Reflective Material Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Reflective Material Market Size and Share:

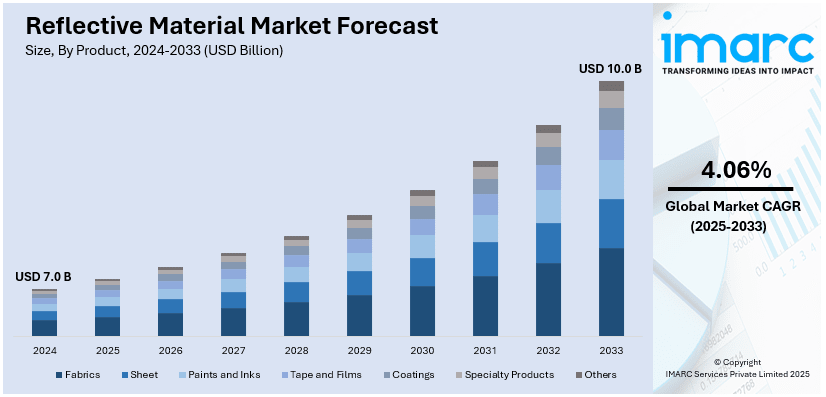

The global reflective material market size was valued at USD 7.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.0 Billion by 2033, exhibiting a CAGR of 4.06% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is experiencing steady growth driven by the increasing global safety standards and the expanding construction and automotive industries. Additionally, the rising awareness of occupational and road safety leading to stringent regulatory mandates, and ongoing urbanization in emerging economies are augmenting the reflective material market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.0 Billion |

|

Market Forecast in 2033

|

USD 10.0 Billion |

| Market Growth Rate 2025-2033 | 4.06% |

The global reflective material market is driven by increasing demand for safety and visibility in various industries, including automotive, construction, and textiles. Growing urbanization and infrastructure development necessitate enhanced road safety measures, enhancing the adoption of reflective materials in traffic signs, vehicles, and workwear. Stringent government regulations mandating high-visibility clothing in hazardous environments further propel market growth. Technological advancements, such as microprismatic and glass bead-based reflective materials, improve performance and durability, expanding applications. A 2024 research study underscores the promise of marine macroalgae as natural indicators for the presence of microplastics and glass bead-based reflective materials in coastal environments. Researchers discovered that various seaweed species in Southwest England have accumulated petroleum-derived fibers, rayon, and retroreflective glass beads essential elements used in road markings adjacent to stormwater drainage systems. These results may influence the reflective materials market by providing insights into their environmental durability and possible regulatory implications. Additionally, rising awareness of pedestrian safety and the need for energy-efficient lighting solutions contribute to market expansion. Emerging economies and increasing disposable incomes also fuel demand for reflective materials.

The United States stands out as a key regional market, primarily driven by increasing demand for safety solutions in automotive, construction, and outdoor recreational activities. The rise in nighttime accidents and pedestrian fatalities has increased the need for reflective materials in road signage, vehicles, and personal safety gear. Growing investments in smart infrastructure and smart cities also drive adoption. On 15th November 2024, Adani Group announced plans to invest USD 10 Billion in the United States over the next decade, focusing on renewable energy and smart infrastructure, including solar, wind, and hydrogen projects. Through the application of finishing and reflective materials and integrating next-generation digital technologies, this project aims to bolster future transportation and grid management. This strategic approach strengthens Adani's expansion before the world and resonates with the United States' commitment to sustainable and technology-driven infrastructure growth. Additionally, the popularity of outdoor sports and fitness activities has spurred demand for reflective apparel and accessories. Innovations in eco-friendly and lightweight materials further expand applications, while heightened consumer awareness about safety and visibility continues to support market growth across diverse sectors in the U.S.

Reflective Material Market Trends:

Increasing Demand for Safety Applications

The reflective material market is experiencing significant growth driven by the escalating demand for safety applications. These materials are essential in enhancing visibility, particularly in low light conditions, and are extensively used in road safety, personal protective equipment, and automotive industries. Government regulations mandating the use for safety purposes are also playing a crucial role in the market expansion. According to the Annual Report on 'Road Accidents in India-2022' released by the Ministry of Road Transport and Highways, a total of 461,312 road accidents were reported in various States and Union Territories during the calendar year 2022. This caused 168491 death cases and 443366 injured cases. This was 11.9% more accidents, 9.4% more dead and 15.3% more injured than the definitive counts for the previous year. The ongoing advancements in material technology, aiming to improve durability and reflectivity, are further bolstering the reflective material market growth.

