Residential Boiler Market Size, Share, Trends and Forecast by Type, Fuel Type, Technology, and Region, 2025-2033

Residential Boiler Market Size and Share:

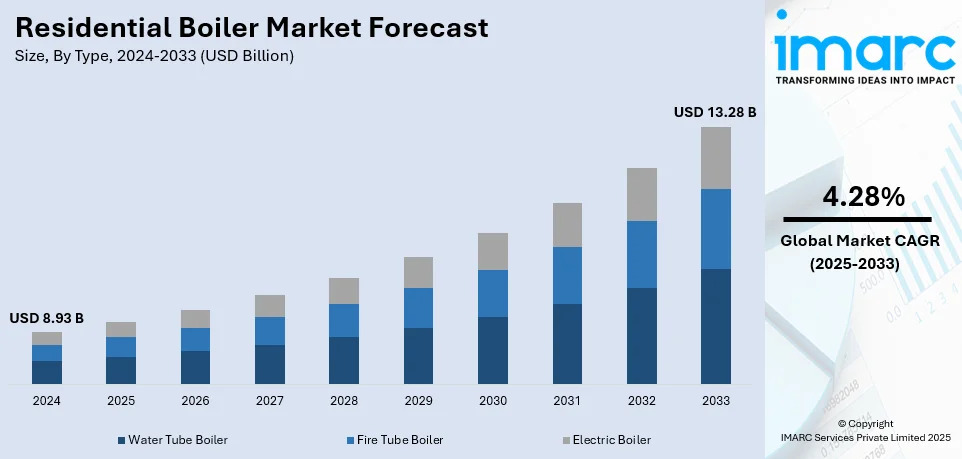

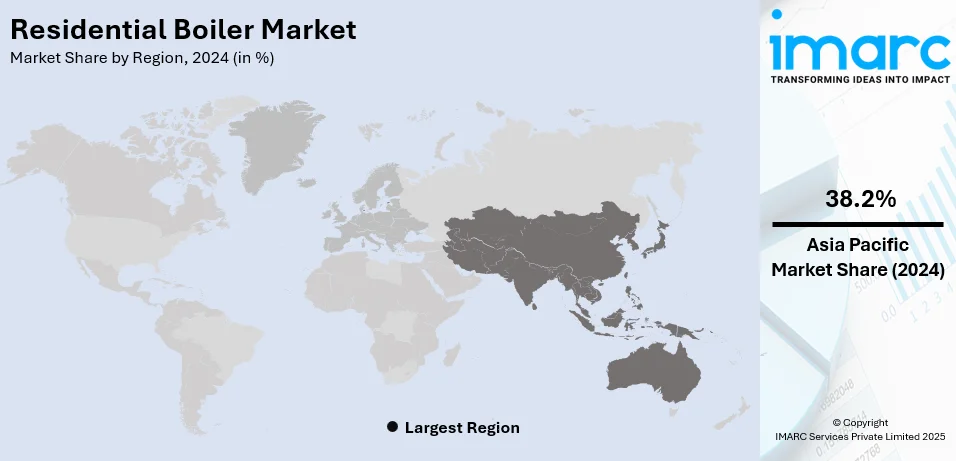

The global residential boiler market size was valued at USD 8.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.28 Billion by 2033, exhibiting a CAGR of 4.28% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of 38.2% in 2024. The market is driven by strict energy efficiency regulations, rising environmental awareness among masses, and government incentives promoting eco-friendly systems. Besides this, the residential boiler market share is influenced by increasing demand in colder regions for reliable heating solutions, while the strong presence of leading manufacturers catalyze innovation and market competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.93 Billion |

