Respiratory Care Devices Market Size, Share, Trends and Forecast by Product, Indication, End User, and Region, 2025-2033

Respiratory Care Devices Market Size and Share:

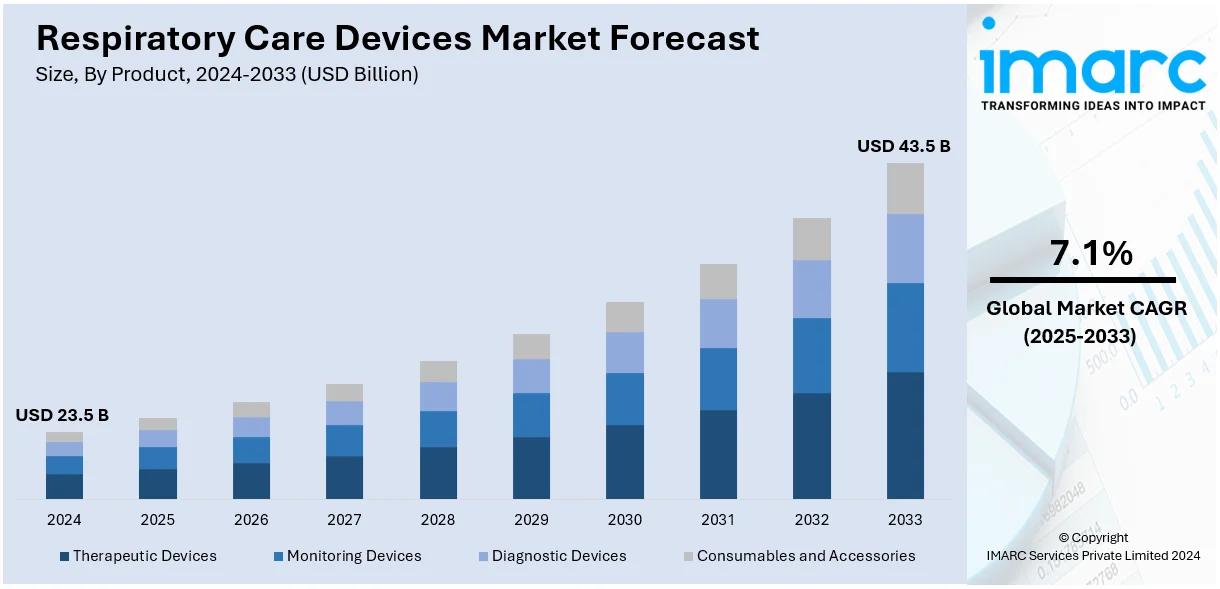

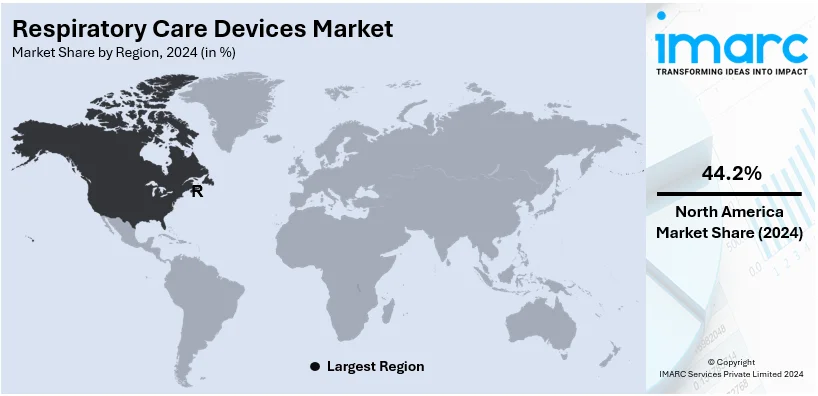

The global respiratory care devices market size was valued at USD 23.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.5 Billion by 2033, exhibiting a CAGR of 7.1% during 2025-2033. North America currently dominates the market. The increasing prevalence of respiratory diseases, rising geriatric population, technological advancements, and growing awareness about respiratory health, are factors driving the market across the North American region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.5 Billion |

|

Market Forecast in 2033

|

USD 43.5 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The global market for respiratory care devices has several driving factors, especially the increasing prevalence of such diseases as COPD, asthma, and sleep apnea, which is attributed to increased pollution levels, lifestyle changes, and consumption of tobacco products across all age groups. According to the Centers for Disease Control and Prevention, 1 out of every 19 middle school students and 1 out of 10 high school students are into numerous tobacco products. Additionally, the geriatric population growing worldwide is more prone to respiratory issues and significantly drives market expansion. Besides this, technological advancements, such as the development of portable and wirelessly enabled respiratory devices-facilitate higher adoption rates and patient compliance with the treatment. Moreover, the COVID-19 epidemic highlighted the critical need for respiratory care, creating enormous demand for ventilators and oxygen concentrators along with other related equipment.

