Protein Engineering Market Size, Share, Trends and Forecast by Product & Services, Protein Type, Technology, End User and Region, 2025-2033

Protein Engineering Market Size and Share:

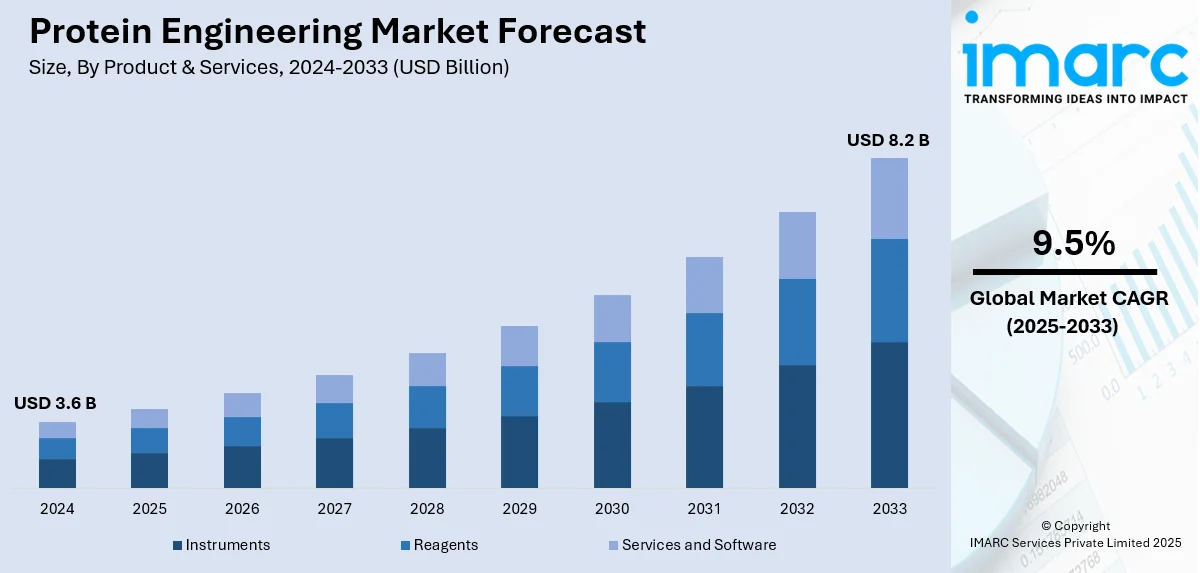

The global protein engineering market size was valued at USD 3.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.2 Billion by 2033, exhibiting a CAGR of 9.5% during 2025-2033. North America currently dominates the market, holding a significant market share of 40.6% in 2024. Artificial intelligence (AI-driven) automation enhances protein modeling, drug discovery, and industrial enzyme optimization, which is a key factor expanding the protein engineering market share. Government funding supports academic research, accelerating innovations in protein therapeutics and synthetic biology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.6 Billion |

|

Market Forecast in 2033

|

USD 8.2 Billion |

| Market Growth Rate (2025-2033) | 9.5% |

Government funding and academic research are accelerating advancements in the protein engineering market through innovation and commercialization. Public research grants support foundational studies in protein structure, function, and bioengineering applications. Government agencies allocate funds to universities for developing novel protein-based therapeutics and industrial enzymes. Research institutions collaborate with biotech firms to translate academic discoveries into commercial protein engineering solutions. Federal funding programs drive advancements in synthetic biology, enabling precision-designed proteins for diverse applications. Academic researchers optimize protein expression systems, improving scalability for pharmaceutical and industrial biomanufacturing. Government-backed initiatives promote AI-driven protein modeling, enhancing drug discovery and targeted therapy development. Academic labs develop new gene editing techniques to refine protein modifications for enhanced functionality.

To get more information on this market, Request Sample

Artificial intelligence (AI)-driven automation is transforming the United States protein engineering market by enhancing efficiency, accuracy, and scalability. Machine learning (ML) algorithms predict protein structures, improving drug discovery and biopharmaceutical development processes. AI-powered tools optimize protein folding, stability, and functionality for therapeutic and industrial applications, thus catalyzing the protein engineering market demand. Automated high-throughput screening accelerates candidate selection, reducing time and costs for engineered protein development. Deep learning models analyze massive biological datasets, identifying novel protein sequences with targeted properties. AI-driven computational biology enhances rational protein design, refining molecular interactions and improving specificity. For instance, in November 2024, Imperial College London launched Imperial Global USA, its first physical presence in the United States, based in San Francisco. The hub aims to foster 100 new US-UK science and technology partnerships in 2025, with a focus on AI, robotics, cleantech, biotech, and engineering biology. Additionally, robotics streamline protein purification and characterization, minimizing errors and increasing experimental reproducibility. AI-integrated laboratory automation enhances efficiency in large-scale protein expression and biomanufacturing workflows, which further propels the market growth.

