Recruitment Process Outsourcing (RPO) Market by Type (On-demand RPO, Function-based RPO, Enterprise RPO), Service (On-site, Off-site), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End Use (BFSI, Healthcare, Manufacturing, IT and Telecom, Education, and Others), and Region 2025-2033

Recruitment Process Outsourcing (RPO) Market Size:

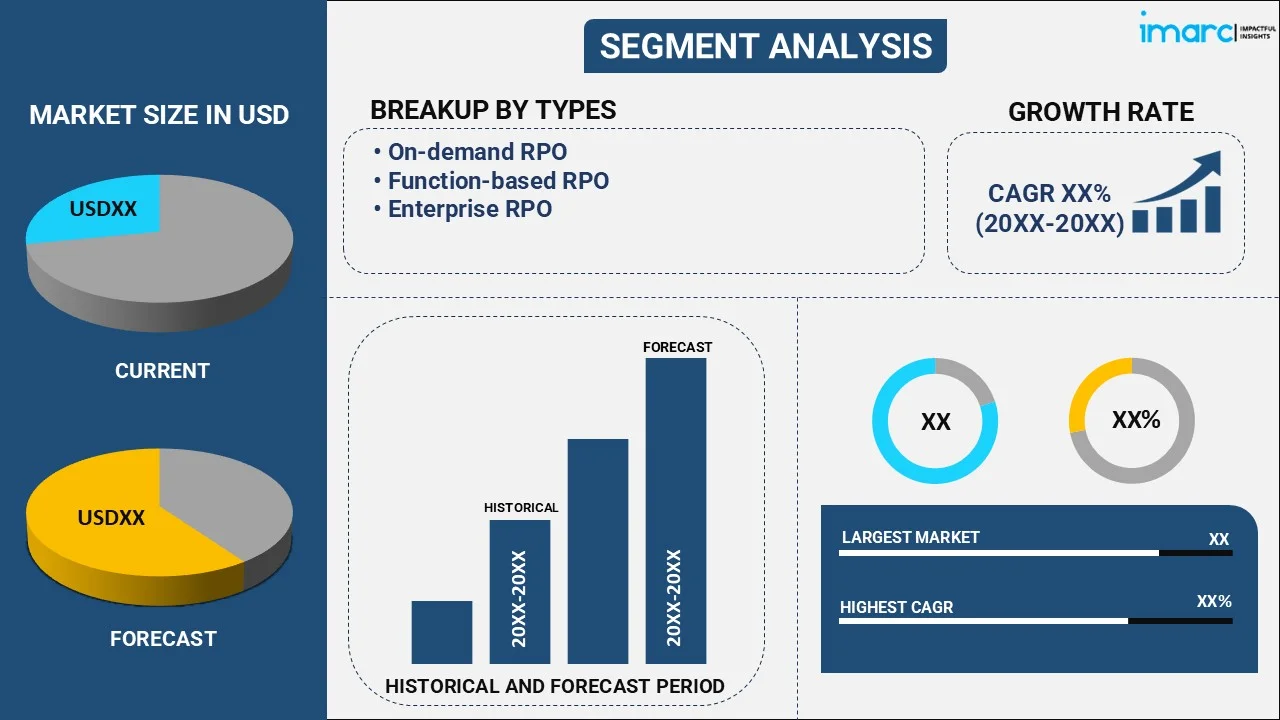

The global recruitment process outsourcing (RPO) market size reached USD 9.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.48% during 2025-2033. The market is experiencing steady growth driven by the escalating demand for efficient individuals as employees, rising automation of the recruitment process to reduce manual error and save time, and increasing utilization of machine learning (ML) algorithms to analyze resumes and match candidates with job requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.4 Billion |

|

Market Forecast in 2033

|

USD 36.4 Billion |

| Market Growth Rate 2025-2033 | 15.48% |

Recruitment Process Outsourcing (RPO) Market Analysis:

- Market Growth and Size: The recruitment process outsourcing (RPO) market is experiencing robust growth on account of the increasing demand for efficient talent acquisition solutions.

- Major Market Drivers: Key drivers include talent scarcity and competition, cost efficiency, and the integration of advanced technologies like artificial intelligence (AI) and data analytics.

- Technological Advancements: RPO providers are leveraging technology to improve efficiency and employing AI, data analytics, and automation tools. This enhances candidate sourcing, assessment, and onboarding, thereby reducing time-to-hire and making processes more accurate.

- Industry Applications: RPO services are widely applied across sectors, such as information technology (IT) and telecom, manufacturing, and education.

