Reusable Straw Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

Reusable Straw Market Size and Share:

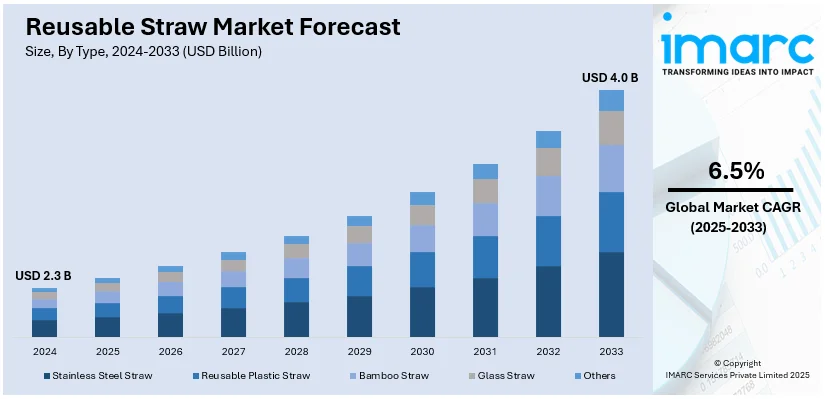

The global reusable straw market size was valued at USD 2.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.0 Billion by 2033, exhibiting a CAGR of 6.5% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 30.0% in 2024. The reusable straw market share in the region is increasing due to environmental awareness, increasing regulations over the use of single-use plastics, a trend in sustainability lifestyles, and increased demand from consumers to avoid waste through sustainable alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.3 Billion |

|

Market Forecast in 2033

|

USD 4.0 Billion |

| Market Growth Rate (2025-2033) | 6.5% |

The reusable straw market is gaining momentum due to the increasing awareness about environmental issues, particularly plastic pollution. Bans and restrictions issued by governments and organizations regarding the use of single-use plastics propel consumers toward adopting eco-friendly alternatives such as reusable straws. Consumers increasingly began focusing on choices concerning lifestyle and sustainability, which increased demand for reusable products. Material innovation advancement expanded options to include stainless steel, silicone, bamboo, and glass straws for durability, aesthetics, and versatility. Reusability straws, mostly with accessories such as cleaning brushes and travel cases that further enhance portability and cleaning ease, further increase their attractiveness. Moreover, social media campaigns and endorsements from socially conscious influencers also raise interest among consumers. Businesses, especially those in the food and beverage industry, are taking up reusable straws for sustainability purposes, which would further fuel the reusable straw market growth.

The United States emerged as a key regional market for reusable straw. Growing awareness about environmental issues as well as government actions taken to regulate single-use plastics have given an impetus to reusable straw sales across the United States. By banning or otherwise restricting the sale of plastic straws across many states and cities, consumers and businesses alike have seen an impetus to go sustainable. Regulations have provided an impetus to use more reusable straws in all of the US. Consumers are very environmentally conscious and tend to have a lot of demand for eco-friendly, reusable products. Market factors are also driven by environmental activism and wide-scale social media advocacy regarding sustainable living. Retailers and restaurants have not been left behind either as they are providing reusable straws as part of the strategies for adopting green practices. The combination of regulatory support, consumer awareness, and business initiatives makes the United States a key market for reusable straws.

Reusable Straw Market Trends:

Rising environmental concerns

Growing concern for the environment is the most prominent factor for the growth of reusable straws market size. Single-use plastic straws are among the primary pollutants of oceans, and single-use plastic straws and other waste can destroy marine life. It is reported that plastic makes up 80% of all ocean pollution, and approximately 8 to 10 Million Metric Tons of plastic end up in the ocean annually. Others also offer reusable straws through eco-friendly materials such as stainless steel, glass, or even bamboo and silicone, and are gaining popularity owing to increased environmental awareness about the part of consumers, so demand for eco-products becomes larger. For example, recently in 2021 Mizu, a California-based company that produces stainless bottles and is exclusively distributed by Ueni Trading Company from Japan, announced the available reusable straws on the company's official online portal. Governments and organizations worldwide are also enacting bans and regulations on single-use plastics, which in turn will create a fueling factor to the market for sustainable options such as reusable straws.

Regulations on single use plastics

Regulatory measures and outright bans for single-use plastics, and single-use straws in numerous regions worldwide, have been a significant driving force in the market for reusable straws. Many governments have introduced or are debating laws to ban or curtail the use of single-use plastic straws. Single-use plastic straws and drink stirrers are already banned in England from 1st October 2020. This regulatory environment is compelling businesses and consumers to shift to reusable alternatives in line with the new rules toward a cleaner environment. As a reaction to such bans, restaurants, cafes, and beverage companies are increasing the supply of reusable straws as part of their sustainability efforts. This legal framework fosters the acceptance of reusable straws, driving market growth.

