Process Analyzer Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Process Analyzer Market Size and Share:

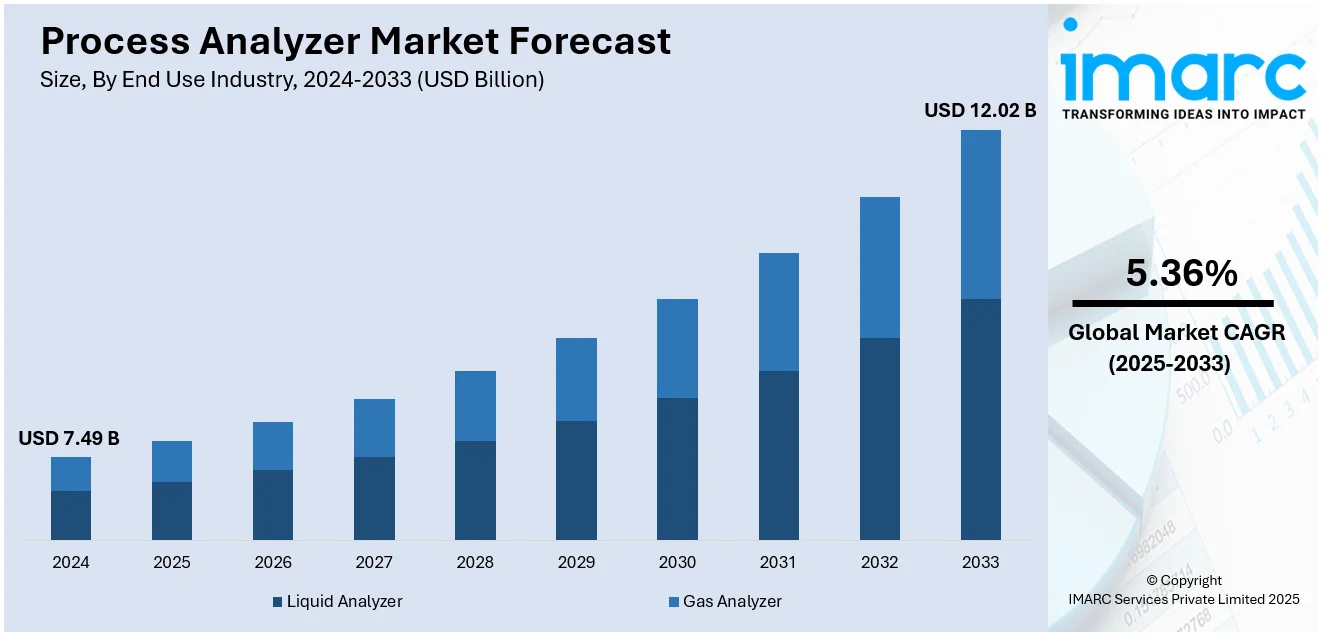

The global process analyzer market size was valued at USD 7.49 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.02 Billion by 2033, exhibiting a CAGR of 5.36% from 2025-2033. North America currently dominates the market, holding a market share of over 32.0% in 2024. The growing emphasis on environmental compliance, increasing focus on quality control and product consistency, rising demand for real-time data and process optimization, and escalating demand for employee safety, environmental protection, and asset protection are some of the factors positively influencing the process analyzer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.49 Billion |

|

Market Forecast in 2033

|

USD 12.02 Billion |

| Market Growth Rate 2025-2033 | 5.36% |

The global market is primarily driven by the increasing complexity of industrial processes and the growing need for real-time data to optimize operations. In accordance with this, continual advancements in automation and the integration of process analyzers into digital systems are significantly enhancing operational efficiency and precision. Veeva Systems' November 19, 2024 launch of its cloud-based digital Hazard Analysis and Critical Control Point (HACCP) solution as part of the Veeva QualityOne Suite exemplifies the shift toward streamlined, data-driven solutions for food safety and quality management. This solution provides global visibility and improves risk management, as demonstrated by its previous adopter Nestlé. Additionally, rising demands for minimizing downtime, improving product quality, ensuring regulatory compliance, and addressing sustainability concerns further fuel the adoption of process analyzers across various industries., which is providing a boost to process analyzer market growth.

