Radiology Information System Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, End User, and Region, 2025-2033

Radiology Information System Market Size and Share:

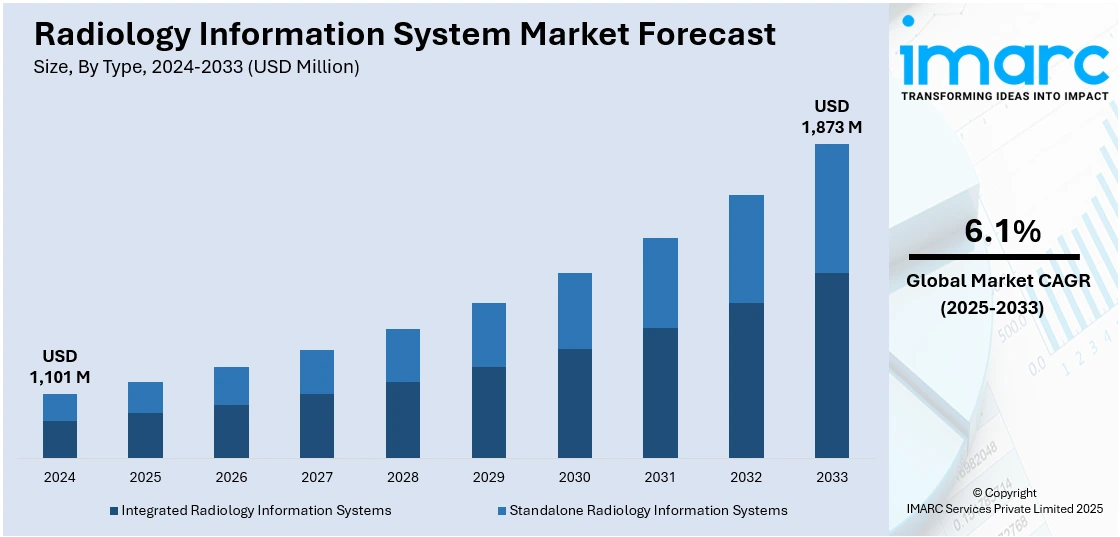

The global radiology information system market size was valued at USD 1,101 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,873 Million by 2033, exhibiting a CAGR of 6.1% during 2025-2033. North America currently dominates the market, holding a significant market share of over 49.2% in 2024. The advanced healthcare infrastructure, high adoption of electronic health records (EHR), increasing prevalence of chronic diseases, regulatory incentives, and the integration of artificial intelligence and cloud-based solutions to enhance diagnostic accuracy and operational efficiency are some factors driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,101 Million |

|

Market Forecast in 2033

|

USD 1,873 Million |

| Market Growth Rate (2025-2033) | 6.1% |

The global radiology information system (RIS) market is propelled by the rising need for effective healthcare IT solutions to oversee radiology processes and information. The growing incidence of chronic illnesses and the rise in imaging procedures drive the demand for more efficient systems to improve operational effectiveness and patient care. Improvements in cloud-based RIS solutions provide scalability and accessibility, drawing healthcare providers in search of affordable and secure systems. Regulatory demands for data management and interoperability additionally promote the adoption of RIS. Moreover, the radiology information system (RIS) market is propelled by the overall expansion of the healthcare sector and rising investments in digital health technologies across the globe. According to the India Brand Equity Foundation (IBEF), the Indian healthcare market is expected to reach USD 638 Billion by 2025.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by the growing with the demand for digitization in the healthcare sector and the rise in the requirement for efficient data management solutions in radiology. High prevalence of chronic diseases and age-related conditions, such as cancer and cardiovascular disorders, has led to an increase in imaging procedures, which requires advanced RIS for smooth operations. Government initiatives in the adoption of EHR and interoperability standards further boost the implementation of RIS. Moreover, improvements in cloud computing and the integration of artificial intelligence boost diagnostic precision and streamline workflows, attracting healthcare professionals. The significant investment in technological infrastructure by the U.S. healthcare sector promotes the expansion of RIS.

