Radiotherapy Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Radiotherapy Market Size and Share:

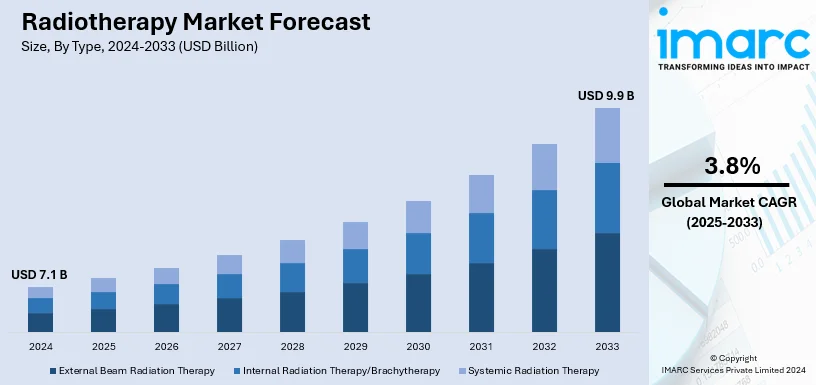

The global radiotherapy market size was valued at USD 7.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.9 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. The market is growing due to a variety of factors, including rising cancer incidence, rapid technological improvements, improved tumor targeting accuracy, rising healthcare costs, and increased awareness of the advantages of radiotherapy as a non-invasive cancer treatment alternative.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.1 Billion |

|

Market Forecast in 2033

|

USD 9.9 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

The growing incidence of cancer is one of the primary factors of the radiotherapy market. Cancer is a growing cause of mortality worldwide, with millions of cases diagnosed each year. It is expected that in 2024, there would be around 2,001,140 new instances of cancer diagnosed in the United States, with 611,720 individuals dying from the same. This growing load raises the need for better treatment options such as radiotherapy. It is a key component of cancer treatment because it can precisely target malignant cells while inflicting minimum harm to healthy tissues. Additionally, the expanding geriatric population contributes to this need, as the risk of cancer grows with age. Aside from this, governments and health care organizations are launching awareness programs and early screening initiatives to detect cancer at treatable stages, which is promoting the use of radiotherapy.

The United States is one market disruptor because of rapid technological advancement, and government expenditure on healthcare. The adoption of non-invasive treatment options also sets it apart. The US market is at the forefront of implementing cutting-edge radiation technology, which has greatly boosted the market growth. Recently, the numerical and geographic expansion of proton treatment facilities, with over 40 operating centers in the United States alone, has resulted in enhanced patient access as well as an exponential increase in the capacity to collect clinical data and complete participation in multicenter clinical studies. Furthermore, the growing healthcare expenditure in the United States, which is expected to expand 7.5% to $4.8 trillion by 2023, is a key driver of radiotherapy growth in the country. Moreover, federal programs like the Cancer Moonshot initiative that work to reduce cancer mortality rates through enhanced research, innovation, and access to care is fueling the market expansion. This increased funding has led to the establishment of specialized cancer centers equipped with state-of-the-art radiotherapy systems.

Radiotherapy Market Trends:

Technological Advancements

Recent advancements and technologies in the radiotherapy industry, such image-guided radiotherapy (IGRT) and intensity-modulated radiotherapy (IMRT), have increased the accuracy and efficacy of cancer treatments, which has aided in the market growth. IGRT involves the use of real-time imaging in order to ensure that the tumor is precisely targeted during radiation therapy sessions even in cases when there is movement between treatments. This enables doctors to adjust the radiation dosage by adjusting the beam intensity during therapy, thereby fitting the radiation dose to the shape of the tumor while reducing exposure to adjacent healthy tissues. Additionally, the IAEA launched a research in April 2020 to investigate how Stereotactic Fractionated Radiotherapy (SFRT) might improve palliative care for cervical and lung malignancies with the goal of reducing symptoms and delaying the course of the disease, which is assisting in boosting the market growth. With Europe’s most comprehensive technical radiotherapy platform, Institut Curie is France’s leading proton therapy center. In 2023, Institut Curie planned to launch a broad-ranging radiotherapy program involving a major investment plan to boost the modernization of its technical platform and offer its patients the most innovative and groundbreaking techniques. This major plan involves 56 million euros (USD 58.98 Million) invested over 6 years, covering all radiotherapy equipment and all Institut Curie sites: Paris, Saint-Cloud and Orsay.

Integration of Artificial Intelligence (AI) in Radiotherapy

AI technologies are being used to streamline the planning process, improve the accuracy of radiation dosing, and optimize treatment schedules. Machine learning (ML) algorithms can analyse large datasets of imaging and treatment records to identify patterns and predict optimal treatment approaches tailored to individual patients. AI is also being utilized to develop predictive models for patient responses to various radiation therapies, which can be used in adaptive radiotherapy to adjust treatments based on the patient's response to ongoing sessions. Radiologists look at approximately 225,000 MRI/CT exams in 40 years, while AI can start with 225,000 scans to train itself and reach millions of scans within a very short period of time. This will streamline operations and expand healthcare services to a larger population, thereby boosting radiotherapy market revenue.

