Protein Bar Market Report by Source (Plant-Based, Animal-Based), Type (Sports Nutrition Bar, Meal Replacement Bar, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2026-2034

Protein Bar Market Size:

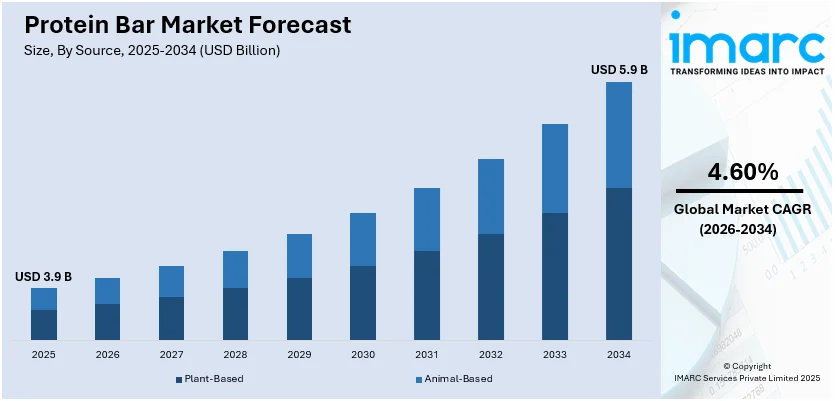

The global protein bar market size reached USD 3.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.60% during 2026-2034. The growing health consciousness and convenience-driven consumer lifestyles, rising dietary shifts toward high-protein and plant-based options, and increasing innovations in flavors and ingredients are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.9 Billion |

|

Market Forecast in 2034

|

USD 5.9 Billion |

| Market Growth Rate 2026-2034 | 4.60% |

Protein Bar Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth due to the increasing health consciousness among the masses and demand for convenient nutrition solutions.

- Key Market Trends: The growing development of specialized protein bars targeting specific dietary needs and preferences, such as keto, vegan, or gluten-free, is offering a favorable protein bar market outlook.

- Geographical Trends: North America dominates the market owing to the rising health awareness among the population and increasing spending power.

- Competitive Landscape: Some of the major market players in the protein bar industry include Amway Corp., General Mills Inc, Kellanova, Mars Incorporated, Mondelez International group, Nestlé S.A, NuGo Nutrition, Premier Nutrition Company, LLC, The Simply Good Foods Company and ThinkThin, among many others.

- Challenges and Opportunities: The high cost of premium ingredients and competing in a saturated market where brand loyalty is often strong affects the protein bar market revenue. However, opportunities in tapping into emerging markets and expanding the user base through product innovation are projected to overcome these challenges.

To get more information on this market Request Sample

Protein Bar Market Trends:

Health and Wellness Trends

More individuals are adopting fitness routines and seeking nutritious snack options that align with their lifestyles. The increase in awareness around physical health, weight management, and balanced diets is making protein bars a preferred choice for maintaining energy levels and managing hunger between meals. These trends are supported by the rising incidences of obesity and diabetes, prompting individuals to choose healthier, protein-rich snacks over traditional high-calorie, sugary alternatives. As per the World Health Organization (WHO), in 2022, globally, 1 in 8 individuals suffered from obesity. 2.5 billion persons (age 18 and over) worldwide were overweight, and 890 million of them suffered from obesity. In addition, 43% of individuals over the age of 18 were overweight, 16% were obese, and 37 million children under five were overweight.

On-the-Go Gains Fueling Market Growth

The rapid speed of contemporary living is a crucial factor influencing the protein bar market growth. Modern consumers, especially working professionals and students, often find little time to prepare meals, making on-the-go snacks like protein bars a convenient alternative. These products meet the demand for quick, portable, and less perishable food options that can be consumed anywhere and at any time. For instance, in May 2025, CLIF BUILDERS expanded its high-protein bar portfolio with three new products. Innovations include BUILDERS OREO-flavored protein bars, boasting 20g of plant protein, and BUILDERS Reduced Sugar Crispy protein bars (16g protein, 5g sugar) in Almond Salted Caramel and Peanut Butter Chocolate. These launches aim to offer purposeful, great-tasting, and high-protein options for consumers seeking recovery fuel and on-the-go snacks.

Advancements in Product Taste and Ingredient Mix

Innovative flavors and ingredients play a crucial role in driving the protein bar demand, with brands working to stand out and meet changing consumer preferences. Businesses are constantly trying out different flavors, ranging from sweet, dessert-inspired varieties to savory options, in order to appeal to a larger user base. Additionally, health-conscious consumers are attracted to superfoods, organic ingredients, and supplements, such as added vitamins or caffeine, for extra benefits. These advancements enhance the flavor and nutritional value of protein bars and ensure continued consumer engagement and market relevance. Protein bar market recent developments like the creation of banana caramel soft protein bars from Barebells Functional Foods LLC in 2023 is offering a favorable market outlook. Its unique combination of smooth caramel sauce, creamy banana, and thick milk chocolate coating is complemented with 16-gram protein content and zero added sugar per bar.

