Private Tutoring Market Size, Share, Trends and Forecast by Learning Method, Course Type, Application, End User, and Region, 2026-2034

Private Tutoring Market Size and Share:

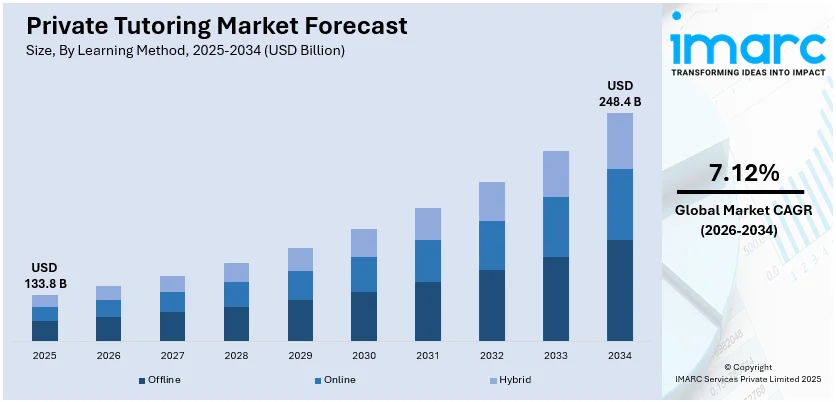

The global private tutoring market size was valued at USD 133.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 248.4 Billion by 2034, exhibiting a CAGR of 7.12% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 35.5% in 2025. The rising competition faced by students, the lack of adequate educational infrastructure, and innovative technological advancements in the industry represent some of the key factors propelling the private tutoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 133.8 Billion |

|

Market Forecast in 2034

|

USD 248.4 Billion |

| Market Growth Rate (2026-2034) | 7.12% |

The private tutoring industry is growing with rising competition in academic tests, higher disposable income and increasing parental investment in education. Demand for one-on-one learning, web-based tutoring services and artificial intelligence-based adaptive learning solutions is driving market growth faster. For instance, in October 2024, UCL startup Medly AI raises £1.2 million to enhance educational equity through its AI-powered tutoring platform aiding students preparing for GCSEs, A-levels and IB exams. Co-founders Kavi Samra and Paul Jung aim to provide personalized learning for all backgrounds having already supported over 10,000 students to improve their scores. Government policies in favor of e-learning, higher student enrollment in competitive test preparation and pressure on academic performance also push the market. Moreover, advances in technology availability of online content and a move towards hybrid learning models are responsible for the industry's ongoing growth.

To get more information on this market Request Sample

The United States private tutoring industry is expanding based on increased academic competition heightened demand for preparation in standardized tests (SAT, ACT, GRE) and a movement towards personalized learning. Online tutoring platforms' expansion, AI-driven adaptive learning and higher disposable income propel private tutoring market growth. For instance, in October 2024, FEV Tutor announced significant results from a study with Stanford University showing its AI-powered Tutor CoPilot improved K-12 math tutoring outcomes by an average of 9 percentage points for less-experienced tutors. The cost-effective platform enhances educational accessibility integrating real-time guidance into sessions and supporting underserved communities. Tutor CoPilot is now live for all users. Parental focus on academic excellence, higher supplementary education enrollment and specialized tutoring demand for science, technology, engineering and mathematics (STEM) subjects fuel the demand further. Also, government aid for e-learning and flexible hybrid tutor-based models drives long-term growth in the market.

Private Tutoring Market Trends:

Growing Demand for STEM and Test Preparation Tutoring

One of the main factors driving the need for private tutoring is the growing significance of STEM education and standardized test preparation. Students look for specialized tutoring to succeed in areas like science, math, and coding because of the competitive academic settings in nations like the U.S., China, and India. The need for private tutoring services is also being fueled by entry exams for higher education, such as the SAT, ACT, GRE, GMAT, and entrance exams for engineering or medicine. In the U.S., the number of students taking the SAT exceeded 1.9 million in 2023, while over 2 million students attempted the ACT, highlighting the demand for test preparation services, as per reports. In order to guarantee academic achievement and professional preparedness, parents are becoming more and more willing to spend money on individualized education. Additionally, this tendency has been strengthened by government programs supporting STEM education and the growing demand for digital literacy, making STEM-focused tutoring a rapidly expanding market niche within the private tutoring industry.

Rising Adoption of Online Tutoring Platforms

The use of online tutoring platforms has increased dramatically as a result of the increased dependence on digital learning resources. Personalized learning experiences catered to each student's needs are becoming possible because to developments in artificial intelligence, machine learning, and data analytics. Online tutoring is becoming more productive and engaging thanks to features like AI-driven tests, interactive video courses, and immediate tutor help. In 2023, over 12 million students in India joined online tutoring programs, highlighting the growing trend towards digital education. Furthermore, there has been a positive private tutoring market outlook due to the flexibility of learning from home and the availability of professional tutors from across the globe. Additionally, parents and kids favor online tutoring due to its affordability and scalability, especially in areas where access to high-quality in-person tutoring is scarce. This tendency will be further propelled by the development of 5G connectivity and enhanced digital infrastructure.

