Reclaimed Lumber Market Size, Share, Trends and Forecast by Application, End Use, and Region, 2025-2033

Reclaimed Lumber Market Size and Share:

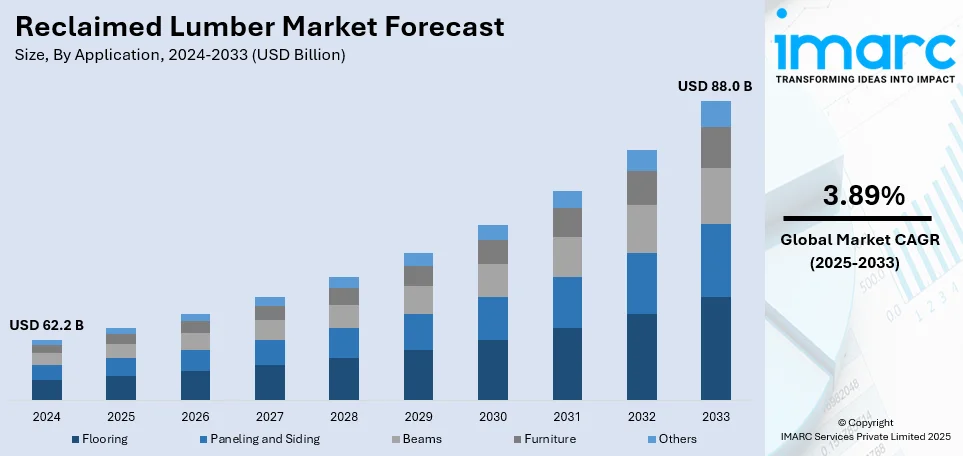

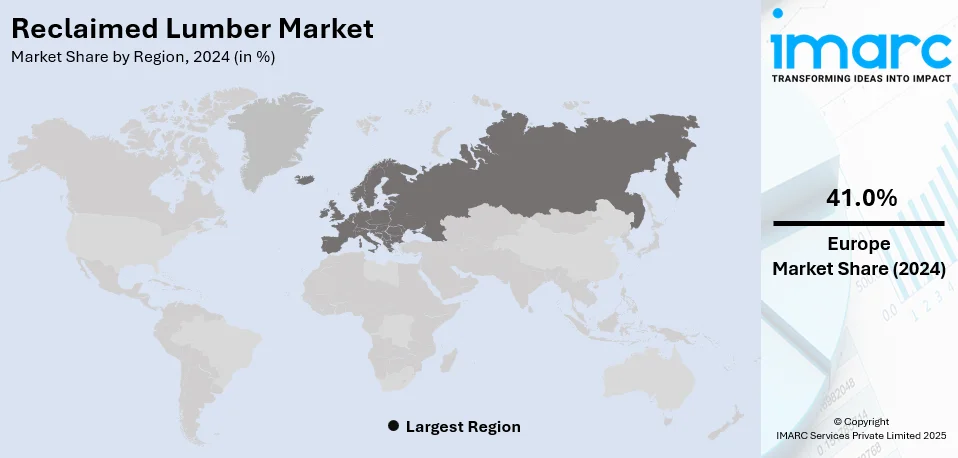

The global reclaimed lumber market size was valued at USD 62.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 88.0 Billion by 2033, exhibiting a CAGR of 3.89% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 41.0% in 2024, driven by strict environmental regulations, rising demand for sustainable construction, and government initiatives promoting circular economy practices and eco-friendly materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 62.2 Billion |

|

Market Forecast in 2033

|

USD 88.0 Billion |

| Market Growth Rate (2025-2033) | 3.89% |

One major driver of the reclaimed lumber market is the growing emphasis on sustainability and environmental conservation. Increasing regulations on deforestation, coupled with rising consumer demand for eco-friendly materials, are accelerating the adoption of reclaimed wood in construction, furniture, and interior design. For instance, as per industry reports, 36,234 deforestation cases were observed in the U.S. during January-February 2025 alone. Businesses and homeowners are prioritizing sustainable building practices, reducing reliance on newly harvested timber. Reclaimed lumber offers durability, unique aesthetics, and lower carbon emissions, making it a preferred choice for architects and designers. Additionally, government incentives promoting sustainable materials and the circular economy are further propelling market growth, reinforcing reclaimed wood as a viable alternative to virgin timber.

