Radar Sensors Market Size, Share, Trends and Forecast by Type, Range, Application, and Region, 2026-2034

Radar Sensors Market Size and Share:

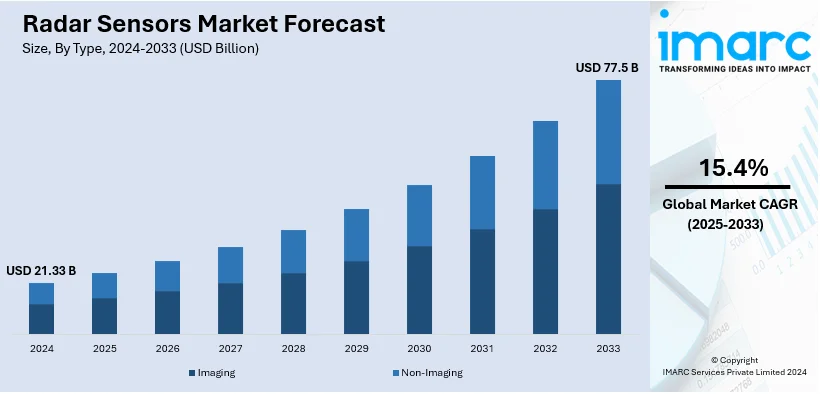

The global radar sensors market size was valued at USD 21.33 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 77.5 Billion by 2034, exhibiting a CAGR of 15.4% from 2026-2034. North America currently dominates the market, holding a market share of over 36.9% in 2024. Ongoing technological advancements, rising demand for autonomous vehicles, stricter safety regulations, expanding applications in aerospace, defense, and industrial sectors, and heightened capabilities in vehicle safety, navigation, and monitoring are some of the key factors influencing the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.33 Billion |

| Market Forecast in 2034 | USD 77.5 Billion |

| Market Growth Rate (2026-2034) | 15.4% |

The growth of the global radar sensors market is being driven by advancements in automotive safety systems, increased adoption of smart home technologies, and rising demand for industrial automation. Enhanced radar capabilities in advanced driver-assistance systems (ADAS) are fueling adoption in the automotive sector. Additionally, radar sensors are becoming integral in security systems and smart devices for precise object detection and motion sensing, bolstered by the proliferation of IoT applications. The demand for improved navigation and collision avoidance systems in the aerospace and defense sectors also supports market expansion. Furthermore, advancements in miniaturization and cost-effective manufacturing processes are increasing accessibility, and encouraging deployment across consumer electronics and industrial applications, further accelerating the market's growth trajectory.

The United States is emerging as one of the key markets with 94.60% of the total share. The automotive sector's push for advanced driver-assistance systems (ADAS) and autonomous vehicles has led to increased integration of radar sensors for functions like collision avoidance and adaptive cruise control. In 2023, global car sales rose to approximately 75.3 million units, up from 67.3 million in 2022, indicating a growing market for automotive radar applications. Additionally, the U.S. defense budget, the highest worldwide, allocates substantial resources to radar technologies for applications such as missile detection and air traffic control. The increasing adoption of Internet of Things (IoT) devices and smart home technologies is driving higher demand for radar sensors in security systems and automation.

Radar Sensors Market Trends:

Continuous Development of Radar Technology:

Rapid technological advancements are revolutionizing radar sensors. Innovations in radar technology, such as phased array radar and synthetic aperture radar (SAR), enhance performance and accuracy. Phased array radar uses electronic beam steering, eliminating the need for physical movement, which enhances its efficiency in detecting and tracking targets. This feature has a higher resolution and quicker response time, which aligns with the need of applications in autonomous vehicles and defense systems. A case in point is the Iron Dome, an Israeli air defense system, which has successfully intercepted over 90% of incoming threats since October 7, 2023. This attests to the accuracy and reliability of radar sensors for any modern defense strategy, while synthetic aperture radar will provide high-resolution images in all weather and light conditions, thereby ensuring some worthwhile applications in surveillance and reconnaissance missions. Incorporating machine learning (ML) and artificial intelligence (AI) into radar sensors enhances their ability to process and interpret complex data, thereby improving the market outlook for radar sensors.