Expansion of Hybrid Tutoring Models

The flexibility and efficacy of hybrid tutoring methods, which combine online and in-person education, are making them more and more popular. Using digital tools for practice, evaluation, and remote support, this method enables students to receive in-person instruction. With planned in-person sessions for conceptual clarity and the ability to learn independently using online resources, hybrid tutoring accommodates a variety of learning styles. In 2023, enrollments in hybrid tutoring rose by 35% compared to the previous year in the U.S., reflecting robust market acceptance, according to an industry report. Hybrid models are being used by private tutoring facilities, edtech businesses, and schools to improve accessibility and affordability. The convenience and financial benefits that come with this strategy are also valued by parents and students. As AI-powered learning analytics become more integrated, hybrid tutoring is anticipated to expand, bridging the gap between digital and traditional schooling for a more thorough educational experience.

Private Tutoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global private tutoring market report, along with forecasts at the global, regional and country level from 2026-2034. Our report has categorized the market based on learning method, course type, application, and end user.

Analysis by Learning Method:

- Offline

- Online

- Hybrid

Offline leads the market with around 76.5% of market share in 2025. Offline tutoring dominates the private tutoring market due to its effectiveness in personalized learning, direct student-teacher interaction, and structured environments. Many parents and students prefer face-to-face tutoring for better engagement, immediate feedback, and customized instruction. Traditional in-person tutoring remains strong in competitive exam preparation, subject-specific coaching, and skill-based learning, particularly in high-income households. Schools and coaching centers continue to integrate private tutoring into academic programs, reinforcing its dominance. While online tutoring is growing, challenges like screen fatigue, lack of hands-on guidance, and digital access limitations contribute to offline tutoring maintaining its lead, especially in regions with strong academic cultures.

Analysis by Course Type:

- Curriculum-Based Learning

- Test Preparation

- Others

The market for curriculum-based private tutoring is growing as students look for customized academic assistance based on school syllabi. The segment is helped by growing parental investment in education, especially in core subjects such as mathematics, science, and language arts. The use of AI-powered adaptive learning and online platforms increases engagement, enhancing student performance and retention.

The segment of test preparation is growing as there is increased competition for college and professional certifications. SAT, ACT, GRE, GMAT, and medical and engineering entrance tests are in high demand. Growth is driven by online tutoring services, AI-driven performance monitoring, and customized study plans. Flexible hybrid models of learning improve accessibility for students from different demographics.

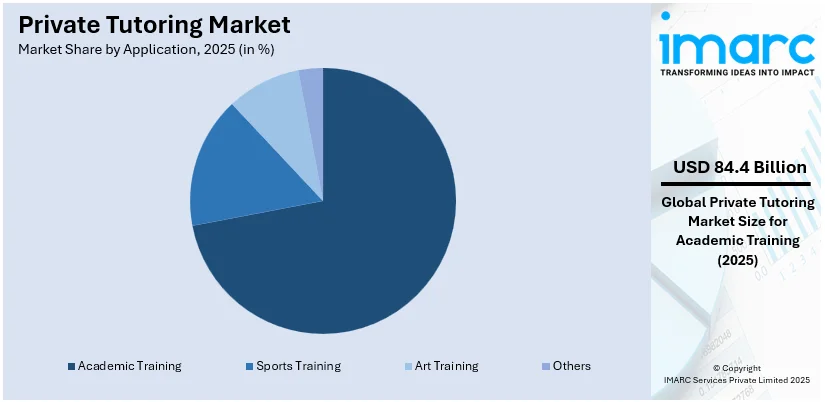

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Academic Training

- Sports Training

- Art Training

- Others

Academic training leads the market with around 67.8% of market share in 2025. Academic training dominates the private tutoring market as students seek additional support to excel in school curricula and standardized exams. Rising parental investment in education, growing competition for college admissions, and increasing demand for STEM tutoring fuel market growth. Online platforms, AI-driven personalized learning, and hybrid tutoring models enhance accessibility and effectiveness. Schools and private institutions increasingly collaborate with tutoring services to bridge learning gaps. Additionally, government initiatives promoting digital education and skill development further strengthen the market for academic training.

Analysis by End User:

- Pre-School Children

- Primary School Students

- Middle School Students

- High School Students

- College Students

- Others

Preschool private tutoring is on the rise as parents increasingly value early childhood education for brain development and fundamental skills. Digital platforms and interactive content drive the demand for language learning, numeracy, and creative education. Online tutoring and customized learning strategies increase engagement and promote early school readiness.

