PVC Pipes Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

PVC Pipes Market Size and Share:

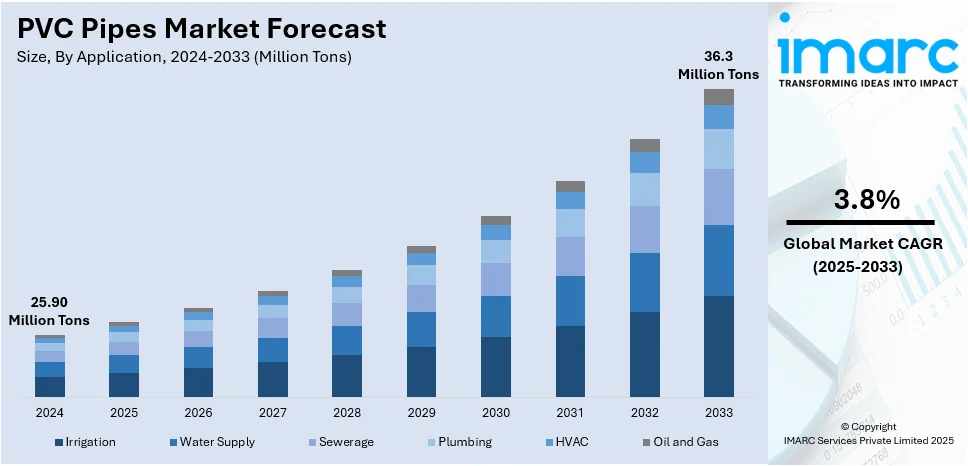

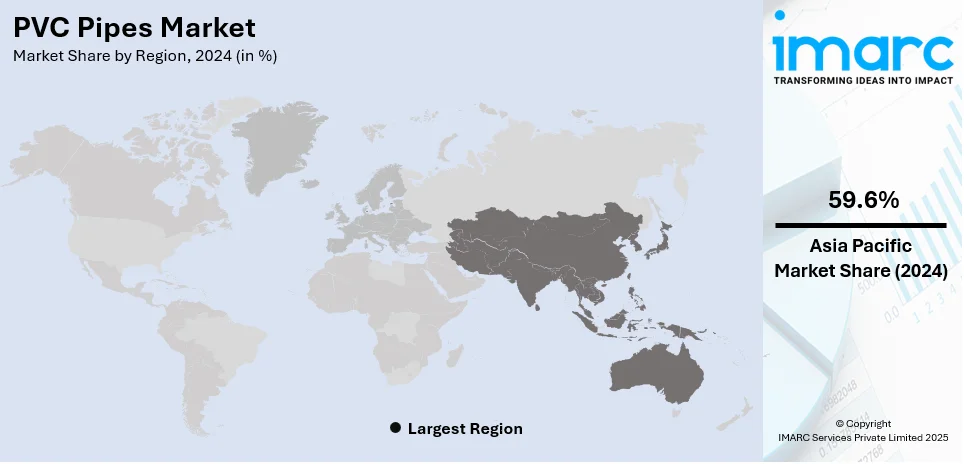

The global PVC Pipes market size was valued at 25.90 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 36.3 Million Tons by 2033, exhibiting a CAGR of 3.8% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 59.6% in 2024. This dominance is driven by rapid urbanization, large-scale infrastructure projects, and strong demand from the agriculture and construction sectors. Government investments in water management, irrigation, and sanitation further drive growth, supported by expanding industrial applications and manufacturing capabilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 25.90 Million Tons |

| Market Forecast in 2033 | 36.3 Million Tons |

| Market Growth Rate (2025-2033) | 3.8% |

The increasing demand for PVC pipes is driven by rapid urbanization, infrastructure expansion, and the growing need for cost-effective, durable piping solutions in water supply and sewage systems. Rising investments in irrigation projects and agricultural modernization further boost market growth. Additionally, advancements in PVC formulation, improving flexibility and chemical resistance, enhance their adoption across industries. The shift toward lightweight and corrosion-resistant materials in industrial and construction applications also supports demand. Growing emphasis on sustainable materials, with recyclability and lower carbon footprints, fosters innovation. Furthermore, the rising popularity of trenchless technology for pipe installation and replacement accelerates the adoption of PVC pipes in both developed and developing regions.

