Real-Time Bidding Market Size, Share, Trends, and Forecast by Auction Type, Advertisement Format, Application, Device, and Region, 2025-2033

Real-Time Bidding Market Size and Share:

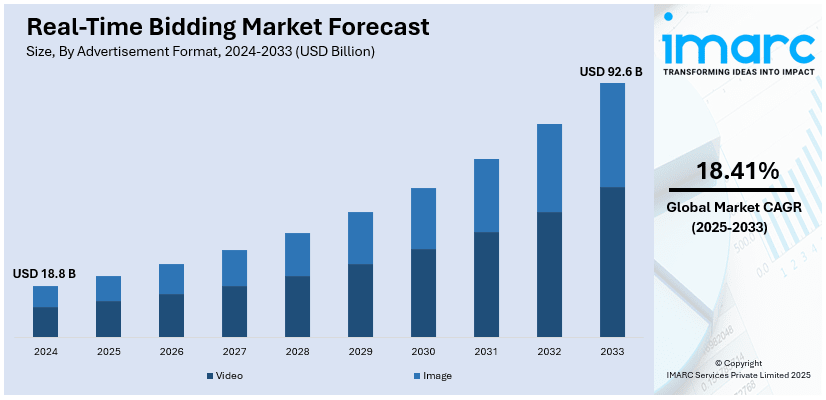

The global real-time bidding market size reached USD 18.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 18.41% during 2025-2033. Currently North America dominates the market, holding a significant share of 42.5%, driven by the increasing digital ad spending, advancements in AI and data analytics for personalized targeting, and the widespread adoption of mobile and video ad formats across various industries seeking efficient, scalable advertising solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.8 Billion |

| Market Forecast in 2033 | USD 92.6 Billion |

| Market Growth Rate (2025-2033) | 18.41% |

A key driver of the real-time bidding (RTB) market is the increasing adoption of programmatic advertising by advertisers and publishers seeking automated, data-driven ad placements. RTB enables precise audience targeting, real-time optimization, and cost efficiency, making it a preferred method for digital ad transactions. The shift toward AI-powered algorithms and machine learning enhances bidding accuracy, ensuring that advertisers reach the most relevant users while maximizing return on investment (ROI). Additionally, the expansion of connected TV (CTV), mobile, and video advertising further accelerates demand for RTB solutions, reinforcing its role in the evolving digital advertising ecosystem. For instance, in December 2024, Roku and FreeWheel expanded their programmatic partnership, enabling real-time bidding on Roku Exchange, providing advertisers with premium CTV inventory and scalable audience targeting through a standardized protocol.

The United States plays a pivotal role in the real-time bidding (RTB) market, driven by a highly developed digital advertising ecosystem, widespread adoption of programmatic technologies, and advanced AI-driven ad optimization. Major demand-side platforms (DSPs), supply-side platforms (SSPs), and ad exchanges operate in the U.S., facilitating seamless RTB transactions. For instance, in January 2025, PubMatic announced rapid adoption of Activate, optimizing ad efficiency with direct premium inventory across CTV, video, display, and mobile, reducing CPMs by 13%, and enhancing transparency for advertisers. The country's strong internet penetration, mobile advertising growth, and increasing investment in connected TV (CTV) and video ads further expand RTB applications. Additionally, stringent data privacy regulations like CCPA encourage innovation in privacy-compliant targeting strategies, positioning the U.S. as a global leader in programmatic advertising and real-time bidding solutions.

Real-Time Bidding Market Trends:

Growing Digital Ad Spend

The rapid increase in digital ad spending is a major driver of the market, as advertisers seek more efficient ways to reach specific audiences. RTB enables advertisers to buy and sell ad space on an impression-by-impression basis, maximizing ad spend by targeting users in real-time based on their interests and behaviors. As digital media consumption grows, businesses are increasingly moving their budgets from traditional advertising channels to digital platforms, where RTB allows for precise audience segmentation. This transition is particularly noticeable in North America, where brands prioritize digital engagement strategies to improve ROI and streamline ad campaigns, making RTB a key component in achieving cost-effective advertising that aligns with user preferences. The largest digital ad platform, Alphabet/Google, generated 0.85% of the U.S. GDP in 2023, according to data from the Federal Reserve Bank of St. Louis. Meta/Facebook contributed another 0.47% of total output, with digital advertising accounting for roughly 77% of the former's revenue and 98% of the latter. The advertising operations of other significant players have also expanded. For example, Amazon's earnings from digital advertising accounted for 0.17% of the GDP in 2023.

