RAN Intelligent Controller Market Size, Share, Trends and Forecast by Component, Function, Technology, Application, and Region, 2025-2033

RAN Intelligent Controller Market Size and Share:

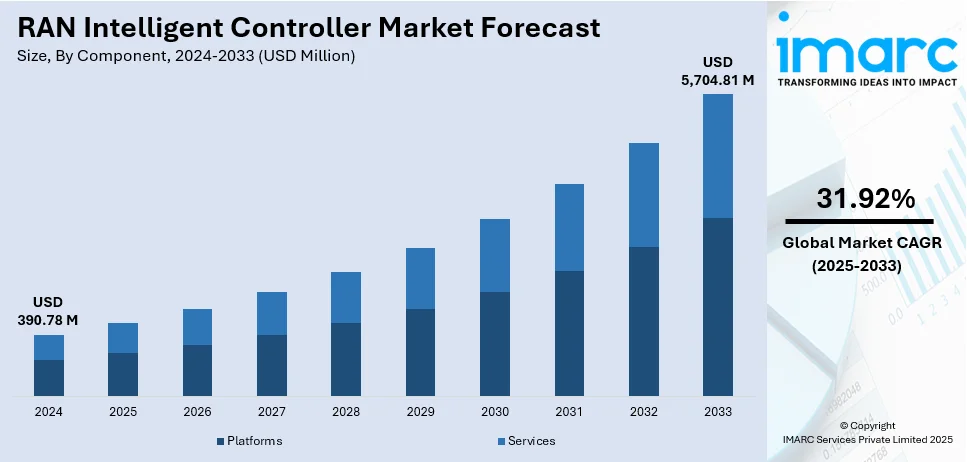

The global RAN intelligent controller market size was valued at USD 390.78 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,704.81 Million by 2033, exhibiting a CAGR of 31.92% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 39% in 2024. The rapid adoption of 5G networks, the increasing demand for enhanced network performance, the growing complexity of heterogeneous networks, and the need for network virtualization and open interfaces are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 390.78 Million |

| Market Forecast in 2033 | USD 5,704.81 Million |

| Market Growth Rate (2025-2033) | 31.92% |

The global RAN intelligent controller market is driven by increasing demand for efficient network management and optimization in the era of 5G deployment. Progress in AI and machine learning tools facilitates adaptive resource management and improved efficiency, effectively meeting increasing demands for connectivity. Open RAN adoption fosters interoperability, encouraging innovation and competition among solution providers. Rising mobile data usage and the proliferation of IoT devices further amplify the need for intelligent network orchestration. Supportive regulatory policies promoting modernized telecom infrastructure also contribute to RAN intelligent controller market growth, creating opportunities for vendors to deliver scalable and flexible RIC solutions.

The United States plays a prominent role in the global RAN Intelligent Controller market, driven by extensive 5G rollouts and advanced telecom infrastructure. For instance, as per industry reports, U.S. 5G performance is surging as carriers deploy mid-band spectrum. T-Mobile leads with 287.14 Mbps median speeds in March 2024, up 29.64 Mbps, especially improving rural connectivity. Verizon improved from 133.56 Mbps to 224.67 Mbps, while AT&T reached 145.36 Mbps, showing steady progress with C-band spectrum access. Besides, key industry players invest in innovative RIC solutions to enhance network efficiency and performance. Furthermore, the region benefits from robust support for Open RAN standards, encouraging the development of interoperable and scalable technologies. High demand for AI-driven network optimization and resource management solutions further propels growth. Besides this, regulatory initiatives promoting network modernization and the adoption of next-generation technologies provide a favorable environment for RIC deployment, positioning the United States as a leader in the telecom sector.

RAN Intelligent Controller Market Trends:

5G Network Deployment

The rapid deployment and expansion of 5G networks worldwide are a significant driving force for the RIC market. 5G promises higher data speeds, lower latency, and increased connectivity, catering to a wide range of applications such as the internet of things (IoT), augmented reality (AR), and autonomous vehicles. According to GSMA Intelligence's global analysis, 5G market penetration has surpassed 40% in regions such as China, the US, Japan, South Korea, several European countries, the UK, Scandinavian nations, and certain states in West Asia. However, the implementation and management of 5G networks come with unprecedented complexities due to the diverse range of devices, varied traffic patterns, and dynamic network requirements. RICs provide real-time data analytics and AI-powered automation, enabling network operators to manage and optimize the 5G RAN efficiently. By dynamically allocating resources, handling network congestion, and adjusting coverage areas, such controllers ensure seamless user experiences and better network efficiency, thereby shaping a positive RAN intelligent controller market outlook.