Growing Demand for Autonomous Vehicles:

The automotive industry is shifting to autonomous and semi-autonomous vehicles, which is helping drive the market. Radar sensors are crucial in making the features of ADAS and autonomous driving possible since they enable the critical functionalities used in adaptive cruise control, collision avoidance, and lane-keeping assistance. For example, by 2035, autonomous driving will bring in USD 300-USD 400 Billion in revenue. According to McKinsey & Company, this is a transformative potential for the automobile sector. Radar sensors are crucial for safety and performance, hence critical for the future of the self-driving car. This, in consequence, is pushing the automotive market to invest heavily in radar technology to ensure the safety and efficient working of these systems. As a result, the stringent requirements of safety regulations and demand by consumers for vehicles with more advanced safety features are further propelling the growth. The demand for radar sensors is projected to keep increasing as automotive manufacturers work to comply with rigorous safety standards and regulatory requirements.

Greater Emphasis on Military and Aerospace Applications

Radar sensors are widely used in the defense and aerospace sectors because of their essential function in surveillance, navigation, and targeting systems. These radars are essential for identifying threats, tracking targets, and guiding missiles, providing significant strategic benefits in contemporary warfare. Advanced radar systems play a crucial role in early warning systems and in managing battlefield operations effectively. In the aerospace industry, radar sensors are used for navigation, weather monitoring, and collision avoidance. For instance, global defense firms increased arms sales by 4% in 2023, as reported by SIPRI, reflecting heightened military investments. This surge underscores the growing demand for radar sensors, vital for enhancing situational awareness and operational precision in modern defense systems. Besides this, the ongoing modernization of military and aerospace systems, coupled with geopolitical tensions and defense budget increases, is driving significant investments in radar technology. Both sectors are continually seeking improvements in radar performance and reliability to enhance operational capabilities and maintain strategic superiority.

Radar Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global radar sensors market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, range, and application.

Analysis by Type:

- Imaging

- Continuous Wave (CW) Radar

- Pulse Radar

- Others

- Non-Imaging

- Speed Gauge

- Radar Altimeter

Non-imaging radar stands as the largest component in 2024, holding around 91.5% of the market. The demand for such non-imaging radar sensors is primarily driven by the requirement for accurate distance measurement and the ability to detect velocity in such diverse applications. The FMCW, as well as other types of pulse radar, can now be seen to serve their use in industrial automation, traffic management, or even in safety systems without having detailed imagery captured in the process by using radar sensors. These factors of robustness against extreme environmental conditions such as poor visibility and bad weather make it very apt for applications such as manufacturing industry object detection and vehicle collision avoidance. Additionally, increasing concern for safety and efficiency in industries such as logistics and transportation is boosting the usage of non-imaging radar sensors as it is used to gather data to enhance the operation of such services and ensure improved safety mechanisms.

Analysis by Range:

- Short Range

- Medium Range

- Long Range

Short range leads the market with around 40.3% of the market share in 2024. As reflected in the radar sensors market demand prediction, short-range sensors hold relevance through their efficiency in applications like close-range detection and even following objects with precision. These sensors are exceedingly necessary for systems such as parking assistance and also close-range proximity sensing and operations automation in warehouses, where their ability to detect objects within short ranges is crucial for functional competence and safety. In environments requiring high-resolution data to navigate tight spaces or monitor the immediate vicinity of equipment and vehicles, short-range radar sensors excel. Their performance in detecting and classifying objects at close distances is both reliable and valuable for use in consumer electronics, robotics, and industrial automation.

