Rayon Fibers Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Rayon Fibers Market Size and Share:

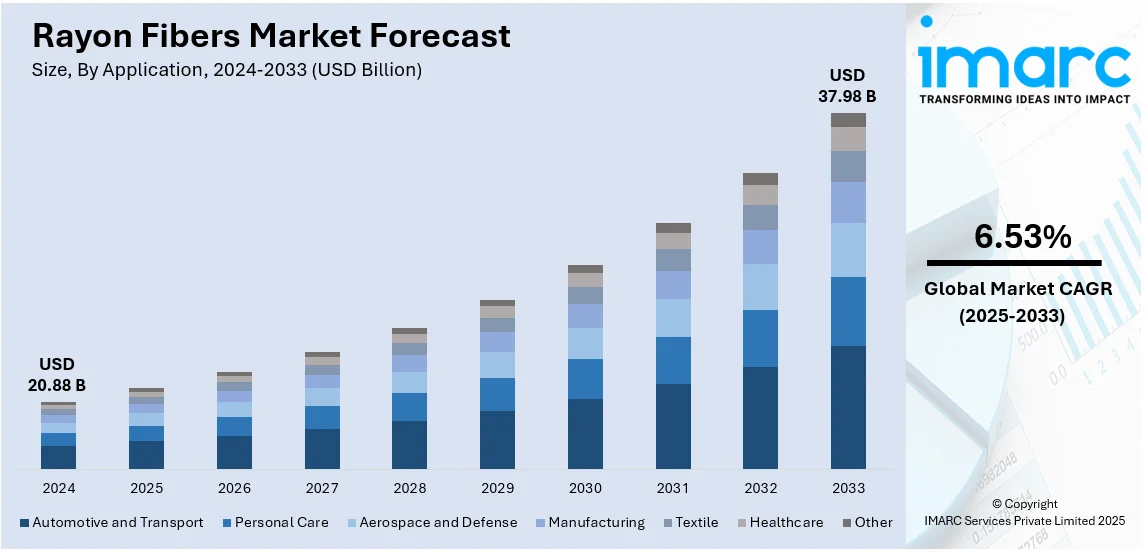

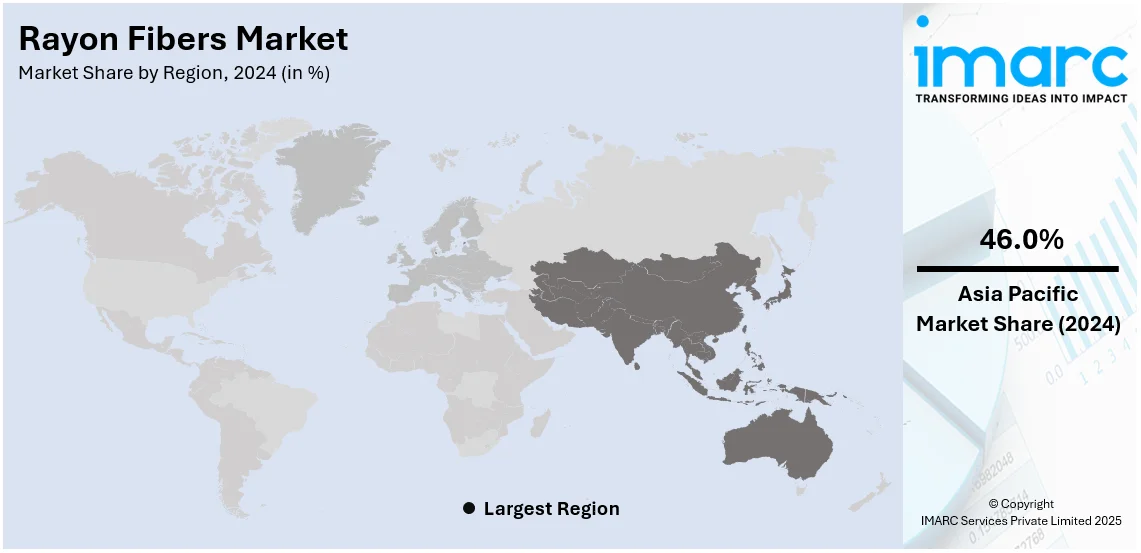

The global rayon fibers market size was valued at USD 20.88 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.98 Billion by 2033, exhibiting a CAGR of 6.53% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 46.0% in 2024. The rising focus on sustainability and biodegradability, the rapid expansion of the textile industry in developing economies, and continuous technological advancements in manufacturing are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.88 Billion |

|

Market Forecast in 2033

|

USD 37.98 Billion |

| Market Growth Rate (2025-2033) | 6.53% |

Rayon fibers are synthetic materials made from regenerated cellulose, typically derived from wood pulp or cotton linters. These fibers undergo a chemical process to transform the natural cellulose into a soluble compound, which is then dissolved and extruded through a spinneret to form filaments. The resulting fibers are characterized by their high absorbency, soft texture, and the ability to be dyed in vivid colors. Rayon is versatile, blending well with other fibers, and is commonly used in textiles like clothing, upholstery, and home furnishings. However, the fiber tends to weaken when wet and may shrink or stretch over time. At present, rayon fibers find extensive applications, offering a cost-effective and highly adaptable solution for manufacturers and consumers alike.

The rise in consumer awareness and preference for comfort in apparel is likely to contribute to the market growth of rayon fibers throughout the forecast period. Rayon fibers provide excellent drape quality and soft smooth texture, hence very much preferred in casual as well as in formal clothing. The increasing usage of rayon fibers in the health and hygiene sector for production, since they have an efficient absorbency with non-irritating properties, has thereby stimulated growth in the market. Simultaneously, the allowance of the combination of rayon with other fibers allows manufacturers to optimize specific characteristics in finished textile products, such as durability, softness, or moisture-wicking abilities. Rayon fibers are highly sought after across various industries, such as automotive, home furnishings, and