Product Engineering Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, Industry Vertical, and Region, 2025-2033

Product Engineering Services Market 2024, Size and Outlook:

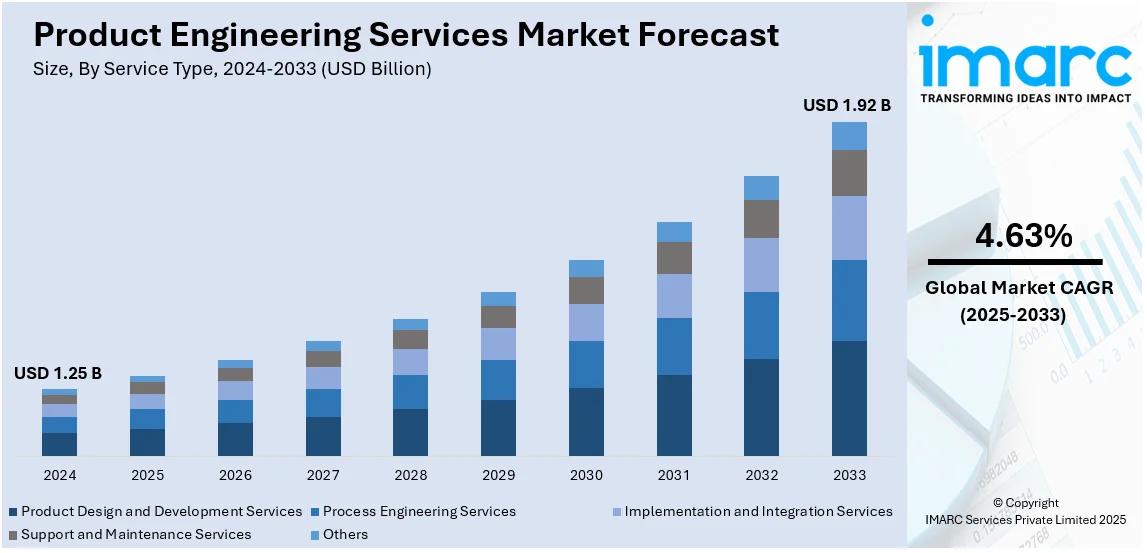

The global product engineering services market size was valued at USD 1.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.92 Billion by 2033, exhibiting a CAGR of 4.63% during 2025-2033. North America currently dominates the market, holding a market share of over 48.7% in 2024. The growing emphasis on creating innovative and advanced products, the rising adoption of cloud-based solutions, and the incorporation of artificial intelligence (AI) and machine learning (ML) are key drivers of the product engineering services market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.25 Billion |

|

Market Forecast in 2033

|

USD 1.92 Billion |

| Market Growth Rate (2025-2033) | 4.63% |

As consumers seek products tailored to their specific needs and preferences, businesses in various industries are turning to product engineering services to create unique solutions. The shift toward more personalized and high-quality products across sectors like automotive, consumer electronics, and healthcare is driving the demand for custom-designed products that stand out in the competitive market. A 2023 report reveals that 36% of consumers are prepared to pay a premium for personalized products and services, underscoring the growing preference for customization in the market. In the same study, 50% of consumers said that they had purchased a product in the last year specifically because it was personalized to their needs. With more complex consumer requirements, companies need to focus on designing and engineering products that cater to individual specifications, which is challenging to achieve without advanced product engineering expertise. These services enable companies to design innovative products, adapt to shifting market trends, and improve customer satisfaction through better user experiences.

The United States holds a 74.70% share in North America and is a major market disruptor. This growth has been due to the increased focus on sustainability among consumers and regulatory bodies that push businesses to focus on designing products that are eco-friendly and meet various environmental regulations. For instance, the adoption of climate-related disclosure rules by U.S. The Securities and Exchange Commission (SEC) has introduced proposed rules aimed at significantly broadening disclosure requirements for public companies to support the product engineering services market growth. Additionally, various federal agencies, including federal bank regulators, the Federal Acquisition Regulatory Council, and the Federal Trade Commission, have proposed regulations and issued guidance focused on climate risk and sustainability-related disclosures and oversight. As such, the Environmental Protection Agency finalized new rules to additionally limit vehicle greenhouse gas and other tailpipe emissions in 2024. Product engineering services are crucial in helping companies design products that minimize energy consumption, reduce waste, and comply with increasingly stringent environmental standards.

