Real Estate Software Market Size, Share, Trends and Forecast by Type, Deployment, Application, End Use, and Region, 2025-2033

Real Estate Software Market Size and Share:

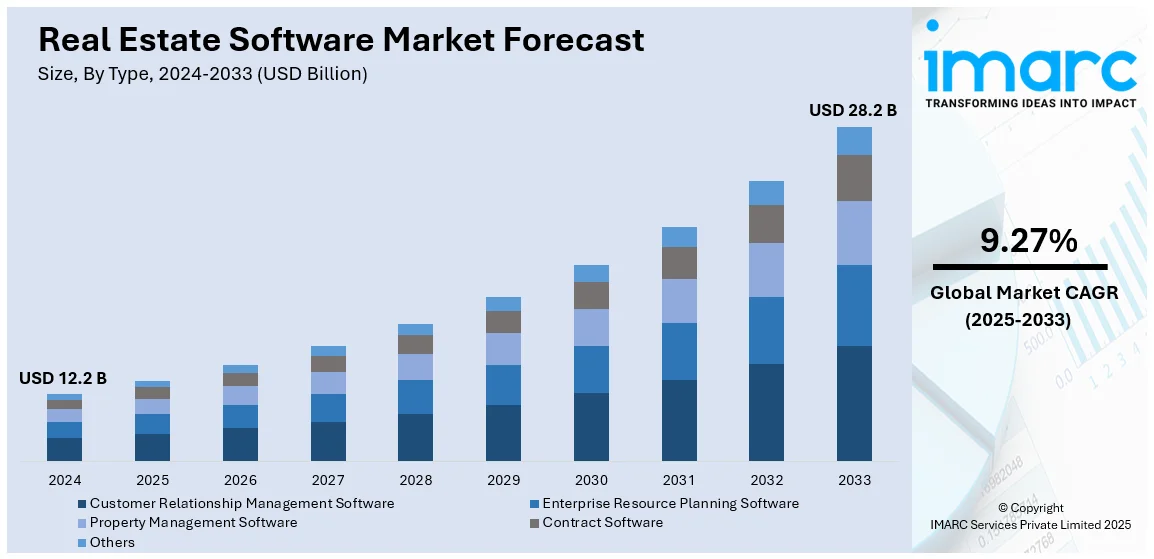

The global real estate software market size was valued at USD 12.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.2 Billion by 2033, exhibiting a CAGR of 9.27% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34% in 2024, driven by its advanced technological infrastructure, high digital adoption, and well-established real estate industry fostering growth and innovation.The growing demand for real estate software is primarily driven by the need for improved data management and analysis within the industry. As real estate companies handle vast amounts of data, advanced software solutions enable efficient organization, real-time insights, and better decision-making. This enhances operational efficiency, optimizes property management, and provides a competitive edge in the increasingly data-driven market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.2 Billion |

| Market Forecast in 2033 | USD 28.2 Billion |

| Market Growth Rate (2025-2033) | 9.27% |

A significant driver of the real estate software market is the growing demand for automation and digital transformation within the real estate sector. Businesses increasingly seek advanced solutions to streamline property management, enhance operational efficiency, and improve customer engagement. For instance, in 2025, Shaw Real Estate, LLC in Wilmington, NC, will transition to Yardi to streamline operations and enhance customer service while managing 578 residential units across multifamily and single-family properties for 100+ owners. Real estate software offers tools for managing listings, tracking leads, and automating routine tasks, reducing manual efforts and associated costs. Additionally, the growing use of cloud technologies and mobile apps facilitates instant data availability and smooth stakeholder collaboration, enhancing operational efficiency and decision-making in various industries. These technological advancements align with the industry's need for agility and scalability, fueling the adoption of real estate software globally.

The United States plays a pivotal role in the real estate software market, serving as a hub for innovation and technological advancement. With a well-established real estate industry and high digital adoption rates, the US fosters the development of cutting-edge software solutions tailored to market needs. Leading companies in the US drive innovation by offering advanced tools for property management, analytics, and customer relationship management. For instance, in 2024, Advanced Management Company (AMC) partnered with AppFolio to enhance property management across 62 communities and 12,000 units in Southern California, investing in future growth and operational efficiency. Additionally, the widespread use of cloud computing, mobile platforms, and AI-powered solutions enhances operational efficiency and decision-making. The robust investment climate and demand for scalable, customizable solutions further position the US as a key contributor to the global market.