|

Market Forecast in 2033

|

USD 13.28 Billion |

| Market Growth Rate (2025-2033) | 4.28% |

Technological progress is significantly influencing the market for home boilers. Contemporary boilers are equipped with intelligent controls, enabling homeowners to adjust heating according to their daily requirements. Improved energy efficiency in new models greatly lowers operational expenses, making them more appealing to users. Advancements in heat exchanger designs enhance heat transfer efficiency, improving boiler performance and lowering energy consumption. Advanced materials, like corrosion-resistant alloys, improve boiler longevity and durability, guaranteeing enduring reliability. The integration of smart home technology is on the rise, enabling homeowners to manage their heating remotely through smartphones or voice assistants. The technology of condensing boilers, which reuses exhaust gases for improved efficiency, is rapidly increasing its market presence. The creation of hybrid systems, integrating gas and renewable energy sources, provides flexible, environmentally friendly heating solutions. Enhanced diagnostic and monitoring capabilities facilitate proactive upkeep, minimizing downtime and repair expenses. Producers are putting more emphasis on designing quieter and more compact products, tackling space and noise issues for homeowners, thereby influencing market expansion.

The United States residential boiler market demand is driven by the increasing focus on energy efficiency and sustainability. Rising energy costs encourage homeowners to adopt energy-efficient systems, which reduce long-term operational expenses. Government regulations, such as ENERGY STAR certification, incentivize customers to choose high-efficiency boilers that meet strict energy-saving standards. The growing emphasis on reducing carbon footprints motivates homeowners to opt for eco-friendly heating solutions. Residential boilers with improved thermal efficiency are gaining traction due to their reduced environmental impact. As energy-conscious homeowners seek cost-effective alternatives, high-efficiency condensing boilers are gaining widespread adoption. Environmental policies and tax credits further accelerate the market shift toward energy-efficient systems in residential properties. The focus on sustainability is also driving technological innovations, leading to the development of greener boiler models. Increased awareness of climate change is compelling manufacturers to produce products with lower greenhouse gas emissions. For example, in February 2024, U.S. Boiler unveiled the Ambient Hydronic Heat Pump, designed for residential applications. This energy-efficient heat pump delivers up to 5 tons of capacity and operates at temperatures as low as -13°F. It utilizes eco-friendly R-32 refrigerant and features quiet operation. The unit can function independently or integrate with existing systems for improved heating.

Residential Boiler Market Trends:

Rising heat and pollution generated by boilers

The rising concerns regarding the heat and pollution generated by boilers are prompting the governing agencies of various countries to undertake stringent initiatives for encouraging the establishment of green buildings and uptake of eco-friendly residential boilers as a sustainable heating technology. This, in turn, assists in improving air quality by mitigating the depletion of natural resources and minimizing the emissions of greenhouse gases (GHGs). For example, global greenhouse gas (GHG) emissions increased by 51% from 1990 to 2021. Moreover, rising urbanization and population density are intensifying pollution levels, leading to stricter environmental standards in residential heating. As the focus on air quality and carbon reduction increases, energy-efficient boilers become a priority for residential properties. Smart technologies integrated into new boilers also help minimize energy consumption, contributing to pollution reduction.

Extensive utilization in residential areas

The extensive utilization of condensing boilers in residential areas on account of its various beneficial properties, including affordability, reduced carbon footprints, and clean heating operation, is propelling the market growth. Rapid urbanization and rising disposable incomes in developing regions, along with the increasing need for high-performance heating devices with easy maintenance and installation, are creating a positive outlook for the market. As per the World Health Organization, more than 55% of the population resides in metropolitan areas, with this percentage expected to increase to 68% by 2050. Besides this, energy-efficient models are gaining traction due to rising awareness of long-term savings on energy bills. High-performance boilers with smart controls offer residents greater flexibility and efficiency in managing heating needs. With ongoing innovations in technology, boilers are becoming more compact, powerful, and environmentally friendly. The trend toward home renovation and upgrading heating systems is driving demand for modern, efficient boilers.

