Professional Diagnostics Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Professional Diagnostics Market Size and Share:

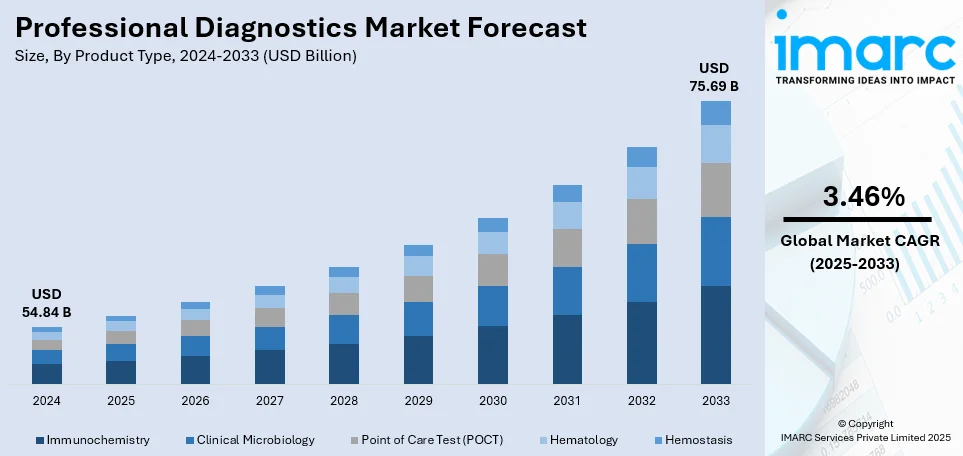

The global professional diagnostics market size was valued at USD 54.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 75.69 Billion by 2033, exhibiting a CAGR of 3.46% from 2025-2033. North America currently dominates the market, holding a professional diagnostics market share of over 43.7% in 2024. Market growth is being driven by factors such as technological advancements, the rising incidence of chronic diseases, the growing demand for early and precise diagnosis, improvements in healthcare infrastructure, increasing health awareness, and a shift toward personalized medicine and preventive care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.84 Billion |

| Market Forecast in 2033 | USD 75.69 Billion |

| Market Growth Rate (2025-2033) |

3.46%

|

One major driver in the global professional diagnostics market is the rising prevalence of chronic and infectious diseases. The increasing burden of conditions such as diabetes, cardiovascular diseases, and cancer is driving demand for advanced diagnostic tools that enable early detection and precise treatment planning. Furthermore, the rising prevalence of infectious diseases, including respiratory infections and antimicrobial-resistant pathogens, has heightened the demand for fast and precise diagnostic solutions. The expanding geriatric population, which is more susceptible to chronic illnesses, further fuels market growth. This demand is reinforced by technological advancements, such as molecular diagnostics and AI-driven testing, enhancing diagnostic accuracy.

The U.S. holds a dominant position in the global professional diagnostics market due to its advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and strong regulatory framework with 88.60% market share. The country benefits from significant investments in research and development, fostering innovation in molecular diagnostics, point-of-care testing, and AI-driven diagnostic tools. A rising prevalence of chronic and infectious diseases, coupled with an aging population, fuels market growth. Additionally, the presence of leading diagnostic companies and a well-established reimbursement system supports market expansion. The growing emphasis on personalized medicine and early disease detection further strengthens the U.S. market’s global influence.

Professional Diagnostics Market Trends:

Technological Advancements

Significant advancements in molecular diagnostics, POCT, and imaging technologies are transforming disease diagnosis and management. Molecular diagnostics provide accurate identification of a genetic marker related to specific diseases, leading to earlier detection and more targeted treatments, which is creating a positive professional diagnostics market outlook. This progress is particularly beneficial in oncology, where they help in identifying specific mutations that will guide personalized treatment plans. A survey revealed that around 81% of patients with advanced non-small cell lung cancer (NSCLC) underwent EGFR mutation testing before starting first-line therapy, with results available prior to treatment in 77% of cases. Additionally, advancements in imaging technologies, such as high-resolution magnetic resonance imaging (MRI) and computed tomography (CT) scans, enhance the detailed visualization of internal structures, facilitating more accurate diagnoses. Moreover, the incorporation of AI and machine learning (ML) improves accuracy, decreases the time required, and enables better patient outcomes by analyzing large datasets at high speeds for hidden patterns and anomalies that the human eye would miss, thus aiding in early disease detection.

