Regenerative Medicine Market Report by Type (Stem Cell Therapy, Biomaterial, Tissue Engineering, and Others), Application (Bone Graft Substitutes, Osteoarticular Diseases, Dermatology, Cardiovascular, Central Nervous System, and Others), End User (Hospitals, Specialty Clinics, and Others), and Region 2025-2033

Global Regenerative Medicine Market:

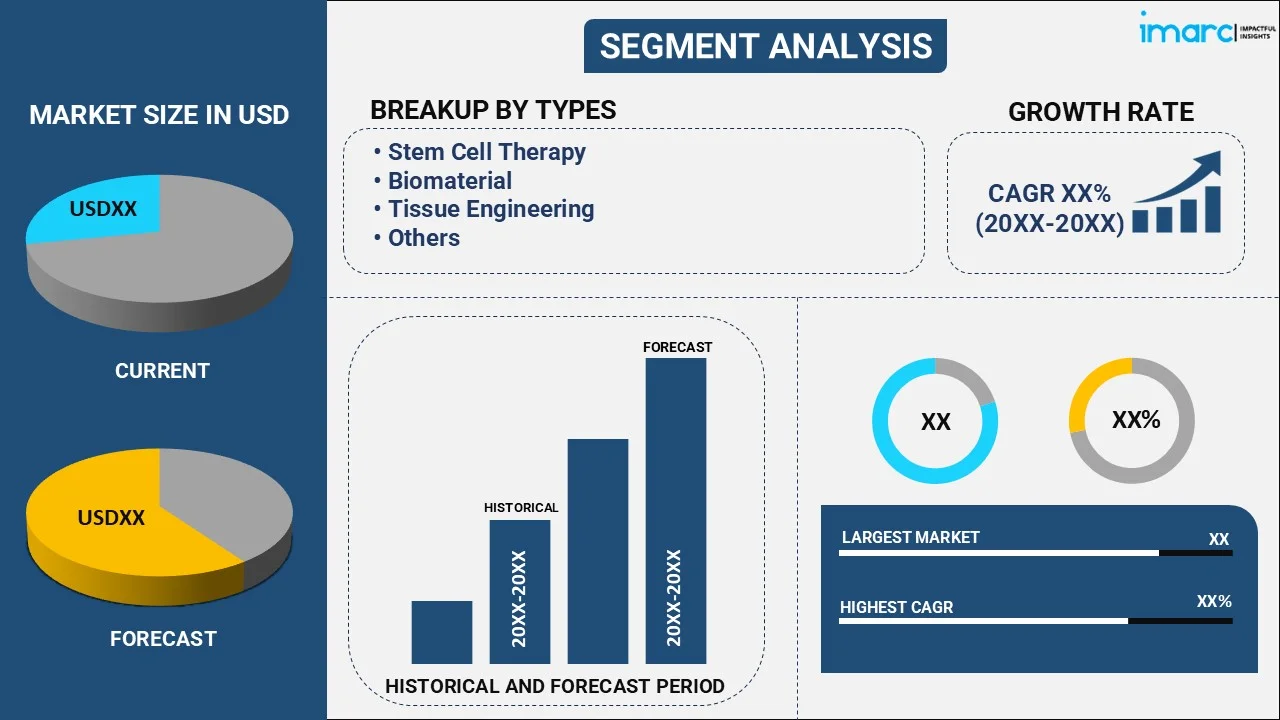

The global regenerative medicine market size reached USD 26.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 130.4 Billion by 2033, exhibiting a growth rate (CAGR) of 19.15% during 2025-2033. The increasing transplant rejection concerns, the rising demand for regenerative therapies for orthopedic conditions, the growing dental regeneration, and the escalating medicine use in wound healing are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.7 Billion |

| Market Forecast in 2033 | USD 130.4 Billion |

| Market Growth Rate (2025-2033) | 19.15% |

Regenerative Medicine Market Analysis:

- Major Market Drivers: The rising prevalence of chronic diseases such as diabetes, heart disease, and osteoarthritis owing to the aging population along with the growing research in stem cell therapies and genetic engineering drives innovation in regenerative medicine. Moreover, the escalating use of stem cells and other cell-based therapies for tissue regeneration and repair is also catalyzing the market.

- Key Market Trends: The increasing awareness among patients about regenerative treatment options along with the funding and regulatory support for regenerative medicine research and development is expected to boost the market demand. In addition to this, the advancements in biotechnology enable more precise and effective regenerative therapies, bolstering the market growth.