Radiology Information System Market Trends:

Rising incidences of chronic illnesses

The growing prevalence of chronic diseases, such as cancer, arthritis, cardiovascular, and diabetes, on account of the increasing consumption of fast food and sedentary lifestyles of individuals represents one of the key factors driving the market. According to the WHO, in 2022, with 20 Million new cancer cases, 9.7 Million deaths, and 53.5 Million survivors within five years of diagnosis, the demand for radiology information systems is intensifying to enhance cancer care management. The increasing incidence of chronic diseases, especially cancer, necessitates more sophisticated and efficient diagnostic tools and data management systems, thereby creating a demand for Radiology Information Systems (RIS). Since cancer diagnosis has become more dependent on imaging modalities such as CT scans, MRIs, and X-rays, robust RIS solutions are required for the effective management of patient data and imaging outcomes. Such systems would facilitate the integration of EHRs and improve data accuracy and accessibility, which would be critical for the time sensitivity of diagnosis and treatment planning.

Increasing healthcare digitization and interoperability standards

The global radiology information system (RIS) market growth is significantly driven by the trend of healthcare digitization currently ongoing, as hospitals and healthcare facilities embrace advanced IT solutions to streamline operations and better care for patients. Due to the transition of many healthcare providers from paper-based systems to electronic systems, a growing demand for efficient data management solutions such as RIS has been experienced. RIS is the help in managing a huge volume of radiology data in terms of imaging results, patient records, and reports. It is stored in digital format, so information is readily accessible, shareable, and updatable. It makes it easy to be connected to EHR and PACS, thus making a harmonious healthcare information system.

Growing demand for artificial intelligence and advances imaging technologies

Artificial intelligence (AI) and machine learning (ML) technologies have further increased the demand for global RIS. AI-based solutions have revolutionized the approach radiologists use to diagnose a condition by analyzing medical images. It has improved both the accuracy and efficiency with which radiologists can conduct these analyses. The integration of AI in RIS allows the automated detection of abnormalities, assessment of conditions, and the suggestion of diagnoses, thus cutting human error significantly. Moreover, AI-powered RIS can automate report generation and workflow management, giving radiologists more time to make critical decisions and interact with patients.

Radiology Information System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global radiology information system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, deployment mode, and end user.

Analysis by Type:

- Integrated Radiology Information Systems

- Standalone Radiology Information Systems

Integrated radiology information systems stand as the largest component in 2024, holding around 67.8% of the market, as its comprehensive functionality seamlessly connects a radiology department with larger healthcare systems. These allow for streamlined workflows through an integration with PACS, EHR, and other forms of healthcare IT solutions; they support the efficient transfer of data and coordinated care. They also support advance features such as real-time reporting, billing, and patient scheduling to enhance operations.

Analysis by Component:

- Hardware

- Software

- Services

The hardware segment of the RIS market comprises physical equipment such as servers, workstations, and imaging modalities that are used for deploying the system. This equipment allow for the storage, processing, and transfer of radiology data, thus becoming the backbone of RIS infrastructure. Hardware solutions are also critical for supporting high-speed data transfer and ensuring system reliability, particularly in high-volume radiology departments.

The software segment is part of RIS applications that can track the workflow of radiology, including patient scheduling, image tracking, reporting, and billing. The operational efficiency and decision-making through AI-driven analytics and cloud-based access are what this segment does best. Other health IT systems' integration for interoperability ensures data flow between departments is not a problem.

The services segment includes installation, maintenance, training, and system upgrades for support activities. This is the most important segment of RIS, as proper deployment and long-term operation are ensured. Implementation services include system setup and customization, maintenance ensures minimal downtime and optimum operation, and training services help radiology staff use the RIS effectively to extract maximum benefits from the system.

Analysis by Deployment Mode:

- Web-based

- Cloud-based

- On-premises

Web based leads the market with around 76.7% of radiology information system market share in 2024, as they are flexible, scalable, and cost-effective. Such systems allow for real-time access, integration, and sharing of data across multiple locations and support remote diagnostics and telemedicine services. They do not require extensive on-site infrastructure, which reduces the implementation and maintenance costs, thus making them ideal for small and medium healthcare providers.