Increasing Demand for Personalized Medicine

Increasing focus on personalized medicine is another important trend boosting the professional diagnostics market revenue. Personalized medicine customizes medical treatment based on each patient's unique characteristics. Hence, highly specific diagnostic tools are needed for the proper line of therapy. Companion diagnostics play a crucial role in customizing treatments according to a patient's genetic profile, especially in oncology. For instance, the FDA has approved assays for drugs targeting specific biomarkers such as EGFR, HER2, and BRAF, enabling healthcare providers to select therapies that are more likely to be effective for individual patients. This shift from the one-size-fits-all model to the customized model in treatments fuels demand for diagnostics that can provide detailed insights into a person's genetic make-up, lifestyle, and environment. Genomic testing, pharmacogenomics, and companion diagnostics are central to this trend. They ease the work of healthcare providers by selecting the most effective treatments with the least side effects. Concurrent with this, the rise in the availability of direct-to-consumer genetic testing has further increased awareness and demand for personalized health solutions, thereby propelling professional diagnostics market demand.

Expansion of Healthcare Infrastructure in Emerging Markets

The swift development of healthcare infrastructure in emerging markets is driving market growth. In Asia, Latin America, and Africa, rising income levels, expanding populations, and government drive toward better health access and investments in healthcare facilities. This expansion is accompanied by a higher demand for diagnostic services as more people gain access to healthcare. Additionally, the prevalence of chronic diseases, such as diabetes and cardiovascular conditions, is rising in these regions, creating a need for reliable and affordable diagnostic solutions. The International Diabetes Federation's 9th edition of the Diabetes Atlas estimates that by 2030, approximately 79.44 million people in the Asia-Pacific region will be living with diabetes. In response, regional and global companies are establishing manufacturing units, distribution channels, and healthcare professional training programs. These initiatives are improving the accessibility and quality of diagnostic services, contributing to the professional diagnostics industry growth.

Professional Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global professional diagnostics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Immunochemistry

- Clinical Microbiology

- Point of Care Test (POCT)

- Hematology

- Hemostasis

The Point-of-Care Testing (POCT) leads with 43.2% of the global professional diagnostics market share, driven by its quick results, convenience, and growing adoption across various healthcare settings. The rising demand for immediate diagnostic insights in emergency departments, outpatient clinics, and remote locations is fueling its growth. Technological advancements, including miniaturized biosensors, AI-driven analysis, and connectivity features, enhance accuracy and accessibility. Increasing prevalence of chronic diseases like diabetes and cardiovascular conditions, along with the widespread need for infectious disease testing, further strengthens demand. Moreover, growing emphasis on decentralized healthcare, home-based testing, and personalized medicine is accelerating POCT adoption, reducing reliance on centralized laboratories while improving patient outcomes through faster clinical decision-making.

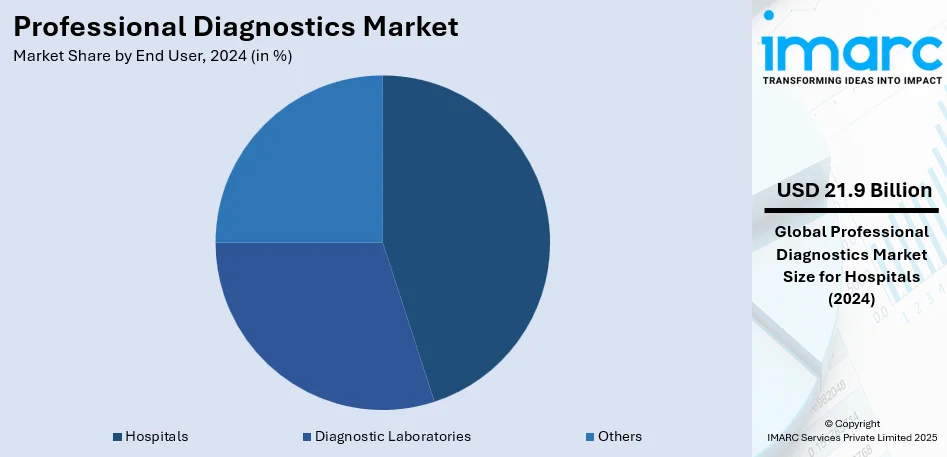

Analysis by End User:

- Hospitals

- Diagnostic Laboratories

- Others

According to the professional diagnostics market forecast, the hospital holds 40.0% of the market share due to high patient inflow, advanced healthcare infrastructure, and the need for comprehensive diagnostic services. Hospitals act as key hubs for disease diagnosis, treatment planning, and patient monitoring, fueling the demand for high-precision diagnostic tests across various specialties such as oncology, cardiology, and infectious diseases. The increasing prevalence of chronic conditions necessitates frequent diagnostic testing, reinforcing hospital-based diagnostics. Moreover, hospitals integrate cutting-edge technologies such as molecular diagnostics, AI-assisted imaging, and automated laboratory systems, ensuring accuracy and efficiency. The availability of skilled professionals, reimbursement support, and emergency testing needs further contribute to market dominance, solidifying hospitals as the leading end-user of professional diagnostic solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the global professional diagnostics market with a 43.7% share, driven by its robust healthcare infrastructure, widespread adoption of advanced diagnostic technologies, and stringent regulatory framework. The region benefits from substantial R&D investments, driving innovation in molecular diagnostics, AI-driven testing, and point-of-care solutions. The rising prevalence of chronic diseases like diabetes cardiovascular disorders (CVD) and cancer is driving the demand for early and precise diagnostics. Additionally, a robust reimbursement system, widespread insurance coverage, and growing government initiatives support market expansion. The presence of leading diagnostic companies and strategic collaborations further enhances growth. The region's increasing focus on personalized medicine, preventive healthcare, and decentralized testing reinforces North America’s leadership in the global professional diagnostics market.