Primary school tutoring is on the rise as parents look for academic support in areas such as mathematics, reading, and science. The proliferation of online platforms, gamification, and adaptive AI tools boosts interest. Bilingual education, STEM enrichment, and homework help are in demand, fueled by rising academic pressure and parental expectations.

Middle school tutoring is picking up as students prepare for advanced classes and standardized tests. The move toward STEM learning, coding, and subject-specific tutoring is fueling demand. Hybrid models of online and in-class instruction enhance access. Competitive test preparation and skill development programs further fuel market growth.

Private tutoring among high school students is driven by the demand for college entrance examination preparation (SAT, ACT, AP) and subject-specific help. Customized learning, AI-based assessment technology, and hybrid tutoring models drive student performance. Increasing academic competition, career-oriented skill building, and the push for STEM education further increase demand in this space.

College students approach private tutoring for niche subjects, professional certification tests, and career-oriented training. GRE, GMAT, MCAT, and LSAT coaching demand is increasing. Flexible schedules, peer-to-peer tutoring, and AI-based analytics offered by online platforms are becoming popular. Academic mentorship and skill-based learning programs drive market growth in higher education.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 35.5%. Asia Pacific leads the private tutoring market due to intense academic competition, high parental spending on education, and a strong culture of supplementary learning. Countries like China, India, South Korea, and Japan drive demand, particularly for test preparation and STEM subjects. The rise of online tutoring platforms, government initiatives supporting digital education, and increasing student enrollment in private coaching centers further boost market growth. Technological advancements, AI-driven personalized learning, and hybrid tutoring models enhance accessibility, making the region the dominant player in the global market.

Key Regional Takeaways:

North America Private Tutoring Market Analysis

The North American private tutoring market is experiencing strong growth, driven by increasing demand for personalized education and digital learning solutions. The region's focus on academic excellence, standardized test preparation, and skill-based learning fuels the expansion of tutoring services. The rise of online platforms has transformed the industry, making tutoring more accessible and flexible for students across different educational levels. High-income households continue to invest in private tutoring, while concerns over learning gaps have led to increased adoption of supplemental education. AI-driven adaptive learning and interactive digital platforms are enhancing engagement, improving student outcomes. Private tutoring companies are also expanding internationally, leveraging technology to offer customized learning experiences. Government initiatives supporting remote education and edtech innovation further contribute to market growth.

United States Private Tutoring Market Analysis

In 2025, the United States accounted for 87.40% of private tutoring market in the North America. The private tutoring demand in the US is escalating with the growing personalized education and test prep. In 2023, U.S. education spending exceeded USD 800 billion, reflecting a strong investment in supplemental learning such as tutoring services. Online tutoring platforms like Varsity Tutors and Chegg are gaining popularity, and test preparation for the SAT, ACT, and AP exams remains profitable, with 1.9 million students participating in the SAT. High income households and concerns about education disparities post pandemic are stabilize the market. Federal initiatives for education technology and remote learning are also driving growth. US based tutoring companies are looking to expand internationally using AI driven adaptive learning to increase student engagement and outcomes.

Europe Private Tutoring Market Analysis

The private tutoring market in Europe is booming due to increasing academic competition and digital learning. In 2023, government expenditure on education in the European Union was recorded at 4.7% of GDP, encompassing both public and private educational institutions, as reported by Eurostat. Germany's emphasis on STEM (Science, Technology, Engineering, and Mathematics) education has led to an increased demand for specialized tutors, particularly in mathematics and science subjects. Meanwhile, in the UK, the tutoring industry has benefited from the National Tutoring Programme (NTP), which was part of a £1.7 billion (approximately USD 1.7 billion) government initiative aimed at helping students recover from learning disruptions caused by the pandemic, according to the UK Department for Education. For the 2023/24 academic year, the NTP subsidized up to 50% of tuition costs for state-funded schools. France has also seen an increase in tutoring demand with over 1 million students doing private lessons especially in language learning. MyTutor and GoStudent are leading the way with AI driven tutoring models to personalise learning. EU edtech regulations on data privacy mean digital tutoring services have to be secure and effective remote learning solutions.

Latin America Private Tutoring Market Analysis

The need for individualized instruction and growing academic rivalry are driving the growth of the private tutoring industry in Latin America. In 2022, Brazil allocated R$490 billion (USD 84.71 billion) to public education, which accounted for nearly 4.9% of its GDP, as reported in the Brazilian Basic Education Yearbook 2024. Despite the continued dominance of public investment, the development of the middle class and the acceptance of digital learning are driving an increase in private education spending. Due to the large number of students studying for university admission examinations, the tutoring industry in Mexico is expanding. The need for language instructors has increased as bilingual schooling has grown in Argentina and Chile. Prominent websites like Tutor.com and Descomplica are profiting from the surge in online tutoring. Digital learning is emphasized by government-backed school changes in Mexico and Brazil, which encourage hybrid tutoring methods. The market for tutoring in the area is poised for further growth as online education infrastructure improves and disposable incomes rise.

