Recreational Boating Market Report by Product Type (Inboard Boats, Outboard Boats, Inflatable, Sail Boats, Personal Watercrafts), Activity Type (Watersports and Cruising, Fishing), Material Type (Aluminum, Fiberglass, Wood, and Others), Size (Less Than 30 Ft, 30 to 59 Ft, 60 to 79 Ft, 80 to 99 Ft, More Than 100 Ft, Full Custom), Power Source (Engine Powered, Human Powered, Sail Propelled), and Region 2025-2033

Recreational Boating Market Overview:

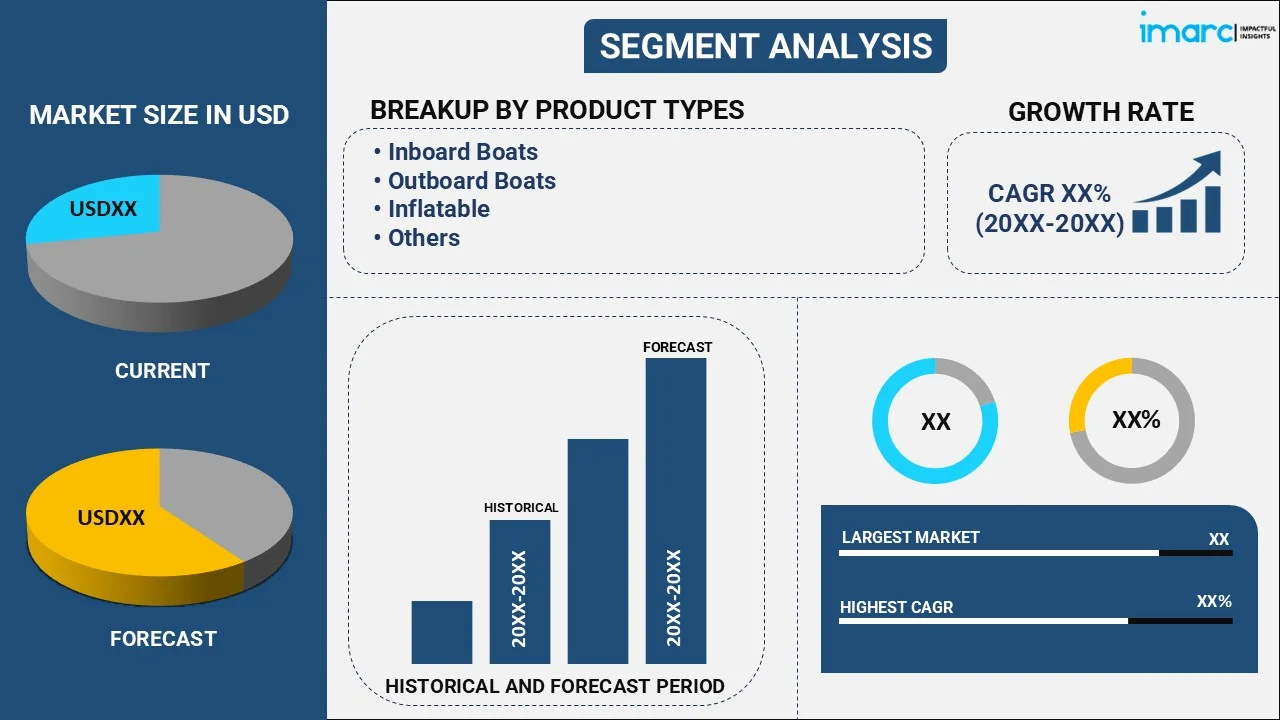

The global recreational boating market size reached USD 24.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.64% during 2025-2033. The market is driven by the growing number of travel agencies and tour operators that are incorporating boating activities into their adventure tourism packages, rising popularity of boat rental, as it is more cost effective for infrequent users than purchasing one, and increasing demand for leisure boats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.3 Billion |

|

Market Forecast in 2033

|

USD 37.4 Billion |

| Market Growth Rate (2025-2033) | 4.64% |

Recreational Boating Market Analysis:

- Major Market Drivers: The rising trend of adventure tourism which includes activities, such as wakeboarding, scuba diving, and fishing, is propelling the market growth.

