Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Region, 2025-2033

Refrigerated Transport Market Size and Share:

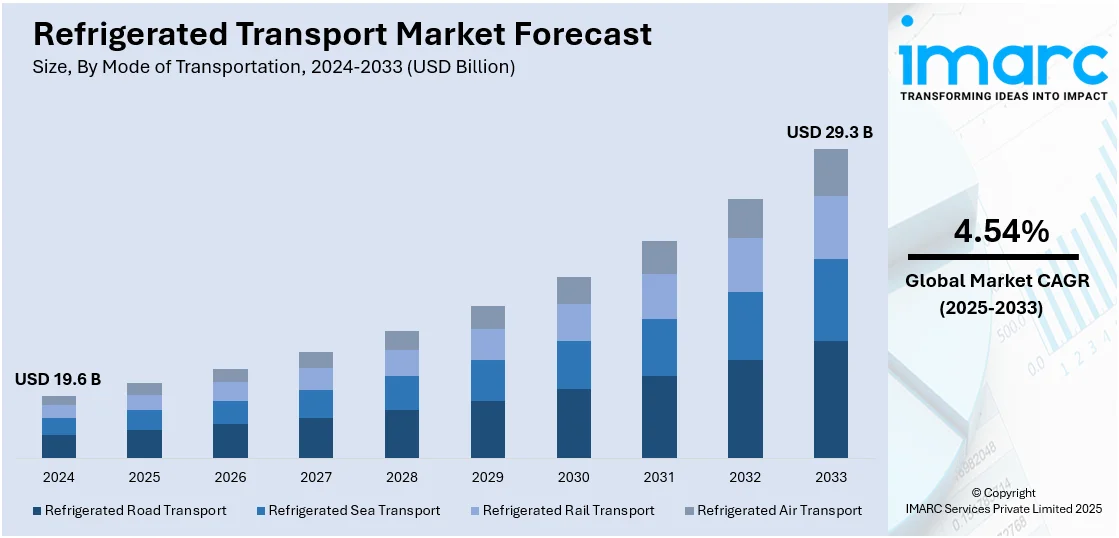

The global refrigerated transport market size was valued at USD 19.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.3 Billion by 2033, exhibiting a CAGR of 4.54% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.2% in 2024. The refrigerated transport market share in the Asia Pacific region is increasing accredited to the strong demand for processed and frozen food, rapid growth in retail and e-commerce logistics, rising pharmaceutical exports, and ongoing improvements in cold chain infrastructure across key regional economies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.6 Billion |

|

Market Forecast in 2033

|

USD 29.3 Billion |

| Market Growth Rate 2025-2033 | 4.54% |

Rising preferences for fresh fruits and vegetables, dairy products, meat, and seafood, which necessitate continuous refrigeration during transportation to uphold quality, safety, and longevity is a vital factor propelling the market growth. Moreover, the growing need for temperature-sensitive medications, vaccines, biologics, and insulin is catalyzing the demand for refrigerated logistics. Worldwide health initiatives, clinical studies, and vaccine distribution efforts are broadening the pharmaceutical cold chain, imposing strict temperature control standards during transport from manufacturer to healthcare facility or pharmacy. In addition to this, fleet managers are incorporating telematics, temperature monitoring, and artificial intelligence (AI)-driven routing to enhance refrigerated transport efficiency. Investing in low-emission vehicles and environmentally safe refrigerants is also contributing to sustainability objectives. The shift towards green logistics is transforming how cold transport fleets operate, monitor performance, and manage energy use.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the increasing consumer demand for fresh, organic, and locally sourced food, which require strict temperature control from farm to store. Major retailers are expanding cold supply chains to meet expectations for quality, safety, and extended shelf life, especially for fruits, vegetables, dairy, and seafood. Additionally, logistics companies are accelerating the shift toward electric trucks with integrated electric refrigeration units. These solutions enable continuous cooling while meeting emission regulations. In 2024, Isuzu showcased its all-electric NRR EV truck integrated with Thermo King's e300 all-electric refrigerated unit at the ACT Expo in Las Vegas. The electric truck offered a range of 60 to 235 miles, with an electric-powered refrigeration system providing continuous cooling. This collaboration aimed to provide zero-emission refrigerated transport solutions for medium-duty delivery.

Refrigerated Transport Market Trends:

Increasing Regulatory Compliance and Quality Standards

The rise in consumer consciousness of the food safety and quality issues more intensifies the need for a compliance system in transporting perishable items. Authorities at various levels are required to create tight legislation on temperature sensitive goods such as pharmaceuticals and food products as they are transported, stored, and handled. This condition has resulted in an increase in demand for refrigerated services that upon high requirements. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. As a result, the industry implements a number of technologies including real-time temperature monitoring, GPS tracking, and data analytics to ensure compliance and minimize risks caused by spoilage and contamination. Adherence to these regulatory requirements safeguards against loss due to spoilage and is an indication of credibility and brand equity with consumers and stakeholders.

