Real-Time Payments Market Size, Share, Trends and Forecast by Payment Type, Component, Deployment, Enterprise Size, End Use Industry and Region, 2025-2033

Real-Time Payments Market Size and Share:

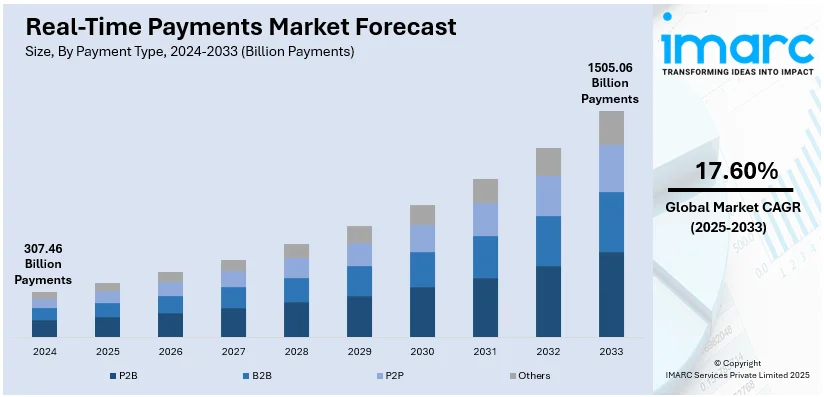

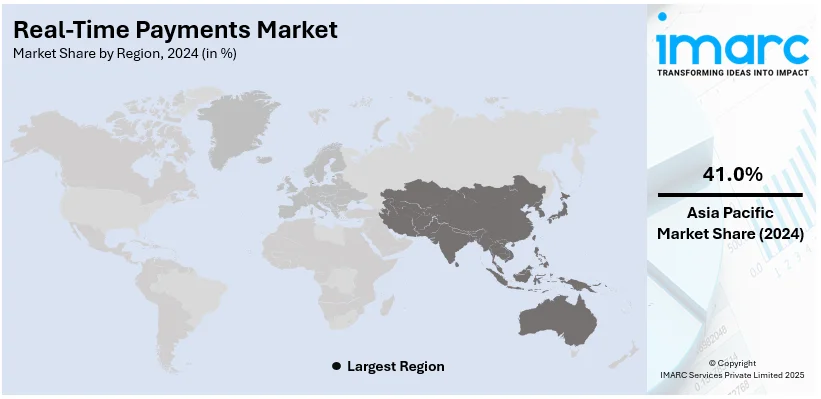

The global real-time payments market size was valued at 307.46 Billion Payments in 2024. Looking forward, IMARC Group estimates the market to reach 1505.06 Billion Payments by 2033, exhibiting a CAGR of 17.60% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 41.0% in 2024. The market is primarily driven by the increasing demand for instant transactions, rapid digitalization of financial services, rising smartphone penetration, expanding adoption of mobile wallets, government initiatives to enhance payment infrastructures, and the need for secure, efficient, and seamless payment solutions across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 307.46 Billion |

| Market Forecast in 2033 | 1505.06 Billion |

| Market Growth Rate (2025-2033) | 17.60% |

The global market is majorly driven by the integration of AI and ML in payment systems. The growing adoption of advanced AI-powered tools that enhance transaction security, optimize routing, and predict payment trends is also providing an impetus to the market. Besides this, the increasing shift towards direct bank payment systems, which reduces reliance on traditional credit card networks, is propelling the growth of the market. Moreover, the rising demand for real-time payment solutions enabling direct transfers from bank accounts is a key factor impelling market growth by ensuring greater efficiency, cost-effectiveness, and transparency for consumers and businesses. On September 20, 2024, Walmart announced a partnership with Fiserv to introduce real-time payments for online shoppers. This initiative enables customers to render instant payments directly from their bank accounts, bypassing traditional credit card networks. The service, which is anticipated to debut next year, will integrate with the Federal Reserve's FedNow system and the clearing house's RTP network using Fiserv's NOW Network. This development aims to enhance payment efficiency and provide consumers with greater choice. Besides this, the considerable rise in cross-border real-time payment solutions is another growth-inducing factor in the market. Businesses and people need faster and cheaper international money transfer solutions more than ever.