Analysis by End User:

- Hospitals

- Office-Based Physicians

- Emergency Healthcare Service Providers

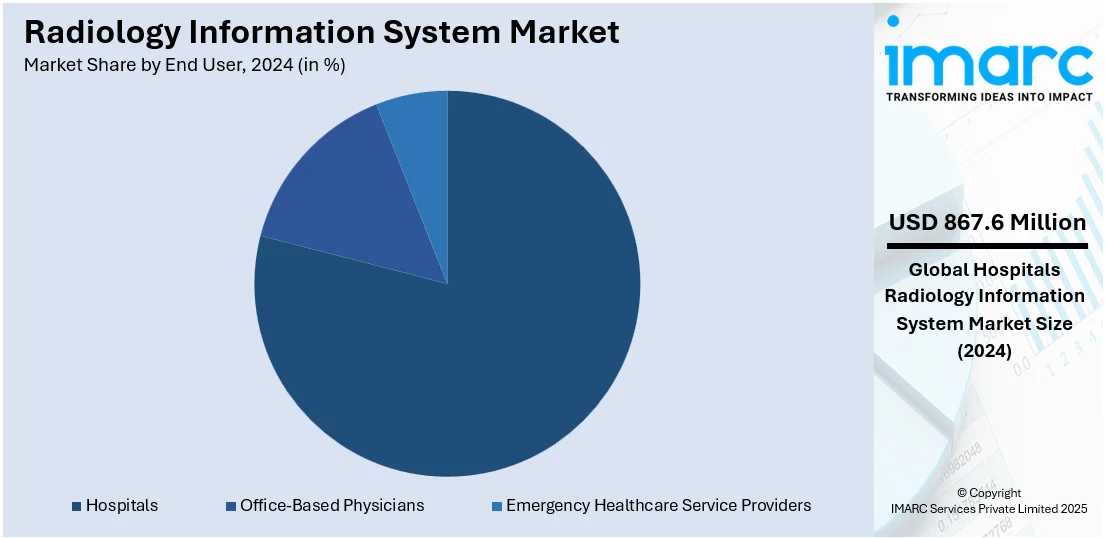

Hospitals lead the market with around 78.8% of market share in 2024, primarily on account of high volumes of patients and extensive requirements for imaging. They conduct multiple diagnostic and therapeutic procedures and require efficient systems to handle radiology workflows and merge the data from the images with electronic health records (EHR). The hospital is also financially capable to invest in advanced RIS technologies such as cloud-based and AI-integrated solutions for improved operational efficiency and quality patient care.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 49.2%, due to its advanced healthcare infrastructure, early adoption of cutting-edge technologies, and significant investments in healthcare IT. High rates of chronic diseases and imaging procedures, combined with the widespread implementation of electronic health records (EHR) and interoperability standards, bolster RIS adoption. Additionally, favorable government initiatives, such as the HITECH Act, promote digital transformation in healthcare. The region’s strong presence of key market players and robust research and development activities further drive growth. According to industry data, the United States leads in healthcare spending, which directly supports RIS adoption and market expansion.

Key Regional Takeaways:

United States Radiology Information System Market Analysis

In 2024, the United States accounts for over 87.90% of the radiology information system market in North America. Urbanization and increasing healthcare investments are pivotal in the adoption of radiology information systems. According to reports, United States healthcare investments are surging, with 55 biopharma companies landing USD 100 Million plus deals in 2024, fostering radiology information system adoption. US firms securing USD 15 Million plus venture capital are facing flat or down rounds, highlighting sector challenges. Expanding urban centers demand healthcare facilities that integrate advanced systems for streamlined diagnostics and patient data management. These systems improve operational efficiency, enabling faster image processing, scheduling, and reporting. Enhanced workflow optimization reduces waiting times, directly benefiting patient care. Additionally, growing investments in advanced imaging technologies and hospital infrastructure are fostering the adoption of radiology systems, as they allow seamless integration with diagnostic equipment. Their ability to provide accurate, real-time patient records aids healthcare professionals in delivering superior services. Expanding urban healthcare hubs necessitate systems that handle large patient volumes while maintaining precision and data security, which these solutions deliver effectively. This development bridges the gap in healthcare accessibility in urban regions, enhancing outcomes and operational efficiency.

