Railway System Market Size, Share, Trends and Forecast by Transit Type, System Type, Application, and Region, 2025-2033

Railway System Market Size and Share:

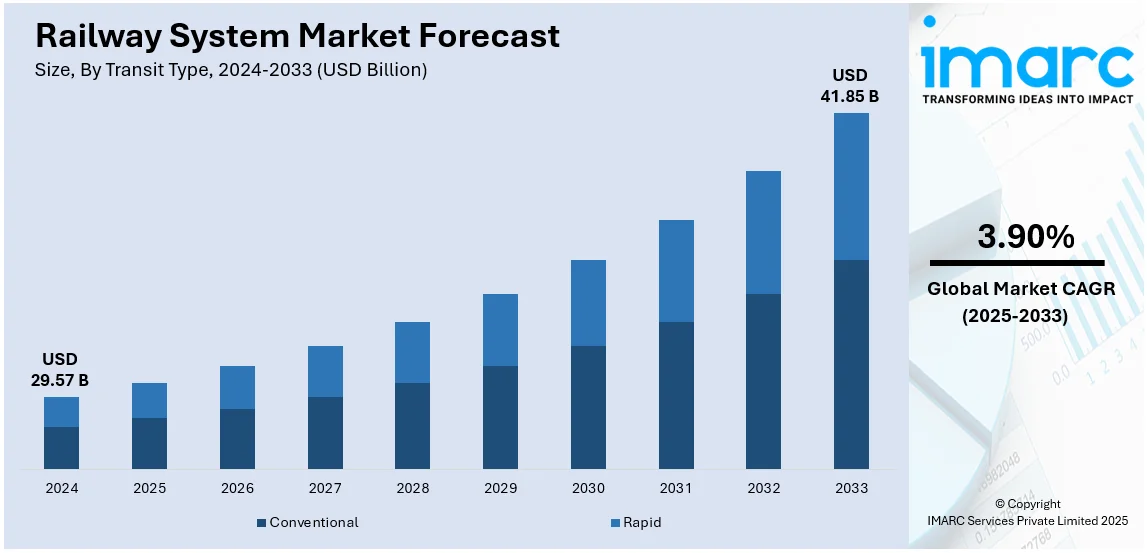

The global railway system market size was valued at USD 29.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.85 Billion by 2033, exhibiting a CAGR of 3.90% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 34.0% in 2024. The growth of the Asia Pacific region is driven by strong investments in rail infrastructure, modernization efforts, government support for sustainability, and increasing demand for efficient transportation. These factors collectively contribute to the significant railway system market share, positioning it as a leader in rail development and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.57 Billion |

| Market Forecast in 2033 | USD 41.85 Billion |

| Market Growth Rate (2025-2033) | 3.90% |

Numerous governing bodies worldwide are investing heavily in the expansion and modernization of their railway networks. Public-private partnerships (PPP) and funding initiatives are also supporting the growth of the market. Additionally, railways are considered a more environment-friendly mode of transportation in comparison to air and road travel due to lower carbon emissions per passenger or ton of freight. This is driving the adoption of rail systems, particularly electric trains, to help reduce carbon footprints and combat climate change. Besides this, innovations in rail technology, such as high-speed trains, autonomous trains, and digital signaling systems, are making rail travel faster, safer, and more efficient. These advancements are attracting more investment and adoption in the railway sector.

The United States is a crucial segment in the market, driven by increased government investments in railway infrastructure, coupled with strategic partnerships between public and private entities. These collaborations enable the development of large-scale projects, improve connectivity, and enhance transportation networks, contributing to the expansion of high-speed and intercity rail systems. Such efforts help accelerate the modernization of railway systems, enhance regional connectivity, and foster economic growth. In 2025, Governor Gavin Newsom and the California High-Speed Rail Authority initiated the Railhead Project in Kern County, signaling the subsequent stage of track and systems development. This comes after the finalization of Construction Package 4, a 22-mile stretch featuring essential infrastructure such as viaducts and overpasses. The program backs California's high-speed rail system, with future links to Las Vegas set to be developed in partnership with Brightline West and the High-Desert Corridor Joint Powers Agency.

