Qatar Cosmetic Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Qatar Cosmetic Products Market Size and Share:

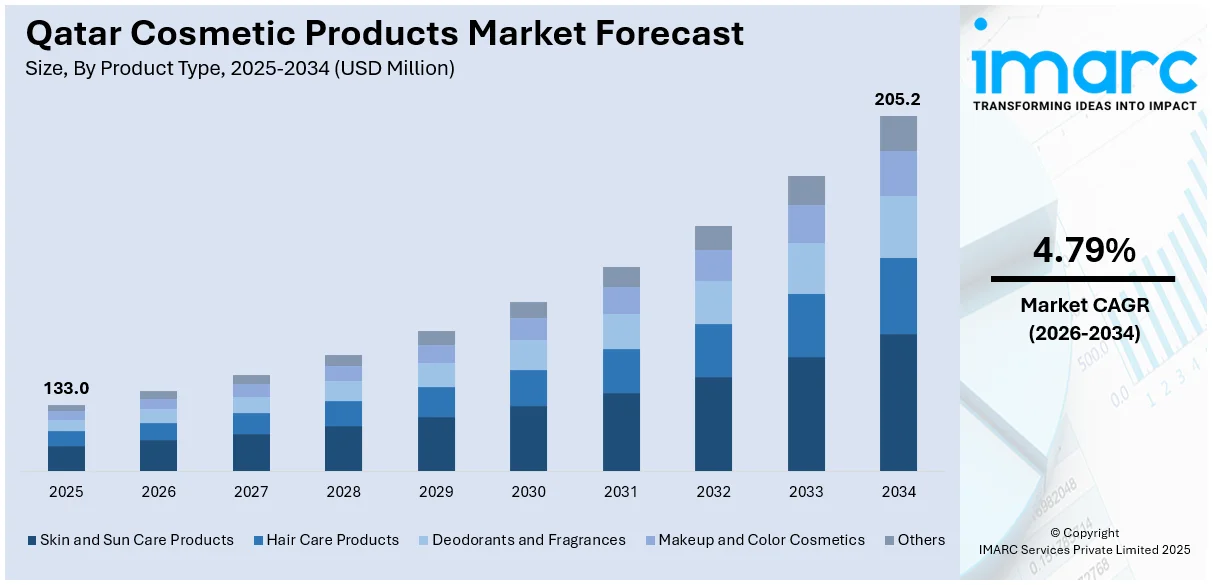

The Qatar cosmetic products market size reached USD 133.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 205.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.79% during 2026-2034. The market is primarily driven by the growing tourism, increasing disposable incomes, the growing young population with increasing beauty awareness, expanding retail channels, and a rising preference for premium and natural products, reflecting evolving consumer preferences and lifestyle changes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 133.0 Million |

| Market Forecast in 2034 | USD 205.2 Million |

| Market Growth Rate (2026-2034) | 4.79% |

The Qatar cosmetic products market growth is attributed to the rising disposable income, shifting consumer preferences, and growing personal grooming awareness. With a very high per capita income, the Qatari is likelier to spend on premium skincare, haircare, and beauty products, especially international luxury brands. Organic and halal-certified cosmetics are also gaining demand in the market due to increased consumer awareness regarding clean beauty and religious compliance. The country's young and fashion-conscious population, influenced by global beauty trends and social media, is driving demand for innovative and high-performance cosmetic products. Government initiatives to encourage local manufacturing and sustainability, along with the increased tourist inflow due to Qatar's growing status as a luxury shopping destination, are further driving market expansion.