- Key Market Trends: The growing demand for leisure boats, as they provide unique experiences, is offering a favorable market outlook.

- Geographical Trends: Europe enjoys the leading position in the market because of its substantial coasts, lakes, and rivers, which generate a strong love for recreational boating activities.

- Competitive Landscape: Some of the major market players in the recreational boating industry include Baja Bound Insurance Services Inc., Brunswick Corporation, Catalina Yachts, Chaparral Boats Inc. (Marine Products Corporation), Edenton Boatworks LLC, Grady-White Boats Inc., Hobie CAT Company, MasterCraft Boat Holdings Inc., Maverick Boat Group Inc. (Malibu Boats), Polaris Inc., White River Marine Group (Bass Pro Shops), and Yamaha Motor Company Limited, among many others.

- Challenges and Opportunities: The market faces challenges, such as regulatory compliance, rising fuel costs, and environmental concerns, while opportunities lie in electric and hybrid propulsion systems and the increasing demand for sustainable boating practices.

Recreational Boating Market Trends:

Adventure tourism

According to the IMARC Group’s report, the global adventure tourism market size reached US$ 407 Billion in 2023. Adventure tourism focuses on experiencing travel, encouraging people to seek out interesting activities. Recreational boating provides a variety of possibilities for adventure seekers, including kayaking, sailing, and jet skiing. Adventure tourism includes activities, such as wakeboarding, scuba diving, and fishing. This expansion is driving the demand for a wide range of recreational boats intended for certain water sports. Many travel agencies and tour operators are incorporating boating activities into their adventure tourism packages. These packages appeal to people seeking entire adventure experiences, increasing involvement in recreational boating. The rising number of social media platforms is resulting in an increase in sharing adventurous experiences. Many tourists seek for social media worthy boating adventures, which promotes the recreational boating industry. Lakes, rivers, and coastal locations are common destinations for adventure tourism. This, in turn, is catalyzing the demand for boats that allow tourists to explore these surroundings, resulting in more boat rentals and purchases.

Increasing demand for leisure boat

As disposable earnings are improving, especially in developing regions, more people and families can afford recreational boats. This financial capability allows them to invest in recreational pursuits, such as boating. Buyers are preferring experiences over material items when making purchases. Leisure boating provides unique experiences, resulting in increased demand for various types of boats. Boating is frequently connected with leisure, family bonding, and a break from everyday routine. Innovations in boat design, materials, and technology like greater fuel efficiency and navigation systems make recreational boats more desirable to buyers. These advances improve the sailing experience and draw a larger audience. The IMARC Group’s report shows that the global leisure boat market is anticipated to reach US$ 61.1 Billion by 2032.

Rising popularity of boat rental

As per the IMARC Group’s report, the global boat rental market size reached US$ 19.4 Billion in 2023. Boat rentals allow people who don't own boats to enjoy the experience of boating without the long-term commitment and costs that come with ownership. This increased accessibility attracts new participants to the recreational boating business. Renting a boat is frequently more cost effective for infrequent users than purchasing one. This cost-effectiveness encourages more people to try boating, hence expanding market participation. Boat rental firms often provide a variety of vessels, ranging from modest fishing boats to luxury yachts. This variety allows customers to select the sort of boat that best meets their needs, tastes, and finances, encouraging greater participation in recreational boating. The introduction of internet platforms and apps for boat rentals is making it easier for customers to find and book boats. This convenience is driving the demand for rental services and broadened the market reach. Many rental companies position their services as part of a larger lifestyle experience. They frequently provide packages that include guided excursions, water sports, and other activities, attracting people looking for unique recreational experiences.

Recreational Boating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, activity type, material type, size, and power source.

Breakup by Product Type:

- Inboard Boats

- Outboard Boats

- Inflatable

- Sail Boats

- Personal Watercrafts

Inboard boats account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes inboard boats, outboard boats, inflatable, sail boats, and personal watercrafts. According to the report, inboard boats represent the largest segment.

