Retort Packaging Market Size, Share, Trends and Forecast by Packaging Type, Material Type, End User, and Region, 2025-2033

Retort Packaging Market Size and Share:

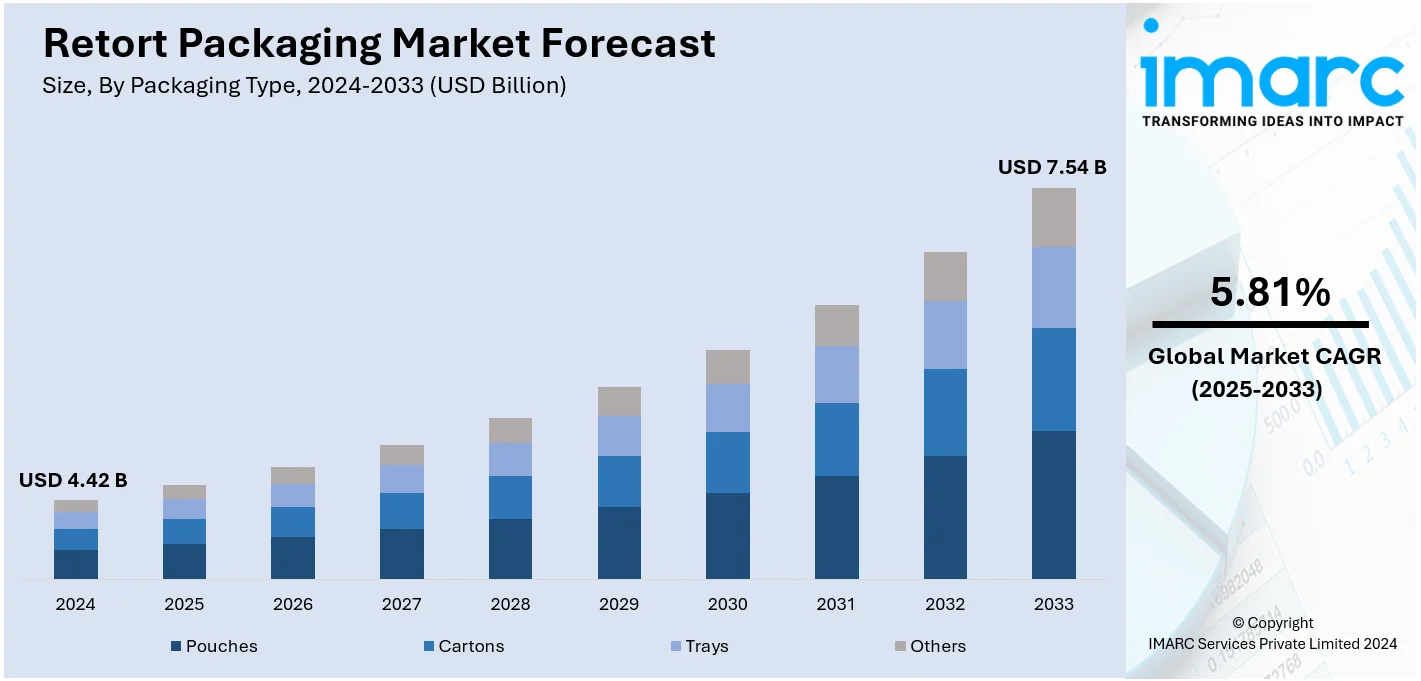

The global retort packaging market size was valued at USD 4.42 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.54 Billion by 2033, exhibiting a CAGR of 5.81% from 2025-2033. Asia Pacific currently dominates the market, driven by rapid urbanization, rising disposable incomes, and a growing demand for convenient, ready-to-eat (RTE) meals across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.42 Billion |

|

Market Forecast in 2033

|

USD 7.54 Billion |

| Market Growth Rate (2025-2033) | 5.81% |

The global retort packaging market is driven by the growing demand for convenience foods and RTE meals, fueling the need for extended shelf life and safe packaging. For example, packaging uses a high-temperature sterilization process to preserve food without refrigeration, retaining its nutritional value, flavor, and texture while extending shelf life for up to 12 months or more. In addition, the rising disposable incomes in emerging markets are increasing consumer spending on packaged food, aiding the market growth. Moreover, ongoing technological advancements in packaging enhance food safety and quality, providing an impetus to the market. Besides this, the expansion of the food processing industry boosts demand for durable packaging solutions, fostering the market growth. Furthermore, eco-friendly, and recyclable packaging solutions are gaining popularity, driven by the expanding e-commerce industry, as they require lightweight, durable packaging for shipping.

