Protein Therapeutics Market Report by Product, Therapy Area, Function, Region and Forecast 2025-2033

Protein Therapeutics Market Size 2024:

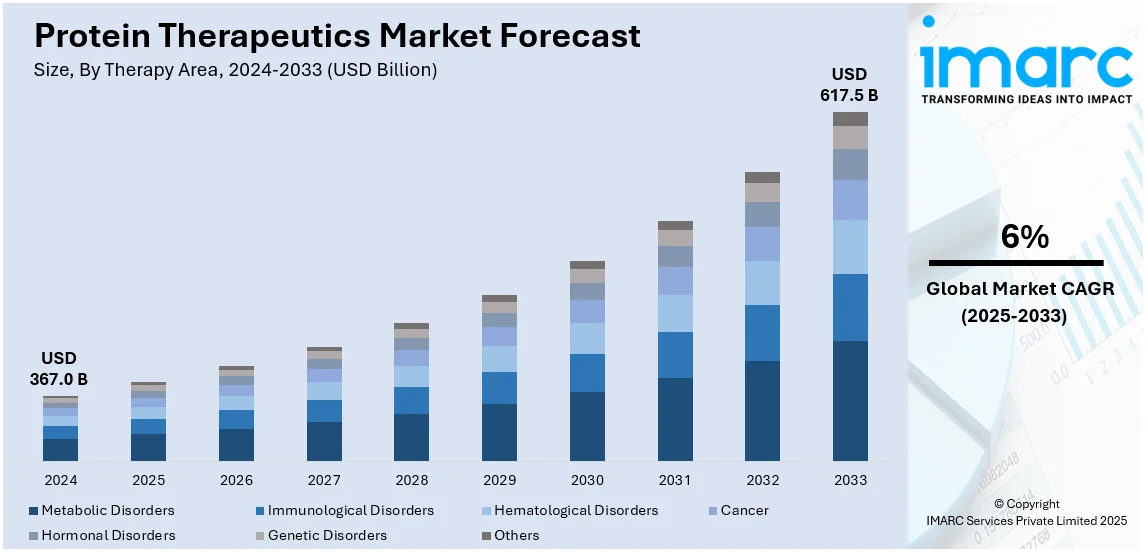

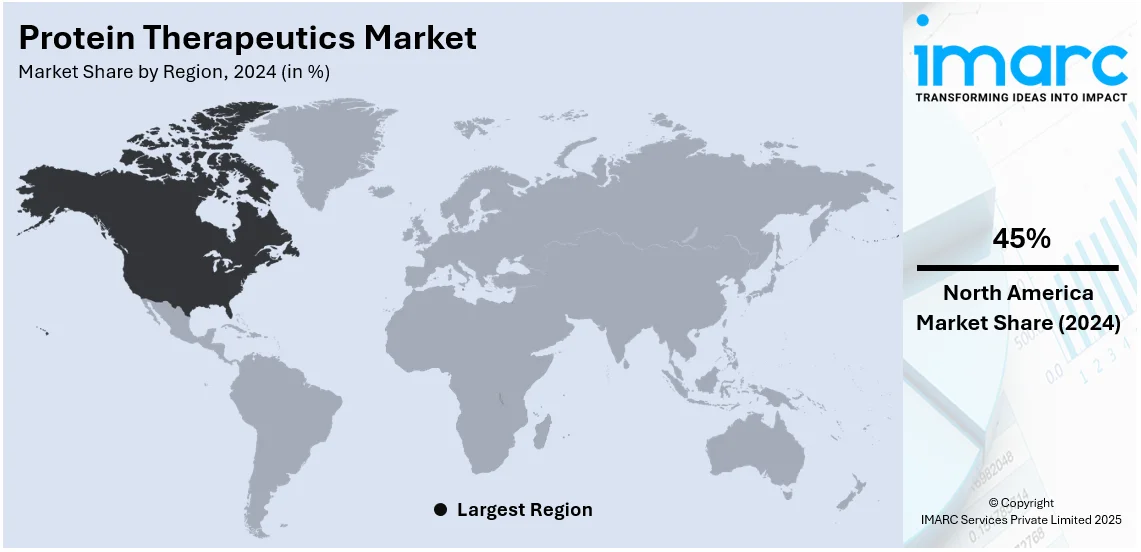

The global Protein Therapeutics market size was valued at USD 367.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 617.5 Billion by 2033, exhibiting a CAGR of 6% during 2025-2033. North America currently dominates the market, holding a significant market share of over 45% in 2024. The increasing prevalence of chronic diseases such as cancer, diabetes, cardiovascular diseases (CVDs), and autoimmune disorders, rapid technological advancements in protein engineering, the expanding biopharmaceutical industry, and the widespread product applications in diverse therapeutic areas are some factors propelling the market. In North America, the market is thriving due to the presence of advanced healthcare infrastructure, high disease prevalence, and ongoing investment in research and development (R&D)..

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 367.0 Billion |

|

Market Forecast in 2033

|

USD 617.5 Billion |

| Market Growth Rate (2025-2033) | 6% |

The escalating prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is a key driver for the global protein therapeutics market. According to the World Health Organization (WHO), about 41 million people die from chronic diseases every year. Of this total, cardiovascular diseases are the biggest killers or 17.9 million people per year, cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million including all deaths caused by kidney diseases due to diabetes). These conditions are frequently chronic and need specific and complex treatment strategies, which are ideal for protein treatments. A large and important type of protein product, monoclonal antibodies, are designed to interact with specific molecules involved in diseases, offered more accurate treatments with less side effects, thus contributing to the protein therapeutics market growth.

