Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

Private Equity Market Overview:

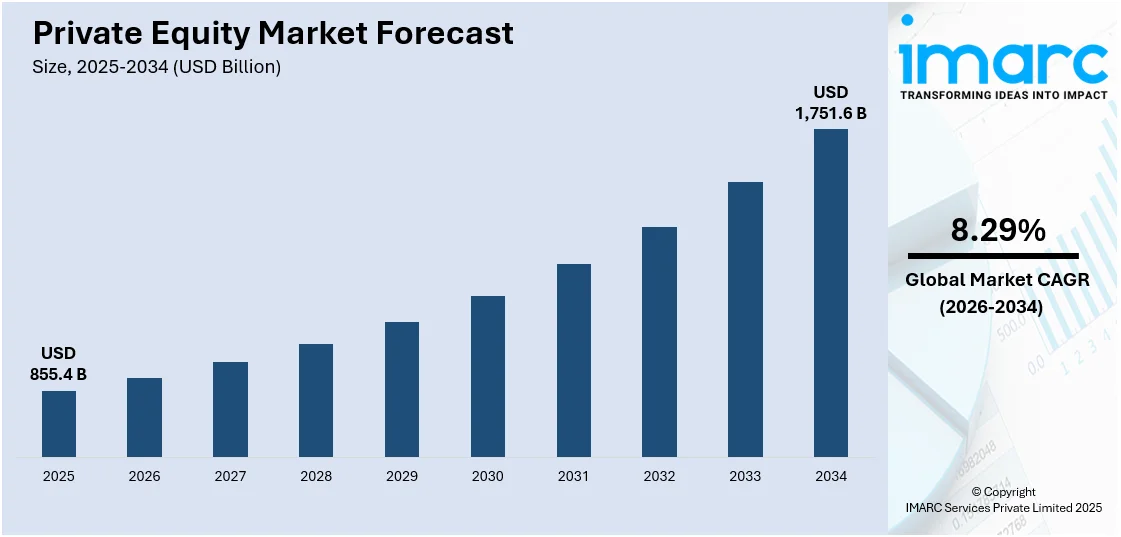

The global private equity market size was valued at USD 855.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,751.6 Billion by 2034, exhibiting a CAGR of 8.29% from 2026-2034. North America currently dominates the market, holding a market share of over 33.8% in 2025. The growth of the North American region is driven by a robust financial ecosystem, significant investor activity, technological advancements, and a focus on innovation across industries like technology and healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 855.4 Billion |

|

Market Forecast in 2034

|

USD 1,751.6 Billion |

| Market Growth Rate 2026-2034 | 8.29% |

The rising demand for alternative investments offering higher returns compared to traditional asset classes is bolstering the private equity market growth. Institutional investors, such as pension funds and sovereign wealth funds, are allocating notable capital to private equity due to its potential for long-term gains. Besides this, technological advancements, including artificial intelligence (AI) and data analytics, are enhancing decision-making and operational efficiencies, making the market more appealing. Additionally, the focus on high-growth sectors, such as technology, healthcare, and renewable energy, is attracting considerable private equity investments. Furthermore, the implementation of favorable regulatory frameworks and tax incentives in key regions is fostering a conducive environment for private equity activity.

To get more information on this market Request Sample

The United States is a key region in the market, driven by robust financial infrastructure, technological innovation, high investor activity, thriving startup ecosystems, and strong demand for sustainable and high-growth investments. Moreover, private equity firms are focusing on funding innovation in supply chains, providing capital and expertise to small businesses. This trend aligns with the growing emphasis on modernizing manufacturing processes and fostering collaborations between industry leaders and private equity stakeholders. In 2024, ASTRO America announced final federal approval for the Stifel North Atlantic AM-Forward Fund to boost additive manufacturing adoption in US supply chains. Backed by Lockheed Martin and GE Aerospace, the fund supports small businesses with capital and technical expertise. Luxembourg's AM 4 AM and Renishaw also advanced 3D printing technologies through funding and material expansions.

Private Equity Market Trends:

Increased Investor Appetite for Alternative Investments

The increasing shift in investor preference for alternative investments, like private equity, is one of the primary market trends. Growing interest in traditional investment options like stocks and bonds on account of their volatility and lower returns due to factors, such as geopolitical uncertainties, fluctuating interest rates, and market saturation is also contributing to the growth of the market. As a result, institutional investors, pension funds, endowments, and high-net-worth individuals are allocating capital to alternative assets, seeking diversification and higher yields to meet their investment objectives. The US private equity deals were valued at USD 611 Billion as of September 30, 2023. In line with this, various key companies are also offering their equity to private players and high-net-worth individuals in order to raise investments and reduce burnout. For instance, Toshiba Corp.’s board has accepted a buyout offer from a group led by private equity firm Japan Industrial Partners, valuing the company at 2 Trillion Yen (USD 15.2 Billion). Such investments are anticipated to propel the private equity market outlook in the coming years.