The United States is a key regional market and is expanding due to the increasing popularity of peer-to-peer (P2P) payment applications. With businesses increasingly using RTPs to ensure prompt and improved customer satisfaction, especially in retailing and e-commerce, the market is witnessing a steady rise. In addition, the increasing prevalence of embedded payment solutions in both mobile and e-commerce sites is improving the convenience and speed of transactions, thus supporting the expansion of the market. Another growth driver to the market has been legislative support for digital payment transformation. Federal and state initiatives on financial inclusion that encourage businesses to adopt the use of digital payments have created a favorable environment for RTP. The growing focus on financial security, supported by advanced fraud detection tools and regulatory compliance, made the consumers even more confident in RTP systems. Also, the introduction of real-time payment capabilities by financial institutions underscores the growing emphasis on member-centric services. For example, On August 22, 2024, Affinity Plus announced the launch of real-time payments in the United States, enabling members to instantly access funds. This initiative enhances financial flexibility and convenience by supporting immediate money transfers, reflecting the growing adoption of real-time payment systems across the country's financial sector.

Real-Time Payments Market Trends:

Enhanced Payment Ecosystems Through Real-Time Payments

The growing demand for instant financial transactions is fueling the adoption of real-time payments, which is revolutionizing the global payments landscape. Real-time payments ensure same-day payouts to merchants, thereby enhancing cash flow management and operational efficiency. It enables businesses to maintain liquidity and respond promptly to market demands. Consumers also benefit from faster, secure transactions that foster trust and convenience, this in turn is supporting the growth of the market. On October 8, 2024, Mastercard announced that South Africa will be the inaugural market to benefit from immediate real-time Payments for card transactions. This initiative enables acquiring banks to process payments instantly, allowing merchants to receive same-day payouts. The advancement aims to enhance cash flow management, provide greater control over funds, and stimulate economic growth by facilitating instant and secure transactions. Financial institutions that adopt real-time technology benefit from a competitive advantage and streamlined processes, which in turn enhance customer satisfaction.

Rising Adoption by Small and Medium Enterprises (SMEs)

Recently, SMEs are increasingly utilizing RTP solutions to address cash flow issues and increase the efficiency of their operations. This business can enjoy same-day fund transfers, faster processing times, and lower transaction costs as compared to other payment modes. Real-time payments allow SMEs to manage their liquidity properly, respond to customer demands, and build better relationships with vendors. Moreover, the emergence of a higher number of cloud-based payment applications suitable for small and medium businesses greatly eased the process of accepting RTPs from any-sized organizations. Continued recognition that RTP offers an increased business competitiveness option for the business is now the key determinant that drives its market growth. For example, on October 11, 2024, Pune-based Easebuzz announced its commitment to formalizing over 150,000 Indian SMEs by providing affordable, sector-specific digital payment solutions. These solutions streamline financial operations, including payment collections, disbursements, integrated banking services, divided payment processing, automated financial reconciliation, supplier payments, management of sub-merchants, and handling of refund transactions across various sectors such as education, government, travel and real estate. Easebuzz's verticalized approach addresses the unique payment needs of each industry, promoting the digitization and growth of India's informal business sector.

Growing Demand for Real-Time Payment Analytics Solutions

Advanced analytics solutions have become a necessity with the high rate of development in payment ecosystem , driven primarily by RTPs and the usage of various standards. On November 14, 2024, Volante technologies introduced volante payments intelligence, a solution offering financial institutions enhanced visibility and operational control over their payments business. This tool analyzes historical and real-time payments data, aiding banks in strategic planning, operational efficiency, and performance tracking. It addresses the complexities of the payments landscape, including the rise of Real-Time Payments and the adoption of ISO 20022. As financial institutions face a high demand to take advantage of innovative analytical tools for increased visibility in payment processes, process improvements, and clarity in decision making, analytics platforms that use real-time and historical payment data empower banks to address complexities, optimize operational efficiency, and align with industry standards. This trend reflects larger demand for information that helps perform, facilitates superior tracking of performance, supports planning and is competitive amid rising turbulence within the overall financial landscape.