Railway System Market Trends:

Increasing urbanization

Urbanization is a key factor driving the global railway system market. The UN predicts that by 2050, 68% of the global population will reside in urban areas. As the world experiences rapid urbanization, there is an increasing demand for efficient and sustainable transportation systems to connect growing urban centers. Railways provide a viable solution to address the challenges associated with urban congestion, traffic jams, and pollution. The convenience of rail transport, especially in densely populated areas, makes it an attractive option for commuters, strengthening the market growth. Moreover, the surge in population density has made railways a more space-efficient mode of transportation compared to individual vehicles. The ability of railways to transport a large number of passengers or goods over long distances with minimal environmental impact is further bolstering its demand.

Ongoing technological advancements

The railway industry is undergoing significant technological advancements that contribute to its growth and efficiency. Automation, digitization, and the implementation of smart technologies have transformed traditional railway systems into modern, high-tech networks. As per reports, global expenditure on digital transformation is predicted to approach nearly USD 4 Trillion by 2027. In line with this, the adoption of advanced signaling systems, predictive maintenance technologies, and real-time monitoring enhances the safety, reliability, and overall performance of railway infrastructure, aiding in market expansion. Additionally, the advent of high-speed rail systems, magnetic levitation (maglev) trains, and the development of intelligent transportation systems are providing an impetus to the market growth. Apart from this, the integration of communication technologies enabling real-time tracking of trains, optimizing scheduling, and reducing delays is propelling the market forward.

The global push toward environmental sustainability

The escalating environmental concerns and the need to reduce carbon emissions have resulted in railways being considered as a sustainable mode of transportation. For example, greenhouse gas emissions in the EU decreased by 32% from 1990 to 2020. Compared to road and air transport, trains are more energy-efficient and produce lower emissions per unit of transported goods or passengers. As a result, governments and organizations worldwide are increasingly prioritizing trains as environmentally friendly transportation solutions to address climate change and air pollution, which is contributing to the market expansion. Furthermore, the electrification of rail networks, the use of renewable energy sources, and the development of energy-efficient rolling stock further enhancing the overall sustainability of the railway system are impelling the market growth.

Favorable government initiatives

Supportive government initiatives play a crucial role in shaping the railway system market, as governments recognize the societal and economic benefits of investing in robust railway infrastructure. As per the India Brand Equity Foundation, the government has set an ambitious goal to invest USD 1.4 Trillion from 2019 to 2023, which encompasses a USD 750 Billion allocation for railway infrastructure by 2030. The implementation of numerous policies and investments aimed at expanding and modernizing rail networks is fostering market expansion. Moreover, increasing public-private partnerships (PPPs), with governments often providing financial incentives, subsidies, and regulatory support to encourage private sector participation in railway projects is fueling the market growth. In line with this, the extensive investment in expanding and modernizing rail networks through high-speed rail lines, electrification initiatives, and the development of intelligent transportation systems is creating a positive outlook for market expansion.

Railway System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global railway system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on transit type, system type, and application.

Analysis by Transit Type:

- Conventional

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Coaches

- Rapid

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Light Rail/Tram

Conventional (diesel locomotive, electric locomotive, electro-diesel locomotive, and coaches) exhibits a clear dominance in the market owing to its reliability, efficiency, and wide applicability across various regions. Diesel locomotive is particularly favored for its versatility and ability to operate in areas without extensive electrification infrastructure, making it ideal for remote or rural regions. Electric locomotive, on the other hand, is increasingly popular in regions with robust electrification networks, offering cost-effective and environment-friendly operations due to its reduced carbon emissions and lower maintenance costs. Electro-diesel locomotive combines the advantages of both, offering operational flexibility across electrified and non-electrified networks. Coaches remain a critical component for both freight and passenger transportation, with constant upgrades to improve comfort, safety, and energy efficiency. The continued dominance of these conventional transit types is also driven by the fact that they offer established, dependable performance at a relatively lower upfront investment compared to newer, more advanced technologies.