- Competitive Landscape: Some of the leading regenerative medicine market companies are bluebird bio, Inc., CRISPR Therapeutics, Gamida Cell Inc, Gilead Sciences, Inc., IOVANCE Biotherapeutics, Inc., Mesoblast Ltd, Novartis AG, Orchard Therapeutics plc, SanBio Co, Ltd., and Vertex Pharmaceuticals, among many others.

- Geographical Landscape: According to the report, North America accounted for the largest market share. Government agencies in the region have shown support for regenerative medicine research through funding initiatives, grants, and regulatory pathways designed to accelerate the development and commercialization of innovative therapies.

- Challenges and Opportunities: Regulatory hurdles in the approval of regenerative medicines along with the high cost of research, development, and clinical trials in regenerative medicines are hampering the market growth. However, advances in regenerative medicine, including cell therapy and gene editing technologies, enable personalized treatment approaches tailored to individual patient characteristics and disease profiles, further escalating the market demand.

To get more information on this market, Request Sample

Regenerative Medicine Market Trends:

Increasing Product Demand in Cancer Treatment

The increasing product demand in cancer treatment is catalyzing the market growth. Cancer, characterized by uncontrolled cell growth, often leads to tissue damage, which can be addressed through regenerative therapies. Regenerative medicine allows for the development of targeted therapies that can repair damaged tissues caused by cancer or side effects of treatments like chemotherapy. For instance, according to an article published by Money Control in April 2024, stem cell therapy, also known as regenerative medicine, is a method of promoting the natural healing response of sick, malfunctioning, or wounded tissues by employing stem cells or their derivatives. Stem cell therapy uses stem cells to replace or repair damaged tissues, which has the potential to be an effective cancer treatment. Moreover, robust research and clinical trials explore the potential of regenerative therapies in various cancer types, fostering the market growth. The potential for regenerative therapies to revolutionize cancer treatment attracts investment in research and development. For instance, in April 2024, Denovo's DB107, a biomarker-guided late-stage gene therapy for high-grade glioma (HGG) including glioblastoma (GBM), received US$ 11.8 Million funding from the California Institute for Regenerative Medicine (CIRM) in order to perform a Phase 1/2 clinical trial of DB107 in patients with newly diagnosed HGG, a type of adult brain cancer. The rising prevalence of cancer and the pursuit of more effective, patient-friendly treatments fuel the demand for regenerative medicine in cancer care, contributing significantly to the market's expansion. These factors are further bolstering the regenerative medicine market revenue.

Rapid Advancements in Immunotherapy

Rapid advancements in immunotherapy are propelling the market. Immunotherapy, a subset of regenerative medicine, harnesses the body's immune system to fight diseases, including cancer and autoimmune disorders. Immunotherapies like CAR-T cell therapy and immune checkpoint inhibitors have revolutionized cancer treatment by enhancing the body's ability to recognize and combat cancer cells. For instance, according to an article published by Pen Medicine, CAR T cell therapy is a form of cancer immunotherapy treatment in which immune cells called T cells are genetically changed in a lab to help them locate and destroy cancer cells more efficiently. CAR T treatment can be extremely effective against certain forms of cancer, even when conventional treatments fail. They often have fewer severe side effects than traditional treatments like chemotherapy and radiation therapy, improving patient outcomes. Moreover, according to an article published by Web MD, immunotherapy has fewer side effects as it targets the immune system rather than the cells in the body. Moreover, robust clinical trials and research initiatives focus on optimizing immunotherapies, driving innovation in the field. For instance, in February 2024, Imunon announced the commencement of patient enrollment in IMNN-001, a Phase I/II clinical trial for DNA-based interleukin-12 (IL-12) immunotherapy in patients with advanced ovarian cancer at Memorial Sloan Kettering Cancer Center. The study intended to include fifty patients with Stage III/IV cancer. These factors are contributing to the regenerative medicine market share.

Widespread Product Applications in Cosmetic Surgery and Aesthetics

The widespread product applications in cosmetic surgery and aesthetics are a driving force behind the growth of this market. Regenerative therapies, including adipose-derived stem cell treatments, are used for natural tissue augmentation in procedures like breast reconstruction and facial rejuvenation. For instance, according to an article published by Umea University, adipose tissue stem cell transplantation makes it possible to regenerate a new breast without the need for silicone implants or extensive surgery following the removal of breast cancer. Moreover, regenerative techniques are employed to minimize the appearance of scars resulting from surgeries, accidents, or injuries, enhancing aesthetic outcomes. Stem cell-based regenerative therapies are utilized for hair restoration, addressing hair loss and baldness concerns. For instance, in March 2024, Aderans Company, the parent company of Bosley and HAIRCLUB, and Stemson Therapeutics signed an agreement to grant Stemson the sole right to conduct research, develop, and market hair regeneration therapeutic products based on Aderans' patented hair regeneration cell therapy technology. Through this collaboration, Stemson, a cell therapy developer in induced pluripotent stem cells (iPSC) for reversing hair loss, obtained a complementary technology. In addition to providing a variety of solutions for individuals suffering from hair loss, Stemson would take up Aderans' Phase 2 clinical-stage cell therapy hair regeneration program and incorporate the technology into its current hair loss cell therapy development pipeline. These factors are driving the adoption of regenerative medicine.

