Refrigerant Market Report by Product Type (Fluorocarbon, Inorganic, Hydrocarbon, and Others), Application (Commercial, Industrial, Domestic, and Others), and Region 2025-2033

Market Overview:

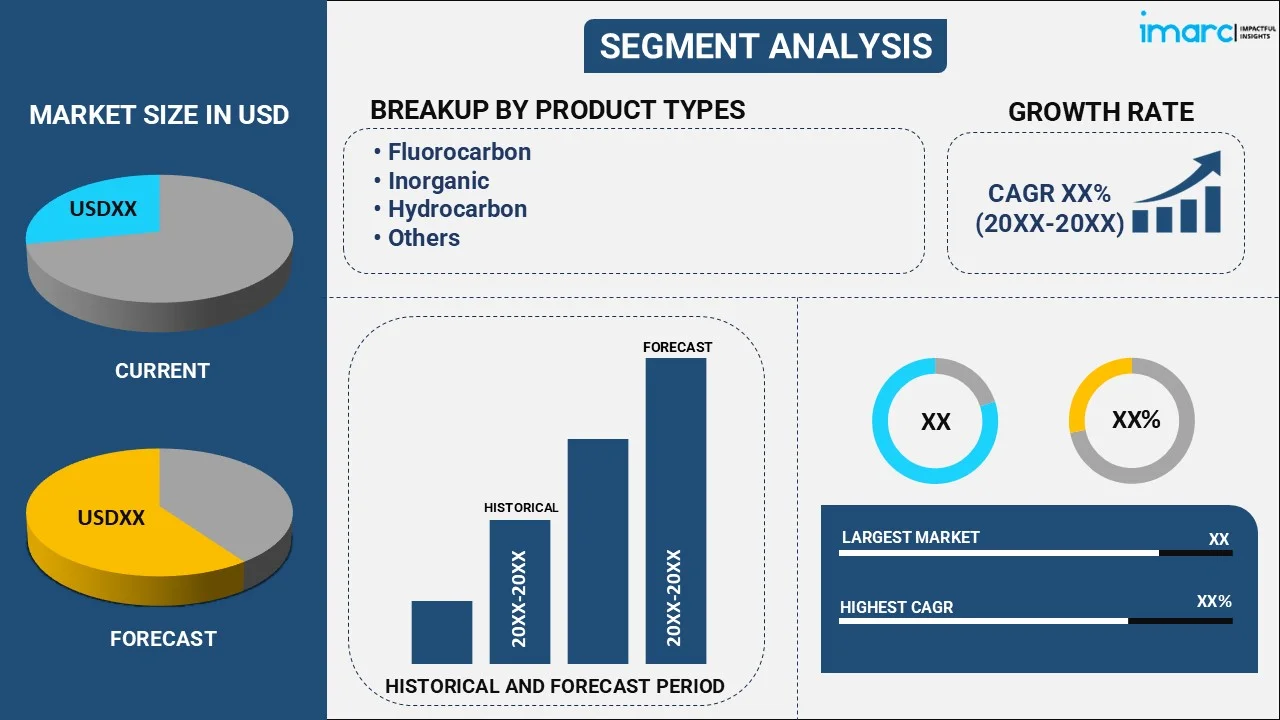

The global refrigerant market size reached USD 21.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.06% during 2025-2033. The increasing need for cooling solutions due to global climate changes, continual advancements in cooling technology, an enhanced focus on global regulatory compliance and considerable rise in urban infrastructure development represent some of the factors that are propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.9 Billion |

| Market Forecast in 2033 | USD 40.7 Billion |

| Market Growth Rate 2025-2033 | 8.06% |

A refrigerant is a chemical compound specifically engineered to undergo phase changes from gas to liquid and back again at temperatures and pressures that are practical for cooling applications. These substances are key to the functionality of refrigerators, air conditioners, and heat pumps, in both industrial and consumer settings. Characterized by their low boiling points and heat-absorbing capabilities, refrigerants are used in a closed-loop system where they circulate, changing states and facilitating the heat exchange process. They possess thermodynamic properties such as specific heat capacity, density, and thermal conductivity that allow them to capture heat from one environment and release it into another, thus maintaining controlled temperatures.

To get more information on this market, Request Sample

The global market is primarily driven by the increasing need for cooling solutions due to global climate changes. In line with this, continual advancements in cooling technology are also providing an impetus to the market. Moreover, the escalating demand in automotive applications for climate control is acting as a significant growth-inducing factor. In addition to this, rising disposable income levels are making cooling systems more accessible, which is resulting in higher investment in advanced cooling solutions. Besides this, stricter regulations regarding food storage are creating lucrative opportunities in the market. Also, the growth in the healthcare sector demanding refrigerated storage is impacting the market positively. The market is further driven by a growing need for data centers, which require controlled temperature environments. Some of the other factors contributing to market expansion include industrialization in emerging economies, heightened awareness about the importance of sustainability leading to the adoption of eco-friendly variants, and extensive research and development (R&D) activities.

