Propylene Oxide Market Size, Share, and Trends by Production Process, Application, End Use Industry, Region, and Forecast 2025-2033

Propylene Oxide Market Size and Share:

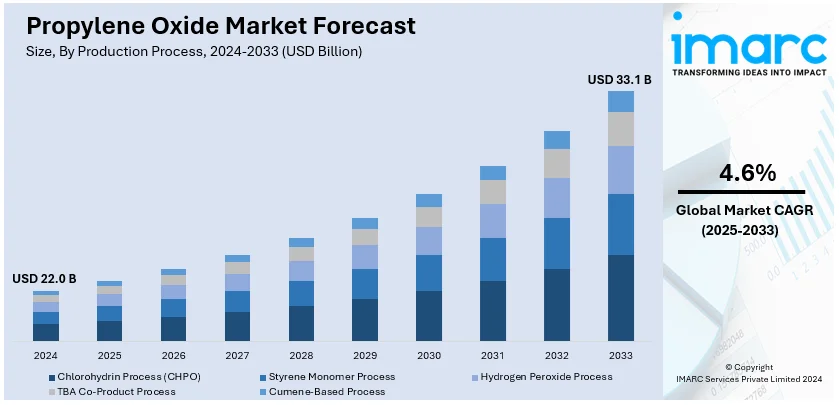

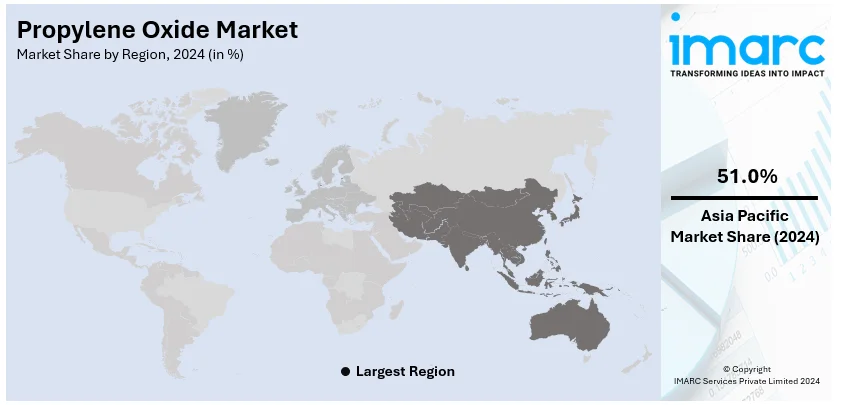

The global propylene oxide market size was valued at USD 22.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.1 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 51% in 2024. The growing demand for polyurethane foams in construction and automotive, expanding production capacities in emerging economies, rising use of propylene glycol in the pharmaceutical and food industries, along with the adoption of eco-friendly production technologies represent some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.0 Billion |

|

Market Forecast in 2033

|

USD 33.1 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

The market is significantly growing due to the diversified applications in numerous sectors, and the increasing demand for polyether polyols, which play a crucial role in producing flexible and rigid polyurethane foams. Polyurethane foams are used widely in furniture and automotive interior components for insulation, cushioning, and structural support in construction. Additionally, improvement in manufacturing processes, for instance, chlorohydrin-free technologies, reduce the production cost and improve the efficiency of production while increasing environmental sustainability. Growth in automotive and construction industries, especially in the emerging markets, is a strong driver for propylene oxide-based products. Further, increasing industrial applications such as adhesives and sealants are enhancing the overall propylene oxide outlook of the market.

The United States propylene oxide market is growing on account of the increasing demand across various industries for a wide array of applications. The growing construction industry is among the major key driver for propylene oxide that strengthens demand for polyurethane foams as insulation and for structural materials. According to the US Department of Commerce, the total construction spending during September 2024 was estimated at USD 2,148.8 Billion, up 4.6% from the September 2023 estimate of USD 2,055.2 billion. Another vital industry responsible to the market is automobile, derivatives such as polyether polyols of propylene oxide are necessary for producing lightweight though durable car components. The constantly increasing applications in the pharmaceutical, cosmetic, and food and beverage markets lead the growth of the market.