Shift Toward Personalized Medicine

The market for radiotherapy is also majorly impacted by the increasing movement toward individualized medicine in cancer treatment. Customizing radiation doses and schedules based on genetic, phenotypic, and environmental factors that may impact treatment response is a component of personalized medicine approaches, which aim to tailor medical treatment to each patient's unique characteristics. By focusing on tailored patient care, healthcare practitioners can boost treatment efficacy and decrease the occurrence of adverse side effects. According to a survey by the Personalized Medicine Coalition, the number of customized medications available in the US market grew between 2016 and 2020. These medications increased from 132 to 286 in 2019, making up 25% of all new pharmaceuticals authorized by the FDA. This is a substantial increase from 5% in 2005. This growth is boosting the radiotherapy market share.

Radiotherapy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global radiotherapy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, end user, and region.

Analysis by Type:

- External Beam Radiation Therapy

- Intensity-Modulated Radiation Therapy (IMRT)

- Image-Guided Radiation Therapy (IGRT)

- Tomotherapy

- Stereotactic Radiosurgery

- Stereotactic Body Radiation Therapy

- Proton Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Internal Radiation Therapy/Brachytherapy

- Systemic Radiation Therapy

External beam radiation therapy leads the market with around 62.0% of market share in 2024. According to radiotherapy industry market research, the increasing demand for external beam radiation treatment (EBRT) is fueled by its adaptability and efficiency in precisely treating a variety of tumors. Accordingly, EBRT continues to be the most widely used type of radiotherapy because it can precisely target tumors with high-energy beams while causing the least amount of harm to nearby healthy tissues. Additionally, the introduction of technologically sophisticated systems such as intensity-modulated radiation therapy (IMRT), stereotactic body radiation therapy (SBRT), and three-dimensional (3D) conformal radiation therapy has greatly boosted the appeal of EBRT and created a favorable outlook for market expansion.

Analysis by Application:

- Skin and Lip Cancer

- Head and Neck Cancer

- Breast Cancer

- Prostate Cancer

- Cervical Cancer

- Lung Cancer

- Others

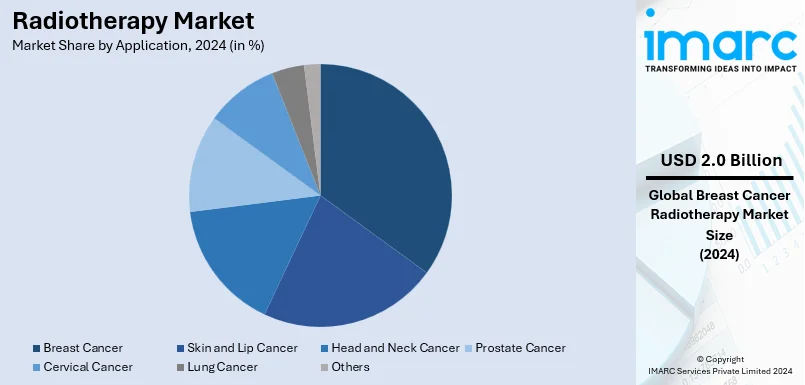

Breast cancer lead the market with around 28.8% of market share in 2024. Radiotherapy’s efficacy as a standard post-operative therapeutic strategy to prevent tumor recurrence in breast cancer represents a crucial factor driving its market demand. According to the World Health Organization (WHO), there were 2.3 million women diagnosed with breast cancer and 670,000 deaths globally in 2022. This increasing incidence of breast cancer globally necessitates effective treatment modalities, and radiotherapy is recognized for its critical role in the early and advanced stages of the disease. It is particularly effective in conserving the breast in cases of early-stage breast cancer, often used following lumpectomy to eliminate any remaining cancerous cells and significantly reduce the risk of cancer returning. Additionally, radiotherapy also helps alleviate symptoms and control tumor growth in advanced metastatic cases, which is further boosting its demand.

