Renewable Energy Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Renewable Energy Market Size and Share:

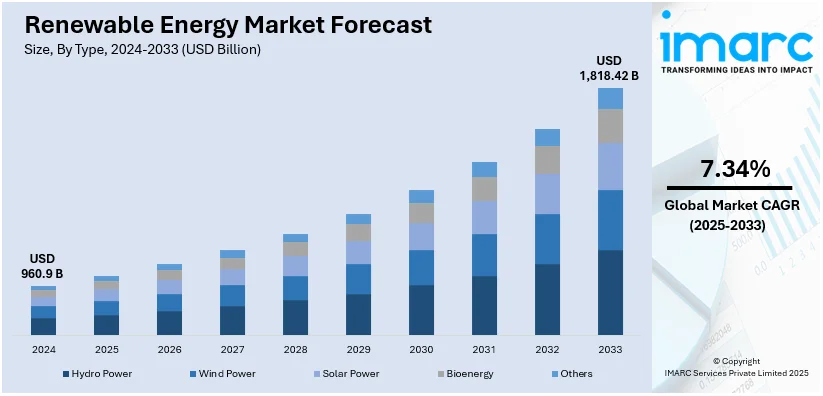

The global renewable energy market size was valued at USD 960.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,818.42 Billion by 2033, exhibiting a CAGR of 7.34% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 41.8% in 2024. The increasing renewable energy market share of the Asia Pacific region is because of infrastructure development, government policies, declining technology costs, energy security concerns, and corporate sustainability commitments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 960.9 Billion |

| Market Forecast in 2033 | USD 1,818.42 Billion |

| Market Growth Rate (2025-2033) | 7.34% |

The rising electricity usage across industries, commercial sectors, and residential areas necessitates an increase in power generation. Renewable energy is being adopted to satisfy this increasing need while minimizing greenhouse gas emissions. Additionally, many governing bodies offer financial assistance via tax incentives, subsidies, and grants to promote investment in renewable energy. Renewable energy targets, mandates, and carbon pricing policies further encourage businesses and utilities to shift towards cleaner energy sources. Moreover, businesses are committing to carbon neutrality and using renewable energy as part of their environmental, social, and governance (ESG) strategies. Power purchase agreements (PPAs) allow corporations to procure clean energy directly from producers. Furthermore, advancements in solar photovoltaics, wind turbines, and battery storage reduce installation and operational costs, making renewables more competitive with fossil fuels.

The United States represents an important segment in the market, as the implementation of virtual power plants (VPPs) improves grid stability by incorporating distributed energy resources such as home solar and battery storage. These systems enhance energy distribution, lower electricity expenses, and facilitate the integration of renewable energy. Collaborative ventures between power companies and solar firms hasten VPP implementation, enhancing grid resilience and optimizing renewable energy use. In 2025, Sonnen and SOLRITE Energy inaugurated a VPP in Texas, leveraging residential solar and batteries to enhance grid efficiency and lower participant expenses by as much as 40%. The VPP effectively coordinates energy storage and release to improve grid stability and facilitate renewable integration. The project seeks to enhance the economics of renewable energy while promoting cooperation between utility companies and the solar sector.

Renewable Energy Market Trends:

Increasing Global Warming Concerns

Rising global temperatures and extreme weather events underscore the urgent need to reduce carbon emissions from fossil fuel combustion. In 2024, global CO₂ emissions from fossil fuels reached 37.4 Billion Tons, marking a 0.8% increase from the previous year. This trend highlights the pressing challenge of mitigating climate change through clean energy transitions. Renewable energy sources, like wind, solar, geothermal, and hydro, provide sustainable alternatives that minimize environmental impact. These energy solutions not only lessen greenhouse gas emissions but also enhance air quality, conserve water resources, and protect ecosystems. Governments and corporations worldwide are implementing aggressive carbon reduction strategies, investing in large-scale renewable projects, and promoting net-zero commitments. Progress in technology for energy storage and grid integration further support the shift to renewables, ensuring reliability and efficiency. As demand for cleaner energy solutions rises, global investments in renewable infrastructure and innovation will continue shaping a more sustainable energy future.