Analysis by System Type:

- Auxiliary Power System

- Train Information System

- Propulsion System

- Train Safety System

- HVAC System

- On-Board Vehicle Control

The propulsion system holds the biggest market share due to its critical role in ensuring the performance and efficiency of the entire railway system. Propulsion system, including diesel and electric technologies, is essential for driving locomotives and maintaining consistent speeds for both passenger and freight trains. An electric propulsion system, particularly, is increasingly favored for its efficiency, reduced operational costs, and lower environmental impact, making it highly suitable for routes with significant traffic. Diesel propulsion system continues to be preferred for regions with less electrification infrastructure, offering flexibility and reliability in diverse terrains. Moreover, advancements in hybrid and dual-mode propulsion systems, such as electro-diesel engines, provide the ability to operate in both electrified and non-electrified networks, enhancing operational reach and performance. The development of more efficient and sustainable propulsion technologies is further contributing to the dominance of propulsion system in the market, as it directly influences fuel usage, speed, and maintenance costs.

Analysis by Application:

- Freight Transportation

- Passenger Transportation

Freight transportation represents the largest segment accredited to its essential role in global supply chains and the movement of goods across regions. Railways offer a highly efficient, cost-effective, and reliable means of transporting large volumes of cargo, including bulk commodities, industrial materials, and consumer goods. Rail freight can carry heavier and more substantial loads over long distances, making it ideal for industries such as mining, agriculture, and manufacturing. Compared to road transportation, rail offers a lower carbon footprint, fewer congestion issues, and the ability to access remote areas, providing an edge in environmental and operational sustainability. Additionally, rail freight offers greater safety, reduced fuel consumption per ton-mile, and improved capacity for bulk shipments. The continual demand for efficient, high-capacity transportation networks, along with technological improvements in rail infrastructure, has cemented freight as the dominant application in the railway system market, with an emphasis on increasing operational efficiency and enhancing logistics capabilities.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia-Pacific region held the biggest market share, exceeding 34.0%. The Asia Pacific region dominates the market owing to its extensive and varied transportation requirements, advantageous geographic location, and continuous investment in railway infrastructure. The area features a vast railway system that facilitates both cargo and travel services, with nations such as China and India significantly investing in upgrading their rail infrastructure. The area is also characterized by some of the most rapidly expanding economies, where enhancing transportation efficiency is a key focus to strengthen connectivity and foster economic development. Moreover, the area's emphasis on improving transportation, linking distant regions, and alleviating traffic congestion has played a role in its supremacy in the railway system market, establishing it as a frontrunner in railway sector advancement and innovation. In 2024, the Northeast Frontier Railway (NFR) introduced a sophisticated water level monitoring system on the Brahmaputra Mail Express at Kamakhya Railway Station to guarantee dependable water access for travelers. The system employs communication based on LoRa and GPRS alongside hydrostatic pressure sensors for monitoring in real-time.

Key Regional Takeaways:

United States Railway System Market Analysis

In North America, the market share for the United States was 85.70% of the total. The adoption of advanced railway systems is surging due to increased investments allocated to upgrading and modernizing of infrastructure and transport networks. According to survey, USD 8.4 Billion in infrastructure investments (2018-2027), emphasizing advancements in technology and facilities, driving efficiency, safety, and modernization in railway systems. The emphasis on creating high-speed corridors, improving freight movement, and ensuring seamless intermodal connectivity has spurred the deployment of sophisticated systems. Key initiatives include modernizing signaling technologies and expanding electrified rail networks for improving efficiency and minimizing operational costs. The integration of automated systems, including advanced train control, and real-time monitoring solutions ensures safety and reliability. Additionally, the development of suburban lines has improved commuter experiences, attracting greater passenger volumes. Governmental policies focused on reducing congestion and diversifying transport options have further accelerated the pace of development. The long-term vision of reducing emissions and promoting sustainability in public transport underscores the growing emphasis on efficient rail infrastructure. Enhanced connectivity between regional hubs and urban areas is another crucial factor driving adoption.