Inboard boats are recognized for their powerful engines, which provide higher performance and speed than outboard ones. This makes them suitable for a variety of water activities, including skiing and wakeboarding. In general, inboard boats provide more stability and control in adverse sea conditions. Inboard boats have more usable deck area because the engine is positioned inside the hull. This design maximizes passenger room and storage, which improves the overall boating experience. Inboard boats can be utilized for a variety of purposes, including cruising, fishing, and watersports. This multifunctionality appeals to a wide range of buyers, catalyzing the demand for inboard units.

Breakup by Activity Type:

- Watersports and Cruising

- Fishing

Watersports and cruising hold the largest share of the industry

A detailed breakup and analysis of the market based on the activity type have also been provided in the report. This includes watersports and cruising and fishing. According to the report, watersports and cruising account for the largest market share.

Wakeboarding, waterskiing, jet skiing, and tubing are becoming popular. This rise is fostered by social media, where influencers and enthusiasts share exhilarating experiences, inspiring more people to participate in these activities. Watersports are frequently enjoyed in groups, making them an enticing option for families and friends seeking to socialize and share memorable experiences. This social aspect contributes to the ongoing appeal of watersports. Similarly, cruising provides a more leisurely and enjoyable boating experience, which appeals to individuals and families wishing to escape their daily routines. The ability to tour gorgeous areas while enjoying onboard facilities adds to the overall attraction of sailing.

Breakup by Material Type:

- Aluminum

- Fiberglass

- Wood

- Others

Aluminum represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aluminum, fiberglass, wood, and others. According to the report, aluminum represents the largest segment.

Aluminum boats are much lighter than traditional materials, such as fiberglass or wood. This lightweight design improves maneuverability, making aluminum boats easier to transport, launch, and operate on the water. Aluminum is known for its excellent strength-to-weight ratio, which makes it a tough material that can resist the demands of recreational boating. It resists corrosion and is less susceptible to impact damage, ensuring durability and dependability in a variety of water conditions. Aluminum boats require less upkeep than wood or fiberglass boats. They are resistant to decay, rust, and ultraviolet (UV) damage, simplifying maintenance and lowering long-term expenditures for boat owners.

Breakup by Size:

- Less Than 30 Ft

- 30 to 59 Ft

- 60 to 79 Ft

- 80 to 99 Ft

- More Than 100 Ft

- Full Custom

Less than 30 ft exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes less than 30 ft, 30 to 59 ft, 60 to 79 ft, 80 to 99 ft, more than 100 ft, and full custom. According to the report, less than 30 ft accounts for the largest market share.

Smaller boats are often less expensive to purchase, operate, and maintain than bigger vessels. This lower price point appeals to a broader spectrum of people, including first-time purchasers and families looking for cost-effective recreational options. Boats under 30 feet are easy to manage and control, making them ideal for new boaters. Their reduced size enables easier docking, launching, and navigation in a variety of water conditions, improving the overall boating experience for inexperienced users. Smaller boats are easier to carry and store. They are readily transported by regular cars and take up less storage space, whether at home or at the harbor. This accessibility appeals to customers who may not have enough space for larger boats.

Breakup by Power Source:

- Engine Powered

- Human Powered

- Sail Propelled

Engine powered dominates the market

The report has provided a detailed breakup and analysis of the market based on the power source. This includes engine powered, human powered, and sail propelled. According to the report, engine powered represents the largest segment.

Engine-powered boats provide better performance and speed than non-motorized alternatives. This feature is essential for a variety of recreational pursuits, including watersports, fishing, and cruising, where fast maneuverability is frequently required. Engine-powered boats are easier to operate, particularly for inexperienced boaters. The ability to start the motor and move makes for a more straightforward boating experience, eliminating the physical work required for paddling and sailing. Engine-powered vessels can travel longer distances faster, making them excellent for exploring enormous bodies of water and reaching remote locations. This increased range improves the entire recreational experience, allowing for both day trips and longer adventures. Engine-powered boats are adaptable and can be built for a variety of purposes, including fishing, cruising, watersports, and recreational tours.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest recreational boating market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for recreational boating.