filtration processes. This diversifies the market for rayon fibers. Moreover, improvements in global supply chains as well as trade liberalization are connecting rayon fibers to manufacturers globally, which is driving the growth of the market. Apart from this, improved logistics and distribution networks ensure that Rayon fibers can be easily sourced and integrated into various manufacturing processes across different regions, which fuels market growth.

The growth of the rayon fibers market in the USA is mainly driven by the increasing demand from consumers for sustainable and eco-friendly textiles. Rayon, being a semi-synthetic fiber derived from renewable cellulose sources, appeals to environmentally conscious consumers seeking alternatives to traditional synthetic fibers. This upward trend will also be supported by superior-quality production techniques that make rayon more qualitative and versatile, with which it garners a lot of demand in clothes and home textiles. Furthermore, the textile industry's inclination towards biodegradable and eco-friendly products aligns with the properties of rayon, thereby also supporting the growth in the market. U.S. market's significant share signifies that the country plays a pivotal role for the present and future growth of the global rayon fibers industry.

Rayon Fibers Market Trends:

Heightened Emphasis on Sustainability and Biodegradability

The escalating focus on sustainability worldwide is a significant market driver for rayon fibers. Consumers and businesses are increasingly prioritizing eco-friendly materials, and rayon, being derived from natural cellulose, fulfills this demand. Unlike synthetic fibers like polyester, rayon is biodegradable, which further adds to its appeal among environmentally conscious consumers. The European Environment Agency states that textile purchases within the EU produced around 270 kg of CO₂ emissions in 2020. This translates to greenhouse gas emissions of 121 million tonnes from textile products consumed within the EU. Companies are eager to align their operations with global sustainability goals, which often include integrating biodegradable materials into their supply chain. Therefore, the increased focus on sustainability further enhances consumer demand for rayon and positively impacts corporate procurement decisions, which is a growth driver for the market.