In the United States, the protein therapeutics market is expanding due to several factors, including a high prevalence of chronic diseases, a strong R&D infrastructure, and supportive healthcare regulations. The country has a high prevalence of diseases and illnesses such as cancer, diabetes, auto immune and other illnesses therefore the need for advanced treatments. It is estimated from reliable sources that at least 129 million people in the country’s population have at least one major chronic disease; 42 million people, two or more chronic diseases; and 12 million people, five or more chronic diseases. There is a growing approval of patients with new biologic drugs like the monoclonal antibodies, insulin analogs and enzyme replacement therapy. Furthermore, the U.S. Food and Drug Administration (FDA) has recently simplified the entry and competition for biologics and biosimilars, which improves access and costs of these products, thereby strengthening the protein therapeutics market share.

Protein Therapeutics Market Trends:

Growing biopharmaceutical research and development investments

Industry and research organizations are paying more attention to bio-pharmaceuticals and drugs based on proteins basically because they are highly selective, effective, and targeted. The global attention on R&D spending in the biopharmaceutical industry is facilitating the development of protein therapeutics. These investments finance activities that include protein engineering, drug discovery, and formulation optimization hence the development of new and enhanced protein therapeutic products. For example, worldwide biopharmaceutical corporations spent $276 billion on R&D processes in the year 2021. This investment spread over 4191 firms globally and reflected the increasing focus on enhancing innovation in the sector. In addition, a large amount of money going into R & D allows researchers to search for additional therapeutic targets, fine-tune the molecule for better function, and perform numerous in vitro in vivo, and clinical trials. The efforts also help in the growth of the market due to the development of new treatments for different diseases. Also, the rise in spending on R&D enhances the commercialization of production procedures of protein therapeutic products making them affordable. This facilitates further commercial utilization and market expansion of protein-based drugs.