To get more information on this market Request Sample

The tourism industry in Qatar has witnessed an excellent growth record. Government Communications Office states that from January till August of 2024, the number of visitors to Qatar was 3.2 Million, marking a 26% increase over 2023. The sudden rise in international visitors has further increased demand for high-end cosmetics, as international tourists prefer to buy luxury beauty products and exclusive skincare items found in the malls and duty-free shops of Qatar. Another major factor is the fast expansion of e-commerce and digital marketing in Qatar. That is as online beauty platforms and social media influencers play a huge role in shaping consumer choices with high internet penetration and smartphone usage. Global and regional brands have harnessed digital channels to offer unique experiences like virtual try-ons and exclusive online deals. Besides that, more people are popping into salons and spas that care for both males and females who want professional skincare and makeup. International cosmetic companies are also investing in research and development to create products suitable for Qatar’s hot and humid climate, ensuring long-lasting and skin-friendly formulations. With an increasing focus on sustainability, biodegradable packaging and cruelty-free certifications are becoming essential, further boosting the market's evolution.

Qatar Cosmetic Products Market Trends:

Rise of organic, natural, and halal-certified beauty products

One among many prominent Qatar cosmetic products market trends is the rising demand for organic, natural, and halal-certified beauty products. Considering a majority population of Muslims is 68% in Qatar, as per the Australian Government Department of Foreign Affairs and Trade, the halal-certified cosmetics market is booming. These products both fulfill religious requirements and answer the trend of global ethics in beauty. Consumers are now becoming more conscious of the chemicals used in skincare, haircare, and makeup products. Thus, demand for chemical-free, paraben-free, artificial fragrance-free, and animal-derived ingredient-free products is rising. This trend of preference has challenged international and regional brands to come up with halal-certified, plant-based, cruelty-free, and ethically sourced cosmetic lines. The clean beauty movement is also gaining popularity in the country of Qatar, as most people are looking for transparent formulations of products and environmentally friendly packaging. Many brands have been adapting by initiating eco-friendly alternatives, using biodegradable materials, and adopting ethical sourcing practices. There is still a substantial demand from the increasing number of dermatologists and skin care professionals who are insisting on recommending gentle, chemical-free solutions for long-term skin health.

Growing demand for gender-neutral and men’s grooming products

There is a rising demand for gender-neutral and men's grooming products. Whereas cosmetics were always considered a women's industry, nowadays, there is growing interest in male grooming. As a result, men also show an interest in understanding skincare, haircare, and personal care routines. High-end men's grooming brands, and mainstream cosmetic companies, are now coming up with specific products targeted to reach male consumers, including beard care, anti-aging creams, and premium shaving kits. Simultaneously, gender-neutral beauty products are creating a rave, signifying that the industry is witnessing a global inclination toward inclusivity. Skincare and minimalist beauty lines for unisex purposes are also catching the attention of young consumers, who seek products that are simple, effective, and ethical. Luxury beauty brands are also adding unisex fragrances and skincare solutions to their portfolios, as this is in line with the trend for versatility in cosmetics. This shift is transforming the market and making beauty and personal care more inclusive across all demographics in Qatar.

Boom of e-commerce and digital beauty innovations

The rapid growth of e-commerce and digital beauty platforms is boosting the Qatari cosmetic products demand. With an estimated value of $6.25 Billion in 2024 for the Qatar ICT market, as per the International Trade Administration and a high internet penetration rate, consumers increasingly look to online shopping for their needs related to beauty. Major international retailers and regional beauty retailers offer seamless digital shopping experiences through fast delivery, exclusive product launches, and personalized recommendations. The purchase decision is influenced by social media platforms like Instagram, TikTok, and Snapchat. Beauty influencers and content creators are promoting skincare and makeup products, and they have a higher engagement and direct sales conversion. Brands are also using AI and AR technologies to make online shopping more engaging. For instance, virtual try-ons and AI-powered beauty consultations allow consumers to find the perfect products without visiting a physical store. Subscription-based beauty boxes and AI-driven personalized skincare routines are also gaining popularity, making online beauty shopping more interactive and consumer-friendly. As digital transformation increases in Qatar, brands keep inventing e-commerce strategies that resonate with the digitally savvy consumers of the nation. This again consolidates the leading position of the digital channels in the country's cosmetic market.