Rapid Growth of the Textile Industry in Developing Economies

The fast growth of the textile industry, particularly in emerging economies such as India, China, and Bangladesh, is the other major growth driver for the rayon fibers market. As these economies grow, so do disposable income levels, meaning there is an increased consumption of clothing and home textiles, mostly consisting of or mixed with rayon. Its flexibility and attractive aesthetic appeal have caused rayon to become an important component in such products either in the pure form or mixed with other fibers. Besides, the textile industries in these countries have invested heavily with both domestic and foreign investments. They have also been favored by sound policy frameworks that encourage the manufacturers to be sustainable and efficient. According to an industry report, 45 million people are employed in the textile sector alone in India. The government is considering increasing the budgetary allocation of the textile ministry by around 10-15% for the year 2025/26 from current INR 4,417 Crore, or USD 511 Million, to further strengthen growth. Government policies in the form of tax benefits, subsidies, and eased regulations are also actively promoting an environment for doing business that will help to adopt Rayon fibers. In addition to this, the development of these economies as global textile production centers is further encouraging export-based production, thereby increasing the spread and demand of rayon around the world.

Increasing Technological Innovations in Production

Innovations in the production of rayon enable the creation of rayon fibers with improved properties, such as higher tensile strength, better retention of dyes, and reduced environmental impact. For example, closed-loop systems allow chemicals to be recycled instead of being lost to waste and waste footprint. One of the good examples is Kelheim Fibres GmbH, which showcased its innovations at the Global Fibre Congress in September 2023. The company stressed waste management and recycling innovations that help strengthen the European supply chain. These innovations are in line with efforts aimed at improving the sustainability of the production processes for rayon. In addition to this, modern manufacturing techniques are concerned with the reduction of hazardous chemicals in use, replacing them with bio-based solvents, and applying techniques for emission capture and reuse, thus making the production process more sustainable. Such advancements are opening new integer for the use of rayon in higher performance industrial applications, like car components and advanced filtration systems, because of the development of new types of rayon fibers designed to have specific performance characteristics, from fire-resistance to anti-microbial properties. As a result, the increasing scope of applications of rayon fibers is providing an impetus to the market growth.

Rayon Fibers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rayon fibers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

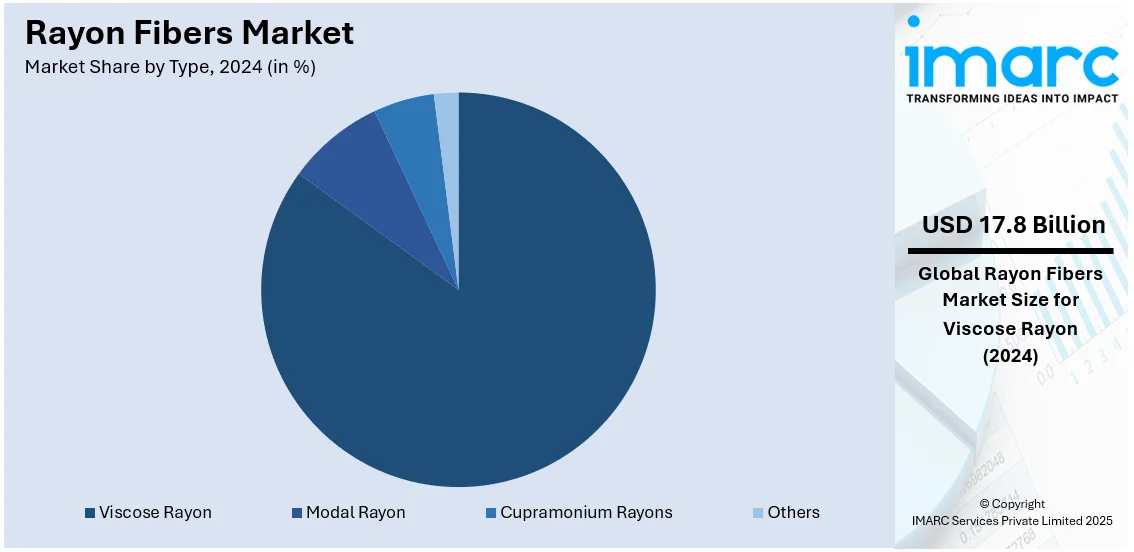

Analysis by Type:

- Viscose Rayon

- Modal Rayon

- Cupramonium Rayons

- Others

Viscose rayon dominates the market with 85.3% shares. It closely mimics the feel and texture of natural fibers like cotton and silk, making it highly desirable for use in apparel, home textiles, and upholstery. Its excellent drape and vibrant color retention are particularly valued in the fashion industry. Additionally, viscose rayon's high absorbency makes it suitable for hygiene products like sanitary napkins, baby diapers, and medical dressings. Besides this, the manufacturing process for viscose rayon is well-established and widely understood, facilitating large-scale production. This efficiency in production meets the high demand and keeps the costs relatively low, making it an attractive choice for both manufacturers and consumers. Furthermore, advances in manufacturing technologies have enabled the development of various types of viscose rayon with specialized properties, such as high-tenacity rayon for industrial uses or modal and lyocell, which offer enhanced comfort and sustainability features. This adaptability allows viscose rayon to penetrate multiple markets more effectively than other types of rayon, further contributing to the segment growth.

Analysis by Application:

- Automotive and Transport

- Personal Care

- Aerospace and Defense

- Manufacturing

- Textile

- Healthcare

- Other

The textile segment leads the market, driven by the fiber's properties and aesthetic appeal, including its soft texture, natural sheen, and excellent drape that make it highly desirable for diverse clothing items, ranging from casual wear to formal attire. Its capability to be dyed in vivid, long-lasting colors further elevates its suitability for fashion applications. In addition, rayon's versatility enhances its value in the textile sector as it can be easily blended with other fibers such as cotton, polyester, and wool to create fabrics with optimized characteristics. For instance, blending Rayon with cotton can result in a material that combines the breathability of cotton with the smooth texture of Rayon, making it ideal for comfortable, everyday wear. Moreover, consumer preferences for sustainable and biodegradable materials are more prominent in the textile industry compared to other sectors. Given rayon's origin from natural cellulose, it aligns well with the increasing demand for eco-friendly apparel and home textiles. This consumer-driven shift toward sustainability fuels the segment growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the report, Asia Pacific accounted for the largest market share at 46.0% share. Asia Pacific is home to rapidly expanding textile industries, particularly in countries like China, India, and Bangladesh. These nations have vast domestic markets and are also major exporters of textile products, leading to a high demand for Rayon fibers. Apart from this, the abundant availability of raw materials, such as wood pulp and cotton linters, in the Asia Pacific facilitates easier and more cost-effective production. This is complemented by relatively lower labor costs, making the manufacturing process economically advantageous. Furthermore, policy support from governments in the region encourages industrial growth and foreign investments. Various incentives, such as tax benefits and subsidies for sustainable practices, create a favorable business environment for rayon fiber production. Moreover, consumer behavior in the Asia Pacific region plays a significant role. The expanding middle-class population with increased disposable incomes and the growing awareness of sustainability are driving consumer preferences toward products that incorporate rayon. With its ability to offer both affordability and quality, rayon fibers align well with the industry dynamics in this region, positioning Asia Pacific as a leading regional market.

Key Regional Takeaways:

North America Rayon Fibers Market Analysis

The North American rayon fibers market is growing significantly, driven by a combination of consumer demand for sustainable textiles and the region's robust industrial infrastructure. This growth is attributed to the region's well-established textile and apparel industry, which emphasizes eco-friendly materials, aligning with the increasing consumer preference for sustainable and biodegradable textiles. Besides this, improvements in manufacturing technologies and proactive approach toward sustainable practices have further supported the adoption of rayon fibers in various applications such as apparel, home textiles, and industrial products. North America continues to give importance to environmental sustainability, which is likely to sustain the expansion of the rayon fibers market in the future.