Rise in Pharmaceutical and Healthcare Needs

The pharmaceutical and healthcare sectors are also the factor behind the electricity growth of the industry of refrigerated transport. The global aging population and a rise of chronic diseases are some of the main contributors to the raising demand for temperature-controlled products, including vaccines, biologics, and insulins. According to WHO, by 2030, 1 in 6 people in the world will be aged 60 years or over. The coronavirus pandemic explains need for dependable temperature-control transport to allow the quick delivery of vaccines and other medical goods. The allocation of these essential medicines includes hospitals, pharmacies, and the healthcare centers, thus it is mandatory for the transportation services to keep exact temperature controls on time and safety. Another force behind the prevailing bullish development in the healthcare and pharmaceutical industry is this consequently, the necessity to provide such solutions becomes even more evident.

Technological Advancements in Refrigeration Systems

Due to advanced technologies that are rapidly emerging, the refrigerated transport business is now reaching greater heights. Development of electric-powered and solar-powered refrigerators not only cause less waste of energy but also less pollutant into the environment compared to the contraptions which use diesel as the source of fuel. Moreover, the application of smart technologies allows you to monitor temperature, humidity, as well as the location of the vehicle in real time, which means that the prime conditions will be observed when transporting the goods. These achievements greatly help diminish the possibility of perishing, contaminating, or failing to achieve an acceptable standard. In February 2024, Sumitomo Corporation and OOCL partnered to launch a refrigerated ocean transport service using electric field technology to preserve product freshness. This low-carbon solution connected new production and consumption areas for chilled food. The service enabled long-term ocean transportation with minimal quality loss, reduced reliance on costly air transport, and aimed to expand food supply areas and ensure a stable product supply.

Refrigerated Transport Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global refrigerated transport market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on mode of transportation, technology, temperature, and application.

Analysis by Mode of Transportation:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

Refrigerated road transportation represents the largest segment in 2024, accounting 39.6% of the market share. Refrigerated road transportation accounts for the largest portion of the market, mainly driven by the expansion of e-commerce. With the growing consumer interest in buying perishable items online, road transport provides both flexibility and efficiency for last-mile delivery. Shifting consumer habits and a growing preference for convenience foods, such as frozen and RTE items, are also fueling the need for temperature-controlled distribution systems. Urban and suburban markets depend significantly on road systems to preserve product quality throughout short- and mid-distance deliveries. Strict regulatory standards regarding food safety bolster the use of advanced refrigerated vehicles that can sustain exact temperature conditions. Furthermore, the growing consumer inclination towards high-quality, specialized food items requires efficient cold chain oversight. Continual advancements in refrigeration technologies, such as real-time monitoring systems and energy-efficient models, are enhancing the reliability, traceability, and performance of refrigerated road transport solutions in diverse market sectors.

Analysis by Technology:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

Air-blown evaporators lead the market with 43.1% of market share in 2024. The adoption of air-blown evaporators technology in the refrigerated transport industry is being propelled by the growing need for rapid and efficient cooling systems capable of maintaining precise temperature control, especially for perishable goods, including pharmaceuticals and specialty foods. Air-blown evaporators are fast and efficient refrigeration systems that are capable of accurate temperature control, especially for chemical perishables and specialty foods. Furthermore, air-blown evaporators offer improved cooling speed and heating uniformity compared to traditional systems, meeting stringent regulatory requirements for quality and safety. Technological advances are also providing energy-efficient and environment-friendly solutions, which are in line with corporate efforts to reduce carbon footprints. Additionally, the increasing international trade in perishables, requires advanced cooling systems that can maintain optimal conditions over long distances, to accommodate air-conditioning equipment atom again. The technology, along with real-time monitoring systems, also enables better compliance and traceability, ensuring that products are delivered under optimal conditions. As a result, air-blown evaporators are becoming the preferred technology in the refrigerated transport industry.