- Key Market Trends: Notable trends include the increasing emphasis on diversity and inclusion factors, the rise of remote work solutions, and a focus on sustainability in hiring practices.

- Geographical Trends: North America leads the market share due to the rising demand for efficient recruitment processes among businesses. However, Asia Pacific is emerging as a fast-growing market on account of the increasing automation of recruitment processes.

- Competitive Landscape: Key players in the RPO market are continuously innovating by investing in technology, expanding their global presence, and offering comprehensive end-to-end solutions. Sustainability and diversity are increasingly emphasized in recruitment strategies.

- Challenges and Opportunities: Challenges include navigating complex regulatory environments, addressing compliance issues, and managing diverse talent pools. Nonetheless, opportunities for expanding services to emerging markets, adapting to remote work trends, and enhancing candidate experience through technology and automation are projected to overcome these challenges.

Recruitment Process Outsourcing (RPO) Market Trends:

Talent Scarcity and Competition

The adoption of recruitment process outsourcing (RPO) is significantly influenced by the ongoing talent scarcity and heightened competition in the global job market. Skilled professionals are required across various industries, and the supply of qualified candidates often falls short of the demand. This imbalance is compelling businesses to seek innovative solutions to identify and secure top-notch talent swiftly. RPO providers are emerging as key players in addressing this challenge. They bring to the table their extensive networks, industry expertise, and the ability to tap into a broader talent pool. By leveraging their resources, RPO firms can identify, attract, and retain candidates with the important and necessary skills and experience. This not only saves time but also gives organizations a competitive edge by ensuring they have access to the best talent available. Moreover, the competition for talent is gradually intensifying. Companies are not only competing with one another but also with startups, remote work options, and the gig economy. RPO services provide an effective way for organizations to stand out as attractive employers and secure top candidates. By partnering with RPO providers, businesses can streamline their recruitment processes and create a positive candidate experience, further enhancing their ability to attract and retain talent in a fiercely competitive market.

Cost Efficiency and Scalability

The compelling need for cost efficiency and scalability in the business landscape is propelling the growth of the market. Companies are continually seeking methods to optimize their operations and allocate resources more effectively, and recruitment processes are no exception. RPO services offer an attractive solution to this challenge. Outsourcing recruitment functions to specialized providers can result in substantial cost savings compared to maintaining an in-house recruitment team. The overhead costs related with hiring, training, and retaining internal recruiters are eliminated, allowing organizations to redirect these resources toward core business activities. Furthermore, scalability is a critical consideration in the modern business environment. Companies often experience changes in their hiring needs due to seasonal demands, market dynamics, or expansion plans. RPO providers offer the flexibility to scale recruitment efforts up or down rapidly in response to these fluctuations. This agility allows businesses to maintain optimal staffing levels without the burden of maintaining a large, fixed recruitment team. Additionally, RPO providers can quickly adapt to the evolving needs of their clients, making it easier for organizations to navigate changing market conditions or industry-specific challenges. They bring industry best practices, market insights, and innovative recruitment technologies to the table, further enhancing efficiency and cost-effectiveness.

Technology Advancements

The continuous advancement of technology in the field of recruitment is supporting the market growth. As the digital landscape evolves, recruitment is no longer limited to traditional methods but is increasingly reliant on cutting-edge technologies, artificial intelligence (AI), and data analytics. RPO providers are at the forefront of integrating these technological advancements into their services. AI and machine learning (ML) algorithms are employed to analyze resumes, match candidates with job requirements, and even conduct initial candidate interviews. This streamlines the candidate screening process, reduces time-to-hire, and enhances the accuracy of candidate selection. Data analytics tools play a pivotal part in RPO by providing insights into market trends, candidate behavior, and the effectiveness of various recruitment strategies. These insights enable RPO providers to make data-driven decisions, optimizing the recruitment processes of their clients for better outcomes. Automation is another key technological aspect that is transforming the RPO landscape. Routine and repetitive tasks, such as job posting, interview scheduling, and candidate communication, can be automated, allowing recruitment teams to focus on more strategic activities like candidate engagement and employer branding.

Recruitment Process Outsourcing (RPO) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, service, enterprise size, and end use.

Breakup by Type:

- On-demand RPO

- Function-based RPO

- Enterprise RPO

On-demand RPO accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes on-demand RPO, function-based RPO, and enterprise RPO. According to the report, on-demand RPO represented the largest segment.