The U.S. PVC pipes market is expanding due to increasing investments in water infrastructure modernization, driven by aging pipeline replacement initiatives. For instance, as per industry reports, the U.S. drinking water infrastructure comprises 2.2 million miles of underground pipes, yet faces aging systems and underfunding. A water main breaks every two minutes, with 6 billion gallons of treated water lost daily. As a result, organizations like the U.S. Environmental Protection Agency (EPA) are compelled to allocate an additional USD 20 Billion for water infrastructure projects across fiscal years 2025 and 2026. By 2026, the total USD 48 Billion investment in water, wastewater, and stormwater infrastructure will be enhancing communities nationwide, providing cleaner, safer, and more reliable water resources for future generations. The rise in residential and commercial construction activities, supported by government spending on housing and smart city projects, fuels demand. Additionally, stringent environmental regulations promote the use of lead-free and recyclable PVC pipes. Growth in industrial applications, including oil and gas transportation and chemical processing, further strengthens market expansion. The increasing adoption of PVC pipes in HVAC systems and electrical conduits due to their thermal insulation and fire-resistant properties enhances market growth. Moreover, rising emphasis on cost-effective, long-lasting piping materials in municipal and private projects boosts demand.

PVC Pipes Market Trends:

Rapid Urbanization and Infrastructure Development

The surge in urbanization has been a major driver for the PVC pipes market growth across the globe. The demand for modern infrastructure, including housing, transportation networks, and water supply systems, has been increasing drastically as more people move to urban areas. More than 4 billion people live in urban areas, according to the World Bank. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities. In many developing countries, urbanization is accompanied by major investments by the government in infrastructure to support the hike in population. These investments are focused on constructing new buildings, expanding sewage and water treatment plants, and improving existing plumbing systems that make use of PVC pipes.

Growing Emphasis on Water Conservation and Management

The growing focus on water conservation and efficient water management has been a crucial driver for the PVC pipes market share. As per the most recent data by WHO and UNICEF, over 2 billion people lack clean drinking water at home, and 1.5 billion lack basic sanitation facilities. This has been highlighting the increasing need to promote the transportation of clean drinking water with reduced wastage. Governments and environmental agencies worldwide are implementing stringent regulations and policies that involve upgrading existing water distribution and sewage systems, where PVC pipes play a pivotal role due to their efficiency and reliability. For instance, there are approximately 153,000 public drinking water systems and more than 16,000 publicly owned wastewater treatment systems in the United States. More than 80 percent of the U.S. population receives their potable water from these drinking water systems, and about 75 percent of the U.S. population has its sanitary sewerage treated by these wastewater systems.

Increasing Application in the Agricultural Sector

The heightened use of PVC pipes in the agricultural sector is promoting the growth of this market. They play an important role in modern irrigation systems by providing a reliable solution for transporting water to fields. Worldwide, over 307 million hectares are currently equipped for irrigation, of which 304 million hectares are equipped for full control irrigation and 261 million hectares are equipped for full control and irrigated, as per reports. PVC pipes’ resistance to ultraviolet (UV) radiation, chemicals, and environmental stressors ensures long-term performance in these applications. These pipes are also used in greenhouse irrigation systems, where precise water delivery is required to maintain optimal growing conditions.

PVC Pipes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global PVC Pipes market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Irrigation

- Water Supply

- Sewerage

- Plumbing

- HVAC

- Oil and Gas

Irrigation leads the market with around 43.9% of market share in 2024, driven by the critical need for efficient water management in agriculture. These pipes are extensively used in agricultural irrigation systems due to their durability, cost-effectiveness, and resistance to corrosion and chemicals. Moreover, they facilitate the reliable transportation of water to fields, ensuring optimal water distribution and improving crop yields. Besides this, the widespread adoption of advanced irrigation techniques, such as drip and sprinkler systems, is positively impacting the PVC pipes market revenue, as they offer precise water delivery and reduced water wastage.

Regional Analysis:

- Asia

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 59.6%, driven by rapid urbanization, industrialization, and extensive infrastructure development. Along with this, the significant growth in construction sectors, leading to increased demand for PVC pipes for residential, commercial, and industrial applications, is anticipated to drive the market growth. Apart from this, the imposition of various government initiatives that are focused on improving water supply, sanitation, and irrigation systems is enhancing the PVC pipes demand. For instance, the Asian Development Bank (ADB) prioritizes water security in Asia and the Pacific, where 2 billion people lack basic water and sanitation. 80% of wastewater remains untreated, worsened by climate change and urbanization. ADB targets USD 100 Billion in climate financing by 2030. The Water Resilience Hub promotes collaboration, while the Water Financing Partnership Facility has mobilized USD 9.5 Billion, benefiting 122 million people. Key initiatives focus on smart water management, circular economy, and digitalization to enhance governance, efficiency, and infrastructure. Additionally, the rise in population and the corresponding need for efficient water management solutions are propelling the market growth.