Product Engineering Services Market Trends:

Technological Advancements and Innovation

As per the product engineering services market trends, rapid advancements in the fields of artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and fifth-generation (5G), are increasingly changing the way products are engineered and manufactured. There is a hike in demand for sophisticated product engineering services because of the need to integrate these advanced technologies into products to make them smarter, more efficient, and responsive. As such, IoT-enabled devices need a seamless design process that connects hardware with cloud-based systems, while AI demands high-tech solutions for data analysis, predictive maintenance, and autonomous functionality. As per a 2023 survey, around 97% of Indian organizations have invested in AI/ML technologies and approximately 84% of organizations had added funds in cloud technology. These technological innovations have led to more complex product designs and pushed companies to employ specialized engineering expertise that bring new concepts to life. Product engineering services, therefore, help businesses stay ahead of the curve, ensuring their products are compatible with emerging technologies and market trends.

Shortened Product Life Cycles and Time-to-Market Pressures

According to the product engineering services market outlook, companies face enormous pressure to shorten the time to launch new goods in the fast-paced commercial world. Since the lifetime of a product is decreasing, companies must hasten their design and development process to survive in the marketplace. Product engineering services allow this through providing business the capability to quickly develop, test, and refine concepts. Engineering services help make the entire process of product development from concept to final manufacturing go more smoothly as there is always a demand for new and better products. Business pressures are increasing with respect to being agile in terms of customer demand and industry trend changes. With engineering services, businesses can react to these developments faster, making time-to-market without compromising functionality or quality. Quick turnaround of a product from ideation to reality is crucial in electronics, automotive, and consumer goods industries, as competition is cutthroat and the expectation of the consumer is always to innovate.

Rising Need for Cost Optimization and Efficiency

Reducing manufacturing costs while preserving product quality has become a major problem as businesses continue to prioritize increasing their bottom line. Product engineering services assist businesses in streamlining designs to cut waste, increase manufacturing efficiency, and save production costs. For instance, engineering services frequently focus on design for manufacturability (DFM) principles, which assist in simplifying the product's design to make it simple and affordable to create. Product engineering services assist companies in finding the most cost-effective ways to acquire materials, choose manufacturing techniques, and save labor costs in industries with high component prices, such as electronics and automobiles. As global supply chains become increasingly complex, engineering services help companies identify cost-efficient manufacturing partners while ensuring supply chain efficiency and resilience.

Product Engineering Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global product engineering services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type, enterprise size, and industry vertical.

Analysis by Service Type:

- Product Design and Development Services

- Product Development

- Design Support

- Prototype Testing

- Process Engineering Services

- Implementation and Integration Services

- Support and Maintenance Services

- Others

Product design and development services represent the largest product engineering services market share in 2024; stimulated by the ever-increasing demand for high-quality, customized, and creative products across diverse industry segments. This includes generating early concepts, design requirements, prototyping to comprehensive development and testing. These services form the backbone on which businesses rely to develop distinctive, useful, and user-friendly goods to fulfill changing consumer demands as they look to be unique in competitive markets. Sectors where companies make extensive use of advanced technologies such as AI, CAD software, and 3D printing, to enhance design accuracy, decrease time-to-market, and speed up the development process, are expected to expand the segment.

