Pro Speakers Market Size, Share, Trends and Forecast by Product, Format, Amplification Method, Distribution Channel, End User, and Region, 2025-2033

Pro Speakers Market Size and Share:

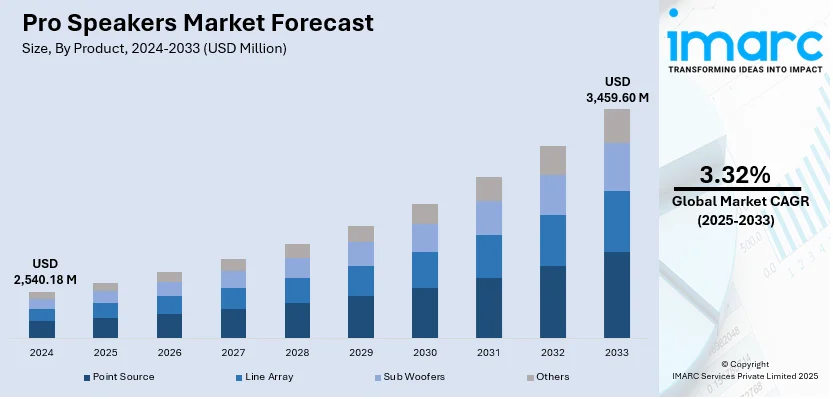

The global pro speakers market size was valued at USD 2,540.18 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,459.60 Million by 2033, exhibiting a CAGR of 3.32% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The increasing demand for professional audio speakers in the commercial sector, various innovations in wireless digital technology, and the integration of the Internet of Things (IoT) with professional audio equipment are some of the factors propelling the pro speakers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,540.18 Million |

|

Market Forecast in 2033

|

USD 3,459.60 Million |

| Market Growth Rate (2025-2033) | 3.32% |

The market for pro speakers is driven by a growing need for quality audio solutions in concerts, corporate events and public assemblies. The surge in live music events and esports competitions drives market growth. Advances in technology such as wireless and smart speakers improve convenience and performance. Market growth is driven by growth in the entertainment industry, digital audio network adoption and AI-enabled sound optimization integration. Growing investment in stadiums, auditoriums and broadcast infrastructure also propels market growth. For instance, the Odisha government has announced a Rs 4,124-crore project to build stadiums in all 314 blocks over five years. This has led to an increase in the demand for pro speakers in stadiums to amplify music or voices.

The United States has emerged as a leading market for pro speakers due to the increasing need for high-performance audio systems in concerts corporate events and sports stadiums. Live music festivals, esports tournaments and streaming events drive market growth. For instance, in June 2024, Pro Audio Technology launched a new line of commercial loudspeakers at InfoComm targeting DJing, corporate venues and hospitality events. The compact and high-output speakers offer premium sound quality and flexible installation options. Key features include ergonomic handles, multiple mounting points and easy portability enhancing audio solutions in various environments. Improvements in wireless connectivity, AI-powered sound optimization and immersive audio technologies boost product uptake. Rising investments in broadcasting infrastructure, stadiums and theme parks coupled with the widespread use of home studios and podcasting also drive market growth further. Furthermore, demand for energy-efficient and durable speakers sustains innovation.

Pro Speakers Market Trends

Growing Product Utilization in the Commercial Sector

The increasing adoption of loudspeakers for communication purposes and the growing utilization of multimedia equipment and digital modes of presentation in the corporate environment, ranging from investor presentations to gamification of employee metrics, are significantly driving the pro speaker market growth. Moreover, acoustic communication systems, such as conferences, seminars, and attending events with large audiences, have elevated the use of pro speakers to a considerable extent. Various key manufacturers are introducing pro speakers with improved sound quality and functionality to cater to the bolstering demand. For instance, in July 2022, Canadian audio company PSB unveiled the Passif 50 loudspeaker, featuring a titanium dome tweeter that utilizes a powerful neodymium magnet and ferrofluid for enhanced performance, better power management and lower distortion. Similarly, in May 2022, Simaudio launched the Voice 22 loudspeakers under their Moon brand. The Voice 22 designed for stand mounting showcases 40 years of sound engineering expertise. Its innovative Hover Base design ensures stability and minimizes vibration making it suitable for placement on any surface.