Protein Engineering Market Trends:

Expanding synthetic biology market

Increasing investments in synthetic biology and the growing emphasis on protein-based drug development are key drivers of the market. The global synthetic biology market was valued at USD 18.5 billion in 2024 and is projected to reach USD 66.7 billion by 2033, registering a 15.3% CAGR from 2025 to 2033, as per IMARC Group’s report. Scientists are designing custom proteins with enhanced stability, specificity, and functionality for diverse industrial and healthcare uses. AI-driven algorithms and CRISPR-based modifications are enabling precise protein modifications for tailored therapeutic and industrial applications. Engineered proteins are revolutionizing drug discovery, enzyme manufacturing, and bio-based materials with increased efficiency and sustainability. Companies are leveraging synthetic biology tools to develop novel biocatalysts for green chemistry and sustainable production methods. Precision fermentation techniques are producing alternative proteins with improved nutritional profiles and functional properties. Bio-based materials from engineered proteins are replacing traditional petrochemical-based products in textiles and packaging. Advancements in metabolic pathway engineering are expanding protein functionality for enhanced enzymatic activity in bioprocessing applications, which is strengthening the market growth.

Rising prevalence of protein-deficient diseases

The high prevalence of protein-deficient diseases is driving the demand for protein engineering. Studies report that 2–10% of children aged 1–9 in developing nations experience severe protein-calorie malnutrition, while in some regions, up to 50% of children aged 1–5 suffer from milder deficiencies. Malnutrition-related disorders and genetic conditions requiring protein supplementation are influencing advancements in protein engineering technologies. Engineered proteins are being developed to address metabolic disorders, enzyme deficiencies, and hereditary protein-related diseases effectively. Biopharmaceutical companies are designing recombinant proteins for treating conditions like cystic fibrosis, hemophilia, and growth hormone deficiencies. Advancements in protein engineering are enabling the production of bioavailable therapeutic proteins with enhanced stability and efficacy. Researchers are modifying protein structures to improve absorption, half-life, and targeted delivery for clinical applications. Increased awareness about protein-deficient diseases is encouraging investment in precision-engineered proteins for personalized medicine solutions. Growing demand for plant-based and fermentation-derived proteins is addressing dietary protein deficiencies in global populations.

Advancements in genetic engineering

Advancements in genetic engineering are transforming protein engineering by enabling precise modifications for enhanced functionality and stability. AI-driven protein design is accelerating the development of novel proteins with optimized structures and specific functions. Directed evolution techniques are refining protein properties by mimicking natural selection for better efficiency and performance. Synthetic biology approaches are integrating genetic circuits to design custom proteins for pharmaceutical, food, and industrial uses. Recombinant deoxyribonucleic acid (DNA) technology is facilitating large-scale production of engineered proteins with superior bioactivity and reduced immunogenicity. Gene synthesis innovations are streamlining the creation of artificial protein sequences tailored for specialized biochemical applications. Protein folding simulations are improving structural predictions, enabling precise engineering of proteins with desired characteristics. Advanced expression systems are enhancing protein yields, stability, and bioavailability for commercial and medical applications. Metabolic engineering is optimizing biosynthetic pathways for increased protein production in microbial and plant-based hosts.

Protein Engineering Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global protein engineering market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product & services, protein type, technology, and end user.

Analysis by Product & Services:

- Instruments

- Reagents

- Services and Software

Instruments stand as the largest component in 2024, holding 53.2% of the market. Advanced analytical instruments enable precise protein characterization, structural analysis, and functional optimization for various applications. High-performance chromatography systems and spectroscopy instruments enhance protein purification and identification processes effectively. Mass spectrometry technologies facilitate accurate protein sequencing, modifications analysis, and molecular weight determination for engineering applications. Automated liquid handling systems streamline high-throughput screening, improving efficiency in protein engineering workflows. Cutting-edge imaging technologies provide real-time insights into protein interactions and conformational changes. Next-generation sequencing (NGS) platforms support genetic modifications and structural modeling for protein engineering advancements. Increased adoption of microfluidics-based devices enhances miniaturized protein assays and accelerates screening processes. Companies invest in instrument development to improve reproducibility, accuracy, and scalability in protein engineering experiments. Rising demand for customized protein structures drives innovation in instrument technologies for targeted design applications. Pharmaceutical and biotech firms rely on advanced instruments for biologics development and structural biology research. Expanding government and private funding boosts investment in instrument-based research infrastructure.