Technological advancements

The evolution of technologies in materials and manufacturing techniques is enhancing the development in the market for reusable straws. Now manufacturers create a variety of straws for different purposes, including a host of benefits such as longevity, flexibility, and temperature resistance. Innovative designs, such as telescopic and collapsible straws, are becoming extremely popular for on-the-go use. The market has also seen the emergence of smart straws with advanced functionalities that include temperature sensing and reminders to clean. For example, ELO is an innovative aluminum reusable straw solution with integration into a mobile application designed for creating awareness and acting toward the problem of plastic pollution. These technological inventions add more appeal and functionality to reusable straws. Consumers are attracted to it and increases market growth.

Consumer demand for sustainable products

Consumers' preferences are shifting to products that are sustainable and eco-conscious, and reusable straws align with this trend. In doing so, more people go out of their way for products that have the minimum ecological footprint. McKinsey reports that 60 to 70% of its consumers say they are ready to pay a premium to accommodate a sustainable package. Reusable straws are "green" and come with long-term cost-cutting compared to single use. The demand for "green" choices is giving manufacturers and retailers a mandate to expand their offerings for reusable straws, propelling market growth. Besides, the availability of a variety of materials, sizes, and designs in reusable straws ensures the consumer can select based on specific preferences and lifestyle requirements.

Reusable Straw Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global reusable straw market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, end user, and distribution channel.

Analysis by Type:

- Stainless Steel Straw

- Reusable Plastic Straw

- Bamboo Straw

- Glass Straw

- Others

Bamboo straws are a market leader in the reusable straw segment, with a share of 36.5%, attributed to their natural and biodegradable properties. The increasing desire for sustainability and eco-friendliness among consumers has led to an increase in demand for bamboo straws. Lightweight and aesthetically pleasing, these straws are in sync with the environmental consciousness of individual consumers as well as businesses. They are chemical-free and safe for health, thus making them a very appealing product for health-conscious consumers. The increased adoption of bamboo straws in regions with strict anti-plastic regulations further supports their market growth. Their perceived premium quality and appeal to environmentally focused consumers also make them a preferred choice.

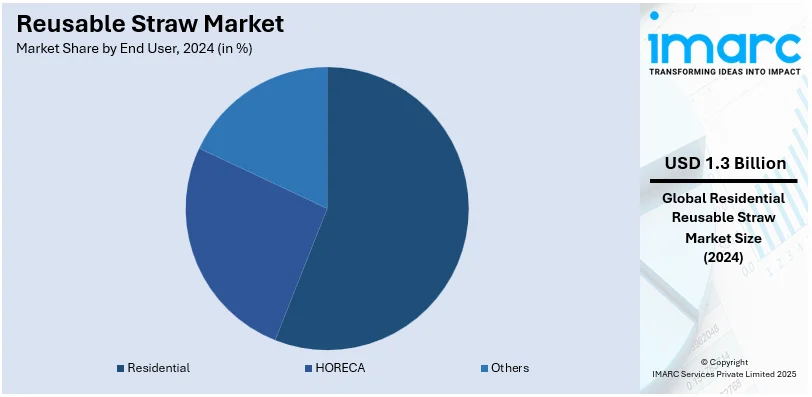

Analysis by End User:

- Residential

- HORECA

- Others

Residential dominates the reusable straw market with a share of 55.7%. Consumer awareness about sustainability has boosted household uptake of reusable straws for personal use. Family and individuals appeal to the convenience of having personal reusable straws, which are often sold in packs with cleaning brushes. Health and environmental benefits strongly resonate with residential users looking for alternatives to plastic. Social media marketing campaigns and environment-friendly influencers have also strongly impacted consumer purchasing behavior. Moreover, the availability and price range of the different types offered like bamboo and stainless-steel straws serve the diversity in consumer demand, therefore securing the leadership of the residential sector.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets are the largest distribution channels for reusable straws, offering accessibility and variety under one roof. There is an opportunity for the consumer to compare materials, designs, and prices before finalizing a purchase from a retail outlet. Their presence in both urban and suburban areas provide higher sales volumes. Besides, supermarkets often run promotions or discounts, which pushes customers to buy more. The convenience of picking up reusable straws during routine shopping trips makes reusable straws a preferred option for many consumers. Along with this, collaborations between retail and eco-friendly brands continue to increase the awareness about and visibility of reusable straw options in this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is currently leading the market with a share of 30.0%, driven by environmental awareness, regulatory support, and the sheer volume of customers, as well as a lot of diversity in the said consumers. China, India, and Japan, with enormous populations and increasing eco-friendly sensitivities, are responsible for the increasing demand for reusable straws as compared to single-use plastics. The above is complemented by government policies, for instance, bans on disposable plastic products and environmental organizations' campaigns that advocate for a greener lifestyle. On the market side, cost-effective and innovative options for reusable straws are bamboo, stainless steel, and reusable plastic ones that are widely available and fit consumer preferences. Companies in the hospitality and retail industries have recently turned to reusable straws in their efforts to achieve sustainability objectives and increase market penetration.