Real Estate Software Market Trends:

Rising Collaborations

Another significant trend in the real estate software market is the growing number of strategic partnerships and collaborations between technology providers, real estate companies, and other industry stakeholders. As the demand for more sophisticated and integrated solutions increases, companies are joining forces to deliver comprehensive platforms that address the diverse needs of property management, leasing, and sales. Partnerships between real estate firms and software developers enable the creation of tailored, industry-specific solutions that enhance operational efficiency and user experience. For example, in July 2024, IBM and one of the real estate companies, JLL, partnered to launch a global sustainability solution using IBM Envizi ESG Suite software to help the commercial real estate sector manage ESG data, drive decarbonization strategies, and enhance sustainability reporting for clients. Additionally, these partnerships enable the incorporation of advanced technologies, including AI, IoT, and big data analytics, significantly enhancing the functionality and performance of real estate software platforms. By forming these alliances, companies can expand their market reach, share resources, and innovate faster to stay competitive in a rapidly evolving market.

Increasing Cloud-Based Platforms

Cloud-based platforms improve data sharing by providing secure and real-time access to information for multiple users, such as MLSs, brokerages, and appraisers. These platforms enhance collaboration, streamline processes, and offer scalable solutions, making data management more efficient and accessible for the industry. For instance, in August 2024, Rexdat launched a cloud-based, subscription-based real estate data-sharing platform to streamline property listings and data access for MLSs, brokerages, and appraisers. It also aids in reducing costs and enhancing collaboration among real estate professionals through a unified source for property information. This is escalating the real estate software market demand. The growth of cloud adoption is also linked to the increasing demand for mobile-friendly applications that provide seamless property management and customer interaction capabilities.

Growing Adoption of Mobile-First Solutions

A growing trend in the real estate software market is the shift toward mobile-first solutions. As mobile device usage continues to rise, real estate companies are increasingly developing software platforms optimized for smartphones and tablets. For example, in May 2024, Hemlane introduced a free version of its management software for landlords. This new offering provides essential tools, such as tenant screening, rental accounting, and AI-powered listing features, thereby helping landlords manage properties efficiently and attract qualified tenants without additional costs. These mobile-first solutions offer greater accessibility and convenience, allowing property managers, tenants, and prospective buyers to manage properties, schedule appointments, make payments, and access documents on the go. The ability to manage tasks remotely through mobile apps is enhancing efficiency and improving customer satisfaction. Additionally, mobile-first solutions are enabling real-time updates, instant communication, and enhanced data security, making them an essential component of modern real estate operations. This trend reflects the industry's commitment to meeting the evolving needs of mobile-savvy users and staying competitive in a fast-paced market.

Incorporation of Advanced Technologies

The integration of advanced technologies such as big data, artificial intelligence (AI), virtual reality (VR), augmented reality (AR), blockchain, and the internet of things (IoT) to enhance functionality is bolstering the market growth. These innovations are transforming the industry by improving operational efficiency, enhancing transparency, and elevating the consumer experience. AI and big data analytics are enabling real estate organizations to make more informed decisions, optimize property listings, and predict market trends with greater accuracy. Blockchain technology is improving transparency by ensuring secure and immutable property transactions, while VR and AR is revolutionizing property viewing by offering immersive, virtual tours for prospective buyers. Additionally, IoT devices are being incorporated into smart buildings, enhancing the management of facilities and improving energy efficiency. In 2025, RSoft launched RealtorsRobot, an AI-powered real estate CRM designed for builders, brokers, developers, and marketers. The software helps manage client relationships, optimize lead management, and improve operational efficiency with features like AI-based lead management, automated follow-ups, and real-time analytics. It also integrates seamlessly with over 1500 tools and offers mobile access for improved productivity.

Real Estate Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global real estate software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, deployment, application, and end use.

Analysis by Type:

- Customer Relationship Management Software

- Enterprise Resource Planning Software

- Property Management Software

- Contract Software

- Others

Customer relationship management software leads the market with around 28.3% of market share in 2024. The driving force behind this dominance is the increasing need of real estate businesses to manage interactions with clients, streamline communication, and improve customer experiences. Advanced tools offered by CRM solutions allow for lead tracking, contact management, follow-up automation, and customer data analysis to enable businesses to convert leads at higher rates and foster long-term relationships with clients. The inclusion of artificial intelligence and machine learning adds another layer of functionality to CRMs, including predictive analytics and personalized recommendations. As real estate companies focus on customer-centric strategies, the adoption of CRM software is increasing, thereby making it an important segment of the market.