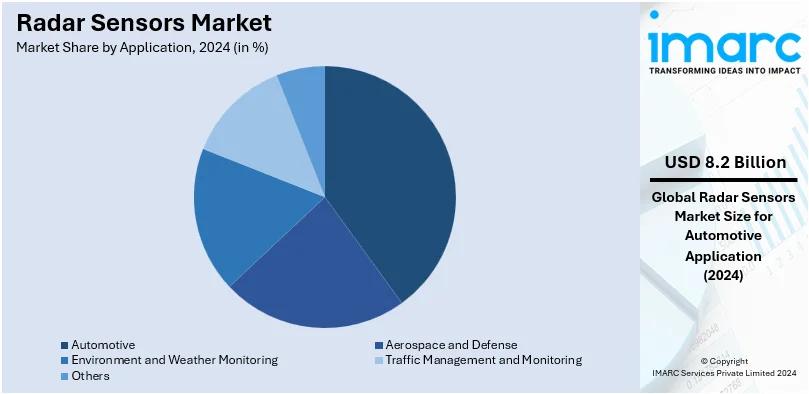

Analysis by Application:

- Automotive

- Aerospace and Defense

- Environment and Weather Monitoring

- Traffic Management and Monitoring

- Others

In 2024, automotive accounts for the majority of the market at around 38.5%. The demand for radar sensors in the automotive sector is driven by the increasing need for enhanced vehicle safety and advanced driver-assistance systems (ADAS). As automakers strive to improve vehicle safety and meet stringent regulatory standards, radar sensors are becoming essential for features such as adaptive cruise control, emergency braking, and blind-spot detection. These sensors provide reliable performance in detecting and tracking objects, even in challenging driving conditions like fog, rain, or low light, where visual sensors might fail. Additionally, the growing focus on integrating radar sensors with other sensor technologies, such as cameras and lidar, to create comprehensive sensing solutions for semi-autonomous and fully autonomous vehicles is accelerating demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America in 2024 captured the largest market share of over 36.9%. The region's emphasis on technological innovation and advancements within the automotive and defense sectors drives demand for radar sensors in North America. North America houses giant automobile and technology companies that influence the usage of sophisticated radar technologies in vehicles, providing such automobiles with cutting-edge ADAS and autonomous features. The region also sees high investment in defense and aerospace sectors, increasing the requirement for advanced radar systems to provide surveillance, navigation, and missile guidance. Besides, regulatory support for safety standards and environmental sustainability promotes the use of radar sensors further because it helps develop safe, efficient, and technologically advanced systems in many fields.

Key Regional Takeaways:

United States Radar Sensors Market Analysis

The U.S. radar sensor market is growing with many important drivers, including high-end defense applications, smartphone penetration, the rise of autonomous vehicles, and a growing demand for consumer electronics devices. With the United States having the highest defense budget in the world, the use of radar sensors has become imperative for a myriad of military applications, while a growing interest in short-range applications has been reflected by the demand for FMCW radar (Frequency Modulated Continuous Wave) sensors. Furthermore, the increasing adoption of autonomous vehicles propels the demand for radar sensors in advanced driver-assistance systems, as these are crucial to enable collision avoidance and adaptive cruise control, among others. Additionally, the smartphone market is a major player, since the integration of radar technology in mobiles enhances gesture control, health monitoring, and environmental sensing functionalities. As 5G connectivity is poised to dominate North America, GSMA estimates that nearly two-thirds of cellular connections in the region will be powered by 5G by the end of 2025, opening further opportunities for radar sensor applications, particularly in the context of mobile connectivity and smart devices.

