Rapeseed Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Rapeseed Oil Price Trend, Index and Forecast

Track real-time and historical rapeseed oil prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Rapeseed Oil Prices February 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Europe | 1.38 | 1.5% ↑ Up |

| Northeast Asia | 1.58 | Unchanged |

Rapeseed Oil Price Index (USD/KG):

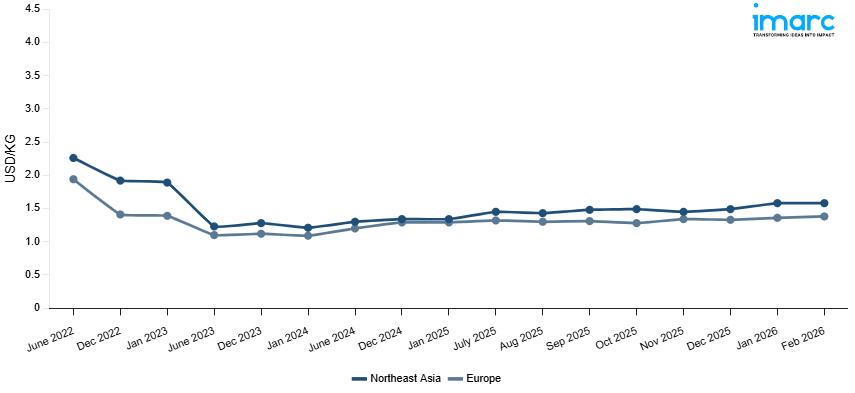

The chart below highlights monthly rapeseed oil prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q4 Ending December 2025

Europe: The rapeseed oil prices in Europe reached 1.33 USD/KG in December 2025. The upward pricing movement registered between September and December 2025 was 1.5%. European markets experienced modest price appreciation as domestic rapeseed crush margins improved and biodiesel demand remained relatively firm throughout the quarter. Derivative pricing was underpinned by tighter rapeseed supplies after a below-average harvest in important producing regions. With strong demand from processors catering to both retail and foodservice channels, the food industry's offtake remained stable. Additional volumes were absorbed by export prospects to nearby markets, avoiding inventory accumulation that could have caused quotations to decline. Due to concerns about the availability of spring supply, buyers were willing to pay higher prices, while sellers took advantage of these favorable fundamentals by making small price adjustments.

Northeast Asia: The rapeseed oil prices in Northeast Asia reached 1.49 USD/KG in December 2025. The upward pricing movement registered between September and December 2025 was 0.4%. Regional pricing exhibited marginal firming as import demand from China and Japan remained consistent, supporting stable trading conditions. Crushing activity proceeded at measured rates, with processors balancing rapeseed meal and oil production to optimize margins across both product streams. Over the three months, regional prices rose slightly as demand from polymer producers remained steady. Crackers ran at balanced rates, balancing output against demand without producing a substantial excess. Northeast Asian import flows decreased slightly, easing the pressure on home manufacturers and allowing small price changes. As buyers' consistent buying habits supported production schedules, vendors felt confident enough to experiment with higher price points. The small gains were not due to a significant change in supply-demand dynamics, but rather to solid market fundamentals.

Market Overview Q3 Ending September 2025

Europe: Old-crop stocks were limited until the arrival of the new harvest, adding to supply pressure. On the demand side, biodiesel mandates under the EU’s renewable energy policies kept consumption levels high, particularly in Germany and France, where rapeseed oil is a primary biofuel feedstock. Additional cost pressures came from port handling fees, international freight, and euro depreciation, which raised the price of imported feedstock and inputs. Despite this, competition from cheaper alternatives such as soybean and palm oils tempered further escalation, as refiners and food manufacturers balanced substitution strategies. Regulatory compliance costs, including sustainability certifications for biodiesel use, also contributed to price firmness.

Northeast Asia: China’s imposition of tariffs on Canadian rapeseed oil sharply reduced import availability, forcing buyers to seek alternative origins at higher costs. India, a key consumer in the region, also faced domestic supply limitations due to reduced sowing acreage and unfavorable weather during crop growth, pushing local spot prices to multiyear highs. Rising edible oil consumption in both food and industrial sectors maintained strong demand, even as buyers contended with elevated costs. Import-dependent countries experienced additional upward pressure from international freight and port handling charges, while weaker regional currencies against the US dollar inflated procurement expenses. Although substitution with palm and soybean oils was explored, strong preferences for rapeseed oil in cooking applications and its role in industrial uses limited large-scale switching. Furthermore, global tightening across vegetable oils restricted relief from substitutes. Together, these factors created a firm bullish environment for rapeseed oil in Northeast Asia through the third quarter, underlining the vulnerability of regional markets to policy changes, supply-side shocks, and logistic cost pressures.

Rapeseed Oil Price Trend, Market Analysis, and News

IMARC's latest publication, “Rapeseed Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the rapeseed oil market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of rapeseed oil at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed rapeseed oil prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting rapeseed oil pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Rapeseed Oil Industry Analysis

The global rapeseed oil industry size reached USD 39.27 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 57.07 Billion, at a projected CAGR of 4.24% during 2026-2034. The market is driven by the rising health consciousness, increasing demand for plant-based and cooking oils, government support for oilseed cultivation, expanding processed food and snack industries, and growing awareness of rapeseed oil’s cardiovascular benefits.

Latest developments in the rapeseed oil industry:

- March 2025: CME Group announced plans to launch cash-settled futures for European rapeseed oil, using an Argus Media index for Dutch prices.

- April 2024: Australian Oilseeds Holdings Limited announced plans to expand its operations into the United States. This expansion will be conducted through its subsidiary, Good Earth Oils, which will distribute Australian cold-pressed NON-GMO canola oil and olive oil to retailers and wholesalers across the United States.

- March 2024: Bunge and Chevron announced a joint venture to construct a new oilseed processing plant in Destrehan, Louisiana. This facility, part of their Bunge Chevron Ag Renewables LLC venture, is designed to process both soybeans and softseeds, including innovative winter oilseed crops like winter canola and CoverCress. The plant is expected to begin operations in 2026 and aims to enhance the production of renewable fuel feedstocks while also supporting the feed and protein markets through meal product production.

Product Description

Rapeseed oil, sometimes referred to as canola oil in some areas, is made from the seeds of the rapeseed plant (Brassica napus or Brassica rapa). It is well known for having a high smoke point, mild flavor, and light texture, which make it useful in a variety of culinary applications. With low levels of saturated fats and high levels of healthful monounsaturated and polyunsaturated fats, including omega-3 fatty acids, this golden-yellow oil is highly valued for its nutritional profile. Additionally, it has a lot of vitamin E, an antioxidant that is good for your whole body. Rapeseed oil is a popular choice for cooking, frying, baking, and salad dressings due to its mild flavor and ability to enhance the natural taste of ingredients. Its high smoke point makes it ideal for high-heat cooking methods without the risk of burning or producing harmful compounds.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Rapeseed Oil |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Rapeseed Oil Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States, Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of rapeseed oil pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting rapeseed oil price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The rapeseed oil price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The rapeseed oil prices in February 2026 were 1.38 USD/Kg in Europe and 1.58 USD/Kg in Northeast Asia.

The rapeseed oil pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for rapeseed oil prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)