Residential Energy Storage System Market Size, Share, Trends and Forecast by Technology Type, Power Rating, Ownership Type, Connectivity Type, and Region, 2025-2033

Residential Energy Storage System Market Size and Share:

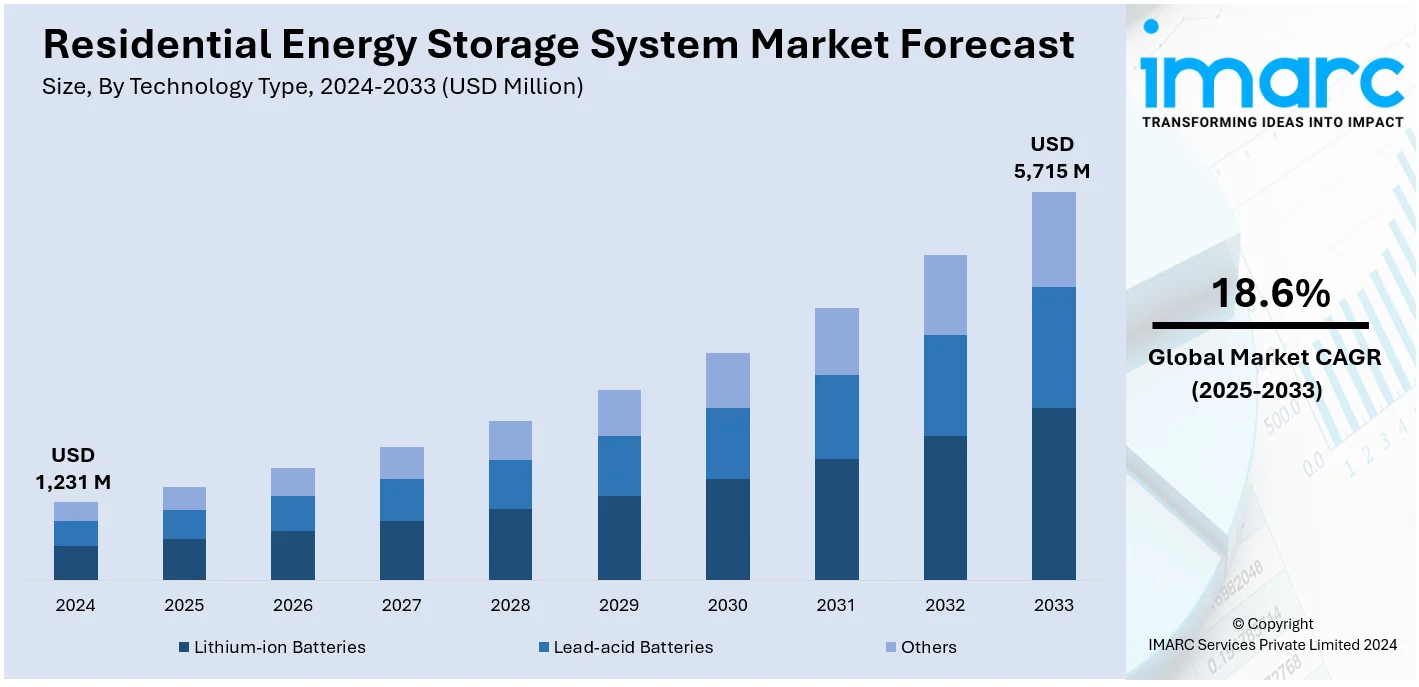

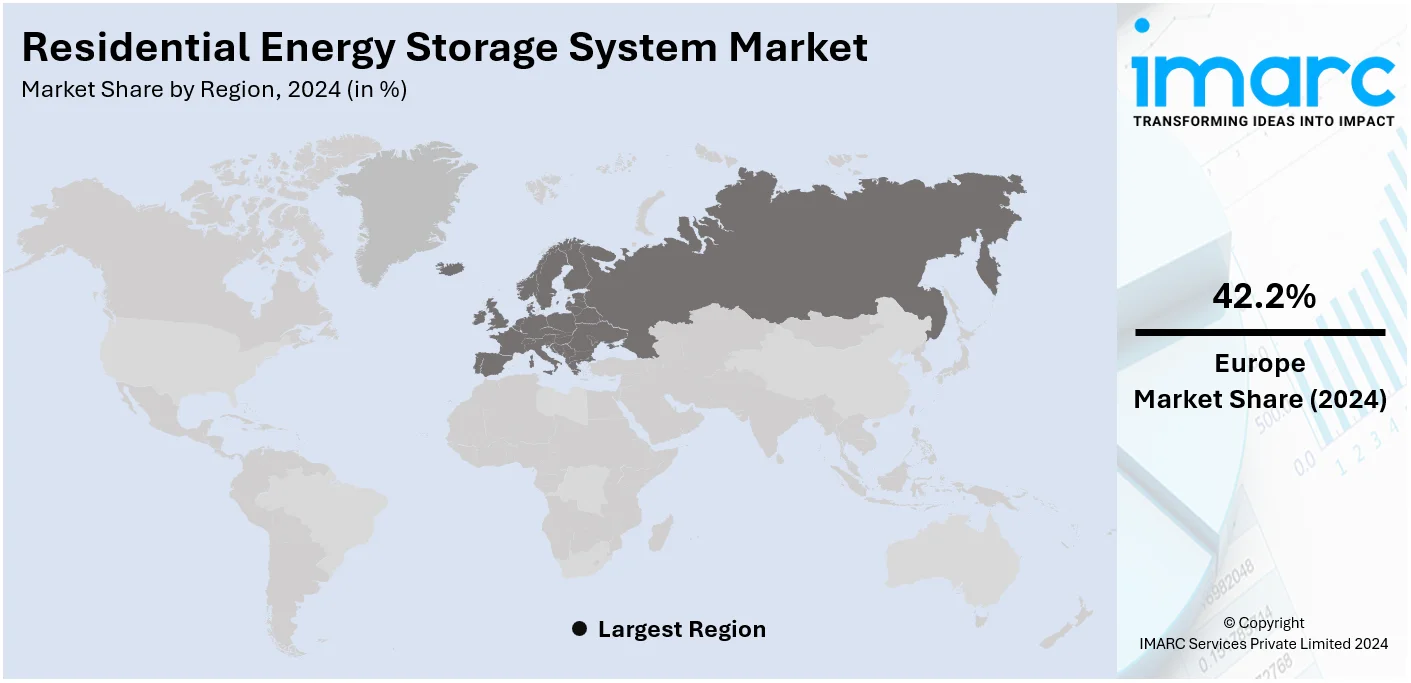

The global residential energy storage system market size was valued at USD 1,231 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,715 Million by 2033, exhibiting a CAGR of 18.6% during 2025-2033. Europe currently dominates the market, holding a market share of over 42.2% in 2024. The aging of several grid assets, the increasing energy consumption, and the growing need for uninterrupted and stable power to perform multiple household activities represent some of the key factors driving the residential energy storage system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,231 Million |

| Market Forecast in 2033 | USD 5,715 Million |

| Market Growth Rate (2025-2033) | 18.6% |

Significantly increasing energy consumption represents one of the key factors driving the residential energy storage system market growth. According to reports, the global energy consumption accelerated in 2023 (+2.2%), much faster than its average 2010-2019 growth rate (+1.5%/year). In line with this, the rising need for uninterrupted and stable power to perform multiple household activities have facilitated the demand for residential ESS, which is acting as another growth-inducing factor. Such devices reduce the involvement of additional incentives by offering tax benefits, eliminate peak load on the local grid networks and optimize power quality; thus, they are widely employed as storage systems. Moreover, the increasing aging of several grid assets due to severe weather conditions and the rising deterioration of chokepoints and bottlenecks in the energy delivery systems resulting in higher costs and risk of local power outages are driving the market growth.

The United States is a major market disruptor with 90% of residential energy storage system market share in North America. The rising demand for reliable backup power solutions is driven by the growing occurrence of power outages caused by extreme weather and the deterioration of aging grid systems. Residential energy storage systems offer homeowners a consistent electricity supply during grid disruptions. In the third quarter of 2024, the U.S. residential energy storage market achieved a new milestone, with 346 MW of storage installed—a 63% jump compared to the previous quarter. This surge indicates a growing consumer emphasis on energy reliability and resilience.