Regenerative Medicine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global regenerative medicine market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Breakup by Type:

- Stem Cell Therapy

- Biomaterial

- Tissue Engineering

- Others

Stem cell therapy dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes stem cell therapy, biomaterial, tissue engineering, and others. According to the report, stem cell therapy represented the largest segment.

According to the regenerative medicine market outlook, stem cell therapy harnesses the unique regenerative properties of stem cells to repair and replace damaged or dysfunctional tissues and organs. It offers diverse therapeutic applications, including orthopedics, cardiology, neurology, and oncology. This versatility attracts investment and research, expanding its market presence. Clinical trials and case studies demonstrate the effectiveness of stem cell therapies in treating previously incurable conditions, boosting patient and physician confidence. With the global population aging, there's an increasing prevalence of age-related diseases and degenerative conditions, driving the demand for regenerative treatments. Furthermore, the regulatory bodies recognize stem cell therapies' potential, resulting in streamlined approvals and guidelines, further encouraging the market growth. Patients seeking alternatives to conventional treatments are turning to stem cell therapies for better outcomes and reduced side effects. The potential of stem cell therapies attracts investments, fostering research and development and expanding accessibility. Advances in stem cell isolation, culturing, and delivery methods improve treatment efficacy, enhancing their applications. Stem cell therapy providers are expanding their reach globally, making these treatments available to a wider patient population. For instance, in October 2022, Century Therapeutics and Bristol Myers Squibb revealed a research collaboration and license agreement to develop and market up to four induced pluripotent stem cell-derived, modified natural killer cell and/or T cell projects for hematologic malignancies and solid tumors.

Breakup by Application:

- Bone Graft Substitutes

- Osteoarticular Diseases

- Dermatology

- Cardiovascular

- Central Nervous System

- Others

Dermatology dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes bone graft substitutes, osteoarticular diseases, dermatology, cardiovascular, central nervous system, and others. According to the report, dermatology represented the largest segment.

According to the regenerative medicine industry analysis, dermatology is a vital application within regenerative medicine, focusing on the restoration and regeneration of skin tissues. It addresses a wide spectrum of dermatological concerns, ranging from scar reduction and wound healing to treating skin disorders and aging-related skin conditions. Regenerative approaches in dermatology include using stem cells, growth factors, and tissue engineering techniques, offering patients innovative and minimally invasive solutions for achieving healthier, more youthful, and blemish-free skin. This segment is gaining traction due to the growing demand for cosmetic and aesthetic enhancements and the need for effective treatments for various skin ailments, ultimately contributing to the overall growth of the regenerative medicine market. For instance, in September 2023, Dr. Samuel Lynch, a biotechnology entrepreneur, launched Lynch Regenerative Medicine, Inc. (LRM), a new advanced biotherapeutics skincare firm that would address unmet clinical requirements in both the cosmetic and advanced wound care industry.

Breakup by End User:

- Hospitals

- Specialty Clinics

- Others

Hospitals dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty clinics, and others. According to the report, hospitals represented the largest segment.

As per the regenerative medicine industry insights, hospitals serve as prominent end users within the regenerative medicine market, playing a pivotal role in the adoption and growth of regenerative therapies. They serve as hubs for advanced medical care and are integral for several reasons. Hospitals provide the infrastructure and expertise necessary for conducting complex regenerative procedures, such as organ transplants and stem cell therapies, ensuring patient safety and optimal outcomes. They also facilitate clinical trials and research initiatives, allowing for the development and testing of innovative regenerative treatments. Furthermore, hospitals are key in delivering regenerative therapies to patients, especially for acute injuries, chronic diseases, or conditions requiring specialized medical attention. As healthcare institutions embrace regenerative medicine, hospitals remain central in its expansion, offering cutting-edge treatments to a diverse patient population.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

As per the regenerative medicine industry statistics, North America represents a significant region in the regenerative medicine market, driving growth through several key factors. The region's advanced healthcare infrastructure, robust research and development capabilities, and high healthcare expenditure contribute to the adoption of regenerative therapies. It is home to numerous renowned research institutions, biotechnology companies, and academic centers specializing in regenerative medicine, fostering innovation and clinical advancements. Regulatory support and well-defined approval processes in countries like the United States accelerate the introduction of regenerative treatments to the market. A growing aging population with age-related conditions also fuels the demand for regenerative solutions. Moreover, a strong focus on addressing chronic diseases, sports injuries, and aesthetic concerns further propels the use of regenerative therapies in North America. These factors collectively position North America as a prominent growth driver in the regenerative medicine sector. For instance, in October 2023, Bayer AG inaugurated its first Cell Therapy launch facility in Berkeley, California, in order to offer regenerative medicines to patients.