The United States is driving the reclaimed lumber market through strong sustainability initiatives, advanced wood processing technologies, and increasing consumer preference for eco-friendly materials. The country has a well-established infrastructure for salvaging wood from old buildings, barns, and industrial structures and repurposing it for construction, furniture, and interior design. Government policies promoting green building practices, such as LEED certification, are further encouraging reclaimed wood usage. Additionally, major market players and specialized suppliers are investing in innovative processing techniques to enhance the durability and aesthetics of reclaimed lumber. Rising demand for rustic and vintage-style interiors is also boosting market growth across residential and commercial sectors.

Reclaimed Lumber Market Trends:

Escalating demand for sustainable building materials

The global reclaimed lumber market is witnessing a significant increase in demand due to the increasing focus on sustainable building practices. For example, the United States spent over USD 86 Billion on green building in 2021. As environmental awareness increases, architects, builders, and homeowners are looking for alternatives to traditional lumber. Reclaimed lumber, obtained from deconstructed buildings, old barns, and other structures, is a compelling alternative. This trend is more or less dominated by the ecological impact of reducing construction projects. Reclaimed wood minimizes fresh logging and serves to divert wood waste from the landfills. As green building certifications gain significance, such as LEED, the eco-friendly attributes of the reclaimed lumber work in its favor as a more preferred choice for construction. This aligns the reclaimed wood with sustainable design principles, thereby reducing its carbon footprint and creating a more circular approach to resource utilization.

Stringent environmental regulations and carbon footprint reduction

The market for reclaimed lumber is highly sensitive to strict environmental legislations and overall efforts at curbing carbon footprints. All governments in the world are setting stricter regulations against deforestation while promoting responsible forestry practices. As a result of this legal backdrop, companies are forced to search for eco-friendly alternatives to engage in such business activities, like construction and furniture manufacturing. Moreover, the carbon emissions associated with logging, transportation, and processing of new lumber are prompting industries to seek lower-impact materials. For instance, according to World Bank, CO2 emissions caused by loss of trees, for instance due to logging or wildfires, averaged 8.1 Billion Tons annually over the past 20 years. Reclaimed wood addresses these concerns by repurposing existing resources without contributing to the depletion of forests. Along with regulatory drivers, corporate social responsibility (CSR) initiatives are nudging businesses toward sustainable sourcing. This is also increasing the demand for reclaimed lumber. Companies opting for reclaimed wood instead of new timber align themselves with ethical and environmental values that contribute to a more sustainable future.

Growth of the construction and furniture industries in emerging economies

The growth trajectory of the reclaimed lumber market is closely tied to the growth of the global construction and furniture industries, particularly in emerging economies. Such a fact is that the global construction industry is projected to expand by USD 4.5 Trillion over the next decade, reaching USD 15.2 Trillion in 2030. In addition, the global wood furniture market size reached USD 288.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 426.9 Billion by 2033. As these economies undergo urbanization, infrastructural development, and rising disposable incomes, there is an increasing demand for construction materials and furnishings. Reclaimed lumber holds a unique charm and historical importance, which both architects looking for unique design features and consumers for authentic, quality furniture find quite appealing. On the other side, the relative cost-effectiveness of reclaimed wood compared to new lumber also serves the budget-sensitive preferences in both markets.

Reclaimed Lumber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global reclaimed lumber market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application and end use.

Analysis by Application:

- Flooring

- Paneling and Siding

- Beams

- Furniture

- Others

Furniture stands as the largest application with a 32.6% share in 2024. The growth of the furniture segment is driven by the changing consumer preferences for sustainable and environmentally friendly choices, which have increased demand for furniture made from reclaimed materials. This trend is part of the larger movement toward eco-friendly lifestyles and responsible consumption. Additionally, the uniqueness and one-of-a-kind appeal of pieces made from reclaimed wood strongly resonates with consumers looking for distinctive interior aesthetics. Reclaimed lumber possesses historic and characterful qualities that imbue furniture designs with a quality of authenticity and charm. Additionally, the affordability of reclaimed wood compared to newly sourced timber serves a broad base of budget-conscious consumers without losing any quality standards. Furthermore, as governments and regulatory bodies promote sustainable practices within industries, furniture manufacturers are turning towards reclaimed wood to prove their commitment to environmental responsibility. Technological advancements in woodworking techniques and finishes further enhance the market by ensuring the quality, durability, and versatility of reclaimed wood furniture.