Analysis by Protein Type:

- Insulin

- Monoclonal Antibodies

- Coagulation Factors

- Vaccines

- Growth Factors

- Others

In 2024, monoclonal antibodies dominate the market, holding a 24.5% market share. These designed proteins are crucial in targeted drug treatments, especially for cancer and autoimmune disorders. Cutting-edge protein engineering methods enhance monoclonal antibodies for better specificity, stability, and therapeutic effectiveness. The growing occurrence of chronic illnesses is fueling the need for antibody-based therapies in biopharmaceutical uses. Biotech firms concentrate on creating advanced monoclonal antibodies that offer improved binding affinity and decreased immunogenicity. Recombinant DNA techniques allow for the intensive production of monoclonal antibodies that are highly pure and yield substantial amounts. Growing regulatory approvals for antibody-based biologics continue to enhance their market leadership in protein engineering. AI-powered protein optimization speeds up the discovery of monoclonal antibodies, decreasing both time and expense in drug development. Collaborative strategies between biotech startups and pharmaceutical companies enhance the research and marketability of monoclonal antibodies. Increasing demand for biosimilars and antibody-drug conjugates boosts market expansion in this sector. Improvements in hybridoma technology and phage display lead to ongoing advancements in the engineering of monoclonal antibodies.

Analysis by Technology:

- Irrational Protein Design

- Rational Protein Design

Rational protein design holds the largest market share due to its precision and efficiency in protein modification. This approach utilizes computational modeling and AI-driven algorithms to predict and optimize protein structures effectively. Scientists design proteins with desired properties by modifying specific amino acid sequences and functional sites. Structural bioinformatics and molecular docking simulations enhance rational protein design applications in drug development. AI and ML significantly improve protein modeling accuracy, accelerating discovery and optimization processes. High-throughput screening techniques validate designed proteins, ensuring optimal stability and performance in applications. Rational protein design reduces trial-and-error methods, leading to faster, cost-effective protein engineering solutions. Pharmaceutical companies leverage this technology for antibody engineering, enzyme optimization, and therapeutic protein development. Continuous advancements in computational tools enhance rational design’s efficiency for industrial and medical applications. Academic research institutions collaborate with biotech firms to refine rational protein design methodologies. Expanding use in enzyme engineering for industrial bioprocessing strengthens its market share in protein engineering.

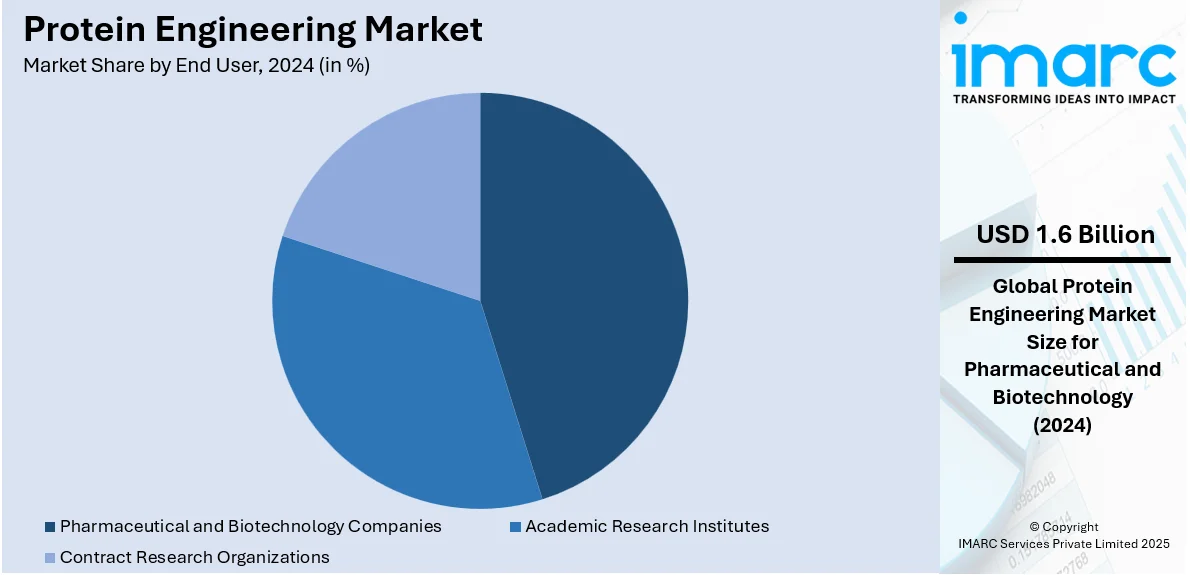

Analysis by End User:

- Pharmaceutical and Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations

Pharmaceutical and biotechnology companies dominate the market with 45.3% of market share in 2024. These firms drive innovation in therapeutic proteins, monoclonal antibodies, and enzyme-based drug development. Biopharmaceutical companies invest heavily in protein engineering to enhance drug efficacy and safety. AI-driven protein design accelerates biologic drug discovery, reducing costs and development timelines. Increased prevalence of chronic diseases increases demand for protein-based biologics in targeted therapies. Expanding applications of engineered proteins in oncology, immunology, and metabolic disorders strengthen market growth. Regulatory approvals for biologics encourage pharmaceutical firms to develop next-generation protein therapeutics. Biotech startups focus on synthetic biology and precision fermentation for sustainable protein-based solutions. Collaborations between pharmaceutical giants and academic institutions advance protein engineering research and commercialization. Continuous innovation in recombinant protein production improves scalability and cost-effectiveness in manufacturing. Rising adoption of engineered enzymes in drug formulation enhances the sector’s market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 40.6%. The region hosts major biotech and pharmaceutical firms driving innovation in engineered proteins. Increased investment in AI-driven protein design strengthens North America’s leadership in protein engineering. Government funding supports academic research institutions engaged in protein engineering advancements. Expanding clinical trials for biologics and monoclonal antibodies boost protein-based drug development. Regulatory agencies, including the FDA, streamline approvals for engineered protein therapeutics. High adoption of precision fermentation and synthetic biology enhances protein engineering applications. North American companies leverage AI and machine learning for rational protein design and optimization. Strong demand for biopharmaceuticals drives growth in engineered protein-based therapies. For example, In November 204, Future Fields, a Canadian biotech company, opened Instar 1.0, a 6,000-square-foot facility in Edmonton dedicated to fruit fly-based biomanufacturing. This innovative approach addresses biomanufacturing challenges by offering a more efficient and scalable protein production method. Instar 1.0 enables custom protein synthesis in exotic cell lines, supporting research into next-generation therapies. This advancement is particularly impactful for the Protein Engineering market, providing a novel platform for producing complex proteins essential for therapeutic applications. Moreover, expanding partnerships between academia and industry foster continuous innovation in protein engineering. Robust venture capital investment fuels biotech startups focused on next-generation protein therapeutics. Leading research universities contribute to groundbreaking discoveries in engineered protein applications.

Key Regional Takeaways:

United States Protein Engineering Market Analysis

The United States accounts for 89.60% of the protein engineering market share in North America, driven by increasing demand for biologics, such as monoclonal antibodies and biosimilars. Rising chronic disease prevalence, with an estimated 129 million Americans affected by conditions like heart disease, cancer, diabetes, obesity, and hypertension, is driving demand for protein-based therapeutics. Strong research and development (R&D) investments, a well-established biopharmaceutical industry, and favorable regulatory policies support continuous advancements in protein engineering. AI-driven protein modeling and CRISPR-based gene editing are improving drug discovery and protein optimization processes. The expansion of synthetic biology applications in personalized medicine, enzyme engineering, and agriculture further strengthens market growth. Government initiatives promoting biopharmaceutical research, tax incentives, and intellectual property protections encourage innovation and commercialization. Collaborations between pharmaceutical companies, research institutions, and biotech startups accelerate new protein-based drug development. Industrial applications, including biofuels, food processing, and environmental biotechnology, are also influencing protein engineering adoption. The presence of advanced healthcare infrastructure, strong financial support, and increasing venture capital investments induces sector’s growth. Continuous technological advancements in protein characterization, structural biology, and metabolic engineering further solidify the US market’s leadership in global protein engineering innovations.