Key Regional Takeaways:

United States PVC Pipes Market Analysis

In 2024, the United States held 85.4% of market share in North America. The U.S. PVC pipes market is experiencing steady growth as a result of the country's strong industrial and infrastructure foundation. The U.S. is a major rice exporter, with foreign markets accounting for 40–45% of its annual sales volume, according to the USDA. This thriving agricultural sector drives demand for durable and corrosion-resistant PVC pipes used in irrigation and water management systems. Additionally, U.S. crude production, including condensate, averaged 12.9 million b/d during 2023, as indicated by the EIA. Due to the fact that PVC pipes are produced using petrochemical feedstocks, the robust domestic oil production supplies a consistent quantity of raw material at low prices, supporting market growth. Besides, increased investment in infrastructure development projects and expanding demand for efficient piping solutions across construction, water supply, and wastewater treatment processes are propelling market growth. With strong agricultural and energy sectors leading demand, the U.S. PVC pipes market will see steady growth over the next few years.

North America PVC Pipes Market Analysis

The North America PVC pipes market is experiencing steady growth due to increasing infrastructure investments, rising demand for durable and cost-effective piping solutions, and regulatory emphasis on water conservation and sanitation. The construction sector, particularly in residential and commercial real estate, drives significant demand. For instance, as per industry reports, the U.S. Department of the Interior is investing USD 849 Million to modernize water infrastructure across 11 Western states under the Infrastructure Investment and Jobs Act (IIJA). The initiative aims to enhance water storage, hydropower capacity, and climate resilience, ensuring long-term water security for agriculture, businesses, and communities facing severe drought and environmental challenges. Municipal projects focusing on water supply, sewage, and wastewater treatment further boost adoption. The oil and gas industry also utilizes PVC pipes for fluid transportation due to their corrosion resistance. Additionally, technological advancements in pipe manufacturing, including high-strength formulations, enhance product performance. Environmental concerns and sustainability initiatives are promoting the use of recyclable and energy-efficient PVC materials. The presence of key manufacturers and a well-established distribution network further support market expansion in the region.

Europe PVC Pipes Market Analysis

The European PVC pipes market is experiencing tremendous growth because of rising investments in infrastructure on the continent. In its 2023 report, the European Commission reported that 107 transport infrastructure projects were chosen to be awarded over Euro 6 Billion (USD 6.3 Billion) of EU funding under the Connecting Europe Facility (CEF). This strategic investment focuses on the development and improvement of necessary transport infrastructure, such as roads, railways, and waterways, which depend on affordable and long-lasting piping materials such as PVC pipes. The increased need for green and long-lasting material in the development of large-scale infrastructure is driving the use of PVC pipes for drainage, sewage, and water supply networks. In addition, the shift toward greener and recyclable building materials supports PVC benefits, yet another stimulus towards market expansion. As continued investments in smart cities, urban growth, and water distribution systems of the sustainable variety continue, European PVC pipes demand will grow consistently to address changing demands of the regional infrastructure needs.

Asia Pacific PVC Pipes Market Analysis

The Asia Pacific PVC pipes industry is experiencing high growth due to rapid urbanization and growing infrastructure developments in the region. According to UNICEF estimates, nearly 55% of the gigantic population of Asia will be living in urban areas by 2030. This population boom is driving huge investment in water supply networks, sewerage systems, and constructions, all of which heavily rely on PVC pipes due to their strength, cost-effectiveness, and resistance to corrosion. The increasing need for efficient water management systems in densely populated urban cities is further propelling demand for PVC pipes for plumbing and drainage applications. Government initiatives related to sustainable infrastructure and smart city development are also driving demand growth for advanced piping solutions. With ongoing investment in residential, industrial, and commercial building construction and rising demand for recyclable and light-weighted materials, Asia Pacific PVC pipe market is bound to witness solid growth to compensate for the additional demand for credible and durable pipes in the country.

Latin America PVC Pipes Market Analysis

The Latin America PVC pipes market is growing because of the fast pace of urbanization and the increasing demand for advanced infrastructure. Based on the UN Population Division, the area has experienced a notable demographic change, with the urban population growing from 49% in the 1960s to 81% in 2020. The change is best represented by densely populated cities such as Mexico City and São Paulo, whose populations have witnessed a historic migration from the countryside. With growing urbanization, there is an increasing need for effective water supply, sanitation, and sewerage systems, all of which rely greatly on PVC pipes because of their longevity, cost-effectiveness, and simplicity of installation. Government programs to enhance housing, transport, and smart city projects further accelerate the use of PVC piping systems. Moreover, investments in sewage treatment and irrigation systems are fueling demand in industrial and agricultural applications. With ongoing urban expansion and infrastructure upgradation, the market for PVC pipes in Latin America is poised for consistent growth in the future years.