Qatar Cosmetic Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar cosmetic products market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, category, gender, and distribution channel.

Analysis by Product Type:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products hold a significant share of Qatar’s cosmetic market, driven by the country’s extreme climate and the increasing need for hydration, sun protection, and anti-aging solutions. With Qatar’s population surpassing 3 Million as of August 2024, according to the Government Communications Office, the demand for high-quality skincare products continues to grow. Moisturizers, sunscreens, and serums are all the rage among consumers, who majorly prefer organic and dermatologist-approved kinds. Hair care products also take precedence due to heat and humidity, leading to the wide use of shampoos, conditioners, and hairstyles that fight hair damage. Specialized treatments, such as keratin-infused and sulfate-free formulations, find preference among consumers who are desperate to nourish their hair properly. To this day, deodorants and fragrances remain part of Qatari culture. These include luxury perfumes and long-lasting deodorants, premium brands are the popular segment, and they are offering traditional oud-based fragrances in tandem with modern ones. Makeup and color cosmetics are also growing due to the growing influence of social media and an increasing number of beauty-conscious consumers. Foundations, lipsticks, and eye makeup products have definite demand due to their sweat-resistant and lightweight formulations. International luxury and clean beauty brands are expanding their presence, catering to evolving consumer preferences in Qatar's dynamic beauty market.

Analysis by Category:

- Conventional

- Organic

Conventional cosmetics are popular due to their wide availability, affordability, and established brand presence. Multinational companies offer an extensive range of skincare, haircare, and makeup products, making them the preferred choice for most consumers. Mass-market and high-end brands cater to different price segments, with growing interest in long-wear, high-performance formulations. Organic cosmetics are, however, the way of the future, where consumers are becoming more conscious about what they ingest in the form of beauty products. The trend in cosmetics has now shifted toward plant-based and chemical-free products, along with their eco-friendliness. Consumer preference is seen in the halal-certified, cruelty-free, and sustainable packaging and ethical sourcing of products for consumption. Organic brands are leveraging this trend by offering products with natural extracts, essential oils, and non-toxic formulations that cater to sensitive skin and environmental concerns. As a result, both international and local brands are investing in organic beauty lines to meet the rising demand in Qatar’s market.

Analysis by Gender:

- Men

- Women

- Unisex

Women in Qatar are increasingly investing in premium skincare routines, anti-aging treatments, and high-quality makeup products, influenced by social media and beauty trends. International brands offering clean beauty and high-performance cosmetics see strong growth in this segment, catering to the female population of 590,953 in Qatar, as reported by the Central Intelligence Agency. The demand for luxury skincare, organic beauty products, and dermatologist-recommended solutions is rising, with Qatari women seeking advanced formulations for hydration, skin brightening, and sun protection. Simultaneously, grooming products for males are increasing very rapidly as more of the male population in Qatar, numbering 1,961,135, are inclined toward changed personal care habits. There has been an upward trend for kits for beard grooming, anti-aging skincare products, and hair care products developed for the professional requirements of males. Premium shaving cream, serum, and aftershave balm are gaining attention, where product lines emphasize premium ingredients and point-to-point skin care. Unisex products are also gaining traction, driven by the trend of gender-neutral beauty. Minimalist skincare lines, hydrating face creams, and fragrances that appeal to all genders are becoming more popular. The rising focus on inclusivity and multipurpose cosmetics is encouraging brands to develop products that cater to a broader consumer base, making gender-neutral beauty a growing segment in Qatar’s market.