Residential Energy Storage System Market Trends:

Increasing Demand for Renewable Energy Integration

The increasing global transition to renewable energy sources has played a key role in driving the residential energy storage systems demand. In 2024, solar capacity installations were set to increase by 29%, marking a record surge in renewable energy adoption. This rise highlights the growing importance of efficient storage solutions to address the variability of renewable energy sources such as solar and wind. More homeowners are adopting battery systems to store surplus energy produced during peak generation periods for use when production decreases. This trend is particularly evident in countries like Japan, where government measures are making solar panels mandatory for new homes, further driving the demand for residential batteries.

Integration with Electric Vehicles (EVs) for Bidirectional Charging

An emerging trend is the integration of residential energy storage systems with electric vehicles (EVs) using bidirectional charging technology. This innovation enables EVs to both draw power from the home and return energy to the household or grid as needed. Such vehicle-to-home (V2H) and vehicle-to-grid (V2G) capabilities enhance energy flexibility and provide additional backup power solutions for homeowners. Companies like SunRun have partnered with automakers to explore these possibilities, contributing to the evolution of integrated energy ecosystems.

Virtual Power Plants (VPPs) and Aggregated Storage Solutions

Virtual Power Plants (VPPs) are revolutionizing how residential energy storage systems interact with the broader electricity grid. By linking multiple home batteries through cloud-based platforms, VPPs can collectively supply energy during peak demand periods, enhancing grid stability and providing homeowners with additional income streams. In Japan, for instance, the government is promoting VPPs, with plans to facilitate the trade of electricity stored in residential batteries in a dedicated market starting in fiscal 2026. Tesla has been proactive in this space, establishing VPPs in Japan using its Powerwall batteries. This strategy supports individual homeowners while also enhancing the resilience and efficiency of the broader energy infrastructure.

Residential Energy Storage System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global residential energy storage system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology type, power rating, ownership type, and connectivity type.

Analysis by Technology Type:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

As per the residential energy storage system market forecast, lithium-ion batteries lead the residential energy storage sector, driven by their high energy density, extended lifespan, and decreasing production costs. Widely adopted in solar-plus-storage solutions, these batteries offer high efficiency and compact designs, making them ideal for residential use. With advancements in materials and manufacturing processes, lithium-ion battery costs dropped by nearly 15% between 2023 and 2024, further driving adoption. Their scalability, compatibility with smart home systems, and ability to integrate with renewable energy sources solidify their position as the preferred technology in the market.

Analysis by Power Rating:

- 3-6 Kw

- 6-10 Kw

- More Than 10 Kw

6-10 Kw dominated the residential energy storage system market share in 2024. This segment’s dominance in this sector is because it perfectly balances capacity and affordability for average household needs. This power rating is ideal for powering multiple appliances, including high-energy devices like HVAC systems, during outages or peak demand. The segment’s popularity surged in the past few years, supported by the growing adoption of solar-plus-storage setups, where this capacity range meets daily energy consumption and nighttime backup requirements. With the increased integration of smart energy management systems, 6–10 kW units offer flexibility, allowing homeowners to optimize energy usage efficiently. Their scalability and suitability for medium-sized homes solidify their position as the most preferred option in the market.

Analysis by Ownership Type:

- Customer-owned

- Utility-owned

- Third-Party Owned

According to the residential energy storage system market outlook, the customer-owned segment holds the largest market share, accounting for 60%. It is driven by homeowners' desire for energy independence and long-term cost savings. This ownership model appeals to those seeking full control over their energy systems, allowing them to maximize returns through savings on utility bills and access to incentives like tax credits. The segment's growth has accelerated recently with declining battery costs and attractive financing options making these systems more accessible. Customer ownership also aligns with sustainability goals, as users can directly manage renewable energy integration and storage. This autonomy and financial benefit make the customer-owned model the preferred choice for most residential users.

