Qatar Digital Payment Market Report by Component (Solutions, Services), Payment Mode (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, and Others), Deployment Type (Cloud-based, On-premises), End Use Industry (BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, and Others), and Region 2026-2034

Qatar Digital Payment Market Overview:

The Qatar digital payment market size reached USD 272.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 528.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.43% during 2026-2034. The market is experiencing significant growth driven by favorable government initiatives for digital transformation and cashless transactions in Qatar, increasing smartphone penetration and internet connectivity driving mobile payment adoption, and rising consumer preference for convenience and contactless payment methods amidst the coronavirus (COVID-19) pandemic.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 272.2 Million |

|

Market Forecast in 2034

|

USD 528.8 Million |

| Market Growth Rate 2026-2034 | 7.43% |

Access the full market insights report Request Sample

Qatar Digital Payment Market Trends:

Government Initiatives Promoting Digital Transformation

The Qatar digital payment market is primarily driven by government activity, which focuses on the development of digital payment. The Qatar Central Bank points out that the country has made a rather remarkable progress in the field of digitalization, and the measures undertaken contain plans related to the improvement of financial access and the development of electronic transactions. For instance, the Qatar National Vision, 2030 underlines the need to develop a knowledge-based economy which is based on digital innovation. Some of these plans include Qatar Digital Government 2020 Strategy that targets to enhance the use of digital services and digital payment systems. They work to support the provision of such facilities that foster the growth of a digital pay environment, which consolidates with Qatar as a country that seeks to maintain a highly digital economy in the Middle East.

Increasing Smartphone Penetration and Internet Connectivity

Currently, Qatar has excellent indices of smartphone usage and internet connection; these are important factors that influence the development of the digital payments market. According to the Communications Regulatory Authority of Qatar, almost all the citizens and residents of Qatar had a smartphone in 2020 with high-speed internet accessibility. This connectivity enables the use of mobile payments, where consumers can complete certain transactions from their mobile devices. Electronic payment systems are anticipated to enhance market growth as Qatar continues to expand its telecommunication and digital technology sectors. This technological foundation can improve consumer satisfaction with digital payment providers to provide better and improved mobile payment solutions in Qatar’s growing digital economy market.

Growth of E-commerce Platforms and Digital Retail

The surge in Qatar's e-commerce market, catalyzed by changing consumer behavior and market dynamics, is accelerating digital payment adoption. According to Qatar Chamber, the adoption of e-commerce can contribute significantly to advancing economic development, which represents a major pillar of the Qatar National Vision 2030, where it will provide business with a better access to the consumer, improve the efficiency of the business, have a direct impact on the other three pillars of Qatar Vision 2030 and the commercial and investment opportunities, and encourage creativity, diversity and competition. This shift toward online shopping has underscored the necessity for efficient and secure payment methods, driving businesses to integrate advanced digital payment solutions into their online platforms. As more Qatari consumers embrace the convenience of shopping online, there has been a rise in demand for seamless payment experiences that align with international standards. This trend is reshaping Qatar's retail landscape, prompting retailers to invest in robust digital payment infrastructures to capitalize on the expanding digital economy and meet evolving consumer expectations.

Qatar Digital Payment Market News:

- September 2023, The Qatar Central Bank (QCB) launched the “Qatar Mobile Payment System” (QMPS) in 2020, boosting electronic wallet adoption and advancing Qatar's digital payment ecosystem.

- June 2024, Mastercard partnered with Doha Bank to enhance digital payment solutions and infrastructure in Qatar. This collaboration aims to promote the secure, convenient, and widespread adoption of digital payments across Qatar's financial landscape.

Qatar Digital Payment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, payment mode, deployment type, and end use industry.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (application program interface, payment gateway, payment processing, payment security and fraud management, transaction risk management, and others) and services (professional services and managed services).

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes bank cards, digital currencies, digital wallets, net banking, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises.

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, healthcare, IT and telecom, media and entertainment, retail and e-commerce, transportation, and others.

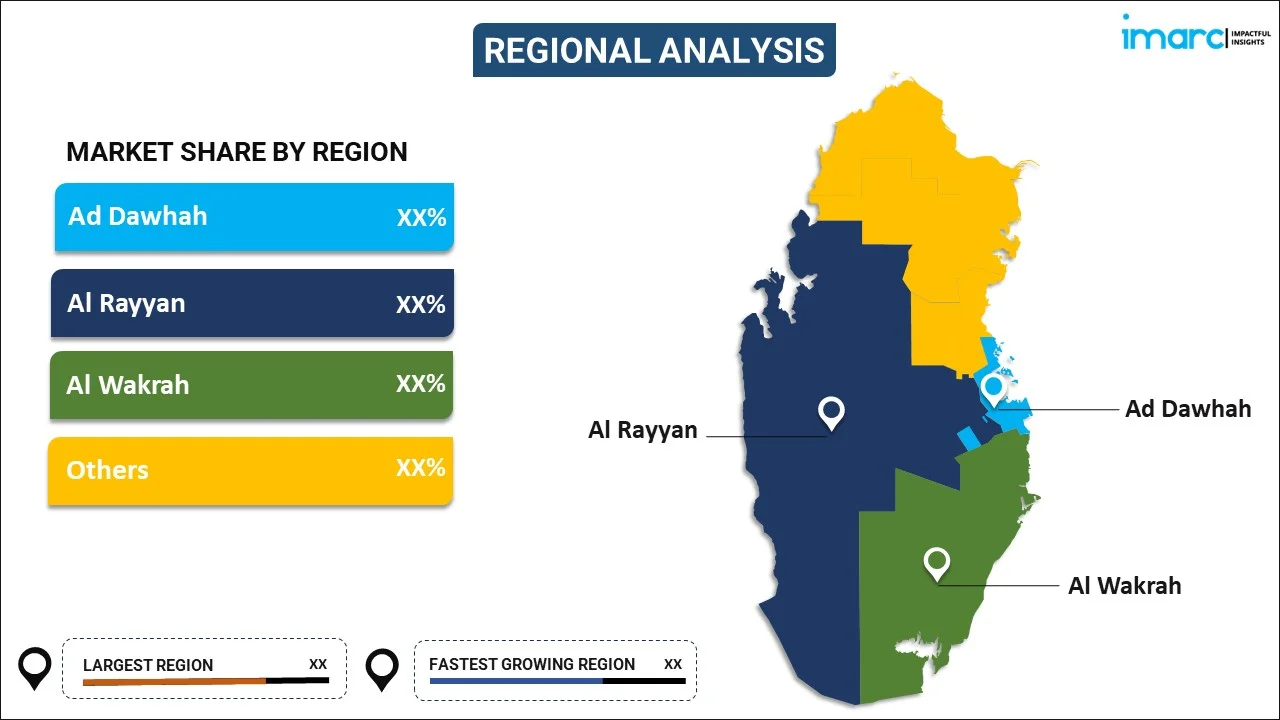

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Digital Payment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Payment Modes Covered | Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar digital payment market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar digital payment market on the basis of component?

- What is the breakup of the Qatar digital payment market on the basis of payment mode?

- What is the breakup of the Qatar digital payment market on the basis of deployment type?

- What is the breakup of the Qatar digital payment market on the basis of end use industry?

- What are the various stages in the value chain of the Qatar digital payment market?

- What are the key driving factors and challenges in the Qatar digital payment?

- What is the structure of the Qatar digital payment market and who are the key players?

- What is the degree of competition in the Qatar digital payment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar digital payment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar digital payment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar digital payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)