Analysis by Temperature:

- Single-Temperature

- Multi-Temperature

Single temperature stands as the largest component in 2024, holding 58.2% of the market share. Single temperature represents the largest segment due to the growing demand for uniform delivery of various products, such as frozen foods or pharmaceuticals, that need to be at a single temperature. This is resulting in an increased adoption of single temperature technology systems. Additionally, it offers ease of use and efficiency, resulting in lower costs for specific corrosive industries. Besides this, strict regulatory guidelines encourage the use of specialized delivery systems that can maintain a constant temperature throughout the journey, providing compliance with uniform temperatures. Developments in specific industries, such as the frozen food market and specialty chemicals, which require constant temperatures to homogenize the products, are increasing the importance of this technology. Additionally, developments in insulation and energy-efficient cooling systems are improving the single-temperature transport of refrigerators and making them more environment-friendly.

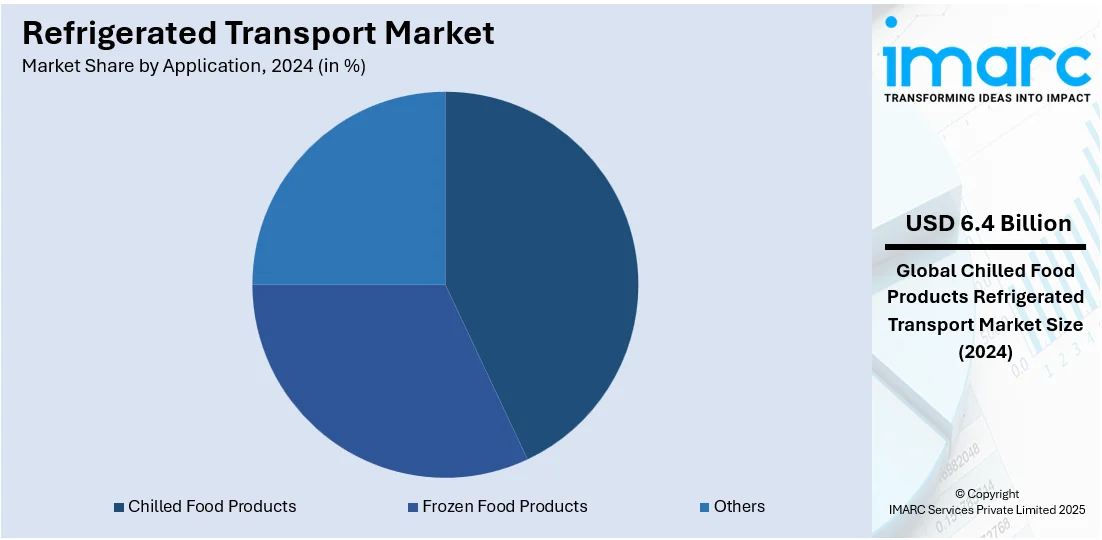

Analysis by Application:

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

Chilled food products represent the largest segment, holding 32.6% in 2024. Chilled food products (dairy products, bakery and confectionery products, fresh fruits and vegetables, and others) lead the market, driven by the rising consumer demand for fresh and quality foods. As consumers become increasingly health-conscious and aware about food safety, the requirement for reliable, temperature-controlled transport solutions for chilled items is gaining prominence. Along with this, the rise of organized retail and e-commerce platforms is catalyzing the demand for efficient refrigerated transport services, particularly for last-mile deliveries. Additionally, urbanization and changing lifestyle patterns contribute to the consumption of convenience foods that require chilled transportation to maintain their quality and freshness. Furthermore, regulatory standards enforcing strict guidelines on food safety and quality are encouraging the industry to adopt specialized refrigerated transport solutions. Advances in technology, including real-time temperature monitoring, also add to the sector's robustness.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific dominates the market, accounting for a share of 35.2% in 2024. The refrigerated transport industry in the Asia Pacific region is experiencing substantial growth, propelled by rapid urbanization and rising disposable incomes. This is catalyzing the demand for perishable goods, such as fresh produce, dairy, and meat products, requiring efficient and reliable refrigerated transport. Along with this, the expansion of organized retail and the booming e-commerce sector is further driving the need for specialized cold chain logistics, particularly for last-mile deliveries. Additionally, stringent food safety regulations are also coming into effect across various countries in the region, boosting the demand for compliant, temperature-controlled transportation services. Advances in refrigeration technology, coupled with increasing investment in sustainable cold chain logistics are bolstering the market growth in the region. In 2024, Yellowings Delivery Services launched India's first 100% electric reefer pickup truck in partnership with Jubilant FoodWorks. The truck, designed for transporting perishable goods, has a 1-ton payload and can maintain temperatures as low as 0°C. This initiative promoted sustainability in cold chain logistics and gender diversity by employing female drivers.