Expansion of biosimilars

The growth of the biosimilar market is a significant contributor to the market. Biosimilars are biological products that are highly similar to an already approved reference protein medicinal product. Because of the expiration of patents on several high-selling biologics, the market for biosimilars is emerging significantly. The availability of biosimilars offers cost-effective alternatives to expensive protein therapeutics, thus making them more accessible to patients and healthcare systems. It increases the affordability of treatments to patients, thus indirectly driving the market into growth. Also, the existence of biosimilars helps create competition in the market. Competition makes prices reduce, hence expanding the market and giving room to innovate and improve among biosimilar manufacturers and also in the case of reference protein therapeutics companies. For instance, in February 2022, Biocon Biologics Ltd., a Biocon subsidiary, signed a definitive business agreement to acquire the biosimilars business of Viatris Inc. With such merit, the deal was set at US$ 3.3 Billion. However, regulation and guidance on biosimilars have evolved and have improved in recent years, creating a definite line of biosimilar development and approval. This has strengthened the healthcare community’s confidence and hence increased biosimilar utilization. As the biosimilar market expands, it stimulates further R&D efforts in protein therapeutics. Manufacturers strive to develop more advanced and differentiated biosimilars, creating a positive protein therapeutics market outlook.

Rising aging population

The market is significantly growing due to the increase in population of the aging people. While the global population ages it is accompanied by increased occurrences of age-related illnesses and diseases like Alzheimer’s, Parkinson's, macular degeneration, and osteoporosis. It was estimated that about 32.9% of adults globally suffer from at least two multiple chronic diseases. These specific health challenges that the aging population face, promote the development and application of protein therapeutics. In addition, protein therapeutics are directly effective in treating age-related diseases and have better advantages than traditional therapies in terms of efficiency and fewer side effects. They also act on selective molecular receptors and focus on the molecular processes of these diseases, which should elevate the standard of treatment and the quality of people’s lives. Furthermore, the surging demand for these products increases with the aging population. Besides this, major pharmaceutical companies and research institutions are seeking new protein therapeutics that align with the needs of this group of people. Apart from this, the rising aging population provides a higher market potential for protein therapeutics, encouraging manufacturers to broaden product ranges and produce more. This results in increased availability of protein therapeutics and influences the expansion of the market further.

Protein Therapeutics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global protein therapeutics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, therapy area, function, and region.

Analysis by Product:

- Monoclonal Antibodies (mAbs)