Protein Bar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on source, type, and distribution channel.

Breakup by Source:

- Plant-Based

- Animal-Based

Plant-based exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant-based and animal-based. According to the report, plant-based accounted for the largest market share.

The plant-based segment emerges as the largest attributed to the shift in consumer preferences toward healthier and more sustainable dietary choices. The growing understanding about the environmental effects of animal farming, combined with health worries associated with animal-derived items, is driving the demand for plant-based substitutes. These products, ranging from meat and dairy substitutes to plant-derived proteins, are gaining popularity not only among vegetarians and vegans but also among a broader base of consumers seeking diverse protein sources. In February 2024, Roquette launched four new NUTRALYS pea proteins, significantly advancing the plant-based protein bar segment. These multi-functional ingredients improve taste and texture, offering high protein content crucial for nutritional bars. This expansion provides food manufacturers with innovative solutions to address common development challenges, catering to the growing demand for plant-based, high-protein options in the dynamic protein bar sector.

Breakup by Type:

- Sports Nutrition Bar

- Meal Replacement Bar

- Others

Sports nutrition bar dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes sports nutrition bar, meal replacement bar, and others. According to the report, sports nutrition bar represented the largest segment.

Sports nutrition bar holds the biggest market share, driven by the heightened focus on fitness and a rising number of health-conscious individuals who are incorporating sports nutrition bars into their eating habits. These bars are designed to boost athletic performance, speed up muscle recovery, and offer a convenient way to get necessary nutrients, such as protein, vitamins, and minerals, for athletes and active people. The convenience and ease of eating sports nutrition bars on the go are making them a perfect option for pre-workout or post-workout. In March 2022, CLIF launched CLIF Thins, offering three flavors, including Chocolate Chip, Chocolate Peanut Brownie, and White Chocolate Macadamia Nut, made with plant-based ingredients and 100 calories per pack. It caters to consumers seeking convenient, flavorful snacks for on-the-go lifestyles. It provides a mindful snacking option with real ingredients like organic rolled oats, addressing the rising demand for portable, nutritious snacks.

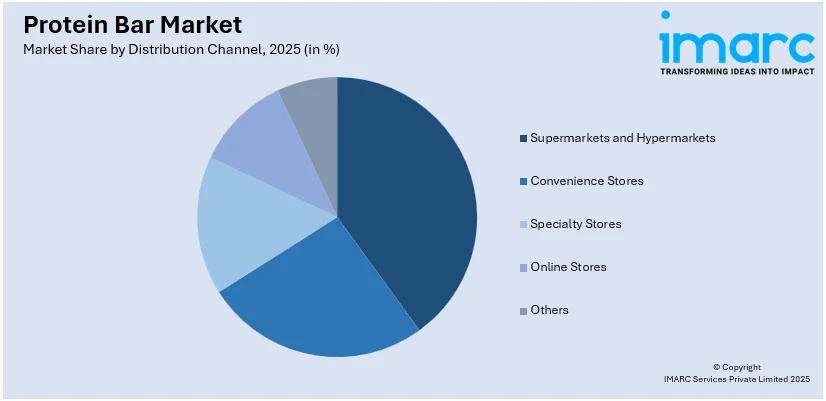

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Supermarkets and hypermarkets form a key distribution channel for a wide array of products due to their extensive reach and ability to stock a large variety of items under one roof. This segment caters to buyers preferring to physically evaluate products before purchase and those who enjoy the convenience of buying all necessities in a single location. They typically offer competitive pricing and frequent promotions, which attract a notable volume of buyers. Their strategic placement in accessible locations further enhances their appeal to the general public, making them a dominant force in the distribution landscape.

Convenience stores have a unique benefit with their extensive reach and long operating hours, making it easy to get necessary items. This channel is especially preferred for fast and spontaneous purchases, meeting the needs of buyers seeking rapidity and ease. Convenience stores are strategically positioned in urban and rural areas, serving as important points for quick utilization and last-minute necessities.

Specialty stores concentrate on individual product categories and provide a carefully selected range that appeals to specific consumer preferences, such as organic foods, dietary supplements, or gourmet products. This channel prospers by offering expert expertise and customized individual care, drawing in discerning clients in search of specialized products. The focused strategy of specialty stores results in a more personalized shopping atmosphere, leading to higher buyer loyalty and greater value for each purchase.