Increasing Adoption of Music Production and Recording Procedures

The growing internet penetration and the rising trend of digitalization are further augmenting the adoption of pro speakers especially in the music industry. Physical music revenue is continuously declining and online streaming platforms like Spotify, Apple Music, YouTube Premium and Tindle are gaining immense traction. In a press release, Spotify announced that by the second quarter of 2019 its global paid subscriber count hit 108 million reflecting an increase of more than 8% from the prior quarter. Such a surge in the adoption of music is anticipated to give rise to music concerts and at the same time augment the need for music production and recording equipment. This in turn provides lucrative growth opportunities for the professional speakers market. In addition to this, various companies in the music business are extensively making strategic partnerships with music streaming service providers to launch new products and increase the consumer base. For example, Napster, an online music service partnered with Sony Music to introduce its new 360 Reality Audio streaming format aimed at consumer businesses. In line with this, in October 2022, Electro-Voice launched the EVERSE 8 an innovative line of weather-resistant and battery-operated speakers equipped with Bluetooth capabilities. These speakers are ideal for various applications including live performances, sound reinforcement, audio streaming and use by DJs, musicians and production and rental companies.

Emergence of Wireless Digital Technology

The increasing demand for wireless audio technology on account of the rising preference for portable gadgets and the shift in customer media consumption habits is further providing lucrative growth opportunities to the overall market. Consumers are increasingly utilizing smartphones, tablets and computers to broadcast audio on loudspeakers wirelessly. Such user behavior is propelling the need for Wi-Fi and Bluetooth-enabled speakers. In response to this demand various key market players are launching compact and wireless sound systems. In August 2022, JBL introduced a 3D soundbar featuring JBL 1000. The JBL Bar 1000, which boasts a 7.1.4-channel system, provides an authentic home theater experience without any wires, thanks to its four up-firing speakers that deliver Dolby Atmos and DTS:X 3D audio. In addition to this, the emerging trend of voice-assisted speakers is creating a positive outlook for the overall market. Bose has recently launched the Smart Soundbar 900, which includes Dolby Atmos technology and supports voice control via Google Assistant and Alexa. The soundbar also offers Wi-Fi and Bluetooth connectivity, features an intuitive app for touch control, and is compatible with Spotify Connect and AirPlay 2. Ongoing innovations in wireless technology are projected to catalyze the pro speakers market demand in the coming years.

Pro Speakers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pro speakers market report, along with forecasts at the global, regional and country levels from 2025-20333. Our report has categorized the market based on product, format, amplification method, distribution channel, and end user.

Analysis by Product:

- Point Source

- Line Array

- Sub Woofers

- Others

Point source leads the market with around 38.6% of market share in 2024. Point source speakers dominate the pro speakers market owing to their sleek design accurate sound dispersal and convenient installation in a wide range of applications. They are suitable for concerts, auditoriums, houses of worship and corporate events because of their ability to provide reliable audio clarity with negligible phase interference. In contrast to line arrays point source speakers offer equal coverage in small to medium-sized venues making them less complex to set up and cost less. Technological developments in DSP (digital signal processing) and coaxial driver technology also add to their market value.

Analysis by Format:

- Digital

- Analog

Digital leads the market with around 57.8% of market share in 2024. Digital format leads the pro speakers market because of its better sound quality, low latency and compatibility with contemporary audio systems. Digital speakers have superior signal processing minimizing noise and distortion and allowing real-time tweaking using software. Increasing use of digital audio networks such as Dante and AES67 enables multi-device connectivity a factor that has made them popular for concerts, corporate events and broadcasting. Growing demand for smart and wireless speakers coupled with developments in AI-driven audio optimization adds to market expansion further.

Analysis by Amplification Method:

- Passive Speakers

- Powered Speakers

Passive speakers are key segment in the pro speakers market due to their versatility and expandability in big sound systems. They need external amplifiers which enable users to tailor power output and signal processing according to the needs of a venue. They see extensive applications in concerts, stadiums and fixed installations where centralized control is vital. Passive speakers provide cost savings and simplicity of maintenance a popular option among professional sound engineers dealing with complicated audio systems in live and installed applications.