Real-Time Payments Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global real-time payments market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on payment type, component, deployment, enterprise size, and end use industry.

Analysis by Payment Type:

- P2B

- B2B

- P2P

- Others

P2B leads the market with around 62.6% of market share in 2024. P2B (Person-to-Business) payments allow for seamless, immediate transactions between a person and a business. With increased consumer demand for speed and convenience, increasing numbers of businesses implement real-time payment solutions to operate more efficiently and receive cash sooner. The growth of e-commerce and mobile commerce has amplified the need for efficient P2B payment systems, which help in instant checkout experiences and less cart abandonment. Technological developments like APIs and payment gateways have made real-time P2B integration easier for businesses of any size. Regulatory frameworks ensure transparent and safe payment systems. Increased digital wallet acceptance and QR-code-based payments, where instant P2B transactions will now reach a greater populace, is further facilitating market growth.

Analysis by Component:

- Solutions

- Payment Gateway

- Payment Processing

- Security and Fraud Management

- Advisory Services

- Integration and Implementation Services

- Managed Services

- Services

Solutions leads the market with around 74.5% of market share in 2024. These solutions provide a backbone for systems of real-time payments, which, in turn, enables interoperability, secure data transfer, and seamless integration of existing financial structures. Business corporations and financial service providers rely highly on these systems to deliver fast, trusted, and sound transactions that will meet consumer and regulatory requirements alike. The adoption of cloud-based and API-driven solutions is accelerating market expansion, as they offer scalability, cost efficiency, and easier deployment. Additionally, the need for advanced fraud detection and data analytics capabilities within real-time payment systems is driving innovation in solution offerings. With growing digital payment ecosystems, these solutions are crucial to improving operational efficiency, enhancing user experience, and building trust among consumers and businesses for real-time payments.

Analysis by Deployment:

- Cloud

- On-premises

On-premises leads the market with around 61.7% of market share in 2024 driven by organizations seeking control, customizability, and data security. Many financial institutions, large enterprises, and government entities adopt on-premises solutions primarily to meet high regulatory compliance demands and to retain immediate control over sensitive financial information. This deployment mode provides custom solutions that can easily integrate with the existing IT infrastructures. Businesses meet their specific operational needs through this type of deployment. Moreover, in regions where cloud adoption is still at its lowest due to issues with data sovereignty or poor internet infrastructure, on-premises deployment is favored. Growth in the market for on-premises solutions is witnessed in sectors that are sensitive to data protection and system reliability.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 65% of market share in 2024, as these systems improve operational efficiency, enhance customer satisfaction, and maintain a competitive edge. High transaction volumes and complex financial ecosystems in large organizations thrive in real-time payments speed and reliability, which allows for faster settlement cycles and better cash flow management. Frequently, such enterprises are leaders in adopting new payment technologies, API-driven platforms, and integrated fraud detection systems. Furthermore, large corporations in retail, healthcare, and e-commerce also push the growth of the market through the adoption of real-time payment capabilities within their systems for streamlining B2B, P2B, and cross-border transactions. The considerable investment capacity and global presence of such companies also help increase the adoption of real-time payment solutions across different markets and regions.

Analysis by End Use Industry:

- Retail and E-commerce

- BFSI

- IT and Telecom

- Travel and Tourism

- Government

- Healthcare

- Energy and Utilities

- Others

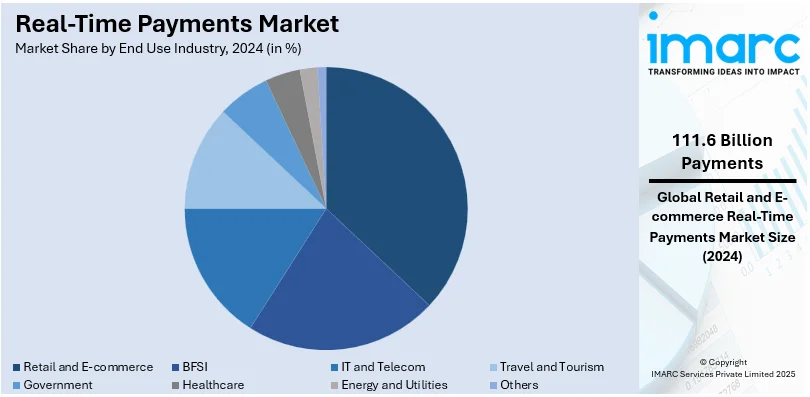

Retail and e-commerce lead the market with around 36.3% of market share in 2024, due to their need for rapid, efficient, and secure transaction systems. Real-time payments facilitate instant checkout processes, diminish payment friction, and lower the rate of cart abandonment. Real-time payments are a critical aspect of support in the sector as they provide instant transaction capabilities and also enable easy cash flow management of transactions for e-commerce. Digital wallet payments, QR code payments, and the resultant mobile-based solutions further integrate real-time payment systems into retail operations. Also, consumers' increasing demand for flexible payment options like BNPL usage would rely on real-time payment capabilities for swift transfer of funds. As these industries continue to expand, their demand for scalable and reliable payment solutions will remain a significant driver of growth in the real-time payment market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific accounted for the largest market share of over 41.0% driven by rapid digital transformation, widespread smartphone penetration, and government initiatives to create cashless economies. China, India, and Japan are the leading adopters of this market, with innovations like unified payments interface (UPI) in India and advanced mobile payment systems in China setting global benchmarks. According to an industry report, in December 2024, India's Unified Payments Interface (UPI) achieved a record 16.73 Billion transactions, totaling INR 23.3 lakh crore, from INR 21.6 lakh crore the previous month, recording a growth of 8%. The average daily transaction count was 539.7 Million, with a daily value of INR 74,990 crore, up from November's figures. This milestone reflects UPI's growing prominence in India's digital payment ecosystem. The large unbanked population of the region, coupled with its large middle class, is highly dependent on accessing real-time payments for available financial services at any time. Also, increased e-commerce and growing Asian-Pacific cross-border trade demand reliable and rapid forms of payment to be undertaken seamlessly. As businesses and consumers take more to the digital payment's world, Asia-Pacific will continue to be a keystone of growth and innovation for the real-time payment market.

Key Regional Takeaways:

United States Real-Time Payments Market Analysis

The United States is a significant player in the North America real-time payments market with a market share of 80.00%, reflecting itself as a leader in payment innovation and infrastructure development. An industry report released on November 12, 2024, stated that the RTP® network of the Clearing House, the biggest instant payments system in the US, currently processes more than 1 Million payments day on average. In October, the network processed a record 31.7 Million transactions valued at USD 25.4 Billion, marking increases of 6.2% in volume and 9% in value from September. Notably, 42% of these transactions occurred outside traditional banking hours, highlighting the system's 24/7 utility for consumers and businesses. This is as it is among the world's largest economies, with its payments landscape having undergone considerable strides through the adoption of real-time payment systems. They enable users to have instant send and receive transactions of funds, thereby inducing further financial inclusion, quick transactions, and reduced cost. With widespread industry support, the U.S. remains a hub for real-time payments technology, setting a trend for other countries. The importance of the U.S. market in the real-time payments sector can also be seen in how it impacts financial institutions, FinTech’s, and businesses.

Europe Real-Time Payments Market Analysis

Europe emerged as a significant player in the real-time payments market. This is due to the regulatory landscape and efforts from the European central bank towards faster payments across the region. A significant milestone for Europe has been the introduction of the SEPA Instant Credit Transfer (SCT Inst) scheme in 2017, enabling cross-border transactions within seconds. With faster and more secure payment solutions in demand by businesses and consumers alike Europe, the UK, Germany, and France have been early adopters of real-time payment systems. Europe remains a critical region in the global real-time payment’s ecosystem given the maturity of the European market in digital banking and payments, with regulatory support from the European Union. The implementation of stringent regulatory frameworks, such as the EU's mandate for euro instant credit transfers by 2025, is accelerating the adoption of real-time payment systems. On October 17, 2024, Broadridge Financial Solutions introduced an instant payments service in Europe, enabling real-time money transfers available 24/7. The service boasts processing times of under 10 seconds, offering a fast and efficient solution for transactions across the region. This service also aligns with new EU regulations mandating euro instant credit transfers by 2025, enhancing payment efficiency across the financial sector.