Propylene Oxide Market Trends:

An enhanced focus on health and safety compliance

The growing propylene oxide demand because of the increased emphasis on creating products that meet strict health and safety standards is positively influencing the market. Its ability to formulate products that meet safety standards has made it an essential component in various applications. Governments, industrial bodies, and international organizations are actively advocating the use of materials that safeguard the well-being of both consumers and the workforce. As a result, the industry has become very conscious about the components used in them and what they are emitting. This consciousness is driving the adoption of materials such as propylene oxide, known for its versatility and compliance with health and safety norms. This shift toward health and safety compliance is responsible for influencing industrial practices and shaping user preferences, thus further propelling the propylene oxide market growth.

Rising product adoption in personal care products

With the growing demand for innovative products and diversification in personal care, an important revolution has been noticed in the industry. The global market for beauty and personal care products stood at USD 529.5 Billion in 2024. According to the market study of IMARC Group, this market is projected to reach USD 802.6 Billion by 2033. Due to the specific modification properties that alter the active structure of propylene oxide to increase functionality, this chemical has gained significant popularity in personal care formulations. From hair care products to advanced skincare solutions, propylene oxide is becoming embedded into a wide range of applications. Individual demand for quality and performance in personal care products is continuously increasing, and manufacturers are responding through the inclusion of components such as propylene oxide. Its use in personal care is a testament to its functional benefits and an indication of the shifting trends in the industry. As people become more discerning and the personal care industry continues to evolve, the role of propylene oxide is expected to become even more significant, driving its market forward.

Continual technological advancements in the formulation of agrochemicals

The global emphasis on enhancing agricultural productivity is fostering innovation in farming practices, including the use of advanced chemicals such as herbicides and insecticides. For instance, the chlorohydrin process and the PO/TBA (tert-butyl alcohol) process are the two primary methods of production, with the PO/TBA process gaining popularity due to its environmental advantages. The application of propylene oxide in the creation of these agricultural chemicals is a vital factor contributing to the growth of the propylene oxide market. Its ability to enhance the efficacy of herbicides and insecticides is enabling farmers to tackle various agricultural challenges effectively. In regions where agriculture is a primary economic activity, such as India (where agriculture GDP contribution is 15-16%), the importance of propylene oxide is further magnified. Governments and agricultural bodies are promoting the use of scientifically developed chemicals that improve crop yield and align with environmental considerations. The alignment of propylene oxide with these imperatives makes it an integral part of modern agricultural practices. As the global community continues to focus on food security and sustainable farming, the market for propylene oxide in agricultural chemical production is anticipated to grow robustly.

Propylene Oxide Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global propylene oxide market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on production process, application, end-use industry, and region.

Analysis by Production Process:

- Chlorohydrin Process (CHPO)

- Styrene Monomer Process

- Hydrogen Peroxide Process

- TBA Co-Product Process

- Cumene-Based Process

Styrene monomer process leads the market. The segment is being driven by advancements in catalyst technologies that improve process efficiency. Growing demand for polystyrene products in various applications, including packaging and insulation, contributes to this trend. Increased focus on cost-effective manufacturing techniques in the styrene monomer process is also a key driver. Furthermore, regulations promoting environment-friendly practices are pushing the industry toward greener alternatives and innovations within this process. Moreover, strategic investments in R&D by key players are enabling new developments to foster growth in this segment.