- Human Insulin

- Erythropoietin

- Clotting Factors

- Fusion Protein

- Others

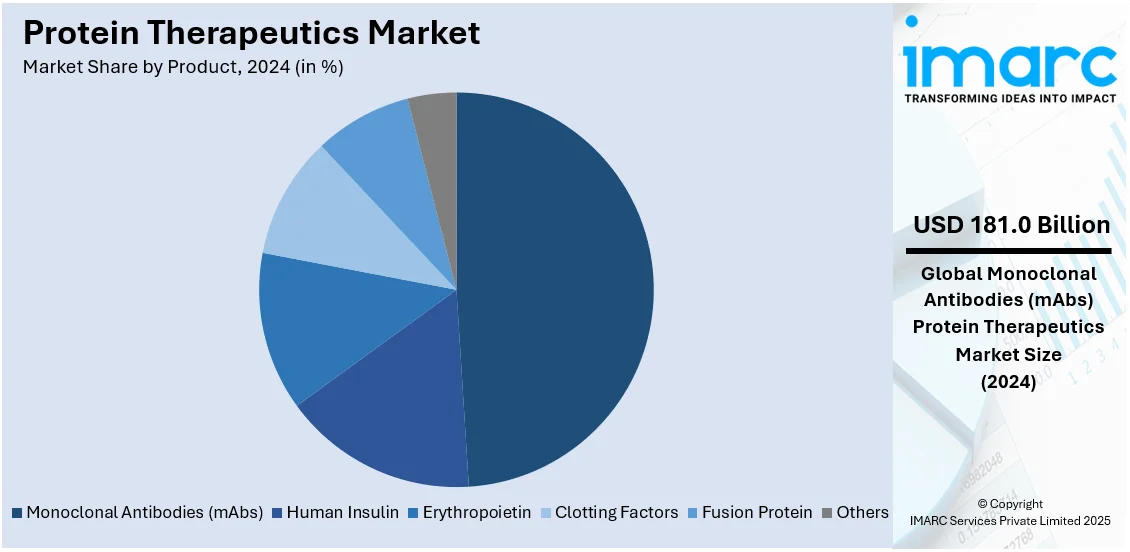

Monoclonal Antibodies (mAbs) products stand as the largest product in 2024, holding over 49% of the market. mAbs are widely applied to cancer therapy, autoimmune disorders, and inflammatory diseases. These diseases are on the rise and with enhancement in the technologies for the development of antibodies, the rising demand for mAbs is contributing to the market expansion.

However, human insulin is an essential protein medicine required for the treatment of diabetes. The growth of incidence of diabetes across the world increases the demand for insulin and insulin analogs, which drives the growth of the market in this segment. Also, erythropoietin more commonly referred to as EPO is one of the most common therapeutic proteins utilized to raise red blood cells’ levels in the body. It is used for anemia especially for patients with chronic kidney disease and patients under chemotherapy. Furthermore, with a higher patient population requiring the indication for EPO therapy, this segment is growing steadily.

Apart from this, clotting factors are proteins which are involved in blood clotting. They are utilized for the control of various types of bleeding disorders such as hemophilia. Consequently, the demand for clotting factors increases with the rise in the awareness, diagnosis and treatment of hemophilia. In addition, chimeric proteins wherein two or more functional protein domains have been joined together have received enormous interest in the development of new therapeutic agents. They offer specific methods of cure of different diseases such as cancer and autoimmune diseases, which is driving the growth of this segment.

Analysis by Therapy Area:

- Metabolic Disorders

- Immunological Disorders

- Hematological Disorders

- Cancer

- Hormonal Disorders

- Genetic Disorders

- Others

Metabolic disorders lead the market, holding the largest market share. Metabolic disorders encompass conditions such as diabetes, obesity, and hypercholesterolemia. Protein therapeutics and drugs like insulin for diabetes are vital in managing these diseases and conditions. The increase in the incidence of metabolic diseases and the need for effective therapies and targeted medications contribute to the growth of the segment.

Immunological disorders, auto-immune diseases, and inflammatory diseases are also some other large therapy areas for protein therapeutics. Small molecules like nitroglycerin operate on the immune system and engage in disease pathways. Some of the drugs classified as monoclonal antibodies, and other protein-based drugs also operate on the immune system and involve the disease pathway. Immunological diseases are on the rise, and the number of protein drugs for these diseases is also on the rise, so it is also driving the market.

Furthermore, cancer continues to be one of the major forces boosting the market growth. While protein and antibody-based medicines are amongst the first-line therapies, they are revolutionizing cancer treatment through monoclonal antibodies, antibody-drug conjugates, and immune checkpoint inhibitors. Global cancer cases are increasing along with the cure such as targeted therapy and immunotherapy, boosting the market in oncology.

Analysis by Function:

- Enzymatic and Regulatory Activity

- Special Targeting Activity

- Vaccines

- Protein Diagnostics

Protein therapeutics with enzymatic and regulatory activity are vital in modulating biological processes and metabolic pathways. These proteins act as enzymes, receptors, or signaling molecules, offering therapeutic benefits in various diseases. The development of novel protein therapeutics with specific enzymatic or regulatory functions drives market growth in this segment.

Special targeting activity refers to protein therapeutics targeting certain cells, tissues, or molecular targets. Monoclonal antibodies and antibody-drug conjugates are examples of protein therapeutics with special targeting activity. They can selectively acknowledge and adhere to particular molecules or cells, offering tailored treatments. The development of targeted therapies in diseases such as cancer as well as autoimmune diseases has boosted the growth of protein therapeutics in this segment.

