Pressure Vessel Market Size, Share, Trends and Forecast By Material, Product, End Use, and Region, 2025-2033

Global Pressure Vessel Market:

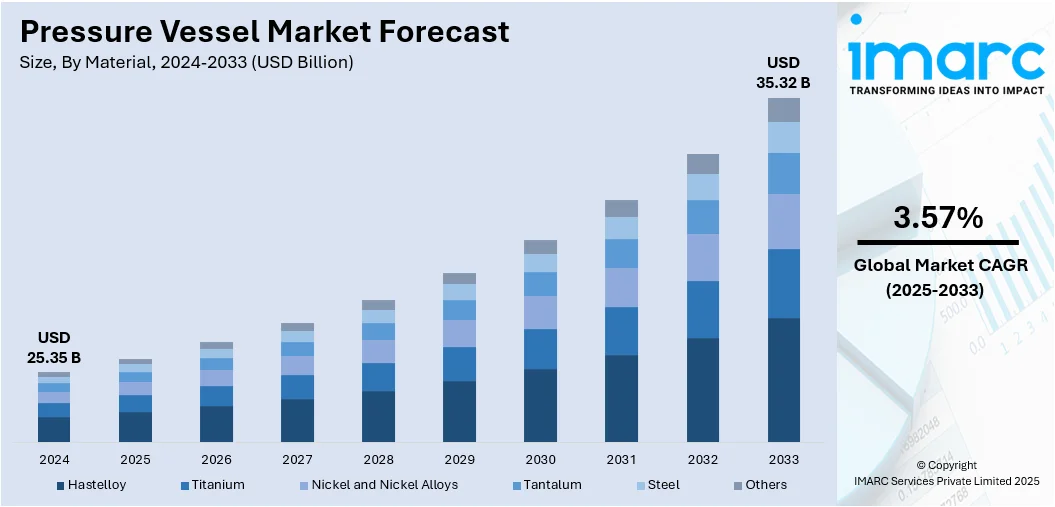

The global pressure vessel market size was valued at USD 25.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.32 Billion by 2033, exhibiting a CAGR of 3.57% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 36.4% in 2024. The market is experiencing strong growth due to rising global energy demand, driven by rapid industrialization and urbanization. As more countries expand their infrastructure, the need for efficient energy systems increases. Additionally, the chemical and petrochemical industries are growing, requiring high-performance pressure vessels for safe and reliable operations. Ongoing technological advancements in materials and design are enhancing vessel durability and efficiency, making them more suitable for modern applications and supporting their wider adoption across various industrial sectors thus surging the pressure vessel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.35 Billion |

|

Market Forecast in 2033

|

USD 35.32 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

Pressure Vessel Market Analysis:

- Major Market Drivers: A considerable rise in the need for energy around the world on account of rapid urbanization and increasing reliance on smart devices represents one of the key factors strengthening the pressure vessel market growth. Moreover, leading players are introducing advanced pressure vessels, such as pressure boilers, which is further proliferating the industry's growth.

- Key Market Trends: The growing usage of supercritical power generation technology is creating a favorable market outlook. Additionally, the thriving chemical and petrochemical industry, the increasing requirement for cooling and heating equipment, and extensive investments in exploration and production activities by leading oil and gas companies are anticipated to drive the market.

- Competitive Landscape: Some of the prominent pressure vessel market companies include Abbott & Co (Newark) Ltd., Alloy Products Corp., Babcock & Wilcox Enterprises Inc., Bharat Heavy Electricals Limited, Doosan Heavy Industries & Construction, GEA Group Aktiengesellschaft, Halvorsen Company, IHI Corporation, Larsen & Toubro Limited, Mitsubishi Power Ltd., Pressure Vessels (India), and Samuel Son & Co., among many others.

- Geographical Trends: According to the pressure vessel market dynamics, Asia Pacific exhibits a clear dominance in the market. The Asia Pacific region is witnessing rapid industrialization, particularly in countries like China, India, and Southeast Asian nations. This industrial boom is leading to increased demand for pressure vessels used in various industrial processes, including chemical, petrochemical, and oil & gas industries.

