Remote Patient Monitoring Market Size, Share, Trends and Forecast by Device Type, Application, End-Use, and Region, 2026-2034

Remote Patient Monitoring Market Size and Share:

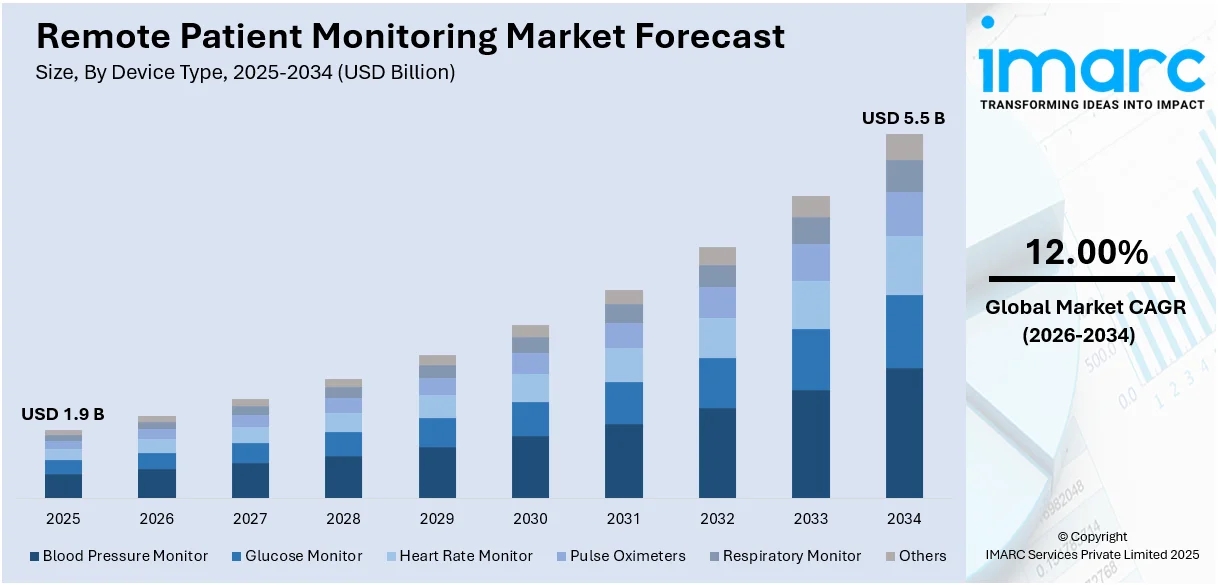

The global remote patient monitoring market size was valued at USD 1.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.5 Billion by 2034, exhibiting a CAGR of 12.00% from 2026-2034. North America currently dominates the market, holding a market share of 43.36% in 2025. The region’s remote patient monitoring market share is driven by rising geriatric population across the globe, increasing prevalence of chronic disease, rapid technological advancements, imposition of supportive government policies, and heightened demand for personalized and preventive healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 5.5 Billion |

| Market Growth Rate (2026-2034) | 12.00% |

Remote patient monitoring is considered as a major factor in achieving excellent patient outcomes. It has enabled many patients to seek quality care from clinics and hospitals without actually going there. A primary factor motivating the requirement for remote patient monitoring is the organic growth of health care technologies. Wearable device, biosensor, and mobile health (mhealth) innovations have changed the pattern of gathering and transferring patient information. The integration of such smart devices by using Bluetooth, wireless fidelity, and cellular connectivity will enable healthcare providers to conveniently monitor patients through their vital signs, such as heart rate, blood pressure, glucose levels, and oxygen saturation. Furthermore, artificial intelligence (AI) and machine learning (ML) algorithms, which are integral parts of any modern healthcare gadget, help extract meaningful data.

To get more information on this market Request Sample

The United States has emerged as a vital region in the remote patient monitoring market due to innumerable reasons. The rising incidence of chronic diseases in the country, including diabetes, hypertension, and cardiovascular conditions, drives the adoption of remote patient monitoring solutions. Continuous monitoring is a requirement for managing symptoms, preventing complications, and reducing hospitalizations in chronic diseases. As more and more elderly become afflicted with chronic illness, there has been a pressing demand for using these systems of remote patient monitoring. According to the FDA, seven out of ten major causes of death in the US are common chronic diseases in 2024. This further increased the need for remote patient monitoring among the masses.