Middle East and Africa PVC Pipes Market Analysis

The Middle East and Africa PVC pipes industry is forecast to witness tremendous growth due to huge infrastructure and industrial investments. Saudi Arabia has estimated expending more than USD 175 Billion annually on mega projects from the years 2025 to 2028, according to industry reports. Major projects such as Neom and the Red Sea resorts will transform the infrastructure of the region, creating high demand for PVC pipes in water supply, drainage, and construction uses. With governments in the region prioritizing urban development, residential developments, and smart city developments, demand for durable, cost-effective piping solutions is increasing. In addition, increasing investments in water treatment and irrigation systems also favor market growth as PVC pipes are widely utilized because of their corrosion resistance and durability. Industrial area and energy project development also fuels demand, particularly in oil-producing nations. With the region still upgrading its infrastructure, the uptake of PVC piping solutions is set to increase, driving sustainable and long-term market growth.

Competitive Landscape:

The major PVC pipe companies are pursuing strategies to enhance their market position and cater to the growing demand. They are investing in research and development (R&D) to innovate and improve the quality and performance of PVC pipes by focusing on advancements in material composition and manufacturing technologies. Besides this, key players are establishing new production facilities and enhancing distribution networks to tap into the growing construction and infrastructure projects in emerging regions. Furthermore, a major factor that is optimizing the PVC pipes market overview is the heightened focus on strategic mergers and acquisitions that allow companies to expand their product portfolios and increase market share.

The report provides a comprehensive analysis of the competitive landscape in the PVC pipes market with detailed profiles of all major companies, including:

- China Lesso Group Holdings Limited

- Fujian Aton Advanced Materials Science & Technology Co Ltd.

- Hebei Bosoar Pipe Co. Ltd.

- Pipelife Austria Gmbh & Co KG

- Plásticos Ferro S.L.

Latest News and Developments:

- November 2024: Chemplast Sanmar, a major PVC industry player, announced plans to create a sustainable series of PVC pipes and fittings based on bio-based feedstock. The move is to decrease the carbon footprint associated with PVC production while responding to growing demand for environmentally friendly products.

- October 2023: A subsidiary of the Shand Group of Industries called Raksha Pipes announced its plans to expand the production capacity for PVC, UPVC, and CPVC pipes by ten-fold. The project is aimed at expanding the market of the company in urban areas as well as rural areas in response to mounting demand for them.

- February 2025: Pipelife Poland launched frost-resistant sewage solutions, including PVC and PP pipes, manholes, and chamber systems, tested for subzero conditions down to -10°C. These systems, designed for winter climates, are durable and easy to install, ensuring reliable wastewater infrastructure in harsh temperatures. Their products include PP Connect pipes, PVC Compact pipes with sewer-lock gaskets, Pragma corrugated PP pipes for high-traffic areas, and PRO sewage chambers known for excellent impact resistance. These solutions are certified for long-term performance and are ideal for year-round installation across Europe.

- May 2023: Westlake Pipe & Fittings announced to construct a new PVCO pipe facility that is moleculeoriented at its Wichita Falls, Texas, production facility. The expansion of its facility is a major step taken by Westlake towards growth, innovation, and creating jobs locally. This expansion proposal involves adding a 190,000 square-foot building to the current facility located at 3348 Industrial Drive, harnessing the area's advantageous geographic location in the center of the United States.

PVC Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Irrigation, Water Supply, Sewerage, Plumbing, HVAC, Oil and Gas |

| Regions Covered | Asia, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | China Lesso Group Holdings Limited, Fujian Aton Advanced Materials Science & Technology Co Ltd., Hebei Bosoar Pipe Co. Ltd., Pipelife Austria Gmbh & Co KG, Plásticos Ferro S.L. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the PVC Pipes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global PVC Pipes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the PVC Pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PVC Pipes market was valued at 25.90 Million Tons in 2024.

The PVC Pipes market is projected to exhibit a CAGR of 3.8% during 2025-2033, reaching a value of 36.3 Million Tons by 2033.

The PVC pipes market is driven by rapid urbanization, increasing infrastructure development, rising demand for durable and cost-effective piping solutions, and growing agricultural irrigation needs. Additionally, government investments in water supply projects, advancements in PVC formulations, and a shift toward eco-friendly piping solutions are accelerating market expansion.

Asia Pacific currently dominates the PVC Pipes market, accounting for a share of 59.6%. The Asia Pacific PVC pipes market is driven by rapid urbanization, expanding infrastructure projects, increasing agricultural irrigation needs, and rising demand for durable and cost-effective piping solutions. Government investments in water supply, sanitation, and construction sectors, along with advancements in material innovation and recycling technologies, further support market growth.

Some of the major players in the PVC Pipes market include China Lesso Group Holdings Limited, Fujian Aton Advanced Materials Science & Technology Co Ltd., Hebei Bosoar Pipe Co. Ltd., Pipelife Austria Gmbh & Co KG, Plásticos Ferro S.L., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)