- Challenges and Opportunities: High initial costs associated with vessel manufacturing, and lack of skilled labor are hampering the market's growth. However, the development of advanced materials such as composites and high-strength alloys can enhance the performance, durability, and safety of pressure vessels, opening new market opportunities.

To get more information on this market, Request Sample

One major driver in the pressure vessel market is the growing demand for energy, particularly from emerging economies. As countries invest in expanding their power generation capacities especially nuclear, oil & gas, and thermal sectors the need for high-performance pressure vessels rises. These vessels are critical for safely containing gases and liquids under high pressure. Additionally, stricter industrial safety regulations and the global push for cleaner energy sources further accelerate their adoption. This trend is reinforced by advancements in material technology, which enable the production of more efficient and durable pressure vessels, supporting their integration into complex energy systems worldwide.

The U.S. plays a pivotal role in the global pressure vessel market, driven by its advanced industrial base and strong footprint in power generation, chemical processing, and oil & gas sectors. A major contributor is the country's commitment to modernizing its aging energy infrastructure. According to the U.S. Department of Energy’s 2025 Infrastructure Funding Progress Update, over $170 billion has been committed through the Bipartisan Infrastructure Law and Inflation Reduction Act to support clean energy and grid resilience, including 67 GW of added capacity and 4,375 miles of new transmission lines by 2031. This large-scale investment fuels demand for high-performance pressure vessels. Moreover, strict regulations from ASME and OSHA, along with U.S. leadership in material innovations, ensure durable and efficient vessel deployment across industries.

Pressure Vessel Market Trends:

Rising Energy Demand

The rising global energy demand, particularly in emerging economies, is a significant pressure vessel market trends. For example, global energy demand rose 2.9% in 2018, and if current trends continue, global energy consumption would rise 30% to 740 million terajoules by 2040. Pressure vessels are essential components in industries, such as oil and gas, chemical, and power generation, which are expanding to meet energy needs. These factors are expected to propel the pressure vessel market growth in the coming years.

Growing Chemical and Petrochemical Industry

One of the main drivers of the industry's expansion is the growing petrochemicals sector. For example, the worldwide petrochemicals market was valued at USD 645.7 billion in 2024, according to IMARC. By 2033, the IMARC Group projects that the market will have grown to USD 971.2 billion. Pressure vessels are crucial in handling corrosive or volatile substances safely at elevated temperatures and pressures, driving significant demand from this industry. These factors further positively influence the pressure vessel market forecast.

Expansion of the Oil and Gas Sector

One of the main drivers propelling the market's growth is the expansion of the oil and gas industry. The India Brand Equity Foundation, for example, projects that by 2045, India's oil consumption will have doubled to 11 million barrels per day. Also, crude oil imports climbed by 5.7% and 0.9% in January 2024 and April-January 2023-24, respectively, compared to the same period last year. The development of advanced materials for handling harsh conditions in the oil and gas sector significantly boosts the manufacturing of durable pressure vessels. Increased exploration and production activities, particularly in offshore and unconventional resources, also drive the market demand, thereby boosting the pressure vessel market revenue.

Pressure Vessel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pressure vessel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, product, and end use.

Analysis by Material:

- Hastelloy

- Titanium

- Nickel and Nickel Alloys

- Tantalum

- Steel

- Stainless Steel

- Duplex Steel

- Carbon Steel

- Super Duplex Steel

- Others

- Others

Steel accounts for the majority of shares of 29.7% in the pressure vessel market due to its excellent mechanical properties, including high strength, durability, and resistance to pressure and temperature extremes. It is particularly well-suited for applications in industries such as oil & gas, chemicals, power generation, and petrochemicals, where vessels must withstand harsh operating conditions. Carbon steel and stainless steel are commonly used because they offer a balance between cost-effectiveness and performance. Additionally, steel is highly versatile and easy to fabricate into various shapes and sizes, making it ideal for custom vessel designs. Its widespread availability and recyclability also contribute to its dominance. As safety and regulatory standards tighten, the demand for reliable steel-based pressure vessels continues to grow across global industrial sectors.