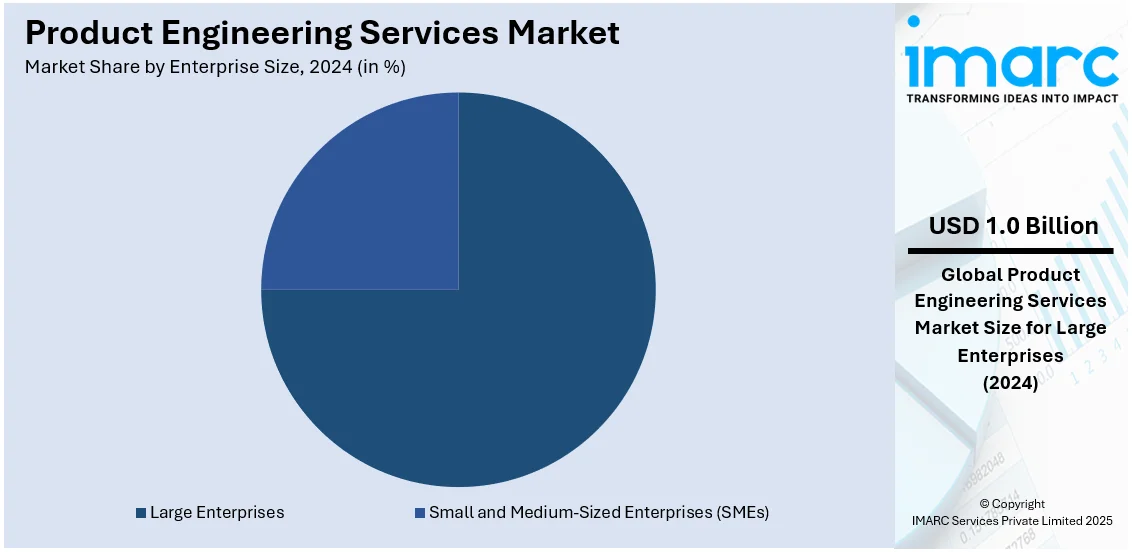

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

In 2024, large enterprises hold a 75.0% market share, leading the industry. These companies can take use of a broad range of engineering services because they have the infrastructure, resources, and sophisticated needs to do so, especially in industries like healthcare, consumer electronics, automotive, and aerospace. The need for complete engineering solutions is fueled by the significant investments made by large corporations in innovation, product creation, and preserving competitive advantages. With sizable R&D divisions and a global presence, these businesses depend on product engineering services to optimize workflows, adhere to legal requirements, guarantee superior output, and adjust to quickly changing technological advancements.

Analysis by Industry Vertical:

- BFSI

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Media and Entertainment

- Healthcare

- Retail and E-commerce

- Others

With a market share of about 22.7% in 2024, the manufacturing sector is the industry leader. It is driven by the urgent demand for cost optimization, efficiency, and innovation. Product engineering services are being used by manufacturers in a variety of subsectors, including automotive, electronics, aerospace, and industrial machinery, to improve product quality, optimize production procedures, and integrate cutting-edge technologies like automation, artificial intelligence, and the Internet of Things. Due to global competitiveness, manufacturing organizations must quickly adjust to new market needs. Rapid time-to-market and regulatory compliance are necessary for this, and using engineering services can help achieve both. These services assist firms with supply chain efficiency, sustainability objectives, and the design and prototype of innovative goods.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the product engineering services market trends, in 2024, North America leads the market share with 48.7%. Strong advanced manufacturing sectors, technical advancements, and a high need for product development across industries including consumer electronics, automotive, aerospace, and healthcare are the reasons for this region's dominance. The region holds robust infrastructure, significant R&D investment, and quick adoption of cutting-edge technologies like 5G, AI, and the Internet of Things. Comprehensive engineering solutions are in greater demand as a result of North American businesses' need to improve product quality, shorten time-to-market, and save expenses. With the most cutting-edge resources for product design, prototyping, and manufacturing assistance, the US is setting the standard. The product engineering services market is further propelled by the region's focus on innovation, sustainability, and adherence to regulatory compliance. North America continues to lead the market for product engineering services with its strong tech ecosystem and ongoing digital transformation.

Key Regional Takeaways:

United States Product Engineering Services Market Analysis

The United States is leading the market with 74.70% share in North America. The adoption of product engineering services is accelerating due to the increasing demand for cloud-based solutions. Reports indicate that the United States is projected to be the largest market for public cloud services, with spending anticipated to reach USD 432 billion by 2024. Organizations across sectors are transitioning from legacy systems to modern, scalable cloud architectures to improve operational efficiency and support seamless collaboration. Cloud integration enables businesses to manage diverse workflows, enhance data security, and achieve real-time analytics, driving the need for specialized engineering services to optimize these solutions. Advanced software applications, powered by cloud technologies, require customization and continuous updates, further fueling this trend. The focus on improving customer experience through personalized digital platforms also contributes to rising investments in engineering expertise. Moreover, the integration of automation tools, powered by cloud infrastructure, enhances product lifecycle management, and accelerates development cycles. As enterprises prioritize digital transformation, the adoption of engineering services is anticipated to scale, driven by the need to align with cloud-enabled innovation strategies.

