Property Management Software Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

Property Management Software Market Size and Trends:

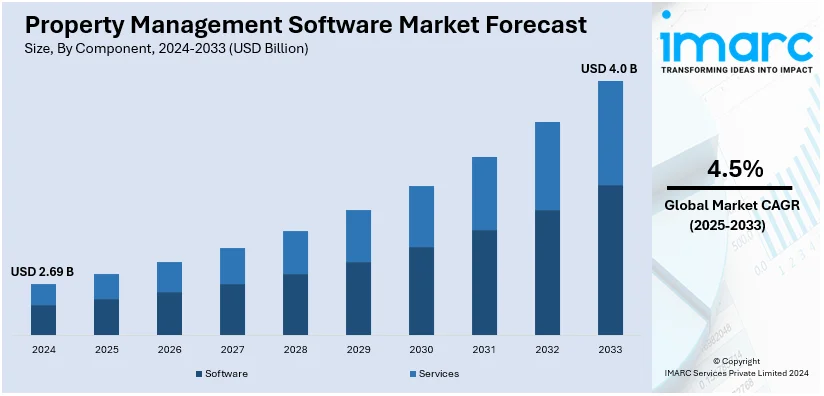

The global property management software market size was valued at USD 2.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.0 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. North America currently dominates the market, holding a market share of over 45.0% in 2024. The rapid digital transformation across the real estate industry, growing adoption of artificial intelligence (AI), ongoing shift towards cloud-based property solutions, and escalating adoption of mobile-first solutions is stimulating the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.69 Billion |

|

Market Forecast in 2033

|

USD 4.0 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

The digital transformation of the real estate industry is a significant driver of the property management software market's growth. As real estate firms increasingly adopt digital tools to enhance operational efficiency and meet evolving customer expectations, the demand for comprehensive property management solutions has surged. A 2023 survey by JLL revealed that over 80% of real estate companies plan to increase their technology investments within the next three years, underscoring a strong commitment to digitalization. This shift is further evidenced by the widespread use of digital platforms in property transactions; for instance, homebuyers are using the internet in their home search, highlighting the necessity for real estate firms to maintain a strong online presence. To cater to this digital-savvy clientele, firms are integrating features such as property listings, virtual tours, and customer reviews into their websites. Additionally, the adoption of software tools like e-signatures, comparative market analysis, and electronic contracts/forms has become prevalent among firms, streamlining processes and reducing reliance on paper-based methods.

The property management software market in the United States holds a share of 87.80%. The market is experiencing significant growth, driven by several key factors, such as the increasing adoption of digital solutions in the real estate sector is a primary contributor. The real estate sector in the country reached $1.7 trillion in 2024, according to the latest report by IMARC Group. It is further projected to reach $2.3 trillion by 2033, growing at a rate of 3.1% annually. Property management software streamlines operations such as tenant tracking, lease management, and financial reporting, enhancing efficiency and reducing manual errors. This shift towards digitalization is evident as property managers seek to optimize their workflows and improve tenant satisfaction. Furthermore, the growing demand for rental properties, both residential and commercial, further propels the market. Urbanization, rising housing costs, and changing lifestyle preferences have also led to an increase in rental housing. Property management software facilitates the efficient handling of large portfolios, automating tasks like rent collection and maintenance scheduling, which is crucial given the expanding rental market.

Property Management Software Market Trends:

Growing Adoption of Artificial Intelligence (AI)

AI is revolutionizing property management software by automating routine processes like rent collection, maintenance scheduling, and tenant interactions. AI-powered predictive analytics enable property managers to foresee maintenance needs and streamline operations, enhancing efficiency and reducing costs. For instance, according to Hostify, AI can reduce errors in lease administration by up to 42%, while automating tasks can save property managers up to 10 hours per week. This trend reflects the growing need for intelligence, thereby escalating the property management software market share. For example, in July 2024, Singapore-based PropertyGuru launched Proptisfy, an AI-driven property management software designed to disrupt traditional property management practices, thereby enhancing efficiency, and transforming how real estate operations are managed across the industry.