Expansion of Wind Energy

Wind power is crucial in the worldwide shift to renewable energy, as investments in both onshore and offshore wind farms continue to rise. The overall installations of wind energy amount to 117GW in 2023, reflecting a 50% increase compared to the previous year, 2022. Furthermore, both governments and private organizations are boosting wind energy implementation via encouraging policies, tax benefits, and extended power purchase contracts. Improvements in turbine technology, such as bigger rotor sizes, increased capacity factors, and better grid connectivity, are boosting efficiency and lowering costs per megawatt. Offshore wind initiatives are gaining traction, utilizing stronger and more stable wind speeds to produce increased output. Energy storage systems and hybrid renewable technologies are enhancing the effectiveness of wind power usage. As nations pursue carbon neutrality, the growth of wind energy is essential for decreasing reliance on fossil fuels, guaranteeing energy security, and satisfying increasing electricity needs.

Government Initiatives Accelerating Renewable Energy Adoption

Government policies and initiatives are key drivers of renewable energy market growth, offering monetary motivations, regulatory frameworks, and long-term energy transition strategies. Subsidies, tax credits, and tariffs for energy input make renewable energy investments more attractive, lowering costs for businesses and individuals. National renewable energy targets and mandates motivate utilities and industries to shift towards clean energy sources. Governments are also implementing carbon pricing mechanisms and emission reduction commitments to accelerate decarbonization. Infrastructure development, including smart grids and energy storage facilities, receives substantial public funding to enhance renewable integration and grid stability. Public-private partnerships and funding for research and innovation further support technological advancements in solar, wind, and bioenergy. Large-scale auctions and tenders for renewable projects drive competition, reducing energy costs and increasing deployment speed. In 2025, Andhra Pradesh approved ₹71,400 crore in renewable energy projects under its Integrated Clean Energy Policy 2024, notified on October 30, 2024. Reliance Industries secured ₹65,000 crore for Compressed Biogas (CBG) plants, Tata Power planned a 400 MW solar plant, and John Cockerill partnered with Greenko for a 2 GW hydrogen electrolyzer facility. The policy targets 160 GW capacity, aiming to attract ₹10 lakh crore in investments and generate 7.5 lakh jobs.

Renewable Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global renewable energy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

Hydro power leads the market with 32.0% of market share in 2024. It exhibits a clear dominance in the market because of its reliability, large-scale energy generation capacity, and ability to provide baseload and peak power supply. It offers grid stability, balancing intermittent sources like wind and solar while supporting energy storage through pumped hydro systems. Government policies, subsidies, and long-term infrastructure investments drive expansion, ensuring consistent energy output. Hydropower plants have long operational lifespans, making them cost-effective over time, reducing dependence on fossil fuels. Continuous technological advancements improve efficiency, reduce environmental impact, and optimize water resource utilization. The growing need for energy security encourages investments in hydroelectric projects, particularly in regions with abundant water resources. Large-scale industrial and commercial users prefer hydropower due to its stable electricity pricing and minimal volatility. Climate goals and carbon reduction strategies further position hydropower as a preferred renewable source. Grid modernization, digital monitoring, and automation enhance operational efficiency, making hydropower a key pillar in global energy transitions and sustainability efforts.

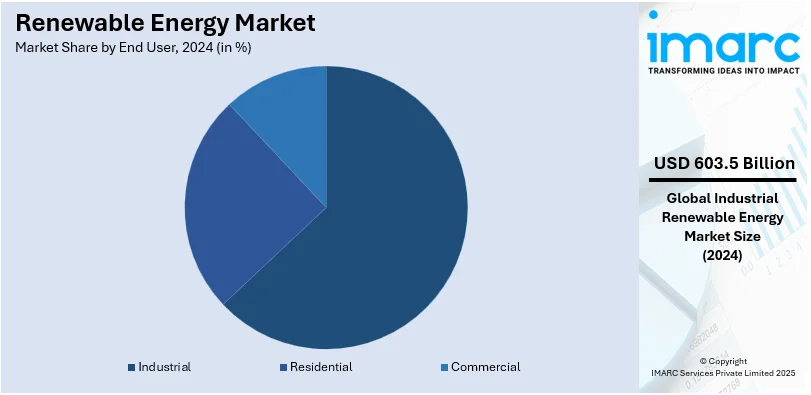

Analysis by End User:

- Industrial

- Residential

- Commercial

Industrial stands as the largest component in 2024, holding 62.8% of the market. It represents the largest segment attributed to high energy usage, stringent regulatory mandates, and sustainability commitments. Industries rely on renewable energy to reduce operational costs, enhance efficiency, and meet environmental compliance standards. Government policies promoting clean energy adoption through incentives, tax benefits, and carbon reduction targets encourage industrial-scale deployment. Large-scale manufacturing, mining, and processing facilities demand uninterrupted power supply, making renewable sources with storage integration a viable solution. Advancements in technology, including smart grids and energy management systems, empower industries to optimize usage and reduce dependency on conventional power sources. Contracts for the long-term purchase of power and corporate renewable procurement strategies promote funding for wind, solar, and bioenergy initiatives. Cost reductions in renewable installations, combined with advancements in grid stability, support industrial adoption. Global sustainability goals and carbon neutrality commitments push industries to transition toward greener energy sources. The shift toward electrification and energy-efficient processes further reinforces renewable energy as a critical component of industrial operations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific holds the biggest market share of over 41.8%. It dominates the market due to strong government policies, increasing investments in infrastructure, and advancements in technology. Supportive regulatory frameworks, renewable energy targets, and financial incentives drive the expansion of clean energy projects. The region gains from plentiful natural resources, including favorable conditions for solar, wind, and hydroelectric power generation. Strategic collaborations between public and private entities accelerate project development and deployment. Furthermore, traditional energy companies are expanding into renewable energy and critical mineral sectors to align with sustainability goals and energy transition strategies. Investments in solar, wind, pumped storage, and new technologies improve energy diversification. In 2025, Singareni Collieries Company Limited (SCCL) revealed its intention to establish two firms focused on rare earth minerals and renewable energy, aiming for 6,000 MW from renewable sources within three years. SCCL is diversifying into pumped storage, wind power, CO2-to-methanol conversion, and coal gasification. The firm is likewise working on solar parks in Rajasthan, Gujarat, and Karnataka, aiming for net-zero emissions.

Key Regional Takeaways:

United States Renewable Energy Market Analysis

In North America, the market share for the United States was 83.20%. The growing renewable energy adoption due to the growing focus on clean energy because of rising global warming concerns is driving significant advancements in the renewable energy sector. For instance, clean energy investment in the U.S. more than tripled from 2018 to 2023, when annual clean investment totaled nearly USD 248 Billion — and has accelerated to record-breaking levels through June 2024. Federal and state policies are reinforcing clean energy transition, with tax credits and incentives boosting solar and wind energy projects. Large-scale corporations are committing to net-zero emissions, increasing investments in renewable infrastructure. Technological advancements in battery storage and grid modernization are improving energy efficiency. Public awareness about climate change is prompting residential and commercial users to shift toward clean energy solutions. The Biden administration’s Inflation Reduction Act is expected to accelerate renewable energy deployment. Utility companies are integrating more clean energy sources into the grid to meet carbon neutrality goals. The rising global warming concern is pushing policymakers to support large-scale offshore wind projects, community solar programs, and green hydrogen developments.