Pursuit Of Higher Returns Amidst Market Volatility

The unpredictable economic conditions and ongoing market volatility are driving investors to seek alternative avenues for generating superior risk-adjusted returns. Investors are focusing on long-term value creation, streamlining operations, and active management, which can be achieved through investments in private equity since they are more reliable and offer higher yields and capital appreciation. As a result, the US Private Equity Index provided by Cambridge Associates shows that private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020. Additionally, during that same time frame, the Russell 2000 Index, a performance tracking metric for small companies, averaged 6.69% per year, while the S&P 500 returned 5.91%. Moreover, the illiquid nature of private equity investments allows fund managers to pursue contrarian investment opportunities and capitalize on market inefficiencies. This means mitigating short-term market volatility and aligning investor interests with long-term value creation. The growing interest in these opportunities is contributing to the increasing private equity market demand, highlighting the appeal of private equity as a stable and high-return investment option.

Favorable Regulatory Environment Fostering Investment Opportunities

Regulatory reforms and evolving market dynamics are contributing to a favorable environment for private equity investments across the globe. Regulatory changes, such as the relaxation of restrictions on fundraising, the easing of investment barriers, and favorable tax policies, are facilitating the growth of the private equity industry and expanding investment opportunities across geographies and sectors. For instance, Composition Capital, led by Nishita Cummings and Leon Chen, has launched as an independent private equity firm providing growth capital to technology companies. The duo previously managed USD 1.3 Billion across 6 funds at Kayne Partners. Moreover, regulatory authorities in various nations are implementing policies and regulations to regulate and monitor the private equity market. For instance, in August 2023, the U.S. Securities and Exchange Commission (SEC) approved the introduction of the Private Fund Adviser Rules. Private equity market analysis states that these rules will require private equity firms and hedge funds to detail all fees and expenses on a quarterly basis. They also include requirements for detailed performance reports to be published every three months. This will protect investors from miscommunication scenarios and any fraudulent activity. Besides this, advancements in technology and communication have enabled private equity firms to access a broader pool of investment opportunities, conduct due diligence more efficiently, and monitor portfolio performance in real-time, thereby contributing to market growth.

Private Equity Industry Segmentation:

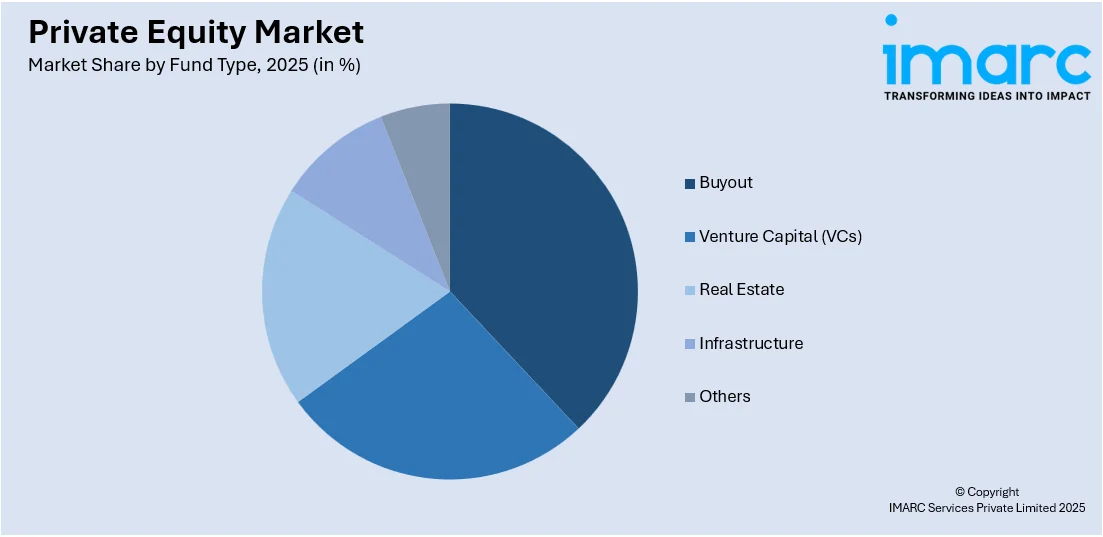

IMARC Group provides an analysis of the key trends in each segment of the global private equity market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on fund type.