Technological Innovations and Material Advancements

Significant technological advancements and innovations in materials represent one of the key factors influencing the growth of the market across the globe. The development of microprismatic technology, which offers superior perfectibility and durability compared to traditional glass bead technology, is a notable example. These advancements are expanding their application scope, enabling their use in more demanding and diverse environments, thereby acting as one of the significant reflective material market trends. The incorporation of them in fashion and sportswear, for enhanced visibility and safety, also demonstrates the versatility of these innovations. For instance, in 2022, 3M, a leading manufacturer of retroreflective materials, has introduced the latest technologies in their 3M Scotchlite Reflective Material series, the Industrial Wash and Industrial Wash Flame Resistant Reflective Transfer Films. The new films offer superior wash durability, resulting in increased film longevity and reduced ownership costs for the specifier. They are also made with sustainability in mind, and they are OEKO-TEX certified.

Growth in Construction and Automotive Industries

The expansion of the construction and automotive industries globally is acting as a major growth-inducing factor in the reflective material market outlook. In the construction industry, the use of reflective material for road markings, signage, and safety gear is essential, especially with the increasing focus on infrastructure development and urbanization. The automotive industry's contribution is equally significant, with reflective materials being integral in vehicle design for both aesthetic and safety purposes, such as taillights, headlights, and reflective tapes. According to Invest India, the EV market is expected to grow at a CAGR of 49% between 2022-2030 and the EV industry would create 5 million direct and indirect jobs by 2030. The automobile industry produced a total of 25.93 million vehicles, including passenger vehicles, commercial vehicles, 3 Wheelers, 2 Wheelers, and quadricycles from April 2022 to March 2023. This is further expected to fuel the reflective material market forecast over the coming years.

Reflective Material Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global reflective material market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Fabrics

- Sheet

- Paints and Inks

- Tape and Films

- Coatings

- Specialty Products

- Others

Fabrics stand as the largest component in 2024, holding around 33.6% of the market, driven by their extensive use in high-visibility clothing and safety gear across industries such as construction, transportation, and emergency services. The growing emphasis on worker safety and stringent regulations mandating reflective apparel in hazardous environments have significantly boosted demand. Reflective fabrics are also widely used in sportswear, outdoor gear, and fashion, catering to the rising trend of safety-conscious consumers. Advancements in textile technology, such as the integration of microprismatic and glass bead-based reflective elements, enhance durability and performance. Additionally, the expansion of end-use industries and increasing urbanization further solidify fabrics' leading position in the reflective material market.

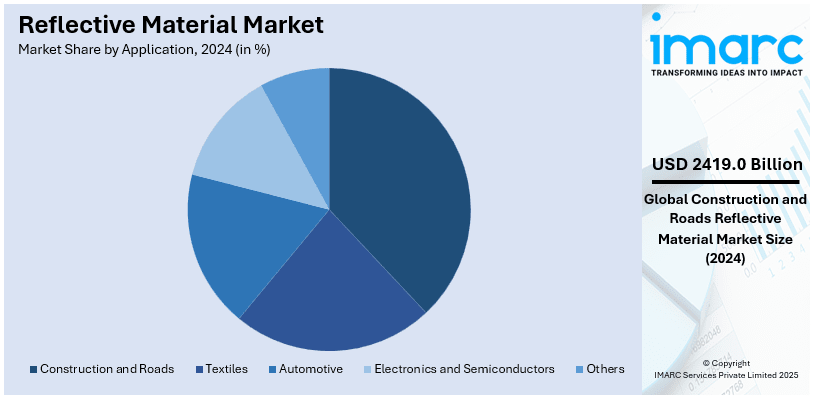

Analysis by Application:

- Textiles

- Construction and Roads

- Automotive

- Electronics and Semiconductors

- Others

Construction and roads lead the market with around 34.7% of market share in 2024. As the largest segment, the use of reflective materials in construction and roads is pivotal for ensuring safety and visibility. This includes a wide array of applications, such as Rd. markings, traffic signs, barrier tapes, and safety gear for construction workers. The segment’s dominance is attributed to the critical role of these materials in traffic management and road safety, essential in reducing accidents and enhancing the overall safety of transportation systems. The widespread use of reflective materials underscores their importance in maintaining safety standards in construction zones and on roads.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. As the largest segment in the market, Asia Pacific's growth is propelled by rapid urbanization, infrastructural development, and expanding automotive and construction industries. According to the Asian Highway Network Design Standards for Road Safety in Design Guideline, incorporation of the red color reflector on alignment delineators facing wrong-way traffic at high-risk locations is essential. Countries such as China and India are leading this growth with their large-scale infrastructure projects and increasing focus on road safety measures. The region's growing textile industry also contributes significantly to the reflective material market demand, particularly in the production of safety apparel and fashion.