Asia Pacific Real-Time Payments Market Analysis

With nations like China, India, and Japan at the forefront, the Asia Pacific region is one of the market's fastest-growing regions . The rapid digitalization of the region and government initiatives to promote financial inclusion are fueling the expansion of real-time payment systems. APAC is driven by a massive population base, and mobile-first means acceleration in instant payment adoption- especially retail, banking, and peer-to-peer payments. A very competitive market in APAC stimulates the innovation needed for broad deployments of real-time payments technology. Moreover, the financial sector is witnessing significant advancements in real-time payment infrastructure, and this is driven by the need for faster, more efficient transaction processing. Financial institutions are increasingly adopting centralized payment platforms that integrate multiple channels, including retail and corporate banking services, to streamline operations and enhance customer experiences. For example, Affin Bank and ACI Worldwide teamed on July 10, 2024, to update Affin Bank's real-time payment capabilities in Malaysia. The collaboration aims to streamline payment processes by consolidating various channels into a centralized system, enhancing efficiency and scalability. This initiative aligns with Affin Bank's digital transformation strategy, focusing on delivering integrated, value-driven payment solutions to meet diverse business needs.

Latin America Real-Time Payments Market Analysis

Latin America is becoming a major player in the global RTP market, as rapid digitalization and expanding financial inclusion fuel the growth of the market. The region has seen a rise in the adoption of innovative payment solutions resulting from the increasing trends toward faster and more secure transactions. Countries like Brazil and Mexico have made significant strides in modernizing their payment infrastructures, supporting real-time payment systems like PIX and SPEI, respectively. The financial sector in Latin America is experiencing significant growth in real-time payment services, driven by the increasing demand for faster and more efficient cross-border transactions. On August 27, 2024, Mexipay and ACI Worldwide extended their collaboration to improve Mexico's real-time payments ecosystem on August 27, 2024. Mexipay will provide new payment choices based on the ISO 20022 standard by leveraging ACI's Digital Central Infrastructure solution, which is a component of the ACI Enterprise Payments Platform. This collaboration aims to drive instant payments adoption, fostering economic growth and financial inclusion for businesses and consumers in Mexico. Mobile payments and digital wallets, are also changing how consumers and business entities render their financial transactions. This creates healthy competition among key players in the region and, in turn, fuels innovation. Latin America is becoming an important region in the global real-time payment market, with continuous investments and uptake expected to strengthen the region's influence in the global landscape.

Middle East and Africa Real-Time Payments Market Analysis

The Middle East and Africa are emerging regions in the RTP market driven by rapid technological advancements, improved financial inclusion, and government initiatives. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are leading the adoption of advanced digital payment systems, enabling instant money transfers, and facilitating seamless financial transactions. These nations are driving innovation in digital finance, enhancing convenience and efficiency within their respective economies. Furthermore, financial institutions are adopting cloud-native, SaaS-based platforms that integrate seamlessly with existing systems, enabling real-time connectivity to multiple remittance networks. Notably, on October 22, 2024, Temenos introduced its cross-border payments enterprise service, a SaaS-based solution designed to enhance cross-border payment efficiency for Payment Service Providers (PSPs) in the Middle East and Africa (MEA) region. By 2027, this service helps businesses to reach the G20's goals for transaction speed, cost transparency, and accessibility while streamlining and lowering the costs of cross-border payments. The cloud-native, pre-configured service provides real-time connectivity to numerous remittance networks and is made to integrate easily with legacy systems. In addition to this, several governments are investing in financial technologies and setting up regulatory frameworks to promote the wide-scale adoption of real-time payments toward a more efficient economy and greater access to finance. As mobile banking penetration increases in MEA, the region will play an important role in the global market.