Remote Patient Monitoring Market Trends:

Rising Geriatric Population Across the Globe

The demographic shift towards geriatric population has profound implications for healthcare systems. The probability of developing diseases such as diabetes, cardiovascular conditions, and other breathing problems tends to increase when patients get older; thus, such health-related conditions need regular observation for the sake of management. Based on the SHARE Survey, approximately 37% of over 65s reported to have, on average across the countries, at least two chronic diseases. Women tend to report having more than two chronic diseases as often as men, averaging at 41% to 32%, respectively. Among people aged 80 and over, on average across EU countries, 56% of women and 47% of men report multiple chronic diseases. Remote patient monitoring systems provide a critical solution by enabling healthcare providers to track patient health data in real-time, thereby facilitating timely interventions before acute episodes occur. Additionally, remote patient monitoring empowers elderly patients to maintain independence and stay in the comfort of their homes while receiving high-quality care.

Rapid Technological Advancements in Healthcare Devices and Connectivity

The rapid advancement in medical technology is significantly promoting the remote patient monitoring market demand. Innovations in wearable health devices and medical sensors are making it easier and more efficient to monitor many health parameters, which include heart rate, blood pressure, glucose levels, and oxygen saturation, outside of traditional clinical settings. The wearable medical devices market is surging at a rapid pace of 19.2% annually. It is also expected to touch USD 143.2 Billion by 2032. Moreover, companies are innovating new products to improve patient satisfaction. For instance, in July 2022, Biobeat partnered with Medidata Solutions and became part of the Sensor Cloud Network. By using Biobeat’s medical-grade wearables, they are able to enhance clinical trials with vital signs collection to generate real-world evidence remotely and conveniently from the patient’s home. These devices are equipped with user-friendly features, like real-time data transmission, alerts, and long battery life, making them accessible to a broad range of patients.

Increasing Healthcare Costs and the Need for Efficient Solutions

The escalating healthcare costs around the world are attributed to the increasing burden of chronic diseases, increasing prices of healthcare services, and the ever-growing demand for sophisticated medical treatments. Chronic conditions make up 90% of the annual healthcare costs in the United States. Heart diseases and strokes cost the healthcare system USD 216 Billion annually and cause USD 147 Billion in lost productivity on the job. This can be reduced through the timely provision of assistance provided to patients by using a remote monitoring system. It may delay the emergency room visit and hospitalization due to the applications of telemedicine that help in digitizing and automating crucial tasks, thus reducing the tasks for the hospitals' administration. Moreover, 3.6 Million people every year in the United States fail to seek medical care due to transportation. This drives the need to make healthcare infrastructure more accessible, thereby increasing the remote patient monitoring market growth.

Remote Patient Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global remote patient monitoring market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on device type, application, and end-use.

Analysis by Device Type:

- Blood Pressure Monitor

- Glucose Monitor

- Heart Rate Monitor

- Pulse Oximeters

- Respiratory Monitor

- Others

Heart rate monitoring stands as the largest component in 2025, holding 23.1% of the market share. Heart rate monitor represented the largest segment. A remote heart rate monitor is an apparatus that measures the number of heartbeats per minute in a continuous process. It may be a chest strap sensor or a wrist-based sensor that detects every heartbeat. Other advanced models can also track irregular heartbeats or measure other cardiac parameters. Heart rate monitors allow people to be proactive in their cardiovascular health, which then leads to improved outcomes and quality of life. Heart rate monitors give individuals real-time feedback so that they can design workouts that suit their fitness level and goals. For instance, a beginner will be able to avoid overexertion with heart rate data, while a seasoned athlete can monitor progress and set benchmarks for improvement.

Analysis by Application:

- Cancer Treatment

- Cardiovascular Diseases Treatment and Monitoring

- Diabetes Treatment

- Sleep Disorder Treatment

- Weight Management and Fitness Monitoring

- Others

Cardiovascular diseases treatment and monitoring leads the market with 25.1% of market share in 2025. The use of this medical technology in patients' homes has a critical role in the treatment and management of cardiovascular diseases through the monitoring of key parameters on their devices, such as heart rate monitors, blood pressure monitors, and electrocardiogram (ECG) machines. This monitoring is quite essential for those patients diagnosed with hypertension, heart failure, or arrhythmias. This provides an immediate opportunity for healthcare providers to change the treatment of the patient and may avoid readmission to hospitals and result in better outcomes for patients, thus boosting the revenue of the remote patient monitoring market. Remote patient monitoring greatly reduces healthcare cost both for the provider and the patient by improving early detection of diseases and by having minimal in-person visitations. Fewer hospital admissions, emergency visits, and complications result in lowering the overall costs.