Asia Pacific Product Engineering Services Market Analysis

The growth of small and medium-sized enterprises (SMEs) is fostering the product engineering services market demand, particularly in the technology-driven landscape. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. As smaller organizations strive to scale operations, they require agile and cost-efficient engineering solutions to streamline product development and achieve market competitiveness. These enterprises often seek tailored services for software development, product prototyping, and innovation to address specific challenges in their operational environments. Cloud-based software, advanced analytics tools, and modular design capabilities are especially attractive to this segment, given their adaptability and affordability. Additionally, SMEs benefit from engineering services that integrate local market nuances into product strategies, enhancing customer-centricity. The expanding use of mobile applications and digital platforms within these businesses further necessitates robust software engineering capabilities. This growing focus on product differentiation and speed-to-market is significantly bolstering demand for engineering services across this sector.

Europe Product Engineering Services Market Analysis

The increase in banking and financial institutions is one of the key factors for the use of product engineering services, since these organizations within the sector have grown to demand sophisticated solutions that help them function effectively. Reports state that in 2021, the EU had 784 foreign bank branches, including 619 from other EU Member States and 165 from non-EU countries. Engineering services are critical in designing secure digital platforms, smoothing payments, and meeting the complexities of regulations. Innovations in mobile banking, contactless payment systems, and fintech applications are creating a robust demand for specialized engineering expertise to design and optimize these technologies. Additionally, engineering services contribute to enhancing fraud detection mechanisms and ensuring secure transaction environments, vital for maintaining consumer trust. In 2021, the EU hosted 784 foreign bank branches, including 619 from other Member States and 165 from third countries. Additionally, engineering services play a crucial role in developing advanced analytics tools to process extensive financial data and deliver actionable insights. As financial institutions prioritize improving operational efficiency and offering seamless digital experiences, demand for tailored engineering solutions continues to rise.

Latin America Product Engineering Services Market Analysis

The increasing focus on modernizing and privatization healthcare systems is driving the product engineering services market growth. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), 62% of Brazil's 7,191 hospitals are privately owned. These services enable the development of customized software platforms and advanced medical devices, addressing the increasing demand for digital health solutions. Engineering expertise contributes to designing telemedicine platforms, optimizing patient management systems, and integrating wearable health monitoring devices. Innovations in diagnostic technologies and precision medicine further require specialized engineering solutions to enhance efficiency and accuracy. As healthcare providers emphasize improving patient outcomes and operational workflows, the role of engineering services in driving digital transformation within the sector becomes increasingly vital.

Middle East and Africa Product Engineering Services Market Analysis

Product engineering services are experiencing a surge in demand in this region due to the increasing investments in IT and telecommunications. In this regard, spending on information and communications technology (ICT) in the META region reached USD 238 Billion in 2024, up 4.5% from 2023. PES services aid in the building of next-generation networks, innovative communication platforms, and scalable IT infrastructures. The need for sophisticated solutions in connectivity also requires more technical expertise to implement 5G technologies that result in high-speed network performance and integration without disruption in the digital platform. The growing use of data-intensive applications, including video conferencing and cloud computing, drives the need for specialized engineering services to enhance performance and ensure reliability. A rise in this technological progress continues to further bolster the relevance of engineering solutions that make IT and telecom transformative endeavors possible.

Competitive Landscape:

The major market players are concentrating on growing their service offerings, using cutting-edge technology, and enhancing their worldwide footprint. Notable organizations are making substantial investments in automation, IoT, ML, and AI to advance their capacity for product creation, testing, and design. In order to facilitate quicker time-to-market and more effective product lifecycle management, they are also incorporating digital twins, virtual prototyping, and 3D printing into their products. Furthermore, these companies are broadening their scope through strategic alliances and acquisitions in order to satisfy the increasing need for innovation in sectors like consumer electronics, healthcare, and automotive. In line with international legislative trends, many businesses are also placing a strong emphasis on eco-friendly product designs and circular economy solutions to meet the growing demand for sustainability. These enterprises are assisting companies in cutting expenses, streamlining supply chains, and enhancing product quality by concentrating on providing end-to-end services, establishing themselves as major forces behind the market expansion.