Analysis by Deployment:

- Cloud

- On-Premises

Cloud leads the market with around 55% of the market share in 2024. This leadership is because of the flexibility, scalability, and cost-effectiveness that cloud technology provides to businesses in the real estate sector. Cloud-based platforms allow access to data, real-time collaboration between stakeholders, and integration with other software solutions to enhance operational efficiency and decision-making. Moreover, the growing adoption of remote working models and reliance on mobile applications have accelerated demand for cloud-based systems. These solutions provide better security, automatic updates, and reduced costs on IT infrastructure. These are also preferred by the business world. The industry is going through a complete digital transformation. Cloud technology continues to be at the heart of growth and innovation.

Analysis by Application:

- Commercial

- Residential

Residential leads the market with around 54.8% of the market share in 2024. This is due to the rising demand for advanced solutions in the management of residential properties, which include apartments, single-family homes, and condominiums. Residential real estate software facilitates some of the property management tasks, such as the tracking of tenants, lease management, scheduling of maintenance, and financial reporting, and is an essential software for the property manager and landlord. Further, the growth in the urban population and the increase in investment in residential real estate stimulate its adoption. Apart from this, integrating technologies like artificial intelligence and mobile platforms make user experience easier with efficient operation. All these elements make the residential segment stronger than others, positioning it as a market leader.

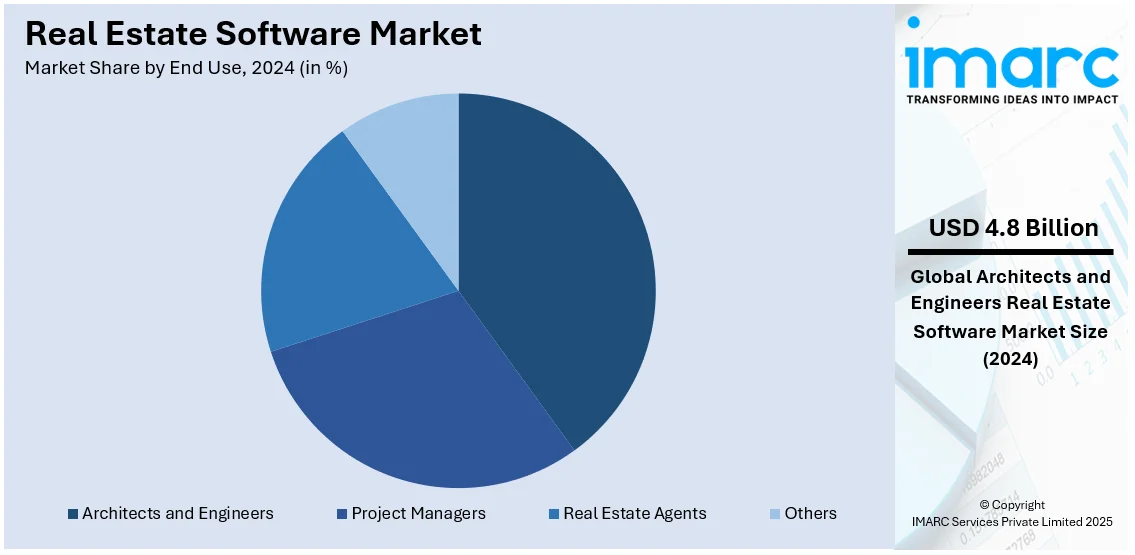

Analysis by End Use:

- Architects and Engineers

- Project Managers

- Real Estate Agents

- Others

Architects and engineers lead the market with around 38.9% of the market share in 2024. This is because the need for more sophisticated tools to aid in design, planning, and project management in real estate development is on the rise. Architect and engineer-specific software streamlines workflow by providing features such as 3D modeling, computer-aided design (CAD), project visualization, and collaboration tools. Such solutions promote accuracy, efficiency, and creativity in meeting the demands of complex projects. The Building Information Modeling (BIM) software rapidly expands this segment, allowing for integrated data applied towards better decision-making. As construction and infrastructure projects expand globally, architects and engineers are indispensable drivers of the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34%. Advanced technological infrastructures, extremely high digital adoption rates, and a highly well-established real estate sector form this leadership. North American businesses are increasingly using real estate software in order to optimize operations, improve customer experiences, and have an edge over competitors. The competition developed by the use of cloud-based solutions, mobile applications, and AI-driven tools has further spurred the growth of this market. Moreover, the key players of the industry and solid research and development investment help make this region strong. Innovation along with customer-centric solutions will always help North America remain the global leader in the real estate software market.