Middle East and Africa Private Tutoring Market Analysis

The increased need for digital learning tools and foreign curricula is driving the growth of the private tutoring industry in the Middle East and Africa. The UAE's commitment to academic achievement is evident in the allocation of USD 2.7 billion, which represents 15.5% of the total budget for the education sector in the 2023 federal budget, according to industry reports. The focus on education reform in Saudi Arabia's Vision 2030 is increasing demand for private instructors, particularly in STEM fields. Online tutoring services that help students get ready for national and international exams have become more popular in Egypt and South Africa. The growth of AI-powered tutoring services and digital learning resources is changing the educational scene in the area. Leading providers are using hybrid learning methods to increase access to high-quality tutoring, such as Orcas and Noon Academy. Initiatives for education supported by the government and rising internet usage also help to market expansion, positioning the region as a key player in the global private tutoring industry.

Competitive Landscape:

The private tutoring market is highly competitive, driven by a mix of established education service providers, online tutoring platforms, and emerging EdTech startups. Companies differentiate through AI-driven personalized learning, interactive digital content, and hybrid tutoring models. Market players focus on expanding subject offerings, integrating adaptive learning technologies, and enhancing accessibility through mobile and web platforms. Strategic partnerships with schools, universities, and government initiatives further strengthen market presence. The rise of subscription-based models and on-demand tutoring services increases competition. Regional and international providers compete by leveraging localized content, multilingual support, and customized learning solutions to attract diverse student demographics.

The report provides a comprehensive analysis of the competitive landscape in the private tutoring market with detailed profiles of all major companies, including:

- Ambow Education Holding Ltd.

- American Tutor Inc.

- Chegg Inc.

- Club Z! Inc.

- Daekyo Co. Ltd.

- Eduboard.com

- EF Education First

- iTutorGroup Inc.

- Kaplan Inc.

- New Oriental Education & Technology Group Inc.

- TAL Education Group

Recent Developments:

- January 2025: EF Dubai has relaunched its upgraded language campus, providing international students with immersive English learning opportunities. Situated in Internet City, the institution offers customized courses, state-of-the-art facilities, and rich cultural experiences. With streamlined visa processes and various accommodation choices, EF Dubai is dedicated to promoting both academic and personal development.

- October 2024: Ambow Education announced a licensing agreement worth USD 1.3 million, renewable annually, with Singapore-based Inspiring Futures Pte. Ltd. for HybriU AI UniBox. This AI-powered educational solution enhances remote learning through 3D technology, increasing HybriU’s footprint in the global digital education sector, with a particular focus on expanding in the U.S.

- October 2024: Club Z! In-Home Tutoring Services, a prominent tutoring franchise in the U.S. since 1995, provides personalized academic assistance across various subjects. The company is also offering franchise opportunities to meet the rising demand for customized educational support.

Private Tutoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Learning Methods Covered | Online, Blended, Others |

| Course Types Covered | Curriculum-Based Learning, Test Preparation, Others |

| Applications Covered | Academic Training, Sports Training, Art Training, Others |

| End Users Covered | Pre-School Children, Primary School Students, Middle School Students, High School Students, College Students, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ambow Education Holding Ltd., American Tutor Inc., Chegg Inc., Club Z! Inc., Daekyo Co. Ltd., Eduboard.com, EF Education First, iTutorGroup Inc., Kaplan Inc., New Oriental Education & Technology Group Inc., Tal Education Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the private tutoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global private tutoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the private tutoring industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The private tutoring market was valued at USD 133.8 Billion in 2025.

IMARC estimates the private tutoring market to reach USD 248.4 Billion by 2034, exhibiting a CAGR of 7.12% during 2026-2034.

The private tutoring market is expanding due to rising academic competition, increasing demand for personalized learning, and the growth of online education platforms. AI-driven adaptive learning, higher disposable income, and government support for digital education further drive growth. Test preparation, STEM tutoring, and hybrid learning models also contribute to market expansion.

Asia Pacific dominates the market due to high academic competition, increasing parental spending on education, and rapid adoption of online tutoring platforms. Countries like China, India, South Korea, and Japan are leading this growth, with strong demand for test preparation, STEM tutoring, and AI-driven personalized learning solutions. Government initiatives supporting digital education and the expansion of EdTech platforms further contribute to the region’s dominance in the global private tutoring market.

Some of the major players in the private tutoring market include Ambow Education Holding Ltd., American Tutor Inc., Chegg Inc., Club Z! Inc., Daekyo Co. Ltd., Eduboard.com, EF Education First, iTutorGroup Inc., Kaplan Inc., New Oriental Education & Technology Group Inc. and Tal Education Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)