Analysis by Product:

- Boiler

- Nuclear Reactor

- Separator

- Others

According to the pressure vessel market analysis, the boilers dominate the pressure vessel market with a market share of 59.6% due to their critical role in power generation, industrial processing, and heating applications. They are essential for producing steam used in thermal power plants, which remain a major source of electricity globally, especially in Asia and developing regions. Industries such as food processing, textiles, chemicals, and refineries also rely heavily on industrial boilers for various heat-related operations. The ongoing expansion of manufacturing facilities and rising energy demands further boost boiler installations. Additionally, advancements in boiler technology—such as improved efficiency, lower emissions, and better safety features—have led to their widespread adoption. Government initiatives to modernize aging energy infrastructure and the push for cleaner, more efficient thermal systems also contribute to the sustained dominance of boilers in this market.

Analysis by End Use:

- Chemicals and Petrochemicals

- Oil and Gas

- Power Generation

- Others

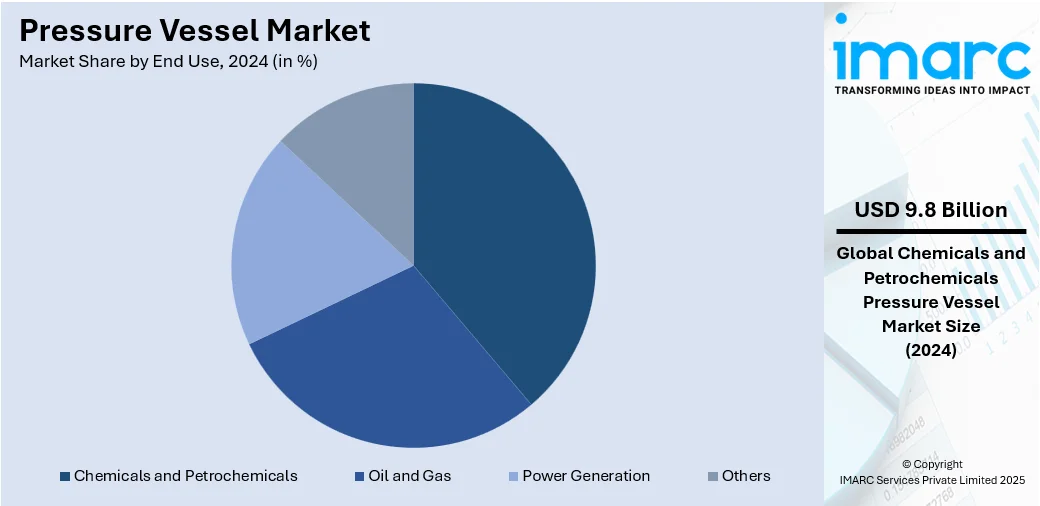

The chemicals and petrochemicals sector holds the largest share of 38.7% of the pressure vessel market due to its extensive use of high-pressure systems in various production processes. These industries rely heavily on pressure vessels for storage, processing, and transportation of volatile and hazardous substances such as gases, acids, and hydrocarbons. The need for safe, corrosion-resistant, and high-performance vessels is critical in handling extreme temperatures and pressures. Additionally, global demand for plastics, fertilizers, and specialty chemicals continues to rise, especially in emerging economies, driving further investment in petrochemical infrastructure. As refineries and chemical plants expand or modernize, they increasingly adopt advanced pressure vessels to meet stringent safety regulations and improve operational efficiency, reinforcing the sector’s dominance in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the leading region in the global pressure vessel with a market share of 36.4% market due to rapid industrialization, urbanization, and growing energy demand, particularly in countries like China, India, Japan, and South Korea. These nations are heavily investing in power generation infrastructure, including thermal, nuclear, and renewable energy projects, which require advanced pressure vessels for safe and efficient operation. The expansion of the chemical, petrochemical, and oil & gas industries further boosts regional demand. Additionally, government initiatives supporting manufacturing growth, coupled with favorable policies for foreign direct investment, have led to the establishment of large-scale industrial facilities. The availability of low-cost raw materials and labor also contributes to the dominance of Asia Pacific, making it a global hub for pressure vessel production and usage.