The United States is a key regional market and is experiencing growth due to the increasing need for operational efficiency and process optimization across industries. Similarly, manufacturers are turning to process analyzers to monitor critical variables in real-time, enhancing decision-making, minimizing downtime, and improving productivity. Additionally, the rapid integration of advanced data analytics with process analyzers enables predictive maintenance, quality control, and optimized supply chain management, further enhancing operational agility and process analyzer market outlook. A notable development is Honeywell’s acquisition of Air Products' liquefied natural gas (LNG) process technology and equipment business for USD 1.81 Billion on July 10, 2024. This acquisition strengthens Honeywell’s energy transition portfolio, allowing it to offer an end-to-end LNG solution with digital automation, enhancing process analyzer capabilities and driving growth in energy efficiency and sustainability in the U.S.

Process Analyzer Market Trends:

Increasing the Use in Drug Safety

According to the global process analyzer market overview, the increasing use of process analyzers in ensuring drug safety is significantly driving the market growth. In the pharmaceutical industry, maintaining stringent safety standards and compliance with regulatory guidelines is paramount. According to the FDA's Adverse Event Reporting System (FAERS), there were over 1 million adverse event reports submitted in 2020, including reports on drugs, biologics, and devices. This highlights the increasing pressure on manufacturers to ensure the purity, safety, and efficacy of pharmaceutical products. Process analyzers are critical in this regard, as they provide real-time monitoring and analysis of pharmaceutical manufacturing processes. These analyzers help in detecting impurities, ensuring the correct chemical composition, and maintaining the purity of drug formulations. The precise data they generate allows for immediate adjustments in the manufacturing process, thereby reducing the risk of non-compliance with regulatory standards and minimizing potential safety issues related to drug purity and efficacy. As drug manufacturers continue to face pressure to meet strict global safety regulations, the demand for reliable and accurate process analyzers is expected to grow, thus bolstering the overall market.

Heightened Emphasis on Environmental Compliance

As environmental regulations are becoming more stringent worldwide, industries are increasingly focusing on compliance with emissions and pollution control standards. According to the EPA's 2023 National Emissions Inventory, industrial sources account for almost 70% of the total U.S. emissions of such pollutants. CEMS and process analyzers, which are commonly used in continuous emissions monitoring in petrochemicals and power generation, respectively, are some of the examples of how regulatory standards are achieved. Process analyzers play a crucial role in monitoring and controlling emissions in industries, such as petrochemicals, power generation, and wastewater treatment. These analyzers deliver real-time data on pollutant levels, allowing companies to promptly implement corrective measures to comply with regulatory standards. The growing awareness about environmental sustainability and the need to reduce carbon footprints is catalyzing the process analyzers market demand. Companies are investing in advanced analyzers that are capable of accurate and continuous environmental monitoring to navigate the changing regulatory landscape and demonstrate their commitment to environmental responsibility.

Quality Control and Product Consistency

In industries, such as pharmaceuticals, food, and beverage (F&B), and chemicals, maintaining product quality and consistency is paramount. According to the U.S. FDA, nearly 2,000 recalls annually are due to quality issues related to improper chemical composition, packaging errors, and contamination in the food and drug sectors. Process analyzers are instrumental in ensuring that products meet stringent quality standards. These analyzers can continuously monitor essential parameters such as chemical composition, purity, and particle size. As consumer expectations for product quality is rising, manufacturers are relying on process analyzers to minimize variations and defects in their products. By implementing advanced process analyzers, companies can reduce waste, improve yield, and enhance product consistency, leading to higher customer satisfaction and brand reputation. This rising demand for quality control and product consistency is propelling the market growth, as industries are seeking to maintain high standards and minimize costly recalls or product rejections.