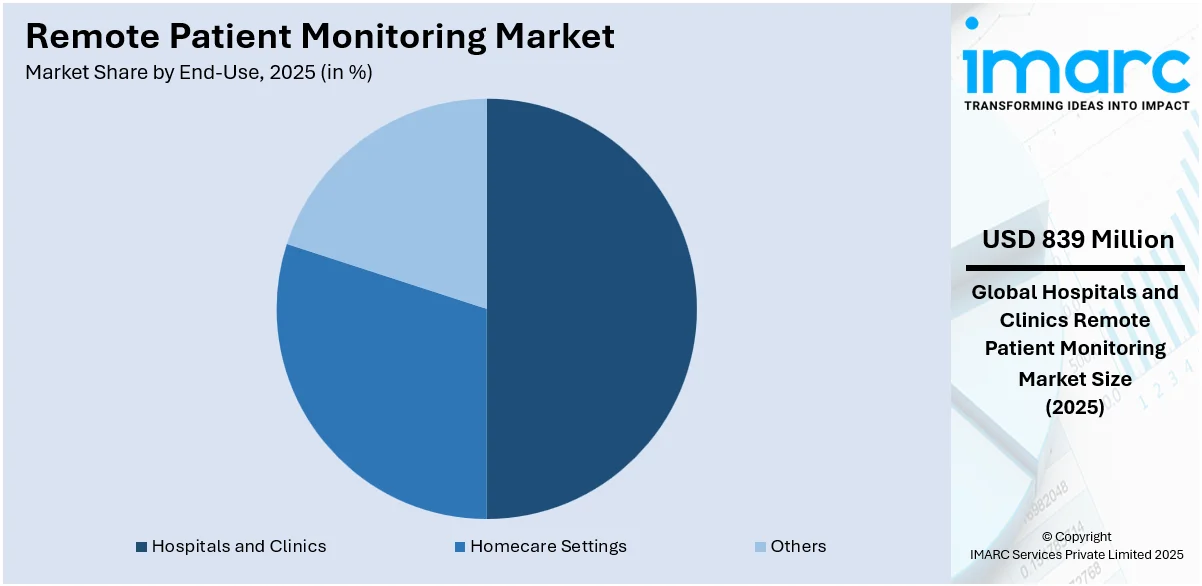

Analysis by End-Use:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Homecare Settings

- Others

Hospitals and clinics lead the market with 50.3% of market share in 2025. They hold the largest share because remote patient monitoring is an extension of traditional healthcare services, making medical care more efficient and effective. Healthcare professionals monitor the patients' vital signs, chronic conditions, and post-operative recovery metrics even when patients are not within the immediate care facility by employing remote patient monitoring devices. It enables resource allocation so that clinicians may prioritize patients in terms of severity of their condition, thereby making hospital operations efficient. Hospitals and clinics benefit by reducing the pressure on healthcare personnel and resources when monitoring patients remotely. Continuous monitoring from home reduces frequent visits to clinics, thus leaving room for clinical capacity for more emergent cases. This is important for resource-poor settings, such as staff shortage and overcrowded patients. Additionally, remote monitoring of patients offers the capability for central monitoring of several patients with the opportunity of clinical teams directing their focus towards those that would require more prompt attention.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America held the largest market share, accounting 43.36%. This can be accredited to the well-established healthcare infrastructure in the region, the growing chronic diseases prevalence, heightening healthcare costs, and technological advancements. The burden of chronic diseases further increases with an aging population in North America. Older adults are more likely to develop chronic conditions, and the demand for remote patient monitoring technologies is increasing accordingly. These technologies enable the aging in place of seniors who remain connected with their healthcare providers and reduce hospitalization and enhance quality of life. The skyrocketing costs of healthcare in North America are pushing stakeholders toward solutions that can help them reduce their expenses while not compromising on quality care. Remote patient monitoring thus fits into the bill as a means of providing cost-effective management of patients outside traditional care settings. Remote patient monitoring helps to avoid hospital admissions, emergency room visits, and long-term care facilities due to the earlier detection and intervention of patients. For example, patients with heart failure monitored from a distance have fewer exacerbations and are thus managed at home more effectively. In 2023, Ricoh USA, Inc. launched RICOH Remote Patient Monitoring (RPM) Enablement for healthcare institutions to streamline workflows.