Key Regional Takeaways:

United States Pressure Vessel Market Analysis

United States has witnessed a notable surge in pressure vessel adoption due to growing energy demand, particularly in oil and gas refining, nuclear power, and natural gas storage. According to Annual Energy Outlook 2025 (AEO2025), crude oil production will increase to about 14.0 Million barrels per day (b/d) in 2027 or 2028 in most of report cases, compared with 13.2 Million b/d in 2024. This demand is closely tied to increasing consumption patterns across industrial and residential sectors. The aging infrastructure is also being replaced or retrofitted with modern pressure vessel systems to enhance safety and performance. In addition, decarbonization goals are prompting utilities to upgrade energy infrastructure, boosting adoption further. Technological innovations in materials and welding processes are making pressure vessels more durable and cost-efficient, which aligns with the energy sector’s long-term goals.

Asia Pacific Pressure Vessel Market Analysis

Asia-Pacific is experiencing substantial growth in pressure vessel adoption driven by rapid industrialization across sectors such as chemicals, power, and manufacturing. According to Ministry of Statistics & Programme Implementation, the index of Industrial Production (IIP) saw a 1.2 % year-on-year increase in May 2025, driven by growth in the manufacturing sector at 2.6%. The rising number of processing units and refineries has created a consistent need for high-capacity, corrosion-resistant pressure vessels. This transformation is supported by increased investments in capital equipment and infrastructure projects. Modernization of existing facilities and the development of large-scale industrial clusters are contributing to this demand surge. Additionally, local production capabilities and technological transfers are encouraging the domestic manufacturing of pressure vessels, reducing dependence on imports.

Europe Pressure Vessel Market Analysis

Europe has demonstrated growing pressure vessel adoption as a result of sustained investment in power generation, particularly in renewable and nuclear segments. According to International Energy Agency, annual spending on grids is set to exceed USD 70 Billion in 2025 in Europe, doubling the amount spent a decade ago. As power utilities shift toward decarbonized systems, pressure vessels are becoming essential for steam generation, heat recovery, and fuel processing applications. Public and private funding in low-carbon energy infrastructure is enhancing the scope of high-performance vessels in modern power plants. Aging power facilities are being replaced or upgraded with advanced equipment designed for greater efficiency and reliability. The adoption of hydrogen-based technologies and small modular reactors has further supported pressure vessel demand.

Latin America Pressure Vessel Market Analysis

Latin America is witnessing a gradual rise in pressure vessel usage due to growing urbanization, which has led to increased demand for electricity, water treatment, and industrial processing. For instance, Latin America and the Caribbean underwent a rapid urbanization process, making it one of the most urbanized regions in the world. In 2025, 82% of the population lives in urban areas, compared to the global average of 58%. Expanding metropolitan infrastructure requires scalable and safe solutions for energy and utility services, where pressure vessels play a central role. Industrial growth linked to urban expansion has added to the regional need for durable and efficient pressure containment systems.

Middle East and Africa Pressure Vessel Market Analysis

Middle East and Africa are embracing higher pressure vessel deployment in response to growing expansion of chemical and petrochemical industry. Saudi Arabia has the largest upstream oil and gas investment in the area, according to the International Energy Agency, and it is expected to reach over USD 40 billion in 2025, which is almost 15% more than it was in 2015. As refining capacity and downstream processing units continue to grow, the need for heat exchangers, separators, and storage systems is increasing.

Competitive Landscape:

The competitive landscape is characterized by the presence of several global and regional players striving for market share through innovation, strategic partnerships, and expansion. Key companies such as Larsen & Toubro, Mitsubishi Heavy Industries, Doosan Heavy Industries, and Babcock & Wilcox dominate due to their advanced manufacturing capabilities and strong industry experience. These players focus on developing high-performance, durable, and customized pressure vessels to meet stringent regulatory standards across industries like oil & gas, power generation, and chemicals. Additionally, smaller manufacturers are entering niche segments with specialized offerings. The market is also influenced by technological advancements, material innovations, and increasing demand for energy-efficient systems, driving competition and fostering continuous product development and global expansion strategies.

The report provides a comprehensive analysis of the competitive landscape in the pressure vessel market with detailed profiles of all major companies, including:

- Abbott & Co (Newark) Ltd.

- Alloy Products Corp.

- Babcock & Wilcox Enterprises Inc.