Significant Advancements in AI and Data Analytics

The growing advancements in AI and data analytics technologies are increasing the overall real-time bidding market share, allowing advertisers to deliver highly personalized and relevant ads to users. Through machine learning algorithms, advertisers can analyze vast amounts of user data, such as browsing habits, preferences, and real-time behaviors, to predict the likelihood of engagement and conversion. This data-driven approach enhances the accuracy of ad targeting and improves campaign effectiveness, as RTB platforms optimize ad placements in real time. Moreover, AI allows advertisers to reduce ad fraud and improve security, protecting investments. The rise in programmatic advertising, driven by AI capabilities, empowers marketers to make informed decisions and achieve higher returns on digital ad spend, thereby fueling the market growth. Adaptive machine learning (ML) techniques have led to notable advancements in real-time bidding (RTB). The efficiency of adaptive machine learning (ML) in RTB is shown in a number of case studies, which improve campaign performance and ROI. For instance, a top UK ad exchange company used reinforcement learning to create a cutting-edge real-time bidder that outperformed conventional techniques by 10.5% on real-world datasets. This success story demonstrates how adaptive machine learning may be used to improve ad income and optimise bidding methods.

Rise in Mobile and Video Advertising

The rise in mobile device usage and the popularity of video content are propelling the demand for RTB, as advertisers prioritize mobile and video ad formats to engage audiences. RTB platforms enable real-time bidding for video and mobile ad spaces, helping advertisers reach consumers effectively across devices, which, in turn, is contributing to the real-time bidding market growth. As video content gains traction on social media and streaming platforms, RTB allows advertisers to capture users' attention through dynamic and interactive ads. The shift to mobile-first strategies also benefits from RTB, as it enables location-based targeting and in-app advertising, reaching users on the go. This focus on mobile and video formats aligns with evolving consumer behavior, making RTB a powerful tool for brands aiming to deliver high-impact advertising experiences. An astounding 87% of marketers say that sales videos have directly increased sales, according to an industry poll. According to projections, by 2029, mobile devices are expected to account for 89% of all ad spending in the digital video advertising market.

Real-Time Bidding Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global real-time bidding market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on auction type, advertisement format, application, and device.

Analysis by Auction Type:

- Open Auction

- Invitation-Auction

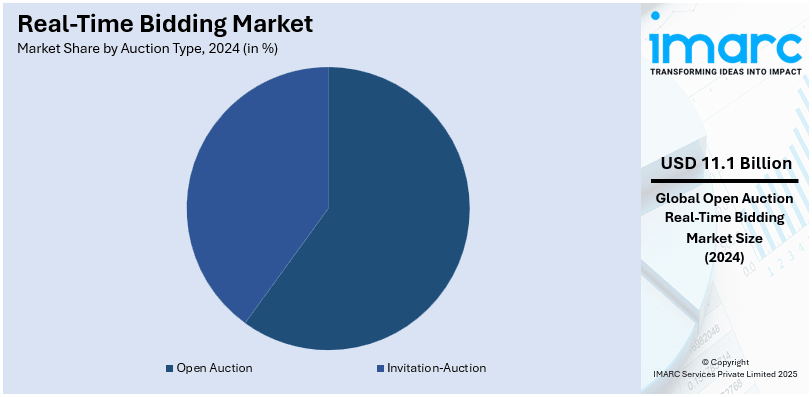

Open auction leads the market with around 58.8% of market share in 2024. This dominance emanates from openness, large reach, and cost efficiency permitting advertisers to bid in a competitive marketplace. The open auction permits real-time advertisements across many publishers for maximum exposure and fill rates for advertisers and publishers. This surge is also being fed by the ever-increasing demands for programmatic advertising solutions, AI-driven targeting, and cross-device advertising. Additionally, advancements in fraud detection, viewability measurement, and data-driven bidding strategies have made it even more responsive, and hence the open auction remains the preferred mode of execution for digital advertising campaigns across display, mobile, video, and connected TV channels.