To get more information on this market, Request Sample

In the United States, the retort packaging market is driven the growing trend of health-conscious consumers, as they are increasing the demand for fresh, preservative-free, yet long-lasting packaged foods. In confluence with this, the convenience of on-the-go food options is boosting the market growth. Additionally, continuous advancements in barrier technologies help enhance product freshness and extend shelf life, contributing to the market expansion. Furthermore, the rise in single-person households encourages demand for smaller, easy-to-store packaging, supporting the market growth. Also, the popularity of outdoor activities fuels the need for portable, ready-to-consume meals, driving the market demand. For instance, outdoor activities increased by 4.1% and reached 175.8 million of Americans in 2023, representing 57.3% of all Americans, aged six or more. Apart from this, stringent food safety regulations push the adoption of retort packaging for compliance and increases emphasis on sustainability, thereby propelling the market forward.

Retort Packaging Market Trends:

Increasing concerns about environmental sustainability

Against the mounting concerns for environmental sustainability, businesses and households across the world are searching for more eco-friendly packaging alternatives. Retort packaging is becoming an increasingly eco-friendly option, as it is able to save on waste and, in parallel, reduce its own carbon footprint. Compared to single-use plastics, retort packaging is often more readily recyclable, and its small size reduces excess materials. Furthermore, the sterilization process used in retort packaging results in an increased product shelf life while reducing food waste. Manufacturers are also exploring alternative materials that are more eco-friendly. For example, in 2023, ProAmpac launched its new product, the ProActive PCR Retort pouches, made from post-consumer recycled material. This new addition was part of its goals toward achieving a circular economy.

Rising consumer demand for convenience

Individuals today lead very hectic lives, and this is one of the main drivers behind the growing demand for convenient food products. This increasing need is pushing the market further, as retort packaging allows manufacturers to secure products in airtight and watertight containers, eliminating the need for expensive refrigeration. This is particularly attractive for processed and RTE meals, snacks, and other food products that can be conveniently consumed on the go. Retort packaging ensures that these items stay safe, tasty, and nutritious for longer periods. According to an article in Business Standard from February 2024, the share of spending on beverages and processed food products increased by up to 10.64% during FY22-23 in India. This rise also led to an increased demand for retort packaging.

Rapid technological advancements

The use of materials and processing technologies has made modern retort packaging more efficient and safer. This helps to reduce the retort packaging market price as well. For example, as a result of the technology and know-how incorporated into new high-barrier films and laminates, used to fabricate pouches, improve performance against oxygen (which can help keep food fresher) or moisture longer, retaining its quality attributes. Advances in sealing technologies ensure that the packages are protected, decreasing dangers from leaks and varieties of contamination. For instance, in 2024, Prepack, Sun Chemical, and Comexi collaborated to achieve a significant advancement in retort pouch technology. They integrated efficient offset printing technology into this highly demanding packaging solution.

Retort Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global retort packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging type, material type, and end user.

Analysis by Packaging Type:

- Pouches

- Cartons

- Trays

- Others

Pouch packaging led the market in 2024. A pouch is a flexible, heat-sealable container used for storage or packaging. It offers several benefits, such as being lightweight and space-efficient, making it perfect for convenient, on-the-go consumption. In addition, pouches provide excellent protection barriers that maintain the freshness and flavor of a wide variety of items, from RTE meals and snacks to pet food and beverages (F&B). It is made from multi-layer components, and is puncture-resistant, presenting high-class protection for the inside contents. In addition, retort pouches use less material than metal cans or glass jars, resulting in reduced packaging waste.

Analysis by Material Type:

- Polypropylene

- Polyester

- Aluminum Foil

- Paper Board

- Nylon

- Food Grade Cast Polypropylene

- Others

Polypropylene led the market in 2024, due to the thermoplastic polymer renowned for its excellent heat resistance and durability, making it essential in many retort packaging applications. This material is highly preferred for creating retort packaging pouches and containers. Polypropylene can withstand the high temperatures and pressures applied during the retort sterilization process, ensuring that the packaging remains hermetically sealed and preserves the quality and safety of the contents.