Key Regional Takeaways:

United States Remote Patient Monitoring Market Analysis

In North America, the market share for the United States was 83.80%. The remote patient monitoring (RPM) market in the United States is experiencing significant growth due to several key drivers. The increasing prevalence of chronic diseases, such as heart disease, cancer, etc., is a major factor. According to the US Department of Health and Human Services, around 129 Million individuals residing in the US are experiencing a minimum of one major chronic condition, creating a high demand for effective healthcare solutions. RPM technology allows for continuous monitoring, early detection, and management of these conditions, minimizing hospital readmissions and enhancing patient outcomes. The rising adoption of wearable devices and mobile health applications has further enhanced the capabilities of RPM, enabling more accessible and efficient care. Additionally, the shift toward telemedicine, accelerated by the COVID-19 pandemic, has expanded the use of remote healthcare solutions, providing patients with greater access to care while reducing healthcare costs. As healthcare systems face increased pressure to manage rising healthcare costs while improving patient care, RPM presents a viable solution. With technological advancements and continued support from both healthcare providers and government initiatives, the RPM market in the US is set to expand rapidly in the coming years.

Asia Pacific Remote Patient Monitoring Market Analysis

The remote patient monitoring market in the Asia-Pacific (APAC) region is poised for significant growth, primarily driven by the region’s rapidly aging population and the increasing burden of chronic diseases. According to reports, the number of older persons in APAC is projected to more than double, from 630 Million in 2020 to approximately 1.3 Billion by 2050, contributing to a higher demand for healthcare services and monitoring solutions. The growing prevalence of chronic conditions such as diabetes, heart disease, and hypertension is further boosting the need for remote patient monitoring. RPM systems provide an efficient and cost-effective means to manage these conditions, reducing hospital visits and improving patient outcomes. Government initiatives promoting the digitization of healthcare, particularly in rural and underserved areas, are also facilitating the adoption of remote care solutions. Moreover, the rise of wearable devices and mobile health applications in the region is enhancing the accessibility of RPM technologies, enabling patients to monitor their health at home. With the combination of technological advancements, an aging population, and increasing chronic disease prevalence, the APAC RPM market is expected to experience rapid expansion in the coming years.

Europe Remote Patient Monitoring Market Analysis

In Europe, the remote patient monitoring (RPM) market is experiencing rapid growth, driven by a combination of factors. A significant contributor to this growth is the growing cases of chronic diseases such as cardiovascular diseases, diabetes, and respiratory disorders. According to reports, more than one-fifth (21.3%) of the EU population was aged 65 years and over as of January 2023, creating a higher demand for long-term care and health monitoring solutions. RPM allows for continuous monitoring of elderly patients, helping manage chronic conditions more effectively and reducing hospital admissions. European governments are also playing a critical role in promoting digital health solutions, with incentives and reimbursement schemes for telemedicine and remote monitoring services. The integration of advanced technologies like AI and data analytics into RPM systems is enhancing their ability to provide more personalized and accurate care. As healthcare systems in Europe continue to shift toward value-based care, RPM presents an efficient solution for managing patient outcomes while reducing healthcare costs. With growing awareness of the benefits of remote patient monitoring, the market in Europe is poised to continue its expansion, driven by technological innovations and supportive policies.

Latin America Remote Patient Monitoring Market Analysis

In Latin America, the remote patient monitoring market is growing due to the rising prevalence of chronic diseases and the need for more accessible healthcare solutions. According to reports, Brazil alone is estimated to experience 928,000 deaths annually due to chronic diseases, highlighting the critical need for effective management and prevention strategies. RPM offers a viable solution, enabling patients to monitor their conditions from home and reduce the strain on healthcare facilities. Government initiatives supporting digital health adoption, along with the increasing use of wearable devices, are further propelling market growth in the region.

Middle East and Africa Remote Patient Monitoring Market Analysis

In the Middle East and Africa, the remote patient monitoring market is expanding due to the rising prevalence of chronic diseases, particularly diabetes, obesity, and cardiovascular conditions. According to reports, in the UAE, the prevalence of self-reported chronic diseases was 23%, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common. RPM offers an effective solution for managing such conditions, especially in underserved areas where healthcare resources are limited. Additionally, government initiatives focusing on enhancing healthcare infrastructure and the adoption of digital health solutions are supporting the growth of RPM in the region, enhancing accessibility and care delivery.