Analysis by Advertisement Format:

- Video

- Image

Video leads the market in 2024, driven by the growing popularity of streaming platforms, mobile video consumption, and connected TV advertising. The advertisers' preference for video is due to its high engagement rates, storytelling appeal, and solid-return-on-investment capabilities. The advent of AI programmatic bidding and dynamic ad insertion allows for precise targeting, enabling brands to reach the audience in real time. Apparently, the growth of social media channels, short-form videos, and interactive ad formats aids the demand. The progress in viewability tracking and fraud prevention gives advertisers more confidence, making video the unrivaled ad format that has captured the imaginations of programmatic advertisers across all digital and mobile horizontals.

Analysis by Application:

- Media & Entertainment

- Retail and E-commerce

- Games

- Travel & Luxury

- Mobile Applications

- Others

In 2024, retail and e-commerce emerge as the dominant sectors in the real-time bidding market, driven by increasing digital ad spending, data-driven targeting, and personalized marketing strategies. Retailers and online marketplaces leverage real-time bidding to optimize ad placements, enhance customer engagement, and maximize conversion rates. AI-powered algorithms analyze user behavior, enabling brands to deliver highly relevant ads across multiple platforms, including mobile, social media, and connected TV. The growing adoption of dynamic product ads, retargeting strategies, and omnichannel marketing further boosts demand. As consumer reliance on e-commerce expands, retailers continue to invest in programmatic advertising, making retail and e-commerce the leading sectors in real-time bidding for driving sales and brand visibility.

Analysis by Device:

- Mobile

- Desktop

- Others

In 2024, mobile leads the real-time bidding market, driven by the widespread adoption of smartphones, increasing mobile internet penetration, and the shift toward app-based advertising. Advertisers prioritize mobile programmatic ads to reach consumers through in-app and mobile web environments, leveraging AI-driven targeting for personalized, real-time engagement. The rise of video ads, rewarded ads, and interactive formats enhances user experience and ad effectiveness. Mobile gaming and social media platforms further fuel demand, with advertisers capitalizing on high engagement levels. Additionally, advancements in 5G technology and improved location-based targeting refine ad delivery, making mobile the dominant channel for real-time bidding. As mobile commerce grows, brands continue to invest in mobile RTB for enhanced reach and conversion optimization.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 42.5%. The region's dominance is driven by advanced digital infrastructure, high internet penetration, and widespread adoption of programmatic advertising. Major players such as Google, The Trade Desk, and Xandr operate extensively in the region, leveraging AI-powered bidding strategies to optimize ad placements. The increasing demand for connected TV (CTV), mobile advertising, and video ads further fuels market growth. Additionally, stringent data privacy regulations, such as the California Consumer Privacy Act (CCPA), encourage the development of transparent and compliant advertising strategies. With continued investment in AI-driven ad technologies, North America remains the leading market for real-time bidding in 2024.

Key Regional Takeaways:

United States Real-Time Bidding Market Analysis

US accounts for 83.7% share of the market in North America. According to reports, the advanced ecosystem of digital advertising, which contributed nearly 60% of all media advertising, is touted as the pushing force for the real-time bidding (RTB) business in America. As per the reports, RTB is gaining the attention of advertisers because it can confidently target them by gathering data from over 331 million active internet users and over 300 million smartphone users. The significance of RTB in the US is further highlighted by the rise of programmatic advertising, which now accounts for more than 80% of digital ad spending. Opportunities for RTB are growing as a result of increased investments in over-the-top (OTT) and connected TV (CTV), which reached more than USD 25 Billion in 2023, as per an industry report. Moreover, as per reports, there are around 240 million monthly active users on other social media sites such as Facebook and Instagram. Their advanced ad-delivery system further propels the demand for RTB. Demand-side platforms (DSPs) and data management platforms (DMPs) have become very common, so it is very easy to introduce RTB into marketing plans.