Europe Radar Sensors Market Analysis

In Europe, the radar sensor market is driven by the automotive sector's push toward safety standards and autonomous driving technology. European countries are key centers for automotive manufacturing, with a significant emphasis on incorporating radar sensors for ADAS features like lane departure warnings, automatic emergency braking, and adaptive cruise control. Additionally, the region's increasing interest in electric vehicles (EVs) and smart cities further stimulates the demand for radar sensors. In June 2022, the European Parliament approved a proposal to prohibit the sale of diesel and gasoline vehicles starting in 2035. EMEA projects that battery electric vehicles will account for over 70% of the market by 2030 and nearly 30% of the European market by 2025. The adoption of radar sensors is also transforming Europe's technological landscape by enhancing precision and reliability across various sectors. In 2024, German startup Xavveo secured USD 8.6 Million in seed funding to advance its photonic radar systems, enhancing radar sensor capabilities in autonomous vehicles, factory automation, thereby favoring market growth.

Asia Pacific Radar Sensors Market Analysis

Radar sensors are transforming various sectors across the region, particularly in defense. They play a pivotal role in early warning systems, target tracking, and surveillance, significantly enhancing national security. Additionally, the region’s manufacturing advancements have lowered costs, making these technologies accessible for broader applications. For instance, on March 17, 2023, India's coastal security is bolstered by 46 radar stations under the Chain of Static Sensors (CSS), operational since 2011, with planned expansions promising enhanced real-time monitoring and opportunities for advanced radar sensor technologies. Beyond defense, these sensors are streamlining traffic management and industrial automation, addressing urbanization challenges. Their versatility and precision, combined with innovations from local industries, are enabling solutions that cater to both security and civilian needs, marking a significant leap in regional technological progress.

Latin America Radar Sensors Market Analysis

The adoption of radar sensors in Latin America is transforming defense operations and enhancing situational awareness and security. These sensors, utilized in applications like border surveillance and maritime monitoring, enable precise detection of threats and unauthorized movements. Their ability to operate under all weather conditions ensures consistent performance, even in challenging environments. On April 6, 2023, Embraer, a Brazil-based aerospace company, expanded its radar portfolio by introducing advanced solutions for defense and security, including the M200 multi-mission radar with a 200 km range and the P600 AEW&C system featuring a GaN AESA radar, enhancing surveillance capabilities and offering flexible, high-performance options for radar sensors. Additionally, radar sensors offer long-range detection capabilities, providing advanced warning to prevent potential conflicts. By integrating radar technology, defense systems in Latin America benefit from improved operational efficiency and reduced response times, fostering a more secure and resilient region against emerging threats.

Middle East and Africa Radar Sensors Market Analysis

Radar sensors are driving advancements across the Middle East and Africa by enhancing precision in sectors like automotive safety and border surveillance. In automotive applications, radar sensors improve collision detection and adaptive cruise control, critical in urban areas such as Dubai. For instance, On July 18, 2022, the UAE announced a National Space Fund of approximately USD 816.9 Million, initiating the Sirb radar satellite constellation to enhance transportation efficiency through advanced remote sensing, fostering global partnerships and technological innovation. Additionally, these sensors strengthen border security in regions like North Africa, ensuring efficient monitoring of remote and rugged terrains.

Competitive Landscape:

The global radar sensors market is characterized by intense competition among established players and emerging firms focusing on technological innovation and market expansion. Major companies dominate due to their robust R&D capabilities and extensive product portfolios. These players focus on developing advanced radar technologies, including millimeter-wave sensors, for applications in automotive, aerospace, industrial, and consumer electronics. Startups and regional firms are also gaining traction by offering specialized solutions, often targeting niche markets like industrial automation and healthcare monitoring. Strategic partnerships, mergers, and acquisitions are prevalent, allowing companies to strengthen their capabilities and broaden their global presence. For example, investments in radar-integrated ADAS systems and autonomous driving platforms are intensifying competition within the automotive industry.

The report provides a comprehensive analysis of the competitive landscape in the radar sensors market with detailed profiles of all major companies, including:

- Continental AG

- DENSO Corporation

- Hitachi Ltd

- Honeywell International Inc.

- Infineon Technologies AG

- L3harris Technologies Inc.

