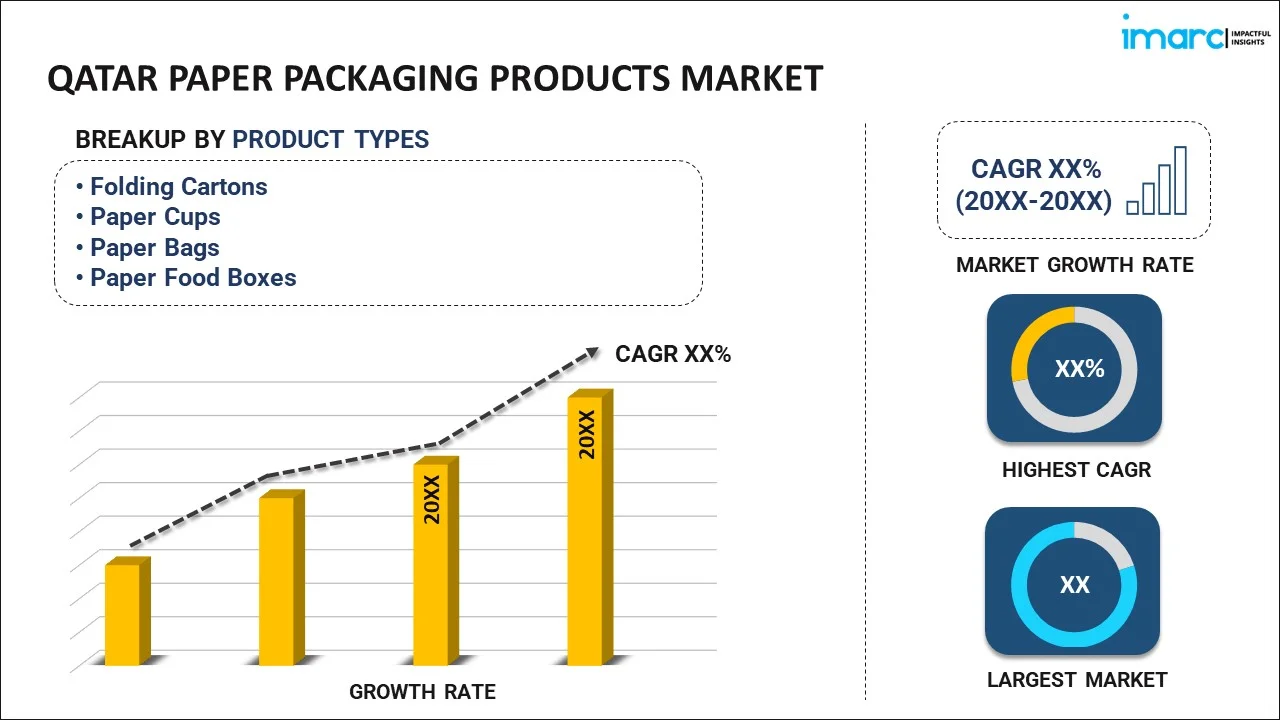

Qatar Paper Packaging Products Market Report by Product Type (Folding Cartons, Paper Cups, Paper Bags, Paper Food Boxes), and Region 2025-2033

Market Overview:

The Qatar paper packaging products market size reached USD 441.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 776.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 441.9 Million |

|

Market Forecast in 2033

|

USD 776.3 Million |

| Market Growth Rate 2025-2033 | 6.14% |

Paper packaging products are manufactured by bleaching fibrous compounds obtained from wood and recycled wastepaper pulp. These products mainly comprise of corrugated boxes, paper bags and sacks, folding boxes and cases, liquid paperboard cartons, etc. Based on their easy recyclability and biodegradability, paper packaging products have gained traction as a sustainable alternative to plastic packaging materials. As a result, these products are widely adopted across diverse sectors, including retail, pharmaceutical, FMCG, hospitality, etc.

In Qatar, the growth of the paper packaging products market can be primarily attributed to the rising environmental consciousness towards reducing carbon footprints from conventional packaging materials. The Qatar government has introduced numerous green economy initiatives, under the National Vision 2030, for minimizing the depletion of non-renewable resources by controlling waste generation in the country. Additionally, the implementation of stringent regulations regarding the ban on single-use plastic is further catalyzing the need for green packaging materials, including paper packaging products. Apart from this, the growing penetration of e-commerce platforms in Qatar is also bolstering the demand for corrugated boxes, folding boxes and cases, inserts and dividers, etc. Furthermore, the rising demand for processed and ready-to-eat food products, along with the growing number of online food delivery services, is augmenting the market for food-grade paper packaging solutions. In addition to this, the increasing popularity of organic beauty products and personal grooming items is also driving the demand for paper packaging solutions to promote ecological sustainability. Additionally, several regional manufacturers of paper packaging materials are heavily investing in the development of innovative product variants with enhanced durability, improved flexibility, better recyclability, etc. In the coming years, numerous advancements in paper recycling technology, along with the introduction of digital printing solutions, will continue to drive the market for paper packaging products in Qatar.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Qatar paper packaging products market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product type.

Breakup by Product Type:

- Folding Cartons

- Straight Line Boxes

- Tissue Boxes

- Pharmaceutical Boxes

- French Fries Boxes

- Others

- Auto Lock Bottom Boxes

- Gift Item Boxes

- Food Item Boxes

- Others

- Straight Line Boxes

- Paper Cups

- Paper Cup 4-7-8 oz

- Paper Cup 12-16-22 oz

- Paper Cup with Handle 7-9-oz

- Paper Cup Double Wall & Ripple Embossing 12-16 oz

- Paper Bucket

- Paper Bags

- Kraft Paper Bag with Twisted Handle

- Kraft Paper Bag with Flat Handle

- Flat Bottom Paper Bag

- Paper Food Boxes

- Burger Boxes

- Tray Boxes

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Al Bayader International LLC, Al Zaini Converting Industries, Breezpack, Ecoleaf Packaging & Printing Co., Golden Paper Cups Manufacturing Co. LLC, Jana International Co. and Papercut Factory.

Key Questions Answered in This Report:

- How has the Qatar paper packaging products market performed so far and how will it perform in the coming years?

- What is the impact of COVID 19 on the Qatar paper packaging products market?

- What is the breakup of the market based on the product type?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the market?

- What is the structure of the Qatar paper packaging products market and who are the key players?

- What is the degree of competition in the market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)