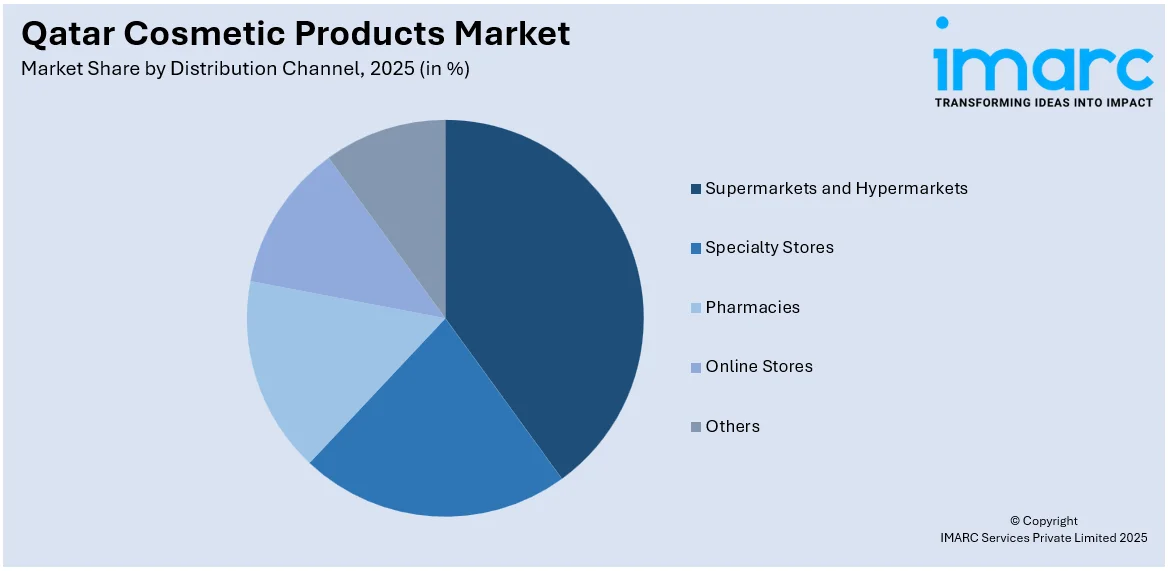

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets remain key distribution channels in Qatar's beauty market, offering a broad selection of affordable and premium beauty products. These stores are favored by consumers for their convenience, competitive discounts, and accessibility. Specialty stores, including high-end beauty retailers, cater to consumers seeking luxury brands, exclusive collections, and expert consultations, meeting the demand for international and organic beauty products. Pharmacies also play a significant role in distributing dermatologically tested skincare and medical-grade cosmetics, with many consumers relying on them for specialized treatments such as acne care, sensitive skin solutions, and professional hair treatments. However, online stores are growing fast, driven by the increasing adoption of e-commerce platforms in Qatar. The Middle East Council of Shopping Centres & Retailers report that the e-commerce market in Qatar reached $1 Billion in March 2024, reflecting a remarkable 43.5% year-on-year increase. This growth is fueled by high internet penetration, smartphone adoption, and the convenience of online shopping, with consumers enjoying doorstep delivery, personalized recommendations, and access to international brands unavailable in local stores. Moreover, on-site virtual try-ons, AI-driven diagnostics for skincare, and influencer marketing are enhancing sales online. Therefore, the e-commerce segment has been a very powerful and fast-growing business in Qatar's beauty industry.

Regional Analysis:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The commercial and luxury hub of Qatar, Ad Dawhah, or Doha, holds a significant market share in high-end product sales. The city is endowed with flagship stores, luxury shopping malls, and select beauty retailers offering exclusive international luxury brands. Doha's affluent population is a major driver of the demand for luxury and organic cosmetics, with consumers increasingly seeking high-quality, ethically sourced beauty solutions. Al Rayyan, Qatar’s second-largest city, is witnessing significant urbanization and economic growth, resulting in rising disposable income and greater consumer spending on personal care products. The growing middle and upper-class population in Al Rayyan fuels demand for mass-market and premium cosmetics, mainly those that are halal-certified and dermatologically tested. Al Wakrah, on the other hand, is a fast-developing region that is increasingly becoming a hub for beauty and personal care products. As the infrastructure develops and the expatriate population grows, Al Wakrah is fast becoming a hub for new beauty brands and retail chains. Supermarkets, hypermarkets, and local pharmacies in this region are expanding their offerings to meet the increasing demand for skincare, haircare, and fragrance products. The Middle East Council of Shopping Centres & Retailers projects an 11% increase in household disposable income in 2024, supporting continued growth in consumer spending across Qatar and driving the demand for beauty products in all regions.