Key Regional Takeaways:

United States Professional Diagnostics Market Analysis

This market is growing in the U.S. due to expansion in healthcare costs and the incorporation of latest technology. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending reached approximately USD 4.5 trillion in 2022, boosting demand for diagnostic services. The rise in chronic diseases has led to increased testing, with over 7 billion clinical lab tests conducted annually across the country. Advancements in molecular diagnostics, automation, and AI-driven analysis improve efficiency and accuracy. Market leaders include Quest Diagnostics and Labcorp, with government policies promoting early disease detection. Point-of-care testing and at-home diagnostic solutions are also shaping market growth. The U.S. remains a leader in professional diagnostics, with companies expanding global operations to capitalize on emerging market opportunities.

Europe Professional Diagnostics Market Analysis

Professional diagnostics in Europe are on the rise because of government spending on health care and the growing demand for the early diagnosis of diseases. Healthcare expenditure in the EU in 2022 averaged €3,685 (USD 3,883) per inhabitant, which increased by 38.6% from 2014 levels at €2,658/USD 2,800, according to reports. Germany, UK, and France top the list, and Germany itself is conducting over 500 million lab tests a year. Policy pushes from the European Commission on personalized medicine is leading the demand for more advanced diagnostics in the shape of genetic and biomarker-based testing. Out of all these countries, EFPIA considered the EU Diagnostic Industry as one of the fastest-growing AI and automation-based. The top leaders such as Roche Diagnostics and Siemens Healthineers invest in the R&D process to make the test more precise and the turnaround time shorter. Strict EU regulations ensure high-quality diagnostics while promoting innovation in precision medicine and digital pathology.

Asia Pacific Professional Diagnostics Market Analysis

The professional diagnostics market in the Asia Pacific region is expanding, fueled by rising investments in healthcare infrastructure and a growing disease burden. In 2022, China's total health expenditure reached 8,532.749 billion yuan (USD 1,268.603 billion), further driving the growth of the diagnostic industry, according to reports. India is on the upswing as well, with a growing diagnostics market with over 700 million tests annually by the National Accreditation Board for Testing and Calibration Laboratories. Molecular diagnostics and AI-powered lab automation are being rapidly adopted to meet the rising demand in the region. Technological adoption is highly dominated by countries such as Japan and South Korea, which have focused more on digital pathology and integration with telemedicine. The "Make in India" initiative has also promoted the local manufacturing of diagnostic kits, thus reducing the imports. Companies such as Sysmex and Mindray are expanding their presence, making Asia Pacific a major player in the global diagnostics market.

Latin America Professional Diagnostics Market Analysis

Latin America's market for professional diagnostics is growing since there is high investment in the healthcare sector with the demand of early detection of diseases. World Bank data based on the 2023 records from the Global Health Expenditure database indicate that Brazil incurred around 9.89 percent of its Gross Domestic Product, which was committed to healthcare activities. Mexico and Argentina are leading countries in such advancements, given that the country's government makes laboratory testing readily available. The region is rapidly growing in the area of point-of-care diagnostics and molecular testing due to rising cases of infectious and chronic diseases. Digital health solutions, such as AI-based diagnostics, are also gaining acceptance for efficiency and accessibility. Abbott, Roche, and others are expanding operations to meet this demand. Furthermore, public-private partnerships are building up diagnostic capabilities, making Latin America a major market for the development and innovation of professional diagnostics.

Middle East and Africa Professional Diagnostics Market Analysis

The growing investments in healthcare sectors across the Middle East and Africa with a mounting requirement for early detection of diseases are boosting this professional diagnostics market. According to the official portal of the UAE government, the healthcare budget for 2022 has touched AED 4.25 billion (approximately USD 1.16 billion), which is further improving diagnostics capabilities. Saudi Arabia's Vision 2030 is focused on upgrading the medical infrastructure, which will increase demands for high-tech testing solutions. Africa's diagnostics market is expanding as more than 25 million tests are done each year for malaria in the continent (WHO). Portable diagnostics, along with AI-driven analysis, are enhancing health care accessibility even in remote places. Companies like Beckman Coulter and BD are increasing operations, backed by government policies favoring local production. Public and private sector cooperation is growing as well, helping to enhance diagnostics capabilities in the region, leading to growth in the market.