On-demand RPO, often referred to as project-based RPO, is emerging as the largest segment within the RPO market. It offers organizations flexibility in their recruitment needs, allowing them to engage RPO services on a project-by-project basis or for specific hiring requirements. This type of RPO is highly scalable and cost-effective, as companies can tailor the scope and duration of the engagement to their immediate needs. It is particularly importat among small and medium-sized enterprises (SMEs) and businesses with variable hiring demands, enabling them to access specialized recruitment expertise without committing to a long-term partnership.

Function-based RPO is another notable segment in the market, focusing on specific areas or functions within the recruitment process of an organization. This approach allows businesses to outsource particular functions, such as executive hiring, information technology (IT) recruitment, or sales talent acquisition, to RPO providers with expertise in those areas.

Enterprise RPO caters to large organizations with comprehensive and ongoing recruitment needs. This segment involves a deep and long-term partnership between the client and the RPO provider, often encompassing end-to-end recruitment processes for the entire organization. Enterprise RPO solutions are highly customized, aligning with the specific hiring objectives, culture, and industry demands. They provide a strategic approach to talent acquisition, workforce planning, and talent management.

Breakup by Service:

- On-site

- Off-site

Off-site holds the largest share in the industry

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes on-site and off-site. According to the report, off-site accounted for the largest market share.

Off-site RPO, also known as remote RPO, stands out as the largest segment in the market. In this approach, RPO providers operate from their own locations, separate from the premises of the client. Off-site RPO offers several advantages, including cost-effectiveness, scalability, and access to a wider talent pool. This model allows RPO firms to leverage their expertise, technology, and resources to manage the entire or specific parts of the recruitment process for clients, often across different geographical locations. Off-site RPO is favored by organizations looking for cost-efficient and flexible recruitment solutions, as it eliminates the need for in-house recruitment teams and infrastructure costs.

On-site RPO, on the other hand, involves RPO providers embedding their teams within the organization of the client, typically at the premises. This approach fosters close collaboration and integration between the RPO provider and the talent acquisition teams of the client. On-site RPO is especially popular among large enterprises and organizations with complex recruitment needs. It offers a high level of customization and adaptability, allowing RPO professionals to align closely with the culture, values, and recruitment processes of the client.

Breakup by Enterprise Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium enterprises and large enterprises. According to the report, large enterprises represented the largest segment.

Large enterprises constitute the largest segment in the recruitment process outsourcing (RPO) market. These organizations typically have expensive and complex recruitment needs due to their size and diverse workforce requirements. Large enterprises often engage RPO services to streamline their recruitment processes, enhance talent acquisition, and gain a competitive edge in securing top-tier talent. They require comprehensive, scalable, and strategic RPO solutions that can align with their organizational culture, values, and industry-specific demands. For many large enterprises, RPO partnerships extend beyond standard recruitment functions to encompass workforce planning, talent management, and long-term talent acquisition strategies.

Small and medium-sized enterprises (SMEs) often face resource constraints and may lack dedicated human resource (HR) or recruitment teams. RPO services are increasingly attractive to SMEs as they provide access to specialized recruitment expertise and resources without the need to establish and maintain an internal recruitment infrastructure. For SMEs, RPO solutions offer flexibility, cost-efficiency, and the ability to rapidly scale their hiring efforts up or down in response to market fluctuations.

Breakup by End Use:

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Education

- Others

IT and telecom exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes BFSI, healthcare, manufacturing, IT and telecom, education, and others. According to the report, IT and telecom accounted for the largest market share.

The information technology (IT) and telecom sector is the largest segment in the recruitment process outsourcing (RPO) market. This industry faces continuous demand for highly skilled and specialized talent due to rapid technological advancements. RPO services are crucial for IT and telecom companies as they require efficient and streamlined recruitment processes to attract top tech talent. RPO providers in this sector often specialize in sourcing IT professionals, software developers, network engineers, and other specialized roles. Their expertise in identifying and securing niche talent is instrumental in helping IT and telecom organizations maintain their competitive edge in a fast-paced industry.

The BFSI sector relies heavily on a diverse workforce, from financial analysts to customer service representatives. RPO services in BFSI aim to enhance recruitment efficiency, ensure regulatory compliance, and meet the evolving needs of financial institutions. Given the highly regulated nature of this sector, RPO providers often specialize in handling background checks, compliance requirements, and risk assessments for candidates.

Healthcare is a vital segment in the RPO market, with a focus on sourcing healthcare professionals, such as doctors, nurses, and administrative staff. The healthcare industry demands a high level of precision and compliance in recruitment processes to ensure patient safety and quality care. RPO services in healthcare are designed to expedite the hiring of medical professionals while adhering to strict regulatory standards.