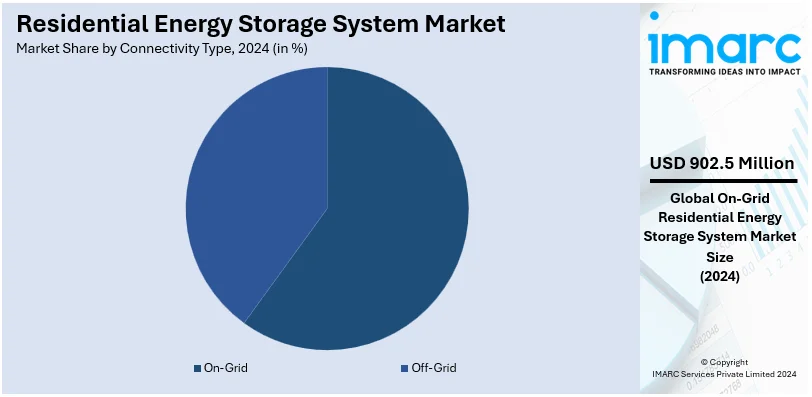

Analysis by Connectivity Type:

- On-Grid

- Off-Grid

Based on the latest residential energy storage system market trends, on-grid type leads the market with around 73.3% of the share in 2024. This growth is driven by its ability to provide seamless energy management while staying connected to the main power grid. On-grid systems allow homeowners to store excess renewable energy, such as solar power, and sell it back to the grid through net metering programs, enhancing cost-effectiveness. The popularity of on-grid systems surged due to their flexibility in balancing grid power and stored energy, especially in regions with time-of-use tariffs. These systems also act as reliable backups during grid outages that makes them an attractive choice for energy-conscious homeowners seeking both savings and reliability. Their compatibility with existing grid infrastructure solidifies their position as the market's leading connectivity type.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share with 42.2%. This expansion is fueled by substantial government incentives, ambitious renewable energy goals, and advancements in grid infrastructure. Countries like Germany, the UK, and Italy are leading in adoption, supported by programs such as Germany’s KfW grants for battery systems. In 2023, Europe’s residential segment accounted for 63% of the total battery energy storage systems (BESS). The region’s focus on achieving carbon neutrality by 2050, coupled with rising electricity prices and growing awareness of energy independence, has accelerated the residential energy storage system market demand. Europe maintains its position as the market leader due to its strong policy framework and high levels of renewable energy integration.

Key Regional Takeaways:

North America Residential Energy Storage System Market Analysis

Currently, the North American residential energy storage market is undergoing rapid growth, with the rising adoption of solar energy, frequent occurrences of outages, and government favorable policies facilitating the growth. The U.S. part of the region remains considerably dominant, with contributions coming from federal tax credits such as the Investment Tax Credit (ITC), state rebates, and programs such California's Self-Generation Incentive Program (SGIP). The increase in energy requirements in disaster-resilient areas and the rise in low-cost batteries and advancements in smart energy solutions, continues to bolster the residential energy storage system market growth across the region.

United States Residential Energy Storage System Market Analysis

The market is experiencing robust growth on account of several key drivers, including the increasing adoption of renewable energy, supportive government policies, advancements in battery technology, and rising energy costs. The shift toward renewable energy sources, such as solar and wind, is largely propelled by the increasing residential energy storage system demand. As per the U.S. Energy Information Administration (EIA), the U.S. solar power generation will grow from 163 billion kilowatthours (kWh) in FY 2023 to 286 billion kWh in FY 2025, which is a 75 percent rise. Homeowners are increasingly installing solar panels to harness clean energy, creating a need for storage solutions to ensure uninterrupted power supply during non-sunny hours or grid outages. Residential energy storage systems enable homeowners to store excess energy, reducing dependence on the grid. Advances in battery technology, especially in lithium-ion batteries, have enhanced efficiency, extended lifespans, and lowered costs. These cost reductions are making lithium-ion batteries increasingly affordable for residential use. As a result, more homeowners are adopting these systems as a practical solution for managing their energy needs. Apart from this, federal and state-level initiatives are critical enablers of the RESS market. States like California and New York are incentivizing the adoption through rebate programs and subsidies, enhancing affordability and driving market penetration.