Asia Pacific Radiology Information System Market Analysis

The proliferation of healthcare applications has revolutionized radiology information systems, offering enhanced integration with mobile and telehealth platforms. For instance, India’s digital healthcare segment is set to expand 10x, from USD 2.7 Billion in 2022 to USD 37 Billion by 2030, driving radiology information system adoption. Increasing healthcare digitalization enhances efficiency and accessibility in radiology workflows. The increased adoption of teleconsultations and remote diagnostics has driven demand for systems capable of secure image-sharing and real-time data access. These applications support radiologists in providing timely consultations, even in remote areas. Enhanced compatibility with wearable health devices also aids in monitoring patient health trends, enabling early diagnosis and intervention. Radiology systems integrated with healthcare applications simplify appointment scheduling and diagnostic result sharing, enhancing patient engagement. This technological advancement aligns with the growing preference for accessible and tech-driven healthcare solutions, enabling personalized patient experiences. The synergy between radiology systems and health-tech platforms fosters data-driven care, ensuring efficient diagnostics and treatment planning.

Europe Radiology Information System Market Analysis

Rising incidences of chronic diseases necessitate advanced radiology information systems for effective disease management and diagnosis. The National Library of Medicine reports that more than 50 million people in Europe suffer from multiple chronic conditions, which may arise from random coincidence, a potential shared risk profile, or interactions in the progression of diseases. The systems' ability to store and retrieve historical imaging data is particularly beneficial for conditions requiring regular monitoring. These technologies enhance diagnostic accuracy and aid in developing tailored treatment plans by consolidating diverse patient data into a centralized platform. Such systems also facilitate multidisciplinary collaboration, crucial for chronic disease care, allowing specialists to access imaging records simultaneously. Streamlined imaging workflows enable quick report generation, essential in managing chronic conditions. The focus on efficient healthcare solutions amid increasing disease prevalence ensures the continued adoption of these systems, providing medical professionals with tools to deliver timely and comprehensive care.

Latin America Radiology Information System Market Analysis

Growing disposable income supports the demand for advanced healthcare solutions, including radiology information systems. According to reports, disposable incomes in Latin America are projected to grow by nearly 60% by 2040, driving demand for radiology information system services, including subscription-based app adoption, as regional disparities narrow and technology advances. The ability of these systems to optimize imaging workflows and improve diagnostic efficiency aligns with rising expectations for better healthcare services. The improved affordability of such solutions enables their adoption in expanding healthcare facilities. Their capacity to store and analyse extensive patient data enhances the accessibility of specialized care, catering to a population seeking more personalized medical services. These systems bridge gaps in diagnostic accuracy, streamlining patient experiences and supporting the growing demand for improved healthcare delivery.

Middle East and Africa Radiology Information System Market Analysis

The expansion of healthcare infrastructure, including increasing number of hospitals, underpins the increasing adoption of radiology information systems. According to Dubai Healthcare City Authority report, by 2022, Dubai had 4,482 private medical facilities, including 56 hospitals and 55,208 licensed professionals, driven by expanding healthcare infrastructure investments. The ability to manage extensive imaging data efficiently supports healthcare facilities in delivering high-quality diagnostics. These systems improve operational workflows, ensuring better utilization of diagnostic equipment. Enhanced data storage and analysis capabilities cater to growing patient volumes, aligning with the rising demand for comprehensive healthcare services. Their seamless integration into newly developed hospitals and clinics ensures a smoother diagnostic process, improving patient outcomes and operational efficiency.

Competitive Landscape:

Key players in the global radiology information system market dominate through strategic activities, such as product innovation and collaborations as well as increased market reach. They offer advanced integration of AI with ML and improve accuracy in diagnostics alongside streamlining workflow processes of RIS. Cloud-based RIS solutions are increasingly popular, providing scalability, cost-effectiveness, and ease of access for healthcare providers. The companies partner with hospitals and imaging centers to offer tailored solutions that meet specific operational needs. They are also expanding their global footprints by entering emerging markets where healthcare infrastructure is rapidly developing.

The report provides a comprehensive analysis of the competitive landscape in the radiology information system market with detailed profiles of all major companies, including:

- Advanced Data Systems

- Agfa-Gevaert Group

- CoActiv Medical

- DeepHealth

- GE HealthCare

- INFINITT North America Inc

- KareXpert, Inc.

- Koninklijke Philips N.V.

