry.

The report provides a comprehensive analysis of the competitive landscape in the global reverse logistics market with detailed profiles of all major companies, including:

- C.H. Robinson Worldwide, Inc

- Core Logistic Private Limited

- DB Schenker

- FedEx

- Happy Returns

- Kintetsu World Express, Inc

- Reverse Logistics Group (RLG)

- Safexpress Private Limited

- United Parcel Service of America, Inc.

- Yusen Logistics Global Management Co., Ltd.

Reverse Logistics Market News:

- In July 2021: FedEx Corporation announced a strategic partnership with Delhivery to enhance its reverse logistics capabilities in India. The collaboration aims to leverage advanced analytics and automation technologies to optimize the handling and processing of returned goods, improving efficiency and reducing costs for both FedEx and its clients. This move underscores FedEx's commitment to innovation in reverse logistics solutions, addressing the growing demand for streamlined returns management in the e-commerce era.

- In July 2023: Optoro Inc. introduced a new software update for its reverse logistics platform, enhancing its capabilities for real-time tracking and processing of returned merchandise. The updated software incorporates advanced algorithms and machine learning algorithms to analyze return data and optimize disposition decisions, enabling retailers to maximize recovery value while minimizing handling costs.

Reverse Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Return Types Covered | Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of life Returns |

| Services Covered | Transportation, Warehousing, Reselling, Replacement Management, Refund Management Authorization, Others |

| End Users Covered | E-Commerce, Automotive, Pharmaceutical, Consumer Electronic, Retail, Luxury Goods, Reusable, Packaging |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | C.H. Robinson Worldwide, Inc, Core Logistic Private Limited, DB Schenker, FedEx, Happy Returns, Kintetsu World Express, Inc, Reverse Logistics Group (RLG), Safexpress Private Limited, United Parcel Service of America, Inc., Yusen Logistics Global Management Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the reverse logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global reverse logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the reverse logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global reverse logistics market was valued at USD 711.1 Billion in 2025.

We expect the global reverse logistics market to exhibit a CAGR of 4.70% during 2026-2034.

The growing volume of returns and replacement items in the e-commerce sector, along with the rising demand for reverse logistics, to provide greater customer satisfaction, improved brand image, faster and better services, etc., is primarily catalyzing the global reverse logistics market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary disruption in reverse logistics process, owing to numerous transportation restrictions.

Based on the return type, the global reverse logistics market has been segmented into recalls, commercial returns, repairable returns, end-of-use returns, and end of life returns. Currently, commercial returns exhibit a clear dominance in the market.

Based on the end user, the global reverse logistics market can be divided into e-commerce, automotive, pharmaceutical, consumer electronic, retail, luxury goods, and reusable packaging. Among these, the e- commerce sector currently accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global reverse logistics market include C.H. Robinson Worldwide, Inc, Core Logistic Private Limited, DB Schenker, FedEx, Happy Returns, Kintetsu World Express, Inc, Reverse Logistics Group (RLG), Safexpress Private Limited, United Parcel Service of America, Inc., and Yusen Logistics Global Management Co., Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)