United States Rayon Fibers Market Analysis

The U.S. rayon fibers market is growing at a steady pace with the country maintaining a strong position in the world textile industry. The U.S. is the world's second-largest exporter of textile-related products, having exported over USD 29 Billion worth of such products in 2021, according to ITA. It reflects the solid manufacturing capabilities in the country and high demand for textile raw materials, like rayon fibers. The rising focus on sustainable and biodegradable fibers has also increased the demand for rayon in the U.S. market, as the fashion and home textile brands are moving toward eco-friendly alternatives. In addition, advancements in fiber processing technology and growing investments in sustainable textile production are driving the demand for rayon. The growing consumer preference for soft, breathable, and moisture-absorbing fabrics is also expanding the market. In addition, the major apparel brands and textile manufacturers in the U.S. are accelerating the adoption of rayon fibers, thus ensuring steady market growth in the coming years.

Europe Rayon Fibers Market Analysis

Europe is showing steady growth in rayon fibers, underpinned by a strong position held by the region in the international apparel industry. Being an apparel manufacturing as well as hub in the fashion textiles sector, this continent has several the world's prominent apparel brands under its umbrella, based in this region. CBI Ministry of Foreign Affairs noted that the European Union apparel import market reached Euro 191.4 Billion (USD 199.1 Billion) in 2022. This high import value reflects the tremendous demand for raw materials in textile production, in particular rayon fibers, with applications in apparel, home textile, and other industrial uses. The increasing concern of consumers with sustainable and bio-degradable fabrics further helps in the absorption of rayon fibers as the most eco-friendly alternative among synthetic materials. Additionally, technological advancements in fiber processing and innovation in textile manufacturing are driving the market. Growing interest in sustainability and circular fashion is expected to boost the European market's consumption of rayon fibers further.

Asia Pacific Rayon Fibers Market Analysis

The Asia Pacific rayon fibers market is showing a high growth rate due to expansion in the textile and apparel sector in the region. Being one of the largest global textile manufacturing centers, Asia Pacific reaps from increasing exports and government programs that increase innovation in the sector. In FY25 (April–June), exports of ready-made garments, including accessories, reached USD 2,244 million, according to IBEF. This is indicative of the rising demand for textile materials, which includes rayon fibers, as these are used extensively in garment production. Moreover, in June 2023, the government sanctioned R&D projects worth INR 61.09 Crore (USD 7.4 Million) in the textile sector, IBEF reports. These investments will help upgrade the manufacturing capabilities of textiles and encourage the use of sustainable fiber alternatives like rayon. Rising preference for eco-friendly fabrics, coupled with strong government support and robust export performance, is likely to result in a steady growth of demand for rayon fibers in Asia Pacific, thus positioning the region as a global textile industry hub.

Latin America Rayon Fibers Market Analysis

Latin America is experiencing steady growth in rayon fibers due to the growth in textile and apparel manufacturing in the region. Brazil, one of the major players in the Latin American textile sector, exported USD 4.92 Billion in textiles and ranked as the 34th largest textile exporter in the world, according to OEC. In the same year, textiles ranked as the 13th most exported product in Brazil, thereby showing the good manufacturing and exporting capabilities of the country. The rising demand for sustainable and versatile fibers such as rayon is further propelling market expansion as textile manufacturers look for eco-friendly alternatives to meet global consumer preferences. In addition, the growth of the fashion and apparel sector in Latin America and investments in textile innovation and production capacity are fueling the adoption of rayon fibers. With Brazil and other regional economies strengthening their textile industries and export networks, the demand for rayon fibers is expected to rise, solidifying Latin America's role as an emerging contributor to the global textile supply chain.

