Qatar Tire Market Report by Design (Radial, Bias), End-Use (OEM, Replacement), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR)), Distribution Channel (Offline, Online), Season (All Season Tires, Winter Tires, Summer Tires), and Region 2026-2034

Qatar Tire Market Overview:

The Qatar tire market size reached USD 366.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 529.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.05% during 2026-2034. The market is primarily driven by Qatar's economic diversification initiatives, rapid urbanization and infrastructure development, increased vehicle ownership, and technological advancements in tire manufacturing and design, including high-performance, eco-friendly, and smart tires that enhance vehicle safety, performance, and meet regulatory standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 366.4 Million |

|

Market Forecast in 2034

|

USD 529.7 Million |

| Market Growth Rate 2026-2034 | 4.05% |

Access the full market insights report Request Sample

Qatar Tire Market Trends:

Economic Diversification Initiatives

The Qatari government's commitment to economic diversification is a primary driver for the tire market. With a strategic vision outlined in the Qatar National Vision 2030, the nation aims to reduce its dependency on hydrocarbon revenues by promoting sectors such as manufacturing, logistics, and automotive industries. These initiatives have resulted in significant infrastructure development and increased investment in road networks, leading to higher demand for commercial and passenger vehicles. Consequently, the automotive sector's growth has propelled the need for tires, contributing to market expansion. Furthermore, policies fostering local manufacturing and industrialization have attracted international tire manufacturers to establish operations in Qatar, ensuring a steady supply of high-quality products to meet the burgeoning demand.

Urbanization and Infrastructure Development

Qatar's rapid urbanization and extensive infrastructure projects significantly influence the tire market's growth trajectory. The construction of new cities, expansion of existing urban areas, and the development of state-of-the-art transportation systems have escalated the demand for both passenger and commercial vehicles. Major projects, including the Doha Metro, Lusail City, and extensive road networks, necessitate a robust automotive fleet, thus driving the need for tires. The government's substantial investment in improving public transportation and logistics infrastructure also stimulates the commercial vehicle segment, further augmenting the market. This continuous urban and infrastructural development ensures a consistent demand for diverse tire types, catering to various vehicle categories and operational requirements.

Technological Advancements and Innovations

Technological advancements and innovations in tire manufacturing and design are pivotal in driving market growth in Qatar. The introduction of advanced materials and cutting-edge manufacturing processes has resulted in the production of high-performance, durable, and energy-efficient tires. Innovations such as run-flat tires, eco-friendly tires, and smart tires equipped with sensors for real-time monitoring are gaining traction among consumers and businesses. These technological advancements not only enhance vehicle safety and performance but also meet the stringent regulatory standards set by Qatari authorities. Moreover, the focus on sustainability and environmental conservation has led to the development of tires with reduced rolling resistance, contributing to lower fuel consumption and emissions. The continuous evolution of tire technology ensures that the market remains dynamic and responsive to the changing needs of consumers and the automotive industry.

Qatar Tire Market News:

- On 17th June 2024, Apollo Tyres launched the Vredestein Wintrac Pro+, a premium winter tyre designed for ultra-high-performance cars and SUVs, including electric vehicles (EVs).

- On 21st May 2024, Bridgestone Corporation was selected by Maserati to develop bespoke 20-inch tyres for the Maserati Grecale Folgore, its first all-electric SUV. This collaboration follows previous successful fitments for the Maserati MC20 supercar and the Maserati Grecale. Bridgestone created the custom Bridgestone Potenza Sport ENLITEN tyres to enhance the on-road capabilities of the Grecale Folgore.

Qatar Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on design, end-use, vehicle type, distribution channel, and season.

Design Insights:

To get detailed segment analysis of this market Request Sample

- Radial

- Bias

The report has provided a detailed breakup and analysis of the market based on the design. This includes radial and bias.

End-Use Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes OEM and replacement.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR).

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Season Insights:

- All Season Tires

- Winter Tires

- Summer Tires

The report has provided a detailed breakup and analysis of the market based on the season. This includes season tires, winter tires, and summer tires.

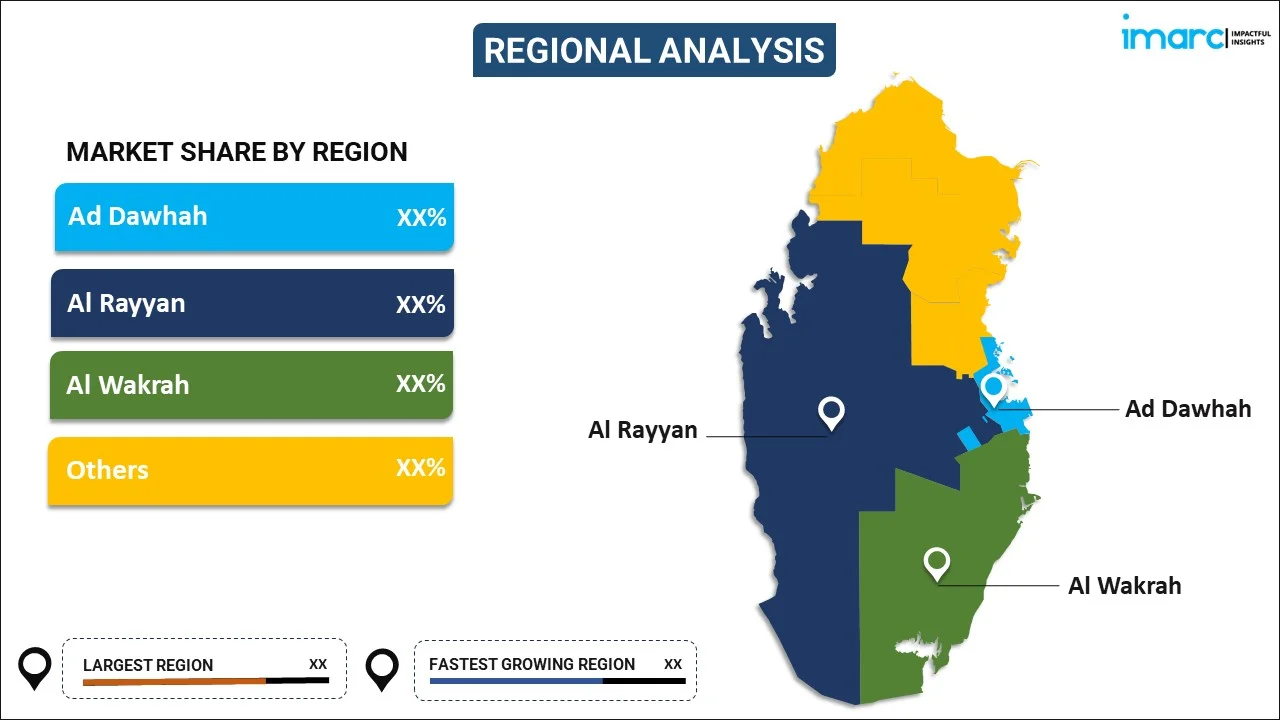

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial, Bias |

| End-Uses Covered | OEM, Replacement |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar tire market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Qatar tire market?

- What is the breakup of the Qatar tire market on the basis of design?

- What is the breakup of the Qatar tire market on the basis of end-use?

- What is the breakup of the Qatar tire market on the basis of vehicle type?

- What is the breakup of the Qatar tire market on the basis of distribution channel?

- What is the breakup of the Qatar tire market on the basis of season?

- What are the various stages in the value chain of the Qatar tire market?

- What are the key driving factors and challenges in the Qatar tire?

- What is the structure of the Qatar tire market and who are the key players?

- What is the degree of competition in the Qatar tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)