Demand for Real-time Data and Process Optimization

Industries are growing more aware of the importance of real-time data in optimizing their processes. Process analyzers provide continuous, accurate, and timely data on various parameters, allowing industries to render immediate adjustments to their operations. The ability to monitor in real-time is essential for maintaining efficiency, minimizing downtime, and lowering production costs. The U.S. Department of Energy's Industrial Assessment Centers (IAC) offer free assessments to small and medium-sized manufacturers, saving them money on energy, reducing waste, and improving productivity. On average, such an assessment finds over USD 130,000 worth of cost-saving opportunities for manufacturers annually. IAC also provides up to USD 300,000 in grants that can be used to implement the recommended improvements, and it is paid for by the manufacturers to the tune of 50%. Process analyzers play a pivotal role in various industries, ranging from the petrochemical sector, where monitoring chemical reactions is vital to power generation, where maintaining optimal conditions is essential. The increasing demand for process optimization to enhance productivity and reduce resource wastage is impelling growth of the market. Companies that integrate advanced analyzers into their operations can gain a competitive advantage by achieving higher process efficiency and cost savings while maintaining product quality. This process analyzer market trend highlights the growing reliance on real-time data analytics to drive operational excellence.

Increasing Focus on Safety and Risk Mitigation

Safety concerns in various industries, including chemical, oil and gas, and pharmaceuticals, are leading to the rising emphasis on risk mitigation. The U.S. Occupational Safety and Health Administration says that in the year 2020, workplace deaths in these sectors, high-risk sectors of chemical manufacturing, and oil and gas, resulted in more than 5,000 deaths. In response to this, OSHA and the U.S. Chemical Safety and Hazard Investigation Board (CSB) recommend the integration of real-time process analyzers to detect hazardous conditions, such as temperature, pressure, and toxic gas levels. Process analyzers are instrumental in identifying and monitoring potential hazards by continuously measuring critical parameters, such as temperature, pressure, and the presence of toxic gases. They provide early warnings and data-driven insights that enable companies to implement preventive measures and emergency response protocols, reducing the likelihood of accidents or catastrophic events. The integration of safety systems with advanced process analyzers further enhances the ability to detect and mitigate risks. As companies are prioritizing employee safety, environmental protection, and asset protection, the demand for process analyzers as a risk management tool is increasing.

Process Analyzer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global process analyzer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end use industry.

Analysis by Product Type:

- Liquid Analyzer

- pH Analyzers

- Conductivity Analyzers

- Dissolved Oxygen Analyzers

- Turbidity Analyzers

- Others

- Gas Analyzer

- Electrochemical

- Zirconia

- Tunable Diode Laser

- Infrared

- Paramagnetic

- Catalytic

- Others

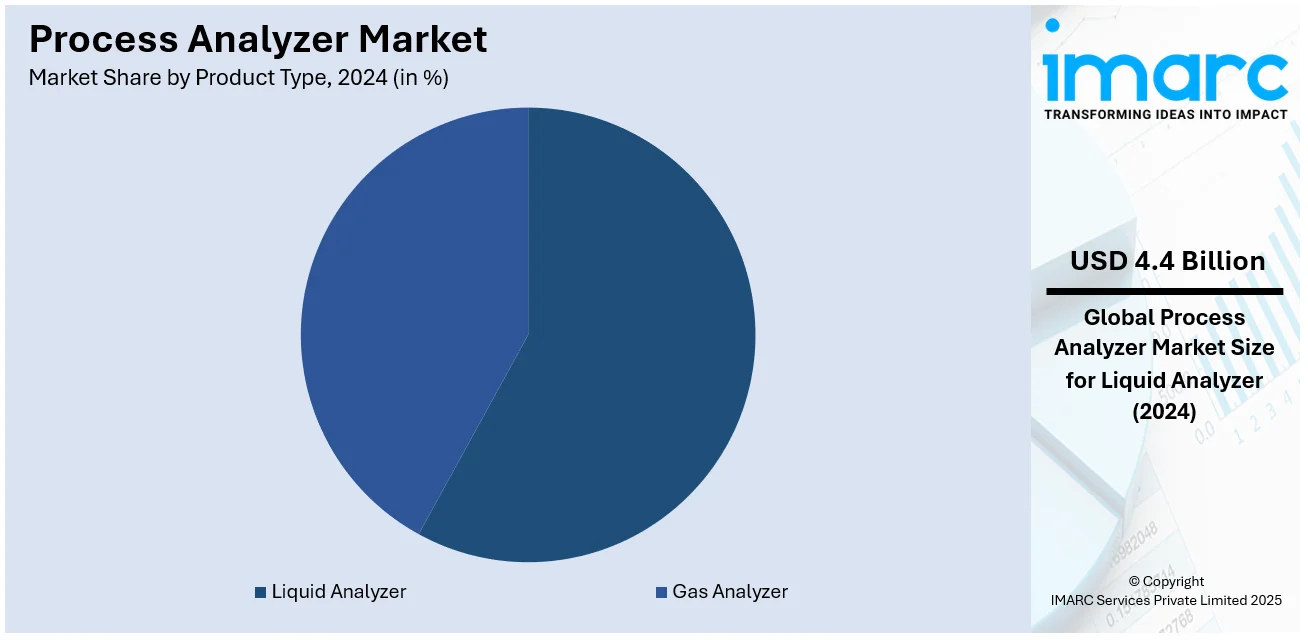

Liquid analyzer leads the market with around 58.2% of market share in 2024, as it is primarily designed to analyze various parameters in liquid samples, including chemical composition, pH levels, conductivity, and turbidity. It finds extensive applications in industries, such as pharmaceuticals, wastewater treatment, food, and beverage (F&B), and petrochemicals. The demand for liquid analyzer is driven by the need for precise monitoring and quality control in liquid-based processes. As industries are focusing on product consistency and regulatory compliance, liquid analyzer is playing a pivotal role in ensuring that liquid products meet stringent standards.

Analysis by End Use Industry:

- Liquid Analyzer

- Power

- Water and Wastewater

- Pharmaceuticals

- Chemicals

- Oil and Gas

- Food and Beverage

- Others

- Gas Analyzer

- Oil and Gas

- Power

- Chemicals

- Food and Beverage

- Pharmaceuticals

- Others

Liquid analyzer (power) leads the market with around 20.0%% of market share in 2024. Liquid analyzers are widely utilized in various industries. One prominent segment is the power industry, where liquid analyzers are indispensable for monitoring the quality of effluents, ensuring compliance with discharge limits, and preventing environmental contamination. They are also extensively used in wastewater treatment plants to monitor water quality and facilitate compliance with environmental regulations. As per the process analyzer forecast, the factors mentioned above are driving the increased adoption of liquid analyzers, and is expected to escalate growth in the power sector.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

In 2024, North America accounted for the largest market share of over 32.0%. The region boasts a robust industrial base, particularly in sectors like oil and gas, chemicals, power generation, and water treatment, where process analyzers are integral for ensuring safety, efficiency, and regulatory compliance. Additionally, North America benefits from strong technological advancements, fostering the development of sophisticated analytical solutions. Increasing stringency in environmental regulations along with an enhanced focus on sustainable practices are impelling the demand for process analyzers. Moreover, the presence of major industry players, well-established infrastructure, and investments in innovation further solidify North America’s market leadership.

Key Regional Takeaways:

United States Process Analyzer Market Analysis

In 2024, the United States accounted for 80.00% of the North America process analyzer market. The market is supported by strong industrial expansion, strict environmental regulations, and technological advancements. According to Federal Reserve Board, the second quarter of 2024 witnessed an industrial production growth rate of 4.3% on an annual basis, as manufacturing output improved by 3.4%. Thus, this upward trend is increasing demand for real-time monitoring solutions primarily in the manufacturing and chemical industries. Emissions regulations are quite stringent and have been enforced by the Environmental Protection Agency, and hence process analyzers find extensive application in industries such as oil refining and pharmaceuticals. Market leaders like Emerson Electric Co. and Honeywell International have led the market with smart and wireless analyzers that support predictive maintenance and optimization of efficiency. The U.S. enjoys federal incentives on clean energy and carbon reduction technologies, which enhance the adoption of advanced analyzers in renewable energy sectors, thus underpinning its leadership in the global process analyzer market.