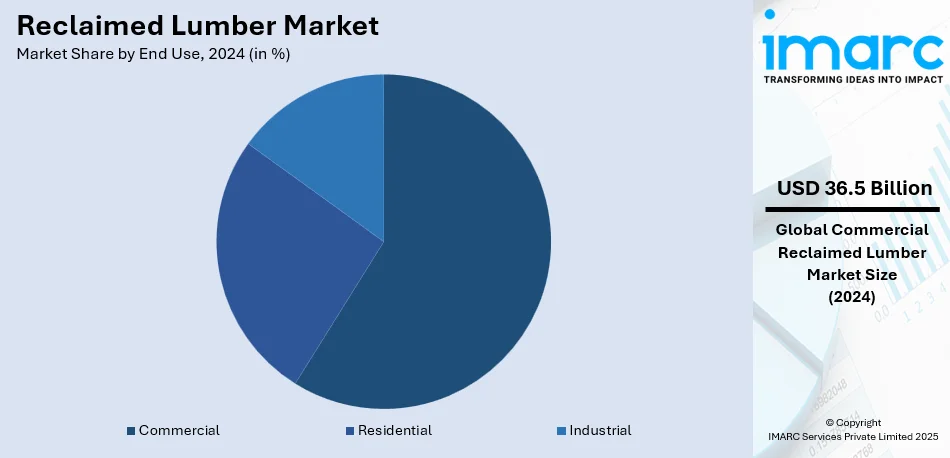

Analysis by End Use:

- Residential

- Commercial

- Industrial

Commercial leads the market with a 58.7% share in 2024. A growth factor in the reclaimed lumber market is the commercial component, which is increasing due to renewed concern for sustainable practices within the corporate sector and thus businesses opting for eco-friendly building materials. The rationale behind the growth is that companies looking for better brand image and corporate social responsibility have enlisted with the cause as it fits into the value system, creating a positive public perception about the company's practice. Additionally, the distinct aesthetic qualities of reclaimed lumber lend a unique and authentic charm to commercial spaces, resonating with modern design trends that value individuality. In line with this, the durability and longevity of reclaimed lumber make it an economically viable choice for commercial applications, ensuring lasting value for investments in interior design and renovations. In addition, collaborative works between salvage lumber providers and commercial architects also bring forth design innovation that could be specifically ordered for a given business's requirement to promote growth in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest share of 41.0% of the market. The growth of the reclaimed lumber market in Europe is significantly influenced by the region's dedication to sustainability and environmental conservation. Strict regulations aimed at carbon emission reduction and forest preservation, along with the appeal of eco-friendly construction materials, make reclaimed lumber a popular choice. This characteristic and cultural value of reclaimed wood will match the rich history and architectural heritage of the region, increasing its usage in adaptive reuse and historical restoration. The incentives to use reclaimed lumber come from green building certifications such as BREEAM and Passivhaus. A healthy tourism industry and a circular economy agenda are driving the demand for reclaimed wood in European countries. This drives resource efficiency and reduces waste. Supplier collaborations, architectural and designer engagement, as well as advancements in wood processing technologies, continue to improve the quality and range of reclaimed wood and drive the material's growing market share in Europe.

Key Regional Takeaways:

United States Reclaimed Lumber Market Analysis

US accounts for 88.90% share of the market in North America. The growing adoption of reclaimed lumber in the United States is largely driven by the rising demand for home remodelling and renovations. For instance, construction spending in the United States stalled month-over-month to a seasonally adjusted annual rate of USD 2,153 Billion in November 2024. As more homeowners focus on sustainability and eco-friendly construction, reclaimed lumber provides an attractive alternative to new wood. The trend is particularly popular in areas focused on historical preservation and rustic aesthetics. Furthermore, there is an increasing interest in using materials that not only offer aesthetic appeal but also contribute to reducing waste in landfills. The home remodelling boom, fuelled by higher disposable incomes and a cultural shift toward personalized and environmentally conscious living spaces, has led to the increased use of reclaimed wood. Additionally, consumers are becoming more educated about the environmental benefits, as reclaimed lumber reduces the need for deforestation, and this awareness drives more homeowners to choose it for various applications, including flooring, furniture, and cabinetry.

North America Reclaimed Lumber Market Analysis

North America is a key market for reclaimed lumber, driven by strong sustainability initiatives, rising consumer demand for eco-friendly materials, and increasing adoption in residential and commercial construction. The region benefits from a well-developed infrastructure for salvaging wood from old buildings, barns, and industrial structures, and repurposing it for flooring, furniture, and architectural applications. The U.S. Green Building Council's LEED certification and other environmental regulations are further encouraging reclaimed wood use in sustainable construction projects. For instance, over 195,000 LEED projects in 186 countries have saved 15.4 million metric tons of carbon in the first certification year and 120 million metric tons since initial certification, promoting sustainability. Key players, including Vintage Timberworks and TerraMai, are focusing on innovative processing techniques to enhance product quality. Additionally, the growing popularity of rustic and vintage-style interiors in residential and commercial spaces is fueling demand, positioning North America as a leading market for reclaimed lumber.