Europe Renewable Energy Market Analysis

The increasing use of renewable energy, fueled by expanding solar power, is leading to a significant transformation in the energy sector. Reports indicate that by the end of 2023, the total installed solar PV capacity in the EU-27 Member States had reached 269 GW. It has increased more than 2,500 times since the start of the millennium. Nations such as Germany, Spain, and France are at the forefront of solar energy installations, bolstered by supportive regulatory frameworks and feed-in tariffs. Improvements in photovoltaic technology are driving down expenses, increasing the accessibility of solar energy. The Green Deal and Fit for 55 initiatives of the European Union are encouraging widespread installation of solar energy to attain climate neutrality. The growing user interest in solar panels for homes and businesses is boosting demand. Expanding solar farms are increasing in Southern Europe, where plentiful sunlight boosts efficiency. Energy storage options are being created to tackle solar intermittency. The growing solar power market is also encouraging cross-border energy trading, allowing surplus solar energy to be shared across nations.

Asia Pacific Renewable Energy Market Analysis

The growing renewable energy adoption due to growing industrial activities is fueling the expansion of solar, wind, and hydroelectric power across the region. For instance, industrial production in India rose 5.2% year-on-year in November 2024, accelerating from a 3.5% rise in the previous month, and easily beating market expectations of 4% gain. Rapid urbanization and rising manufacturing demands in China, India, and Southeast Asia are increasing the need for sustainable energy solutions. Governments are implementing aggressive renewable energy targets to meet rising industrial electricity consumption. Large corporations are investing in independent solar and wind farms to secure stable power supply while reducing dependency on fossil fuels. Japan and South Korea are pushing for renewable hydrogen and offshore wind technologies to sustain industrial growth. India’s Make in India initiative is attracting foreign investments in renewable energy, aligning with rising industrial activities. Grid expansion projects are underway to accommodate higher renewable energy penetration. The growing industrial activities are compelling regional utilities to modernize energy storage solutions and improve energy efficiency.

Latin America Renewable Energy Market Analysis

The growing renewable energy adoption due to growing number of residentials is leading to increased demand for solar and wind power solutions. Growing urban populations in Brazil, Mexico, and Argentina are fueling the demand for sustainable energy solutions. As per reports from the Atlantic Council, by 2025, 315 million individuals are expected to reside in major cities of Latin America, where the per-capita GDP is projected to hit USD 23,000. Governments are enacting net metering regulations to encourage the use of residential solar energy. Homeowners are more frequently investing in solar panels on their rooftops to lower electricity expenses and enhance energy security. The decreasing price of solar panels and battery storage is making renewable energy increasingly accessible. Increasing electricity demand in new housing projects is driving utilities to incorporate additional solar and wind energy into the grid. The increasing amount of households is prompting financial institutions to provide green financing alternatives for solar panel installations in homes.

Middle East and Africa Renewable Energy Market Analysis

The increasing use of renewable energy, driven by the expanding commercial sector and investments in renewable sources, is propelling the growth of solar and wind power. The International Energy Agency forecasts that energy investments in the Middle East will likely hit about USD 175 Billion in 2024, with clean energy making up roughly 15% of the overall investment. Nations such as the UAE, Saudi Arabia, and South Africa are boosting investments in large-scale solar farms and wind initiatives to meet commercial energy needs. Companies are embracing renewable energy to lower operational expenses and meet sustainability objectives. Governments are initiating incentive programs to draw private sector investments into clean energy. The expanding commercial sector is also boosting the need for distributed solar energy in business facilities. Global investors are financing extensive solar and wind energy initiatives to satisfy local energy demands.

Competitive Landscape:

Major participants in the market are increasing capacity, investing in technology improvements, and obtaining long-term power purchase agreements. They are reinforcing supply chains, advancing energy storage systems, and incorporating smart grid technologies to boost efficiency. Businesses are prioritizing offshore wind, next-gen solar panels, and innovative biofuels to broaden energy options. Strategic mergers, acquisitions, and collaborations are fueling market consolidation and speeding up innovation. Digital technology, predictive analytics, and artificial intelligence are enhancing operations and lowering maintenance expenses. Investments in hybrid renewable projects and green hydrogen are aiding energy transition objectives. In 2024, AM Green BV and GAIL (India) Ltd. teamed up to create up to 2.5 GW of hybrid renewable energy projects throughout India, combining solar, wind, and eMethanol generation. The arrangement involved providing 350 KTA of CO₂ from GAIL’s gas facilities for green methanol, aiding decarbonization in the shipping, steel, and cement industries. AM Green aimed to achieve 5 MTPA of green ammonia capacity by 2030, aligning with India’s and Europe’s green hydrogen targets.