Europe Process Analyzer Market Analysis

Europe's process analyzer market is growing due to industrial sustainability objectives, stringent emission regulations, and more sophisticated manufacturing practices. The European Environment Agency (EEA) reported that the industries in the EU have set a target of decreasing greenhouse gas emissions by 55% by 2030, which requires the use of highly advanced monitoring equipment. Germany tops the list with its investments in industrial automation, committing EUR 15 Billion (USD 15.36) to Industry 4.0 in 2022, as per a government report. The European Green Deal also fosters the implementation of advanced process analyzers in chemical and pharmaceutical industries. The companies like Siemens AG and ABB are crucial for this purpose as they provide high-end technologies, such as spectroscopic analyzers, for accurate monitoring. The market is also gaining momentum in the bioprocessing and energy transition sectors due to the EU's enforcement of compliance standards. Joint research and development (R&D) projects further strengthen Europe's position as a global innovation hub for process analyzer technology.

Asia Pacific Process Analyzer Market Analysis

Asia Pacific market is growing at a very fast rate because of industrialization, urbanization, and environmental policies. The Ministry of Industry and Information Technology of China allocated more than USD 300 Billion in 2023 to promote industrial automation. As a result, the demand for real-time analysis solutions increases. The National Manufacturing Policy of India also focuses on process optimization. So, opportunities for process analyzers in oil, gas, and chemical industries arise. Rising environmental awareness in Japan and South Korea created demand for state-of-the-art emission monitoring solutions. Investment in smart manufacturing and clean energy in the region fosters innovation in gas and liquid analyzers. Japanese and South Korean companies like Yokogawa Electric and Endress+Hauser work with multinational companies to enhance the market further. Government support for infrastructure development makes Asia Pacific the main market for process analyzers across the globe.

Latin America Process Analyzer Market Analysis

The process analyzer market in Latin America continues to grow steadily, led by the rise of petrochemical and mining industries within the region. A regional industrial report reports that Brazil allocated USD 50 Billion to energy and resource extraction projects in 2023 and that demand for accurate monitoring technologies is increasing. Adoptive markets in Mexico remain focused on the energy reform and Colombia remains dedicated to mining compliance. Solutions on environmental monitoring in terms of water treatment and emission are under increasing demand, therefore, matching up to global levels. Multinationals provide improved technological benefits while reducing local reliance on importing solutions. Availability of digital portals to monitor industry-specific activities in collaboration with other sustainability projects in a country attract significant market demands, further augmenting local business. Various major companies also operate in Latin America, having extensive knowledge of such an industrial arena, one among them is ABB-Thermo Fisher Scientific.

Middle East and Africa Process Analyzer Market Analysis

Middle East and Africa's industrial diversification and sustainability have enabled the market to prosper. Vision 2030 is a high-value plan, Saudi Arabia is using in its bid to diversify the economy, which depends more on the oil revenue base. Total investment under Vision 2030 stands at an estimated USD 3 Trillion from 2019 through 2030, with a huge thrust toward large-scale industrial projects in the region, such as petrochemicals and renewable energy. The International Trade Administration projected for 2022 Saudi Arabia's defense budget at USD 75.01 Billion, which reflects allocation heavily toward military modernization, including purchases of process analyzers for advanced facilities. South Africa is leading adoption for mining and water treatment processes through government regulations on environmental impact. Global companies such as Emerson and Yokogawa are teaming up with local firms to improve technological expertise, further propelling the growing market for process analyzers designed for various applications in the region.