Europe Real-Time Bidding Market Analysis

The fact that the digital ad spend of the region fuels the growth of the RTB market in Europe can be credited to the huge dependence on programmatic advertising, accounting for more than half the total digital ad spending. Though a perceptional constraint when first implemented, the GDPR standards have standardized data usage protocols, and most marketers are confident to use RTB. Digital advertising is the largest advertising medium in Europe and accounts for 37.2% of total advertising revenue, IAB Europe being the European-level association for the digital marketing and advertising ecosystem. This means that the European economy benefits by Euro 526 Billion (USD 539.40 Billion) per annum due to digital advertising. The market shall grow as online advertising constitutes 51.9% of online video platform revenues and 81.5% of publisher revenues in the EU, reports state. With video ads forming a considerable portion of all programmatic spending, the growth in video advertising is especially visible in regions such as the UK, Germany, and France. In addition, advanced AI and machine learning technology allow for more precise targeting and personalization, which makes RTB an attractive option for marketers who are seeking ROI optimization.

Asia Pacific Real-Time Bidding Market Analysis

With more than 2.5 billion internet users, Asia-Pacific's RTB industry stands to reap the most from the contributions of countries like China and India. In fact, data already pegs programmatic ad buys at more than 80% of all digital ad spending in Asia, as per reports. Digital ad spend on mobile platforms is over half of the budget, underlining mobile internet usage being the order of the day. RTB is in great demand as marketers seek to customize their ads for online shoppers with the tremendous rise of e-commerce. According to estimates, retail eCommerce accounted for 21% of Asia Pacific's total retail sales as of 2023, a massive leap from 10.2% in 2019. Video-based programmatic ad spending is driven by the popularity of video content, given the hundreds of millions of monthly active users on platforms like YouTube and TikTok. Government programs in countries like South Korea and Singapore also facilitate the adoption of RTB technology by supporting the implementation of 5G and digital infrastructure.

Latin America Real-Time Bidding Market Analysis

Growing digital advertising usage is driving the market in Latin America. Industry reports indicate that digital ad spending accounted for more than 60% in Mexico in 2024, and more than 50% for Brazil, Colombia, Chile, and Argentina. Programmatic advertising accounted for nearly half of their digital ad spend; the nations included Brazil and Mexico. Mobile RTB growth also received a spurt due to the sharp increase in smartphone penetration, which already stands at above 70% in important areas. Social media usage is also another important driver; throughout the region, reports suggest over 300 million active users on platforms like Facebook, Instagram, and WhatsApp combined. In addition, with the rise in video streaming services, which includes regional players and platforms such as Netflix, there is considerable potential for video-based RTB campaigns.

Middle East and Africa Real-Time Bidding Market Analysis

As per an industry study, the rising use of digital advertising, which currently generates over USD 5 Billion annually, supports the RTB industry in Middle East and Africa. Increasing internet penetration rate in this region with more than 75% of people getting internet connectivity nowadays, thus increasing the front for the RTB solutions; more than 80% of the users are said to be accessing mobile internet in this area. Thus, there is a massive impact of mobile advertisements. The younger generation, which makes up about half of the population, is quite fond of social media sites such as Instagram and Snapchat, and this encourages programmatic advertising. The growth in digital video consumption, especially on YouTube and regional streaming services, also makes possible RTB in video advertising campaigns. There is also an increasing need to integrate AI technologies into RTB platforms, where advertisers can more effectively target the right audiences.