Vaccines are another significant segment in the market. Protein-substance vaccines are based on proteins or peptides that produce an immune response and protect against infections. The rising concern for vaccination programs throughout the world, the development of new infectious diseases, and the need for new and better types of vaccines are bolstering the market demand.

Protein diagnostics involves using proteins or protein-based assays for diagnostic purposes. These diagnostics can identify certain proteins or biomarkers that are linked to diseases, and can help in the early diagnosis, disease management or even in tailoring the treatment. The need for better diagnostic tools in ever increasing and as such, protein diagnostics are on the rise which helps support the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45%. The region is endowed with well-developed healthcare system, a large number of bioscience and biopharmaceutical firms, and high levels of research and development. The availability of prominent companies and high investments in protein therapeutics research has boosted the growth of the market in North America. Besides, the increased incidence of chronic diseases, a vast number of aging patients, and reasonable compensation policies also strengthen the market in the region.

Asia Pacific is in the process of becoming a rather fast-developing market. This region holds a large population base, higher healthcare spending and growing incidences of chronic diseases. There is an increasingly growing pace of biopharmaceutical industry development and innovation within the Asian nations including China, Japan and India. However, the increasing perception of the existence of personalized medicine and the increasing need for affordable treatment is contributing to the growth of the market in the region.

Key Regional Takeaways:

North America Protein Therapeutics Market Analysis

The protein therapeutics market in North America is witnessing robust growth due to a combination of advanced healthcare infrastructure, high disease prevalence, and significant investment in research and development (R&D). The region has one of the highest incidences of chronic diseases, including cancer, diabetes, and autoimmune disorders, which necessitate innovative and effective treatment options. With a well-established biotechnology sector, North America is a global leader in developing and commercializing protein-based therapeutics, including monoclonal antibodies and fusion proteins. Favorable regulatory frameworks, such as expedited drug approvals by the U.S. FDA, further accelerate the market growth. Additionally, the region benefits from a strong focus on personalized medicine, where protein therapeutics play a critical role in offering targeted therapies with improved patient outcomes.

United States Protein Therapeutics Market Analysis

The United States accounts for 75% share of the market in North America. The high prevalence of chronic diseases, such as diabetes, autoimmune disorders, and cancer, is driving the market for protein therapies in the country. With more than 37 million Americans living with diabetes as of 2023, there is a high need for insulin and other protein-based treatments. The need for cutting-edge biologics to treat age-related disorders is further fueled by the aging population, which is predicted to reach more than 78 million by 2040. The development of next-generation protein therapies, such as fusion proteins and antibody-drug conjugates, is being streamlined by technological developments like recombinant DNA technology and the manufacture of monoclonal antibodies.

Innovation has been aided by regulatory support, such as the FDA's accelerated approval processes for innovative biologics. Biopharmaceutical firms are making significant investments in research and development; in 2023, the United States will still be the world's largest market, generating about 60% of biopharmaceutical innovation. Furthermore, the manufacture of protein therapies is now more scalable due to the availability of a strong infrastructure for manufacturing and clinical trials. The industry is anticipated to be further supported by the rise of customized medicine and the launch of biosimilars, which provide affordable substitutes for pricy biologics without sacrificing efficacy or safety.

Europe Protein Therapeutics Market Analysis

Growing chronic illness rates and a strong focus on healthcare innovation in the region are driving the market for protein therapies in Europe. The European Medicines Agency (EMA) recommended 77 medicines for marketing authorization in 2023, demonstrating the region's dedication to cutting-edge protein-based therapies. Since cancer accounts for 2.7 million new cases in Europe each year, there is a great need for targeted therapy using protein medicines like interferons and monoclonal antibodies. European governments and health institutions are making significant investments in biotechnology and personalized medicine, with programs such as Horizon Europe offering major financing for research and development. The market is led by nations with strong healthcare systems and high patient awareness, such as Germany, France, and the UK. Furthermore, the EU's cost-cutting measures are encouraging the growing acceptance of biosimilars, which is increasing market penetration by making protein-based medications more accessible.