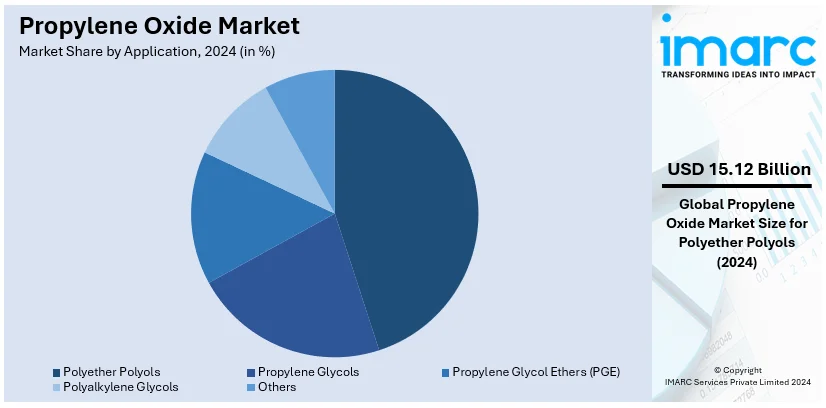

Analysis by Application:

- Polyether Polyols

- Propylene Glycols

- Propylene Glycol Ethers (PGE)

- Polyalkylene Glycols

- Others

Polyether polyols lead the market with around 69% of market share in 2024. The polyether polyols segment is being driven by a growing demand for flexible foams in applications such as furniture and bedding. Increased utilization in automotive interiors and insulation applications is also contributing to the growth of the segment. The push toward environmentally friendly products has further amplified the demand for polyether polyols in creating sustainable solutions. Technological advancements and increased R&D focus on high-performance polyols also fuel growth in this major segment. Overall, the convergence of these factors creates a robust demand for polyether polyols, reflecting broader trends in user preferences and industrial applications.

On the other hand, the propylene glycols, propylene glycol ethers (PGE), and polyalkylene glycols segments are driven by their versatile applications across various industries such as personal care, pharmaceuticals, and food & beverages. Enhanced performance characteristics, including stability and solvency, contribute to their widespread adoption. The development of specific grades catering to different industrial requirements also plays a crucial role in boosting this segment.

Analysis by End Use Industry:

- Automotive

- Construction

- Chemicals and Pharmaceuticals

- Packaging

- Textile and Furnishing

- Others

Automotive leads the market with around 35% of market share in 2024. The automotive segment is seeing significant growth in the propylene oxide market due to the increased usage of propylene oxide derivatives in vehicle interiors, manufacturing, and coatings. Rising automotive production, coupled with a growing emphasis on lightweight and fuel-efficient materials, propels the segment forward. Individual preferences for enhanced comfort and aesthetic appeal are also influencing the adoption of propylene oxide-based products in automotive applications. Strict emissions regulations and the trend toward environmentally sustainable solutions further drive the demand within this segment. Demand for polyurethane foams, a primary application of propylene oxide, in seating, insulation, and other automotive parts completes the growth picture for this major segment.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 51%. The market for propylene oxide is dominated by Asia-Pacific due to the fast industrialization, urbanization, and expanding end-use sectors, of the region which include electronics, automotive, and construction. India and China, two of the largest economies of the region, make substantial contributions. Polyurethanes are widely used in the building industry of China, which is expanding at a steady rate in the past decade, and the automobile industry of India, which produces more than 4 million vehicles a year, increases demand for strong, lightweight materials. The need of the region for polyurethanes and propylene glycol has been further fueled by the growing use of energy-efficient appliances and structures. Furthermore, the need for propylene oxide in electronic adhesives and coatings has increased due to the growth of the electronics sector, especially in South Korea and Japan. Foreign investments and government incentives in the chemical industry also support the market of the region. Notably, the propylene oxide market price remains a critical economic indicator, affecting production costs and investment decisions within these industries.

Key Regional Takeaways:

North America Propylene Oxide Market Analysis

The North American propylene oxide market is growing due to demand from automotive, construction, and packaging industries. Polyurethane foam used in furniture, insulation, and automotive interiors, which is driving consumption, supported by infrastructure projects boosting demand for energy-efficient insulation materials. The thriving automotive sector, which relies on polyether polyols for lightweight components, is acting as another growth inducing factor. Sustainability trends are further reshaping the market, with bio-based propylene oxide and eco-friendly production methods gaining traction amid stricter regulations. Technological advancements like the HPPO process are improving efficiency and lowering emissions. Moreover, increased use of glycol ethers in paints, coatings, and cleaning agents, along with post-pandemic industrial recovery, is supporting steady market growth.