Growing shift toward renewable energy

Homeowners are progressively choosing boilers that work with renewable energy sources like solar thermal or biomass. Governments across the globe are encouraging the use of cleaner heating options by providing subsidies and incentives for renewable energy projects. According to the Renewable Energy Statistics 2023-24 released by the Ministry of New and Renewable Energy India, in 2023-24, renewable energy sources provided 359.89 BU, representing 20.75% of the overall energy production in India. From 2014-15, energy generation from Solar, Wind, Bio, and Small Hydro Power has risen by 265.89%, indicating significant advancement. This change lessens dependence on fossil fuels, leading eco-friendly homeowners to favor boilers compatible with renewable energy. Contemporary boilers are crafted to operate effectively with renewable energy systems, reducing total carbon footprints. Biomass and heat pump technologies are becoming more popular in residential neighborhoods because of their ecological advantages. The emergence of green building standards is encouraging the incorporation of renewable energy in home heating systems. With energy prices varying, homeowners are looking for renewable options to lessen reliance on traditional energy sources. Boilers powered by renewable energy provide enduring cost benefits, rendering them more appealing for home heating. Producers are constantly enhancing boiler efficiency to optimize the utilization of renewable energy. As renewable energy grows more cost-effective and reachable, the need for suitable residential boilers consistently rises.

Residential Boiler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Residential Boiler market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, fuel type, and technology.

Analysis by Type:

- Water Tube Boiler

- Fire Tube Boiler

- Electric Boiler

Water tube boiler stand as the largest component in 2024, holding 47.5% of the market. These boilers are ideal for residential applications requiring efficient heating with minimal space. They provide greater heat transfer efficiency, offering faster heating capabilities compared to fire tube boilers. The rising demand for high-efficiency and compact heating solutions increase water tube boiler adoption in the residential sector. Their design allows for easier maintenance, which contributes to higher operational reliability and long-term savings. As the focus on energy efficiency intensifies, water tube boilers align well with these demands due to their advanced design. Additionally, water tube boilers are highly flexible, capable of using various fuel sources, such as gas, oil, and biomass. Their ability to support large-scale, residential heating systems makes them the preferred choice in markets with high heating demands. The growing trend of smart home technologies, which require reliable heating systems, also influence the adoption of water tube boilers.

Analysis by Fuel Type:

- Coal Fired

- Oil Fired

- Gas Fired

- Others

Gas fired leads the market with 57.6% of market share in 2024. Natural gas infrastructure is well-established in developed regions, making gas-fired boilers the preferred heating choice. Homeowners opt for gas boilers due to lower fuel costs compared to oil, electricity, and biomass alternatives. High thermal efficiency and rapid heating capabilities enhance gas-fired boilers’ attractiveness for residential heating applications. Technological advancements enable modern gas boilers to achieve better efficiency and lower emissions, supporting environmental goals. Government incentives and rebates encourage homeowners to replace outdated systems with energy-efficient gas-fired boilers. The reliability and continuous fuel supply of gas-fired boilers ensure uninterrupted heating during cold weather conditions. Compact and lightweight designs make modern gas boilers easy to install and integrate into homes. Many gas-fired boilers now feature condensing technology, improving energy savings and reducing carbon footprints. Compatibility with smart home systems enhances user control and efficiency, influencing gas boiler demand. Gas-fired boilers offer quick heating response times, making them ideal for fluctuating residential heating demands. Increasing urbanization and residential construction projects further fuels gas-fired boiler market growth worldwide.

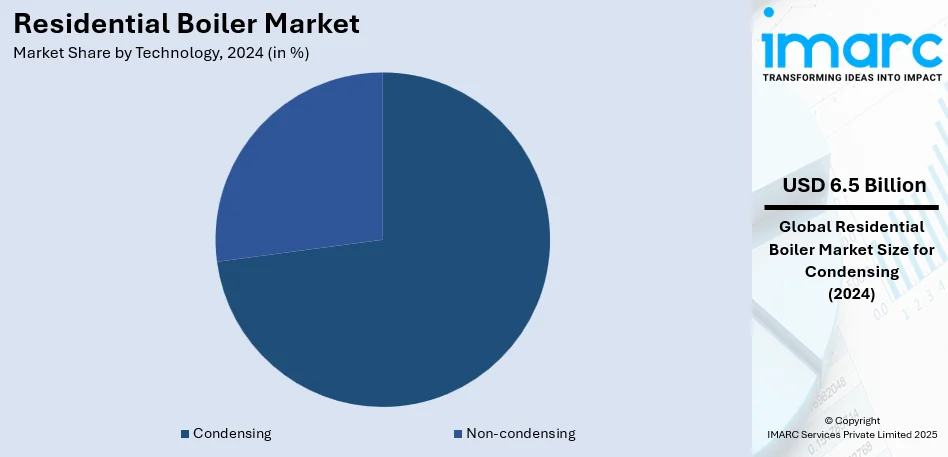

Analysis by Technology:

- Condensing

- Non-condensing

Condensing dominates the market with 72.6% of market share in 2024. These boilers capture and reuse heat from exhaust gases, maximizing energy utilization and reducing wastage. Higher thermal efficiency allows condensing boilers to significantly lower household energy bills over long-term operation. Government regulations mandating energy-efficient heating systems drive widespread adoption of condensing boiler technology in homes. Environmental concerns encourage homeowners toward condensing boilers, which reduce greenhouse gas emissions and carbon footprints effectively. Manufacturers focus on improving condensing technology to meet strict energy efficiency standards in global markets. Advanced heat exchanger designs improve condensing boiler performance, ensuring better fuel utilization and consistent heating. Growing awareness about energy savings motivates homeowners to switch from conventional boilers to condensing alternatives. Governing agencies of several countries offer financial incentives and rebates for installing condensing boilers, accelerating their residential market penetration. Compact models of condensing boilers save space, are thus ideal for small apartments and urban homes, and increase efficiency through the intelligent operation of the boiler's heating cycles, depending on usage patterns. Higher gas prices make condensing boilers more attractive because of their superior fuel efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 38.2%. Growing populations in countries like China and India drive increased demand for residential heating solutions. Rising disposable incomes and improved living standards are leading to greater investments in home comfort technologies. As economic growth accelerates, homeowners are increasingly prioritizing energy-efficient heating systems, which are also compact. To cater this demand, in September 2024, Midea launched the CirQHP Indoor Hybrid, a space-saving heat pump that removes the need for an external unit, allowing for easier installation. The system works in harmony with existing gas boilers, delivering an eco-friendly and affordable heating option. It operates efficiently even in temperatures as low as -20°C, achieving an A++ energy efficiency rating for heating. Moreover, government initiatives aimed at improving energy efficiency in residential buildings are strengthening market growth. The growth of the construction sector, especially in upcoming economies, is significantly contributing to residential boiler demand. Additionally, many countries in the Asia Pacific region are focusing on reducing emissions, promoting cleaner energy solutions. The availability of low-cost manufacturing and affordable labor makes the region a key production hub for boilers. The demand for gas-fired and condensing boilers in developed countries within the region in increasing, which supports market growth.

Key Regional Takeaways:

United States Residential Boiler Market Analysis

In the United States, the growing adoption of residential boilers is linked to the development of smart cities. For example, the US plans to invest approximately 41 trillion USD in developing IoT-based smart city infrastructure by 2035. As urban areas modernize, there's a significant momentum toward enhancing energy efficiency and sustainability. Residential boilers portray a vital component in this shift, giving more reliable and eco-friendly heating solutions. The integration of smart technology in residential buildings facilitates precise temperature control, reducing energy consumption and minimizing waste. The advancement of digital infrastructure in American cities supports the installation of more efficient systems, such as smart thermostats and demand-based energy usage. As smart cities continue to expand, the demand for residential heating solutions, like boilers, that contribute to sustainable and cost-effective living grows, influencing their widespread adoption in urban areas. Moreover, the increased focus on reducing the environmental footprint aligns with the benefits that modern residential heating systems provide.