Competitive Landscape:

Market players are actively looking for ways to increase their share through product innovation, strategic partnerships, and digital transformation in the cosmetic industry in Qatar.. AI-powered beauty consultations, personal skincare recommendations, and AR try-ons have all become integral for brands to get better at providing a digital shopping experience and hence sales. Other international and regional brands will also develop a product range suited to the environment of the emirate: a humidity-resistant range of cosmetics or hydrating care products, adapted to local demand. Several firms reformulate products so that they adhere to increasingly expected ethical or religious standards, organic, cruelty-free, halal, for instance. High-end cosmetic companies are now exploiting Qatar's tourism and retail industries as a business avenue through high-end retail chains and duty-free shops. At the same time, the male grooming segment is highly in growth, where companies have now been offering high-end skincare products and beard care. With further digitalization and adoption of AI, the cosmetics market of Qatar will also have an excellent potential to grow while it is bound to give its consumers a more technologically advanced, personal experience with beauty. These efforts are creating a positive Qatar cosmetic products market outlook.

The report provides a comprehensive analysis of the competitive landscape in the Qatar cosmetic products market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: Nessa International, a subsidiary of FSN E-Commerce Ventures, forayed into the beauty and personal care market in Qatar with the launch of Nysaa Cosmetics Trading. In the country, Nessa International will trade cosmetics, toiletries, hair care, perfumes, and soap, all after appointing high-quality distributors for the convenience of consumers.

- November 2024: L'Oréal Travel Retail, YSL Beauty, Qatar Duty Free, and Qatar Airways created a "pentarchy" with a "pentarchy" alliance at Hamad International Airport. The innovative partnership allowed for customized experiences based on the pop-up for YSL's "Summer Mirage" campaign, utilizing the mileage of Qatar Airways loyalty program. The successful partnering helped YSL Beauty grab their market share and redefine travel retail.

- August 2024: M·A·C Cosmetics teamed up with Qatar Duty Free for a one-month-long National Lipstick Day event at Hamad International Airport. The pop-up invited travelers to explore the "power of lipstick" through makeup expert services, personalized purchases of lipstick, and games. M·A·C Artists helped shoppers in finding suitable lipstick shades, where they could win exclusive prizes and free lipsticks with their purchase.

- December 2024: With the launch of Tory Burch Beauty in international travel retail, Shiseido Travel Retail has increased the variety of fragrances it offers. With the goal of increasing Shiseido's sales in the rapidly expanding fragrance industry, the company debuted its scents at the airports of Dubai International and Hamad International Qatar duty free.

- April 2024: Gold Apple opened its first Middle Eastern store at Doha Festival City, Qatar. This Gold Apple Store concept has been rolled out across a 1,300 sqm area, having over 600 global brands and 25,000 products like makeup, fragrances, skincare, and Korean beauty. The store also provides makeup stations, relaxing zones, VIP shopping rooms, and even a coffee bar for a holistic beauty experience.

Qatar Cosmetic Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar cosmetic products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Qatar cosmetic products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar cosmetic products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Qatar cosmetic products market was valued at USD 133.0 Million in 2025.

The Qatar cosmetic products market is driven by tourism growth, improving disposable incomes, a growing youthful population with higher beauty awareness, increasing retail channels, and a greater preference for premium and natural products, which portray the changing dynamics of consumer habits and lifestyle shifts.

The Qatar cosmetic products market is estimated to exhibit a CAGR of 4.79% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)