Refrigerant Market Trends/Drivers:

An enhanced focus on global regulatory compliance

The introduction of numerous international accords has been monumental in setting global standards for substances that have global warming or ozone depletion potential. These regulations not only lay the groundwork for phasing out harmful substances but also stimulate investment in the development of eco-friendly alternatives. As these accords are ratified and implemented by a growing number of countries, industries are compelled to comply with these new standards. This leads to an accelerated phase-out of older, environmentally detrimental substances and ushers in a new era of greener, more sustainable alternatives. The stringent regulations are often accompanied by heavy fines and legal repercussions, making compliance a significant concern for industries. Therefore, regulatory frameworks serve as a powerful catalyst, compelling both manufacturers and consumers to gravitate towards environmentally responsible choices, thereby facilitating significant market growth.

Considerable rise in urban infrastructure development

Another significant factor driving the market is the rampant urbanization observed globally. As cities burgeon, the construction of new commercial and residential buildings is on the rise. Each of these structures, more often than not, requires integrated cooling systems for temperature control and ventilation. The demand for efficient and reliable cooling is not limited to living spaces but extends to shopping malls, office complexes, and transportation hubs. This cumulative need places a considerable demand on the market for effective and safe substances to facilitate cooling. As urban areas continue to swell, the necessity for scalable, efficient, and environmentally friendly cooling solutions becomes even more pressing. This constant expansion of urban infrastructure has a domino effect on various other sectors like construction, electrical systems, and retail, thereby creating a continuously widening avenue for the market to grow.

Continual innovations in retail and supply chain network

The expansion of the retail and supply chain network plays a pivotal role in advancing the market. Innovations in inventory management systems, along with advancements in e-commerce platforms, have revolutionized the way these cooling agents are procured. Previously, the purchase of these substances was constrained by limited accessibility and a complex procurement process. However, the modernization of supply chains has made it possible for a broader range of consumers to easily access these products. Furthermore, sophisticated inventory systems ensure that supplies are consistently available, preventing any potential bottlenecks that could otherwise impede market growth. The enhanced efficiency and accessibility provided by these retail and supply chain innovations thus serves to attract a more extensive customer base, be it industries or individual consumers, thereby significantly contributing to market growth.

Refrigerant Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global refrigerant market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Breakup by Product Type:

- Fluorocarbon

- Inorganic

- Hydrocarbon

- Others

Fluorocarbon represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fluorocarbon, inorganic, hydrocarbon, and others. According to the report, fluorocarbon represented the largest segment.

Fluorocarbons are mostly preferred in the global market due to their high energy efficiency and low toxicity. Regulatory frameworks in developed nations also favor fluorocarbons as a safer alternative to older, ozone-depleting refrigerants. The automotive and HVAC sectors particularly prefer fluorocarbons due to these advantageous properties. However, concerns regarding global warming potential (GWP) have led to a push for alternative refrigerants. R&D investments for eco-friendly fluorocarbons are therefore a major focus.

On the other hand, inorganic and hydrocarbon refrigerants are gaining traction due to their lower GWP compared to fluorocarbons. These refrigerants are commonly used in specialized industrial applications where low temperature ranges are required. Regulatory changes in developing countries are encouraging the adoption of these alternatives. Cost factors and adaptability to existing systems remain challenges. Nevertheless, continuous improvement in material technology is propelling the growth of this segment.

Breakup by Application:

- Commercial

- Industrial

- Domestic

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, industrial, domestic and others.

The commercial segment is driven by increasing demand for air conditioning and refrigeration in retail, healthcare, and hospitality sectors. The construction boom, particularly in emerging economies, is also fueling this segment. Stringent energy-efficiency regulations are encouraging the adoption of modern, efficient refrigerants. Rapid urbanization and higher disposable incomes are also major contributing factors. Technological innovations in commercial HVAC systems are expected to further support this segment's growth.

On the other hand, the industrial sector's need for refrigerants is primarily fueled by process cooling in manufacturing, petrochemical, and pharmaceutical industries. Energy-efficiency is a key factor, especially with the global focus on reducing carbon footprints. The complexity of industrial systems demands high-performance, reliable refrigerants. Regulatory standards for workplace safety also influence the types of refrigerants used. The push for sustainable industrial practices is expected to further stimulate the market.