Rising Shift Towards Cloud-Based Property Solutions

The shift towards cloud-based software is providing flexibility, scalability, and remote access to live data. This approach reduces IT expenses, simplifies updates, and allows property managers to oversee operations from any location. As per an industrial report, cloud adoption is expected to reduce IT costs by 30-40% for property management firms. For instance, in March 2024, Planon announced the introduction of its real estate management solution for SAP S/4HANA, an SAP Endorsed App. It integrates real estate management with SAP's cloud ERP, enabling smart, sustainable building operations and automatic incorporation of real estate financial data into enterprise accounts. This is escalating the property management software market demand.

Escalating Adoption of Mobile-First Solutions

This software is evolving towards mobile-first solutions with the increasing reliance on smartphones and tablets. These platforms allow property managers to perform tasks such as monitoring maintenance requests, communicating with tenants, and managing leases directly from their mobile devices, which elevates the property management software statistics. A 20% increase in tenant engagement and 15% speedup in completing tasks were seen in mobile adoption property management. For example, in May 2024, Hemlane introduced a free version of its property management software for landlords. This new offering provides essential tools, such as tenant screening, rental accounting, and AI-powered listing features, helping landlords manage properties efficiently and attract qualified tenants without additional costs.

Property Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global property management software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component and application.

Analysis by Component:

- Software

- On-Premises

- Cloud-Based

- Services

- System Integration

- Training and Support

- Consulting

Software stands as the largest component in 2024, holding around 67.0 % of the market due to its ability to streamline complex real estate operations and improve overall efficiency. Solutions like lease management, tenant tracking, and financial reporting are integral for property managers, making software the dominant component in the market. Cloud-based software is particularly in demand due to its scalability, ease of integration, and remote accessibility. Additionally, AI-powered solutions are enabling advanced analytics for predictive maintenance and tenant behavior insights, further boosting their adoption. The flexibility of software to cater to various scales of operations, from single-property landlords to large enterprises, ensures its relevance across the market.

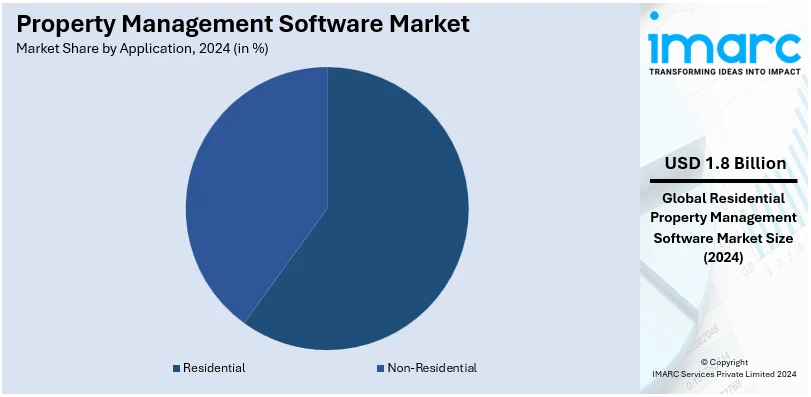

Analysis by Application:

- Non-Residential

- Retail Spaces

- Office Spaces

- Hotels

- Others

- Residential

- Multi-Family Housing

- Single-Family Housing

- Others

The residential segment leads the market with a share of 65.8% in 2024 due to increasing urbanization and the rising demand for rental housing globally. Property management software simplifies the management of large residential portfolios by automating rent collection, maintenance scheduling, and tenant communication. As cities expand, property managers face heightened competition, making efficiency and tenant satisfaction critical, which software solutions effectively address. Residential applications benefit from features like tenant screening, lease tracking, and integrated payment systems, which ensure smooth operations for landlords and managers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 45.0 % due to its advanced real estate sector and high adoption of digital technologies. The region’s large rental housing market, particularly in the U.S. and Canada, drives demand for efficient property management solutions. A supportive regulatory environment, combined with widespread internet penetration, has further encouraged the use of cloud-based platforms. The U.S. accounts for the largest share, fueled by the increasing popularity of multi-family housing and corporate real estate investments. Additionally, government initiatives supporting smart city projects and green building standards have incentivized the integration of sustainability features into property management software.