United States Propylene Oxide Market Analysis

The United States accounted for over 73% of the market in North America. The market for propylene oxide in the US is fueled by its wide range of uses in the manufacturing of propylene glycol, polyether polyols, and other chemical intermediates. The strong expansion of the automotive and construction sectors, which use polyurethanes for furniture, coatings, insulation, and car interiors, is a major motivator. One of the largest users of polyurethane foams derived from propylene oxide is the construction industry in the United States, which is expected to be worth more than USD 2 Trillion in 2024.

Adoption of goods based on propylene oxide is also being aided by the growing need for environmentally benign and energy-efficient materials. As lightweight polyurethanes improve fuel efficiency, the growth of the automotive industry, where the production of electric vehicles (EVs) is expected to increase significantly, also boosts market expansion. The HPPO (hydrogen peroxide to propylene oxide) method is one instance of a technological development in propylene oxide manufacturing that has improved sustainability and decreased production costs, which has further fueled market expansion. The United States market is further supported by the existence of well-established firms and a sophisticated infrastructure for the chemical sector.

Europe Propylene Oxide Market Analysis

Stronger environmental restrictions in Europe and the demand for sustainable products are propelling the market of Propylene Oxide in Europe. As companies focus on light-weight and energy-efficient materials because of the European Union's Green Deal, where carbon neutrality is aimed to be achieved by 2050, usage of polyurethanes is growing in the construction and automotive sectors. Propylene oxide, according to United Nations Environment Programme, accounts for nearly 40% of the energy consumption by the building sector in 2023.

The market is further bolstered by the considerable use of polyurethane in major automotive manufacturing centers located in France, Italy, and Germany. Furthermore, the progress of eco-friendly alternatives to propylene oxide has been supported by the implementation of circular economy concepts and advancements in bio-based production methods, expanding the potential applications for this product. The need for innovation and the presence of significant global chemical manufacturers largely motivates the European market.

Latin America Propylene Oxide Market Analysis

Growing construction and automotive industries, particularly in Brazil and Mexico, are driving the propylene oxide market in Latin America. Demand has grown as energy-efficient construction materials and goods made of polyurethane are increasingly used. The emphasis of the region on developing infrastructure, which is aided by government programs, is another important factor driving the industry. Propylene oxide is needed in chemical intermediates for agrochemicals on account of the booming agricultural sector of Brazil.

Middle East and Africa Propylene Oxide Market Analysis

The increasing industrialization and construction efforts, particularly in the United Arab Emirates, Saudi Arabia, and South Africa, are propelling the propylene oxide market within the Middle East and Africa. The region's emphasis on developing energy-efficient infrastructure through initiatives like Saudi Arabia's Vision 2030 boosts the demand for insulation products based on propylene oxide. Furthermore, the growth of downstream oil and gas industries in the Middle East bolsters the production and consumption of propylene oxide.

Competitive Landscape:

The major players in the market are focusing on R&D activities to develop new manufacturing methods and increase efficiency. Market leaders are investing in automation and digital technologies to enhance efficiency and maintain a competitive edge in the market. The leading companies are constantly monitoring the propylene oxide market price to strategically control the cost of production and successfully alter their pricing strategies. They are expanding their footprints in new geographical markets, particularly in developing economies, and enhancing product offerings to cater to various industrial requirements. Such leading companies also focus on sustainability by developing bio-based and green propylene oxide. They have been making strategic partnerships, mergers, and acquisitions to upgrade technological capabilities and expand their offerings. In addition, they are enhancing the effectiveness of the supply chain and adopting user-focused strategies to understand the unique needs of various industries.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AGC Chemicals Americas Inc.

- Air Liquide S.A.

- BASF SE

- Dow Inc.

- Eastman Chemical Company

- Huntsman International LLC

- Ineos Chemicals Company

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals

- Repsol S.A.