Online stores are becoming popular due to their convenience and the growing digitization of the shopping habits of individuals. This channel allows buyers to shop from anywhere at any time, offering a vast selection of products that can be delivered directly to their doorstep. Online platforms often provide detailed product information, user reviews, and competitive pricing, which can help buyers make informed purchasing decisions. The rise of e-commerce is also facilitating the growth of direct-to-consumer (DTC) brands, further expanding the diversity and availability of products online. For example, in November 2024, SuperYou, co-founded by Ranveer Singh and Nikunj Biyani, entered the India protein bar market with the country's first protein wafer bar. These bars offer 10g protein and 3g fiber per serving with no added sugar, leveraging fermented yeast protein technology for better digestion. Available in diverse flavors like chocolate and cheese, SuperYou aims to be a significant player in India's growing wellness and snacking segment. The products are sold via their website, major e-commerce platforms, and select modern retail stores, initially targeting India's top 10 cities.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest protein bar market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for protein bar.

North America, which includes the United States and Canada, is the biggest segment in regional market segmentation as per the protein bar market overview. The strong presence in the market is mainly caused by rising purchasing power, a robust retail system, and a high demand for unique products. The North American market is positively affected by a strong health and wellness trend that promotes the consumption of nutritionally enhanced and convenient food choices. This area is also the base for many top companies in the food and beverage (F&B) industry, who regularly introduce a variety of new products to cater to changing consumer tastes. Furthermore, the market dominance of North America is reinforced by its strong focus on dietary supplements and functional foods, driven by a health-conscious population looking for personalized nutritional options. In January 2025, global sweet-packaged food company Ferrero Group announced signing an agreement to acquire Power Crunch from Bio-Nutritional Research Group, Inc. Established in 1996, Power Crunch has experienced significant recent growth, fueled by its popular range of protein snacks, which includes various wafer bars and high-protein crisps introduced in 2024.

Competitive Landscape:

Major protein bar companies are intensifying their efforts to innovate and capture consumer interest. They are focusing on developing products that cater to specific dietary preferences and health requirements, such as low-carb, high-protein, vegan, and gluten-free options. For instance, in Augusts 2023, Mars Inc. launched Snickers Hi Protein Low Sugar bars in peanut and nougat flavors, containing 20g of protein and only 2g of sugar, aiming to expand its presence in the protein bar market. Moreover, these companies are also expanding their reach by leveraging online platforms for direct-to-consumer (DTC) sales, enhancing their visibility and accessibility. Strategic marketing campaigns, including partnerships with fitness influencers and sponsored events, are being employed to strengthen brand recognition and loyalty.

The report provides a comprehensive analysis of the competitive landscape in the global protein bar market with detailed profiles of all major companies, including:

- Amway Corp.

- General Mills Inc

- Kellanova

- Mars Incorporated

- Mondelez International group

- Nestlé S.A

- NuGo Nutrition

- Premier Nutrition Company, LLC

- The Simply Good Foods Company

- ThinkThin

Protein Bar Market News:

- May 2025: David, a protein bar brand, secured USD 75 Million in Series A funding led by Greenoaks and Valor Equity Partners. Its flagship bar, boasting 28g protein and zero sugar for 150 calories, has driven rapid expansion into 3,000+ US retail locations, including Wegmans. David is projected to exceed USD 100 Million in revenue in its first year, highlighting significant growth in the protein bar market.

- January 2025: Once Upon a Farm launched refrigerated protein bars for kids, targeting the growing children's nutrition market. These bars, packed with 8g of protein, real fruit and vegetables, and no added sugar, tap into the increasing parental demand for healthy, convenient snacks. The global protein bar market, currently valued at billions, is driven by rising health consciousness and on-the-go lifestyles, with refrigerated and plant-based options emerging as key trends.

Protein Bar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plant-Based and Animal-Based |

| Types Covered | Sports Nutrition Bar, Meal Replacement Bar, and Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amway Corp., General Mills Inc, Kellanova, Mars Incorporated, Mondelez International group, Nestlé S.A, NuGo Nutrition, Premier Nutrition Company, LLC, The Simply Good Foods Company, ThinkThin, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the protein bar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global protein bar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the protein bar industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global protein bar market was valued at USD 3.9 Billion in 2025.

We expect the global protein bar market to exhibit a CAGR of 4.60% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic had led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of protein bars.

The rising consumer health consciousness towards healthy and convenient snacking options, such as protein bars, along with the introduction of gluten-free, plant-based, and organic variants, is primarily driving the global protein bar market.

Based on the source, the global protein bar market has been segregated into plant-based and animal-based. Currently, plant-based holds the largest market share.

Based on the type, the global protein bar market can be bifurcated into sports nutrition bar, meal replacement bar, and others. Among these, sports nutrition bar exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global protein bar market include Amway Corp., General Mills Inc, Kellanova, Mars Incorporated, Mondelez International group, Nestlé S.A, NuGo Nutrition, Premier Nutrition Company, LLC, The Simply Good Foods Company, and ThinkThin.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)