Key Regional Takeaways:

United States Property Management Software Market Analysis

The U.S. property management software market is thriving, thanks to the advancement of real estate technology and the growing adoption of automation. The rise in renting houses, at 36% share of housing units (as cited by the Census Bureau) is driving software adoption and effective tenant management. Cloud-based market solutions are popular due to scalability and data security with added features. Market leaders - Yardi Systems and RealPage - address residential and commercial segments, respectively, thus contributing growth to the market through constant innovation. Federal policies promoting a digital transformation and sustainability drive even further adoption. Its integration of artificial intelligence and IoT capabilities improves efficiency in operations, and the thrust for green buildings promotes software especially focused on energy efficiency. Export opportunities are also being used in the United States to expand global reach.

Europe Property Management Software Market Analysis

Europe's property management software market is growing due to the region's focus on sustainability and smart city initiatives. An industrial report stated that the European real estate technology market will reach USD 16 Billion by 2025, driven by automation and data analytics. Germany leads adoption due to its USD 8.1 Trillion real estate market value, according to Savills. Demand is growing from EU regulations like the Energy Performance of Buildings Directive towards solutions that facilitate energy monitoring and compliance. Players like Buildium and Arthur offer tailored software for both residential and commercial sectors aligned with regulations. Countries such as the UK and France are making smart property solutions integrated into IoT to create better tenant experiences. Digitalization by governments and collaborations with software developers are speeding up innovation. Europe's focus on high technology adoption makes it a good position in the global property management software landscape.

Asia Pacific Property Management Software Market Analysis

The Asia-Pacific property management software market is influenced by changing real estate trends and challenges. According to a report by "Emerging Trends in Real Estate Asia Pacific 2023," with high inflation and rising interest rates, many development projects were put on hold, and focus was shifted to defensive asset classes such as logistics, data centers, and life sciences. The hospitality sector still has a positive trend for recovery, most prominently led by Japan as rebounding travel continues. Investment in the region has grown due to interest from investors that seek to establish an interest base in Southeast Asian countries like Vietnam and Indonesia. Net-zero carbon mandates, meanwhile, shape real estate investments, influencing owners' moves towards adherence to the global sustainability standard. Multifamily build-to-rent and short-term rental opportunities expand in countries like Japan, Australia, and China. Such dynamics point to the need for advanced property management solutions to address complex demands and improve operational efficiency in the region.

Latin America Property Management Software Market Analysis

Property management software in Latin America has been growing as real estate reforms and digital transformation have expanded. The World Bank reports that reforms in Ceará, Brazil, will raise annual revenue from real estate exploitation from R$13.4 Million (USD 2.6 Million) in 2022 to R$118 million (USD 23 Million) by improving asset utilization and reducing the vacancy rate of state properties from 18.5% to 8% by 2025. Such measures enhance private sector access to public assets and attract financial investors, thus increasing demand for advanced property management solutions. Unified registry databases and vacant properties are sources of opportunities for implementing new technology. The new wave of focus on modernization in Brazil's real estate market as well as surrounding nations facilitates software adoption. Financial investors also join the movement by engaging the government-led digital innovation to further strengthen the regional sustainability potential.

Middle East and Africa Property Management Software Market Analysis

The property management software market in the Middle East and Africa is boosted by urbanization and transformative real estate initiatives. As mentioned in TradeArabia, the Vision 2030 by Saudi Arabia is pouring USD 1.3 Trillion into real estate, infrastructure, and transportation. Specifically, the country has set aside USD 164 Billion for real estate contracts, such as the Neom project that spans USD 28.7 Billion. More than 1 million new homes are expected by 2030, with 32.5% in Riyadh, offering tremendous potential for digital property management solutions. The tourism industry's aim of 150 million annual visitors and 362,000 new hotel rooms also increases the demand for customized software. Firms such as MRI Software exploit these trends, providing cloud-based solutions to simplify property management. Government-backed programs as well as rapid urbanization across Africa, where urban rates now hit 43% in 2022 (UN-Habitat), accelerate demand. Sustainable real estate projects make higher demands for software optimized toward energy efficiency and compliance.