Analysis by Fund Type:

Access the comprehensive market breakdown Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout accounts for the majority of the market share due to its focus on acquiring controlling stakes in established companies to drive operational and financial improvements. It caters to investors seeking substantial returns through strategic transformations and long-term value creation. The popularity of buyout is supported by its ability to streamline business operations, enhance efficiencies, and unlock growth potential in acquired companies. Its flexibility to target diverse industries, including technology, healthcare, and consumer goods, further broadens its appeal. Buyout often deploys significant capital, enabling it to take full control of businesses, implement decisive changes, and scale operations effectively. Institutional investors and affluent individuals are attracted to the relatively consistent and foreseeable returns that buyout strategies usually provide. Moreover, the growing application of data-driven insights and sophisticated financial technologies is enhancing decision-making, risk evaluation, and execution in this sector, reinforcing buyout as the dominant category in private equity.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North holds 33.8% of the total private equity market share in 2025. North America represents the largest segment, driven by its well-established financial infrastructure and notable investor activity. The existence of leading private equity companies and institutional investors creates a competitive atmosphere, promoting innovation and strategic buyouts. Strong capital markets, beneficial regulatory systems, and access to a variety of investment options across sectors like technology, healthcare, and consumer products, also enhance market supremacy. High-net-worth individuals and institutional investors in the area show a significant inclination towards alternative investments, boosting private equity activity. Moreover, the developed economies in North America offer reliable growth prospects for buyouts, venture capital, and growth equity investments. Cutting-edge financial technologies and analytics-based decision-making are optimizing processes, improving returns, and bolstering investor trust. In June 2024, Niobrara Capital Partners was established as a private equity firm focused on the middle market, aiming for strategic investments in technology and tech-enabled services in North America and Europe. Headquartered in New York, the firm aims to concentrate on businesses utilizing groundbreaking technology trends and intends to partner with founders, families, and Fortune 500 firms to promote growth and innovation.

Key Regional Takeaways:

United States Private Equity Market Analysis

The US private equity market is growing, holding 88.0% of the North American market share, driven by a combination of favorable economic conditions, technological innovation, and evolving investor preferences. According to PwC, passive funds are expected to increase from 44% to 58% of total US mutual fund and ETF assets by 2030, reflecting a shift towards lower-cost investment options. This trend towards passive investing also highlights a growing demand for efficiency and cost-effectiveness, which private equity firms are increasingly addressing through advanced analytics and AI-driven decision-making. Additionally, specialized funds targeting sectors such as technology, healthcare, and renewable energy are supporting deal-making activity. The robust start-up ecosystem, particularly in emerging hubs beyond Silicon Valley, provides ample opportunities in venture capital-backed companies. The availability of liquidity, low interest rates, and an active secondary market further bolster fundraising and exit strategies. As sustainability becomes a key concern, private equity firms are also integrating ESG (Environmental, Social, and Governance) frameworks to attract institutional investors. The expansion of SPACs as an exit route adds an alternative dimension, making the US private equity market a dynamic and attractive space for investors.

Europe Private Equity Market Analysis

Europe's private equity sector thrives due to a developed financial ecosystem, varied industries, and government-supported innovation efforts. Eurostat reports that on January 1, 2023, the estimated population of the EU was 448.8 million, with more than 21% (roughly 95 million) being 65 years or older. This change in demographics leads to considerable demand for healthcare, life sciences, and retirement services, generating appealing investment prospects in these areas. The technology industry continues to be a primary area of interest, highlighting fintech, cleantech, and artificial intelligence. The European Green Deal and targets for decarbonization boost investments in sustainable energy and infrastructure initiatives. In spite of macroeconomic difficulties such as inflation and geopolitical unrest, the private equity scene in the region continues to be robust, backed by significant institutional capital investments. Mid-market buyouts and bolt-on acquisitions remain key strategies for private equity firms aiming for value enhancement. Moreover, the increasing incorporation of ESG principles in investment strategies draws in socially responsible investors.

Asia Pacific Private Equity Market Analysis

The private equity sector in the Asia-Pacific region is driven by swift economic growth, technological advancements, and increasing urbanization. UNICEF reports that almost 55% of Asia's large population is projected to reside in urban regions by 2030, increasing the need for infrastructure, real estate, and digital services. Key markets such as China and India lead the way, featuring growing start-up ecosystems and governmental efforts backing industries like fintech, healthcare, and e-commerce. The increasing middle class in the region and higher disposable incomes generate appealing investment opportunities. Furthermore, the growing emphasis on sustainability and digital transformation is influencing investment approaches, as private equity companies aim for tech-oriented solutions and ESG-compliant projects. Collaborations across borders, supported by local and global investment managers, improve deal flows throughout the region, establishing APAC as a vibrant and developing private equity market.