- Royal Dutch Shell PLC

- Saudi Arabia Basic Industries Corporation (Saudi Aramco)

- SK Chemicals Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Tokuyama Corporation

Recent Developments:

- November 2024: Solvay licensed its hydrogen peroxide process technology to North Huajin Refining for a facility in Panjin, China, set to produce 300 kilotons of propylene oxide annually by 2026. This agreement uses Solvay's advanced HPPO technology, supporting efficient and environmentally friendly production.

- July 2024: JAY Chemical Industries commissioned a new specialty chemicals plant in Saykha, near Dahej. The facility specializes in the production of derivatives based on ethylene oxide and propylene oxide, mainly for textile additives and various industrial uses. JAY Chemicals, a worldwide frontrunner in reactive dyes, seeks to improve product efficiency across various sectors with this latest initiative.

- May 15 2024: Chandra Asri purchased Shell's Bukom assets located on Jurong Island, comprising a refinery and a petrochemical facility that manufactures more than 2 million tons of ethylene, propylene, and their derivatives. This action bolsters the supply of propylene oxide in Southeast and Northeast Asia, lessening reliance on imports. Enhanced agreements with local crude suppliers might boost margins and stabilize propylene oxide production in the area.

- April 2024: KBR and Sumitomo Chemical revealed a partnership, naming KBR the sole licensing partner for Sumitomo's environment-friendly Propylene Oxide by Cumene (POC) technology. This technology provides significant yields, lowers carbon emissions, and lessens wastewater, supporting worldwide sustainability objectives. KBR will leverage its expertise to deliver this advanced solution to a global user base.

- February 2024: Baker Hughes and Dussur inaugurated the Saudi Petrolite Chemicals facility in Saudi Arabia, featuring ethylene oxide and propylene oxide pipeline feedstock for producing oilfield, power generation, and industrial chemicals. Covering 90,000 sq. m, the facility boosts regional chemical manufacturing, reaches more than 70% Saudization, and supports Saudi Arabia's industrial development objectives.

- March 2023: LyondellBasell launched the largest propylene oxide and tertiary butyl alcohol (TBA) facility globally in Texas, boasting an annual capacity of 470,000 metric tons of propylene oxide and 1 million metric tons of TBA. The facility supports products like polyurethane foam, detergents, and insulation while incorporating energy-efficient innovations.

Propylene Oxide Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Processes Covered | Chlorohydrin Process (CHPO), Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-based Process |

| Applications Covered | Polyether Polyols, Propylene Glycols, Propylene Glycol Ethers (PGE), Polyalkylene Glycols, Others |

| End Use Industries Covered | Automotive, Construction, Chemicals and Pharmaceuticals, Packaging, Textile and Furnishing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Chemicals Americas Inc., Air Liquide S.A., BASF SE, Dow Inc., Eastman Chemical Company, Huntsman International LLC, Ineos Chemicals Company, LyondellBasell Industries Holdings B.V., Mitsui Chemicals, Repsol S.A., Royal Dutch Shell PLC, Saudi Arabia Basic Industries Corporation (Saudi Aramco), SK Chemicals Co. Ltd., Sumitomo Chemical Co. Ltd., Tokuyama Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the propylene oxide market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global propylene oxide market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the propylene oxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The propylene oxide market was valued at USD 22.0 Billion in 2024.

IMARC estimates the keyword market to exhibit a CAGR of 4.6% during 2025-2033.

Growing demand for polyurethane foams in construction and automotive industries, increasing applications of propylene glycol in pharmaceuticals and cosmetics, advancements in eco-friendly production technologies, rising use of adhesives and sealants in industrial applications, expanding consumer goods and packaging sectors are some of the major factors driving the propylene oxide market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the propylene oxide market include AGC Chemicals Americas Inc., Air Liquide S.A., BASF SE, Dow Inc., Eastman Chemical Company, Huntsman International LLC, Ineos Chemicals Company, LyondellBasell Industries Holdings B.V., Mitsui Chemicals, Repsol S.A., Royal Dutch Shell PLC, Saudi Arabia Basic Industries Corporation (Saudi Aramco), SK Chemicals Co. Ltd., Sumitomo Chemical Co. Ltd., Tokuyama Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)