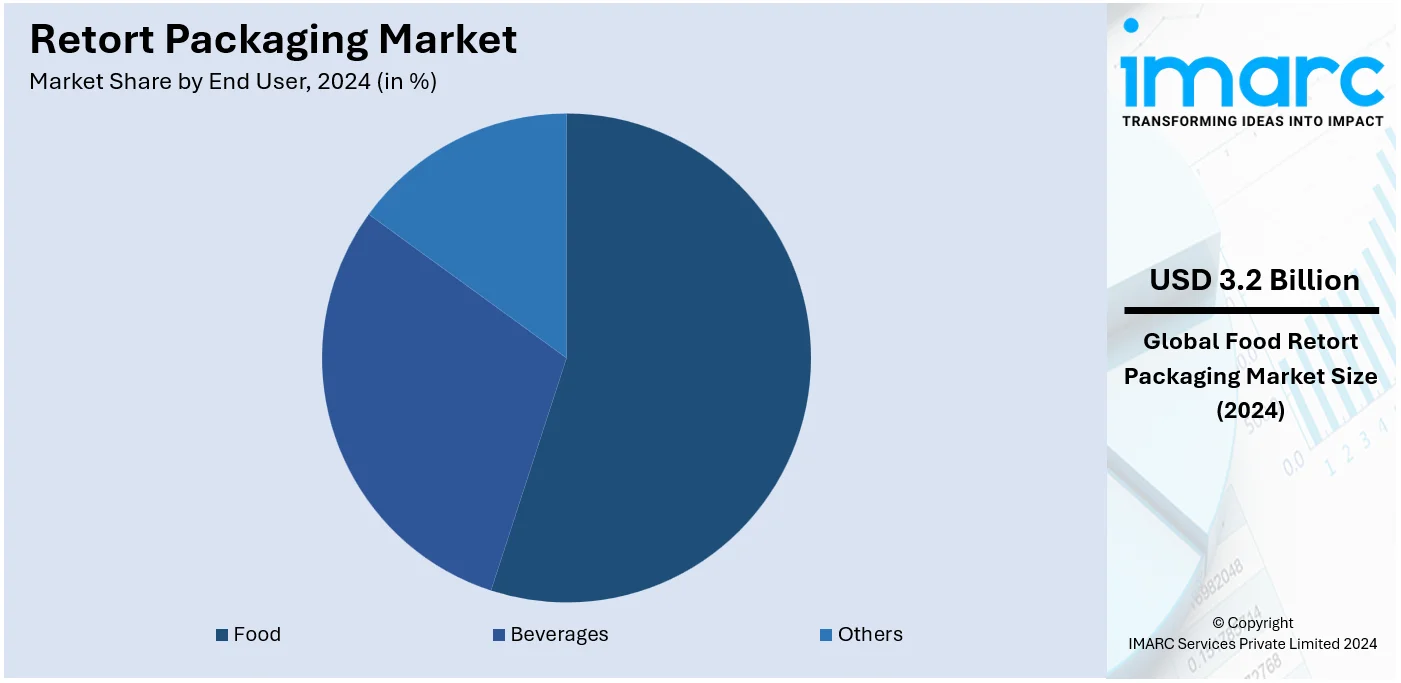

Analysis by End User:

- Food

- Beverages

- Others

The food industry led the market, driven by the heightened need for RTE meals, convenience foods, and long shelf-life products. Retort packaging is increasingly being used for soups, sauces, and curries, as well as baby food or pet food, which can also be protected by special heat sterilization against pathogenic germs. Urbanization, rapid lifestyles, and double-income households are always looking for convenience food products that eliminate the need for elaborate cooking. Moreover, the increasing disposable income and shifting dietary patterns are driving the demand for packaged food.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share due to its expanding population and increasing demand for convenience foods and RTE meals. This shift in consumer dietary preferences toward on-the-go and time-saving options has created a substantial market for retort packaging, which offers extended shelf life and food safety. Moreover, the F&B industry in Asia Pacific is experiencing robust growth, with a diverse range of products entering the market. The Indian convenience food market is expected to reach 3,498.9 million by 2032, as per the predictions of the IMARC Group. Retort packaging caters to this diversity by providing a versatile solution suitable for various cuisines and culinary preferences. According to the retort packaging market industry overview, the region's focus on sustainability and eco-friendly packaging options aligns with the development of more environmentally responsible retort packaging materials and practices. As a result, the dynamic F&B industry, changing consumer preferences, and heightened environmental awareness in Asia Pacific collectively drive the growth of the retort packaging market in this region.

Key Regional Takeaways:

North America Retort Packaging Market Analysis

The North America retort packaging market is also growing at a constant rate because of the growing demand for convenient foods through packaged foods and RTE meals. The consumers in the region have relatively high disposable income and are leading very busy lives, therefore they seek products with a long shelf life that do not require refrigeration to preserve freshness. Moreover, the food processing industry in the United States and Canada is well developed and has played a key role in the market growth. Furthermore, the region enjoys the prospects of technology in packaging in as much as it improves the safety and quality of the food. The increasing market for pet food also provides market opportunities because packaging requirements shift toward durable and lightweight options. Besides this, the growth of e-commerce sales increases the demand for effective and low-cost packaging, and the appeal to sustainability policies promotes the usage of recyclable packaging, providing an impetus to the market. For instance, Amcor PLC acquired Berry Global Group for $8.4 billion, strengthening its U.S. market position, enhancing research and development (R&D), and promoting sustainable packaging, benefiting North America's innovation and sustainability efforts.