Europe Railway System Market Analysis

Rail systems in Europe are gaining momentum as the demand for environmentally sustainable transportation solutions increases. The region’s commitment to reducing greenhouse gas emissions has positioned rail as a preferred mode for both passenger and freight transport. For instance, the EU rail network in 2020 spanned 201,000 kilometers, with 57 percent electrified and 11,500 kilometers as high-speed lines, marking a 14.5 percent growth since 2015, while infrastructure spending rose to approximately 49 Billion USD, with 28 percent on upgrades, enhancing railway technology for efficient management and sustainable operations. Electrification of tracks has advanced, significantly lowering the dependency on fossil fuels and aligning with carbon-neutral goals. The focus on seamless cross-border connectivity has spurred investment in high-speed rail links that encourage intercity travel, reducing the reliance on air and road transport. Energy-efficient technologies, such as regenerative braking systems and lightweight train designs, are being adopted to further reduce operational emissions. Enhanced railway logistics have also contributed to a modal shift in freight transportation, replacing long-haul trucking with cleaner alternatives. Initiatives to modernize existing infrastructure, coupled with efforts to implement advanced digital signaling systems, ensure smoother, more efficient railway operations while contributing to sustainable development.

Asia Pacific Railway System Market Analysis

The accelerated urban growth in metropolitan and emerging cities has intensified the need for efficient transportation solutions, leading to the widespread adoption of rail systems. According to World Bank Group, India's rapid urbanization, with urban areas projected to house 600 Million people (40% of the population) by 2036 and contribute 70% to GDP, underscores the critical need for efficient railway systems to support sustainable urban growth and drive the nation's development goals by 2047. With the increasing demand for mass transit options to manage high population densities, metro and light rail systems have become integral to city planning. Major initiatives to establish or expand metro networks in densely populated areas reflect efforts to alleviate traffic congestion and reduce commute times. The deployment of integrated ticketing systems and upgraded rolling stock has improved user convenience, encouraging more commuters to shift from road to rail. Investment in last-mile connectivity through feeder networks and improved station infrastructure highlights the focus on building holistic transport ecosystems. Furthermore, the emphasis on sustainable urban mobility plans has prioritized rail systems for their ability to handle large capacities while minimizing environmental impact. The region's rapidly expanding middle class has also contributed to rising commuter rail demand.

Latin America Railway System Market Analysis

Efforts to strengthen transportation networks have driven the adoption of modern rail systems to connect isolated areas with urban hubs. For instance, Brazil's National Railway Plan aims to double rail's modal share from 17.7% to 34.6%, driving sustainable growth and enhancing food security with efficient grain export corridors, supported by a transformative investment of approximately USD 30 Billion. These railway systems are pivotal in improving access to essential services, fostering regional trade, and facilitating economic growth. Investments in new lines and the refurbishment of outdated tracks aim to bridge gaps between remote communities and urban centers. The focus on enhancing passenger comfort and reliability has also encouraged greater use of railway transport. Developing better freight corridors supports agricultural and industrial exports, contributing to broader economic benefits. Railways are increasingly viewed as a viable alternative to alleviate road congestion, promoting better logistics and accessibility. Furthermore, the prioritization of long-term development plans underlines the essential role of rail systems in achieving regional connectivity goals.

Middle East and Africa Railway System Market Analysis

The growth of the railway system in the Middle East and Africa is largely fueled by the expanding logistics sector in the region. For instance, the logistics industry provides 6% of the KSA GDP and is expected to add 10% by 2030, which is approximately USD 5.36 Billion. As demand for efficient and cost-effective transportation solutions increases, railways provide a reliable alternative to road and air freight. The rising need for the movement of goods, including natural resources, raw materials, and finished products, is creating significant demand for infrastructure upgrades and expansion. Additionally, investments in high-speed rail and urban transit systems are enhancing connectivity between major cities and industrial hubs. Governments are prioritizing sustainable transportation, with railways emerging as a key solution for reducing congestion and environmental impact. This growing focus on the logistics sector has led to a robust development of the railway system, enhancing trade and improving economic prospects in the region.