Asia Pacific Residential Energy Storage System Market Analysis

The growing pace of urbanization and rising energy demands in the region are key factors driving the increased adoption of residential energy storage systems. According to the CIA, the urban population in China in 2023 was 64.6% of total population. With grid reliability issues in densely populated areas, RESS provides a dependable solution for uninterrupted power supply and energy cost optimization. Besides this, the Asia Pacific region has witnessed a significant surge in the deployment of renewable energy systems, particularly solar photovoltaic (PV) installations. Nations such as China, Japan, and Australia are at the forefront of residential solar adoption, driving demand for energy storage systems to address intermittency challenges and enhance energy security. Residential storage systems complement solar power, enabling households to maximize energy self-sufficiency. In line with this, governing agencies in the Asia Pacific are actively promoting energy storage adoption through subsidies, tax incentives, and favorable policies. Ongoing developments in battery technology, particularly in lithium-ion batteries, continue to improve the efficiency and affordability of energy storage systems. The cost of lithium-ion batteries is dropping significantly in recent years, enabling mass-market adoption. Coupled with innovations in smart energy management systems, these technologies are propelling the Asia Pacific RESS market.

Europe Residential Energy Storage System Market Analysis

As per the residential energy storage system market forecast, the rising security concerns, along with favorable government policies, are propelling the market growth. There is an increase in the focus on renewable energy sources because they does not emit harmful emissions. As per reports, renewable energy sources represented around 24.1% of the European Union’s final energy use in the year 2023. Moreover, the European Union's commitment to achieving carbon neutrality by 2050 is leading to a significant rise in residential solar installations. Countries like Germany, Italy, and Spain are leading in rooftop solar adoption, creating a demand for energy storage systems to manage surplus energy and ensure grid stability. Apart from this, the Russia-Ukraine conflict is highlighting Europe's dependency on imported energy, driving efforts to enhance energy security. Rising electricity prices are motivating households to adopt energy storage solutions, helping them minimize grid dependency and better control their energy expenses. Furthermore, governing agencies in Europe are actively promoting residential energy storage through incentives and subsidies. The European Green Deal and REPowerEU plan further emphasize energy storage as a critical component of the region's energy transition. Additionally, the European Union's Battery 2030+ initiative aims to develop sustainable and high-performance batteries, enhancing the competitiveness of European RESS. Smart energy management systems integrated with storage solutions further enhance household energy efficiency.

Latin America Residential Energy Storage System Market Analysis

The unreliable grid infrastructure, government incentives, and technological advancements are key factors in the Latin America region, which are bolstering the residential energy storage system market growth. Countries like Brazil, Mexico, and Chile are expanding their renewable energy capacity, especially solar PV installations. In addition, frequent power outages and grid instability across parts of Latin America are encouraging households to adopt energy storage systems for backup power. RESS solutions provide a reliable alternative to mitigate power disruptions. Apart from this, governing agencies in the region are introducing subsidies and tax incentives for residential solar-plus-storage systems, supporting affordability and adoption. Furthermore, declining battery costs and improvements in lithium-ion technology are making energy storage more accessible, fostering widespread adoption in the residential sector. According to reports, costs of battery manufacturing process decreased by 50% in Brazil.

Middle East and Africa Residential Energy Storage System Market Analysis

The Middle East and Africa (MEA) region have been increasingly adopting renewable energy applications, especially solar energy, due to solar abundance. As a result, nations such as South Africa, UAE, and Saudi Arabia are pursuing the installation of residential solar systems, thus raising energy storage demand to address the discontinuous energy supply and improve efficiency. Regular blackouts as well as grid unreliability are forcing people in most regions to adopt RESS as a power backup utility, especially in rural and underserved areas. The demands for energy is also increasing as the population grows. The International Monetary Fund reports that the population in Saudi Arabia will reach an estimate of about 34.15 million by 2025. Moreover, governing authorities and households have decoupled energy strategies from traditional energy forms and are looking for energy independence. This therefore stimulates the need for solar-plus-storage systems in self-sufficient homes.