In North America, for instance, environmental awareness runs high, with regulations regarding single-use plastics being at an all-time high. U.S. and Canadian consumers are on the looking for alternatives that bring them closer to sustainability and fulfill their desire to save the planet. This robust demand calls for stainless steel, silicone, and glass-based reusable straws. Restaurants, cafes, and food service establishments are growingly embracing reusable straws to be in line with sustainability initiatives and meet the local plastic straw bans. The factors that affect the market can be attributed to corporate social responsibility initiatives wherein businesses are offering brandable reusable straws as items for promotions.

The European market is fueled by rigorous environmental regulations, a deep-rooted sustainability culture, and increasing public awareness of plastic waste. Other places in Europe are at the forefront of single-use bans, which push the proliferation of reusable straws to grow amongst the consumer masses around. Thus far, consumers across Europe seek reusable alternatives as a preference to reduce plastic pollution across water, land, and air spheres and foodservice operators are emulating business as usually set toward providing reusable straws to all consumers alike to share in the design and resource variations taking precedence toward reusable straws.

Latin America is experiencing an increasing concern for reusable straws and the need to live more sustainably about environmental issues. Countries in the region are implementing plastic reduction policies and regulations, and it promotes the use of reusable straws. The market for straws is a combination of the most traditional materials, such as bamboo, and new ones such as silicone and stainless steel. Latin American consumers, especially urban ones, embrace reusable straws for their consumption and are pushing for them to be adopted in the food and beverage industry.

Emerging markets are seen in the Middle East and Africa regions, as sustainability and eco-friendly alternatives are growing in interest. Although the adoption of reusable straws is not widespread in this region, gradual steps are being taken toward reducing single-use plastics. Urban centers and tourist destinations in the Middle East, such as Dubai and Abu Dhabi, see increased use of reusable straws in hospitality establishments. In Africa, efforts to address plastic pollution are leading to the promotion of reusable straws as eco-friendly options.

Key Regional Takeaways:

United States Reusable Straw Market Analysis

In 2024, United States hold a market share of 78.80% for the reusable straw in North America. The ban of single use plastic straws in California, Maine, New Jersey, New York, Oregon, Rhode Island, Vermont, and Washington of several states of USA drives the reusable straws market. California is the first state to enact legislation that enforces a statewide ban on single-use plastics in big-box retailers. It has also been reported that the US alone uses about 500 Million straws each day. In return, the daily growth of consumption in straws keeps on enhancing. The market growth is driven by the increasing eco-friendliness of the population, particularly in urban areas, who prefer to use reusable straws. According to the Census Bureau, in 2020, around 265,149,027 people lived in urban areas of the United States, making up 80% of the population. Also, population density in urban areas rose by 9.0% from 2010 to 2020. Correspondingly, the growing trend of sustainability is forcing restaurants and cafes to replace disposable straws with reusable ones by environmentally friendly standards.

Europe Reusable Straw Market Analysis

European Union policy- such as the Single Use Plastics Directive aimed at reducing plastic waste has positively influenced the market. Most EU countries also enforced a ban on plastic straws. Reusable straws are also encouraged in tourist-geared places of Spain and Italy to help minimize plastic pollution that contributes to the market's expansion in the European region. In its recent report, the Spanish government said that during the first ten months of 2024, Spain welcomed more than 82.8 Million international visitors, a growth rate of 10.8% compared to the similar time in 2023. Meanwhile, spending by tourists in October was recorded at €11.898 Billion (USD 12.610 Billion), also a rise of 15.5% year-on-year. More so, arrivals increased by 9.5%, reaching more than 8.9 Million in October. In line with this, reports show that Italy's Travel & Tourism sector contributed USD 251.55 Billion, accounting for 10.5% of the nation's total economic output in 2023, reinforcing its critical role in Italy's economy.

Asia Pacific Reusable Straw Market Analysis

Rapid urbanization and a rising middle-class population are driving the reusable straw market growth across the region. As per the India Brand Equity Foundation (IBEF), Indian rich households earn more than ₹2 crore (around USD 242,709) annually. This rose from USD 1.06 Million in 2016 to 1.8 Million in 2021. To that effect, according to the Central Intelligence Agency (CIA), in 2023, the total population of India had an urbanized population of 36.4%. Further, the cities across India are mainly composed of New Delhi (32.941 Million), Mumbai (21.297 Million), Kolkata (15.333 Million), Bangalore (13.608 Million), Chennai (11.776 Million), and Hyderabad (10.801 Million). Also, reusable straws are on the rise significantly in the urban food chains and cafes of burgeoning markets like China and India.