Analysis by End User:

- Hospitals

- Cancer Research Institutes

- Ambulatory and Radiotherapy Centers

As per the radiotherapy market report, its demand in ambulatory and radiotherapy centers is driven by an increasing preference for outpatient care settings, which offer cost-efficiency, convenience, and reduced patient burden compared to in-hospital treatments. Ambulatory care centers are particularly appealing because they enable patients to receive high-quality, specialized care without the need for overnight hospital stays. Additionally, these centers can often provide services at a lower cost than traditional hospital settings due to their specialized nature and efficiency in managing specific treatments like radiotherapy. This cost-effectiveness attracts patients and healthcare payers seeking to manage expenditures. Furthermore, the proliferation of radiotherapy centers and technological advancements that make sophisticated radiotherapy equipment more compact and affordable, are propelling the market forward.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. The demand for radiotherapy in North America is propelled by numerous factors such as well-established healthcare infrastructure, robust funding for cancer research, and the high prevalence of cancer. North America boosts some of the world’s leading cancer research facilities and hospitals, which adopt and also develop cutting-edge radiotherapy technologies. In addition to this, the region benefits from substantial healthcare spending both from the public and private sectors, allowing for significant investments in advanced medical equipment and treatment modalities. Furthermore, there is a strong focus on early cancer detection and screening programs, which identify patients who can benefit from early intervention using radiotherapy, which is impelling the market growth.

Key Regional Takeaways:

United States Radiotherapy Market Analysis

In North America, the United States held a market share of over 85.00% in 2024. High cancer incidence rates and improvements in treatment technology exerted an impact on the U.S. radiotherapy market. The American Cancer Society estimates that more than 1.9 million new cases of cancer were recorded in 2023. Additionally, the national health spending is projected to rise from USD 4.8 trillion in 2023 to USD 7.7 trillion by 2032, according to the Centers for Medicare & Medicaid Services (CMS). In actuality, this highlights the pressing need for sophisticated and affordable therapies like radiotherapy. The adoption of novel radiation treatments is being further accelerated by initiatives such as the National Cancer Moonshot, which aims to double the rate of improvements in cancer research and treatment. Repute players like Varian and Elekta are introducing AI-powered radiotherapy systems, which would help improve accuracy and patient outcomes. The actual utilization of proton therapy centers saw a rise of 30% in the period between 2020 and 2023, reflecting the growing demand for specialized cancer treatments in the region.

Europe Radiotherapy Market Analysis

Europe's radiotherapy market is strewn with a mighty emphasis on cancer care and sizeable government funding for innovation in healthcare. Cancer remains the second cause of death in Europe with approximately 2.7 million new cases every year. The European Union has allocated USD 5.31 Billion to health programs under Horizon Europe for 2021–2027. Such funds are bound to nudge acceptance of advanced radiotherapy equipment. The leading nations are Germany, France, and the UK, investing significant amounts in proton therapy and stereotactic radiotherapy technologies. The acceleration in this market has been further driven by a surge in non-invasive treatments and the fulfilment of the European Medical Device Regulation (MDR). The ESTRO indicated that in 2014, there were more than 2,192 linear accelerators across 27 European countries, with a significant increase in modern linear accelerators in recent years. By 2023, more than 75% of radiation oncology centers in Europe used modern linacs and ensured better patient access to precision therapy.

Asia Pacific Radiotherapy Market Analysis

Asia Pacific is one of the fastest-growing regions in terms of radiotherapy due to incidence of cancer, improved healthcare infrastructure, and growing awareness. Government initiatives, such as India's National Cancer Grid and China's Healthy China 2030 plan, form the very basis of the increasing adoption of advanced radiotherapy equipment. The region also sees massive private investment, with Japan and South Korea always at the forefront of their own research in proton therapy. According to an industrial report, China saw a 40% increase in installations of linear accelerators from 2018 to 2023. In India, oncology centers continue to adopt brachytherapy solutions at a rapid pace. Collaborative projects, such as Elekta's training programs for radiotherapists in the region, are tackling the shortage of skilled workforce to make such treatments more widely accessible.

Latin America Radiotherapy Market Analysis

The radiotherapy market in Latin America is expanding due to rising cancer rates and efforts to improve access to healthcare in the region. Brazil and Mexico capture the largest market share, with an increasing number of radiotherapy installations in public and private hospitals. In August 2024, Elekta (a Swedish Company) received a USD 64 Million order for advanced linear accelerators and the Elekta Esprit Gamma Knife from Mexico's Hospital Angeles Health System. This reflects the country's increased efforts to improve cancer care across the nation. Medical tourism in Costa Rica and Colombia is also on the rise, and clinics have taken up state-of-the-art systems to attract international patients. Such development indicates that the region is committed to managing their carcinogenic burdens effectively.

Middle East and Africa Radiotherapy Market Analysis

The radiotherapy market in Middle East and Africa is on the growth trajectory based on government initiatives and private investments in healthcare. The International Agency for Research on Cancer (IARC) reports that the African region recorded around 1.1 Million new cancer cases in the year 2020, and the burden would continue to grow with population increase and exposure to more risk factors. The Vision 2030 initiative in Saudi Arabia and the National Cancer Strategic Framework 2022–2027 in South Africa are also promoting the adoption of radiotherapy. There is also an effort to increase access by like-minded global firms partnering with local delivery providers; a case in point is the partnership by Elekta to train radiotherapists in sub-Saharan Africa. Rising telemedicine adoption and mobile health platforms further support treatment planning and follow-ups, enhancing patient outcomes.