Key Regional Takeaways:

United States Refrigerated Transport Market Analysis

In North America, the market portion held by the United States was 92% of the overall total. United States is witnessing an increasing demand for refrigerated transport due to growing refrigerated transport adoption driven by the expanding e-commerce sector. According to reports, e-commerce sales in the United States have been steadily increasing for over a decade in the United States have been consistently rising for more than ten years, reaching an all-time high of USD 1.12 Trillion in 2023. That is a 330% increase from USD 260.4 Billion in 2013. Online grocery platforms are pushing for efficient cold chain logistics to ensure product integrity. Retailers and food service providers are enhancing their supply chain efficiency to meet consumer expectations for fresh and frozen products. The surge in direct-to-consumer meal kits and perishable deliveries is further accelerating refrigerated transport expansion. Additionally, regulatory frameworks are emphasizing stringent temperature-controlled transportation, compelling businesses to invest in advanced refrigeration solutions. Warehousing and distribution networks are evolving to accommodate real-time tracking and automation, ensuring timely and safe product deliveries. The continuous advancements in refrigerated fleet technology, including electric and hybrid solutions, are shaping a sustainable logistics infrastructure.

Europe Refrigerated Transport Market Analysis

Europe is witnessing a rapid expansion in refrigerated transport due to growing refrigerated transport adoption supported by the expanding food and beverage industry. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. The increasing consumer demand for dairy, meat, seafood, and ready-to-eat meals is necessitating efficient cold chain logistics. Food manufacturers and retailers are focusing on enhancing transportation networks to maintain quality and safety standards. Stricter food safety regulations are further driving the need for reliable temperature-controlled logistics solutions. The expansion of premium and organic food categories is amplifying the requirement for advanced refrigeration technologies. Additionally, the region's preference for sustainable logistics is encouraging the adoption of energy-efficient refrigerated transport solutions. Warehousing and distribution facilities are evolving to incorporate smart cooling systems and automation, optimizing supply chain operations.

Asia Pacific Refrigerated Transport Market Analysis

Asia-Pacific is experiencing a surge in refrigerated transport due to growing refrigerated transport adoption fueled by the rise in pharmaceutical and healthcare requirements. According to India Brand Equity Foundation, the total FDI equity inflow in the drugs and pharmaceuticals sector amounts to USD 22.52 Billion from April 2000 to March 2024, representing nearly 3.4% of the overall inflow received by all sectors. The increasing need for temperature-sensitive medicines, vaccines, and biologics is catalyzing the demand for reliable cold chain solutions. Pharmaceutical companies are investing in state-of-the-art refrigerated logistics to comply with stringent storage and transportation regulations. The expansion of biopharmaceuticals and personalized medicine is further intensifying the reliance on temperature-controlled distribution. Healthcare providers and research institutions are pushing for enhanced logistics infrastructure to ensure seamless pharmaceutical supply. Additionally, urbanization and healthcare advancements are amplifying the demand for efficient cold chain management across hospitals and clinics.

Latin America Refrigerated Transport Market Analysis

Latin America is experiencing rising demand for refrigerated transport due to growing refrigerated transport adoption supported by the rising demand for fresh and processed foods due to growing disposable income. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Consumers are shifting towards high-quality perishable goods, driving the need for efficient cold storage and transportation. Retail chains and food distributors are expanding their refrigerated logistics networks to cater to changing consumption patterns. The increasing penetration of modern supermarkets and convenience stores is further fueling the adoption of cold chain solutions.

Middle East and Africa Refrigerated Transport Market Analysis

The refrigerated transport market in the Middle East and Africa is experiencing notable growth, supported by the growing need for temperature-sensitive goods like pharmaceuticals, perishable food items, and chemicals. As the region's logistics and supply chain infrastructure continues to improve, the need for efficient refrigerated transport solutions to preserve product quality during transit has surged. The expansion of e-commerce and changing consumer preferences for fresh, frozen, and convenience foods are further fueling the market's growth. The Saudi Arabia convenience food market size is projected to exhibit a growth rate (CAGR) of 4.7% during 2025-2033. Additionally, the rise in international trade, especially in the Gulf Cooperation Council (GCC) countries, has increased the movement of goods that require precise temperature control. The market is also being supported by technological advancements in refrigeration units, real-time tracking, and telematics, which ensure better management of the transportation process.

Competitive Landscape:

Major participants in the market are concentrating on enlarging their fleets with energy-efficient and temperature-regulated vehicles to satisfy the increasing need for cold chain logistics. They are putting money into sophisticated telematics, IoT-based monitoring systems, and automation to guarantee real-time tracking, temperature regulation, and compliance with regulations. For instance, in 2025, Kenya Railways launched Reefer wagons for transporting perishable goods to the Port of Mombasa. This initiative aims to create a Cool Logistics Corridor for fresh farm produce in East Africa, enhancing the horticulture sector. The wagons feature real-time temperature monitoring to ensure freshness during transit. Furthermore, businesses are forming strategic alliances with logistics providers and cold storage operators to enhance last-mile connectivity and distribution abilities. Multiple companies are also striving to decrease carbon emissions by utilizing electric and hybrid refrigerated vehicles. Market participants are enhancing their footprint in developing areas via acquisitions, partnerships, and localized production facilities.