Asia Pacific Residential Boiler Market Analysis

In the Asia-Pacific region, the uptake of residential boilers is speeding up because of swift urbanization in developing countries. For example, India is undergoing swift urban transformation. By 2036, urban regions are projected to host 600 million individuals, or 40% of the populace, an increase from 31% in 2011. The continuous expansion of the area, particularly in heavily populated zones, has prompted a rise in housing projects, demanding effective residential heating options. With an increasing number of individuals relocating to urban areas, the need for dependable, energy-efficient heating solutions is expanding. Boilers are becoming more popular for their ability to deliver steady heat, particularly in regions with variable weather conditions. City planners and builders are prioritizing the integration of contemporary, energy-saving systems in new housing structures. This trend is motivated by the need to lower energy usage in rapidly expanding cities that frequently face challenges with their energy infrastructure. With the ongoing increase in housing prices in cities, the use of residential boilers is becoming crucial for maintaining comfort and controlling energy expenses. The emphasis on energy efficiency is especially noticeable in newly constructed residential complexes, where contemporary heating solutions are increasingly standard.

Latin America Residential Boiler Market Analysis

In Latin America, the increasing adoption of residential boilers is closely tied to rising disposable incomes. For example, disposable income in Latin America is projected to increase by nearly 60% in real terms between 2021 and 2040. As more households experience financial growth, there's a greater demand for home improvements and higher-quality living standards. This shift leads to greater investment in heating solutions, particularly in regions with cold climates. The growing middle class is seeking advanced heating technologies that offer improved comfort and efficiency. Residential boilers, known for their reliability and cost-effectiveness, are becoming an attractive option for homeowners looking to enhance their quality of life. As incomes rise, homeowners are able to afford the upfront costs of installing modern heating systems, leading to a rise in demand for residential boilers. The ability to maintain comfortable home environments year-round further influences the appeal of these systems in many residential areas.

Middle East and Africa Residential Boiler Market Analysis

In the Middle East and Africa, the growing adoption of residential boilers is being fueled by the expansion of real estate projects. Reports indicate that Saudi Arabia is experiencing rapid growth in its construction sector, with over 5,200 projects valued at USD 819 billion currently underway. As urban development accelerates and residential construction booms, there is a rising need for modern heating solutions. New residential buildings, particularly in regions with cooler climates, are incorporating advanced heating technologies to improve comfort for residents. The construction is leading to a higher demand for reliable, energy-efficient systems that can be easily integrated into new homes. As the real estate sector continues to expand, the demand for residential boilers is expected to rise, with developers increasingly focusing on providing homes that meet modern standards of efficiency and sustainability. These systems not only improve the comfort of residential spaces but also offer long-term benefits in terms of energy savings and environmental impact, aligning with the growing focus on sustainable construction practices across the region.

Competitive Landscape:

Key players are spending in research and development (R&D) to improve boiler performance and energy savings significantly. Strategic partnerships and acquisitions are helping companies expand their product portfolios and market presence effectively. Leading manufacturers are focusing on smart boiler technologies with Internet of Things (IoT) integration for improved operational efficiency. Compliance with stringent energy efficiency regulations is prompting key players to introduce advanced eco-friendly boiler models. Companies are strengthening their distribution networks to reach a broader customer base across multiple regions efficiently. Increasing collaborations with government bodies are enabling manufacturers to offer rebate-eligible energy-efficient boilers to customers. Market leaders are prioritizing customer-centric approaches by providing tailored heating solutions and after-sales services efficiently. Expanding production capacities and regional manufacturing units are supporting cost-effective product availability and timely delivery. Major brands are using digital marketing tactics and online platforms to improve customer engagement and sales. Continuous technological advancements in condensing boilers and hybrid heating systems are reshaping competitive dynamics among key players. For example, in November 2024, Daikin Industries Ltd. introduced the EWYE-CZ air-to-water inverter heat pump series for residential use, available in 16 kW to 70 kW sizes. These eco-friendly systems, using R-454C refrigerant, offer efficient heating and hot water production, with an operating range from -25°C to 40°C. Their Inverter Scroll Compressor ensures minimal on-off cycles for increased energy efficiency.

The report provides a comprehensive analysis of the competitive landscape in the residential boiler market with detailed profiles of all major companies, including:

- A. O. Smith Corporation

- Ariston Holding N.V.

- Bradford White Corporation

- Burnham Holdings Inc.

- Daikin Industries Ltd.

- FERROLI S.p.A

- Lennox International Inc.