Competitive Landscape:

The competitive landscape is characterized by the presence of prominent radiotherapy companies who are engaged in fierce competition through technological innovation, mergers, and acquisitions, and expansion into emerging markets. They are developing advanced radiotherapy systems with enhanced precision and adaptability and leveraging their broad technological portfolios and strong global presence to enhance their market share and penetrate new geographical regions. Additionally, specialized companies are focusing on niche technologies like brachytherapy and compact proton therapy systems, respectively to offer tailored solutions that meet specific clinical needs and gain a competitive edge in the market.

The report has provided a comprehensive analysis of the competitive landscape in the radiotherapy market with detailed profiles of all major companies, including:

- Accuray Incorporated

- Becton Dickinson and Company

- Eckert & Ziegler

- Elekta AB

- General Electric Company

- Hitachi Ltd

- Ion Beam Applications

- Isoray Inc.

- Mevion Medical Systems Inc.

- Nordion Inc. (Sotera Health)

- Siemens Healthineers AG (Siemens AG)

Latest News and Developments:

- October 2024: Eckert & Ziegler SE, the nuclear medicine leading supplier of isotopes, has announced that it has entered into a global clinical supply agreement with GlyTherix Ltd, an Australian company focused on targeted radiotherapy for solid tumors. Pursuant to this agreement, Eckert & Ziegler will offer GMP-grade non-carrier added Lutetium-177 chloride (n.c.a. Lu-177) for the clinical trials conducted by GlyTherix in its efforts to develop novel treatments for aggressive and invasive cancers.

- August 2024: Accuray Incorporated announced that they received CE Mark approval for the Accuray Helix, a CT-guided helical radiotherapy system. The system is targeting emerging markets where limited access exists to advanced cancer care, filling in the shortfall of linear accelerators compared to WHO recommendations. Accuray Helix will offer high performance, cost-effectiveness, and short treatment times, allowing non-urban clinical teams to provide advanced radiotherapy options to underserved patient populations.

- August 2024: Elekta announced it has received a USD 64 Million order from the Hospital Angeles Health System in Mexico for advanced linear accelerators and the company's Elekta Esprit Gamma Knife. The deal will bolster cancer care across Mexico, focusing on innovative radiotherapy solutions and ensuring the hospital's commitment to effectively tackling the country's cancer burden.

- September 2023: Siemens Healthineers acquired Aspekt to strengthen its radiation oncology services.

- May 2023: General Electric Company launched multiple radiotherapy instruments, including auto segmentation, intelligent radiation therapy (IRT), and an updated MR radiation therapy suite

Radiotherapy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Skin and Lip Cancer, Head and Neck Cancer, Breast Cancer, Prostate Cancer, Cervical Cancer, Lung Cancer, Others |

| End Users Covered | Hospitals, Cancer Research Institutes, Ambulatory and Radiotherapy Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accuray Incorporated, Becton Dickinson and Company, Eckert & Ziegler, Elekta AB (publ), General Electric Company, Hitachi Ltd, Ion Beam Applications, Isoray Inc., Mevion Medical Systems Inc., Nordion Inc. (Sotera Health), Siemens Healthineers AG (Siemens AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the radiotherapy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global radiotherapy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the radiotherapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Radiotherapy is a transformative force that empowers businesses to unearth invaluable insights from their data. Its sophisticated techniques enable organizations to make informed decisions and drive growth. Analyzing historical data and spotting trends helps anticipate future outcomes, contributing to strategic planning.

The radiotherapy market was valued at USD 7.1 Billion in 2024.

IMARC estimates the global radiotherapy market to exhibit a CAGR of 3.8% during 2025-2033.

The radiotherapy market is driven by the rising cancer prevalence, rapid technological advancements in treatment modalities, increasing healthcare investments, growing preference for non-invasive therapies, and expanding applications in non-oncological conditions.

According to the report, external beam radiation therapy represented the largest segment by type, due to its widespread use for treating various cancer types with precision and minimal invasiveness.

Breast cancer leads the market by application as it is one of the most commonly diagnosed cancers.

Ambulatory and radiotherapy centers are the leading segment by end user, due to their focus on outpatient care and the growing demand for cost-effective and specialized cancer treatment services.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global radiotherapy market include Accuray Incorporated, Becton Dickinson and Company, Eckert & Ziegler, Elekta AB (publ), General Electric Company, Hitachi Ltd, Ion Beam Applications, Isoray Inc., Mevion Medical Systems Inc., Nordion Inc. (Sotera Health), Siemens Healthineers AG (Siemens AG), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)