Competitive Landscape:

The real-time bidding (RTB) market is highly competitive, driven by the presence of global technology companies, ad exchanges, demand-side platforms (DSPs), and supply-side platforms (SSPs). Key players continuously innovate to enhance targeting accuracy, AI-driven bidding strategies, and fraud prevention measures. The increasing adoption of connected TV (CTV), mobile advertising, and AI-powered programmatic solutions fuels market expansion. For instance, in 2024, In 2024, Google Ads underwent significant changes, integrating AI-powered features for display ads, expanding Demand Gen campaigns, and enhancing Performance Max transparency. Advertisers gained greater control over search placements, while privacy updates encouraged first-party data use. These updates optimized ad efficiency, improved targeting, and refined automation. Additionally, regulatory compliance with GDPR and CCPA shapes data-driven advertising strategies. Strategic partnerships, acquisitions, and technological advancements remain critical for companies seeking to strengthen their market position in the evolving RTB ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the real-time bidding market with detailed profiles of all major companies, including:

- Adobe Inc.

- AppNexus Inc.

- Criteo SA

- Facebook Inc.

- Google LLC

- Match2One AB

- MediaMath, Inc.

- MoPub/ Twitter, Inc.

- PubMatic, Inc.

- Salesforce.com, inc.

- Smaato, Inc.

- The Rubicon Project, Inc.

- Verizon Media

- WPP plc

- Yandex Europe AG

Recent Developments:

- December 2024: Omnicom has publicly stated that it acquired Interpublic Group, thus forming a conglomerate of power in sales and marketing. This strategic shift is set to enhance digital capabilities, improve data-driven insights, and market services worldwide. The merger would elevate integrated marketing solutions by enhancement in branding, communication, and advertising capabilities.

- April 2024: Roblox has brought on PubMatic to help boost sales of video ads set to launch on the gaming platform later this year. The partnership with PubMatic will allow brands to purchase Roblox's video-ad inventory via real-time bidding directed at users aged 13 and above.

- November 2023: RTB launched a new generative AI solution that uses first-party publisher data to give marketers finer insights into their consumers. This generative AI tool will be assisting RTB House's core and performance-orientated services, while on the other hand gain in accuracy in relevance of content targeting via AdLook buying and auience segmentation through PrimeAudience tool.

- October 2023: Google Ads intended to adopt real-time bidding auctions for applications and to no longer Mediate Multiple Calls to Improve Media Purchasing Efficiencies. Google Ads therefore would not engage with or participate in mediation that would allow requests for the same ad impression to be serviced multiple times.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Auction Types Covered | Open Auction, Invitation-Auction |

| Advertisement Formats Covered | Video, Image |

| Applications Covered | Media & Entertainment, Retail and E-commerce, Games, Travel & Luxury, Mobile Applications, Others |

| Devices Covered | Mobile, Desktop, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Adobe Inc., AppNexus Inc., Criteo SA, Facebook Inc., Google LLC, Match2One AB, MediaMath, Inc., MoPub/ Twitter, Inc., PubMatic, Inc., Salesforce.com, inc., Smaato, Inc., The Rubicon Project, Inc., Verizon Media, WPP plc, Yandex Europe AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the real-time bidding market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global real-time bidding market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the real-time bidding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real-time bidding market was valued at USD 18.8 Billion in 2024.

IMARC estimates the real-time bidding market to reach USD 92.6 Billion by 2033, exhibiting a CAGR of 18.41% during 2025-2033.

The key factors driving the real-time bidding market include the growing adoption of programmatic advertising, AI-powered algorithms, and machine learning for optimized ad placements. These technologies enable precise audience targeting, real-time optimization, cost efficiency, and enhanced ad performance. Additionally, the expansion of mobile, video, and CTV advertising boosts RTB demand.

North America currently dominates the market with 42.5% share, driven by the region's strong adoption of programmatic advertising, advanced AI and machine learning technologies, and widespread use of digital platforms. Additionally, the growing demand for mobile, video, and connected TV (CTV) advertising further reinforces North America's market leadership.

Some of the major players in the real-time bidding market include Adobe Inc., AppNexus Inc., Criteo SA, Facebook Inc., Google LLC, Match2One AB, MediaMath, Inc., MoPub/ Twitter, Inc., PubMatic, Inc., Salesforce.com, inc., Smaato, Inc., The Rubicon Project, Inc., Verizon Media, WPP plc, Yandex Europe AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)