The United States stands out as a critical market disruptor, driven by resurfacing of diseases such as asthma, COPD, and obstructive sleep apnea. The general ageing of the US citizen contributes toward a large number prone to the respiratory illness, resulting in much-needed demand. Advances in technology such as portable and user-friendly products have enhanced patient compliance, which is increasing global respiratory care devices market growth further. The COVID-19 pandemic has underlined the needs of respiratory care, and the demand has increased for ventilators, oxygen concentrators, and allied equipment. The increase in healthcare spending, coupled with suitable reimbursement policies, has promoted larger adoption of advanced respiratory care solutions. Increasing public awareness relating to their respiratory health and that there must be early diagnosis, which improves the management of respiratory conditions themselves is key factors driving market demand.

Respiratory Care Devices Market Trends:

Growing prevalence of respiratory diseases

Respiratory diseases, including chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and others, are the most critical global health concerns affecting millions of individuals worldwide. The rising incidence of these diseases, the growing aged population, the increasing air pollution, and changes in lifestyle are creating a strong demand for respiratory care devices. The National Center for Health Statistics report from 2022 indicated that nearly 4.6% of adults in the United States have been diagnosed with chronic obstructive pulmonary disease (COPD), emphysema, or chronic bronchitis. Further, the WHO published report in 2023 revealed that the number of individuals affected by asthma reached 262 million and caused 45,5000 deaths. The role of respiratory care devices is crucial in the management and treatment of respiratory diseases. They improve lung function, reduce symptoms, and improve the quality of life of a patient suffering from a respiratory condition. Except for this, the increasing trend of unhealthy lifestyle habits along with the alcohol consumption and chain smoking are anticipated to fuel the demand for respiratory care devices in the future.

Increasing government initiatives

Governments of almost every country in the world are creating awareness regarding the increase incidences of respiratory diseases. In addition, regulatory bodies in various countries are implementing plans to enhance the prevention, diagnosis, and treatment facilities of respiratory diseases that support the growing demand in the respiratory market. An instance of this, is the Centers for Disease Control and Prevention, that has developed the Hospital Respiratory Protection Program Toolkit to be used by healthcare facilities when implementing respiratory protection programs. The toolkit provides information to help healthcare facilities in implementing a comprehensive respiratory protection program to protect healthcare workers against tuberculosis and influenza. Government agencies further launch smoking cessation programs, immunization campaigns, and the control of pollution to decrease cases of respiratory diseases. With India's National Tuberculosis Elimination Programme, vast progress has been made on reducing TB incidence and its mortality. The TB incidence rate has declined by 17.7%, from 237 per 100,000 in 2015 to 195 per 100,000 in 2023, as per industry report. TB-related deaths have also declined by 21.4%, from 28 per lakh population in 2015 to 22 per lakh population in 2023. The five-year trend of TB case notification also shows steady progress, indicating the program's impact. Also, as per industrial news, the NACP funds 29 state, territorial, and municipal partners in the United States to improve the reach, quality, and sustainability of asthma control services, with an aim to reduce asthma morbidity, mortality, and disparities through evidence-based strategies implemented under a 5-year cooperative agreement.

Rising geriatric population

The geriatric population is more predisposed to developing respiratory problems, such as chronic obstructive pulmonary disease, pneumonia, and sleep apnea. The United Nations reports indicate that by 2021, individuals aged 65 years or older will amount to over double - which will increase from 761 million to 1.6 billion in 2050. Moreover, those aged 80 years and above will increase even more rapidly. And this trend of population ageing is irreversible, thus increasingly creating a demand for respiratory care solutions. For instance, the World Health Organization reports that by 2030, 1 in 60 individuals across the world will be aged 60 years or more. The old age population across the world will increase by 2050. The aging process also causes weakening of the respiratory muscles and reduction in lung function, hence making elderly individuals prone to respiratory problems. There are devices such as oxygen therapy, nebulizer, and CPAP devices that are majorly given to elderly patients for conditions related to respiration. In addition, manufacturers in the industry have been conducting research on how to present new and more innovative models that specifically help elderly patients, such as making portable products that are easily used outside the hospitals and clinics or even at home. To illustrate this, Xplore Health Technologies launched Airofit Pro, an innovative RMT device, in November 2022.

Respiratory Care Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the respiratory care devices market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on product, indication, and end-user.