- Lockheed Martin Corporation

- NXP Semiconductors N.V

- Raytheon Technologies Corporation

- Robert Bosch GmbH

- Saab AB

- STMicroelectronics

- Texas Instruments Incorporated

- Thales Group

Latest News and Developments:

- In June 2024, OndoSense introduced a compact radar sensor for collision avoidance, vehicle detection, and object positioning. The OndoSense reaches WA (Wide Angle) and is suitable for detecting obstacles like vehicles, people, or objects, even at close range from 0.1 m. It can be integrated into confined spaces and is suitable for applications in transport, logistics, mining, shipping, engineering, and agriculture.

- In January 2024, NXP Semiconductors introduced the SAF86xx, an addition to its automotive radar one-chip family. This chip integrates a high-performance radar transceiver, a multi-core radar processor, and a MACsec hardware engine for secure data communication over Automotive Ethernet. This advancement supports software-defined radar systems, enhancing advanced driver-assistance systems (ADAS) architectures.

- In November 2023, Lockheed Martin announced that the U.S. Air Force would begin evaluating its advanced TPY-4 radar. Following comprehensive internal testing, this software-defined sensor is poised to replace the outdated TPS-75 radar within the Three-Dimensional Expeditionary Long Range Radar (3DELRR) program. The TPY-4 can detect and track a broad spectrum of aerial threats, including small drones and ballistic missiles.

- In September 2023, TagMaster agreed to acquire the radar division of Image Sensing Systems (ISS) for USD 4.8 Million via its US subsidiary, Sensys Networks. The acquisition will strengthen Sensys Networks' position as the accuracy leader for vehicle detection and traffic data solutions by augmenting its in-ground sensing solutions with high-performance radar-based above-ground sensors.

- In June 2021, Gapwaves, a Swedish technology innovator, partnered with Bosch, a leading automotive supplier, to design and mass-produce high-resolution radar antennas. These antennas are intended to enhance advanced driver-assistance systems (ADAS) and enable highly automated driving solutions. The collaboration focuses on cutting-edge radar technology to meet the increasing demand for precision in vehicle safety systems.

Radar Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Ranges Covered | Short Range, Medium Range, Long Range |

| Applications Covered | Automotive, Aerospace and Defense, Environment and Weather Monitoring, Traffic Management and Monitoring, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Continental AG, DENSO Corporation, Hitachi Ltd, Honeywell International Inc., Infineon Technologies AG, L3harris Technologies Inc., Lockheed Martin Corporation, NXP Semiconductors N.V, Raytheon Technologies Corporation, Robert Bosch GmbH, Saab AB, STMicroelectronics, Texas Instruments Incorporated, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the radar sensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global radar sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the radar sensors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Radar sensors are devices that utilize radio waves to identify objects, measure distances, and assess the speed or direction of movement.They are widely utilized across automotive, aerospace, defense, and industrial applications due to their precision in challenging environments.

The global radar sensors market was valued at USD 21.33 Billion in 2024.

IMARC estimates the global radar sensors market to exhibit a CAGR of 15.4% during 2025-2033.

The market is driven by advancements in automotive safety systems, growing adoption in aerospace and defense, and rising demand for industrial automation and IoT-enabled devices.

In 2024, non-imaging radar represented the largest segment by type, driven by its reliability in speed and distance measurements across multiple applications.

Short-range radar sensors lead the market by range owing to their precision in close-range object detection and tracking in safety-critical systems.

The automotive sector is the dominant application segment, fueled by the growing demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global radar sensors market include Continental AG, DENSO Corporation, Hitachi Ltd, Honeywell International Inc., Infineon Technologies AG, L3harris Technologies Inc., Lockheed Martin Corporation, NXP Semiconductors N.V, Raytheon Technologies Corporation, Robert Bosch GmbH, Saab AB, STMicroelectronics, Texas Instruments Incorporated, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)