Additionally, in the domestic segment, the increasing prevalence of air conditioners in homes drives the need for refrigerants. Climate change, resulting in hotter summers, has increased the necessity for cooling systems. Government incentives for energy-efficient home appliances also play a role. Affordability and easy availability are important factors contributing to growth. Consumer awareness about eco-friendly options is gradually increasing, affecting market trends.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest refrigerant market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe; North America; Asia Pacific; the Middle East and Africa; and Latin America. According to the report, Asia Pacific accounted for the largest market share.

The Asia-Pacific region in the global market is mainly driven by its rapid industrialization and urbanization. China and India are major contributors, with their expanding manufacturing and construction sectors. High population density in these nations creates a substantial demand for commercial and domestic cooling solutions. Regulatory landscapes are evolving, with governments pushing for environmentally friendly refrigerants.

Additionally, the region is home to several key players in the refrigerant industry, facilitating easier access to raw materials and technology. Rising middle-class incomes have led to an increase in consumer spending on appliances like air conditioners, further boosting the market. Southeast Asian nations are also contributing to market growth due to similar trends.

The focus on sustainable development and renewable energy integration in this region further compounds the demand for advanced refrigerants. Climate conditions, with hotter temperatures year-round, also play a role.

Competitive Landscape:

Key players in the global refrigerant market are actively focusing on developing environmentally friendly solutions to meet the challenges of stringent greenhouse gas emission regulations. These entities are conducting research into alternative, low-GWP (Global Warming Potential) refrigerants. They are also investing significantly in creating efficient manufacturing processes to improve productivity and reduce environmental impact. To accelerate market adoption, they are establishing partnerships with OEMs and HVAC companies, ensuring seamless integration of new refrigerants into existing systems. Furthermore, they are taking steps to strengthen the resilience and security of their supply chains, thereby ensuring stable delivery timelines. Additionally, they are engaging in constructive dialogue with regulatory bodies, aiming to influence future standards and practices in the industry.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Honeywell International Inc.

- Daikin Industries Ltd

- Arkema S A

- Dongyue Group

- The Chemours Company

- Orbia Advance Corporation S.A.B. de CV

- Sinochem Group

- Air Liquide

- AGC Group

- Linde Group

- SRF Limited

- Gujarat Fluorochemicals Limited

Recent Developments:

- In June 2021, Honeywell International Inc. announced partnership with Trane Technologies to accelerate the transition to a next-generation, environmentally preferable refrigerant by field testing Honeywell's Solstice® N41 (R-466A), the industry's first nonflammable alternative to R-410A. Trane will deploy and test Solstice N41 at three customer locations in different parts of the United States as part of a one-year field trial.

- In August 2023, Daikin Industries, Ltd. acquired land in Tsukubamirai City, Ibaraki Prefecture, Japan, to establish a new production base aimed at optimizing the domestic supply of air conditioners. The new facility will be Daikin's first in the Kanto region and is expected to enhance the company's production capabilities in terms of supply, cost competitiveness, and technology.

- In July 2023, Arkema S A partnered with Polymem and Tergys to develop autonomous filtration systems aimed at providing clean drinking water in remote and disaster-stricken areas. Utilizing Kynar FSF PVDF based membranes that meet rigorous French Sanitary standards ACS, the containerized solutions offer scalable filtration capacity, effectively removing contaminants down to tens of nanometers for the efficient in-situ production of safe drinking water.

Refrigerant Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Fluorocarbon, Inorganic, Hydrocarbon, Others |

| Applications Covered | Commercial, Industrial, Domestic, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International Inc., Daikin Industries Ltd, Arkema S A, Dongyue Group, The Chemours Company, Orbia Advance Corporation S.A.B. de CV, Sinochem Group, Air Liquide, AGC Group, Linde Group, SRF Limited, Gujarat Fluorochemicals Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the refrigerant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global refrigerant market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the refrigerant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global refrigerant market was valued at USD 21.9 Billion in 2024.

We expect the global refrigerant market to exhibit a CAGR of 8.06% during 2025-2033.

The advent of energy-efficient cooling systems across the domestic and industrial sectors, owing to the rising consumer awareness towards the adverse effects of refrigerants on the environment, is primarily driving the global refrigerant market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for refrigerants.

Based on the product type, the global refrigerant market can be bifurcated into fluorocarbon, inorganic, hydrocarbon, and others. Currently, fluorocarbon exhibits a clear dominance in the market.

On a regional level, the market has been classified into Europe, North America, Asia Pacific, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global refrigerant market include Honeywell International Inc., Daikin Industries Ltd, Arkema S A, Dongyue Group, The Chemours Company, Orbia Advance Corporation S.A.B. de CV, Sinochem Group, Air Liquide, AGC Group, Linde Group, SRF Limited, Gujarat Fluorochemicals Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)