Powered speakers are increasingly popular in the pro speakers market because of their onboard amplifiers, easy setup and lower equipment needs. They provide plug-and-play simplicity which makes them suitable for mobile DJs, small venues and corporate events. DSP technology integrated into them improves sound quality through frequency response optimization and reduction of distortion. With the advancement of Bluetooth and wireless connectivity powered speakers facilitate flexible configuration which makes them ideal for live performances, conferences and portable use with rapid setup and minimal cabling.

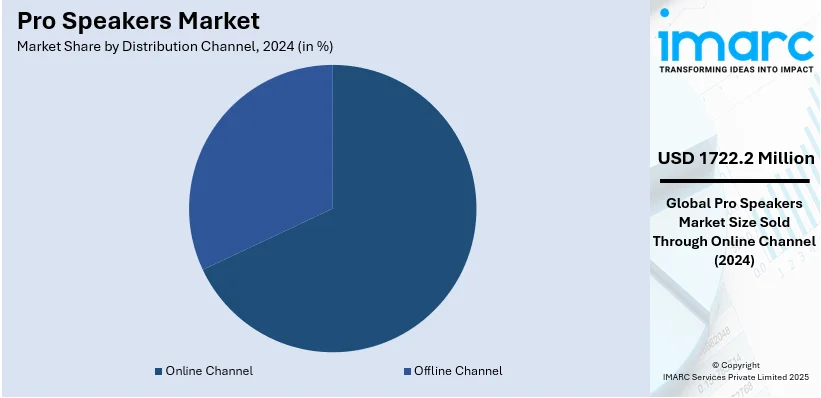

Analysis by Distribution Channel:

- Online Channel

- Offline Channel

Online channel leads the market with around 67.8% of market share in 2024. The pro speakers market is dominated by the online channel because of the growing trend towards e-commerce websites, direct-to-consumer sales and digital marketing tactics. Competitive prices, large product offerings, reviews and door-step delivery attract consumers promoting increased adoption. Top manufacturers utilize Amazon, eBay and brand websites for international reach. Growth in virtual demonstrations, AI-based recommendations and hassle-free return policies also fuels online sales. Furthermore, one-on-one partnerships with event experts and bulk-buying provision further fuel the online market's development.

Analysis by End User:

- Corporates

- Large Venues and Events

- Educational Institutes

- Government and Military

- Studio and Broadcasting

- Hospitality

- Others

The corporate dominates the pro speakers market owing to the growing need for excellent audio solutions during conferences, seminars and business meetings. Organizations spend on sound systems with better technology to upgrade communication, presentation and video conferencing. The increasing adoption of hybrid working models and video conferencing systems fuels the demand for high-end audio clarity. Integration with online platforms, wireless connectivity and voice speaker technology also supports business demand thus making this segment a significant force behind market growth.

Regional Analysis

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. North America holds the largest share in the pro speakers market due to the strong presence of leading manufacturers, high consumer spending on entertainment and widespread adoption of advanced audio technologies. The region's thriving live events industry including concerts, corporate conferences and esports drives demand. Increasing investments in smart venues, digital audio networks and immersive sound experiences further boost market growth. Additionally, the rising number of music festivals, theatres and broadcasting studios strengthens North America's dominance in the industry.

Key Regional Takeaways:

United States Pro Speakers Market Analysis

In 2024, the United States accounted for over 84.20% of the pro speakers market in North America. The market is growing as high demand is now paid for in areas of corporate training, motivational speaking, and leadership development. The U.S. Bureau of Labor Statistics anticipates consistent job growth in the speaking and training sector as organizations increasingly focus on enhancing workforce skills. Additionally, virtual conferences and hybrid events are boosting engagement with speakers. Corporations pay a lot for the keynote sessions to keep the level of efficiency as high as possible. As per reports, top speakers can command fees exceeding USD 50,000 per event. The sector is profitable, and organizations are still looking for expert-led training in sales, leadership, and personal development. Top influences in the industry include Tony Robbins and Simon Sinek; however, new voices continue to find significant support online. These big names are also supported by corporate sponsorships and publishing deals. The U.S. is the largest global market for professional speakers, and companies use speaking engagements to improve employee performance and business strategy.