Growing Demand for Enhanced Network Performance

With the exponential growth in data usage and the continuous evolution of digital services, there is an increasing demand for improved network performance. According to a survey, 81% of users access digital services online daily, with over 82% regularly using online banking services. Users expect reliable connectivity and low latency for high-quality multimedia streaming, real-time communications, and other data-intensive applications. RICs address these demands by intelligently managing RAN functions, identifying and mitigating performance bottlenecks, and allocating resources based on real-time traffic analysis. This leads to optimized network performance, reduced drop rates, and improved throughput, all of which contribute to enhanced user satisfaction and elevated RAN intelligent controller market demand.

Network Efficiency and Cost Savings

Network operators are continually seeking ways to optimize their infrastructure and reduce operational costs. RICs offer significant cost-saving opportunities by enabling better resource utilization and reducing unnecessary network expenditures. Industry reports indicate that rApp can lower RAN energy consumption by 65% over a simulated one-year period. Through AI-driven automation, RICs minimize the need for manual interventions, leading to streamlined network operations and reduced labor costs. Additionally, by dynamically adjusting network parameters, RICs improve energy efficiency, further contributing to cost savings and environmental sustainability. As operators face the challenge of delivering high-performance networks while maintaining profitability, RICs emerge as a strategic solution to achieve both objectives simultaneously.

RAN Intelligent Controller Market Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global RAN intelligent controller market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, function, technology, and application.

Analysis by Component:

- Platforms

- Services

Platforms stand as the largest component in 2024, holding around 63.7% of the market, driven by their essential role in enabling seamless integration of advanced functionalities. These platforms serve as foundational frameworks, supporting the deployment of both real-time and non-real-time RIC solutions. Vendors emphasize platform scalability, flexibility, and interoperability to meet diverse network requirements across regions. The growing adoption of Open RAN standards has further fueled the development of sophisticated platforms that facilitate multi-vendor collaboration. In addition, by offering a centralized environment for managing network resources, these platforms enable telecom operators to enhance network efficiency and deliver optimized services. Moreover, continuous innovation in platform architecture ensures compatibility with emerging technologies, including AI-driven network management and 5G applications, making them indispensable in modern telecom infrastructure.

Analysis by Function:

- Non-RT RIC (Non-Real-Time-RAN Intelligent Controller)

- Near-RT RIC (Near-Real-Time-RAN Intelligent Controller)

Non-RT RIC (non-real-time-RAN intelligent controller) leads the market with around 63.6% of market share in 2024, offering advanced capabilities in network optimization and orchestration. This controller type excels in predictive analytics, long-term resource allocation, and policy-driven decision-making, which are crucial for managing complex network environments. Non-RT RIC integrates seamlessly with existing infrastructure, leveraging AI and machine learning to process large datasets and improve network performance. Furthermore, its ability to execute non-real-time tasks, such as load balancing and traffic forecasting, ensures enhanced service quality for end-users. This functionality is particularly vital for 5G networks, which require efficient handling of dynamic workloads. Besides this, non-RT RIC solutions also provide a framework for innovation by supporting the deployment of third-party rApps, further enhancing their value proposition in the telecom ecosystem.

Analysis by Technology:

- 4G

- 5G

4G leads the market with around 67.6% of market share in 2024, reflecting its widespread adoption and continued relevance alongside the deployment of 5G networks. Telecom operators rely on RAN Intelligent Controller solutions to maximize the performance and efficiency of their 4G infrastructure. These solutions enable operators to extend the lifecycle of their networks by optimizing spectrum usage, reducing latency, and enhancing overall service quality. In addition to this, the integration of RICs with 4G networks facilitates smoother transitions to 5G by supporting hybrid network environments. As many regions continue to rely on 4G for connectivity, particularly in rural and underdeveloped areas, RIC solutions tailored to this technology are critical for maintaining network stability and meeting consumer demands for high-speed data services.