The manufacturing sector relies on a diverse workforce, from skilled laborers to engineers and management personnel. RPO services for manufacturing companies aim to optimize the hiring of both technical and non-technical roles. They help organizations adapt to changing production needs, maintain quality standards, and address labor shortages efficiently.

The education sector focuses on recruiting a range of professionals, from educators and administrators to support staff. RPO services in education help institutions streamline their recruitment processes, particularly during peak hiring seasons. RPO providers in this sector understand the importance of finding candidates who are not only qualified but also aligned with the educational values and mission of the institution.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest recruitment process outsourcing (RPO) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The North America recruitment process outsourcing (RPO) market is driven by the growing trend of the adoption of remote work. The growing emphasis on diversity and inclusion factors in hiring practices, driving the demand for RPO services that can help organizations source a more diverse talent pool, is bolstering the market growth.

Asia Pacific maintains a strong presence driven by the increasing demand for RPO providers to assist with international talent acquisition and comprehensive workforce management.

Europe stands as another key region in the market, driven by the rise in talent mobility, with professionals seeking opportunities in different countries within the region.

Latin America exhibits growing potential in the recruitment process outsourcing (RPO) market, fueled by the increasing focus on complying with various labor laws and compliance requirements.

The Middle East and Africa region show a developing market for recruitment process outsourcing (RPO), primarily driven by the digital transformation and increasing the demand for IT and technology talent.

Leading Key Players in the Recruitment Process Outsourcing (RPO) Industry:

The key players in the recruitment process outsourcing (RPO) market are consistently innovating and expanding their services to remain competitive. They are heavily investing in advanced technologies, such as artificial intelligence (AI) and data analytics, to enhance candidate sourcing, assessment, and engagement. Furthermore, these players are focusing on providing more comprehensive end-to-end RPO solutions, which often include workforce planning, talent management, and employer branding. Additionally, key players are expanding their global presence by establishing partnerships and operations in emerging markets to cater to the growing demand for RPO services worldwide. They are also emphasizing sustainability and diversity in their recruitment processes to align with evolving industry trends and client preferences, ensuring they stay at the forefront of the RPO industry.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alexander Mann Group Limited

- Automatic Data Processing, Inc.

- Cielo Inc.

- Hudson Global Inc.

- IBM Corporation

- Korn Ferry

- ManpowerGroup

- PeopleScout Inc. (Trueblue Inc.)

- Pontoon Solutions Inc. (The Adecco Group)

- Randstad N.V.

- Sevenstep

- WilsonHCG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- July 2020: Alexander Mann Group Limited announced the launch of high-volume recruitment process outsourcing (RPO) to deliver large-scale hiring to clients nationwide.

- August 2022: Cielo Inc. announced the launch of its first office in Gurugram, India, to deliver fresh and proven talent acquisition solutions to various companies across the IT, engineering, life sciences, automotive and consulting sectors.

Recruitment Process Outsourcing (RPO) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | On-demand RPO, Function-based RPO, Enterprise RPO |

| Services Covered | On-site, Off-site |

| Enterprise Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Uses Covered | BFSI, Healthcare, Manufacturing, IT and Telecom, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alexander Mann Group Limited, Automatic Data Processing, Inc., Cielo Inc., Hudson Global Inc., IBM Corporation, Korn Ferry, ManpowerGroup, PeopleScout Inc. (Trueblue Inc.), Pontoon Solutions Inc. (The Adecco Group), Randstad N.V., Sevenstep, WilsonHCG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the recruitment process outsourcing (RPO) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global recruitment process outsourcing (RPO) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the recruitment process outsourcing (RPO) industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The recruitment process outsourcing (RPO) market reached USD 9.4 Billion in 2024.

The recruitment process outsourcing (RPO) market is projected to exhibit a CAGR of 15.48% during 2025-2033, reaching a value of USD 36.4 Billion by 2033.

The growth of the market is largely propelled by the surging demand for skilled personnel in professional roles, the increasing automation of hiring procedures aimed at minimizing human errors and enhancing time efficiency, along with the expanding application of machine learning (ML) algorithms to screen resumes and align potential candidates with specific job profiles.

North America leads the market, accounting for the largest recruitment process outsourcing (RPO) market share.

Some of the major players in the global recruitment process outsourcing (RPO) market include Alexander Mann Group Limited, Automatic Data Processing, Inc., Cielo Inc., Hudson Global Inc., IBM Corporation, Korn Ferry, ManpowerGroup, PeopleScout Inc. (Trueblue Inc.), Pontoon Solutions Inc. (The Adecco Group), Randstad N.V., Sevenstep, and WilsonHCG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)