Key Regional Takeaways:

United States Reflective Material Market Analysis

The reflective material market in the United States is significantly driven by stringent safety regulations and growing demand for high-visibility solutions across the automotive, construction, and personal protective equipment (PPE) sectors. For instance, the Federal Highway Administration (FHWA) mandates the use of reflective materials in road safety applications, augmenting the need for retroreflective films, tapes, and paints. Additionally, the automotive industry drives demand with regulations requiring reflective coatings for visibility. Furthermore, the growing adoption of reflective smart textiles in fashion and sportswear, along with infrastructure development, improves product use in road signs, barriers, and construction safety gear. For instance, the U.S. Department of Transportation allocated USD 1.32 Billion in Round 1 awards from the FY2025 RAISE grant program for 109 projects, including USD 25 Million for New York’s Olean Street makeover, USD 19.9 Million for Mississippi’s I-55 pedestrian improvements, USD 21.3 Million for Colorado’s Orchard Avenue upgrades, and USD 25 Million for Wisconsin’s National Avenue. The total program funding is nearly USD 5 Billion. Leading manufacturers are advancing micro prismatic and glass bead-based reflective materials for enhanced durability and visibility. Besides this, expanding smart city projects and government road safety initiatives will further drive the market growth.

Europe Reflective Material Market Analysis

Europe’s reflective material market is expanding due to strict safety regulations and sustainability initiatives. Countries such as Germany, France, and the UK enforce high standards for road safety, requiring reflective materials in signage, road markings, and vehicle components. In 2023, 20,400 individuals lost their lives in road crashes across the EU. EU safety mandates also drive adoption in personal protective equipment (PPE), industrial workwear, and firefighting gear. The automotive sector, especially in Germany, plays a key role in the demand for reflective films, particularly in electric and autonomous vehicles. Phase 3 in 2026 will introduce additional pedestrian and cyclist safety measures, increasing demand for reflective materials in transportation safety. Expanding cycling infrastructure and pedestrian safety initiatives further enhance the need for reflective materials in bike lanes and wearable safety gear. Manufacturers are investing in advanced micro prismatic and glass bead-based technologies to improve durability and visibility, ensuring compliance with Europe’s changing safety and sustainability standards.

Asia Pacific Reflective Material Market Analysis

The Asia Pacific region leads the global market attributed to rapid industrialization, infrastructure growth, and increasing road safety concerns. The Second Decade of Action for Road Safety 2021–2030 aims to cut road traffic deaths by 50%, yet the region remains off track, with only a 7% reduction in the past decade. Achieving the target requires a 7.4% annual decline, but at the current pace, fatalities may reach 604,598 by 2030, exceeding the 351,130 target. China, India, Japan, and South Korea drive market growth, with expanding construction and automotive industries fueling demand for high-visibility solutions. Government regulations mandate reflective materials in road signs, traffic signals, and work zone safety, further supporting the product adoption. Reflective textiles in sportswear and fashion are also gaining traction. Urbanization and smart city initiatives in China and India’s focus on industrial safety enhance demand. Advanced reflective films for electric vehicles and nanotechnology-based coatings further foster market expansion.

Latin America Reflective Material Market Analysis

Latin America's rise in the reflective material market is influenced by increasing road safety concerns, industrial regulations, and infrastructure projects. Brazil, Mexico, and Argentina drive demand in construction, automotive, and road safety applications. Government efforts to reduce traffic accidents augment high-visibility signage and vehicle reflector adoption. The São Paulo government and iRAP launched BrazilRAP São Paulo to improve highway safety, addressing 5,439 traffic deaths in 2023. The initiative targets 199,800 km of roads, including 13,100 km managed by DER-SP, supported by a USD 429 Million World Bank project that surveyed 26,000 km in 2021–2022. Reflective textiles are also gaining traction in industrial gear, fashion, and sportswear. Despite price sensitivity and reliance on imports, investments in smart cities and road safety initiatives will drive future market growth.

Middle East and Africa Reflective Material Market Analysis

The Middle East and Africa (MEA) market is driven by infrastructure development, occupational safety regulations, and road safety improvements. The UAE, Saudi Arabia, and South Africa lead demand, with government investments in smart cities and transportation. Dubai’s RTA reported 702 million public transport passengers in 2023, a 13% increase from 2022, highlighting the need for reflective materials in urban mobility. Highways, construction sites, and industrial workwear rely on reflective coatings and films, while the oil and gas sector demands reflective PPE for worker safety. In Africa, urbanization and expanding road networks stimulate the need for reflective road signage. Challenges include limited domestic production and high import costs, but stricter safety regulations and rising awareness are expected to drive market growth.