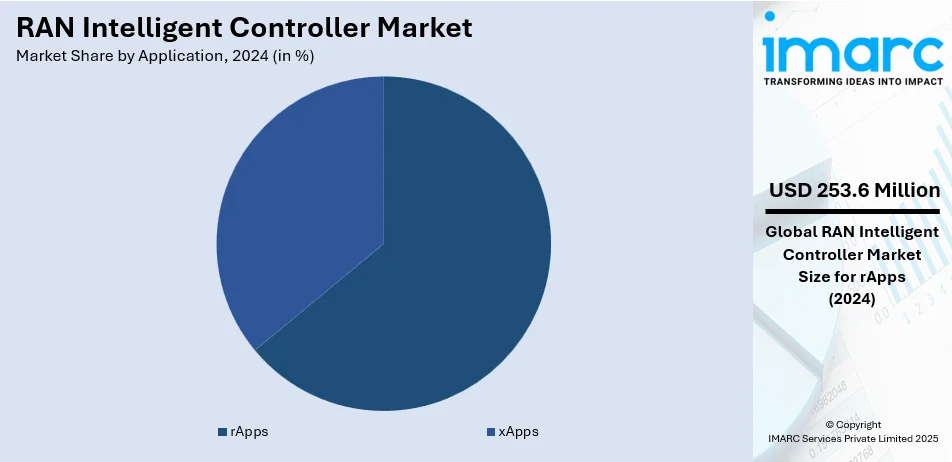

Analysis by Application:

- rApps

- xApps

rApps lead the market with around 64.9% of market share in 2024, providing modular and customizable solutions for various network optimization tasks. These applications enable telecom operators to implement advanced features such as energy efficiency, traffic management, and interference mitigation, aligning with specific operational needs. rApps’ flexibility allows seamless integration with Non-RT RIC platforms, creating an ecosystem for innovation and efficiency. In addition, their role in supporting Open RAN standards fosters collaboration among vendors, accelerating the development of cutting-edge solutions. By leveraging AI and machine learning, rApps enable proactive decision-making, ensuring optimal network performance. Furthermore, the scalability and versatility of rApps position them as a cornerstone in modern RAN management, addressing the growing complexity of next-generation networks.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 39%. The Asia-Pacific region is experiencing rapid digital transformation, with countries like China, India, Japan, and South Korea at the forefront. GSMA reported that by the end of 2022, South Korea had 31.3 million 5G connections, making up more than 48% of the nation's total mobile connections. Meanwhile, China boasts over 1.15 billion 5G connections as of August 2024, representing approximately 57% of the total mobile connections. This substantial 5G adoption is driving demand for RAN intelligent controllers to efficiently manage the increasing data traffic and ensure seamless connectivity. Government initiatives promoting smart city developments, digital economies, and the expansion of 4G and 5G networks further contribute to the region’s adoption of advanced network technologies. The growing number of IoT devices and data-intensive applications also fuels the need for efficient network management solutions, positioning RAN intelligent controllers as a vital component in the modernization of telecom infrastructures across Asia-Pacific.

Key Regional Takeaways:

United States RAN Intelligent Controller Market Analysis

In 2024, the United States accounted for 83.60% of the market share in North America. The United States continues to be a critical market for RAN intelligent controllers, fueled by the swift rollout of 5G infrastructure and an increasing emphasis on optimizing network performance. This expansion is strongly supported by the nation’s position at the forefront of technological advancements. According to reports, the U.S. has been the breeding ground for the majority of AI startups, with 4,633 new AI startups emerging between 2013 and 2022. In 2022 alone, 524 AI startups were founded, attracting USD 47 Billion in non-governmental funding. This innovation ecosystem fuels the demand for advanced technologies like RAN intelligent controllers, as telecom operators seek to optimize network operations, reduce latency, and deliver superior user experiences. The government’s substantial investments in 5G infrastructure further accelerate the adoption of advanced network technologies. The growing proliferation of IoT devices and data-intensive applications increases the need for intelligent controllers to efficiently manage network traffic. The competitive landscape among U.S. telecom operators also drives innovation, positioning RAN intelligent controllers as a critical component in the country’s digital transformation. These factors, combined with the continued advancement of AI and other cutting-edge technologies, position the U.S. as a leading market for RAN intelligent controllers with significant growth potential.