Middle East and Africa Rayon Fibers Market Analysis

Rayon fibers market is booming in the Middle East and Africa regions. The growth of the textile industry in this region has been triggered by the increased number of digitally connected people. The World Bank mentioned that in 2021, Saudi Arabia had 100% internet penetration, which enabled fast e-commerce and digital retail growth. Therefore, the growth in e-commerce and digital retail raises the demand for textiles and apparels. More importantly, it is becoming more of an integral player globally concerning the textile industries, importing the whole world by about 25 percent, if reports are true. There would be an escalating demand in terms of sustainable fibers and multi-uses such as rayon amid increased attention put on the issue of better textile quality in respect to the regional environment. Heavy investments by governments in textile manufacturing, infrastructure, and industrial diversification under visions like Saudi Vision 2030 will grow rayon fiber. Growth in consumer spending and expansion in retail support the fashion and apparel industries to become an emerging hub for rayon fiber demand in the Middle East and Africa region.

Competitive Landscape:

The market is experiencing steady growth as various key players in the global rayon fibers industry are engaging in numerous strategic activities to maintain and expand their market share. They are heavily investing in research and development (R&D) to produce more sustainable and higher-quality fibers, catering to the heightened consumer demand for eco-friendly and versatile products. Mergers and acquisitions are also commonplace as companies seek to diversify their product portfolios and expand their geographical reach. Additionally, these market leaders are increasingly collaborating with downstream users like textile manufacturers and brands to develop customized solutions that cater to specific industry needs. Through these multi-faceted approaches, key players are solidifying their positions and driving innovation and sustainability in the rayon fibers market.

The report provides a comprehensive analysis of the competitive landscape in the rayon fibers market with detailed profiles of all major companies, including:

- Aditya Birla Group

- Kelheim Fibres GmbH

- The Lenzing Group

- Toray Industries Inc.

Latest News and Developments:

- October 2024: The Lenzing Group, a leading provider of regenerated cellulose fibers for the textile and nonwovens sectors, has taken a minority stake in TreeToTextile AB. It joins an existing group of shareholders including H&M Group, Inter IKEA Group, Stora Enso, and LSCS Invest.

- September 2023: Kelheim Fibres GmbH, a leading manufacturer of specialty viscose fibers, showcased its latest developments at the Global Fiber Congress in Dornbirn. The focus was on innovative solutions that promote environmental sustainability as well as strengthen the European supply chain.

- April 2023: The Lenzing Group, a leading global producer of wood-based specialty fibers, announced the expansion of its sustainable viscose fiber portfolio globally with the launch of carbon-neutral VEOCEL branded viscose fibers for Europe and the US. In Asia, the company will convert the existing production capacity for conventional viscose into capacity for responsible specialty fibers in the second half of this year. This new responsible fiber offering exemplifies VEOCEL’s mission to care for the environment and future generations.

Rayon Fibers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Viscose Rayon, Modal Rayon, Cupramonium Rayons, Others |

| Applications Covered | Automotive and Transport, Personal Care, Aerospace and Defense, Manufacturing, Textile, Healthcare, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aditya Birla Group, Kelheim Fibres GmbH, The Lenzing Group, Toray Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rayon fibers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rayon fibers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rayon fibers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rayon fibers market was valued at USD 20.88 Billion in 2024.

IMARC Group estimates the market to reach USD 37.98 Billion by 2033, exhibiting a CAGR of 6.53% from 2025-2033.

The rayon fibers market is driven by increasing demand for sustainable and biodegradable textiles, growing adoption in apparel and home furnishings, advancements in eco-friendly production technologies, and rising consumer preference for soft, breathable fabrics. Additionally, the expanding fashion industry and regulatory support for sustainable fibers fuel market growth.

Asia Pacific currently dominates the rayon fibers market, driven by strong textile manufacturing hubs in China, India, and Indonesia. The region benefits from abundant raw material availability, cost-effective labor, and high domestic demand for rayon-based apparel and home textiles.

Some of the major players in the rayon fibers market include Aditya Birla Group, Kelheim Fibres GmbH, The Lenzing Group, Toray Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)