Europe Pro Speakers Market Analysis

Professional speaking in Europe is on the rise as companies increase their focus on leadership development, personal growth, and industry know-how. A recent industry analysis reveals that in 2023, corporate training expenditures in Europe reached USD 34.2 billion, with keynote speakers playing a crucial role in executive education. The highest demand is observed in the UK, Germany, and France. Companies are making investments in keynoters to be used during conferences and summits on leadership. Digital transformation has led to growth in online speaking engagements, increasing audience reach. Premium fees are commanded by high-profile speakers such as Richard Branson and Yuval Noah Harari, while TEDx events and industry forums open up opportunities for new voices. The European market also demands multilingual speakers who can cater to the diverse corporate environments. With government initiatives promoting professional education and skill development, the region remains a strong contributor to the global speaking industry.

Asia Pacific Pro Speakers Market Analysis

The Asia Pacific pro speakers market is growing at a tremendous rate due to increased corporate training investments and the increasing emphasis on upskilling the workforce. As reported by the National Bureau of Statistics of China, the number of employed individuals in China reached 740.41 million in 2023. This signifies a substantial labor force that requires ongoing skill development. India, Japan, and Australia are also witnessing increased demand for leadership training, executive coaching, and motivational speaking as companies focus on employee engagement and performance improvement. The adoption of digital platforms has allowed virtual speaking engagements, making professional speakers more accessible across the region. Moreover, multinational corporations are working with local training firms to deliver region-specific content, which further provides a favorable pro speakers market outlook. These also comprise government initiatives at promoting professional development and increased numbers of corporate events, conferences, and summits, and further propel demand for expert speakers; Asia Pacific therefore remains at the forefront in this global industry for professional speakers.

Latin America Pro Speakers Market Analysis

Corporate training programs and leadership development initiatives in Latin America represent a growing professional speakers market. In 2023, the Brazilian Institute of Geography and Statistics (IBGE) indicated that approximately 100.7 million individuals were part of the workforce in Brazil, highlighting a significant population in search of professional development opportunities. More Brazilian, Mexican, and Argentinean companies are turning to executive coaching, sales training, and motivational programs for the employees to work more productively. Entrepreneurial and startup trends have also pushed demand for business coaching and motivational speakers. With digital transformation and the rise of virtual speaking events, it's easier for more people to become inspirational speakers today. International conferences and summits on leadership are now also spreading throughout Latin America, drawing international speakers to the region. Government-led initiatives for professional development and corporate sponsorships with training organizations further help to solidify the market in the region as an emerging source of professional speaking engagements.

Middle East and Africa Pro Speakers Market Analysis

The Middle East and Africa pro speakers market is gaining pace with increasing corporate training programs, leadership development, and workforce initiatives from government. According to information from the Ministry of Human Resources and Emiratisation (MoHRE), the number of Emirati employees in the private sector of the UAE saw an impressive increase of 157% in 2023. This has reached approximately 92,000, marking significant growth compared to the figures from 2021.This reflects the region's focus on workforce nationalization and professional development. Countries like Saudi Arabia and South Africa are investing in executive education and motivational speaking engagements to increase business leadership and entrepreneurship. More global businesses and multinational corporations bring demand for the corporate training event, conferences, and summits. Digitalization is further able to make it possible to create virtual speaking engagement opportunities, therefore making professional speakers more accessible. Government initiatives on skills enhancement and corporate partnerships with international training organizations are strengthening the market growth in the region, positioning it as a key hub for professional development.

Competitive Landscape:

The pro speakers market is highly competitive with key players focusing on innovation, strategic partnerships and product diversification. Major companies dominate the market through advanced audio technologies, digital integration and smart speaker solutions. Competition is driven by technological advancements including DSP-based enhancements, wireless connectivity and AI-driven sound optimization. Companies are expanding their product portfolios to cater to various applications from live events to corporate and entertainment sectors. Mergers, acquisitions and collaborations with event organizers and streaming platforms further strengthen market positioning and drive industry growth.

The report provides a comprehensive analysis of the competitive landscape in the pro speakers market with detailed profiles of all major companies, including:

- B&c Speakers

- B&W Group Ltd.

- Bose Corporation

- CELTO Acoustique Ltd.