Competitive Landscape:

The competitive landscape of the reflective material market is characterized by intense rivalry among key players, who are focusing on innovation, strategic partnerships, and geographic expansion to strengthen their market position. Companies are investing heavily in research and development to create advanced, eco-friendly, and high-performance reflective materials that cater to diverse applications. Many are also expanding their product portfolios to include customized solutions for industries including automotive, construction, and textiles. Strategic collaborations with end-users and distributors are being pursued to enhance market reach. Additionally, players are adopting sustainable practices and leveraging digital technologies to optimize production processes and meet the growing demand for safety and visibility solutions globally.

The report provides a comprehensive analysis of the competitive landscape in the reflective material market with detailed profiles of all major companies, including:

- 3M Company

- ALANOD GmbH & Co. KG

- Avery Dennison Corporation

- Changzhou Hua R Sheng Reflective Material Co. Ltd

- Coats Group Plc

- Daoming Reflective Material India Pvt. Ltd.

- NIPPON CARBIDE INDUSTRIES CO. INC.

- ORAFOL Europe GmbH

- Reflomax

- SKC Co Ltd.

- Yeshili NEW Materials Co. Ltd.

Latest News and Developments:

- August 2024: Caldera launched the TotalColor qb Digital Press Edition, an automatic spectrophotometer for reflective materials. It ensures precise color measurement, integrates with CalderaRIP’s EasyMedia, and features a 2-6mm variable aperture for materials up to 20mm thick. Cost-effective and efficient, it enhances digital printing, packaging, and label production workflows.

- August 2024: UMass Amherst researchers introduced a chalk-based coating for reflective textiles, cooling fabric by up to 8°F. Using calcium carbonate and barium sulfate, it enhances UV and near-IR light reflection, reducing heat absorption. Durable and washable, it can be applied to various fabrics, improving passive cooling for high-visibility and protective clothing.

- July 2024: Bemis introduced Super Stretch Reflective RS4601, a high candlepower reflective material designed for high-stretch fabrics. It offers excellent recovery, low modulus, and a soft hand feel, making it ideal for thin strip lamination on leggings and tights. The innovation enhances garment design and visibility.

- April 2024: AkzoNobel expanded its Keep Cool Technology in South and Southeast Asia, offering heat-reflective paints including Dulux Weathershield Sun Reflect, reducing surface temperatures by up to 5°C. A study showed 10-15% energy savings in cooling. Widely adopted in India, Pakistan, Malaysia, Singapore, Thailand, Vietnam, and Indonesia, it enhances building comfort and sustainability.

Reflective Material Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fabrics, Sheet, Paints and Inks, Tape And Films, Coatings, Specialty Products, Others |

| Applications Covered | Textiles, Construction and Roads, Automotive, Electronics and Semiconductors, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, ALANOD GmbH & Co. KG, Avery Dennison Corporation, Changzhou Hua R Sheng Reflective Material Co. Ltd, Coats Group Plc, Daoming Reflective Material India Pvt. Ltd., NIPPON CARBIDE INDUSTRIES CO. INC., ORAFOL Europe GmbH, Reflomax, SKC Co Ltd., Yeshili NEW Materials Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the reflective material market from 2019-2033.

- The market research report provides the latest information on the market drivers, challenges, and opportunities in the global reflective material market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the reflective material industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The reflective material market was valued at USD 7.0 Billion in 2024.

IMARC estimates the reflective material market to exhibit a CAGR of 4.06% during 2025-2033, reaching a value of USD 10.0 Billion by 2033.

The reflective material market is driven by the increasing demand for safety and visibility across industries such as automotive, construction, and textiles. Strict government safety regulations, growing urbanization, infrastructure development, and advancements in microprismatic and glass bead-based reflective materials further fuel market growth. Additionally, rising awareness of occupational and road safety, along with technological innovations, expands the application of reflective materials.

Asia-Pacific currently dominates the reflective material market, accounting for a share exceeding 40.0%. This dominance is fueled by rapid urbanization, large-scale infrastructure projects, and strong growth in the automotive and construction industries, particularly in China and India.

Some of the major players in the reflective material market include 3M Company, ALANOD GmbH & Co. KG, Avery Dennison Corporation, Changzhou Hua R Sheng Reflective Material Co. Ltd, Coats Group Plc, Daoming Reflective Material India Pvt. Ltd., NIPPON CARBIDE INDUSTRIES CO. INC., ORAFOL Europe GmbH, Reflomax, SKC Co Ltd., and Yeshili NEW Materials Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)