- MedInformatix, Inc

- NEXUS / CHILI GmbH

- Novarad

- Pro Medicus, Ltd.

- RamSoft

- Siemens Healthcare

Latest News and Developments:

- December 2024: RamSoft's cloud based RIS/PACS platform has powered Advanced Imaging's rapid expansion to 10 imaging centers across Arizona and Texas within five years. As a leading provider of diagnostic imaging for personal injury patients, Advanced Imaging relies on RamSoft's platform for efficient scheduling, imaging, and reporting, enabling seamless growth and scalability.

- December 2024: DeepHealth, a subsidiary of RadNet, unveiled advanced AI-powered informatics and SmartTechnology solutions at RSNA 2024, featuring its cloud-native DeepHealth OS. Innovations include the Diagnostic Suite™ and TechLive™1 for radiologists and technologists, alongside updates in Radiology Information System (RIS) and clinical AI to optimize imaging workflows.

- November 2024: Scriptor Software has unveiled rScriptor Impressions, a free AI-powered tool for generating radiology impressions. Leveraging Generative AI, the software integrates with existing dictation systems to boost accuracy and efficiency in reporting. The innovative solution enhances workflow within radiology information systems, addressing the demand for streamlined operations.

- November 2024: Apollo Radiology International (ARI), the radiology arm of India's Apollo Group, has acquired InHealth Group's radiology reporting division in the U.K. The move aims to tackle the global radiologist shortage while expanding ARI's teleradiology reach. With this acquisition, ARI plans to report over 2 Million scans annually across 24 countries for over 200 healthcare organizations.

- November 2024: The American College of Radiology has launched the National Radiology Data Registry to track AI performance in radiology. This initiative provides imaging providers with analytics on clinical AI applications, incorporating patient data, clinical metadata, and radiology reports. It aims to enhance AI quality monitoring and adoption across radiology practices. The registry offers a robust tool for evaluating AI's clinical impact over time.

Radiology Information System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

| Types Covered | Integrated Radiology Information Systems, Standalone Radiology Information Systems |

| Components Covered | Hardware, Software, Services |

| Deployment Modes Covered | Web-based, Cloud-based, On-premises |

| End Users Covered | Hospitals, Office-Based Physicians, Emergency Healthcare Service Providers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Data Systems, Agfa-Gevaert Group, CoActiv Medical, DeepHealth, GE HealthCare, INFINITT North America Inc, KareXpert, Inc., Koninklijke Philips N.V., MedInformatix, Inc, NEXUS / CHILI GmbH, Novarad, Pro Medicus, Ltd., RamSoft, Siemens Healthcare, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the radiology information system market from 2019-2033.

- The radiology information system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the radiology information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Radiology information system is a software platform used by healthcare providers to manage, store, and track radiology data, including patient information, imaging procedures, and reports, to streamline workflow and improve efficiency in radiology departments.

The radiology information system market was valued at USD 1,101 Million in 2024.

IMARC estimates the radiology information system market to exhibit a CAGR of 6.1% during 2025-2033.

The radiology information system (RIS) market is driven by the increasing demand for efficient healthcare data management, advancements in cloud-based and AI-integrated solutions, growing healthcare digitization, regulatory compliance, and the rising prevalence of chronic diseases requiring imaging procedures.

According to the report, integrated radiology information systems represented the largest segment by type, driven by their ability to streamline workflows by combining radiology management with electronic health records (EHR) and other hospital information systems, enhancing operational efficiency and improving patient care.

Web based leads the market by deployment mode due to its cost-efficiency, scalability, ease of access from any location, and reduced need for on-site infrastructure maintenance.

Hospitals hold maximum number of shares due to their high volume of imaging procedures, need for streamlined patient data management, and the integration of RIS with electronic health records (EHR) to improve workflow and diagnostic accuracy.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the radiology information system market include Advanced Data Systems, Agfa-Gevaert Group, CoActiv Medical, DeepHealth, GE HealthCare, INFINITT North America Inc, KareXpert, Inc., Koninklijke Philips N.V., MedInformatix, Inc, NEXUS / CHILI GmbH, Novarad, Pro Medicus, Ltd., RamSoft, Siemens Healthcare, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)