United States Retort Packaging Market Analysis

Growing demand from consumers for convenience foods, better technology in packaging, and increased awareness about food safety are the major driving forces behind the retort packaging industry in the United States. Retort pouches and trays are increasingly becoming popular due to their benefits of being lightweight, space-saving, and having a longer shelf life, as more than 50% of American homes consume RTE meals on a weekly basis, as per industry reports. One of the major drivers is the pet food market, which stands at over USD 42 Billion in 2020 according to Forbes. Retort packaging is gaining popularity for wet food items. Moreover, due to its long-lasting and durable nature, the military employs retort packaging for ration meals. Two innovations addressing customer convenience and health concerns are microwavable pouches and BPA-free retort materials. The expansion of premium and organic food categories supports the F&B industry, which accounts for a sizable demand for retort packaging. Adoption is further fueled by regulatory standards set by organizations such as the FDA, which guarantee adherence to food safety regulations. The need for robust yet lightweight packing solutions is expanding as e-commerce expands at a significant rate yearly.

Europe Retort Packaging Market Analysis

The major drivers of the retort packaging industry in Europe are stricter food safety laws, the need for sustainable solutions, and the rise in the consumption of processed foods. According to an industry report, retort packaging is integral to the more than Euro 1.11 trillion (USD 1.15 Billion) European food business, which produces infant food, soups, and prepared meals. Major contributors include the likes of Germany, France, and UK, who on environmental grounds avoid cans and prefer cartons and pouches. The EU's Circular Economy Action Plan pushes the producers to use recyclable and biodegradable retort materials, with a vision of having 50% recyclable plastic packaging by 2025. With this, in Europe alone, there are more than 80 million households that have pets, according to reports, which increases the demand for retort packaging in wet pet food. Moreover, the growing vegan and organic food industries, which will see a huge number of new product launches in 2023, rely on premium retort packaging to ensure quality and freshness.

Asia Pacific Retort Packaging Market Analysis

The retort packaging market in Asia-Pacific is being driven by growing disposable incomes, an expanding food processing industry, and fast urbanization. There are over 4.5 billion people living in the region, as per IMF data. The middle-class population is increasingly consuming convenience foods and RTE meals, and thus needs retort pouches and trays. Food processing industries amount to over USD 800 Billion in India, as per an industry report. FAS Post Guangzhou reported that China's food business has grown steadily in 2022, with big corporations reporting USD 1.3 Trillion in revenue, a 5.6% annual gain. China keeps importing more and more food ingredients. The market is also supported by the pet food sector, which is expanding rapidly in the region. For packaged products, e-commerce expansion in China and Southeast Asia requires retort packaging that is lightweight and durable. Government initiatives, such as Japan's food waste reduction policy and India's Make in India scheme, also support advanced packaging solutions. Growth is fueled further by the awareness of recyclable and sustainable packaging materials among consumers.

Latin America Retort Packaging Market Analysis

The main factors driving the retort packaging industry in Latin America are the growing consumption of processed foods, a growing middle class, and a strong emphasis on food export sectors. According to an industrial report, Brazil and Mexico lead more than 60% of the regional food market by utilizing retort packaging for ready meals and soups. Retort pouches are used for wet food in the pet food sector, which is currently growing at an impressive rate. The rise in contemporary retail formats, such as supermarkets and online portals, necessitates attractive, long-lasting, and sustainable packaging solutions, and it finds support in the requirement for sustainable and recyclable retort materials in countries like Chile and Colombia. Retort packaging is also vital to the region's successful fruit and coffee export industries to ensure that product quality is maintained during longer transportation times.

Middle East and Africa Retort Packaging Market Analysis

The growth of urbanization, the growth of the processed food industry, and the growth of e-commerce are the key drivers for the retort packaging market in the Middle East and Africa. There is increased consumption of RTE meals and packaged beverages mainly because of the high growth rates experienced by urban populations year after year. According to recent reports, by 2050, over 60% of Africa will reside in the cities. Government initiatives such as Vision 2030, with a focus on food security, facilitate the investment of leading-edge packaging technologies in Saudi Arabia and the United Arab Emirates. Increasingly, retort packaging is being employed in the pharmaceuticals sector to obtain sterility and ruggedness, which is augmenting regional market growth. The advancement of the sector is further strengthened by trends on sustainability along with increasing consumer need for recyclable materials.