Analysis by Product:

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Ventilators

- Nebulizers

- Humidifiers

- Inhalers

- Others

- Monitoring Devices

- Pulse Oximeters

- Gas Analyzers

- Others

- Diagnostic Devices

- Spirometers

- Polysomnography Devices

- Peak Flow Meters

- Others

- Consumables and Accessories

- Masks

- Disposable Resuscitators

- Breathing Circuits

- Tracheostomy Tubes

- Nasal Cannulas

- Others

Therapeutic devices lead the market in 2024. In respiratory care devices, the demand for therapeutic, monitoring devices, and diagnostic devices is increasing, as they aid in ensuring a smooth respiration process by delivering an sufficient amount of oxygen to the lungs and avoiding any blockage in the process. Consumables and accessories, including masks and tubing, are adopted with oxygen therapy devices, CPAP machines, and nebulizers to deliver oxygen or medication to the patient.

Analysis by Indication:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Sleep Apnea

- Infectious Disease

- Others

Chronic obstructive pulmonary disease (COPD) accounts for the majority of the global respiratory care devices market share in 2024. COPD is a chronic inflammatory lung disease that affects blocked airflow from the lungs. While asthma refers to a chronic condition characterized by inflammation and narrowing of the airways, leading to wheezing, coughing, chest tightness, and shortness of breath. It is often triggered by allergens, irritants, or respiratory infections. Besides this, sleep apnea is a sleep disorder characterized by pauses in breathing or shallow breathing during sleep. All these diseases are augmenting the need for respiratory care devices market.

Analysis by End-User:

- Hospitals

- Home Care Settings

- Ambulatory Care Centers

- Others

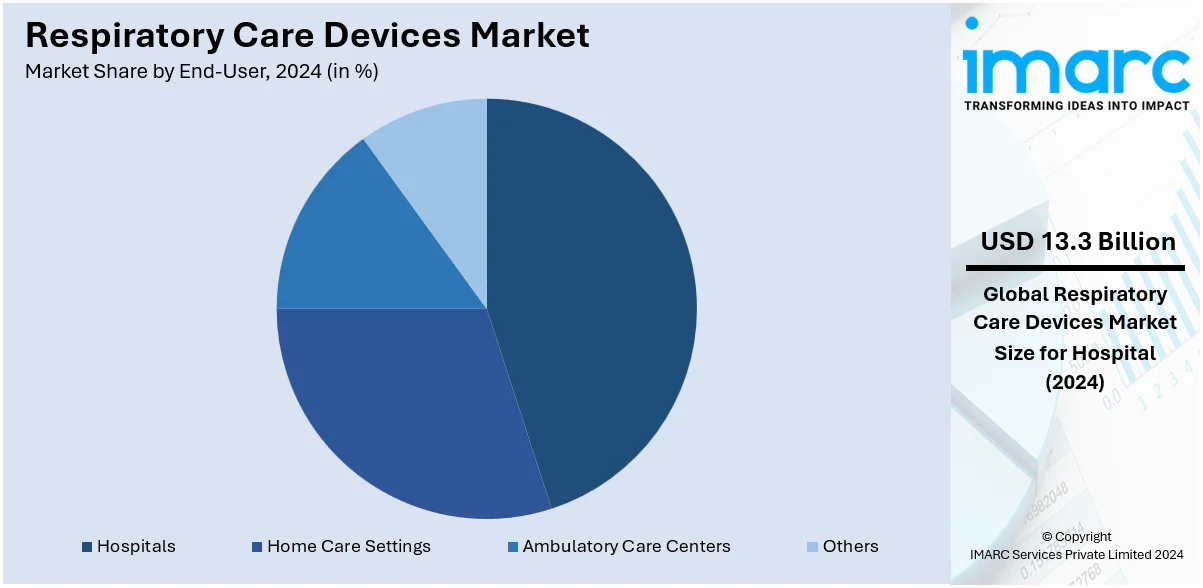

Hospitals lead the market in 2024. The respiratory care devices market demand is experiencing a significant growth in hospitals, homecare settings, ambulatory care centers, etc. As the serious respiratory conditions require both in-patient and outpatient settings. Apart from this, home care settings are also gaining extensive traction, as more patients prefer to obtain care at home than in hospitals.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest. According to the respiratory care devices market outlook, the demand for the devices is experiencing a significant increase in North America, Europe, and Asia Pacific, owing to various factors, including the high prevalence of chronic illnesses, the ageing population, the development of healthcare infrastructures, and government initiatives. The rising R&D activities in North America are also acting as the prominent growth inducing factors. For instance, according to the National Health Expenditure Account (NHEA), healthcare spending in the United States increased significantly by 4.1% in 2022 and reached US$ 4.5 Trillion.