Competitive Landscape:

Key market players in the remote patient monitoring (RPM) industry are employing a variety of strategies to improve their business and capture a larger share of the growing market. Many companies are focusing on product innovation by integrating advanced technologies like artificial intelligence (AI), machine learning (ML), and 5G connectivity into their devices to enhance real-time data analysis, predictive capabilities, and user experience. For instance, leading players are developing wearable devices with multi-functionality, such as continuous monitoring of vital signs like heart rate, oxygen levels, and blood pressure, all in a single, compact unit. LG Electronics launched a new venture, Primefocus Health, which presents a provider-facing healthcare-delivery platform that aids in remote patient monitoring and provide patients novel therapies via tech applications. Strategic collaborations and partnerships with healthcare providers, technology firms, and insurers are another common approach. These alliances allow companies to expand their distribution networks, improve reimbursement coverage, and co-develop solutions tailored to specific healthcare needs.

The report provides a comprehensive analysis of the competitive landscape in the remote patient monitoring market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Biotronik

- Boston Scientific Corporation

- GE Healthcare

- Guangdong Transtek Medical Electronics Co., Ltd.

- Koninklijke Philips N.V.

- LifeWatch

- Medtronic plc

- Nihon Kohden Corporation

- OMRON Healthcare Co., Ltd.

- Telecare USA Inc

- VitalConnect

- VivaLNK, Inc.

Latest News and Developments:

- July 2024: TeleMedCare launched a remote chronic patient monitoring (RPM) program with a major U.S. health provider covering over 500,000 people across five states. The pilot phase targeted 300 patients with chronic conditions like heart disease, COPD, diabetes, and hypertension. The company chose TeleMedCare for its adaptable technology, meeting specific requirements.

- January 2024: Blue Spark Technologies has launched VitalTraq™, a remote monitoring platform that combines contactless rPPG technology and the TempTraq® sensor. Patients can measure vital signs like heart rate and blood pressure with a simple selfie scan, reducing the need for multiple devices. rPPG is currently available under investigational use.

- May 2023: Milestone Systems has launched XProtect Hospital Assist, a remote patient monitoring solution to help hospitals manage staff shortages and improve care. The video technology allows medical staff to remotely monitor multiple patients, easing routine tasks and supporting high-quality care amid a global healthcare professional shortfall.

- April 2023: Cadence and Providence partnered to expand remote patient monitoring (RPM) and virtual care across seven states, enhancing chronic disease management. Providence integrated Cadence's RPM solution to remotely collect vital signs, with initial success in Washington clinics showing improved patient engagement and outcomes.

- April 2023: Chennai-based LifeSigns iMS launched a wireless remote patient monitoring solution, using wearable biosensors and cloud analytics to track eight vitals.

Remote Patient Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Blood Pressure Monitor, Glucose Monitor, Heart Rate Monitor, Pulse Oximeters, Respiratory Monitor, Others |

| Applications Covered | Cancer Treatment, Cardiovascular Diseases Treatment and Monitoring, Diabetes Treatment, Sleep Disorder Treatment, Weight Management and Fitness Monitoring, Others |

| End-Uses Covered | Hospitals and Clinics, Homecare Settings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Guangdong Transtek Medical Electronics Co., Ltd., Koninklijke Philips N.V., LifeWatch, Medtronic plc, Nihon Kohden Corporation, OMRON Healthcare Co., Ltd., Telecare USA Inc, VitalConnect, VivaLNK, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the remote patient monitoring market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global remote patient monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the remote patient monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The remote patient monitoring market was valued at USD 1.9 Billion in 2025.

IMARC estimates the remote patient monitoring market to exhibit a CAGR of 12.00% during 2026-2034.

Key factors driving the remote patient monitoring market include the rising prevalence of chronic diseases, growing demand for cost-effective healthcare solutions, technological advancements in wearable devices and connectivity, increased adoption of telehealth, supportive government policies and reimbursement frameworks, and a shift toward value-based care models emphasizing preventive and personalized healthcare.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the remote patient monitoring market include Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Guangdong Transtek Medical Electronics Co., Ltd., Koninklijke Philips N.V., LifeWatch, Medtronic plc, Nihon Kohden Corporation, OMRON Healthcare Co., Ltd., Telecare USA Inc, VitalConnect, VivaLNK, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)