Competitive Landscape:

The market has a moderate growth rate as the major players have been vigorous in their innovation processes to address the changing consumer and market needs. They are creating new materials with improved barriers that increase shelf life and product performance. Additionally, some players are offering smart packaging solutions containing sensors and indicators to track the freshness and safety of a product in real-time. Automation and robotics have also seen increased integration, leading to enhanced production efficiency and reduced operational costs. Moreover, there are wide ecological choices, and the key players consider the utilization of recyclable and biodegradable materials. These innovations by key players are geared toward providing safer, more sustainable, and convenient retort packaging solutions for a wide range of products, from F&B to pharmaceuticals and cosmetics, thus fostering market growth.

The report provides a comprehensive analysis of the competitive landscape in the retort packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Clifton Packaging Group Limited

- Constantia Flexibles

- Dai Nippon Printing Co., Ltd.

- FLAIR Flexible Packaging Corporation

- HPM Global Inc

- Huhtamaki Oyj

- Logos Packaging

- Mondi

- ProAmpac

- Sealed Air Corporation

- Sriram Flexibles Private Limited

Latest News and Developments:

- In August 2024: Constantia Flexibles revealed it will feature its most recent innovations at FACHPACK 2024 in Nuremberg, Germany between 24 to 26 September 2024. It will focus on more sustainable innovations for this occasion and those innovations would also include the lightweight recyclable retort packaging solution called EcoAluTainer.

- In March 2024: H.B. Fuller gained RecyClass Technology Approval for its adhesive solutions in Europe. This certification showcases its commitment to circular economy objectives and provides eco-friendly packaging solutions by proving that the company's adhesives are recyclable with plastic recycling processes.

- In April 2023: Huhtamäki Oyj launched three new and effective sustainable concepts in mono-material flexible packaging. The solution comprises Paper, PE (Polyethylene), and PP (Polypropylene) Retort formats to address the growing demand for eco-friendly packaging and meet the diverse needs of the company’s clients.

Retort Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Pouches, Cartons, Trays, Others |

| Material Types Covered | Polypropylene, Polyester, Aluminum Foil, Paper Board, Nylon, Food Grade Cast Polypropylene, Others |

| End Users Covered | Food, Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Clifton Packaging Group Limited, Constantia Flexibles, Dai Nippon Printing Co., Ltd., FLAIR Flexible Packaging Corporation, HPM Global Inc, Huhtamaki Oyj, Logos Packaging, Mondi, ProAmpac, Sealed Air Corporation, Sriram Flexibles Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the retort packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global retort packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the retort packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Retort packaging is a type of heat-resistant, airtight packaging designed to preserve food and beverages. It involves sealing food in a flexible or rigid pouch or container, which is then subjected to high heat and pressure to kill bacteria and extend shelf life without refrigeration, ensuring safety and maintaining nutritional quality.

The retort packaging market was valued at USD 4.42 Billion in 2024.

IMARC estimates the global retort packaging market to exhibit a CAGR of 5.81% during 2025-2033.

Key factors driving the global retort packaging market include increasing demand for convenience foods, longer shelf life, and the need for food safety. Additionally, the growing preference for lightweight, eco-friendly packaging, along with advancements in packaging technology and rising consumer interest in ready-to-eat meals, further propel market growth.

In 2024, pouches represented the largest segment by packaging type, due to their lightweight nature, which reduces transportation costs. Their flexibility allows for easy customization in size and shape, making them ideal for a wide range of products, from soups to ready meals, while ensuring longer shelf life.

Polypropylene leads the market by material type owing to its ability to withstand high temperatures during the sterilization process, ensuring food safety. Additionally, its durability and moisture resistance make it ideal for maintaining the quality of packaged products, while being cost-effective for manufacturers.

The food industry is the leading segment by end user, as consumer demand for convenient, nutritious, and shelf-stable meals increases. Retort packaging helps preserve food quality, extend shelf life, and offer easy-to-transport options for products like soups, sauces, and ready-to-eat meals, making it highly popular in this sector.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global retort packaging market include Amcor plc, Clifton Packaging Group Limited, Constantia Flexibles, Dai Nippon Printing Co., Ltd., FLAIR Flexible Packaging Corporation, HPM Global Inc, Huhtamaki Oyj, Logos Packaging, Mondi, ProAmpac, Sealed Air Corporation, Sriram Flexibles Private Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)