Latin America Reusable Straw Market Analysis

Increased environmental issues awareness and efforts to minimize plastic usage drive the adoption of reusable straws as alternatives in place of single-use plastic straws in urban settings throughout Latin America. The Central Intelligence Agency states that, as of 2023, urban residents represent 87.8% of the population in Brazil. Similarly, the Central Intelligence Agency (CIA) shows that in 2023, urban residents accounted for 81.6% of Mexico's total population. Moreover, local festivals are actively promoting reusable products to reduce environmental impact which is stimulating market growth.

Middle East and Africa Reusable Straw Market Analysis

The region's thriving tourism industry has led to a rise in the use of reusable straws, thereby expanding the market for these products. The Ministry of Economy reported that in 2022, the travel and tourism sector accounted for approximately USD 45.09 Billion in the GDP of the UAE, thus comprising 9% of the total GDP. In the same year, the overall spending of international tourists accounted for USD 32.01 Billion. The number of hotels in the UAE increased to 1,189, and hotel capacity in the country went up to 203,000 rooms.

Competitive Landscape:

Market players in the business of reusable straws have been keenly innovating, sustainably, and strategically partnering to strengthen their market presence. Companies are creating a variety of products from bamboo to stainless steel, glass, and silicone aimed at all kinds of consumer preferences. Customized engraved designs and personalized packaging are in high demand as companies look to innovate and stand out. Many manufacturers are aligning with environmental movements, stating that their products are 'eco-friendly' solutions against plastic waste. Partnerships with retail chains, e-commerce platforms, and HORECA businesses have increased the access and visibility of the product. Furthermore, targeted marketing campaigns, influencer endorsements, and competitive pricing are some of the strategies adopted to attract the environmentally conscious consumer and thereby expand their market share in the global market.

The report provides a comprehensive analysis of the competitive landscape in the reusable straw market with detailed profiles of all major companies, including:

- Eco-Products, Inc

- EcoStraws Ltd

- Crate and Barrel

- Eco Imprints

- Ever Eco

- The Final Co. LLC

- Greens Steel

- Jungle Straws/Jungle Culture (Chalk & Skinner Ltd)

- Klean Kanteen

- Koffie Straw

- Simply Straw

- Steelys Drinkware

- StrawFree.org

- Shopterrain.com LLC

- U-KONSERVE

Latest News and Developments:

- September 2023: Filing of patent and subsequent grant by the Patent Office of the Government of India to Botanical Survey of India entitled an invention for 'reusable straw and its manufacturing process,' wherein innovative straw prepared from a species of endemic bamboo unique to the Andaman and Nicobar Islands.

- October 2023: The Team Kalpavruksha heavily advertised the use of locally handmade bamboo straws during the festival season as a more environmentally friendly alternative to plastic and paper straws. Also, the raw material used was locally sourced.

Reusable Straw Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stainless Steel Straw, Reusable Plastic Straw, Bamboo Straw, Glass Straw, Others |

| End Users Covered | Residential, HORECA, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Eco-Products, Inc, EcoStraws Ltd, Crate and Barrel, Eco Imprints, Ever Eco, The Final Co. LLC, Greens Steel, Jungle Straws/Jungle Culture (Chalk & Skinner Ltd), Klean Kanteen, Koffie Straw, Simply Straws, Steelys Drinkware, StrawFree.org, Shopterrain.com LLC, U-KONSERVE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the reusable straw market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global reusable straw market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the reusable straw industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Reusable straw is made of a material like stainless steel, silicone, glass, or bamboo that allows repeated use, unlike plastic straws, which are only used once and thrown away. It saves waste to the environment, being strong and handy, while also being easy to wash and portable for all sorts of beverages.

The global reusable straw market was valued at USD 2.3 Billion in 2024.

IMARC estimates the global reusable straw market to exhibit a CAGR of 6.5% during 2025-2033.

The reusable straw market share is increasing due to environmental awareness, increasing regulations over the use of single-use plastics, a trend in sustainability lifestyles, and increased demand from consumers to avoid waste through sustainable alternatives.

In 2024, bamboo straw represented the largest segment, driven by their natural and biodegradable properties.

Residential leads the market due to increased consumer awareness about sustainability.

The supermarkets and hypermarkets are the leading segment as they offer accessibility and variety under one roof.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global reusable straw market include Eco-Products, Inc, EcoStraws Ltd, Crate and Barrel, Eco Imprints, Ever Eco, The Final Co. LLC, Greens Steel, Jungle Straws/Jungle Culture (Chalk & Skinner Ltd), Klean Kanteen, Koffie Straw, Simply Straws, Steelys Drinkware, StrawFree.org, Shopterrain.com LLC, U-KONSERVE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)