Progressing Cavity Pump Market Report by Pumping Capacity (Up to 500 GPM, 501-1,000 GPM, Above 1,000 GPM), Power Rating (Up to 50 HP, 51-150 HP, Above 150 HP), End User (Water and Wastewater Management, Oil and Gas, Food and Beverages, Chemicals and Petrochemicals, and Others), and Region 2025-2033

Market Overview:

The global progressing cavity pump market size reached USD 5.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.55% during 2025-2033. The growing demand for energy efficient solutions, continuous innovation and technological advancements in PCP designs, and rising adoption in the wastewater treatment to transport the sludge from one treatment process to another represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 3.55% |

A progressing cavity pump (PCP) is a type of positive displacement pump used to move fluid or viscous substances. It consists of a helical-shaped rotor, typically made of metal, and a stator, which is a rubber or elastomer-lined tube, wherein the rotor is connected to a drive shaft. It can efficiently pump substances with varying viscosities, ranging from thin liquids to highly viscous materials. It creates suction and draws fluid into the pump without the need for additional priming equipment.

At present, the growing demand for PCPs in the oil and gas industry for artificial lift systems, drilling operations, and well servicing is offering a favorable market outlook. Besides this, the rising focus on environmental regulations and the need to extract hydrocarbons from challenging reservoir conditions, such as high viscosity fluids and high sand content, are creating lucrative growth opportunities for industry investors. Moreover, upgrades and expansions of existing infrastructure and the construction of new facilities are propelling the growth of the market. In addition, the food and beverage (F&B) industry requires these pumps for handling viscous and shear-sensitive fluids, which are common in the production and processing of food products. Progressing cavity pumps also offer gentle product handling and precise metering capabilities, making them suitable for various food and beverage applications.

Progressing Cavity Pump Market Trends/Drivers:

Growing demand for energy efficient solutions

PCPs offer advantages, such as low power consumption, high volumetric efficiency, and the ability to handle varying fluid viscosities. These features make PCPs an attractive choice for energy-conscious industries, leading to their increasing adoption and market growth. They are positive displacement pumps that can displace a fixed amount of fluid with each rotation of the pump, resulting in a constant flow rate regardless of changes in pressure, which helps optimize energy consumption. They operate at low rotational speeds, minimizing shear forces on the pumped fluid to maintain the integrity of the fluid and prevent degradation. In addition, PCPs are known for their ability to maintain high efficiency even at varying load conditions.

Technological advancements in PCPs

Continuous innovation and technological advancements in PCP designs are improving their efficiency, reliability, and performance. Manufacturers are introducing advanced PCPs with features like variable frequency drives, smart pumping systems, and corrosion-resistant materials, which enhance their capabilities and offer operational benefits. They are also introducing PCPs with improved material to minimize internal leakage and enhance the volumetric and mechanical efficiency of pumps. PCPs can also be equipped with sensors and monitoring systems to enable real-time performance tracking. This allows operators to monitor and optimize pump performance, detect anomalies, and predict maintenance requirements accurately. In addition, the integration of variable frequency drives (VFDs) with PCPs enables precise control over pump speed, allowing for efficient adjustment of flow rates and operating conditions.

Rising focus on wastewater treatment

PCPs are used in wastewater treatment plants to transport the sludge from one treatment process to another, such as from sedimentation tanks to digesters or dewatering units. They are also used in dewatering applications to remove water from sludge, reducing its volume and weight. These pumps are employed in processes, such as belt filter presses, centrifuges, and other dewatering equipment. PCPs can accurately and reliably add chemicals for various purposes, such as pH adjustment, coagulation, or disinfection, into the wastewater stream, ensuring precise control and efficient mixing.

Progressing Cavity Pump Industry Segmentation:

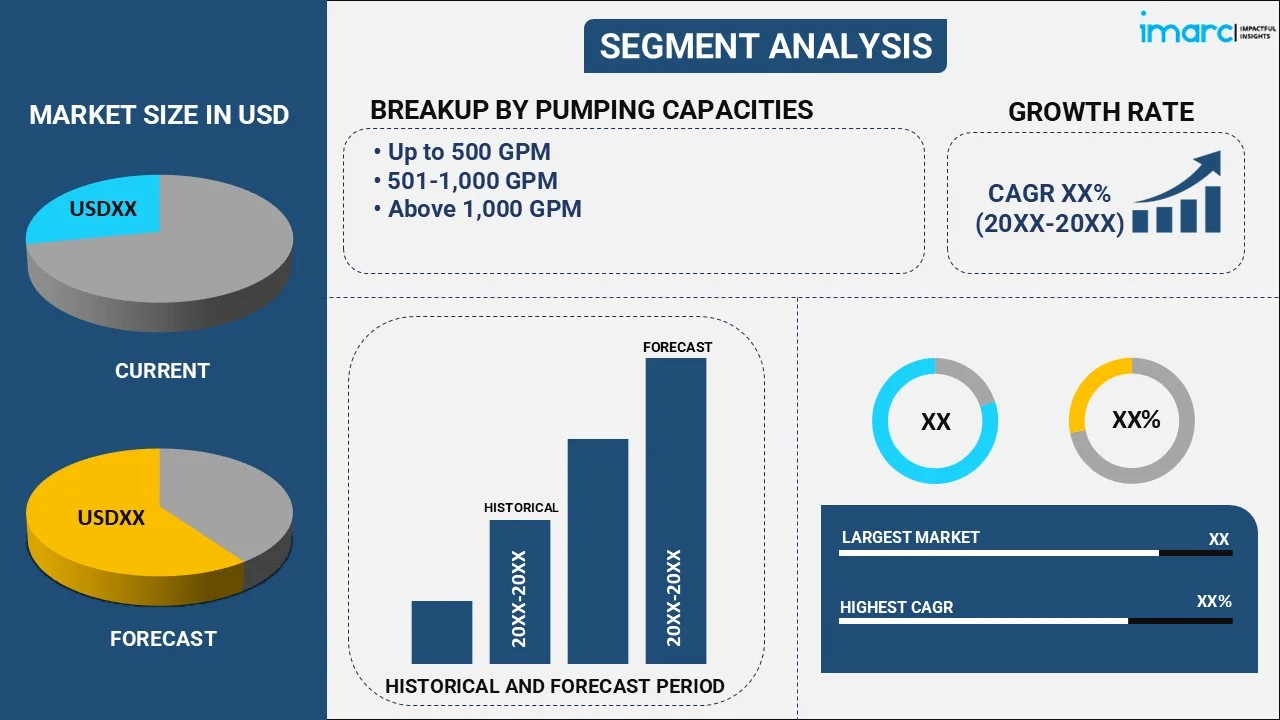

IMARC Group provides an analysis of the key trends in each segment of the global progressing cavity pump market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on pumping capacity, power rating and end user.

Breakup by Pumping Capacity:

- Up to 500 GPM

- 501-1,000 GPM

- Above 1,000 GPM

Up to 500 GPM dominate the market

The report has provided a detailed breakup and analysis of the market based on the pumping capacity. This includes up to 500 GPM, 501-1,000 GPM, and above 1,000 GPM. According to the report, up to 500 GPM represented the largest segment due to its ability to handle flow rates of up to 500 GPM. It is suitable for applications requiring large volumes of fluid to be moved efficiently. It is known for its versatility and ability to handle a wide range of fluids, including viscous, abrasive, and shear-sensitive liquids. It can effectively pump fluids with varying viscosities, making it ideal for diverse industries, such as oil and gas, wastewater treatment, food processing, and chemical manufacturing.

Breakup by Power Rating:

- Up to 50 HP

- 51-150 HP

- Above 1,50 HP

Up to 50 HP holds the biggest market share

A detailed breakup and analysis of the market based on the power rating has also been provided in the report. This includes up to 50 HP, 51-150 HP, and above 150 HP. According to the report, up to 50 HP accounted for the largest market share.

By increasing the power rating to 50 HP, PCPs can deliver higher flow rates and improved pressure, allowing them to handle more demanding applications. Industries, such as oil and gas, wastewater treatment, mining, and food processing, often require pumps with higher power ratings to meet their operational requirements effectively. This power rating of PCPs enables them to efficiently handle high viscosity, abrasive particles, or corrosive properties fluids, ensuring reliable and consistent performance even under demanding conditions.

Breakup by End User:

- Water and Wastewater Management

- Oil and Gas

- Food and Beverages

- Chemicals and Petrochemicals

- Others

Water and wastewater management accounts for the majority of the market share

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes water and wastewater management, oil and gas, food and beverages, chemicals and petrochemicals, and others. According to the report, water and wastewater management accounted for the largest market share.

PCPs are capable of handling highly viscous fluids, including sludges and wastewater with high solids content. They can efficiently transfer fluids with varying viscosities, making them suitable for a wide range of water and wastewater management processes. They are also used to handle fluids containing solids, such as sand, grit, and sewage sludge. In addition, these pumps generate a smooth, non-pulsating flow, which is beneficial for water and wastewater management processes. The consistent flow helps maintain system stability, prevents pipe damage, and allows for accurate dosing and mixing of chemicals.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.