The report provides a comprehensive analysis of the competitive landscape in the refrigerated transport market with detailed profiles of all major companies, including:

- C.H. Robinson Worldwide, Inc.

- Daikin Industries, Ltd.

- DB Schenker

- FedEx

- Great Dane LLC

- Hyundai Motor Company

- KRONE Trailer

- Kuehne+Nagel

- Lamberet SAS

- Schmitz Cargobull

- Swift Transportation Company

- Utility Trailer Manufacturing Company, LLC

- Wabash National Corporation

Latest News and Developments:

- December 2024: SeaCube and Greensee launched Green and Net-Zero Reefer Leases, integrated AI-driven CO2 emissions reporting for sustainable refrigerated transport. Partnering with Thermo King and CMA CGM, SeaCube field-tested the E-COOLPAC electric genset, a zero-emission battery-powered solution. This technology enabled last-mile electrification and enhanced energy efficiency in cold chain logistics. The E-COOLPAC offered modular battery packs from 35kWh to 105kWh, replaced traditional diesel gensets.

- November 2024: Carrier Transicold showcased its latest digital and electric refrigeration solutions at Intermodal Europe 2024 in Rotterdam. Visitors explored innovations that enhanced cold chain efficiency, sustainability, and reliability at booth C30. Willy Yeo, Director of Sales Marketing and Strategy, delivered a keynote on sustainability and fleet futureproofing. The company highlighted OptimaLINE™ as a key solution for energy efficiency and environmental impact reduction.

- September 2024: Carrier Transicold launched the Vector® HE 19 unit at IAA Transportation 2024, featured a low-GWP refrigerant and HVO biofuel compatibility. The unit cut CO2 emissions by nine times compared to R452A and reduced carbon output by 80% with biofuel. This resulted in an overall 84% CO2 reduction annually while maintaining high performance. Carrier Transicold was a part of Carrier Global Corporation, a leader in climate and energy solutions.

- June 2024: MHI Thermal Systems launched the TEK series of electric-driven transport refrigeration units for small and mid-size trucks. The compact units featured a plug-in hybrid system for maintaining cargo temperature during parking and idling. With enhanced cooling and heating capacity, the TEK series expanded on the TE20/30 series’ capabilities. Mitsubishi Heavy Industries Thermal Transport Europe GmbH handled sales in Europe.

Refrigerated Transport Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Mode of Transportations Covered | Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport |

| Technologies Covered | Vapor Compression Systems, Air-Blown Evaporators, Eutectic Devices, Cryogenic Systems |

| Temperatures Covered | Single-Temperature, Multi-Temperature |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | C.H. Robinson Worldwide, Inc., Daikin Industries, Ltd., DB Schenker, FedEx, Great Dane LLC, Hyundai Motor Company, KRONE Trailer, Kuehne+Nagel, Lamberet SAS, Schmitz Cargobull, Swift Transportation Company, Utility Trailer Manufacturing Company, LLC, Wabash National Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the refrigerated transport market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global refrigerated transport market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the refrigerated transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The refrigerated transport market was valued at USD 19.6 Billion in 2024.

The refrigerated transport market is projected to exhibit a CAGR of 4.54% during 2025-2033, reaching a value of USD 29.3 Billion by 2033.

The refrigerated transport market is growing because of the rising demand for perishable food, increased pharmaceutical distribution, and stricter regulations on cold chain logistics. Expansion of e-commerce grocery platforms, advancements in refrigeration technology, and global trade of temperature-sensitive goods are also catalyzing the demand.

Asia Pacific currently dominates the refrigerated transport market, accounting for a share of 35.2%. The dominance of the region is attributed to strong demand for processed and frozen food, rapid growth in retail and e-commerce logistics, rising pharmaceutical exports, and ongoing improvements in cold chain infrastructure across key regional economies.

Some of the major players in the refrigerated transport market include C.H. Robinson Worldwide, Inc., Daikin Industries, Ltd., DB Schenker, FedEx, Great Dane LLC, Hyundai Motor Company, KRONE Trailer, Kuehne+Nagel, Lamberet SAS, Schmitz Cargobull, Swift Transportation Company, Utility Trailer Manufacturing Company, LLC, Wabash National Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)