- CODA Audio GmbH

- D&B Audiotechnik GmbH & Co. KG

- K-Array

- Klipsch Group Inc. (Voxx International)

- L-Acoustics Group

- Meyer Sound Laboratories Incorporated

- Renkus-Heinz Inc.

- Sennheiser electronic GmbH & Co. KG

- Sony Group Corporation

- Yamaha Corporation

Latest News and Developments:

- February 2025: CODA Audio introduced the APS-Pro Series loudspeakers, which feature the APS-Pro-D model with a 10-degree angle for long-range sound and the APS-Pro-S model with a 30-degree angle for nearfield coverage. Both are three-way designs equipped with DDC Wave Driver technology, Instafit APS-Couplers that allow for adjustable coverage, and Dynamic Airflow Cooling for improved power handling and performance.

- December 2024: Bowers & Wilkins launched the Zeppelin Pro Edition, which boasts Titanium Dome tweeters, 90mm midrange drivers utilizing FST technology, and a 150mm subwoofer. Available in Solar Gold and Space Grey, it also includes a customizable downlight with 15 color options, enhancing both its aesthetic appeal and functionality.

- November 2024: Bose Corporation announced its acquisition of McIntosh Group, a prominent name in high-performance luxury audio. This merger brings together 175 years of experience, allowing Bose to enhance its premium offerings with McIntosh’s high-end amplifiers, speakers, and turntables, thereby solidifying its position in the luxury audio sector.

- April 2024: Electrotec Audio revealed its new STAGE ONE wireless portable Bluetooth speaker, designed for both professional and consumer use, which is now available for pre-order via Electrotec’s Kickstarter campaign.

- January 2024: Endefo, based in Dubai, unveiled two new audio products at the Mobile India Expo in Delhi: the Entun’z Mega Pro and Double Barrel party speakers. These products can be accessed on their website, covering 19,000 Indian postal codes, and will soon be available at over 2000 retail locations, including Sangeetha Mobiles, Supreme Paradise, Lot Mobile, Nandilath Digital, Ideal Home Appliances, Easy Store, Gulf Own Digital, and Image Mobiles and Computers.

Pro Speakers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Point Source, Line Array, Sub Woofers, Others |

| Formats Covered | Digital, Analog |

| Amplification Methods Covered | Passive Speakers, Powered Speakers |

| Distribution Channels Covered | Online Channel, Offline Channel |

| End Users Covered | Corporates, Large Venues and Events, Educational Institutes, Government and Military, Studio and Broadcasting, Hospitality, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B&c Speakers, B&W Group Ltd., Bose Corporation, CELTO Acoustique Ltd., CODA Audio GmbH, D&B Audiotechnik GmbH & Co. KG, K-Array, Klipsch Group Inc. (Voxx International), L-Acoustics Group, Meyer Sound Laboratories Incorporated, Renkus-Heinz Inc., Sennheiser electronic GmbH & Co. KG, Sony Group Corporation, Yamaha Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pro speakers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pro speakers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the pro speakers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pro speaker market was valued at USD 2,540.18 Million in 2024.

IMARC estimates the pro speakers market to reach USD 3,459.60 Million by 2033, exhibiting a CAGR of 3.32% during 2025-2033.

The pro speakers market is driven by rising demand for high-quality audio in live events, corporate conferences, and entertainment venues. Advancements in digital signal processing, wireless technology, and AI-driven sound optimization enhance performance. Increasing investments in smart venues, esports, and streaming services further fuel market growth.

North America accounted for the largest market share of over 35.0%, driven by a strong presence of key manufacturers, high consumer spending on entertainment, and widespread adoption of advanced audio technologies. The region's thriving live events industry, corporate sector demand, and increasing investments in smart venues, digital audio networks, and immersive sound experiences further contribute to its market leadership.

Some of the major players in the pro speakers market include B&c Speakers, B&W Group Ltd., Bose Corporation, CELTO Acoustique Ltd., CODA Audio GmbH, D&B Audiotechnik GmbH & Co. KG, K-Array, Klipsch Group Inc. (Voxx International), L-Acoustics Group, Meyer Sound Laboratories Incorporated, Renkus-Heinz Inc., Sennheiser electronic GmbH & Co. KG, Sony Group Corporation, Yamaha Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)