- Bharat Heavy Electricals Limited

- Doosan Heavy Industries & Construction

- GEA Group Aktiengesellschaft

- Halvorsen Company

- IHI Corporation

- Larsen & Toubro Limited

- Mitsubishi Power Ltd.

- Pressure Vessels (India)

- Samuel Son & Co.

Latest News and Developments:

- May 2025: The first European-built CO₂ carrier, featuring onboard cooling and pressure vessel systems, was fully assembled at the Royal Niestern Sander shipyard ahead of its scheduled christening. The vessel marked a key milestone for INEOS and Greensand's full-scale CCS project as it entered the final construction phase involving retrofitting, commissioning, and pressure vessel testing.

- February 2025: Shanghai Electric Nuclear Power Group delivered the reactor pressure vessel for unit 1 of the Lianjiang nuclear power plant to the construction site in Guangdong on 13 February 2025. The pressure vessel marked a key transition from manufacturing to installation for the CAP1000 reactor project led by State Power Investment Corp.

- January 2025: AZL Aachen GmbH and 25 industry partners completed a 12-month R&D project on hydrogen pressure vessels, delivering a final report detailing design trends, production insights, and CAD-CAE results. The study highlighted thermoset and thermoplastic pressure vessel innovations, showcasing fiber-reinforced solutions for hydrogen storage and transport across mobile and stationary applications.

- January 2025: DEEP Manufacturing Limited secured DNV approval in principle for using Wire Arc DED Additive Manufacturing in producing steel pressure vessels for human occupancy. The pressure vessel innovation followed extensive R&D and was launched in January 2025 to enhance production speed and supply chain growth.

Pressure Vessel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered |

|

| Products Covered | Boiler, Nuclear Reactor, Separator, Others |

| End Uses Covered | Chemicals and Petrochemicals, Oil and Gas, Power Generation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott & Co (Newark) Ltd., Alloy Products Corp., Babcock & Wilcox Enterprises Inc., Bharat Heavy Electricals Limited, Doosan Heavy Industries & Construction, GEA Group Aktiengesellschaft, Halvorsen Company, IHI Corporation, Larsen & Toubro Limited, Mitsubishi Power Ltd., Pressure Vessels (India), Samuel Son & Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pressure vessel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pressure vessel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pressure vessel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure vessel market was valued at USD 25.35 Billion in 2024.

The pressure vessel market is projected to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 35.32 Billion by 2033.

Key factors driving the pressure vessel market include rising global energy demand, rapid industrialization, and expansion of the chemical and petrochemical sectors. Additionally, investments in power generation infrastructure, technological advancements in materials and design, and strict safety regulations further boost the demand for high-performance and durable pressure vessels.

Steel holds the largest share in the pressure vessel market with a share around 29.7% due to its superior strength, durability, and resistance to high pressure and temperature. Its cost-effectiveness, ease of fabrication, and suitability for demanding industrial environments make it the preferred material across sectors like power, oil & gas, and chemicals.

Boilers dominate the pressure vessel market with a market share of 59.6% because they are essential in power generation, industrial processing, and heating systems. Their ability to efficiently produce steam for energy and manufacturing processes makes them vital across industries, especially in thermal power plants, driving consistent demand globally.

The chemicals and petrochemicals sector leads the pressure vessel market with a share of 38.7% due to its constant need for high-pressure systems to store and process reactive and hazardous substances. Pressure vessels are vital for safety and efficiency in producing fertilizers, plastics, and chemicals, making them indispensable in this industry.

Asia Pacific is the leading region with a market share of 36.4% in the global pressure vessel market due to rapid industrialization, urbanization, and growing energy demand, particularly in countries like China, India, Japan, and South Korea.

Some of the major players in the pressure vessel market include Abbott & Co (Newark) Ltd., Alloy Products Corp., Babcock & Wilcox Enterprises Inc., Bharat Heavy Electricals Limited, Doosan Heavy Industries & Construction, GEA Group Aktiengesellschaft, Halvorsen Company, IHI Corporation, Larsen & Toubro Limited, Mitsubishi Power Ltd., Pressure Vessels (India), Samuel Son & Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)