Competitive Landscape:

The professional diagnostics market globally is highly competitive with the presence of many key players, major multinational corporations, regional firms, and emerging companies that specialize in niche areas. Leading companies are dominant in the market, mainly because of extensive R&D capabilities, broad product portfolios, and strong distribution networks. Industry leaders constantly innovate to retain their market positions, including development of high-tech diagnostic technologies, such as molecular diagnostics, AI-driven analytics, and point-of-care testing solutions. The competition is also enhanced by smaller regional players who specialize in offering more cost-effective or niche solutions targeted at specific markets or applications. Acquisitions, partnerships, and mergers are well adopted in an organization seeking to gain a higher market share, enhance technological capabilities, and seek to enter other geographical markets.

The report provides a comprehensive analysis of the competitive landscape in the professional diagnostics market with detailed profiles of all major companies, including:

- A. Menarini Diagnostics s.r.l

- Abaxis, Inc. (Zoetis Inc.)

- Abbott Laboratories

- Bio-Rad Laboratories Inc.

- F. Hoffmann-La Roche AG

- SEKISUI Diagnostics (Sekisui Medical Co. Ltd.)

- Siemens AG

- Thermo Fisher Scientific Inc., etc.

Latest News and Developments:

- December 2024: Roche has gained the CE mark for its cobas® Mass Spec solution, which includes the cobas i 601 analyser and Ionify reagent packs. It is a fully automated mass spectrometry platform that improves routine clinical diagnostics by supporting hormone, vitamin D, immunosuppressants, drug monitoring, and abuse testing with more than 60 analytes.

- November 2024: SEKISUI Diagnostics completed a £15.7 million (USD 20.7 million) cGMP expansion at its UK site, enhancing microbial CDMO capabilities for enzymes, proteins, antibody fragments, and gene therapy plasmids. The new Grade C fermentation suites support production up to 1,000L, addressing rising biopharma manufacturing demand.

- April 2024: Bio-Rad Laboratories introduced the ddPLEX ESR1 Mutation Detection Kit, an ultrasensitive multiplexed digital PCR assay for breast cancer study. Designed for the QX600 ddPCR System, it detects seven ESR1 mutations with 0.01% VAF sensitivity using ctDNA or FFPE samples. The assay incorporates NuProbe’s allele enrichment technology.

- March 2024: Bayer and Thermo Fisher Scientific partnered to develop next-generation sequencing (NGS)-based companion diagnostics (CDx) aimed at improving patient access to Bayer’s precision cancer therapies. By leveraging Thermo Fisher’s Oncomine Dx Express Test, the collaboration enables decentralized genomic testing with a rapid 24-hour turnaround, advancing personalized oncology treatment.

- May 2023: A.Menarini Diagnostics announced the commercial launch of its PRIME MDx platform, a fully automated molecular diagnostics platform for real-time PCR testing. The platform, developed in response to the Covid-19 pandemic, allows users to process a range of sample types using pre-filled plates and universal extraction solutions. The AI-driven software ensures a flawless customer experience from sample loading to result interpretation.

Professional Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Immunochemistry, Clinical Microbiology, Point of Care Test (POCT), Hematology, Hemostasis |

| End Users Covered | Hospitals, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A. Menarini Diagnostics s.r.l, Abaxis, Inc. (Zoetis Inc.), Abbott Laboratories, Bio-Rad Laboratories Inc., F. Hoffmann-La Roche AG, SEKISUI Diagnostics (Sekisui Medical Co. Ltd.), Siemens AG, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the professional diagnostics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global professional diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the professional diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The professional diagnostics market was valued at USD 54.84 Billion in 2024.

The professional diagnostics market was valued at USD 75.69 Billion in 2033 exhibiting a CAGR of 3.46% during 2025-2033.

Key factors driving the professional diagnostics market include the rising prevalence of chronic and infectious diseases, advancements in diagnostic technologies, and increasing demand for point-of-care testing. Additionally, growing healthcare expenditure, personalized medicine adoption, and government initiatives for early disease detection further propel market expansion, enhancing diagnostic accuracy and accessibility worldwide.

North America dominates the market with 43.7% share due to its advanced healthcare infrastructure, rapid adoption of innovative diagnostics, and high disease prevalence. Strong R&D investments, robust reimbursement policies, and the presence of key industry players further drive growth. The region’s focus on personalized medicine and preventive healthcare strengthens its market leadership.

Some of the major players in the professional diagnostics market include A. Menarini Diagnostics s.r.l, Abaxis, Inc. (Zoetis Inc.), Abbott Laboratories, Bio-Rad Laboratories Inc., F. Hoffmann-La Roche AG, SEKISUI Diagnostics (Sekisui Medical Co. Ltd.), Siemens AG, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)