Europe has a rich maritime past and a robust boating culture that dates back centuries. Many European countries have substantial coasts, lakes, and rivers, which generate a strong love for recreational boating activities. The continent has a diverse range of water bodies, including the Mediterranean Sea, North Sea, Baltic Sea, and countless rivers and lakes. This diversity provides enough opportunity for a wide range of boating activities, attracting enthusiasts from around the world. Many European countries have relatively large disposable incomes, which is also catalyzing the demand for luxury yachts. This economic capacity allows a greater segment of the community to purchase or rent luxury yachts. According to the IMARC Group’s report, the Europe luxury yacht market is expected to reach US$ 4.8 Billion by 2032.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the recreational boating industry include Baja Bound Insurance Services Inc., Brunswick Corporation, Catalina Yachts, Chaparral Boats Inc. (Marine Products Corporation), Edenton Boatworks LLC, Grady-White Boats Inc., Hobie CAT Company, MasterCraft Boat Holdings Inc., Maverick Boat Group Inc. (Malibu Boats), Polaris Inc., White River Marine Group (Bass Pro Shops), and Yamaha Motor Company Limited.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Manufacturers are essential to the recreational boating industry, creating a wide range of boats, such as powerboats, sailboats, personal watercraft, and fishing boats. They are emphasizing on innovations and technology, including innovative materials, engine designs, and features to improve performance and user experience. They are creating and selling outboard, inboard, and electric propulsion systems for many types of vessels. These players are also prioritizing fuel efficiency, performance, and sustainability, which is strengthening the recreational boating market growth. For instance, in January 2023, Volvo Penta in collaboration with Groupe Beneteau planned to launch a trail vessel to provide sustainable, intuitive, near-silent, and leisure boating experiences to boaters while exploring and experiencing life on the water.

Recreational Boating Market News:

- February 2024: Yamaha Motor Corporation, USA revealed the world’s first hydrogen-powered outboard for recreational boats with a prototype fuel system integrated into a vessel that the company plans to further refine for testing.

- February 2024: Bosch Engineering presented electrification solutions for recreational boats and motorized yachts, enabling shipyards, shipbuilders, and system integrators to implement electrification quickly and easily.

Recreational Boating Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Recreational Boating Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Inboard Boats, Outboard Boats, Inflatable, Sail Boats, Personal Watercrafts |

| Activity Types Covered | Watersports and Cruising, Fishing |

| Material Types Covered | Aluminum, Fiberglass, Wood, Others |

| Sizes Covered | Less Than 30 Ft, 30 To 59 Ft, 60 To 79 Ft, 80 To 99 Ft, More Than 100 Ft, Full Custom |

| Power Sources Covered | Engine Powered, Human Powered, Sail Propelled |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baja Bound Insurance Services Inc., Brunswick Corporation, Catalina Yachts, Chaparral Boats Inc. (Marine Products Corporation), Edenton Boatworks LLC, Grady-White Boats Inc., Hobie CAT Company, MasterCraft Boat Holdings Inc., Maverick Boat Group Inc. (Malibu Boats), Polaris Inc., White River Marine Group (Bass Pro Shops), Yamaha Motor Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the recreational boating market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global recreational boating market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the recreational boating industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The recreational boating market was valued at USD 24.3 Billion in 2024.

The recreational boating market is projected to exhibit a CAGR of 4.64% during 2025-2033, reaching a value of USD 37.4 Billion by 2033.

The market is driven by inflating disposable incomes, rising interest in outdoor recreational activities, and the rise in water sports tourism. Advancements in boating technology, eco-friendly vessels, and rising awareness of wellness and leisure activities also contribute to market growth. Furthermore, the development of marinas and increasing boat rental services boost demand.

Europe currently dominates the recreational boating market in 2024. The dominance is fueled by a strong maritime culture, high disposable incomes, and rising interest in leisure boating. Countries like Italy, France, and the UK are leading in boat ownership, while a well-established infrastructure of marinas and boating events further drives market growth.

Some of the major players in the recreational boating market include Baja Bound Insurance Services Inc., Brunswick Corporation, Catalina Yachts, Chaparral Boats Inc. (Marine Products Corporation), Edenton Boatworks LLC, Grady-White Boats Inc., Hobie CAT Company, MasterCraft Boat Holdings Inc., Maverick Boat Group Inc. (Malibu Boats), Polaris Inc., White River Marine Group (Bass Pro Shops), and Yamaha Motor Company Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)