Competitive Landscape:

Top companies are strengthening the market through innovation, strategic partnerships, and extensive research. They invest heavily in research and development, pushing the boundaries of regenerative medicine, uncovering new therapies, and expanding treatment options. They conduct large-scale clinical trials to demonstrate the safety and efficacy of regenerative therapies, gaining regulatory approvals and boosting market confidence. Top companies develop a diverse portfolio of regenerative products, catering to various medical conditions and applications, from orthopedics to oncology. These companies expand globally, ensuring wider access to their therapies and increasing market reach. Partnerships with research institutions, healthcare providers, and pharmaceutical companies facilitate knowledge sharing and the development of novel therapies. They navigate complex regulatory landscapes, ensuring their therapies meet stringent safety and quality standards instilling trust in healthcare professionals and patients. Top companies engage in patient advocacy and education, raising awareness about the benefits of regenerative medicine, thus driving demand. Their track record of success attracts investments, enabling further research and development of groundbreaking therapies.

The report has provided a comprehensive analysis of the competitive landscape in the regenerative medicine market. Detailed profiles of all major companies have also been provided.

- bluebird bio, Inc.

- CRISPR Therapeutics

- Gamida Cell Inc

- Gilead Sciences, Inc.

- IOVANCE Biotherapeutics, Inc.

- Mesoblast Ltd

- Novartis AG

- Orchard Therapeutics plc

- SanBio Co, Ltd.

- Vertex Pharmaceuticals

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Regenerative Medicine Market Recent Developments:

- June 2024: Nava Health, a longevity, integrative, and functional medicine provider, signed a lease for the first Nava Center in New York. The center would offer functional medicine, which focuses on the underlying causes of health problems; regenerative medicine, which aims to restore cellular and tissue function; and personalized wellness plans that provide a road map for long-term health.

- April 2024: SCG Cell Therapy (SCG) and the Agency for Science, Technology, and Research established joint laboratories for cellular immunotherapies to accelerate the development of induced pluripotent stem cell (iPSC) technology and generate innovative cell therapies that satisfy Good Manufacturing Practice (GMP) requirements.

- March 2024: Aderans Company, the parent company of Bosley and HAIRCLUB, and Stemson Therapeutics signed an agreement to grant Stemson the sole right to conduct research, develop, and market hair regeneration therapeutic products based on Aderans' patented hair regeneration cell therapy technology.

Regenerative Medicine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stem Cell Therapy, Biomaterial, Tissue Engineering, Others |

| Applications Covered | Bone Graft Substitutes, Osteoarticular Diseases, Dermatology, Cardiovascular, Central Nervous System, Others |

| End Users Covered | Hospitals, Specialty Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | bluebird bio, Inc., CRISPR Therapeutics, Gamida Cell Inc, Gilead Sciences, Inc., IOVANCE Biotherapeutics, Inc., Mesoblast Ltd, Novartis AG, Orchard Therapeutics plc, SanBio Co, Ltd., Vertex Pharmaceuticals, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the regenerative medicine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global regenerative medicine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the regenerative medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The regenerative medicine market reached a value of USD 26.7 Billion in 2024.

The market is projected to exhibit a CAGR of 19.15% during 2025-2033, reaching a value of USD 130.4 Billion by 2033.

Key drivers of the market include the rising prevalence of chronic diseases, advancements in cell and gene therapy, increasing investments in stem cell research, and growing demand for organ and tissue regeneration solutions. Favorable regulatory frameworks and expanding applications in neurology, oncology, and orthopedic treatments further support market growth.

North America currently dominates the regenerative medicine market, supported by a strong biotechnology sector, well-established healthcare infrastructure, and robust R&D investments.

Some of the major players in the regenerative medicine market include bluebird bio, Inc., CRISPR Therapeutics, Gamida Cell Inc, Gilead Sciences, Inc., IOVANCE Biotherapeutics, Inc., Mesoblast Ltd, Novartis AG, Orchard Therapeutics plc, SanBio Co, Ltd., Vertex Pharmaceuticals, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)