Competitive Landscape:

Leading players in the property management software market are focusing on innovation, strategic partnerships, and expanding their offerings to cater to evolving customer needs. Companies are integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML) into their platforms. These enhancements enable predictive analytics for property maintenance, tenant behavior analysis, and rent optimization, providing property managers with actionable insights. Moreover, cloud-based solutions remain a focal point, as they allow real-time access and scalability. Firms are actively developing mobile applications and self-service portals to enhance user experience and streamline tenant interactions. Partnerships with financial institutions for seamless payment processing and compliance solutions are also on the rise, ensuring that clients can manage transactions and adhere to regulations effortlessly.

The report provides a comprehensive analysis of the competitive landscape in the property management software market with detailed profiles of all major companies, including:

- Accruent LLC (Fortive Corporation)

- Appfolio Inc.

- Chetu Inc.

- Console Australia Pty Ltd

- Corelogic Inc.

- London Computer Systems Inc.

- MRI Software LLC

- Oracle Corporation

- Realpage Inc.

- Resman LLC

- Yardi Systems Inc.

Latest News and Developments:

- October 2024: According to AppFolio, Inc., the generative AI capabilities now available on Realm-X automate property management and save users more than 10 hours per week. Features include streamlined workflows, automated communications, and improved resident experiences.

- September 2024: Hyatt announced that it has chosen Oracle OPERA Cloud as its global property management system for more than 1,000 hotels. This shift is centralizing data, improving the efficiency of operations, and providing personalized guest experiences. Utilizing Oracle Cloud Infrastructure and the Hospitality Integration Platform, Hyatt will focus on delivering innovative, seamless, and scalable services for long-term operational success.

- July 2024: Singapore-based PropertyGuru launched Proptisfy, an AI-driven property management software designed to enhance efficiency and transform how real estate operations are managed across the industry.

- June 2024: Livly and AppFolio announced an integration that places Livly's resident experience platform hand in hand with AppFolio's property management software to enhance operational efficiency and deliver unified, data-driven insights for a multifamily housing experience through LivlyOS integration onto AppFolio's Marketplace, which is its latest innovation milestone in proptech.

- May 2024: Hemlane introduced a free version of its property management software for landlords. This new offering provides essential tools, such as tenant screening, rental accounting, and AI-powered listing features, thereby helping landlords manage properties efficiently and attract qualified tenants without additional costs.

Property Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accruent LLC (Fortive Corporation), Appfolio Inc., Chetu Inc., Console Australia Pty Ltd, Corelogic Inc., London Computer Systems Inc., MRI Software LLC, Oracle Corporation, Realpage Inc., Resman LLC, Yardi Systems Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the property management software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global property management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the property management software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Property management software is a digital system that automates and streamlines the many operations involved in managing real estate properties. It is widely used by property owners, managers, and real estate professionals to enhance efficiency, reduce manual workloads, and improve tenant or client satisfaction.

The property management software market was valued at USD 2.69 Billion in 2024.

IMARC estimates the global property management software market to exhibit a CAGR of 4.5% during 2025-2033.

The market is growing rapidly due to the emerging digital transformation across the real estate industry, growing adoption of artificial intelligence (AI), ongoing shift towards cloud-based property solutions, and escalating adoption of mobile-first solutions.

In 2024, software represented the largest segment by component due to its ability to streamline complex real estate operations and improve overall efficiency.

Residential leads the market by application owing to the increasing urbanization and the rising demand for rental housing globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global property management software market include Accruent LLC (Fortive Corporation), Appfolio Inc., Chetu Inc., Console Australia Pty Ltd, Corelogic Inc., London Computer Systems Inc., MRI Software LLC, Oracle Corporation, Realpage Inc., Resman LLC, Yardi Systems Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)