North America RAN Intelligent Controller Market Analysis

North America plays a critical role in the global RAN intelligent controller (RIC) market, driven by advanced telecom infrastructure and rapid adoption of 5G technologies. For instance, as per industry reports Canada's telecommunications segment adds around USD 81 Billion to the nation's GDP. In line with this, it is anticipated that by the year 2035, implementation of 5G networks will add an extra USD 112 Billion to the GDP. Furthermore, the region exhibits significant interest in technologies that improve network optimization, expand scalability, and boost overall performance. Leading firms allocate substantial resources to R&D, advancing RIC solutions tailored to rising connectivity demands. In addition to this, the widespread presence of telecom operators accelerates the integration of artificial intelligence and machine learning in RAN systems. Regulatory frameworks supporting network modernization further propel market growth. As a result, North America remains at the forefront of technology-driven advancements, creating a favorable ecosystem for RIC adoption in diverse industries, including healthcare, manufacturing, and transportation.

Europe RAN Intelligent Controller Market Analysis

Europe is witnessing a significant surge in the adoption of RAN intelligent controllers, driven by the rapid deployment of 5G networks and the increasing demand for enhanced network performance. The European Union’s strategic initiatives, including the EUR 110 Million (USD 115 Million) government investment in research and development for next-generation 5G and 6G wireless technology and telecoms security, are accelerating the integration of advanced network solutions. Telecommunications operators are leveraging RAN intelligent controllers to optimize network operations, reduce latency, and improve user experiences across diverse applications, such as autonomous vehicles, industrial automation, and smart homes. The growing proliferation of IoT devices and data-intensive applications necessitates robust network management solutions, positioning RAN intelligent controllers as essential components in modernizing network infrastructures. Additionally, the competitive landscape among European telecom operators is spurring innovation and the adoption of cutting-edge technologies to maintain market leadership. These developments, alongside supportive regulatory frameworks, position Europe as a key market for RAN intelligent controllers, with substantial growth prospects in the near future. The government's push towards enhancing telecoms security and next-gen wireless technologies further strengthens the region’s commitment to maintaining a leading position in the global telecom landscape.

Latin America RAN Intelligent Controller Market Analysis

Latin America is recognized as one of the fastest-growing mobile markets globally. According to reports, in 2018, the region had 326 Million mobile internet users, and this figure is expected to rise to 422 Million by 2025. The growing adoption of mobile internet, alongside the widespread rollout of 4G and 5G networks, is fueling the need for sophisticated network management tools such as RAN intelligent controllers. These technologies are critical in handling the surge in data consumption and enhancing overall network performance in the region’s rapidly evolving telecom landscape.

Middle East and Africa RAN Intelligent Controller Market Analysis

The Middle East and Africa region is seeing significant growth in 5G adoption, with Saudi Arabia leading the way. According to reports, Saudi Arabia had over 11.2 Million 5G subscriptions by the end of 2022, representing more than a quarter of the country’s total mobile sector. This growth is fueling the demand for advanced network management solutions, including RAN intelligent controllers, to optimize network operations and ensure efficient handling of the increased data traffic. As the region continues to invest in next-generation wireless technologies, the role of intelligent network controllers becomes increasingly critical.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of established telecom vendors and emerging technology firms. Companies focus on innovation, leveraging artificial intelligence and machine learning to optimize network management and secure major RAN intelligent controller market share. Moreover, strategic partnerships, acquisitions, and collaborations drive market dynamics, enabling businesses to expand their portfolios and geographic reach. For instance, in July 2024, Keysight Technologies, Inc. collaborated with MobileNet: Mobile & Aerospace Networks Lab to boost open RAN development by utilizing Keysight's RAN Intelligent Controller Test Solutions (RICtest). The solution will facilitate the development of testing models for RIC encompassing both non-real-time and near-real-time RIC for improved functions of network intelligence management. In addition to this, open RAN standards play a pivotal role, encouraging competition among solution providers while fostering interoperability. Furthermore, suppliers focus on enhancing adaptability, robust protection measures, and operational efficiency in their solutions to align with shifting client expectations. Competitive differentiation is often achieved through advanced analytics, cost efficiency, and tailored solutions targeting diverse industry applications.