Asia Pacific Reclaimed Lumber Market Analysis

In the Asia-Pacific region, the adoption of reclaimed lumber is gaining traction due to the rapid development of smart cities and the increasing demand for commercial spaces. For instance, India's Smart Cities Mission (SCM), with 100 cities at the forefront, has completed 7,380 out of 8,075 projects, involving an investment of approximately USD 18,000 Million. As urbanization continues to drive infrastructure growth, there is a growing focus on sustainable construction practices. Reclaimed wood is seen as an attractive alternative to traditional building materials, offering not only environmental benefits but also unique visual appeal. With commercial spaces such as office buildings, retail outlets, and public facilities undergoing renovation or construction, reclaimed lumber is often used for flooring, furniture, and other decorative elements. Additionally, the increasing demand for eco-conscious buildings and sustainable urban planning practices has further contributed to the rise of reclaimed wood adoption. This growing trend is fuelled by both government policies promoting sustainable construction and a consumer preference for green materials in the built environment.

Europe Reclaimed Lumber Market Analysis

In Europe, the rising adoption of reclaimed lumber can be attributed to the expanding industrial sector, which is witnessing increased production across various manufacturing industries. According to reports, the EU's industrial production in 2021 and it increased by 8.5% compared with 2020. It continued with an increase in 2022 by 0.4% compared with 2021. As industries look for ways to reduce their carbon footprint and embrace sustainability, reclaimed wood has become a valuable resource for manufacturing facilities. It is increasingly used in the construction of industrial buildings, warehouses, and factories. Additionally, the demand for reclaimed wood is also driven by the growing trend of repurposing materials in the manufacturing sector. By utilizing reclaimed lumber, industrial businesses can meet environmental regulations while maintaining cost-effectiveness. The rise in production activities across Europe, paired with the emphasis on sustainability, has further accelerated the adoption of reclaimed lumber in both industrial and commercial construction projects. Reclaimed wood offers a cost-effective and sustainable alternative to traditional materials, making it an appealing choice for a wide range of industrial applications.

Latin America Reclaimed Lumber Market Analysis

The growing adoption of reclaimed lumber in Latin America is primarily driven by the expanding residential construction sector. For instance, Brazil's urban population grew by 0.73% in 2022, following a 0.81% increase in 2021, driving demand for residential construction. As more people seek to build or renovate homes, reclaimed wood provides an eco-friendly and cost-effective solution for homeowners and builders alike. The emphasis on sustainability has led to increased interest in reclaimed materials for various residential applications, including flooring, wall panels, and furniture. Reclaimed lumber is also gaining popularity in the region due to its durability and the unique character it brings to residential spaces. As the demand for more sustainable housing increases, so does the use of reclaimed wood, further solidifying its place in the growing construction landscape.

Middle East and Africa Reclaimed Lumber Market Analysis

In the Middle East and Africa, the adoption of reclaimed lumber is on the rise due to the booming construction sector and an increasing number of ongoing projects. According to reports, Saudi Arabia is currently overseeing over 5,200 construction projects valued at USD 819 Billion, representing 35% of the total active project value across the GCC. As the demand for residential, commercial, and mixed-use developments grows, builders are turning to reclaimed wood as an eco-friendly and aesthetic alternative to traditional materials. This trend is fuelled by the desire to incorporate sustainable construction practices and the region’s ongoing push toward greener urban planning. Reclaimed lumber is increasingly utilized in the construction of residential buildings, offices, and public spaces, offering a unique blend of sustainability, style, and functionality. As the construction sector continues to thrive, the demand for reclaimed wood is expected to grow, contributing to the region’s overall commitment to sustainability in the built environment.

Competitive Landscape:

The competitive landscape of the reclaimed lumber market is characterized by a mix of established players, niche suppliers, and specialized woodworking firms focusing on sustainability. Key market participants are investing in advanced wood processing techniques to enhance quality and durability. Companies are differentiating through unique sourcing strategies, offering custom finishes and certifications for sustainable practices. For instance, in 2024, Tessenderlo Group announced plans to restructure its Vilvoorde (Belgium) site and close its Treforest (UK) site as part of operational adjustments within its PB Leiner business unit. Increasing collaborations with architects, designers, and construction firms are expanding market reach. Additionally, growing consumer demand for eco-friendly materials is driving competition, with firms emphasizing product authenticity, supply chain efficiency, and adherence to environmental regulations to gain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the reclaimed lumber market with detailed profiles of all major companies, including:

- Altruwood Inc.