Latin America Private Equity Market Analysis

The private equity market in Latin America is supported by the swift expansion of digital industries, notably e-commerce, which experienced a 39% increase in 2022, reflecting a lagged reaction to the widespread digitization initiated by the pandemic in 2020-2021, as reported by PCMI. This upward trend is anticipated to persist, with e-commerce expected to grow by more than 20% each year. Moreover, the area enjoys a youthful, technologically adept populace, rising mobile adoption, and growing fintech prospects. Governments are advancing infrastructure and energy reforms, drawing in long-term private equity investments. In spite of political and economic hurdles, these elements establish Latin America as a vibrant and rapidly growing area for private equity.

Middle East and Africa Private Equity Market Analysis

The private equity market in the Middle East and Africa (MEA) is driven by economic diversification, increasing technology investments, and infrastructure growth. In the Middle East, state efforts like Vision 2030 are transforming economies by decreasing reliance on oil and promoting innovation. In Africa, the swift increase in mobile internet users, surpassing 380 million by late 2021, which represents 60% of the population, is fostering expansion in areas such as fintech and digital payments. These trends, coupled with investments in renewable energy and infrastructure, draw private equity funding. Sovereign wealth funds and development finance institutions are also playing a key role in funding impactful projects, positioning MEA as a growing market for private equity investments. With a positive private equity market forecast, this region is expected to continue attracting significant investment and opportunities in the coming years.

Competitive Landscape:

Leading firms are actively pursuing strategic acquisitions across various sectors, including technology, healthcare, and energy, to diversify their portfolios and enhance returns. They are integrating advanced technologies, such as AI, to improve investment analysis and operational efficiency. Additionally, there is a notable emphasis on environmental, social, and governance (ESG) factors, with firms implementing sustainable investment practices to meet evolving investor expectations and regulatory requirements. Additionally, the development of specialized private equity divisions by leading companies reflects a strategic effort to attract high-net-worth individuals and institutional investors by offering focused investment opportunities. In September 2024, InvesTek introduced a Private Equity Business Unit to provide high-net-worth individuals and institutional investors with strategic investment opportunities. The unit will focus on late-stage and pre-IPO companies in emerging sectors, leveraging advanced fintech capabilities to streamline transactions and support informed decision-making.

The report provides a comprehensive analysis of the competitive landscape in the private equity market with detailed profiles of all major companies, including:

- AHAM Asset Management Berhad

- Allens

- Apollo Global Management, Inc.

- Bain and Co. Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc.

- CVC Capital Partners

- Ernst and Young Global Ltd.

- HSBC Holdings Plc

- Morgan Stanley

- The Carlyle Group

- Warburg Pincus LLC

Latest News and Developments:

- September 2024: Institutional investor Oister Global and Tribe Capital India have partnered to establish a secondaries franchise in India, targeting USD 500 Million in investments over the next two years. The initiative aims to capitalize on India's growing secondaries market, which has recorded USD 7.7 Billion in transactions over five years. The firms will combine Oister’s local expertise with Tribe Capital India’s quant-driven diligence to execute their investment strategy.

- March 2024: A U.S.-based energy private equity firm, Kimmeridge, made a USD 2.1 Billion bid for Houston exploration company SilverBow Resources. The firm is offering to buy USD 32.4 Million shares at USD 34 per share, or more than USD 1.1 Billion total.

- March 2024: The Federal Trade Commission held a virtual workshop, Private Capital, Public Impact: An FTC Workshop on Private Equity in Health Care, on March 5, 2024. The event explored private equity's impact on health care markets through presentations and panel discussions with experts and officials.

Private Equity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AHAM Asset Management Berhad, Allens, Apollo Global Management, Inc., Bain and Co. Inc., Bank of America Corp., BDO Australia, Blackstone Inc., CVC Capital Partners, Ernst and Young Global Ltd., HSBC Holdings Plc, Morgan Stanley, The Carlyle Group, Warburg Pincus LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the private equity market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global private equity market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Private equity refers to the investment of capital in privately held companies or the acquisition of publicly traded companies to transition them into private ownership. It is typically made by private equity firms, venture capitalists, or institutional investors seeking higher returns over a medium to long-term period.

The global private equity market was valued at USD 855.4 Billion in 2025.

IMARC estimates the global private equity market to exhibit a CAGR of 8.29% during 2026-2034.

The global private equity market is driven by increasing demand for alternative investments, strong corporate growth opportunities, and rising capital inflows from institutional investors. Enhanced returns compared to traditional asset classes and the growing focus on innovation and technology-driven businesses are positively influencing the market.

In 2025, buyout represented the largest segment by fund type, driven by the increasing demand for control investments, the ability to optimize operational efficiencies, and the potential for substantial returns through strategic management.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global private equity market include AHAM Asset Management Berhad, Allens, Apollo Global Management, Inc., Bain and Co. Inc., Bank of America Corp., BDO Australia, Blackstone Inc., CVC Capital Partners, Ernst and Young Global Ltd., HSBC Holdings Plc, Morgan Stanley, The Carlyle Group, Warburg Pincus LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)