- NORITZ Corporation

- Robert Bosch GmbH

- Slant/Fin Corporation

- SPX Corporation and Viessmann

Latest News and Developments:

- January 2025: Sussman Electric Boilers, a division of Diversified Heat Transfer, Inc. (DHT), introduces the EWx Series Electric Hot Water Boiler, a sustainable solution for commercial and industrial HVAC applications. Its ultra-compact design fits through standard 36-inch doorways, with 32 models available, ranging from 270 kW to 1200 kW. Perfect for retrofitting or electric hydronic systems, the EWx Series offers zero emissions, reducing carbon footprints. This innovation meets the growing global demand for decarbonized heating solutions, aligning with sustainability goals in the HVAC industry.

- September 2024: Weil-McLain introduces the Simplicity high-efficiency combination gas boiler, designed for residential use. This advanced unit offers both space heating and on-demand domestic hot water (DHW) in an affordable, easy-to-install package. Michael Boyd, product manager, emphasizes its versatility, durability, and cost-effective design. The Simplicity boiler is built to address the growing need for energy-efficient and budget-friendly heating options.

- June 2024: Beretta introduces the Exclusive Evo X, a premium wall-mounted condensing boiler delivering exceptional comfort and performance. This model is IoT-ready and compatible with natural gas and hydrogen blends up to 20%. The Evo X upholds Beretta’s legacy of innovation within its Exclusive range. As part of Carrier Global Corporation, Beretta is committed to advancing sustainable energy solutions.

- May 2024: Lochinvar unveils the LECTRUS Light Commercial Electric Boiler, a groundbreaking high-efficiency water heater designed for electrification and decarbonization. This electric boiler offers versatile power options from 15 kW to 150 kW, suitable for both residential and commercial use. As Lochinvar’s first electric boiler, the LECTRUS provides an eco-friendly solution for diverse heating requirements.

- January 2024: Nexol Photovolthermic AG introduces the NEX R1 and NEX R2 water heaters, fully powered by home PV systems. These boilers include one or two 1,500 W heating elements and are equipped with Nexol Energy Controllers, designed in-house to optimize energy consumption. The new models offer sustainable, solar-powered solutions for residential heating.

Residential Boiler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Water Tube Boiler, Fire Tube Boiler, Electric Boiler |

| Fuel Types Covered | Coal Fired, Oil Fired, Gas Fired, and Others |

| Technologies Covered | Condensing, Non-condensing |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | A. O. Smith Corporation, Ariston Holding N.V., Bradford White Corporation, Burnham Holdings Inc., Daikin Industries Ltd., FERROLI S.p.A, Lennox International Inc., NORITZ Corporation, Robert Bosch GmbH, Slant/Fin Corporation, SPX Corporation and Viessmann, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, residential boiler market outlook, and dynamics of the market from 2019-2033.

- The residential boiler market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the residential boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential boiler market was valued at USD 8.93 Billion in 2024.

The residential boiler market is projected to exhibit a CAGR of 4.28% during 2025-2033, reaching a value of USD 13.28 Billion by 2033.

The residential boiler market growth is driven by rising demand for energy-efficient heating systems, government regulations promoting eco-friendly technologies, and increasing awareness among homeowners about sustainability. The shift toward renewable energy sources, such as solar and biomass, is also driving demand for compatible boilers.

Asia Pacific currently dominates the residential boiler market, accounting for a share of 38.2% in 2024. Growing populations, especially in countries like China and India, drive demand for reliable heating solutions. Rising disposable incomes and improved living standards contribute to the increased adoption of energy-efficient boilers. Government initiatives promoting sustainable energy use further strengthen market growth. Additionally, the construction boom in emerging economies accelerates the need for modern residential infrastructure.

Some of the major players in the residential boiler market include A. O. Smith Corporation, Ariston Holding N.V., Bradford White Corporation, Burnham Holdings Inc., Daikin Industries Ltd., FERROLI S.p.A, Lennox International Inc., NORITZ Corporation, Robert Bosch GmbH, Slant/Fin Corporation, SPX Corporation and Viessmann, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)