Asia Pacific Protein Engineering Market Analysis

The Asia Pacific market is expanding due to rising investments in biotechnology and pharmaceutical research and development (R&D), supported by favorable government policies. The increasing cancer incidence, recorded at 169.1 per 100,000 in 2020 and accounting for 49.3% of global cases, is driving demand for engineered proteins in targeted therapies. Expanding biopharmaceutical manufacturing capabilities in China, India, and South Korea further fueling market growth. Leading academic and research institutions are fostering innovation in protein engineering technologies. Growing adoption of synthetic biology and CRISPR-based protein modifications is advancing precision medicine applications. Collaborations between global biotech firms and regional players facilitate technology transfer and commercialization. The demand for personalized medicine, along with a skilled workforce at competitive costs, strengthens regions market position. Expansion of biopharma contract development and manufacturing organizations (CDMOs) is increasing production capacity and efficiency. Supportive regulatory frameworks, rising healthcare expenditure, and government-backed initiatives enhance industry development. The increasing focus on monoclonal antibodies, biosimilars, and next-generation biologics further accelerates protein engineering adoption. Strengthening infrastructure for AI-driven drug discovery and large-scale biomanufacturing ensures sustained growth. Overall, the regions dynamic biopharmaceutical sector and strong research ecosystem position the region as a key player in protein engineering advancements.

Europe Protein Engineering Market Analysis

The European market is expanding due to a strong biotechnology sector backed by significant public and private investments. Rising demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies, is driving advancements in protein engineering technologies. With the European Union population reaching 448.8 million in 2023 and 21.3% aged 65 and above, the increasing prevalence of chronic and age-related diseases is catalyzing demand for innovative protein-based therapeutics. Favorable regulatory policies, such as expedited biologic approvals, further support market growth. Region’s well-established biomanufacturing infrastructure, particularly in Germany, Switzerland, and the UK, strengthens protein production capabilities. Strategic partnerships between academic institutions, biotech firms, and pharmaceutical companies are enhancing research-driven innovation in protein engineering. Expanding contract development and manufacturing organization (CDMO) capabilities improve scalability and efficiency in biopharmaceutical production. Increasing adoption of AI-driven protein design, precision medicine, and sustainable bioprocessing further influencing industry demand. Government initiatives supporting biosimilars and next-generation biologics accelerate innovation and commercialization. AI and ML integration in protein engineering enhance drug discovery and structural optimization. Growing investments in cell and gene therapy are further driving industry expansion. With a rising elderly population, increasing healthcare needs, and continued focus on biologics, Europe remains a key global player in protein engineering advancements.

Latin America Protein Engineering Market Analysis

Latin America's market is growing due to rising biotechnology investments, increasing biologics demand, and improving healthcare infrastructure. The region faces a significant chronic disease burden, with Brazil alone reporting approximately 928,000 deaths annually from chronic illnesses, driving the need for innovative protein-based therapeutics. Governments are actively supporting biotech innovation through favorable policies, research funding, and foreign investment incentives. Expanding biosimilar adoption and collaborations between universities, research institutions, and global biotech firms are accelerating market development. Additionally, protein engineering applications in food processing and agriculture are gaining prominence. Competitive biomanufacturing costs position Latin America as an emerging hub for biopharmaceutical production and innovation.

Middle East and Africa Protein Engineering Market Analysis

The Middle East and Africa region market is expanding due to rising healthcare investments, growing biopharmaceutical manufacturing, and an increasing chronic disease burden. In the UAE, 23% of individuals report chronic illnesses, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common, driving demand for protein-based therapeutics. Governing agencies of Saudi Arabia and the UAE are investing heavily in biotechnology research and personalized medicine to advance healthcare innovation. Collaborations with global biotech firms and academic institutions are strengthening regional research and development (R&D) capabilities. Expanding applications in food processing, industrial enzymes, and biosimilar production, along with improving regulatory frameworks, are further supporting market growth.

Competitive Landscape:

Leading biotechnology companies are investing heavily in AI-driven protein design to optimize molecular structures efficiently. Pharmaceutical firms are utilizing engineered proteins for developing targeted therapies, biologics, and enzyme-based treatments. In April 2024, Abzena Ltd. launched EpiScreen 2.0, an advanced platform for immunogenicity assessment, enhancing the development of complex biologics and bioconjugates. Leveraging over 20 years of expertise from the original EpiScreen platform, this next-generation suite delivers highly sensitive, multi-parametric, and data-rich assays to predict and evaluate preclinical immunogenicity risks in proteins, antibodies, and gene therapy therapeutics. Additionally, synthetic biology startups are introducing novel protein engineering approaches for food, healthcare, and industrial applications. Contract research organizations are supporting drug discovery by providing protein engineering solutions for biopharma clients. Academic institutions are advancing protein engineering techniques through collaborations with biotech companies and government research programs. Investments in precision fermentation are enabling large-scale production of engineered proteins for various commercial applications. Mergers and acquisitions are strengthening the market by integrating expertise in protein design and biomanufacturing. Companies are forming strategic alliances to accelerate protein-based drug development and industrial enzyme production.