Key Regional Takeaways:

United States Real Estate Software Market Analysis

US accounts for 84.3% share of the market in North America. The growth of the U.S. population is a significant driver of the real estate software market, fueled by demographic shifts and increased demand for housing and property management solutions. As reported by the U.S. Census Bureau, the population of the country increased by almost 1.0% from 2023 to 2024, with net international migration being the primary factor driving this growth. Net international migration refers to the change in residence of people moving into or out of the 50 states or the District of Columbia. Such demographic growth has been associated with an increase in the demand for real estate, particularly in urban and suburban regions, thereby prompting property managers and real estate companies to implement the most advanced software available for the facilitation of such activities. Tools for property management, CRM, and predictive analytics are now essential tools in efforts to cater to the growing housing demand and provide reams of growth in the real estate portfolios. Together, these factors continue to fuel the growth of the U.S. real estate software market.

Europe Real Estate Software Market Analysis

The Europe real estate software market is expected to experience significant growth as ambitious sustainability goals and increasing investment activity continue to drive the region. The European Commission has established an ambitious goal to at least double renovation rates by 2050, emphasizing energy efficiency and sustainable infrastructure across the area. This will speed up demand for advanced real estate software to manage renovation projects, optimize energy performance, and ensure regulatory compliance. This is in addition to real estate investment activity in the U.K. and other major European markets, which is expected to surge by 15% next year, according to industry reports. The investments have increased with rising demand for modernized residential and commercial properties, which has created a necessity for digital solutions, such as property management software, customer relationship management, and analytics platforms. These technologies enable efficient portfolio management, tenant engagement, and data-driven decision-making altogether in line with the region's push toward sustainable and technology-driven real estate operations.

Asia Pacific Real Estate Software Market Analysis

The rapidly growing Indian real estate market is the major impeller of the Asia-Pacific real estate software market. Investments are on the rise, coupled with economic contributions that influence this growth. According to IBEF, the country's real estate sector is expected to reach USD 5.8 trillion by 2047, with its GDP share growing from 7.3% to 15.5%. Institutional investments rise 51% in 2024 to USD 8.87 billion due to demand for residential, office, and warehouse spaces. This points out that increasing complexity in operations calls for improved software solutions in real estate management for an efficient handling of property, better tenant engagement, and data-driven decisions. Urbanization trends and growing investments in the property sector in the Asia-Pacific region are driving the demand for customer relationship management (CRM) tools, project management platforms, and predictive analytics. The boom in India's real estate market is a precedent, and the broader Asia-Pacific market will continue to experience the adoption of real estate software, which will help companies seize growth opportunities and increase operational efficiency.

Latin America Real Estate Software Market Analysis

Latin America's real estate software market is rising with increasing foreign investment and spreading real estate activity, especially in Brazil. This is evident because the real estate market in Brazil depicts a 15% increase in foreign investment since 2023, according to reports, whereby the interest overseas is high with respect to residential, commercial, and industrial properties. This has prompted the need for modern real estate management solutions to help optimize operations, manage diverse portfolios of properties, and improve relations with investors. With foreign investment driving large-scale property development and acquisitions, there is an increased reliance of real estate companies on advanced software for tasks including project management, tenant engagement, and regulatory compliance. Adoption of cloud-based platforms, customer relationship management, predictive analytics by the businesses indeed helps streamline workflow and take data-driven decisions. Brazil is really driving the growth in the region, so the needs of real estate software shall emerge across Latin America and help in supporting the sector's evolution.

Middle East and Africa Real Estate Software Market Analysis

The Middle East and Africa real estate software market is expected to experience a growth spurt because of the accelerated expansion of key real estate hubs, such as Dubai. As per the Dubai Real Estate Market Forecast for 2025, yearly price increases are projected to be between 5-8%, with average rental returns at 7%. Industry reports have shown that, in 2023, Dubai experienced a 34% increase in transaction values, with off-plan properties making up 60% of the sales. Such a market indicates that there is an increased demand for sophisticated real estate software to handle transactions, optimize property portfolios, and enhance investor relations. Real estate companies are resorting to software solutions, including property management systems, CRM tools, and predictive analytics, to manage increasing complexity in operations. The growth in the off-plan sales also indicates the necessity for project management platforms that would track the construction progress and ensure the delivery of projects on time. Overall, thriving in the Dubai market creates a benchmark across the Middle East and Africa region as regards real estate technology adoption to further drive regional growth.

