Proximity Sensor Market Report by Technology (Inductive, Capacitive, Photoelectric, Magnetic, and Others), Sensing Range (0 MM–20 MM Sensing Range, 20 MM–40 MM Sensing Range, Greater Than 40 MM Sensing Range), End Use Industry (Aerospace and Defense, Automotive, Industrial, Consumer Electronics, Food and Beverage, and Others), and Region 2025-2033

Proximity Sensor Market Size:

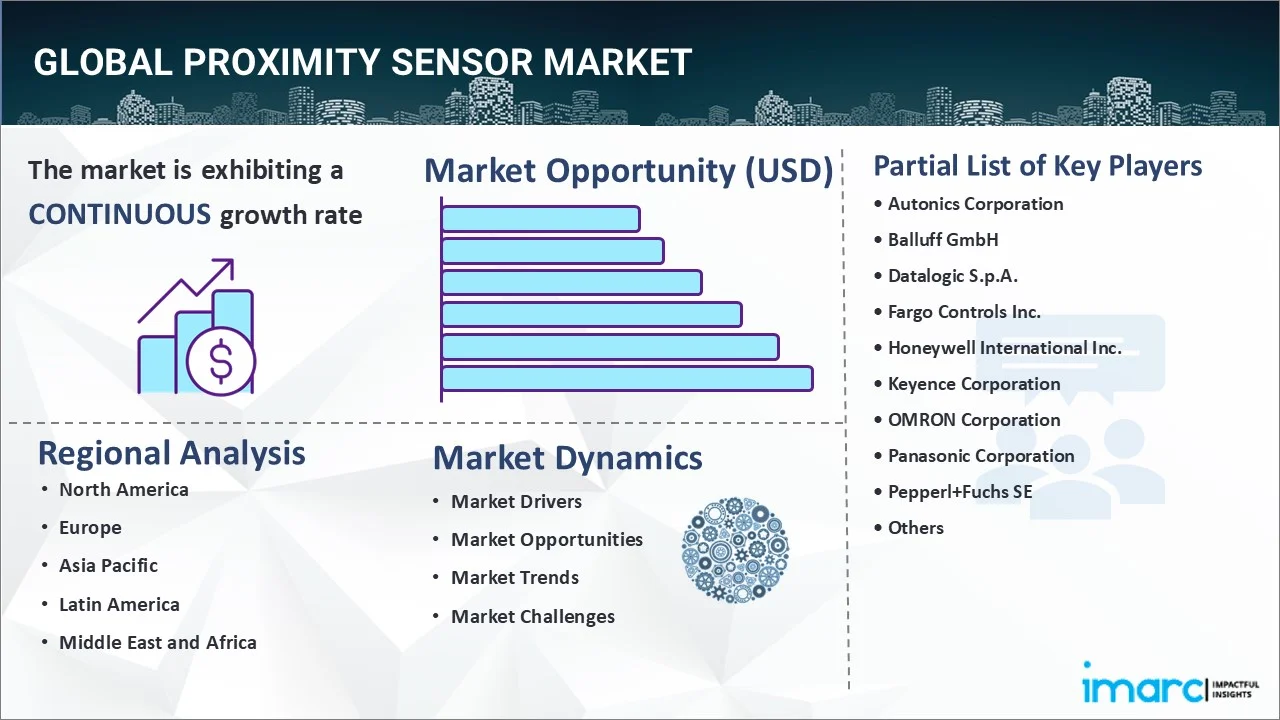

The global proximity sensor market size reached USD 4.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.71% during 2025-2033. The market is experiencing rapid growth, driven by increasing automation in industries, rising demand in consumer electronics, rapid advancements in automotive safety features, the development of smart cities and building automation systems, and the ongoing innovations in sensor technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.9 Billion |

|

Market Forecast in 2033

|

USD 8.4 Billion |

| Market Growth Rate (2025-2033) | 5.71% |

Proximity Sensor Market Analysis:

- Major Market Drivers: The proximity sensor market outlook suggests that rising demand for automation in industries such as manufacturing, automotive, and consumer electronics, combined with increased usage of smart devices and sophisticated safety systems in automobiles, is driving the market expansion. Aside from that, the rising reliance on industrial automation to improve productivity and lower labor costs is driving the demand for proximity sensors.

- Key Market Trends: Technological advancements in sensor accuracy, miniaturization, and wireless communication are major market trends. Furthermore, the integration of proximity sensors on the Internet of Things (IoT) devices and autonomous systems, as well as wearable and mobile devices, are fostering the expansion of this industry.

- Geographical Trends: Asia Pacific is dominating the market due to its strong industrial base, particularly in electronics manufacturing and automotive manufacturing. Other regions are also experiencing consistent rise in proximity sensor demand, particularly in the automotive and aerospace industries, owing to restricted safety standards.