Competitive Landscape:

The key players in the real-time payments market are expanding their services, improving infrastructure, and adopting advanced technologies to support increasing demand for instant payments. Major financial institutions, including JPMorgan Chase, Wells Fargo, and Bank of America, are adding real-time payment solutions to their offerings to provide businesses and consumers with faster, secure transactions. Strategic collaborations between financial institutions, fintech startups, technology providers, and payment networks are common, as they help address gaps in infrastructure, enhance security, and improve customer experience. For instance, on March 4, 2024, Galileo Financial Technologies announced an expanded partnership with The Bancorp Bank to enable real-time payment services through The Clearing House's RTP® network. This collaboration enables instant fund transfers between bank accounts, addressing cash flow challenges for small businesses and consumers. Further driving adoption are companies like PayPal, Stripe, and Square, which accelerate the adoption of real-time payments by integrating them into their platforms, targeting e-commerce and mobile payments. The other players are also focusing on optimizing cross-border payments and enabling instant global transactions.

The report provides a comprehensive analysis of the competitive landscape in the real-time payments market with detailed profiles of all major companies, including:

- ACI Worldwide

- Fidelity National Information Services, Inc. (FIS)

- Finastra

- Fiserv, Inc.

- Mastercard Inc.

- Montran

- Temenos

- Visa Inc

- Volante Technologies, LLC

- Worldpay LLC

Latest News and Developments:

- On February 21, 2024, Montran successfully launched its cutting-edge Immediate Payment Service (IMPS) real-time payment solution at two major banks in India. The solution facilitates inter-bank domestic transfers and foreign remittances via mobile, internet banking, ATMs, and other channels. With an XML-based IMPS Switch and built on Spring Boot and microservices, the system ensures efficient, adaptive, and secure real-time payment capabilities, benefiting both retail and corporate customers.

- On December 12, 2024, Visa Inc. announced that Visa Direct will enable U.S. cardholders to access funds within one minute or less, starting in April 2025. This enhancement allows real-time payments to eligible debit cards, improving convenience for consumers, businesses, and governments by ensuring rapid fund availability and supporting various payment scenarios. This advancement highlights Visa's commitment to accelerating real-time payment solutions.

Real-Time Payments Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Types Covered | P2B, B2B, P2P, Others |

| Components Covered |

|

| Deployments Covered | Cloud, On-premises |

| Enterprises Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Use Industries Covered | Retail and E-commerce, BFSI, IT and Telecom, Travel and Tourism, Government, Healthcare, Energy and Utilities, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East, and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Worldwide, Fidelity National Information Services, Inc. (FIS), Finastra, Fiserv, Inc., Mastercard Inc., Montran, Temenos, Visa Inc, Volante Technologies, LLC, Worldpay LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the real-time payments market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global real-time payments market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the real-time payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Real-time payments refer to instantaneous money transfers between accounts, allowing for immediate settlement and availability of funds. This payment method ensures faster transactions for businesses and consumers, enhancing convenience and operational efficiency. It is facilitated through advanced digital infrastructures, offering secure and seamless experiences in various financial activities.

The global real-time payments market was valued at 307.46 Billion Payments in 2024.

IMARC estimates the global real-time payments market to exhibit a CAGR of 17.60% during 2025-2033.

The global market is propelled by increasing demand for quick and secure payment solutions, rapid adoption of smartphones and digital wallets, growing e-commerce, and supportive regulatory frameworks. Enhanced user experience, reduced transaction costs, and the expansion of internet connectivity also contribute to market growth.

P2B represented the largest segment by payment type, driven by the rising need for quick and hassle-free money transfers, especially in personal remittances and small-value transactions.

Solutions is the leading segment by component, driven by demand for advanced payment platforms, integration tools, and software that enable seamless, secure, and efficient real-time payment capabilities for businesses and consumers.

On-premises represented the largest segment by deployment, driven by organizations' need for greater control over payment infrastructure, enhanced security, and compliance with specific regulatory requirements.

Large enterprises represented the largest segment by enterprise size, driven by the need to manage high transaction volumes, optimize operational workflows, and ensure compliance with evolving financial regulations.

Retail and e-commerce represented the largest segment by end use industry, driven by the growing consumer preference for instant payments, streamlined checkout processes, and the rise in digital shopping experiences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global real-time payments market include ACI Worldwide, Fidelity National Information Services, Inc. (FIS), Finastra, Fiserv, Inc., Mastercard Inc., Montran, Temenos, Visa Inc, Volante Technologies, LLC, and Worldpay LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)