Asia Pacific held the biggest market share due to rapid industrialization, which is resulting in the increasing application of PCPs in various industries, such as oil and gas, mining, chemicals, food and beverage (F&B), and wastewater treatment. The growing number of oil and gas reserves, along with the rising investment in their exploration and production activities, is catalyzing the demand for PCPs in the region. Moreover, PCPs are used in construction applications for pumping concrete, slurries, and other viscous materials. The emphasis on infrastructure development in the region is also contributing to the growth of the market.

Competitive Landscape:

Established companies in the industry have strong brand recognition, established customer relationships, and a track record of delivering reliable pumping solutions. They also have a competitive advantage in terms of economies of scale, extensive product portfolios, and established distribution networks. Nonetheless, the market is attracting new players who offer innovative technologies, improved efficiency, or competitive pricing. These entrants can disrupt the market by introducing novel designs, materials, or manufacturing techniques. Additionally, evolving industry regulations and standards are creating opportunities for new entrants to address specific compliance requirements. Moreover, to succeed in the progressing cavity pump market, companies are differentiating themselves through factors, such as product quality, reliability, efficiency, after-sales support, and customization capabilities.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ChampionX

- Circor International Inc.

- Continental Pump Company Inc.

- Erich NETZSCH GmbH & Co. Holding KG

- Liberty Process Equipment Inc.

- Nov Inc.

- Nova Rotors Srl

- PCM Inc. (Insight Enterprises Inc.)

- Pumpenfabrik Wangen GmbH

- Schlumberger Limited

- Vogelsang GmbH & Co. KG

- Weatherford International LLC

- Xylem Inc.

Recent Developments:

- ChampionX recently earned the top honors for the third consecutive year in Artificial Lift, Production Chemicals, and Intelligent Sensors and Controls in the 2023 Oilfield Products Customer Satisfaction Survey conducted by EnergyPoint Research.

- In June 2023, CIRCOR International, Inc. announced the amended of its definitive merger agreement with affiliates of investment funds managed by KKR at $56.00 per share in cash.

- In 2019, Continental Pump Company Inc. offered new metal water pump housing for the automotive aftermarket.

Progressing cavity pump Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Pumping Capacities Covered | Up to 500 GPM, 501-1,000 GPM, Above 1,000 GPM |

| Power Ratings Covered | Up to 50 HP, 51-150 HP, Above 150 HP |

| End Users Covered | Water and Wastewater Management, Oil and Gas, Food and Beverages, Chemicals and Petrochemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ChampionX, Circor International Inc., Continental Pump Company Inc., Erich NETZSCH GmbH & Co. Holding KG, Liberty Process Equipment Inc., Nov Inc., Nova Rotors Srl, PCM Inc. (Insight Enterprises Inc.), Pumpenfabrik Wangen GmbH, Schlumberger Limited, Vogelsang GmbH & Co. KG, Weatherford International LLC, Xylem Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the progressing cavity pump market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global progressing cavity pump market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the progressing cavity pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global progressing cavity pump market was valued at USD 5.6 Billion in 2024.

We expect the global progressing cavity pump market to exhibit a CAGR of 3.55% during 2025-2033.

The rising environmental awareness, along with the emerging utilization of progressing cavity pumps in sewage treatment plants for pumping slurries and sludges, is primarily driving the global progressing cavity pump market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of the numerous end-use industries for progressing cavity pumps.

Based on the pumping capacity, the global progressing cavity pump market can be segmented into up to 500 GPM, 501-1,000 GPM, and above 1,000 GPM. Currently, up to 500 GPM holds the majority of the total market share.

Based on the power rating, the global progressing cavity pump market has been divided into up to 50 HP, 51-150 HP, and above 150 HP. Among these, up to 50 HP exhibits a clear dominance in the market.

Based on the end user, the global progressing cavity pump market can be categorized into water and wastewater management, oil and gas, food and beverages, chemicals and petrochemicals, and others. Currently, the water and wastewater management sector accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global progressing cavity pump market include ChampionX, Circor International Inc., Continental Pump Company Inc., Erich NETZSCH GmbH & Co. Holding KG, Liberty Process Equipment Inc., Nov Inc., Nova Rotors Srl, PCM Inc. (Insight Enterprises Inc.), Pumpenfabrik Wangen GmbH, Schlumberger Limited, Vogelsang GmbH & Co. KG, Weatherford International LLC, and Xylem Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)