- Competitive Landscape: Some of the major market players in the proximity sensor industry include Autonics Corporation, Balluff GmbH, Datalogic S.p.A., Fargo Controls Inc., Honeywell International Inc., Keyence Corporation, OMRON Corporation, Panasonic Corporation, Pepperl+Fuchs SE, Riko Opto-Electronics Technology Co. Ltd, Rockwell Automation Inc., Sick AG, STMicroelectronics, among many others.

- Challenges and Opportunities: The proximity sensor market overview emphasizes that high production costs and the complexity of integrating sensors into advanced systems, particularly in harsh environments, hinder industry growth. However, the increasing use of proximity sensors in upcoming technologies such as autonomous cars and smart infrastructure is presenting considerable market growth opportunities.

Proximity Sensor Market Trends:

Increasing Adoption of Automation in Industrial and Manufacturing Sectors

The growing adoption of automation in various industrial and manufacturing sectors is one of the primary factors of proximity sensor market growth. According to industry reports, the global industrial automation market is valued at $224 billion. Along with this, India's industrial automation market was valued at $15 billion in 2024 and is predicted to expand to around $29 billion by 2029. As enterprises strive to enhance efficiency, lower costs, and limit human interaction, the integration of advanced sensor technologies, such as proximity sensors, is becoming increasingly important. These sensors are critical for remotely monitoring and controlling machinery and processes. They detect objects, determine distance, and ensure the safe and accurate operation of automated systems.

Growth in Consumer Electronics Industry

The proximity sensor market revenue is majorly driven by the expanding consumer electronics industry. Proximity sensors are widely used in smartphones, tablets, laptops, wearable devices, and gaming consoles to enhance user experiences and device functionality. The market for smartphones is expected to reach 1,968.7 million units by 2032, with a growth rate of 3.2% between 2024 and 2032. In this context, proximity sensors are utilized in smartphones to detect the presence of the user near the device, enabling features like automatic screen locking during calls or dimming the display to save battery life. Besides this, the proliferation of the Internet of Things (IoT) devices, which rely on various sensor technologies, is accelerated the proximity sensors demand.

Rising Demand for Proximity Sensors in the Automotive Industry

The automotive industry is another major sector driving the proximity sensor market growth. These sensors are extensively used in modern vehicles for applications such as parking assistance, collision avoidance, blind-spot detection, and automated driving systems. Proximity sensors help in enhancing vehicle safety by detecting objects in the vicinity of the car, providing real-time feedback to drivers, and assisting in making informed decisions. Along with this, the increasing focus on vehicle safety and the implementation of stringent safety regulations by governments and regulatory bodies is boosting the growth of the industry. As per the IMARC report, the market for automotive active safety systems is expected to reach US$ 51.6 billion by 2032, exhibiting a growth rate of 14% during 2024-2032. In autonomous and semi-autonomous vehicles, proximity sensors play a critical role in enabling the vehicle to navigate and respond to its surroundings, making them an essential component in the development of advanced driver-assistance systems (ADAS).

Proximity Sensor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, sensing range, and end use industry.

Breakup by Technology:

- Inductive

- Capacitive

- Photoelectric

- Magnetic

- Others

Photoelectric accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes inductive, capacitive, photoelectric, magnetic, and others. According to the report, photoelectric represented the largest segment.

As per the proximity sensor market research report, the photoelectric segment holds the largest share due to its versatility and high accuracy in detecting objects across various industrial applications. These sensors use light to detect objects, making them ideal for non-contact detection, which is crucial in automation, robotics, and safety systems. Moreover, the photoelectric technology's ability to detect objects over long distances with precision has driven its adoption in industries like automotive, packaging, and manufacturing. Additionally, the increasing demand for advanced automation systems, thus fueling the adoption of photoelectric sensors, is bolstering the market growth.

Breakup by Sensing Range:

- 0 MM–20 MM Sensing Range

- 20 MM–40 MM Sensing Range

- Greater Than 40 MM Sensing Range

A detailed breakup and analysis of the market based on the sensing range have also been provided in the report. This includes 0 MM–20 MM sensing range, 20 MM–40 MM sensing range, and greater than 40 MM sensing range.

As per the proximity sensor market overview, the 0 MM-20 MM sensing range is widely used in applications requiring precise, short-distance detection, especially in electronics manufacturing, robotics, and consumer devices. These sensors are ideal for detecting objects or changes in proximity within a confined space, making them crucial for high-precision tasks.

Proximity sensors in the 20 MM–40 MM sensing range are commonly deployed in mid-range industrial applications, particularly in automated assembly lines, packaging systems, and automotive sectors. This range strikes a balance between accuracy and distance, making it suitable for detecting larger objects or machinery components that move at varying distances.

Proximity sensors with a sensing range greater than 40 MM are essential for detecting objects over long distances, used in heavy machinery, logistics, and outdoor applications. These sensors are designed to function in harsher environments and offer more robust performance in detecting large objects or obstacles at greater distances. They are used in industries such as construction, transportation, and mining as they enhance operational safety and automation.