The report provides a comprehensive analysis of the competitive landscape in the renewable energy market with detailed profiles of all major companies, including:

- ABB Ltd.

- Acciona S.A.

- Duke Energy Corporation

- Électricité de France S.A.

- Enel S.p.A.

- General Electric Company

- Innergex Renewable Energy Inc.

- Invenergy

- National Grid plc

- Ørsted A/S

- Siemens Energy AG

- Tata Power Company Limited

- Xcel Energy Inc.

Latest News and Developments:

- December 2024: GE Vernova Inc. received a 3Q’2024 contract from Dominion Energy South Carolina to upgrade two hydropower units at the Saluda Hydro power facility. This initiative improves reliability, efficiency, and adaptability, prolonging the plant’s nearly hundred-year renewable energy production. Dominion Energy, utilizing GE Vernova’s technology for 70% of its fleet, provides energy to more than 7 million households in the U.S. The cooperation enhances their alliance in the Power, Wind, and Electrification sectors.

- December 2024: NHPC Ltd will invest Rs 5,500 crore to establish a 1,000 MW solar power project in Bihar. The company signed an MoU with the state government at the Bihar Business Connect 2024 summit. The project is expected to be completed within 1.5-2 years after land acquisition. NHPC has urged the state government to expedite land allocation for timely execution.

- November 2024: Adani Green Energy will invest USD 35 Billion over five years to develop solar, wind, and hybrid power plants across India. This initiative aims to boost India's renewable energy capacity and meet rising energy demands. Sagar Adani highlighted the company's commitment to large-scale green energy expansion. The investment aligns with India's sustainable growth goals.

- July 2024: ReNew has inaugurated a 400 MW solar project in Rajasthan, part of a 600 MW PPA with SECI for 25 years. The project spans 2,000 acres in Jaisalmer and will generate 1,331 Million units of electricity annually. It will offset 1.4 Million tons of CO2 emissions yearly, promoting environmental sustainability. Rajasthan CM Bhajan Lal Sharma led the inauguration, highlighting the state’s commitment to clean energy.

- May 2024: NHPC will complete all four units of the 800 MW Parbati-II hydroelectric project in Himachal Pradesh by December 2024. The 2,000 MW Subansiri Lower projects will see three units ready by March 2025 and full completion by May 2026. Meanwhile, the Teesta-V power station in Sikkim faced estimated losses of Rs 788 crore. NHPC continues advancing renewable energy projects to boost India’s hydroelectric capacity.

Renewable Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Acciona S.A., Duke Energy Corporation, Électricité de France S.A., Enel S.p.A., General Electric Company, Innergex Renewable Energy Inc., Invenergy, National Grid plc, Ørsted A/S, Siemens Energy AG, Tata Power Company Limited, Xcel Energy Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the renewable energy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global renewable energy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The renewable energy market was valued at USD 960.9 Billion in 2024.

IMARC estimates the renewable energy market to exhibit a CAGR of 7.34% during 2025-2033, reaching a value of USD 1,818.42 Billion by 2033.

The renewable energy market is expanding due to government policies, declining technology costs, energy security concerns, and corporate sustainability commitments. Innovations in storage, grid modernization, and hydrogen fuel enhance adoption. Rising electricity demand, carbon neutrality goals, and public awareness further accelerate investments in wind, solar, hydro, and bioenergy, shaping a resilient and sustainable energy landscape.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the renewable energy market include ABB Ltd., Acciona S.A., Duke Energy Corporation, Électricité de France S.A., Enel S.p.A., General Electric Company, Innergex Renewable Energy Inc., Invenergy, National Grid plc, Ørsted A/S, Siemens Energy AG, Tata Power Company Limited, Xcel Energy Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)