The report provides a comprehensive analysis of the competitive landscape in the RAN intelligent controller market with detailed profiles of all major companies, including:

- Juniper Networks Inc.

- Mavenir Plc

- Nokia Corporation

- Parallel Wireless Inc.

- Samsung Corporation

- Telefonaktiebolaget LM Ericsson

- VMware Inc.

Latest News and Developments:

- January 2025: VIAVI Solutions has introduced the TeraVM AI RAN Scenario Generator (AI RSG), an upgrade to its RAN Intelligent Controller (RIC) Test platform. It simulates real-world RAN behavior for system-level testing and supports NTIA’s Public Wireless Supply Chain Innovation Fund applicants. Using AI/ML, it optimizes network performance and energy efficiency, supporting simulations with up to 10,000 user devices and thousands of cells, deployable in cloud or on dedicated servers.

- November 2024: EchoStar’s Hughes Network Systems secured a USD 6.5 Million contract to deploy a 5G Open RAN prototype with a RAN Intelligent Controller (RIC) at Fort Bliss, Texas. The project will test military network applications and later integrate into Hughes' commercial network. Hughes, in collaboration with the U.S. Army, will evaluate capabilities like rapid spectrum changes for resilient communications.

- September 2024: Fujitsu launched Virtuora® Intelligent Control, a RAN Intelligent Controller (RIC) platform to simplify 5G Open RAN lifecycle management. It uses AI and machine learning for real-time decision-making, optimizing network performance and enabling monetization opportunities like RAN slicing. The platform integrates with Virtuora SMO for enhanced RAN optimization and quality of service.

- April 2024: At the 2024 Huawei Analyst Summit, Huawei launched RAN Intelligent Agents, integrating telecom models, RAN digital twins, and intelligent computing to enhance 5.5G networks. These agents improve network operations, energy efficiency, and management, supporting features like intent-driven interactions and multi-objective decision-making to optimize 5.5G network performance.

- February 2023: Mavenir has introduced its O-RAN alliance Radio Access Network Intelligent Controller (RIC), enabling network optimization through open APIs. The O-RIC enhances performance, cost efficiency, and user experience while providing real-time insights. It is currently deployed with two tier-one Communications Service Providers. Traditional RAN networks rely on Self-Organizing Network (SON) models for non-real-time optimization.

RAN Intelligent Controller Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Platforms, Services |

| Functions Covered | Non-RT RIC (Non-Real-Time-RAN Intelligent Controller), Near-RT RIC (Near-Real-Time-RAN Intelligent Controller) |

| Technologies Covered | 4G, 5G |

| Applications Covered | rApps, xApps |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Juniper Networks Inc., Mavenir Plc, Nokia Corporation, Parallel Wireless Inc., Samsung Corporation, Telefonaktiebolaget LM Ericsson, VMware Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the RAN intelligent controller market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global RAN intelligent controller market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the RAN intelligent controller industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The RAN intelligent controller market was valued at USD 390.78 Million in 2024.

IMARC estimates the RAN intelligent controller market to reach USD 5,704.81 Million by 2033, exhibiting a CAGR of 31.92% during 2025-2033.

Key factors driving the market encompass increase in 5G implementations, escalating mobile data requirement, innovations in machine learning and AI for network optimization, bolstering Open RAN adoption for interoperability, and beneficial regulatory frameworks incentivizing telecom infrastructure modernization and effective resource management.

Asia Pacific currently dominates the RAN intelligent controller market, accounting for a share exceeding 39%. This dominance is fueled by increased 5G deployment, escalated mobile penetration, and heavy investments in leading-edge telecom infrastructure across key countries like South Korea, China, and Japan.

Some of the major players in the RAN intelligent controller market include Juniper Networks Inc., Mavenir Plc, Nokia Corporation, Parallel Wireless Inc., Samsung Corporation, Telefonaktiebolaget LM Ericsson, VMware Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)