Competitive Landscape:

Major stakeholders in the market are concentrating on upgrading their technological abilities by investing in modern rail infrastructure, automation, and digitalization to boost operational efficiency. They are creating more sustainable and energy-efficient options, such as electric and hybrid trains, to conform to worldwide environmental objectives. Working together with government and industry partners is growing more essential to obtain financing for major projects, including high-speed rail and intelligent signaling systems. Moreover, these players aim to broaden their service offerings by providing integrated solutions that address both passenger and freight transportation, improving overall system efficiency and dependability. Ongoing research and development initiatives are being conducted to enhance safety features, lower operational expenses, and implement innovative solutions for improved connectivity and capacity. In 2024, the Mysuru division of South Western Railway introduced a QR code ticketing system at 81 stations in Karnataka, enabling travelers to purchase General Class and platform tickets online. Moreover, 25 Automatic Ticket Vending Machines (ATVMs) were set up at 12 sites to improve accessibility.

The report provides a comprehensive analysis of the competitive landscape in the railway system market with detailed profiles of all major companies, including:

- ABB Ltd.

- Alstom SA

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- Hitachi, Ltd.

- Ingeteam A.S.

- Knorr-Bremse AG

- Mitsubishi Electric Corporation

- Siemens AG

- Škoda Transportation a.s.

- Stadler, Inc.

- Toshiba Corporation

- Wabtec Corporation

Latest News and Developments:

- December 2024: Indian Railways has introduced the Integrated Track Monitoring System (ITMS) to enhance safety, speed, and efficiency across its 17 zones. This advanced system leverages cutting-edge technology for real-time monitoring. The initiative aims to revolutionize rail operations and ensure safer journeys. The launch was reported by Railway Supply.

- December 2024: Indian Ministry of Railways has introduced Kavach, an Automatic Train Protection (ATP) system certified with Safety Integrity Level 4 (SIL-4) for unparalleled safety in train operations. Kavach integrates infrastructure like stations, locomotives, trackside equipment, and communication systems, enabling real-time train protection across the railway network.

- September 2024: Mitsubishi Electric Klimat Transportation Systems, the Italian subsidiary of Mitsubishi Electric, has secured a landmark order from Siemens Mobility for 1,350 R290-refrigerant HVAC systems. These systems will equip next-generation S-Bahn trains in Munich, Germany, contributing to decarbonization efforts. Deliveries, including 1,170 cabin units and 180 cockpit units, are scheduled from fiscal 2026 to 2032. This marks the first supply of R290-based HVAC systems by a Japanese affiliate for railways.

- July 2024: Liebherr Transportation Systems will offer advanced HVAC units for Etihad Rail’s high-speed trains to facilitate passenger comfort in the UAE's extreme climate. Partnering with CRRC Qingdao Sifang, the units are designed to withstand temperatures up to 60°C and sand gusts. This marks a key milestone in the UAE's first national railway network development.

- January 2024: Alstom partnered with the Royal Commission for AlUla to introduce a cutting-edge battery-powered tramway system in AlUla, Saudi Arabia. This initiative aims to enhance the region's connectivity while promoting sustainable transportation. The project integrates innovative rail technology tailored for eco-friendly urban mobility. Once operational, it will strengthen AlUla's railway system and support its development as a global cultural and tourism hub.

Railway System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transit Types Covered |

|

| System Types Covered | Auxiliary Power System, Train Information System, Propulsion System, Train Safety System, HVAC System, On-Board Vehicle Control |

| Applications Covered | Freight Transportation, Passenger Transportation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Alstom SA, Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, Hitachi, Ltd., Ingeteam A.S., Knorr-Bremse AG, Mitsubishi Electric Corporation, Siemens AG, Škoda Transportation a.s., Stadler, Inc., Toshiba Corporation, Wabtec Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the railway system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global railway system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the railway system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The railway system market was valued at USD 29.57 Billion in 2024.

IMARC estimates the railway system market to exhibit a CAGR of 3.90% during 2025-2033, reaching a value of USD 41.85 Billion by 2033.

The railway system market is driven by the growing need for eco-friendly transportation, improvements in rail infrastructure, government investments in modernization, and the growing need for efficient freight and passenger transport. Technological innovations such as electrification, automation, and smart signaling systems are also playing a crucial role in supporting the market growth and efficiency.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the railway system market include ABB Ltd., Alstom SA, Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, Hitachi, Ltd., Ingeteam A.S., Knorr-Bremse AG, Mitsubishi Electric Corporation, Siemens AG, Škoda Transportation a.s., Stadler, Inc., Toshiba Corporation, Wabtec Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)