Breakup by End Use Industry:

- Aerospace and Defense

- Automotive

- Industrial

- Consumer Electronics

- Food and Beverage

- Others

Automotive represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes aerospace and defense, automotive, industrial, consumer electronics, food and beverage, and others. According to the report, automotive represented the largest segment.

Based on the proximity sensor market forecast, the automotive industry represented the largest segment, driven by the increasing integration of advanced safety features and autonomous technologies in vehicles. Proximity sensors are vital components in modern automobiles, used for applications such as parking assistance, collision detection, blind-spot monitoring, and autonomous driving systems. Moreover, the rising demand for safer and smarter vehicles, prompting automakers to incorporate more sophisticated proximity sensors to enhance both driver assistance systems and overall vehicle performance, is fostering the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest proximity sensor market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for proximity sensor.

Based on the proximity sensor market analysis, Asia Pacific is dominating the market, driven by rapid industrialization, the expansion of manufacturing sectors, and the growing demand for consumer electronics. Moreover, the region is a hub of major electronics and automotive manufacturers, which heavily utilize proximity sensors in automation and production processes. Along with this, the rising adoption of advanced technologies in industries such as automotive, consumer electronics, and robotics is fueling the market growth. Additionally, the growing focus on smart city development and infrastructure modernization that boost the deployment of proximity sensors in building automation and urban planning projects is enhancing the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the proximity sensor industry include Autonics Corporation, Balluff GmbH, Datalogic S.p.A., Fargo Controls Inc., Honeywell International Inc., Keyence Corporation, OMRON Corporation, Panasonic Corporation, Pepperl+Fuchs SE, Riko Opto-Electronics Technology Co. Ltd, Rockwell Automation Inc., Sick AG, STMicroelectronics, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The leading players in the market are focusing on technological advancements, product innovation, and strategic collaborations to strengthen their market position. Moreover, they are investing in research and development (R&D) to create more efficient, durable, and compact sensors to cater to evolving industry needs. Besides this, these players are also expanding their product portfolios to offer sensors with enhanced accuracy, longer detection ranges, and improved reliability, especially for industrial automation and automotive applications. Additionally, key players are engaging in mergers, acquisitions, and partnerships to expand their global footprint and tap into emerging markets.

Proximity Sensor Market News:

- In December 2023, Panasonic Life Solutions India’s Industrial Devices Division (INDD) introduced an innovative 6-in-1, 6DoF (Degrees of Freedom) inertial sensor. It measures vehicle acceleration and angular rate across three axes (X, Y, and Z) and provides critical information that enhances vehicle safety and stability. These sensors adhere rigorously to the ISO26262 Functional Safety Standards, like the Automotive Safety Integrity Level (ASIL-D).

- In February 2024, STMicroelectronics announced an all-in-one, direct Time-of-Flight (dToF) 3D light detection and ranging (LiDAR) proximity sensor module with 2.3k resolution and revealed an early design win for the world’s smallest 500k-pixel indirect Time-of-Flight (iToF) sensor. The VL53L9 integrates a dual scan flood illumination that can detect small objects and edges and captures both 2D infrared (IR) images and 3D depth map information.

Proximity Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Inductive, Capacitive, Photoelectric, Magnetic, Others |

| Sensing Ranges Covered | 0 MM–20 MM Sensing Range, 20 MM–40 MM Sensing Range, Greater Than 40 MM Sensing Range |

| End Use Industries Covered | Aerospace and Defense, Automotive, Industrial, Consumer Electronics, Food and Beverage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Autonics Corporation, Balluff GmbH, Datalogic S.p.A., Fargo Controls Inc., Honeywell International Inc., Keyence Corporation, OMRON Corporation, Panasonic Corporation, Pepperl+Fuchs SE, Riko Opto-Electronics Technology Co. Ltd, Rockwell Automation Inc., Sick AG, STMicroelectronics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the proximity sensor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global proximity sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the proximity sensor industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global proximity sensor market was valued at USD 4.9 Billion in 2024.

We expect the global proximity sensor market to exhibit a CAGR of 5.71% during 2025-2033.

The increasing demand for proximity sensors in the automotive industry to prevent back-over

accidents by detecting the physical closeness of humans and other vehicles is primarily driving the global proximity sensor market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries, thereby negatively impacting the demand for proximity sensors.

Based on the technology, the global proximity sensor market has been segmented into inductive, capacitive, photoelectric, magnetic, and others. Among these, photoelectric technology represents the largest market share.

Based on the end use industry, the global proximity sensor market can be bifurcated into aerospace and defense, automotive, industrial, consumer electronics, food and beverage, and others. Currently, the automotive industry accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global proximity sensor market include Autonics Corporation, Balluff GmbH, Datalogic S.p.A., Fargo Controls Inc., Honeywell International Inc., Keyence Corporation, OMRON Corporation, Panasonic Corporation, Pepperl+Fuchs SE, Riko Opto-Electronics Technology Co. Ltd, Rockwell Automation Inc., Sick AG, and STMicroelectronics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)