Competitive Landscape:

To promote growth, major market participants are concentrating on strategic alliances, technology developments, and increasing their footprint in crucial areas. The main focus is on enhancing battery affordability, safety, and efficiency, especially using lithium-ion technology. Businesses are also integrating intelligent capabilities to energy management systems so that residential customers can monitor and optimize them in real time. In response to the increasing demand from customers for seamless systems, they are additionally working with installers and suppliers of renewable energy to deliver integrated solar-plus-storage solutions. Alongside these efforts, they are investing in research and development (R&D) to drive advancements like long-duration storage and improved materials, with focused marketing initiatives to expand awareness about the benefits of energy storage. Additionally, leveraging government incentives and financing options has allowed market leaders to make these systems more accessible to a broader audience, supporting adoption in both developed and emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the residential energy storage system market with detailed profiles of all major companies, including:

- ABB Ltd.

- BYD Company Limited

- Delta Electronics Inc.

- Eaton Corporation plc

- Eguana Technologies Inc

- Enphase Energy Inc

- Huawei Technologies Co. Ltd.

- LG Energy Solution Ltd

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Schneider Electric SE

- SENEC (EnBW Energie Baden-Württemberg AG)

- Sonnen GmbH

- Tesla Inc.

- Varta AG

Latest News and Developments:

- October 2024: Enphase Energy, Inc. announced plans to extend its support for grid services programs, including virtual power plants (VPPs), in New Hampshire, North Carolina, and California. This initiative will utilize the company’s new IQ Battery 5P to enhance energy storage and grid integration capabilities. Grid services programs are controlled by regional utilities and rely on energy stored in household batteries to power communities when they are most required, such as during peak electricity demand. This minimizes reliance on expensive and polluting power plants for electricity, while also providing incentives to households through their local utilities.

- June 2024: Sonnen's announced that its virtual power plant (sonnenVPP) is available in Sweden as part of a bespoke electricity tariff solution developed in conjunction with Tibber. The partnership combines Sonnen's extensive expertise in managing virtual power plants (VPPs) with Tibber's innovative approach to dynamic energy pricing in Sweden.

- June 2022: Toyota Motor Corporation (Toyota) has developed batteries focused on principles such as safety, durability, high quality, cost-effectiveness, and strong performance, aiming to meet customer satisfaction and reliability standards. The O-Uchi Kyuden System, a home storage battery system, was created using this technology, which combines many years of electric vehicle research with on-board parts and modules.

- May 2022: Mango Power, a renowned green energy firm, unveiled the Mango Power M Series at Intersolar Munich. The Mango Power M Series is recognized as the world's first all-in-one energy storage solution designed to cater to multiple scenarios. It may function as a PV energy system, storage with a 10-20 kWh battery for everyday and emergency usage, and full-house power backup, including quick charging EVs for the contemporary family.

Residential Energy Storage System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Power Ratings Covered | 3-6 Kw, 6-10 Kw, More Than 10 Kw |

| Ownership Types Covered | Customer-owned, Utility-owned, Third-Party Owned |

| Connectivity Types Covered | On-Grid, Off-Grid |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., BYD Company Limited, Delta Electronics Inc., Eaton Corporation plc, Eguana Technologies Inc, Enphase Energy Inc, Huawei Technologies Co. Ltd., LG Energy Solution Ltd, Panasonic Corporation, Samsung SDI Co. Ltd, Schneider Electric SE, SENEC (EnBW Energie Baden-Württemberg AG), Sonnen GmbH, Tesla Inc., Varta AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the residential energy storage system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global residential energy storage system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the residential energy storage system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential energy storage system market was valued at USD 1,231 Million in 2024.

IMARC estimates the residential energy storage system market to exhibit a CAGR of 18.6% during 2025-2033.

The residential energy storage system market is driven by the increasing renewable energy adoption, rising electricity costs, advancements in battery technology, government incentives, growing demand for energy reliability, and smart home integration.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the residential energy storage system market include ABB Ltd., BYD Company Limited, Delta Electronics Inc., Eaton Corporation plc, Eguana Technologies Inc, Enphase Energy Inc, Huawei Technologies Co. Ltd., LG Energy Solution Ltd, Panasonic Corporation, Samsung SDI Co. Ltd, Schneider Electric SE, SENEC (EnBW Energie Baden-Württemberg AG), Sonnen GmbH, Tesla Inc., Varta AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)