Key Regional Takeaways:

United States Respiratory Care Devices Market Analysis

The United States respiratory care devices market is growing at a great rate, primarily because of the high prevalence of chronic respiratory conditions, along with better healthcare infrastructure, and a rising demand for treatment solutions. According to the American Lung Association, which published an article in February 2023, there are more than 34 million Americans suffering from chronic lung diseases, including COPD, asthma, chronic bronchitis, and emphysema. In addition, 11.7 million adults, or 4.6% of the population, were diagnosed with COPD in 2022, including chronic obstructive pulmonary disease, chronic bronchitis, and emphysema.

Another reason for increased demand is sleep-related respiratory disorders. According to the National Institutes of Health (NIH), OSA is prevalent among 10–15% of females and 15–30% of males in North America.

Moreover, as of January 2023, industry sources report that the U.S. has about 7,335 active hospitals. Such a large health infrastructure along with the growing number of patients will drive the advanced respiratory care devices into use for better patient care and respiratory health management.

Europe Respiratory Care Devices Market Analysis

Growth opportunities for the Europe respiratory care devices market lie in its rising prevalence of chronic respiratory diseases and positive regulatory advancement. In 2022, asthma emerged as one of Germany's most common chronic diseases, with prevalence of 4–5% among adults and 10% among children, as per an industry report. While biological therapies exist, research points to real-life uncontrolled severe asthma and hence to more sophisticated solutions for respiratory care.

The market also advantages through speedy approval of medical oxygen concentrators for the reimbursement procedure in Europe. For instance, in January 2023, the British Standards Institution (BSI) granted European Medical Device Regulation (EU MDR) certification to Inogen, Inc. This has allowed the firm to take its portable oxygen concentrator products further into the markets of U.S. and EU.

The increasing incidence of respiratory diseases is another factor that is contributing to the growth of the market. According to the World Health Organization, in Switzerland, asthma-related deaths occurred in 95 cases in 2020, and lung disease deaths accounted for 2,902 or 5.01% of total deaths. This increase in demand for respiratory devices across Europe is expected to drive the growth of the market during the forecast period.

Asia Pacific Respiratory Care Devices Market Analysis

The Asia-Pacific respiratory care devices market is expected to grow considerably due to the rising prevalence of respiratory allergies and favorable market conditions. In Japan, hay fever, which is attributed to the spread of cedar pollen, is the most common respiratory allergy. According to a May 2023 report by Firstpost, hay fever affects approximately 40% of the Japanese population, which increases the demand for therapeutic respiratory devices in the region.

Moreover, measures of market leaders in lowering the prices of respiratory care equipment to increase accessibility is encouraging this market's growth. For instance, in April 2021, Koninklijke Philips N.V. brought down its oxygen concentrator price by 7% in India, a direct fallout of the cuts that have been taken by the Government on customs duty. This reduction in price has brought down the MRP of oxygen concentrators sold by the company to INR 68,120 or USD 940 from the erstwhile existing INR 73,311 or USD 1,012. In this manner, this lifeline equipment will come within the reach of many consumers. These factors combined with heightened awareness about the condition of respiratory health, is likely to spur growth in this Asia-Pacific market.

Latin America Respiratory Care Devices Market Analysis

COPD, also known as chronic obstructive pulmonary disease, is ranked as one of the six leading causes of death in Brazil showing 15.8 %prevalence rate due to which it is going to be one of the main drivers for the market's growth in the form of expanding chronic respiratory diseases. The growing instances of asthma and sleep apnea fuel an upsurge in the demand for respiratory care. Additionally, as per an industry report, Brazil is increasing healthcare infrastructure with 2,725 public hospitals in operation in the year 2022. The same has been shown in comparison with 2021 when 2,702 public hospitals were functioning, hence an increasing respiratory care capacity. The rising health care facility, the efforts of the government for upgrading public health, and increasing treatment of respiratory disorders will increase demand for respiratory care devices. Moreover, growing awareness and adoption of homecare solutions, including oxygen concentrators and CPAP devices, will further propel the market in Latin America.

Middle East and Africa Respiratory Care Devices Market Analysis

Due to growing healthcare initiatives as well as the incidence of chronic respiratory conditions, the Middle East and Africa (MEA) respiratory care devices market will grow remarkably. During July 2024, the UAE has launched the Zayed Humanitarian Legacy Initiative that program has ten years' of investment exceeding over USD 150 Million. It shall fund the construction of as many as 10 new hospitals that shall improve access to healthcare for the underserved communities. It is estimated that this shall also contribute to the demand of respiratory care devices in that area.