Asia Pacific Protein Therapeutics Market Analysis

The market for protein therapies in Asia-Pacific is expanding quickly as a result of rising healthcare costs, an increase in the number of chronic illnesses, and the use of cutting-edge medical technology. Insulin and other protein-based therapies are essential in tackling this expanding healthcare issue in China and India, which have the highest diabetes populations in the world. Leaders in biopharmaceutical innovation, South Korea and Japan have made large expenditures in the development of biosimilars and monoclonal antibodies.

Demand is being increased by the burgeoning middle class and rising knowledge of sophisticated biologics in emerging economies. To lessen reliance on imports, the governments in the area are encouraging domestic manufacturing and research and development. China's "Healthy China 2030" policy, for instance, promotes the creation of innovative biopharmaceuticals, such as protein therapies. Furthermore, collaborations between regional and international pharmaceutical firms are augmenting the introduction of reasonably priced protein therapies throughout Asia-Pacific.

Latin America Protein Therapeutics Market Analysis

The rising incidence of chronic illnesses and the development of better healthcare facilities are driving the market for protein therapies in Latin America. To improve patient outcomes, nations with high incidences of diabetes and cancer, such as Brazil and Mexico, are implementing cutting-edge biologics. Government healthcare initiatives and increased investments in biopharmaceutical R&D are boosting the manufacturing and marketing of protein therapies. Additionally, the emergence of biosimilars, which provide affordable substitutes, is opening up more therapy possibilities in the area.

Middle East and Africa Protein Therapeutics Market Analysis

The rising prevalence of chronic illnesses and a growing emphasis on expanding access to healthcare are driving the market for protein therapies. In line with their goal of modernizing healthcare systems, nations in the Middle East like as Saudi Arabia and the United Arab Emirates are making significant investments in biopharmaceuticals. Access to protein therapies, especially for conditions like diabetes and cancer, is being improved in Africa thanks to international partnerships and funding programs run by agencies like the WHO. Furthermore, local production facilities and awareness campaigns are progressively extending the reach of these cutting-edge remedies throughout the region.

Competitive Landscape:

Top companies are now investing heavily in scientific research with the aim of identifying new therapeutic targets and creating protein-based drugs with enhanced efficacy and safety profiles. They can use their skills in protein engineering, molecular biology, and biotechnology to create and optimize therapeutic proteins. Additionally, top companies form strategic collaborations with academic institutions, research organizations, and other pharmaceutical companies in order to acquire new technologies and expand their pipeline while accelerating the development process. Collaborations allow the parties to share knowledge, resources, and expertise with each other for innovation and for driving the market. Also, successful commercialization strategies play an important role in promoting market growth. These companies implement strong marketing and sales activities in order to offer their products to healthcare providers and patients worldwide. They perform detailed clinical trials, develop significant clinical data, and gain regulatory approval to access the market. The top companies also invest continually in manufacturing capabilities and quality control systems to be able to produce a consistent supply of their products to meet growing demand. These efforts at excellence in manufacturing thus help them in meeting the requirements of patients, healthcare providers, and payers, further driving the market.

The report provides a comprehensive analysis of the competitive landscape in the protein therapeutics market with detailed profiles of all major companies, including:

- Amgen Inc.

- Abbott Laboratories

- Abbvie Inc.

- Baxter International Inc.

- Biogen Inc.

- Csl Behring L.L.C. (CSL Limited)

- Eli Lilly and Company

- F. Hoffmann-La Roche AG (Roche Holding AG)

- Johnson & Johnson

- Merck & Co. Inc.

- Novo Nordisk A/S (Novo Holdings A/S)

- Pfizer Inc.