The report provides a comprehensive analysis of the competitive landscape in the product engineering services market with detailed profiles of all major companies, including:

- Accenture plc

- AKKA Technologies (The Adecco Group)

- Capgemini SE

- Happiest Minds Technologies

- HCL Technologies Limited

- Nous Infosystems

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Wipro Limited

- Xoriant Corporation

Latest News and Developments:

- January 2025: EPAM Systems, a prominent provider of digital transformation and product engineering services, has strengthened its strategic alliance with Google Cloud. This collaboration utilizes Google Cloud's Vertex AI platform to deliver innovative solutions across media, entertainment, energy, and retail industries. The partnership focuses on enabling generative AI, legacy system modernization, and advanced data analytics to drive meaningful digital transformation and business outcomes for clients.

- December 2024: ACL Digital, a global leader in digital engineering, has inaugurated a new office in Ahmedabad to enhance its digital product engineering and embedded engineering services. The facility will drive innovation across industries like automotive, aerospace, and semiconductors, offering expertise in cloud, embedded firmware, and hardware development.

- June 2024: Cognizant and Gentherm have signed a strategic agreement for product engineering services to develop next-generation automotive thermal management solutions. Cognizant will provide systems engineering, validation, and model-based development from its Hyderabad center, enhancing Gentherm's software and technology innovation. The partnership includes a dedicated delivery center to improve product agility and scalability. This collaboration aims to elevate vehicle experiences and drive advancements in thermal comfort and lumbar support systems.

- September 2024: Goavega has unveiled an advanced suite of AI-driven product engineering services designed to help businesses create next-gen software that is humane and hyper-efficient. With over a decade of expertise, the company aims to address challenges in AI adoption, where 70-90% of projects often fall short. This launch positions Goavega as a key partner in driving innovation across industries. The global artificial intelligence (AI) market is expected to reach USD 2 trillion by 2030.

- May 2024: Quest Global, a global leader in product engineering services, has acquired a majority stake in People Tech Group, bolstering its digital transformation capabilities in North America. This partnership enhances Quest Global's expertise in Software Defined Vehicles, ADAS testing, HMI development, and Hi-Tech solutions, furthering its growth in the Automotive and Hi-Tech sectors.

Product Engineering Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered |

|

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises (SMEs) |

| Industry Verticals Covered | BFSI, IT and Telecom, Energy and Utilities, Manufacturing, Media and Entertainment, Healthcare, Retail and E-commerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, AKKA Technologies (The Adecco Group), Capgemini SE, Happiest Minds Technologies, HCL Technologies Limited, Nous Infosystems, TATA Consultancy Services Limited, Tech Mahindra Limited, Wipro Limited, Xoriant Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the product engineering services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global product engineering services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the product engineering services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The product engineering services market was valued at USD 1.25 Billion in 2024.

IMARC Group estimates the market to reach USD 1.92 Billion by 2033, exhibiting a CAGR of 4.63% during 2025-2033.

Key factors driving the product engineering services market include the increasing demand for product customization, rapid technological advancements, shorter product lifecycles, cost optimization pressures, growing focus on sustainability, digital transformation, and the need for high-quality, innovative solutions across various industries.

Large enterprises lead the market share with 75.0%, based on enterprise size due to their extensive resources and demand for advanced solutions.

North America currently dominates the market, driven by the strong presence of advanced manufacturing sectors, rapid technological innovations, and high demand for product development across various industries.

Some of the major players in the product engineering services market include Accenture plc, AKKA Technologies (The Adecco Group), Capgemini SE, Happiest Minds Technologies, HCL Technologies Limited, Nous Infosystems, TATA Consultancy Services Limited, Tech Mahindra Limited, Wipro Limited, Xoriant Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)