Another factor increasing the market is the incidence of respiratory diseases. Diabetes, for instance, affects 17.7% of the population in Saudi Arabia, and the number of diabetes cases among adults is estimated to be at 4,274,100, according to the International Diabetes Federation. Chronic diseases such as diabetes normally result in the onset of secondary respiratory disorders such as COPD and sleep apnea, and therefore the need for the solutions in the MEA region for respiratory rises.

Competitive Landscape:

Leading manufacturers in the global respiratory care devices market is driving business growth through varied strategic steps, including deep investments into research and developments to release innovative and technological advanced apparatus such as portable ventilators and wearables and monitor-based respiratory care devises. Companies are strategic partnerships with mergers acquisitions to achieve expansion in business presence. Alongside that, manufacturers are actively pushing awareness campaigns among healthcare workers and patients to educate the latter about respiratory diseases as well as management solutions in general. The use of leading manufacturers' artificial intelligence and telemedicine technologies has also positively streamlined the efficiency of respiratory care, allowing for better distant monitoring and personalization for its treatments.

The report provides a comprehensive analysis of the competitive landscape in the respiratory care devices market with detailed profiles of all major companies, including:

- Philips Healthcare

- ResMed

- Chart Industries Inc.

- Hamilton Medical

- Medtronic

- Masimo

- Drägerwerk

- Invacare Corporation

- Allied Healthcare Products Inc

- 3B Medical Inc.

- Air Liquide

- Fisher & Paykel Healthcare

- GE Healthcare

- Vyaire Medical Inc.

- Rotech Healthcare Inc.

Recent Developments:

- April 2024: OMRON Healthcare, Co., Ltd., has acquired the fast-growing firm Luscii Healthtech, that specializes in platforms for digital health and service platforms on remote consultation.

- February 2024: ResMed launched its AirCurve 11 series bilevel positive airway pressure devices in the United States. These devices use IPAP and EPAP. Equipped with advanced digital technology, the AirCurve 11 looks to help healthcare providers treat sleep apnea more effectively and help patients stick to their therapy.

- February 2024: Getinge launched its Servo-c mechanical ventilator in India. The mechanical ventilator has lung-protective therapy tools and caters to respiratory care. It also supports the strategy of accessible and cost-effective healthcare solutions for hospitals in India from Getinge.

- January 2024: Inspira Technologies OXY B.H.N Ltd. has launched a blood oxygenation disposable kit for its INSPIRA ART medical device series. The kit is also compatible with other life support machines, thereby allowing the company to enter the market for single-use perfusion systems.

Respiratory Care Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Indications Covered | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Sleep Apnea, Infectious Disease, Others |

| End-Users Covered | Hospitals, Home Care Settings, Ambulatory Care Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Philips Healthcare, ResMed, Chart Industries Inc., Hamilton Medical, Medtronic, Masimo, Drägerwerk, Invacare Corporation, Allied Healthcare Products Inc, 3B Medical Inc., Air Liquide, Fisher & Paykel Healthcare, GE Healthcare, Vyaire Medical Inc., Rotech Healthcare Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the respiratory care devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global respiratory care devices market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the respiratory care devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Respiratory care devices are medical instruments designed to diagnose, monitor, and treat respiratory disorders, improving lung function and supporting patients with breathing difficulties.

The respiratory care devices market was valued at USD 23.5 Billion in 2024.

IMARC estimates the global respiratory care devices market to exhibit a CAGR of 7.1% during 2025-2033.

The global respiratory care devices market is driven by the rising prevalence of respiratory diseases, advancements in medical technology, increasing geriatric population, and growing awareness about respiratory health.

According to the report, therapeutic devices represented the largest segment by product, driven by their critical role in managing and treating a wide range of respiratory conditions, including COPD, asthma, and sleep apnea, ensuring consistent demand.

Chronic obstructive pulmonary disease (COPD) leads the market by indication owing to its high prevalence, chronic nature, and the extensive use of respiratory care devices for its long-term management.

Hospitals are the leading segment by end user, driven by an increasing need for data-driven insights to optimize operations, manage risk, and enhance consumer experiences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global respiratory care devices market include Philips Healthcare, ResMed, Chart Industries Inc., Hamilton Medical, Medtronic, Masimo, Drägerwerk, Invacare Corporation, Allied Healthcare Products Inc, 3B Medical Inc., Air Liquide, Fisher & Paykel Healthcare, GE Healthcare, Vyaire Medical Inc., Rotech Healthcare Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)