Latest News and Developments:

- February 2024: BioNTech SE and Autolus Therapeutics plc announced today that they have entered into a strategic collaboration aimed at moving the autologous CAR-T cell therapy programs from both companies into commercialization subject to obtaining any necessary regulatory approvals. The terms of the deal include a license and option agreement as well as a securities purchase agreement. Combining the strengths of both companies, the partnership is focused on progressing their respective CAR-T programs as part of their next-generation immunotherapies for cancer and other serious diseases.

- February 2024: Taiwan-based Lumosa Therapeutics launched two Phase II clinical trials to explore LT3001 for the acute ischemic stroke treatment candidate. The trials, which are randomized, placebo-controlled, and double-blinded, include the Lumosa 203 (NCT05198323) and Bright (NCT05403866). Lumosa 203 The study will assess the efficacy of LT3001 versus a placebo in patients with AIS who receive EVT in addition to appropriate standard-of-care therapies.

- January 2024: Ractigen Therapeutics partnered with University Medical Center Utrecht to develop saRNA-based therapies for neurodevelopmental disorders. This collaboration was set to utilize Ractigen's saRNA platform and oligonucleotide delivery systems in collaboration with Professor Bobby Koeleman's group, who have been leaders in childhood epilepsies. This collaboration is going to translate promising preclinical results into effective treatments by identifying novel gene targets for therapeutic development.

- January 2021: The Tendyne Transcatheter Mitral Valve Replacement TMVR system won clearance from Abbott Laboratories from FDA. It's a minimally invasive therapy directed at patients experiencing severe mitral regurgitation. This should give patients minimally invasive alternate options for their mitral valve replacement, where functioning and overall quality of life would be more enhanced for such selected patients presenting with symptomatic, severe MR ≥ grade 3, against the traditional forms of mitral valve surgery.

- May 2020: AbbVie Inc. acquired pharmaceutical company Allergan, also known for its product portfolio of various therapeutic products and Botox. The purchase was completed after the obtaining of the needed government authorities approvals and the final Irish High Court ruling as prescribed by the purchase agreement.

Protein Therapeutics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Monoclonal Antibodies (mAbs), Human Insulin, Erythropoietin, Clotting Factors, Fusion Protein, Others |

| Therapy Areas Covered | Metabolic Disorders, Immunological Disorders, Hematological Disorders, Cancer, Hormonal Disorders, Genetic Disorders, Others |

| Functions Covered | Enzymatic and Regulatory Activity, Special Targeting Activity, Vaccines, Protein Diagnostics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., Abbott Laboratories, Abbvie Inc., Baxter International Inc., Biogen Inc., Csl Behring L.L.C. (CSL Limited), Eli Lilly and Company, F. Hoffmann-La Roche AG (Roche Holding AG), Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S (Novo Holdings A/S) and Pfizer Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the protein therapeutics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global protein therapeutics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the protein therapeutics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Protein therapeutics are medical treatments developed from proteins, including enzymes, antibodies, and hormones, used to treat a variety of conditions such as cancer, diabetes, and autoimmune disorders by targeting specific biological mechanisms.

The Protein Therapeutics market was valued at USD 367.0 Billion in 2024.

IMARC estimates the global protein therapeutics market to exhibit a CAGR of 6% during 2025-2033.

The market growth is driven by the rising prevalence of chronic diseases, advancements in protein engineering, expansion of the biopharmaceutical industry, and increasing applications across diverse therapeutic areas.

Monoclonal antibodies (mAbs) represented the largest segment by product, driven by their widespread use in cancer and autoimmune disease treatments.

Metabolic disorders lead the market by therapy area owing to the high prevalence of conditions like diabetes and obesity, which necessitate effective protein-based treatments.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global protein therapeutics market include Amgen Inc., Abbott Laboratories, Abbvie Inc., Baxter International Inc., Biogen Inc., Csl Behring L.L.C. (CSL Limited), Eli Lilly and Company, F. Hoffmann-La Roche AG (Roche Holding AG), Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S (Novo Holdings A/S) and Pfizer Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)