The report provides a comprehensive analysis of the competitive landscape in the protein engineering market with detailed profiles of all major companies, including:

- Abzena Limited

- Agilent Technologies, Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Codexis Inc.

- DH Life Sciences, LLC

- GenScript

- Merck KGaA

- Novo Nordisk A/S

- Protomer Technologies (Eli Lilly and Company)

- Revvity, Inc.

- Thermo Fisher Scientific Inc.

- Waters Corporation

Latest News and Developments:

- November 2024: Cradle Bio secured USD 73 million in Series B funding, bringing its total investment beyond USD 100 million. Its AI-powered platform enhances protein engineering in therapeutics, diagnostics, agriculture, chemicals, and food, streamlining R&D timelines. The company now collaborates with 21 clients, including leading pharmaceutical firms, to advance protein innovation.

- October 2024: Avenue Biosciences raised EUR 2.3 million (USD 2.38 million) in seed funding, headed by Voima Ventures in collaboration with Inventure and US angel investors. The investment supports its platform for improving protein production efficiency in biopharmaceuticals, advancing therapies like gene therapies, monoclonal antibodies, and mRNA vaccines.

- September 2023: Tel Aviv-based Scala Biodesign secured USD 5.5 million in seed funding, led by TLV Partners. Its AI-driven platform enhances protein engineering by combining computational modeling, biological data analysis, and physics-based simulations for therapeutics, vaccines, and industrial applications.

- April 2023: Adaptyv Bio launched a protein foundry to validate AI-designed proteins using robotics, microfluidics, and synthetic biology. While AI tools like AlphaFold and RFDiffusion advance protein modeling, translating designs into functional proteins remains challenging. Adaptyv Bio simplifies this process by improving data generation, refining AI feedback, and accelerating innovations in medicine, enzymes, and novel materials.

Protein Engineering Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product & Services Covered | Instruments, Reagents, Services and Software |

| Protein Types Covered | Insulin, Monoclonal Antibodies, Coagulation Factors, Vaccines, Growth Factors, Others |

| Technologies Covered | Irrational Protein Design, Rational Protein Design |

| End Users Covered | Pharmaceutical and Biotechnology Companies, Academic Research Institutes, Contract Research Organizations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abzena Limited, Agilent Technologies, Inc., Bio-Rad Laboratories Inc., Bruker Corporation, Codexis Inc., DH Life Sciences, LLC, GenScript, Merck KGaA, Novo Nordisk A/S, Protomer Technologies (Eli Lilly and Company), Revvity, Inc., Thermo Fisher Scientific Inc., Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, protein engineering market outlook, and dynamics of the market from 2019-2033.

- The protein engineering market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the protein engineering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The protein engineering market was valued at USD 3.6 Billion in 2024.

The protein engineering market is projected to exhibit a CAGR of 9.5% during 2025-2033, reaching a value of USD 8.2 Billion by 2033.

The protein engineering market growth is driven by rising demand for biologics, including monoclonal antibodies and gene therapies. Advancements in AI-driven protein modeling, CRISPR-based gene editing, and synthetic biology enhance drug discovery and enzyme optimization. Increasing prevalence of chronic diseases fuels the need for targeted protein-based therapeutics. Government funding, academic research, and growing biopharmaceutical investments accelerate innovation. Expanding applications in food, agriculture, and industrial enzymes further strengthens market growth.

North America currently dominates the protein engineering market, accounting for a share of 40.6% in 2024. The region leads in biologics development, including monoclonal antibodies and gene therapies, driven by rising chronic disease prevalence. Government funding, favorable regulatory frameworks, and AI-driven protein design accelerate innovation. Leading biotech firms, pharmaceutical giants, and academic institutions foster continuous advancements.

Some of the major players in the protein engineering market include Abzena Limited, Agilent Technologies, Inc., Bio-Rad Laboratories Inc., Bruker Corporation, Codexis Inc., DH Life Sciences, LLC, GenScript, Merck KGaA, Novo Nordisk A/S, Protomer Technologies (Eli Lilly and Company), Revvity, Inc., Thermo Fisher Scientific Inc., Waters Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)