Competitive Landscape:

The real estate software market exhibits a competitive environment shaped by prominent global firms and rising startups, driving significant rivalry and innovation. As the industry evolves, the real estate software market forecast predicts substantial growth, with increasing demand for advanced solutions that streamline property management, enhance customer experiences, and support data-driven decision-making across real estate businesses. Leading players prioritize innovation, utilizing advancements like AI, cloud platforms, and data analytics to improve their solutions. For instance, in June 2024, AppFolio introduced Realm-X, an embedded AI platform enhancing property management productivity. New capabilities include AI-driven tools like Realm-X Assistant and Messages for task automation and real-time assistance, along with Realm-X Flows for customizable workflow automation. These innovations streamline operations, boosting efficiency and enabling property managers to focus on resident services. Additional platform enhancements target student and affordable housing, alongside AppFolio Stack marketplace expansion. Strategic initiatives, including mergers, acquisitions, and partnerships, are common as firms aim to expand their market share and geographic reach. Personalized offerings designed to address varied customer requirements, combined with strong client assistance, act as key distinguishing elements. Additionally, growing investments in R&D and the launch of user-friendly, feature-rich platforms contribute to the dynamic and competitive nature of this market.

The report provides a comprehensive analysis of the competitive landscape in the real estate software market with detailed profiles of all major companies, including:

- Altus Group Ltd.

- AppFolio Inc.

- CoStar Group Inc.

- Fortive Corporation

- LanTrax Inc.

- MRI Software LLC

- RealPage Inc.

- SAP SE

- Yardi Systems Inc.

Latest News and Developments:

- July 2024: Lone Wolf Technologies launched Lone Wolf Foundation, an end-to-end platform for the real estate industry. This comprehensive software integrates key real estate functions, from websites and CRM to transactions, accounting, and insights, all in one platform. It includes new tools like Lone Wolf Back Office, Transact, and Front Office, designed to streamline operations for agents, brokers, and developers.

- June 2024: Commonwealth Bank of Australia (CBA) announced a partnership with MRI Software to integrate CBA’s Smart Real Estate Payments solution into MRI’s Property Tree software. This collaboration will streamline rental payment processes, offering tenants flexible payment options and improving efficiency for property managers and agents. The solution will support major digital payment types and enhance payment security.

- March 2024: VTS launched VTS 4, a new software platform powered by the VTS Demand Model, offering AI-driven predictive data to commercial real estate landlords. The platform aggregates over 300 million data points to forecast tenant demand 6-9 months in advance and provides insights into supply, demand, marketing, and pricing. It also expands VTS Data to the London market, enhancing global real estate intelligence.

- August 2024: Rexdat introduced a subscription-based platform for sharing real estate data in the cloud. This unified platform simplifies property listings and data retrieval for MLSs, brokerages, and appraisers.

- July 2024: IBM collaborated with real estate firm JLL to introduce a worldwide sustainability solution utilizing IBM Envizi ESG Suite software. This partnership seeks to assist the commercial real estate industry in managing ESG data, promoting decarbonization initiatives, and improving sustainability reporting for clients.

- May 2024: Hemlane launched a no-cost version of its real estate software that offers key tools like tenant screening, rental accounting, and AI-driven listing capabilities, thus aiding landlords in managing properties effectively and drawing in qualified tenants without extra expenses.

Real Estate Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Customer Relationship Management Software, Enterprise Resource Planning Software, Property Management Software, Contract Software, Others |

| Deployments Covered | Cloud, On-Premises |

| Applications Covered | Commercial, Residential |

| End Uses Covered | Architects and Engineers, Project Managers, Real Estate Agents, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altus Group Ltd., AppFolio Inc., CoStar Group Inc., Fortive Corporation, LanTrax Inc., MRI Software LLC, RealPage Inc., SAP SE, Yardi Systems Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the real estate software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global real estate software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the real estate software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate software market was valued at USD 12.2 Billion in 2024.

IMARC estimates the real estate software market to reach USD 28.2 Billion by 2033, exhibiting a CAGR of 9.27% during 2025-2033.

Key factors driving the real estate software market include increasing demand for automation, digital transformation, and enhanced operational efficiency. The adoption of cloud-based solutions, mobile applications, AI, and data analytics also plays a crucial role. Additionally, the need for improved customer experiences and streamlined property management fuels market growth.

North America currently dominates the market with a 34% share. This leadership is driven by the region's advanced technological infrastructure, high adoption of digital solutions, and a robust real estate sector. Strong investments in innovation and the presence of key market players further support this dominance.

Some of the major players in the real estate software market include Altus Group Ltd., AppFolio Inc., CoStar Group Inc., Fortive Corporation, LanTrax Inc., MRI Software LLC, RealPage Inc., SAP SE, Yardi Systems Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)