Competitive Landscape:

Key players in the global market are actively investing in research and development (R&D) activities to advance their product offerings. They are focusing on developing cutting-edge technologies that enhance the accuracy, efficiency, and connectivity of process analyzers. These companies are also expanding their portfolios to cater to a wider range of applications, offering customized solutions to meet the specific needs of various industries. Furthermore, they are emphasizing the integration of Internet of Things (IoT) and cloud-based solutions, allowing for remote monitoring and data analytics, which enhances the capabilities of process analyzers and enables predictive maintenance. In addition, many key players are strategically acquiring smaller companies to broaden their market reach and provide comprehensive solutions to their consumers.

The report provides a comprehensive analysis of the competitive landscape in the process analyzer market with detailed profiles of all major companies, including:

- ABB Group

- Ametek Inc.

- Emerson Electric Co.

- Endress+Hauser AG

- Honeywell International Inc.

- Horiba Group

- Mettler Toledo SA

- Schneider Electric SE

- Siemens AG

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Latest News and Developments:

- October 2024: AMETEK Process Instruments introduced the 3050-OLV, the advanced quartz crystal microbalance (QCM) moisture analyzer, engineered for industrial applications and characterized by precision, improved design, and ATEX/IECEx Zone 1 certification for hazardous areas.

- August 2024: The German sensor company SICK and the Swiss automation leader Endress+Hauser announced a strategic partnership. Under this agreement, the former will worldwide manage sales and service for SICK's process analyzers and gas flowmeters, supported by a joint venture for production and development. The deal is awaiting an antitrust approval by year-end.

- May 2024: Honeywell partners with Enel North America to enhance building automation and demand response solutions for commercial and industrial organizations by using automation to control and regulate energy loads to help stabilize the power grid. This strategic partnership leverages Enel’s global leadership in demand response and Honeywell’s renowned automation systems to deliver solutions to customers that improve energy efficiency, flexibility, and revenue generation potential.

- November 2023: Thermo Fisher Scientific Inc. formed a strategic partnership with Flagship Pioneering to develop and commercially scale multiproduct platforms on an accelerated basis. Through this collaboration, the companies worked together to create new platform companies focusing on novel tools and capabilities that seek to power the biotech ecosystem and accelerate the development of first-in-class therapies.

- September 2023: ABB partnered with Porsche Consulting. The partnership leverages best practices from the automotive industry for a new manufacturing line for ABB’s process and laboratory analyzers in Canada. The partnership establishes new benchmarks for innovation in the analytical sector and reinforces ABB's leadership in the analyzer market.

Process Analyzer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, United States, Canada, Turkey, Saudi Arabia, Iran, United Arab Emirates, Brazil, Mexico, Argentina, Colombia, Chile, Peru |

| Companies Covered | ABB Group, Ametek Inc., Emerson Electric Co., Endress+Hauser AG, Honeywell International Inc., Horiba Group, Mettler Toledo SA, Schneider Electric SE, Siemens AG, Teledyne Technologies, Inc., Thermo Fisher Scientific Inc., Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the process analyzer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global process analyzer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the process analyzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The process analyzer market was valued at USD 7.49 Billion in 2024.

The process analyzer market is expected to value USD 12.02 Billion and exhibit a CAGR of 5.36% during 2025-2033.

Key factors driving the market include the increasing complexity of industrial processes, demand for real-time data to optimize operations, stringent environmental regulations, the need for improved quality control, product consistency, enhanced safety measures, and the growing adoption of automation and digitalization across various industries.

North America currently dominates the process analyzer market, accounting for a share of over 32.0% in 2024. This dominance is fueled by a robust industrial base, stringent environmental regulations, advanced technological adoption, and significant investments in automation and efficiency improvements.

Some of the major players in the process analyzer market include ABB Group, Ametek Inc., Emerson Electric Co., Endress+Hauser AG, Honeywell International Inc., Horiba Group, Mettler Toledo SA, Schneider Electric SE, Siemens AG, Teledyne Technologies, Inc., Thermo Fisher Scientific Inc., and Yokogawa Electric Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)