- Atlantic Reclaimed Lumber LLC

- Beam and Board LLC

- Carpentier Hardwood Solutions

- Elemental Republic

- Elmwood Reclaimed Timber (Worldwide Steel)

- Imondi Flooring

- Jarmak Corporation

- Longleaf Lumber Inc.

- Montana Reclaimed Lumber Co.

- Olde Wood Ltd.

- TerraMai

- Trestlewood

- True American Grain Reclaimed Wood

- Vintage Timberworks Inc.

Latest News and Developments:

- November 2024: Montana Reclaimed Lumber (MRL), a pioneer in recycled wood products, partnered with MMEC to craft a strategic growth plan. Founded in 2002, MRL transforms reclaimed wood from barns and buildings into custom lumber and furniture. With MMEC’s guidance, MRL is optimizing operations and workforce strategies to sustain long-term success. Owner Mike Halverson aims to expand beyond the company's 35-acre footprint and renowned antique lumber collection.

- October 2024: The Softwood Lumber Board, in collaboration with the USDA Forest Service, has launched a USD 1.8 Million competition to advance mass timber use in K-12 educational facilities. This initiative promotes sustainable construction and encourages the integration of reclaimed lumber in classrooms, libraries, and other learning spaces across the U.S.

- April 2024: Urban Machine’s robot at All Bay Lumber Mill utilizes AI, cameras, and robotics to reclaim lumber by removing metal fasteners. The reclaimed lumber is used to build an inventory of premium wood for sale. All Bay also produces Dowel-Laminated Timber (DLT) with reclaimed lumber, advancing sustainable construction practices.

- February 2024: Fortnum & Mason's 2023 refurbishment of their Piccadilly store's third floor features reclaimed timber flooring, blending heritage with sustainability. Designed by CADA Design, the space includes Franklin, a reclaimed herringbone wood floor by Woodworks, showcasing ecological materials. The antique collection flooring adds character through time-worn craftsmanship. Senior designer Ellie Koumparos emphasized reclaimed materials as central to ethical, future-focused design.

- February 2024: The Baltimore Wood Project is transforming urban wood renewal by focusing on creating a regional economy around wood and land restoration. Through the initiative, reclaimed lumber is salvaged from vacant homes, reducing landfill waste while honoring the city's legacy. By expanding its model, the project impacts both the environment and the lives of those involved.

Reclaimed Lumber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Flooring, Paneling and Siding, Beams, Furniture, Others |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altruwood Inc., Atlantic Reclaimed Lumber LLC, Beam and Board LLC, Carpentier Hardwood Solutions, Elemental Republic, Elmwood Reclaimed Timber (Worldwide Steel), Imondi Flooring, Jarmak Corporation, Longleaf lumber Inc., Montana Reclaimed Lumber Co., Olde Wood Ltd., TerraMai, Trestlewood, True American Grain Reclaimed Wood, Vintage Timberworks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the reclaimed lumber market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global reclaimed lumber market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the reclaimed lumber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The reclaimed lumber market was valued at USD 62.2 Billion in 2024.

IMARC estimates the reclaimed lumber market to reach USD 88.0 Billion by 2033, exhibiting a CAGR of 3.89% during 2025-2033.

Key factors driving the reclaimed lumber market include increasing sustainability awareness, strict deforestation regulations, rising demand for eco-friendly construction materials, government incentives, and the unique aesthetic appeal of reclaimed wood. Additionally, growing adoption in residential and commercial projects, circular economy initiatives, and advancements in wood processing technologies are fueling market growth.

Europe currently dominates the market with a 41.0% share in the market, driven by stringent environmental regulations, strong demand for sustainable construction materials, and growing adoption in residential and commercial projects. Government initiatives promoting circular economy practices and eco-friendly building certifications further boost market growth, reinforcing Europe’s leadership in sustainable wood solutions.

Some of the major players in the reclaimed lumber market include Altruwood Inc., Atlantic Reclaimed Lumber LLC, Beam and Board LLC, Carpentier Hardwood Solutions, Elemental Republic, Elmwood Reclaimed Timber (Worldwide Steel), Imondi Flooring, Jarmak Corporation, Longleaf lumber Inc., Montana Reclaimed Lumber Co., Olde Wood Ltd., TerraMai, Trestlewood, True American Grain Reclaimed Wood, Vintage Timberworks Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)